Market Overview:

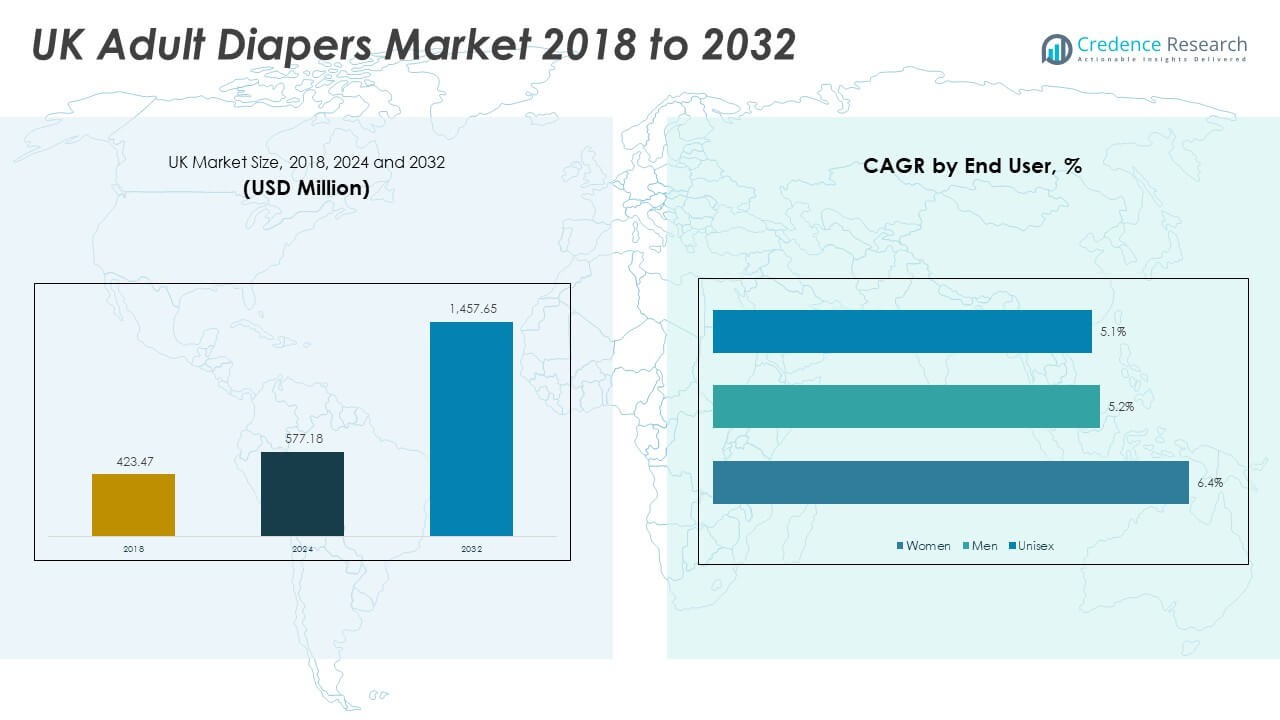

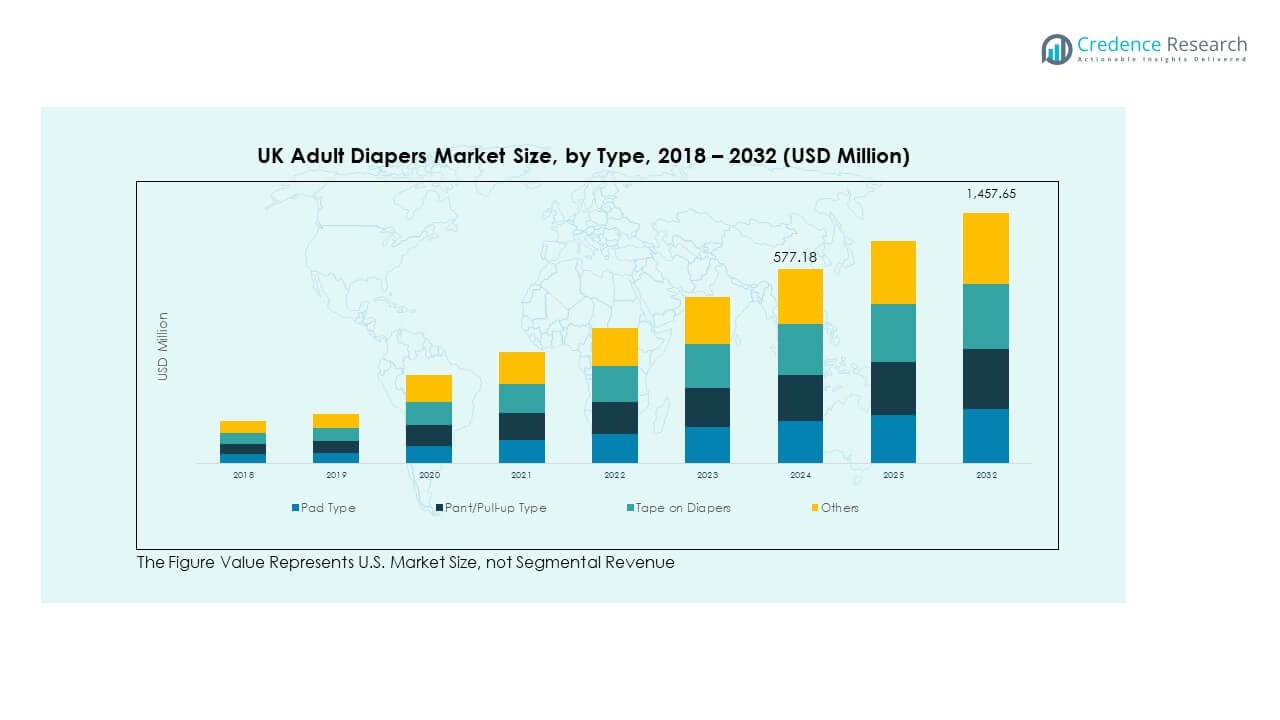

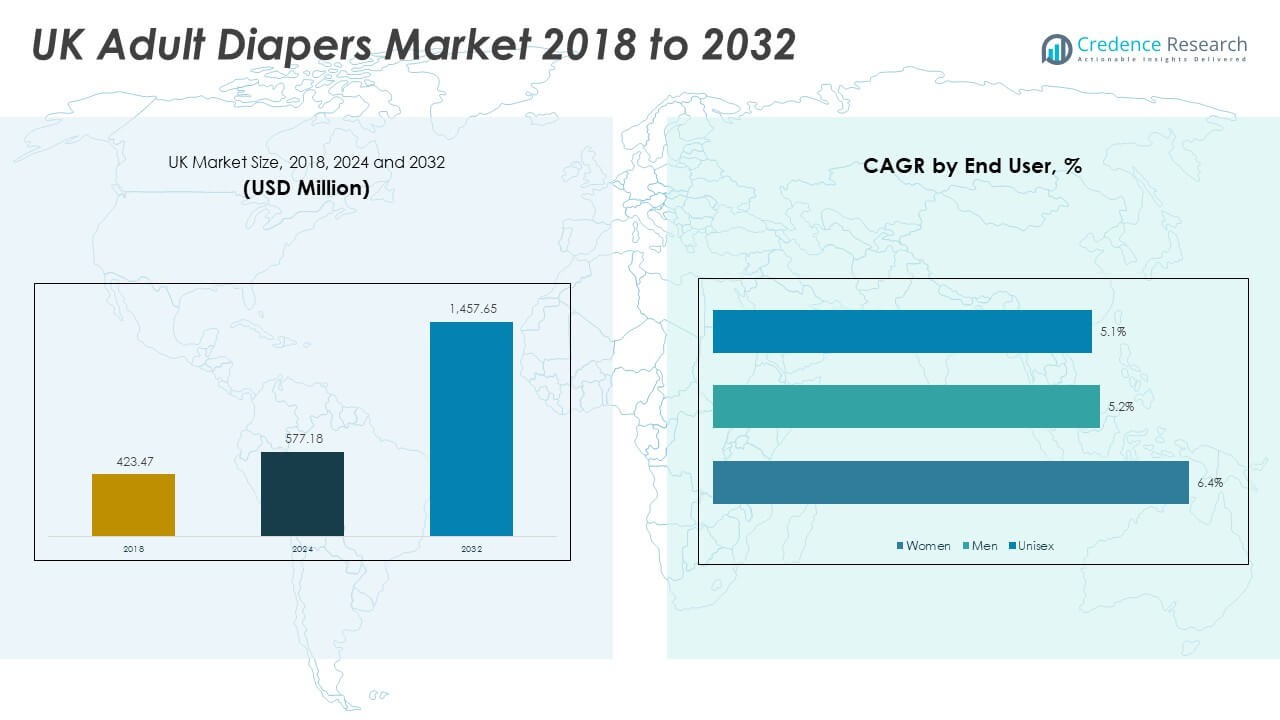

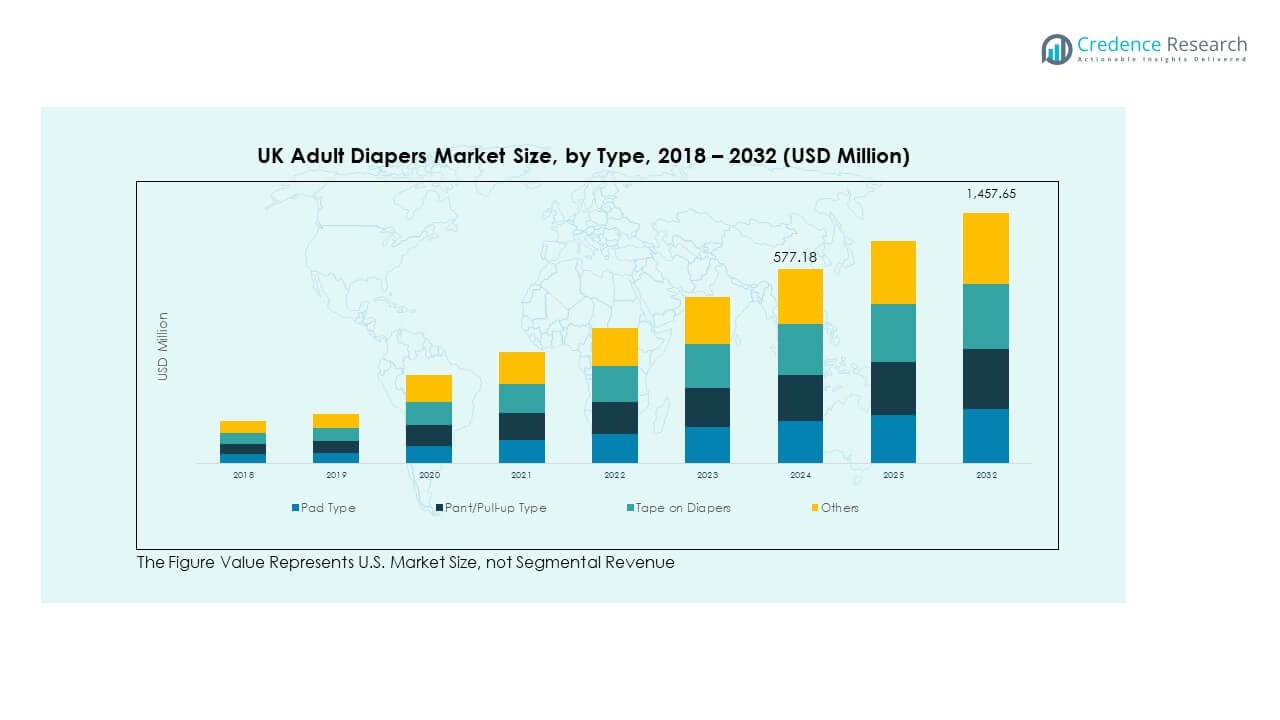

The UK Adult Diapers Market size was valued at USD 423.47 million in 2018 to USD 577.18 million in 2024 and is anticipated to reach USD 1,457.65 million by 2032, at a CAGR of 12.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Adult Diapers Market Size 2024 |

USD 577.18 Million |

| UK Adult Diapers Market, CAGR |

12.28% |

| UK Adult Diapers Market Size 2032 |

USD 1,457.65 Million |

The market is expanding due to a rapidly aging population and rising cases of incontinence among older adults. Growing acceptance of adult hygiene products in the UK, along with reduced stigma, has widened adoption. Manufacturers are introducing discreet and high-absorbency products to improve comfort and lifestyle integration. The surge in online retailing and the presence of private labels from retail giants are strengthening accessibility and affordability, further supporting market penetration and steady demand across diverse consumer groups.

Within the UK, urban regions hold significant market share due to higher population density and greater healthcare access. Metropolitan areas such as London and Manchester lead adoption, supported by strong retail networks and awareness programs. Emerging demand is also observed in semi-urban regions, where growing healthcare infrastructure and shifting consumer attitudes drive uptake. The regional spread indicates a steady expansion from core metropolitan hubs to broader UK regions, signaling a balanced growth trajectory across the market landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Adult Diapers Market was valued at USD 423.47 million in 2018, reached USD 577.18 million in 2024, and is anticipated to hit USD 1,457.65 million by 2032, growing at a CAGR of 12.28%.

- England dominated with a 62% share in 2024 due to its large elderly population, advanced healthcare system, and strong retail presence. Scotland followed with 15%, supported by robust public health initiatives, while Wales contributed 13%, benefiting from urban healthcare access.

- Northern Ireland, holding 10% share, is the fastest-growing region, supported by expanding online sales, affordability-focused product lines, and growing awareness programs.

- By type, pad diapers represented the largest segment in 2024, accounting for around 40% share, driven by affordability and high usage among elderly consumers.

- Pant or pull-up diapers captured about 30% share, emerging as the fastest-growing type due to rising demand from active adults seeking comfort, discretion, and lifestyle compatibility.

Market Drivers:

Growing Aging Population and Rising Healthcare Awareness:

The UK Adult Diapers Market is driven strongly by its expanding elderly population, with life expectancy improving steadily across the country. The rising prevalence of urinary incontinence among aging adults fuels consistent product demand. Healthcare professionals increasingly recommend adult diapers for effective hygiene management, improving acceptance levels. Public health campaigns and social organizations also highlight the benefits of maintaining dignity and comfort through reliable hygiene products. Consumers are gradually reducing stigma and openly purchasing these products in retail and online outlets. Higher awareness across families has created better preparedness for elderly care. It has led to stronger penetration of both branded and private label products. This growing demand reinforces the importance of hygiene and long-term care solutions.

- For instance, BladderHealth’s iD For Men Level 3 pad utilizes Power Dry Technology to provide superior absorption and odor control, achieving over 80% higher absorbency compared to conventional products in clinical tests, boosting user confidence among elderly males in the UK.

Product Innovation with Comfort, Discretion, and High Absorbency:

Innovation has become a central driver, with manufacturers introducing diapers that focus on comfort, discretion, and superior absorbency. The UK Adult Diapers Market reflects this trend, with product ranges offering thinner materials and odor-control technology. Lightweight and breathable fabrics provide skin-friendly solutions that improve user satisfaction. Consumers now expect features like leak-proof barriers, multiple sizing options, and ergonomic fits. Companies are integrating smart designs that allow longer usage periods while reducing discomfort. These innovations help adults integrate hygiene solutions into daily routines without social hesitation. Retailers and pharmacies stock wide portfolios to appeal to varying consumer preferences. It strengthens customer loyalty and encourages repeat purchases across different demographics.

- For instance, the brand Pampers launched their Pure Protection Hybrid diapers, which combined a soft, disposable insert with a reusable cloth cover, offering a more sustainable alternative to their previous all-disposable models.

Rising Retail Expansion and Online Sales Accessibility:

The availability of adult diapers has expanded across hypermarkets, supermarkets, specialty stores, and e-commerce platforms. Strong retail penetration increases product accessibility in both urban and semi-urban areas. The UK Adult Diapers Market benefits from online platforms offering discreet home delivery, which appeals to privacy-sensitive buyers. E-commerce promotions and subscription models encourage long-term usage and loyalty. Retail giants have also introduced private labels that compete effectively with international brands. Affordable options enhance adoption among middle-income groups and strengthen consumer confidence. Discounts, bundled packs, and easy availability ensure consistent purchase patterns. These factors collectively enhance growth momentum across different consumer categories.

Supportive Government Initiatives and Healthcare Systems:

Government healthcare policies support the adoption of adult diapers through hospitals, care homes, and elderly support programs. The UK Adult Diapers Market gains traction from NHS-supported initiatives that highlight patient comfort and hygiene. Hospitals and nursing homes account for large-scale procurement to support long-term care patients. Policy-driven subsidies improve affordability for low-income groups in need of regular supplies. Partnerships between healthcare organizations and suppliers ensure steady product distribution across regions. It strengthens trust in adult hygiene products and promotes their role in long-term healthcare planning. Training programs for caregivers also emphasize the importance of adult hygiene solutions. Such institutional support reinforces both demand and awareness.

Market Trends:

Adoption of Smart and Eco-Friendly Hygiene Products:

The UK Adult Diapers Market is witnessing strong movement toward sustainable and eco-friendly solutions. Consumers are increasingly conscious about the environmental footprint of disposable diapers. Manufacturers are investing in biodegradable and recyclable materials that reduce landfill pressure. Brands promoting eco-certified products appeal to both individual buyers and institutions. Smart diapers with wetness indicators are gaining traction in care homes and hospitals. This innovation supports caregivers in timely changes while reducing waste. Younger caregivers prefer eco-conscious products, which aligns with national sustainability goals. It signals long-term growth in eco-friendly product lines.

Strengthening Brand Loyalty Through Personalization and Customization:

Brands are focusing on personalization strategies that improve customer loyalty and repeat purchase rates. The UK Adult Diapers Market now offers sizing options, gender-specific designs, and variants for active users. Consumers demand tailored features that meet individual comfort preferences. Companies are deploying digital tools and mobile apps for product recommendations. Subscription-based models offer customized delivery schedules that ensure convenience and privacy. Marketing campaigns emphasize dignity and lifestyle compatibility, appealing to younger caregivers and family buyers. This approach reduces customer churn and strengthens competitive differentiation. It reflects how personalization has become a key growth lever in the market.

- For instance, CustomZ Diapers, a UK company primarily active in niche online marketplaces, released new products in 2024 aimed at specific adult users. The company offers a variety of diapers with different designs.

Growth of Institutional Sales in Hospitals and Nursing Homes:

The expansion of institutional sales is an important trend shaping future market dynamics. Hospitals, nursing homes, and elderly care facilities represent consistent bulk demand. The UK Adult Diapers Market benefits from institutional contracts that guarantee stable supply. Facilities prefer reliable, high-absorbency products that reduce patient discomfort and minimize caregiver workload. Manufacturers partner directly with healthcare providers to supply tailored product lines. Institutional usage also boosts brand credibility and consumer trust. These partnerships lead to broader retail acceptance when caregivers recommend brands outside facilities. The institutional channel remains critical for reinforcing market stability and brand leadership.

Increasing Influence of Social Campaigns and Awareness Programs:

Social campaigns and media initiatives are reshaping public perception of adult hygiene. The UK Adult Diapers Market reflects growing acceptance as awareness programs reduce stigma. Organizations highlight how adult diapers maintain dignity and enable active lifestyles. Caregiver networks and healthcare NGOs conduct educational sessions on hygiene management. Media coverage and testimonials normalize adoption among younger families caring for elders. Social acceptance contributes to more confident purchasing behavior in stores and online. This trend also supports premium product sales, as consumers value comfort and health benefits. Social engagement has become an essential growth factor across the market landscape.

Market Challenges Analysis:

High Cost Pressures and Affordability Concerns Among Consumers:

The UK Adult Diapers Market faces challenges linked to affordability, especially among middle- and low-income groups. Premium products with advanced features such as odor control and breathable fabrics are priced higher, limiting access for cost-sensitive buyers. Private labels attempt to bridge the affordability gap, but branded products still dominate institutional and retail channels. Rising raw material costs contribute to fluctuating prices, affecting both manufacturers and end users. Consumers in rural and semi-urban areas remain hesitant to purchase higher-priced products due to budget limitations. It restricts wider adoption despite strong awareness campaigns. This challenge forces manufacturers to balance innovation with cost efficiency while maintaining product quality. The demand for affordable solutions continues to shape strategic decisions across the market.

Persistent Social Stigma and Limited Awareness in Certain Regions:

Despite increasing acceptance, social stigma around adult diaper usage continues to pose a barrier in the UK Adult Diapers Market. Many individuals perceive the product as a sign of dependency, discouraging open purchasing behavior. Families often delay adoption until conditions worsen, leading to discomfort for elderly members. Awareness programs are helping, but some communities remain less receptive to discussions on adult hygiene. Limited dialogue in smaller towns and rural areas slows down adoption rates. Caregivers in these regions often resort to alternatives, reducing the potential for consistent growth. It highlights the need for stronger education and normalization strategies. Overcoming these barriers is critical for ensuring consistent market penetration across all demographics.

Market Opportunities:

Expansion Through Product Diversification and Premium Offerings:

The UK Adult Diapers Market offers growth opportunities through diversification of product portfolios. Manufacturers can capture wider audiences by developing gender-specific, size-inclusive, and activity-based variants. Premium lines focusing on comfort, discretion, and skin health are increasingly valued by urban buyers. Hospitals and nursing homes also seek advanced designs that improve patient outcomes and ease caregiver workload. It creates potential for companies to expand into specialized categories such as overnight or travel-friendly diapers. Customization and premiumization provide differentiation in a competitive environment. This strategic focus opens pathways for capturing both institutional and retail customers with evolving needs.

Leveraging Digital Platforms and Expanding Distribution Networks:

E-commerce and digital platforms are unlocking new opportunities for both established and emerging players. The UK Adult Diapers Market benefits from discreet online channels that address privacy concerns among buyers. Subscription services and digital marketing campaigns help brands build direct engagement with consumers. Expanding into underserved regions through retail partnerships ensures stronger accessibility and awareness. Companies can also leverage data analytics to anticipate consumer preferences and tailor offerings. This integration of digital and physical networks strengthens market reach. It positions brands to capture growth from both traditional and modern retail channels effectively.

Market Segmentation Analysis:

By Type

Pad type products dominate demand due to their affordability and convenience for light incontinence. Pant or pull-up types are gaining popularity among active adults, offering discretion and comfort during daily activities. Tape-on diapers maintain strong adoption in hospitals and long-term care facilities because they allow caregivers to adjust easily. Others, including niche or specialty designs, serve smaller consumer bases but reflect innovation in the market. The UK Adult Diapers Market shows balanced demand across categories, with pull-up types growing fastest due to lifestyle compatibility.

- For example, in May 2024, Pampers introduced its new Swaddlers 360° diapers, which feature a pull-on waistband for easier changes. Similarly, Huggies launched its Skin Essentials diaper line in 2024, focusing on skin protection with enhanced absorbent technology to prevent rashes.

By End-User

Women represent the largest consumer group, supported by higher reported cases of incontinence and active participation in preventive hygiene. Men are gradually adopting adult diapers as awareness and product variety expand. Unisex options provide flexibility for both institutional buyers and families, enhancing affordability and simplifying stocking for retailers. It demonstrates consistent growth across gender groups, with unisex products acting as a key bridge for bulk and household demand.

By Distribution Channel

E-commerce continues to expand its share with discreet delivery and subscription models that meet privacy needs. Online platforms also promote premium lines effectively, supported by digital marketing campaigns. Offline channels such as pharmacies, supermarkets, and specialty stores still dominate overall sales due to consumer preference for physical inspection before purchase. It indicates a dual-track distribution environment, where online sales grow steadily while offline networks maintain broad accessibility across regions.

Segmentation:

By Type

- Pad Type

- Pant/Pull-up Type

- Tape on Diapers

- Others

By End-User

By Distribution Channel

- E-Commerce

- Offline Channel

Regional Analysis:

England Leading with Strong Market Dominance

England accounts for nearly 62% of the UK Adult Diapers Market, making it the most dominant region. Its large elderly population, high healthcare spending, and strong retail infrastructure support widespread adoption. Major cities such as London, Manchester, and Birmingham drive demand with better access to hospitals, nursing homes, and organized retail chains. The presence of multinational players and private-label competition creates a highly competitive landscape. Consumers in urban centers show higher preference for premium and eco-friendly products, reflecting rising lifestyle awareness. It continues to act as the primary hub for innovation, distribution, and long-term institutional demand.

Scotland Showing Steady Growth in Healthcare-Backed Demand

Scotland holds around 15% of the UK Adult Diapers Market, driven by its robust healthcare system and growing focus on elderly care. Regional hospitals and care homes procure significant volumes through public health initiatives. Demand is supported by government-backed programs that provide hygiene products to low-income groups and care facilities. Urban centers such as Glasgow and Edinburgh lead consumption due to concentrated healthcare and retail access. Rural adoption is increasing, but affordability remains a limiting factor in some areas. It reflects steady growth prospects as awareness and institutional support continue to expand.

Wales and Northern Ireland Emerging with Niche Opportunities

Wales and Northern Ireland collectively account for nearly 23% of the UK Adult Diapers Market, representing smaller but growing segments. Wales contributes about 13%, with demand concentrated in Cardiff and Swansea where healthcare services are strong. Northern Ireland holds nearly 10%, supported by a mix of private retail adoption and public sector programs. Both regions show rising interest in online purchasing due to privacy concerns and wider product variety. Manufacturers are targeting these regions with affordable and unisex product lines to strengthen penetration. It highlights the potential of emerging geographies where gradual awareness and digital sales channels are boosting market access.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Svenska Cellulosa Aktiebolaget (SCA) / Essity Aktiebolag

- Kimberly-Clark Corporation

- Unicharm Corporation

- First Quality Enterprises, Inc.

- Procter & Gamble Co.

- Medline Industries, Inc.

- Abena A/S

- Ontex Group

- Paul Hartmann AG

- TZMO SA

Competitive Analysis:

The UK Adult Diapers Market is characterized by strong competition between global leaders and domestic players. Companies such as Essity, Kimberly-Clark, Unicharm, Procter & Gamble, and Ontex dominate through wide product portfolios and retail penetration. Private labels from major retailers are expanding their share by offering affordable alternatives. Innovation in absorbency, skin health, and discreet design is a critical differentiator. It has intensified competition, with firms investing in eco-friendly materials and digital marketing strategies. Institutional contracts with hospitals and nursing homes also strengthen brand visibility. This dynamic landscape ensures that product quality, affordability, and brand trust remain decisive factors for market leadership.

Recent Developments:

- Essity Aktiebolag initiated joint programs with local hospitals in the UK to train caregivers in the proper use and disposal of adult diapers to improve care quality.

- In 2025, First Quality Enterprises announced a significant expansion of their manufacturing capacity including adult incontinence products, with investments in new manufacturing lines and an automated warehouse expected to complete by June to September 2025, aiming to introduce innovative products and enhance supply chain optimization.

- In August 2025, Kimberly-Clark Corporation reported a 3.9% rise in organic sales in their fiscal second quarter, driven by increased volume growth attributed to the aging population, and enhanced their profit outlook. They have expanded their product range with features combining premium and budget offerings, reinforcing their presence in adult diaper markets globally including the UK.

- Abena A/S continues its long-standing focus on quality and sustainability in adult diapers with ongoing product delivery and a strong value proposition reported as of June 2025.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand will be driven by the expanding elderly population.

- Pull-up adult diapers will continue to gain preference among active adults.

- Institutional sales will strengthen through hospitals and nursing homes.

- E-commerce will capture more share due to discreet delivery options.

- Premium and eco-friendly products will see rising adoption in urban markets.

- Private labels will expand presence through affordability and accessibility.

- Awareness campaigns will reduce stigma and drive higher retail acceptance.

- Product innovation will focus on comfort, breathability, and skin health.

- Regional growth will expand beyond England into Wales and Northern Ireland.

- Strategic partnerships will help global players consolidate market share.