Market Overview:

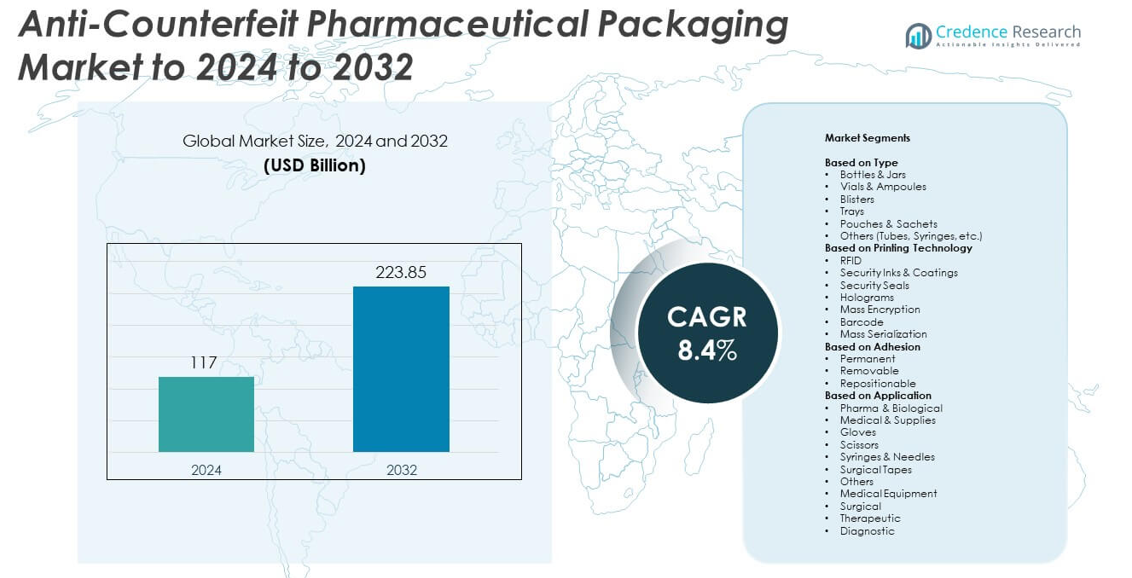

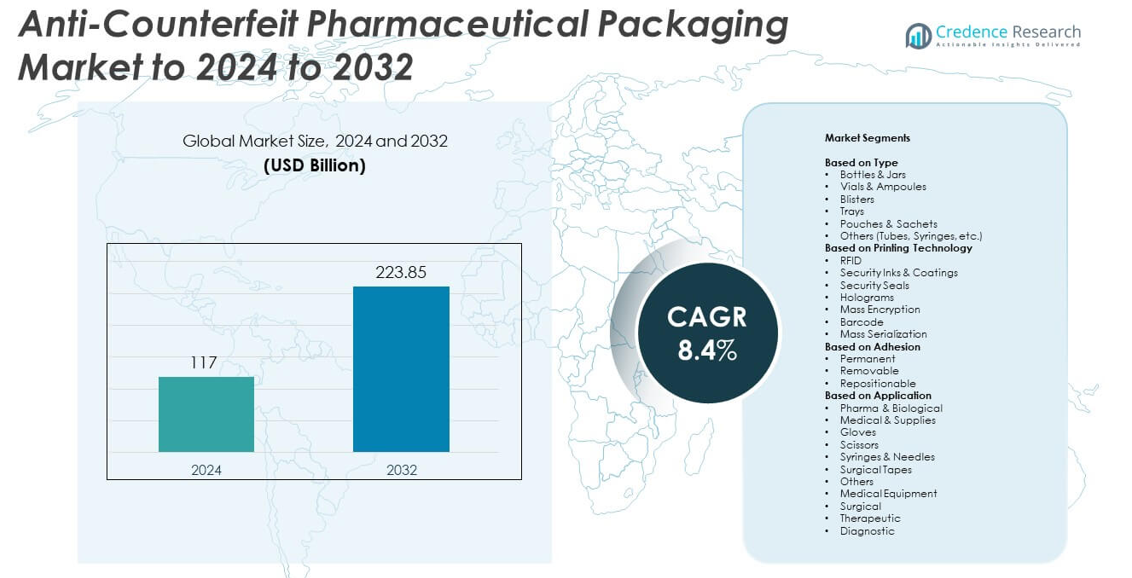

Anti-Counterfeit Pharmaceutical Packaging Market size was valued USD 117 billion in 2024 and is anticipated to reach USD 223.85 billion by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Counterfeit Pharmaceutical Packaging Market Size 2024 |

USD 117 billion |

| Anti-Counterfeit Pharmaceutical Packaging Market, CAGR |

8.4% |

| Anti-Counterfeit Pharmaceutical Packaging Market Size 2032 |

USD 223.85 billion |

The anti-counterfeit pharmaceutical packaging market is driven by key players such as 3M, Avery Dennison, Zebra Technologies, CCL Industries, and SICPA Holdings, among others, who are leading advancements in serialization, smart labeling, and secure printing technologies. These companies focus on innovation to enhance supply chain transparency and combat the growing issue of counterfeit drugs. North America dominates the market with around 34.2% share, supported by strict regulatory compliance and widespread use of digital authentication systems. Europe follows with 27.6% share, while Asia Pacific, with 22.8%, is the fastest-growing region due to rising pharmaceutical production and regulatory tightening.

Market Insights

- The anti-counterfeit pharmaceutical packaging market was valued at USD 117 billion in 2024 and is projected to reach USD 223.85 billion by 2032, expanding at a CAGR of 8.4%.

- Increasing global regulations enforcing serialization and traceability are driving market growth, as governments and pharmaceutical companies prioritize supply chain security and drug authenticity.

- Technological advancements, including RFID, blockchain, and smart labeling, are key trends transforming packaging transparency and enabling real-time product verification.

- The market is highly competitive with companies focusing on innovation, sustainability, and strategic partnerships to strengthen authentication solutions and expand regional presence.

- North America leads with 34.2% share, followed by Europe at 27.6%, while Asia Pacific holds 22.8% and is the fastest-growing region, driven by rising pharmaceutical production and tightening regulatory frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Blisters dominate the anti-counterfeit pharmaceutical packaging market, accounting for nearly 32.8% share in 2024. Their leadership stems from widespread use in solid dosage packaging and high adaptability to advanced authentication features. The segment benefits from integration of tamper-evident seals, holographic films, and serialized QR codes, enhancing product traceability across distribution channels. Bottles and vials follow closely due to increasing adoption in biologics and liquid formulations, while trays and pouches gain traction in personalized and small-batch packaging applications requiring compact and secure formats.

- For instance, Huhtamaki said European pharma flexible-pack sales were €1.1 billion in 2020, with blister packaging at about 80% of that category, supporting blister dominance in tablets.

By Printing Technology

Barcode technology leads the market, holding around 27.4% share in 2024, driven by its cost efficiency and compatibility with global serialization mandates. The growing enforcement of regulations like the EU Falsified Medicines Directive (FMD) and U.S. Drug Supply Chain Security Act (DSCSA) has accelerated barcode adoption for unit-level tracking. RFID and hologram technologies are expanding rapidly, providing high-end security and real-time product authentication. Advancements in mass encryption and security inks further strengthen protection against counterfeiting in complex pharmaceutical supply chains.

- For instance, TraceLink reported 26,070 companies enabled for DSCSA with 47,000+ EPCIS links for item-level data exchange.

By Adhesion

Permanent adhesion dominates this segment with approximately 58.6% share in 2024, driven by its robust bonding and tamper-evident properties crucial for regulatory compliance. Permanent adhesives ensure packaging integrity during long storage and transport conditions, reducing the risk of unauthorized label removal. Removable and repositionable types are gaining moderate adoption for temporary identification and secondary labeling used in clinical and research applications. Rising focus on sustainable and solvent-free adhesives is influencing material innovation and driving manufacturers toward eco-compliant solutions.

Key Growth Drivers

Stringent Regulatory Mandates Promoting Serialization and Traceability

Global regulations such as the U.S. Drug Supply Chain Security Act (DSCSA) and the EU Falsified Medicines Directive (FMD) are key growth drivers in this market. These mandates require unique product identifiers and end-to-end traceability across pharmaceutical supply chains. As a result, drug manufacturers and packaging firms are increasingly integrating serialization and authentication systems like barcodes and RFID. Compliance with these laws enhances patient safety, improves inventory management, and strengthens overall supply chain transparency.

- For instance, EMVS connects 2,900+ MAHs, 4,000+ wholesalers, 115,000+ retail pharmacies, and 6,000+ hospital pharmacies across Europe.

Rising Incidence of Counterfeit Drugs in Global Supply Chains

The growing presence of counterfeit medicines in both developed and emerging economies is driving rapid adoption of anti-counterfeit packaging. The World Health Organization estimates that nearly 10% of medical products in low- and middle-income countries are falsified. This threat has encouraged pharmaceutical companies to invest in multi-layered packaging solutions combining holograms, security inks, and tamper-evident labels. These solutions safeguard brand reputation and ensure patient safety by preventing unauthorized replication and diversion of genuine drugs.

- For instance, SEA Vision states 1,500+ serialization lines use its systems for aggregation and notification up to authority level.

Technological Advancements in Smart and Digital Packaging

Emerging technologies such as smart labels, blockchain-enabled traceability, and embedded IoT sensors are transforming anti-counterfeit pharmaceutical packaging. These innovations enhance supply chain visibility and real-time product verification. Integration of digital authentication tools allows stakeholders to track the journey of each product unit from manufacturing to end-user delivery. As digitalization advances, technology-driven packaging solutions are becoming essential for manufacturers aiming to improve operational transparency and build consumer trust.

Key Trends & Opportunities

Adoption of AI and Blockchain in Supply Chain Verification

AI-powered data analytics and blockchain-based traceability systems are reshaping the anti-counterfeit landscape. These technologies enable immutable records of product movement, making counterfeiting detection faster and more reliable. Pharmaceutical firms are increasingly leveraging blockchain networks to verify product authenticity and reduce manual verification errors. This trend presents major opportunities for vendors developing secure, decentralized supply chain ecosystems aligned with regulatory compliance.

- For instance, the MediLedger DSCSA Pilot Project, which submitted its final report to the FDA in February 2020, involved leaders from 24 companies across the pharmaceutical supply chain, including major pharmaceutical companies and all three major U.S. wholesalers (McKesson, AmerisourceBergen, and Cardinal Health).

Sustainability Integration in Anti-Counterfeit Packaging Design

A growing shift toward eco-friendly packaging materials is creating new opportunities in this market. Manufacturers are developing biodegradable labels, recyclable security films, and solvent-free inks without compromising safety or traceability. Regulatory bodies and consumers are increasingly favoring sustainable packaging options that balance environmental responsibility with product protection. This transition offers packaging firms a competitive edge while meeting global sustainability goals.

- For instance, Bluesight (Kit Check) reports use in 900+ hospitals for medication tracking.

Key Challenges

High Implementation and Integration Costs

The deployment of advanced authentication technologies such as RFID, holograms, and digital watermarks involves significant upfront investment. Small and mid-sized pharmaceutical companies often struggle to absorb these costs, limiting widespread adoption. Additionally, integrating serialization and verification systems across existing production lines can disrupt workflows and increase operational complexity. These financial and technical constraints remain key challenges for market expansion.

Complexity in Global Supply Chain Coordination

Coordinating anti-counterfeit systems across diverse international supply chains presents considerable challenges. Variations in regulatory standards, data-sharing protocols, and serialization requirements among regions create inconsistencies. Pharmaceutical companies must ensure seamless interoperability between multiple stakeholders including manufacturers, distributors, and regulatory agencies. Addressing these coordination gaps is essential to establish a unified and secure global pharmaceutical supply network.

Regional Analysis

North America

North America leads the anti-counterfeit pharmaceutical packaging market with around 34.2% share in 2024. The region’s dominance stems from strong regulatory enforcement under the Drug Supply Chain Security Act and high adoption of serialization systems by major drug manufacturers. Widespread use of advanced technologies such as RFID and barcode tracking enhances product traceability. The presence of leading pharmaceutical firms and consistent investment in digital authentication tools further boost regional demand. Growing consumer awareness of drug authenticity continues to support long-term market expansion.

Europe

Europe holds approximately 27.6% share of the global anti-counterfeit pharmaceutical packaging market in 2024. The region benefits from strict compliance with the Falsified Medicines Directive, mandating serialization and tamper-proof packaging for all prescription drugs. Increasing emphasis on supply chain transparency and the widespread use of security labels and holograms strengthen market growth. Technological innovation in digital verification systems and the strong presence of multinational pharmaceutical companies contribute to Europe’s sustained leadership in packaging authentication solutions.

Asia Pacific

Asia Pacific accounts for about 22.8% share in 2024, emerging as the fastest-growing region in the anti-counterfeit pharmaceutical packaging market. Rapid expansion of the pharmaceutical sector in China, India, and Japan is fueling demand for secure packaging technologies. Governments are introducing stricter labeling and serialization regulations to combat counterfeit drugs. Local packaging manufacturers are investing in smart labels and track-and-trace systems, driving regional competitiveness. Increasing healthcare expenditure and rising export of generic medicines further accelerate growth in the region.

Latin America

Latin America captures nearly 8.6% share in 2024, supported by increasing awareness of counterfeit medicines and strengthening healthcare infrastructure. Countries such as Brazil and Mexico are adopting regulatory frameworks similar to those in developed markets, promoting serialization and secure labeling. The region is witnessing gradual integration of barcodes, QR codes, and holographic packaging across pharmaceutical distribution channels. Ongoing government initiatives to modernize supply chain security and rising private investment in drug packaging innovation contribute to steady market expansion.

Middle East & Africa

The Middle East & Africa region holds around 6.8% share in the global anti-counterfeit pharmaceutical packaging market in 2024. Market growth is driven by the rising influx of counterfeit drugs in import-dependent economies and increasing government enforcement of traceability measures. Adoption of tamper-evident labels and serialized packaging is gaining traction among local pharmaceutical manufacturers. The Gulf Cooperation Council countries, in particular, are investing in advanced packaging technologies to ensure medicine authenticity and strengthen pharmaceutical trade security across borders.

Market Segmentations:

By Type

- Bottles & Jars

- Vials & Ampoules

- Blisters

- Trays

- Pouches & Sachets

- Others (Tubes, Syringes, etc.)

By Printing Technology

- RFID

- Security Inks & Coatings

- Security Seals

- Holograms

- Mass Encryption

- Barcode

- Mass Serialization

By Adhesion

- Permanent

- Removable

- Repositionable

By Application

- Pharma & Biological

- Medical & Supplies

- Gloves

- Scissors

- Syringes & Needles

- Surgical Tapes

- Others

- Medical Equipment

- Surgical

- Therapeutic

- Diagnostic

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The anti-counterfeit pharmaceutical packaging market features prominent players such as 3M, Zebra Technologies, Avery Dennison, CCL Industries, Systech, SICPA Holdings, Stevanato Group, Authentix Inc., TruTag Technologies, AlpVision, ATL Security Label Systems, and Alien Technology. These companies focus on developing advanced authentication technologies, including serialized barcoding, holographic labeling, and RFID-enabled smart packaging. Strategic partnerships with pharmaceutical manufacturers and regulatory authorities enhance product integrity and traceability across supply chains. Continuous investment in digital printing, blockchain integration, and material innovation drives competitive differentiation. Firms are emphasizing scalable, cost-effective, and environmentally sustainable solutions to meet evolving compliance standards. The competitive environment is further shaped by acquisitions and technology collaborations aimed at expanding geographic reach and digital capabilities. Increasing demand for multi-layered security packaging and real-time verification platforms continues to foster innovation and intensify competition among both established global firms and emerging technology providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M

- Zebra Technologies

- Avery Dennison

- CCL Industries

- Systech

- SICPA Holdings

- Stevanato Group

- Authentix Inc.

- TruTag Technologies

- AlpVision

- ATL Security Label Systems

- Alien Technology

Recent Developments

- In 2025, Stevanato Group expanded its drug delivery systems capacity to strengthen its global integrated offerings, which include advanced primary packaging solutions for pharmaceuticals.

- In 2024, Avery Dennison introduced the AD 2Metal Rock M781 RFID tag for difficult-to-tag objects, including those in the pharmaceutical industry.

- In 2023, Systech launched the next generation of its UniSecure® platform, a major anti-counterfeiting product security upgrade.

Report Coverage

The research report offers an in-depth analysis based on Type, Printing Technology, Adhesion, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing global enforcement of serialization and traceability laws.

- Smart packaging technologies such as RFID and NFC will become standard for drug authentication.

- Integration of blockchain platforms will enhance supply chain transparency and reduce counterfeit risks.

- Demand for eco-friendly and recyclable security materials will gain strong traction among manufacturers.

- Pharmaceutical companies will adopt AI-based data analytics for real-time product verification.

- Emerging economies will experience rapid adoption of digital labeling and smart tracking systems.

- Collaborative efforts between governments and industry players will strengthen anti-counterfeit frameworks.

- Continuous innovation in holographic films and tamper-evident solutions will enhance packaging reliability.

- Adoption of cloud-based serialization platforms will improve data management and compliance efficiency.

- The market will see increasing mergers and technology partnerships to accelerate innovation and cost efficiency.