Market Overview

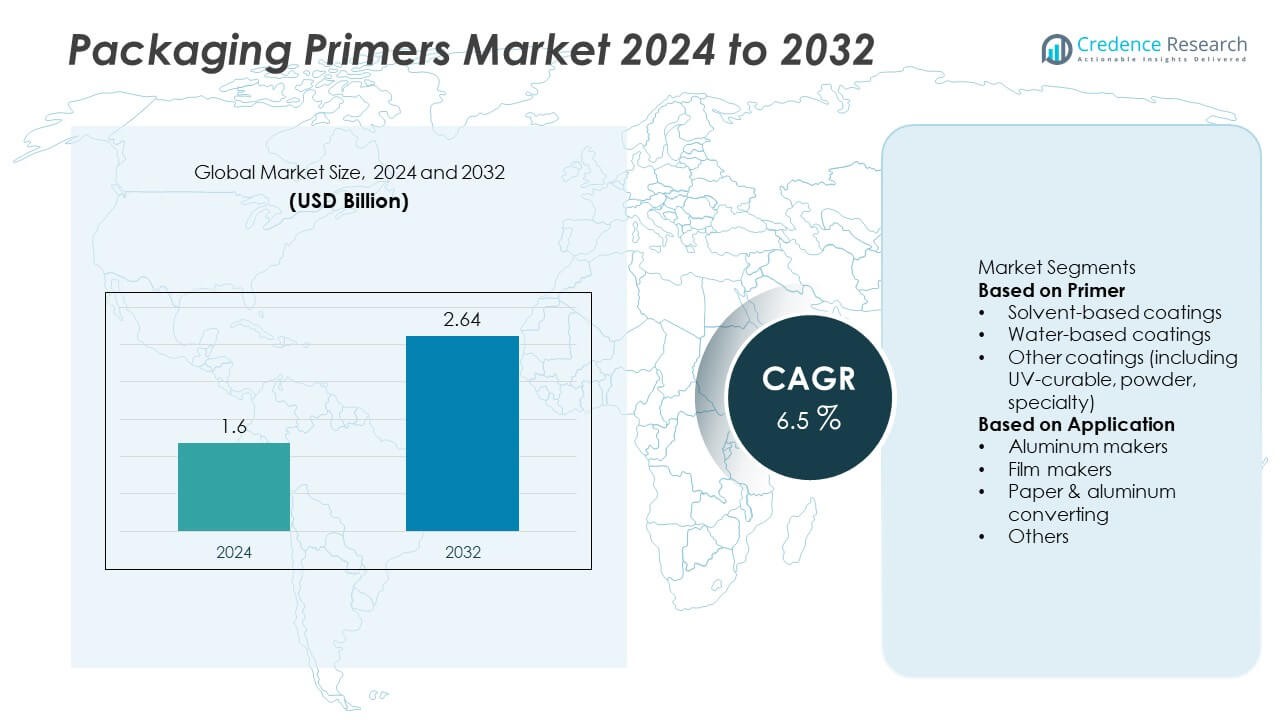

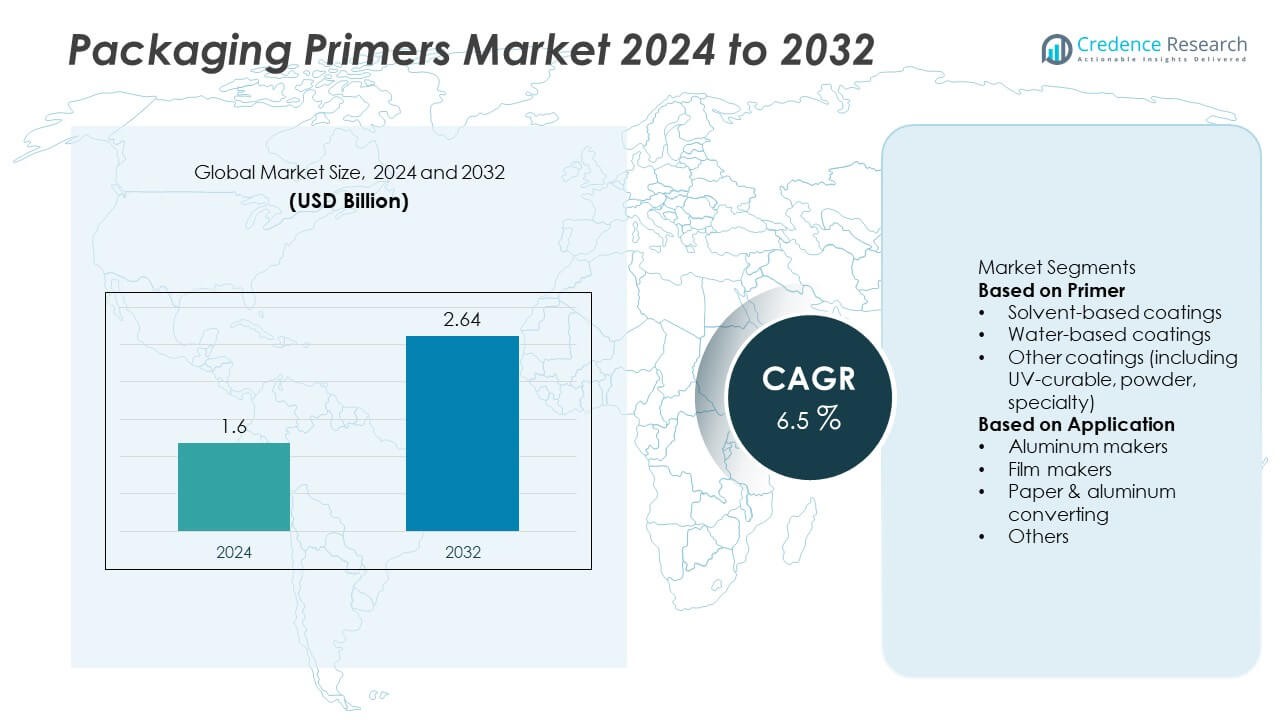

The Packaging Primers Market was valued at USD 1.6 billion in 2024 and is expected to grow to USD 2.64 billion by 2032, registering a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Primers Market Size 2024 |

USD 1.6 Billion |

| Packaging Primers Market, CAGR |

6.5% |

| Packaging Primers Market Size 2032 |

USD 2.64 Billion |

The leading players in the Packaging Primers market include The Sherwin‑Williams Company, Axalta Coating Systems, PPG Industries, Inc., and Akzo Nobel N.V.. These companies leverage strong R&D, broad portfolios and global networks to secure competitive positions. Regionally, the Asia‑Pacific region leads the market with a 37.3% share in 2024, supported by rapid industrialisation and growth in packaging manufacturing. North America follows, driven by mature demand in food and beverage, pharmaceuticals and personal care sectors. Europe also plays a key role with strong regulatory frameworks promoting sustainable packaging.

Market Insights

- The global packaging primers market was valued at USD 1.6 billion in 2024 and is projected to grow at a CAGR of 6.5% through the forecast period.

- Key growth drivers include increasing demand for sustainable packaging solutions, rising demand for high‑quality printed packaging, and advances in packaging coatings and printing technologies.

- Current market trends highlight a shift towards water‑based and UV‑curable primer formulations, the rise of e‑commerce packaging demand, and growing application in emerging markets; the solvent‑based coatings segment held around 56.3% share in 2024.

- Competitive analysis shows leading companies leveraging innovation, global distribution networks and sustainability credentials to differentiate their offerings; market concentration remains high.

- Regional analysis reveals Asia‑Pacific leading with approximately 37.3% market share, followed by North America and Europe, driven by industrial growth, packaging sector expansion and strong regulatory frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Primer

In the Packaging Primers market, the solvent-based coatings sub-segment held the largest share at 50% in 2024. Solvent-based primers dominate due to their superior adhesion and fast drying properties, making them highly suitable for industrial and high-speed manufacturing applications. However, water-based coatings are gaining momentum, capturing around 35% of the market share, driven by environmental concerns and regulations around VOC (volatile organic compounds) emissions. Water-based coatings are preferred for their eco-friendliness and non-toxic nature, making them increasingly popular in consumer-facing products.

- For instance, AkzoNobel offers various water-based primers, some utilizing advanced polymer technology to boost intercoat and substrate adhesion, particularly on specific metal and composite structures.

By Application

Among the application segments, aluminum makers hold the dominant share in the Packaging Primers market, contributing to 40% of the total market in 2024. This dominance is driven by the high demand for durable and corrosion-resistant coatings for aluminum packaging, especially in the food and beverage industry. The film makers segment follows closely, with a 30% market share, as the growing demand for flexible and high-quality films, especially in the pharmaceutical and cosmetic industries, drives the use of specialized primers for film coatings. Other applications account for the remaining 30%, including niche industries like automotive and electronics.

- For instance, PPG Industries offers a range of innovative internal coatings for food and beverage cans, such as the water-based acrylic polymer formulations in the non-BPA PPG Innovel family and the PPG Nutrishield systems.

Key Growth Drivers

Increasing Demand for Sustainable Packaging

The growing emphasis on sustainability is a significant driver for the packaging primers market. With stricter environmental regulations and heightened consumer demand for eco-friendly products, manufacturers are shifting towards water-based and UV-curable primers. These formulations are not only environmentally safer but also cater to the increasing preference for recyclable and biodegradable packaging. As sustainability becomes a key focus across industries, packaging primers that support greener solutions will continue to see rising adoption, particularly in the food and beverage, cosmetics, and pharmaceuticals sectors.

- For instance, BASF offers numerous water-based dispersions that enable the formulation of low-VOC or zero-VOC primers and coatings.

Rising Demand for High-Quality Packaging

As the global packaging industry expands, particularly in sectors such as food, pharmaceuticals, and cosmetics, there is an increased demand for high-performance primers. Packaging primers play a crucial role in enhancing the durability, appearance, and functionality of packaging materials. The need for improved adhesion, corrosion resistance, and printability is pushing demand for advanced primers that can meet the rigorous standards of modern packaging. This demand is further amplified by the rise in e-commerce, where packaging quality directly influences brand perception.

- For instance, Axalta developed a corrosion-resistant powder coating system that passed 1,000 hours of endurance testing under ASTM B117 standards.

Advancements in Printing and Coating Technologies

Innovations in printing and coating technologies are boosting the packaging primers market. The adoption of digital printing and advanced coating methods, such as flexographic and gravure printing, requires primers that offer excellent bonding and compatibility with various substrates. These advancements are opening up opportunities for manufacturers to develop specialized primers that meet the evolving needs of industries seeking high-quality, customizable packaging solutions. With improvements in printing speed, efficiency, and quality, the demand for packaging primers is expected to increase across multiple sectors.

Key Trends & Opportunities

Shift Toward Water-Based and UV-Curable Primers

One of the prominent trends in the packaging primers market is the increasing shift toward water-based and UV-curable primers. These primers are gaining popularity due to their low environmental impact and compliance with stringent regulations on volatile organic compound (VOC) emissions. As consumer preferences lean toward greener alternatives, manufacturers are investing in water-based and UV-curable technologies to provide safer, more sustainable packaging options. This trend offers significant growth opportunities for companies to differentiate their products in a competitive market.

- For instance, Flint Group offers the AQUACode range of water-based inks for paper and board applications, which feature low VOC levels and are designed to meet sustainability requirements.

Emerging Markets and Expanding E-commerce

Emerging markets, particularly in Asia-Pacific and Latin America, present new growth opportunities for the packaging primers market. As industrialisation and urbanisation progress, the demand for packaged goods is rising, alongside an expanding e-commerce sector. The rapid growth of online shopping increases the need for high-quality, protective packaging solutions that ensure product safety and appeal during transit. Manufacturers can capitalize on this trend by offering specialized primers tailored for the unique demands of e-commerce packaging, such as lightweight materials and durable coatings.

- For instance, DIC Corporation develops various primers and coatings for packaging with properties designed for adhesion to challenging substrates and resistance to abrasion.

Key Challenges

Fluctuating Raw Material Prices

Fluctuating prices of raw materials, such as resins, solvents, and pigments, pose a significant challenge for manufacturers in the packaging primers market. These price fluctuations can disrupt the production process, affecting profit margins and pricing strategies. Manufacturers must manage their supply chains carefully and seek cost-effective, sustainable alternatives to mitigate the impact of raw material cost volatility. This challenge requires continuous innovation and strategic sourcing to ensure product consistency while maintaining competitive pricing.

Regulatory Compliance and Environmental Constraints

As environmental regulations around packaging materials become stricter, packaging primers must comply with increasingly complex requirements related to VOC emissions and waste disposal. Manufacturers face the challenge of balancing the demand for high-performance coatings with the need to meet these regulatory standards. Compliance with these regulations requires investment in research and development of low-VOC, non-toxic, and eco-friendly primers, which can increase production costs. Additionally, managing the environmental impact of production processes remains a crucial issue for industry players.

Regional Analysis

North America

North America holds a substantial share in the packaging primers market, commanding 30.0% in 2024. The region’s strong demand stems from advanced packaging industries in food & beverage, pharmaceuticals and personal care. Mature regulatory frameworks regarding coatings and sustainability further drive adoption of high-performance primers. Established players and robust R&D infrastructure support innovation in eco‑friendly and high‑functionality formulations. High consumer expectations for quality and safety in packaging reinforce North America’s leading position and sustain growth in premium primer products.

Europe

Europe accounted for 25.0% of the global packaging primers market in 2024. The region’s demand is fueled by stringent environmental regulations, inclusively low‑VOC and recyclable packaging mandates, pushing primer manufacturers to innovate. With a strong industrial and manufacturing base in countries like Germany, France and the UK, Europe supports high‑end packaging applications needing advanced primers. The shift toward sustainable packaging across the EU further broadens market prospects. Together, regulatory pressure and consumer focus on sustainability give Europe a resilient position in the packaging primers market.

Asia‑Pacific

Asia‑Pacific dominated the packaging primers market in 2024 with a share of 37.3%. Rapid industrialisation, expansion of the packaging sector, and surging e‑commerce activity in China, India and Southeast Asia drive this leadership. The growing middle‑class and rising demand for printed and barrier packaging boost primer usage. Cost‑effective manufacturing and increasing foreign investment also support growth. Asia‑Pacific’s role as a global manufacturing hub, combined with expanding consumer markets and infrastructure development, underpins its dominance in the packaging primers sector.

Latin America

Latin America represented 6.3% of the packaging primers market in 2024. Growth in this region is driven by expanding food & beverage industries in Brazil and Mexico, along with increasing demand for packaging solutions in retail and e‑commerce. Regulatory improvements around packaging safety and sustainability are encouraging adoption of quality primers. However, slower industrial development and higher cost sensitivities temper market expansion. Nonetheless, Latin America offers strategic opportunities for growth as infrastructure and consumer markets continue to develop.

Middle East & Africa

The Middle East & Africa region held a 5.0% share of the packaging primers market in 2024. The number reflects growth from increased manufacturing in oil & gas, chemicals, and construction sectors across the region. Urban‑population growth and rising consumption in cosmetics and packaged goods contribute to demand for improved packaging materials. Yet, challenges such as infrastructure gaps and weaker regulatory frameworks limit rapid expansion. Overall, Middle East & Africa offers gradual growth prospects, especially as industries upgrade and packaging standards rise.

Market Segmentations:

By Primer

- Solvent‑based coatings

- Water‑based coatings

- Other coatings (including UV‑curable, powder, specialty)

By Application

- Aluminum makers

- Film makers

- Paper & aluminum converting

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the Packaging Primers market, key players such as The Sherwin‑Williams Company, Axalta Coating Systems, PPG Industries, Inc., and Akzo Nobel N.V. lead the industry with their extensive product portfolios, innovative technologies, and strong global presence. These companies maintain a competitive edge through continuous investment in research and development, focusing on eco‑friendly and low‑VOC formulations to comply with increasingly stringent environmental regulations. Their ability to offer high-performance, durable, and sustainable primers has strengthened their position across various industrial and consumer packaging applications. Additionally, these major players benefit from vast distribution networks, allowing them to capture market share in both established and emerging markets. Regional and smaller players also play an important role by offering cost-effective and customized primer solutions tailored to specific local requirements. These companies typically focus on niche markets, leveraging flexibility and specialized knowledge to meet unique customer needs. With the rise in demand for sustainable and high-quality packaging solutions, competition in the market has become more intense. Success in the Packaging Primers market increasingly relies on product innovation, cost efficiency, sustainability practices, and the ability to adapt to regulatory changes. As a result, companies are investing in partnerships, acquisitions, and technological advancements to strengthen their market position and expand their product offerings.

Key Player Analysis

- The Sherwin‑Williams Company

- Akzo Nobel N.V.

- Axalta Coating Systems

- PPG Industries, Inc.

- BASF SE

- DIC Corporation

- Paramelt B.V.

- Coim Group

- KANGNAM JEVISCO CO., LTD.

- National Paints Factories Co. Ltd.

Recent Developments

- In June 2025, Akzo Nobel N.V. published a white paper titled Material Matters, outlining its sustainable packaging-coating innovations and regulatory compliance approach for metal packaging.

- In November 2024, Axalta Coating Systems received an R&D 100 Award for its “Primerless Consolidated Coating System” that removes the need for a separate primer layer, delivering improved sustainability and productivity in coatings.

- In July 2024, Akzo Nobel introduced its Securshield™ 500 series of bisphenol-free, PVC-free coatings for metal food cans, supporting sustainability and regulatory transition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Primer, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increasingly focus on water‑based and UV‑curable primer formulations to meet sustainability goals and regulatory requirements.

- Growth in e‑commerce and ready‑to‑eat packaged goods will drive demand for high‑performance packaging primers that enhance print quality, barrier performance and durability.

- Emerging markets in Asia‑Pacific and Latin America will present strong growth opportunities as industrialisation, urbanisation and packaging production expand in these regions.

- Demand for recycled and mono‑material packaging formats will push innovation in primer chemistry designed for easier recyclability and circular‑economy compatibility.

- Adoption of smart coatings and digital printing compatibility will enable packaging primers to support advanced decorative, functional and security features.

- Consolidation and collaboration among primer manufacturers, chemical suppliers and packaging companies will strengthen market positioning and accelerate product innovation.

- Cost pressures from raw materials and energy will prompt manufacturers to optimise formulations and seek alternative supply‑chain strategies to maintain margins.

- End‑users will demand primers with shorter curing times and lower environmental impact, creating opportunities for rapid‑dry technologies and low‑VOC systems.

- Regulatory scrutiny over VOC emissions and packaging waste will increase, pushing companies to adopt compliant and eco‑certified primer solutions.

- Differentiation through premium primers offering enhanced adhesion, barrier performance and aesthetics will be critical as competition intensifies and basic grades become commoditised.