Market overview

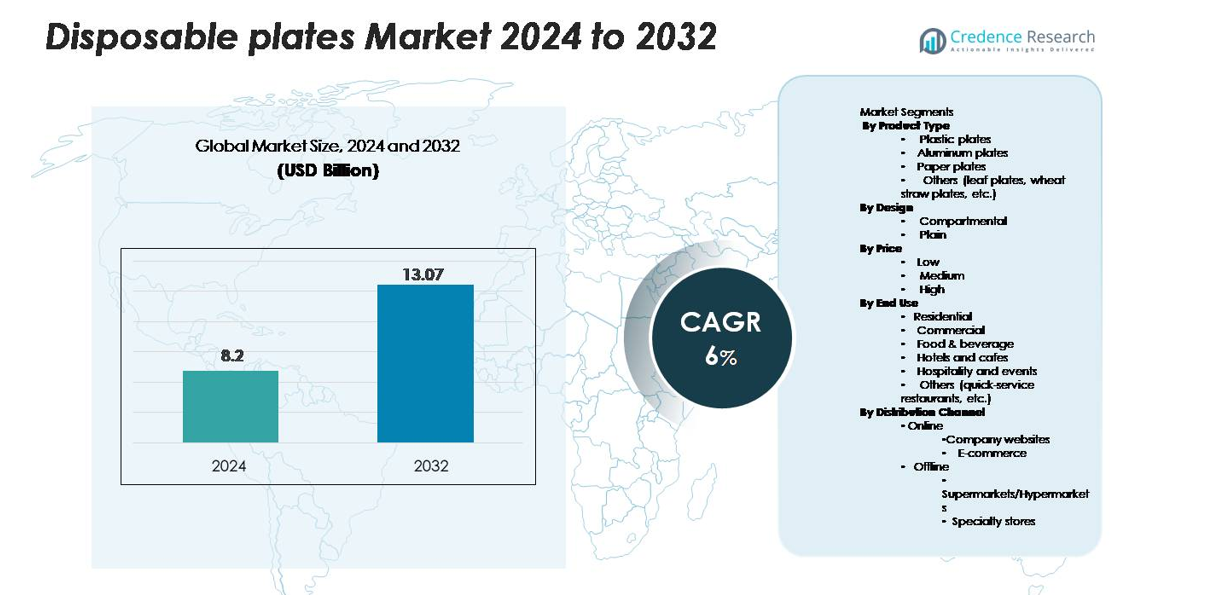

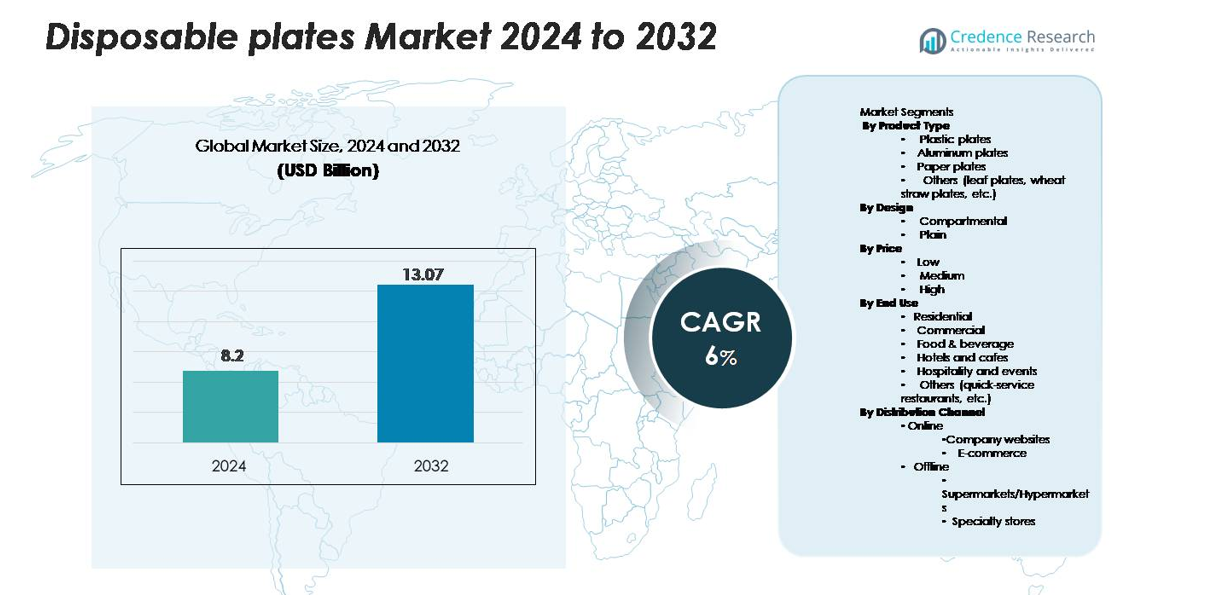

The Disposable Plates market was valued at USD 8.2 billion in 2024 and is anticipated to reach USD 13.07 billion by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Plates Market Size 2024 |

USD 8.2 billion |

| Disposable Plates Market, CAGR |

6% |

| Disposable Plates Market Size 2032 |

USD 13.07 billion |

The disposable plates market features established players and strong regional competition across material categories. Major manufacturers supply large supermarket chains, food-service distributors, and e-commerce channels, while private labels hold a growing share in household and party-use segments. North America leads the global market with 34% share, driven by high takeaway consumption and rapid adoption of paper-based and compostable plates. Europe follows with strong regulatory pressure that pushes restaurants and retail buyers toward sustainable options. Asia-Pacific continues to expand due to population growth, catering demand, and street-food culture, supporting high-volume sales of low-cost paper and plastic plates.

Market Insights

- The Disposable Plates market was valued at USD 8.2 billion in 2024 and will reach USD 13.07 billion by 2032, growing at a 6% CAGR during the forecast period.

- Rising sustainability awareness drives demand for paper and plant-based plates, making paper plates the largest segment due to low cost, easy disposal, and wide retail presence.

- Key trends include adoption of compostable materials like bagasse and wheat straw, along with private-label branding supported by supermarkets, cafes, and e-commerce platforms for customized and bulk offerings.

- Market competition remains moderate, with global and regional players focusing on recyclable coatings, lightweight strength, and low-cost production, while pricing pressure and waste-management challenges restrain profitability for smaller producers.

- North America leads with 34% share, followed by Europe with strict plastic regulations, while Asia-Pacific shows rapid growth due to high food-service volume. Low-price disposable plates dominate market share across emerging regions because of bulk institutional and street-food consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

Paper plates hold the largest market share in the product type segment, supported by rising demand for eco-friendly and biodegradable food-serving solutions. Paper variants gain strong traction in residential and commercial uses due to low cost, easy disposal, and wide availability. Environmental regulations on single-use plastics further accelerate the shift toward paper-based alternatives. Plastic plates still remain common in large gatherings and outdoor catering because of durability and low material cost, but their usage continues to decline. Aluminum and leaf-based plates serve premium and sustainable niches, driven by increasing consumer preference for compostable options.

- For instance, Huhtamaki’s U.S. plants produce fiber-based disposable plates using responsibly sourced wood pulp or recycled fiber, and its automated lines manufacture products at high speed for food-service customers.

By Design:

Plain disposable plates dominate the design segment with a high market share, as they are widely used across household consumption, food stalls, catering services, and corporate events. Their simple structure lowers production cost and enables bulk usage for daily serving, institutional meals, and quick-service formats. Compartmental plates are gaining adoption in corporate cafeterias, airline meals, and packaged outdoor catering where portion-separation is needed. Growth of packaged takeaway meals and ready-to-eat segments drives additional uptake for compartmental products, but plain plates continue to lead due to lower price and stronger retail availability.

- For instance, High-throughput industrial paper-plate converting lines are engineered for efficiency, with advanced machinery often producing between 60 to 150 plain plates per minute (approximately 3,000 to 9,000 plates per hour), often featuring automated stacking for retail multipacks.

By Price:

Low-priced disposable plates account for the largest market share, supported by bulk consumption across public gatherings, food-service vendors, street food operators, and household events. Low-cost products remain popular in emerging economies where affordability drives volume sales. Medium-priced options are expanding, especially within biodegradable and premium paper categories used by cafes, corporate offices, and quick-service restaurants. High-priced plates—often made from aluminum, sugarcane bagasse, and wheat straw—serve niche customers seeking compostable or premium tableware. However, the low-price category continues to dominate due to mass adoption and strong distribution across offline retail channels.

Key Growth Drivers

Growing Shift Toward Sustainable and Biodegradable Tableware

Global demand for eco-friendly tableware continues to rise. Many consumers choose paper, bagasse, wheat straw, and leaf-based plates instead of single-use plastic. Governments also ban or restrict plastic food-service items in public and commercial spaces. These rules encourage food chains, hotels, and caterers to replace plastic plates with sustainable options. Brands promote compostable labels and green packaging to attract responsible buyers. Large events and corporate cafeterias also switch to greener plates to meet sustainability targets. As a result, paper plates lead the market due to low cost, faster decomposition, and high availability. The shift toward green food-service goods remains a long-term growth driver.

- For instance, Fast Plast manufacturers produce molded areca leaf plates with a typical thickness between 1 and 3 millimeters, enabling strength without chemical coatings

Rising Food Delivery and On-the-Go Consumption

The share of takeaway meals continues to grow due to fast urban lifestyles. Quick-service restaurants, cloud kitchens, bakery chains, and street vendors rely on disposable plates for fast serving. Busy consumers prefer ready-to-eat snacks that do not require washing or storage. Food aggregators expect hygienic, spill-resistant, single-use serving formats for outdoor and doorstep delivery. Commercial users buy plates in bulk to save time and reduce cleaning cost. Tourism and event catering also support volume demand. As travel, outdoor dining, and home deliveries continue to expand, disposable plates remain a preferred serving medium across cities and suburban regions.

- For instance, Huhtamaki supplies smooth molded-fiber (SMF) products, including trays and lids (and potentially plates), in Europe for foodservice applications, which can include airline catering units.

Growing Penetration in Institutional Catering and Mass Gatherings

Schools, canteens, corporate offices, railway catering, hospitals, and government events rely on disposable tableware for hygiene and fast service. Bulk buyers prefer lightweight plates that lower water use, labor needs, and cleaning time. Events such as religious gatherings, weddings, festivals, and community meals push seasonal volume sales. Large gatherings adopt low-cost paper and plastic plates that support quick food distribution. When hygiene rules tightened across public dining, demand for single-use food-contact products increased. The institutional sector continues to adopt paper plates due to safety, easy disposal, and strong cost advantage.

Key Trends & Opportunities

Premium Compostable and Plant-Based Plates Gain Momentum

Brands introduce products made from bagasse, rice husk, bamboo fiber, and palm leaves. These plates offer higher strength and a natural appearance. Hotels and eco-friendly restaurants use them to enhance brand identity. Many buyers pay a higher price for safe, chemical-free, and plastic-free options. Retail chains promote compostable plates as sustainable lifestyle goods. Product innovation also improves heat resistance, oil resistance, and structural strength. This segment creates opportunities for manufacturers that invest in material science and green certifications. Growing awareness about climate impact will continue to support high-value, plant-based offerings.

- For instance, Huhtamaki’s molded fiber plates are certified to withstand oven heating up to 220°C while remaining grease- and oil-resistant for hot meals.

Growth of Private Labels and Custom Branding

Retailers and food chains launch private-label disposable plates with custom prints and premium finishes. Branding on plates helps restaurants and cafes improve identity and marketing recall. Bulk buyers demand customized shapes, thickness, and impressions. Printing technology supports food-safe inks and biodegradable coatings. This trend creates value for manufacturers that offer low-cost customization and high-volume output. E-commerce platforms also showcase custom printed plates for birthdays, weddings, and corporate events. As consumers shift to personalized products, custom printing becomes a profitable opportunity for suppliers.

Key Challenges

Environmental Waste and Recycling Limitations

Although paper plates are biodegradable, many products include plastic coatings and chemical additives. These coatings delay breakdown and complicate recycling. Waste management systems struggle to separate food-soiled paper from clean recyclables. Many regions lack composting plants that can handle large volumes of used disposable tableware. Plastic plates add further load to landfills and waste streams. Governments monitor single-use waste and may impose taxes, bans, or extended producer responsibilities. Suppliers must invest in cleaner materials, certifications, and better disposal messaging to manage this challenge.

Price Pressure and Raw Material Volatility

Producers rely on wood pulp, coatings, aluminum sheets, and plastic resins. Fluctuating raw material prices make pricing unpredictable. Low-cost manufacturers dominate retail shelves, which increases competition. Premium biodegradable plates cost more than standard paper or plastic, which limits mass adoption in price-sensitive regions. Commercial buyers such as caterers and street vendors focus on lowest unit price. As a result, margins can shrink, especially for small producers. Manufacturers target efficiency through automation, bulk sourcing, and material optimization to protect profitability.

Regional Analysis

North America

North America holds the highest market share, supported by the strong presence of quick-service restaurants, large supermarkets, and structured food delivery networks. The United States leads consumption due to high disposable income and strong preference for takeaway meals. Paper plates dominate in this region as consumers and retailers adopt eco-friendly serving options and follow plastic reduction policies. Catering companies, school cafeterias, and outdoor events continue to buy in bulk. The region also supports demand for compostable leaf and bagasse plates, driven by sustainability goals set by food chains and hospitality brands.

Europe

Europe accounts for a significant market share, driven by strict environmental regulations and strong consumer awareness of sustainability. Many countries restrict single-use plastic items, encouraging restaurants and retail buyers to switch to paper and bio-based materials. Germany, France, and the United Kingdom lead consumption due to large food-service sectors and strong retail distribution. Premium plant-fiber plates and custom-printed offerings gain traction across cafes, bakery chains, and catering agencies. The region continues to support innovation in recyclable coatings and food-safe inks, helping manufacturers introduce plastic-free designs.

Asia-Pacific

Asia-Pacific holds a growing market share, supported by rapid urbanization, population expansion, and high volume consumption across street food, catering, and delivery services. India and China drive bulk demand due to strong outdoor food culture and rising quick-service restaurant penetration. Low-priced paper and plastic plates dominate sales in informal and retail markets. Manufacturers scale production to serve local distributors and wholesalers in festival seasons and mass gatherings. Sustainability adoption is slower than Western regions, yet the shift toward biodegradable materials accelerates due to government campaigns and urban consumer awareness.

Latin America

Latin America maintains a moderate market share, driven by expansion of neighborhood eateries, food carts, local bakeries, and quick meals. Brazil and Mexico lead regional demand, supported by large populations and strong tourism activity. Cost-effective paper and plastic plates remain common for residential and outdoor uses. Retail chains promote multi-pack plates for parties, events, and takeaway meals. Environmental pressure increases interest in compostable options, but price sensitivity still limits high-value categories. Growing investment in retail packaging and food delivery platforms helps expand distribution and product visibility across urban markets.

Middle East & Africa

The Middle East & Africa region shows steady market share growth, supported by rising takeaway demand, commercial catering, and hospitality expansion. The United Arab Emirates and Saudi Arabia lead consumption due to large tourism and event industries. Hotels and food chains adopt high-quality disposable plates for hygiene and convenience. Affordable paper and plastic products drive sales across street vendors, parties, and institutional meals. Interest in biodegradable materials grows, but adoption remains in early phases due to higher cost. Retail outlets and wholesalers continue to push bulk-pack sales for residential and commercial uses.

Market Segmentations:

By Product Type

- Plastic plates

- Aluminum plates

- Paper plates

- Others (leaf plates, wheat straw plates, etc.)

By Design

By Price

By End Use

- Residential

- Commercial

- Food & beverage

- Hotels and cafes

- Hospitality and events

- Others (quick-service restaurants, etc.)

By Distribution Channel

- Company websites

- E-commerce

- Supermarkets/Hypermarkets

- Specialty stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The disposable plates market remains moderately fragmented, with a mix of global manufacturers, private-label brands, and regional producers competing across price and material categories. Leading companies focus on biodegradable paper and plant-based products to align with sustainability laws and consumer expectations. Retailers and food chains increasingly collaborate with private-label suppliers to source customized and bulk plates at lower cost. Large manufacturers invest in automation, recyclable coatings, stronger fiber blends, and food-safe printing to improve durability and brand appeal. Small producers dominate low-cost paper and plastic segments, especially in emerging economies, where affordability drives volume. Online platforms expand competition by enabling direct-to-consumer sales and easier access to customized designs. Industry players also monitor regulations related to plastic bans, compostability standards, and food-contact safety, reshaping innovation and product strategies across markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fast Plast

- Huhtamaki

- D&W Fine Pack

- International Paper

- Hotpack Group

- Genpak

- Duni

- Dopla

- Georgia-Pacific

- Dart Container Corporation

Recent Developments

- In January 2025, Huhtamaki announce the launch of the recyclable single coated paper cups ProDairy, which are tailored for yogurt and dairy. Yogurt is a food product with stringent food safety demands. This extremely functional and innovative packaging solution fulfills all the demands and provides a lower polymer content than conventional alternative products. With less than 10% plastic content throughout its entire product range, it is completely recyclable in Europe.

- In January 2023, Stora Enso finalized the acquisition of Netherland-based De Jong Packaging Group. The acquisition will strongly enhance Stora Enso’s market position in European packaging markets and enable an entry to the Netherlands, Belgium, Germany and UK’s corrugated packaging market. The acquisition will result in Stora Enso’s Packaging Solutions division enhancing its capacity for corrugated packaging by around 1,200 million m2 to over 2,000 million m2, subject to the development projects by De Jong Packaging Group.

Report Coverage

The research report offers an in-depth analysis based on Product type, Design, Price, End use, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and compostable plates will continue to rise across commercial and residential use.

- Paper and plant-fiber plates will gain stronger adoption as governments restrict single-use plastic items.

- Private-label brands will expand through supermarkets and e-commerce platforms offering bulk and custom options.

- Food delivery and takeaway services will keep driving high consumption in urban regions.

- Manufacturers will invest in recyclable coatings and higher strength fiber blends to improve product quality.

- Custom printing for events, cafes, and restaurant branding will create new revenue opportunities.

- Low-priced products will remain popular in developing regions due to bulk institutional demand.

- Automation in production will help companies reduce cost and manage pricing pressure.

- Retail packaging formats and multi-pack offerings will increase visibility in supermarkets and online channels.

- Sustainability certifications and clean-label materials will become a key factor in buyer preference.