Market Overviews

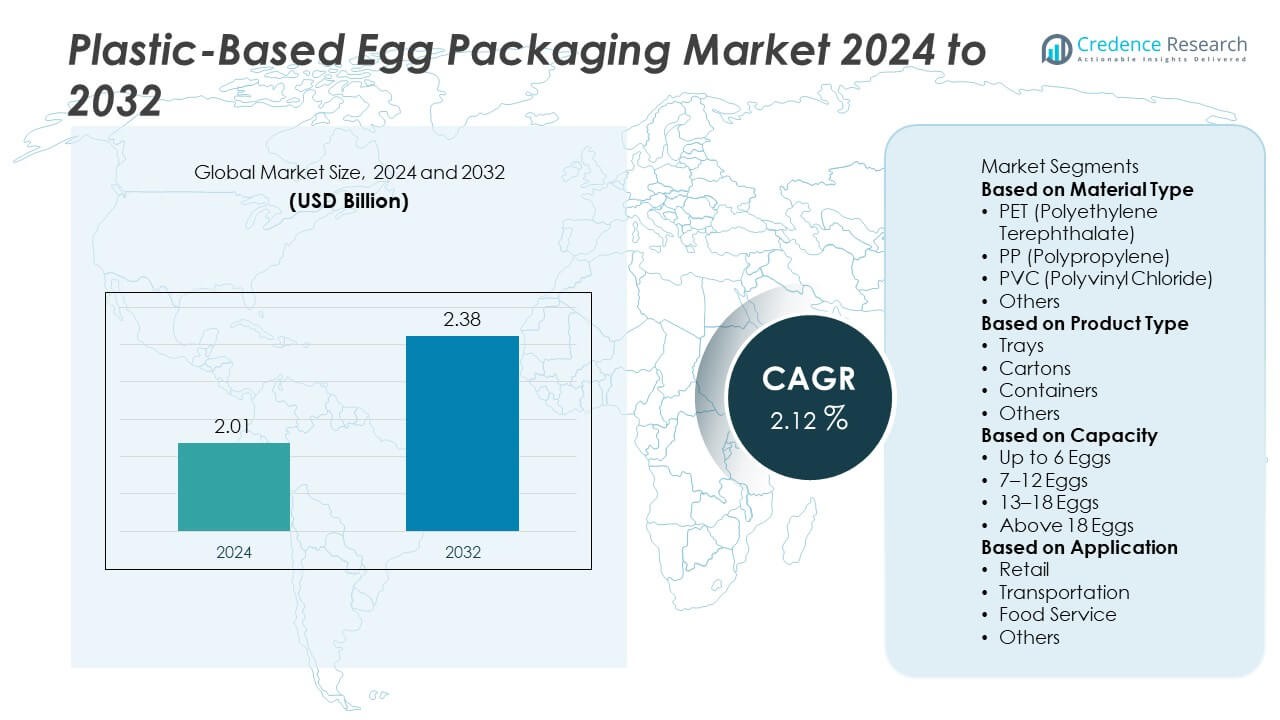

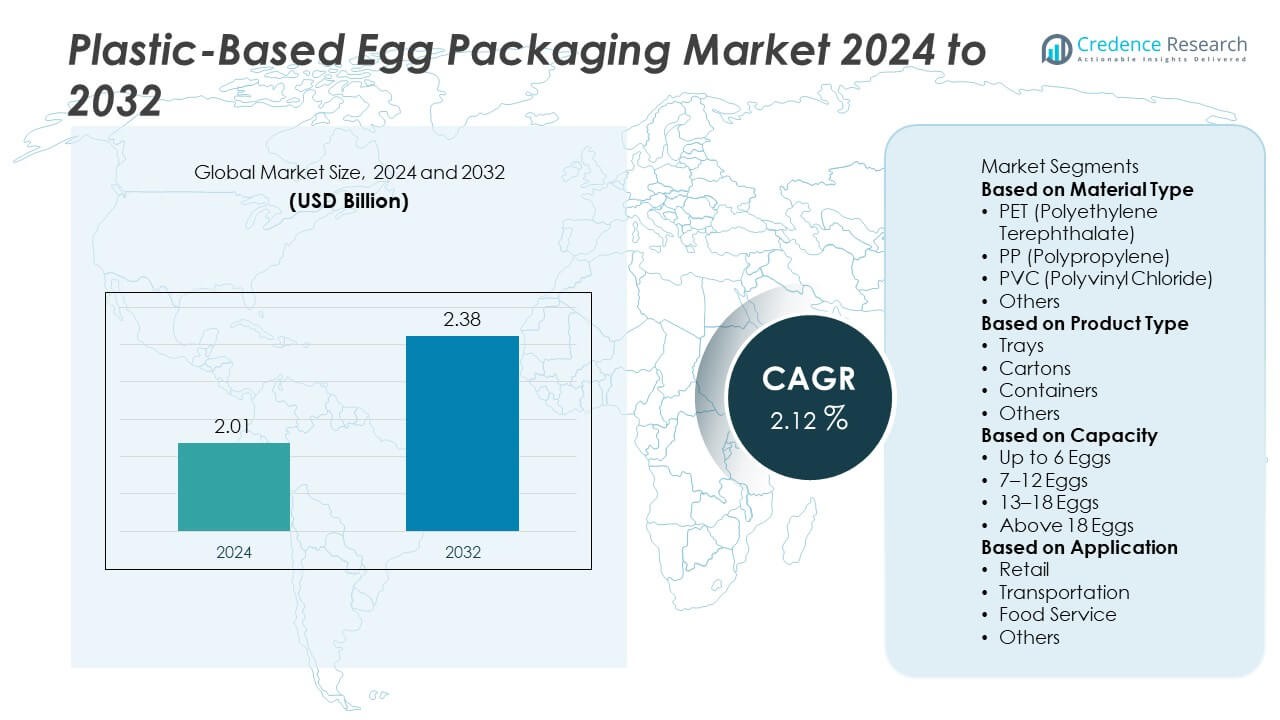

The Plastic-Based Egg Packaging Market was valued at USD 2.01 billion in 2024 and is projected to reach USD 2.38 billion by 2032, expanding at a CAGR of 2.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic-Based Egg Packaging Market Size 2024 |

USD 2.01 Billion |

| Plastic-Based Egg Packaging Market, CAGR |

2.12% |

| Plastic-Based Egg Packaging Market Size 2032 |

USD 2.38 Billion |

The Plastic-Based Egg Packaging Market is led by major players including Huhtamaki Oyj, DFM Packaging Solutions, CKF Inc., Hartmann Packaging, Ovotherm International GmbH, Pactiv Evergreen Inc., Tekni-Plex Inc., Placon Corporation, Sanovo Technology Group, and Eggs Cargo System (Gi-Ovo B.V.). These companies dominate through advanced packaging technologies, strong global distribution, and a focus on recyclable plastic materials. Asia-Pacific emerged as the leading region with a 37.9% market share in 2024, driven by growing poultry production, rising egg consumption, and expanding retail infrastructure. Europe followed with a 28.6% share, supported by stringent sustainability regulations and strong recycling initiatives, while North America accounted for 21.8%, driven by high demand for durable, food-safe packaging and well-established cold-chain logistics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plastic-Based Egg Packaging Market was valued at USD 2.01 billion in 2024 and is projected to reach USD 2.38 billion by 2032, growing at a CAGR of 2.12%.

- Rising egg consumption and the need for durable, hygienic, and lightweight packaging drive demand, with PET material leading the segment with a 46.8% share.

- Key trends include the growing shift toward recyclable and rPET packaging, technological advances in thermoforming, and adoption of sustainable plastic alternatives.

- Leading companies such as Huhtamaki Oyj, DFM Packaging Solutions, and Ovotherm International GmbH focus on innovation, strategic partnerships, and sustainability-driven designs to strengthen competitiveness.

- Asia-Pacific leads with a 37.9% share, followed by Europe (28.6%) and North America (21.8%), supported by strong poultry production, expanding retail sectors, and increasing regulatory focus on eco-friendly packaging solutions.

Market Segmentation Analysis:

By Material Type

The PET (Polyethylene Terephthalate) segment dominated the plastic-based egg packaging market in 2024 with a 46.8% share. PET packaging offers high transparency, impact resistance, and recyclability, making it the preferred material for egg cartons and trays. Its lightweight structure ensures better protection during transport and reduces breakage risk. Growing consumer preference for sustainable and food-safe materials supports PET adoption. The PP and PVC segments follow, driven by their cost efficiency and durability, particularly in regions with high transportation volumes and extended supply chains.

- For instance, Ovotherm International GmbH produces PET egg packs made from 100% post-consumer recycled PET, achieving an annual recycling volume of 25,000 tons of plastic waste, significantly reducing carbon emissions across its European production lines.

By Product Type

The cartons segment led the market in 2024 with a 52.3% share, primarily due to its extensive use in retail packaging and ease of stacking. Plastic cartons provide strong protection and visibility, improving product appeal in supermarkets and convenience stores. The trays segment also gained traction in bulk and transport applications due to their lightweight design and low material usage. Manufacturers are developing eco-friendly, recyclable plastic cartons to meet growing sustainability demands from retailers and regulatory authorities.

- For instance, Pactiv Evergreen Inc. manufactures Dolco ProPlus egg cartons using 25% post-consumer recycled polystyrene, ensuring durability while recycling over 3 million kilograms of recovered material annually to enhance circular economy efforts in North America.

By Capacity

The 7–12 eggs capacity segment held the largest market share of 58.6% in 2024, supported by its dominance in household and retail packaging. This capacity range is standard for supermarkets and offers an ideal balance between convenience, size, and cost. Rising global egg consumption and expanding modern retail formats further boost demand for this packaging type. Smaller packs (up to 6 eggs) are growing in popularity in urban markets, while larger packs above 18 eggs cater to food service and bulk transportation sectors emphasizing storage efficiency.

Key Growth Drivers

Rising Global Egg Consumption

The increasing global demand for eggs as an affordable and protein-rich food source drives the plastic-based egg packaging market. Expanding poultry production and urban consumption trends boost the need for reliable, protective packaging. Plastic packaging provides excellent durability and hygiene, reducing breakage and contamination during transport. Retail expansion and organized food distribution channels further strengthen market growth across both developed and emerging economies.

- For instance, Sanovo Technology Group introduced automated egg-handling and packaging systems capable of processing up to 180,000 eggs per hour, integrating robotic stacking and cleaning modules to minimize contamination and damage during large-scale distribution.

Shift Toward Recyclable and Lightweight Packaging

Manufacturers are increasingly adopting recyclable plastics like PET to address environmental concerns and comply with sustainability regulations. Lightweight plastic packaging reduces transport costs and carbon emissions while maintaining strength and product safety. This shift enhances material efficiency and aligns with circular economy goals. The demand for eco-friendly, reusable, and transparent packaging options continues to reshape product innovation in the global market.

- For instance, Huhtamaki Oyj launched advanced Futuro fiber-based egg cartons using 100% recycled content that are 100% plastic-free and an alternative to plastic cartons, with a flapless design that makes the cartons lighter than standard fiber cartons.

Expansion of Organized Retail and E-commerce

Growth in supermarkets, hypermarkets, and online grocery platforms has significantly increased the visibility and accessibility of eggs in packaged formats. Plastic-based cartons and trays offer better display appeal, branding options, and protection during shipping. Rising consumer preference for hygienically packed food items, especially after the pandemic, supports this expansion. Improved cold-chain logistics and retail packaging standards further drive demand across developed and developing regions.

Key Trends & Opportunities

Adoption of Sustainable Plastic Materials

The transition toward recyclable and bio-based plastics creates major opportunities for market players. PET and biodegradable polymer packaging solutions are gaining popularity due to their reduced environmental impact. Companies are investing in rPET (recycled PET) production to lower dependency on virgin materials. This trend supports brand positioning as environmentally responsible and appeals to eco-conscious consumers and retailers globally.

- For instance, Tekni-Plex Inc. expanded its Dolco Packaging division with an advanced polystyrene recycling line capable of reprocessing up to 4,500 tons of post-consumer material annually, allowing the production of food-safe egg cartons that meet FDA compliance for recycled-content plastics in direct food contact applications.

Advancements in Packaging Design and Manufacturing

Technological improvements in thermoforming and injection molding are enabling the production of lighter, stronger, and more efficient egg packaging. Manufacturers are integrating tamper-proof seals, improved ventilation, and transparent lids for better visibility and safety. Custom designs enhance branding and differentiate products on retail shelves. These innovations drive premiumization and create competitive advantages for packaging producers.

- For instance, Placon Corporation developed Ecostar® RPET packaging with ultra-thin thermoformed walls, which allowed for material cost reductions and maintained structural integrity across automated filling and stacking operations.

Key Challenges

Environmental Concerns and Regulatory Restrictions

Stringent regulations on plastic waste and single-use materials pose major challenges to market growth. Governments across Europe and North America are imposing restrictions on non-recyclable plastics, compelling producers to switch to alternative materials. Compliance with extended producer responsibility (EPR) norms and recycling mandates increases operational costs. These sustainability pressures push companies to invest heavily in eco-friendly material development and waste management infrastructure.

Fluctuating Raw Material Prices

Volatility in crude oil and resin prices affects the cost of producing plastic-based packaging. The dependency on petroleum-based polymers like PET and PP makes manufacturers vulnerable to price fluctuations in global energy markets. Rising raw material costs can squeeze profit margins, especially for small and medium enterprises. To counter this, companies are focusing on efficient material utilization and exploring recycled content to maintain profitability and supply stability.

Regional Analysis

Asia-Pacific

Asia-Pacific dominated the plastic-based egg packaging market with a 37.9% share in 2024, driven by rapid growth in poultry farming and egg consumption across China, India, and Southeast Asia. Expanding retail infrastructure and demand for hygienically packaged food products are boosting plastic packaging adoption. The rise in disposable incomes and urban population further supports retail egg sales. Manufacturers in the region are investing in lightweight and recyclable plastic packaging to align with sustainability goals, enhancing market competitiveness and production capacity.

Europe

Europe held a 28.6% share of the plastic-based egg packaging market in 2024. The region’s growth is supported by strong consumer preference for sustainable, food-safe, and recyclable packaging materials. Countries such as Germany, France, and the Netherlands lead due to their advanced poultry production and strict packaging standards. Regulatory support for rPET and circular economy practices encourages innovation in eco-friendly packaging. The shift toward replacing traditional materials with recyclable plastics continues to fuel steady market expansion across European retail and logistics sectors.

North America

North America accounted for a 21.8% share of the plastic-based egg packaging market in 2024. The United States and Canada lead due to high packaged food consumption and well-established cold-chain logistics. Strong retail penetration and e-commerce growth have increased demand for durable, lightweight plastic cartons. The presence of leading packaging companies and adoption of advanced thermoforming technologies contribute to regional dominance. Ongoing investment in sustainable packaging materials, including recycled PET and biodegradable plastics, reflects the region’s shift toward environmentally responsible manufacturing practices.

Latin America

Latin America captured a 6.3% share of the plastic-based egg packaging market in 2024, supported by growing poultry production and urban population expansion. Brazil, Mexico, and Argentina are key contributors, driven by rising consumer preference for safe and cost-efficient packaging solutions. Retail expansion and improving supply chain infrastructure are increasing the adoption of plastic egg cartons. Local manufacturers are investing in low-cost recyclable plastics to enhance accessibility and meet emerging sustainability goals, supporting consistent market growth across the region.

Middle East & Africa

The Middle East & Africa region held a 5.4% share of the plastic-based egg packaging market in 2024. Market growth is fueled by expanding poultry farms, rising urbanization, and demand for hygienically packaged eggs in retail and food service sectors. Countries such as Saudi Arabia, South Africa, and the UAE are leading contributors, supported by investment in modern packaging facilities. The growing shift toward lightweight, moisture-resistant plastics and efforts to reduce post-harvest losses are further propelling market adoption across the region.

Market Segmentations:

By Material Type

- PET (Polyethylene Terephthalate)

- PP (Polypropylene)

- PVC (Polyvinyl Chloride)

- Others

By Product Type

- Trays

- Cartons

- Containers

- Others

By Capacity

- Up to 6 Eggs

- 7–12 Eggs

- 13–18 Eggs

- Above 18 Eggs

By Application

- Retail

- Transportation

- Food Service

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Plastic-Based Egg Packaging Market is characterized by the strong presence of leading companies such as Huhtamaki Oyj, DFM Packaging Solutions, CKF Inc., Hartmann Packaging, Ovotherm International GmbH, Pactiv Evergreen Inc., Tekni-Plex Inc., Placon Corporation, Sanovo Technology Group, and Eggs Cargo System (Gi-Ovo B.V.). These players compete through innovation, product sustainability, and expansion of eco-friendly packaging portfolios. Many are focusing on recyclable PET and lightweight plastic designs to reduce environmental impact and meet global sustainability standards. Strategic partnerships with poultry producers and retailers help strengthen distribution networks and market reach. Additionally, technological advancements in thermoforming and molding processes are enhancing product strength and cost efficiency. Companies are also investing in R&D to develop biodegradable and rPET-based packaging solutions, ensuring compliance with strict regulatory norms while maintaining product protection and visual appeal in both retail and transportation applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huhtamaki Oyj

- DFM Packaging Solutions

- CKF Inc.

- Hartmann Packaging

- Ovotherm International GmbH

- Pactiv Evergreen Inc.

- Tekni-Plex Inc.

- Placon Corporation

- Sanovo Technology Group

- Eggs Cargo System (Gi-Ovo B.V.)

Recent Developments

- In August 2025, Huhtamäki Oyj marked 100 days since acquiring its egg-packaging facility in Zellwood, Florida, reinforcing its presence in the moulded fibre egg carton segment in the U.S. market.

- In January 2025, Pactiv Evergreen Inc. announced that all its moulded-fibre egg cartons and filler flats across multiple facilities have earned the FSC®-Recycled certification, verifying 100 % recycled content in those products.

- In August 2024, Hartmann Packaging A/S launched a major expansion of its Canadian facility aimed at increasing capacity for egg-packaging production (moulded-fibre trays and cartons).

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing steadily with rising global egg consumption.

- Demand for recyclable and eco-friendly plastic materials will accelerate innovation.

- PET-based packaging will maintain dominance due to strength and recyclability.

- Lightweight and transparent designs will gain traction in retail applications.

- Automation in packaging production will enhance efficiency and reduce costs.

- Asia-Pacific will remain the leading region with strong poultry industry growth.

- Europe will expand with stricter sustainability and recycling regulations.

- North America will advance through technological innovation and cold-chain logistics.

- Manufacturers will focus on biodegradable and rPET-based product development.

- Strategic collaborations with poultry producers and retailers will boost market competitiveness.