Market Overview:

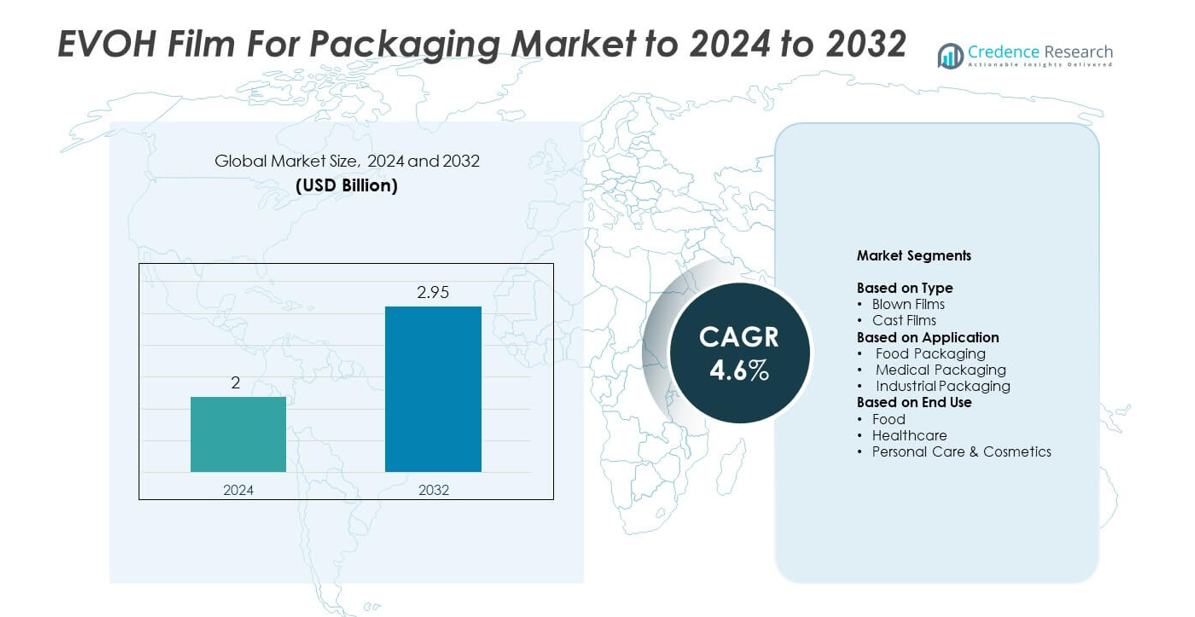

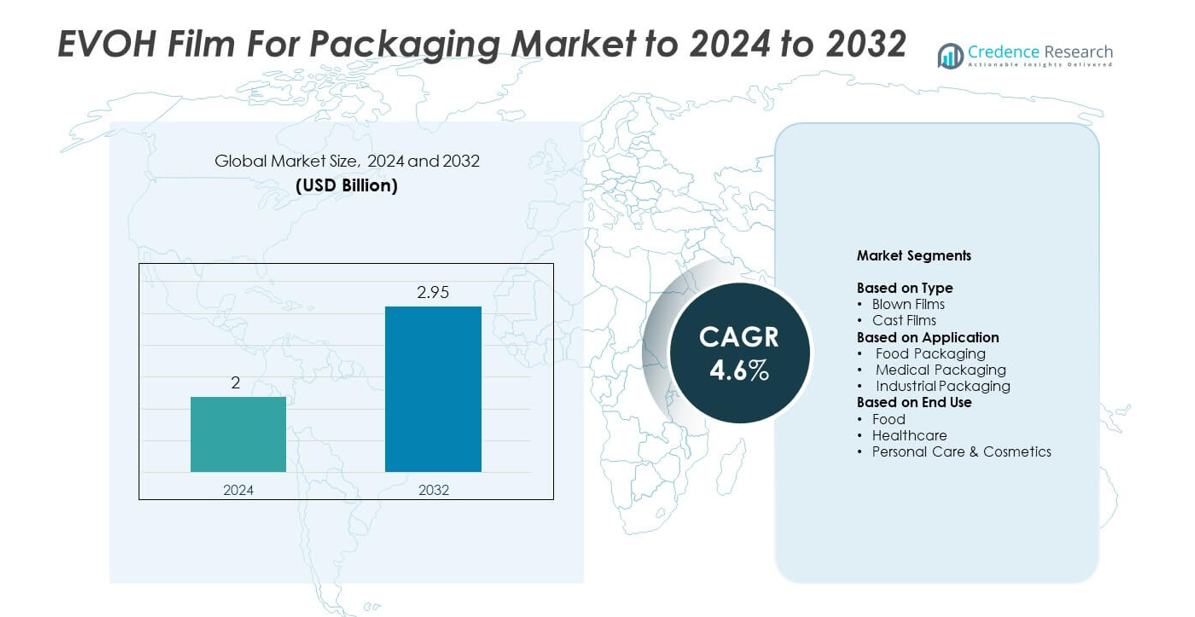

EVOH Film for Packaging Market size was valued at USD 2 billion in 2024 and is anticipated to reach USD 2.95 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EVOH Film for Packaging Market Size 2024 |

USD 2 billion |

| EVOH Film for Packaging Market, CAGR |

4.6% |

| EVOH Film for Packaging Market Size 2032 |

USD 2.95 billion |

The EVOH film for packaging market includes major players such as Mitsubishi Chemical Corporation, Sealed Air Corporation, Kuraray Co., Ltd., Amcor plc, Schott AG, EVAL Europe N.V., Coveris Holdings S.A., Chang Chun Petrochemical Co., Ltd., The Nippon Synthetic Chemical Industry Co., Ltd., and Krones AG. These companies compete through advanced barrier technologies, recyclable multilayer structures, and expanded production capabilities. North America leads the market with a 32% share, driven by strong demand from food and healthcare packaging. Europe follows with a 29% share, supported by strict sustainability regulations, while Asia Pacific holds a 28% share, boosted by rapid growth in packaged food consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The EVOH film for packaging market reached USD 2 billion in 2024 and USD 2.95 billion in 2032 and will grow at a 4.6 % CAGR to 2032.

- Demand rises due to strong use in high-barrier food packaging, where the segment holds a 71 % share supported by long shelf-life needs.

- Key trends include growing adoption of recyclable mono-material structures and high-clarity multilayer films that enhance visibility and sustainability performance.

- Competition strengthens as major companies invest in advanced co-extrusion technology, lightweight designs, and improved oxygen-barrier formulations to expand global reach.

- North America leads with a 32 % share, followed by Europe at 29 % and Asia Pacific at 28 %, while blown films dominate the type segment with a 63 % share.

Market Segmentation Analysis:

By Type

Blown films dominate the type segment with a 63% share, driven by strong demand for multilayer structures with high oxygen-barrier strength. Blown EVOH films support excellent puncture resistance and stability, which makes them suitable for food packaging that requires extended shelf life. Flexible converters prefer blown formats due to better thickness control and compatibility with co-extrusion lines. Cast films grow steadily because they offer improved clarity for premium packaging, but their adoption remains lower. Rising preference for lightweight packaging strengthens the leadership of blown films across major applications.

- For instance, the Kuraray Eval™ F171B technical data sheet lists the oxygen transmission rate as approximately 0.3 cm³·20µm/m²·day·atm when measured under specific conditions of 20°C (68°F) and 65% relative humidity (RH).

By Application

Food packaging leads the application segment with a 71% share, supported by the rising need for barrier protection in meat, dairy, fresh produce, and ready-to-eat products. EVOH films help reduce oxidation and maintain product freshness, which drives strong use across multilayer pouches and trays. Medical packaging expands as sterile products require strong contaminant resistance, while industrial packaging grows in chemicals and electronics. Regulatory focus on food safety and reduced waste continues to reinforce the dominance of food packaging in this market.

- For instance, Amcor’s AmLite Ultra Recyclable film is a high-barrier, metal-free polyolefin film that uses a Silicon Oxide (SiOx) coating to provide exceptional barrier performance. The film demonstrates oxygen barrier values of less than 0.1 cm³/m²/day at 23 °C and 50% RH (Relative Humidity)

By End Use

Food remains the dominant end-use category with a 68% share, driven by rapid adoption of oxygen-barrier solutions in processed and chilled foods. Manufacturers choose EVOH films to extend product shelf life and support safe global distribution. Healthcare grows as sterile packaging requires consistent barrier performance, and personal care rises with demand for odor- and moisture-resistant films. Rising consumption of packaged meals and stronger retail supply chains support the strong position of food end users in the EVOH packaging ecosystem.

Key Growth Drivers

Rising Demand for High-Barrier Food Packaging

Consumers prefer packaged foods with longer freshness, which increases the need for strong oxygen-barrier materials. EVOH films support extended shelf life for meat, dairy, and ready-to-eat products. The growing processed food sector boosts adoption across multilayer pouches and trays. Retail expansion and stricter food safety norms also push companies to shift from traditional plastics to high-performance barrier films. This demand strengthens the position of EVOH films as essential materials in modern food packaging systems.

- For instance, the official technical data sheet for Soarnol® ET3803RB reports an oxygen permeability of 0.5 cm³·20µm/m²·day·atm at 20°C and 65% relative humidity.

Shift Toward Sustainable and Lightweight Packaging

Brand owners now prioritize materials that reduce environmental impact and support recycling. EVOH films help create lightweight multilayer structures with lower material usage while maintaining high protection levels. Their compatibility with reduced-plastic formats makes them attractive for eco-focused brands. Regulations on packaging waste further accelerate the shift toward recyclable flexible packaging. This transition drives higher consumption of EVOH films across food, healthcare, and personal care applications.

- For instance, Borealis verified that its Borcycle™ M PE + EVOH structures meet RecyClass PE-stream recyclability criteria with EVOH loading below 5 wt%, as published in RecyClass recyclability assessments.

Growing Use in Pharmaceutical and Medical Packaging

Sterile medical and pharmaceutical products require packaging with strong barrier stability. EVOH films meet these needs by blocking oxygen and contaminants, supporting safe transport and extended shelf life. Rising global healthcare demand increases the use of pouches, blister lidding, and sterile protection formats that rely on EVOH layers. Regulatory focus on quality and long-term product safety also drives adoption. This growth strengthens EVOH film’s role in critical healthcare packaging environments.

Key Trends and Opportunities

Expansion of Multilayer Flexible Packaging Solutions

Converters now invest in advanced co-extrusion lines to develop multilayer structures that balance strength, clarity, and barrier performance. EVOH films fit well into these systems, enabling improved formulation flexibility for food and medical products. Demand for resealable pouches, stand-up bags, and thermoformed trays increases the need for high-performance barrier layers. Growing interest in premium packaging enhances opportunities for EVOH-based designs across global markets.

- For instance, Reifenhäuser’s EVO Ultra Stretch technology enables up to 10:1 film stretching ratios, improving orientation and barrier uniformity in multilayer EVOH films, as published in its technical release.

Adoption of Recyclable and Mono-Material Structures

Sustainability initiatives encourage companies to redesign packaging using mono-material or recycling-friendly formats. EVOH films support these structures due to their low inclusion rates and compatibility with polyolefin-based systems. Industry efforts to meet recycling guidelines create new opportunities for EVOH-enabled pouches and trays. Collaboration between film manufacturers and resin suppliers also improves recyclability performance, opening new application areas.

- For instance, ExxonMobil conducted recycling trials with high-barrier full PE packaging solutions (utilizing Exceed™ S and EVOH) where the regrind was used in the production of new heavy-duty sacks. The test results showed that the new bags with 50% recycled content (PCR) exhibited key properties like dart impact and tear strength.

Growth of High-Clarity and Transparent Packaging

Brands increasingly adopt clear packaging to improve shelf visibility and support premium positioning. EVOH films offer strong transparency paired with barrier strength, making them suitable for fresh foods and high-value goods. Rising demand for visibility-enhancing packaging formats creates opportunities in chilled foods, snacks, and ready meals. This trend expands EVOH film usage in display-oriented packaging lines.

Key Challenges

Complexity of Recycling Multilayer Structures

Most EVOH-based films are part of multilayer structures that combine several polymers, making recycling challenging. Limited recycling infrastructure and varying regional guidelines restrict large-scale recovery. Efforts to reduce material complexity require advanced redesign and compatible resins. These constraints slow adoption in markets with strict sustainability demands. Overcoming this challenge requires technological improvements in material separation and collection systems.

High Material and Production Costs

EVOH films are costlier than conventional polymers because they require specialized resins and multilayer processing. These higher costs make adoption difficult for price-sensitive sectors and regions. Fluctuations in raw material prices also affect production economics. Manufacturers must balance performance benefits with cost constraints to maintain competitiveness. This challenge limits rapid scaling in applications that prioritize low-cost packaging solutions.

Regional Analysis

North America

North America holds a 32% share in the EVOH film for packaging market, supported by strong demand from food processing, healthcare, and ready-meal sectors. The region benefits from advanced manufacturing lines and high adoption of recyclable flexible packaging. Strict food safety regulations push companies to use high-barrier materials for shelf-life extension. Growth in chilled foods, meat packaging, and MAP trays strengthens EVOH usage across retail supply chains. Expanding pharmaceutical production further boosts demand for contamination-resistant films. Strong investments in sustainable multilayer structures help maintain North America’s leading position in this market.

Europe

Europe accounts for a 29% share of the EVOH film for packaging market, driven by strict sustainability targets and rising adoption of recyclable mono-material structures. Food producers use EVOH films widely in pouches, trays, and barrier liners to meet shelf-life requirements. The region’s advanced packaging standards encourage broader usage in premium and organic food categories. Healthcare applications also expand due to strong regulatory emphasis on product safety. Growing interest in lightweight packaging and reduced material usage supports continued market growth across major European economies.

Asia Pacific

Asia Pacific holds a 28% share and represents the fastest-growing region, supported by expanding food processing industries and rising consumption of packaged meals. Rapid urbanization and retail growth increase the need for high-barrier packaging across China, India, Japan, and Southeast Asia. Manufacturers adopt EVOH films to improve freshness in snacks, dairy, and ready-to-eat meals. Strong regional investment in packaging automation and multilayer film lines accelerates adoption. Pharmaceutical and personal care markets also expand their use of EVOH for contamination control and product stability.

Latin America

Latin America captures an 8% share of the EVOH film for packaging market, driven by rising demand for packaged meat, dairy, and processed foods. Growth in supermarket chains and chilled food products increases the need for high-barrier packaging. Local converters adopt multilayer films to extend shelf life and improve distribution efficiency across long transport routes. Expanding healthcare needs also support EVOH usage in sterile medical packaging. Economic improvements and greater emphasis on packaged convenience foods contribute to steady market expansion across key countries.

Middle East & Africa

Middle East and Africa hold a 3% share, supported by gradual growth in packaged foods and rising adoption of modern retail formats. Demand increases for high-barrier films used in dairy, snacks, and frozen foods as consumers shift toward ready-to-cook products. Healthcare packaging also expands with rising investments in pharmaceutical production. Limited local manufacturing capacity leads to higher imports of multilayer films, but regional packaging converters increasingly adopt EVOH to meet quality and shelf-life needs. Urban growth and rising food safety awareness contribute to stable expansion in this market.

Market Segmentations:

By Type

By Application

- Food Packaging

- Medical Packaging

- Industrial Packaging

By End Use

- Food

- Healthcare

- Personal Care & Cosmetics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the EVOH film for packaging market features leading companies such as Mitsubishi Chemical Corporation, Sealed Air Corporation, Kuraray Co., Ltd., Amcor plc, Schott AG, EVAL Europe N.V., Coveris Holdings S.A., Chang Chun Petrochemical Co., Ltd., The Nippon Synthetic Chemical Industry Co., Ltd., and Krones AG. The market remains highly concentrated, with major participants investing in advanced co-extrusion technologies, recyclable barrier structures, and high-clarity film innovations to strengthen their portfolios. Companies focus on expanding manufacturing capacities, improving resin performance, and developing lightweight multilayer solutions to meet rising demand across food, healthcare, and personal care sectors. Strategic partnerships with converters and packaging firms enhance product reach, while continuous R&D efforts support improved oxygen-barrier stability and processing efficiency. Sustainability remains a central competitive factor, pushing firms to innovate recycling-compatible structures for global regulations. Competition intensifies as players pursue regional expansion, customized film grades, and high-performance barrier applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Kuraray showcased innovative recyclable vacuum pouches made with polyethylene-rich structures combined with their EVAL™ EVOH, providing excellent oxygen barrier performance and recyclability for food packaging.

- In 2025, Mitsubishi Chemical secured RecyClass approval for PE flexibles containing SoarnoL EVOH resins.

- In 2025, Schott AG launched high-precision glass tubing for syringes and cartridges at its Indian manufacturing facility, supporting pharmaceutical packaging needs with precision products aligned with sustainability and expanded local production capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market demand will rise as brands shift to high-barrier and lightweight packaging.

- Adoption of recyclable mono-material structures will expand across major applications.

- Food packaging will remain the largest growth contributor due to longer shelf-life needs.

- Healthcare and pharmaceutical packaging will strengthen EVOH consumption for sterile protection.

- Advanced co-extrusion lines will increase production efficiency and improve multilayer designs.

- Clear and transparent barrier films will gain higher preference in premium product segments.

- Sustainability regulations will push manufacturers toward recycling-compatible structures.

- Growth in ready-to-eat and chilled foods will drive demand for oxygen-barrier formats.

- Regional converters will adopt higher-performance resins to improve packaging stability.

- Technological innovation will enhance EVOH film processing and expand new end-use applications.