Market Overviews

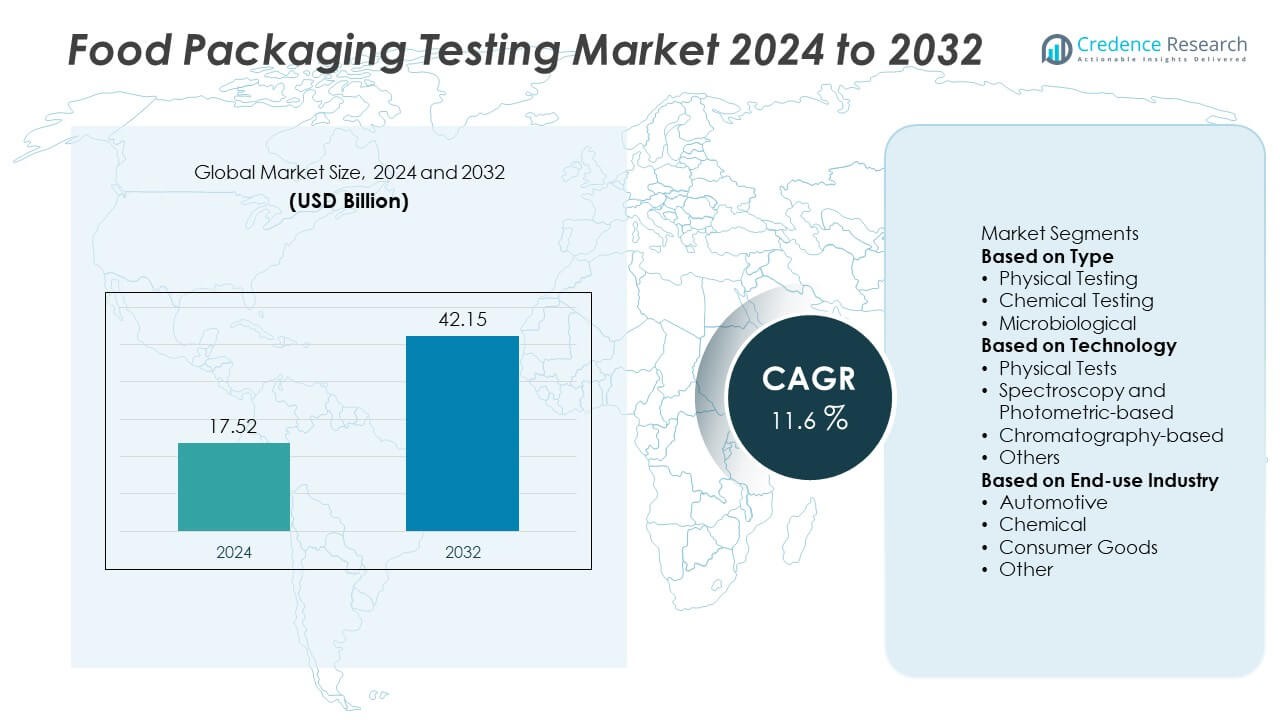

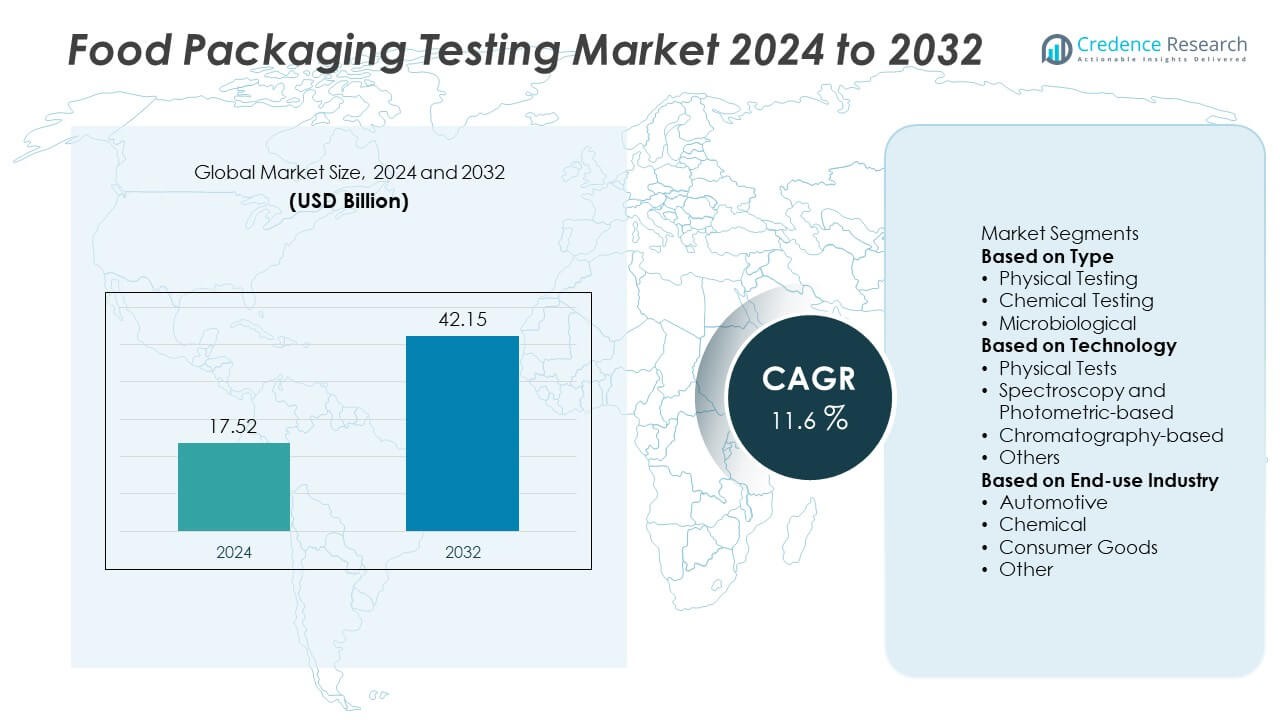

The Food Packaging Testing market was valued at USD 17.52 billion in 2024 and is projected to reach USD 42.15 billion by 2032, growing at a CAGR of 11.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Packaging Testing Market Size 2024 |

USD 17.52 Billion |

| Food Packaging Testing Market, CAGR |

11.6% |

| Food Packaging Testing Market Size 2032 |

USD 42.15 Billion |

The Food Packaging Testing market is led by key players such as Eurofins Scientific, Intertek Group, ALS, Merieux NutriSciences, Bureau Veritas, Ametek, Element Materials Technology, Campden BRI, Measur, and DDL. These companies maintain dominance through advanced testing technologies, global laboratory networks, and strong regulatory compliance expertise. They offer a wide range of services covering chemical, physical, and microbiological testing to ensure packaging safety and integrity. North America leads the global market with a 37.9% share, driven by strict food safety standards and advanced testing infrastructure, followed by Europe with a 30.6% share, supported by strong regulatory enforcement and increasing adoption of sustainable packaging materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Packaging Testing market was valued at USD 17.52 billion in 2024 and is expected to reach USD 42.15 billion by 2032, growing at a CAGR of 11.6% during the forecast period.

- Rising food safety concerns, stringent regulatory standards, and growing demand for contamination-free packaging are major drivers boosting market expansion.

- Technological advancements in chromatography, spectroscopy, and microbiological testing are shaping key market trends and enhancing precision in quality control.

- The market is highly competitive, with key players such as Eurofins Scientific, Intertek Group, ALS, and Merieux NutriSciences focusing on global network expansion and automation-based testing solutions.

- North America leads the global market with a 37.9% share, followed by Europe at 30.6% and Asia-Pacific at 23.1%, while the chemical testing segment dominates with a 46.8% share driven by increasing regulatory compliance and material safety verification.

Market Segmentation Analysis:

By Type

The chemical testing segment dominated the Food Packaging Testing market in 2024, accounting for a 46.8% share. This dominance is driven by the growing need to detect harmful chemical migration from packaging materials into food products. Increasing regulatory requirements for testing contaminants such as heavy metals, plasticizers, and residual solvents have boosted demand for advanced analytical testing methods. Food manufacturers are adopting strict quality assurance practices to comply with global food safety standards. The segment’s growth is further supported by the expansion of sustainable and bio-based packaging materials requiring compatibility and safety validation.

- For instance, Eurofins Scientific developed multi-residue LC-MS/MS methods capable of quantifying a wide range of chemical migrants, including phthalates, bisphenols, and PFAS.

By Technology

The chromatography-based segment held the largest 44.5% share of the Food Packaging Testing market in 2024. Chromatography techniques, including gas and liquid chromatography, are extensively used to analyze chemical residues, migration levels, and trace contaminants. Their high accuracy, reproducibility, and versatility make them ideal for identifying complex compounds in packaging materials. Growing demand for rapid and sensitive analytical methods in quality control laboratories is fueling adoption. Integration of chromatography with mass spectrometry further enhances precision, supporting compliance with global safety regulations and expanding the segment’s dominance across the testing industry.

- For instance, Intertek Group introduced GC-MS testing solutions capable of detecting residual styrene and benzene in packaging films at concentrations as low as 0.05 µg/g, improving traceability and meeting EFSA’s safety thresholds for food-grade polymeric materials.

By End-use Industry

The consumer goods segment accounted for a 41.3% share of the Food Packaging Testing market in 2024, emerging as the leading end-use sector. Increasing use of flexible and multi-layer packaging for processed and ready-to-eat products is driving testing demand. Manufacturers prioritize packaging integrity and contamination control to ensure extended shelf life and compliance with safety standards. Rising consumer awareness of packaging-related health risks also promotes stricter testing protocols. The rapid expansion of packaged snacks, beverages, and convenience foods globally further strengthens this segment’s leadership in the overall market.

Key Growth Drivers

Stringent Food Safety Regulations

Rising enforcement of global food safety regulations is a major driver of the Food Packaging Testing market. Agencies such as the FDA, EFSA, and FSSAI mandate testing for chemical migration, contaminants, and microbiological hazards in packaging materials. Compliance with these strict standards ensures consumer protection and brand credibility. Manufacturers are investing in advanced testing methods and certified laboratories to meet evolving safety norms. This growing regulatory pressure continues to strengthen the demand for reliable and standardized food packaging testing services worldwide.

- For instance, Bureau Veritas utilizes various analytical methods, including in-house LC-MS/MS and GC-MS methods, for specific migration and substance of very high concern (SVHC) screening (covering over 1,000+ substances) to help ensure compliance with safety requirements under EU Regulation 1935/2004 on food contact materials.

Growing Demand for Packaged and Processed Foods

The increasing consumption of ready-to-eat and convenience food products is fueling demand for rigorous packaging testing. Urbanization, busy lifestyles, and expanding retail networks are driving reliance on packaged foods globally. As packaging directly influences food quality, freshness, and safety, manufacturers are emphasizing quality assurance through material compatibility and shelf-life testing. The surge in e-commerce-based food delivery has further intensified the need for durable and contamination-free packaging. This shift in consumer behavior continues to expand testing requirements across the food industry.

- For instance, Mérieux NutriSciences established a dedicated packaging performance lab equipped with gas-chromatography-headspace analyzers capable of detecting oxygen transmission rates down to 0.001 cm³/m²/day and assessing shelf-life stability under accelerated aging conditions for processed food packaging.

Adoption of Sustainable and Bio-based Packaging Materials

The shift toward eco-friendly packaging is creating new opportunities for packaging testing. Bio-based and recyclable materials require extensive testing to ensure they meet safety, durability, and migration standards. Manufacturers are innovating with biodegradable polymers and coatings that demand verification for chemical stability and food interaction. The trend toward sustainability aligns with corporate ESG goals and government initiatives promoting circular economy models. As green packaging adoption accelerates, demand for specialized testing services tailored to these materials continues to rise globally.

Key Trends & Opportunities

Integration of Advanced Analytical Technologies

Technological innovation is reshaping the food packaging testing landscape. Advanced techniques such as mass spectrometry, high-performance liquid chromatography (HPLC), and spectroscopy enhance precision and speed in detecting trace contaminants. Automation and AI-based data analytics improve result accuracy and reporting efficiency. These advancements support compliance with stringent regulatory frameworks and enable high-throughput testing. Growing adoption of digital testing platforms and portable devices is expanding laboratory capabilities, creating opportunities for faster, cost-effective, and standardized testing across global food manufacturing facilities.

- For instance, ALS Limited employs advanced analytical techniques including HPLC, GC, MS, ICP-MS, and robotic automation in its global network of laboratories to perform food packaging migration testing. These technologies allow for the detection of various chemical contaminants, including phthalates, at trace concentrations, significantly improving analytical throughput and precision in global food packaging safety programs.

Rising Focus on Supply Chain Transparency and Traceability

Growing consumer awareness of food safety and sustainability has increased the need for transparent supply chains. Packaging testing plays a key role in verifying the integrity and authenticity of food products throughout the distribution process. Blockchain-enabled traceability systems and digital labeling are being integrated with testing data for improved monitoring. This shift toward end-to-end quality assurance supports trust between manufacturers, retailers, and consumers, driving long-term adoption of advanced packaging testing protocols.

- For instance, Intertek Group deployed its digital assurance platform EUDRtrace (as part of the Assuris suite of solutions), integrating cutting-edge blockchain technology with geolocation and risk data to provide end-to-end traceability for key commodities (such as timber, coffee, soy, rubber, and palm oil products) to ensure compliance with the EU Deforestation Regulation for global clients.

Key Challenges

High Testing Costs and Limited Infrastructure

Food packaging testing often involves complex analytical methods and expensive instruments, creating cost challenges for small and medium-sized manufacturers. The need for certified laboratories, skilled personnel, and advanced equipment adds to operational expenses. Developing regions face limited testing infrastructure and regulatory gaps, slowing market adoption. Outsourcing services can mitigate costs but may compromise turnaround times. Balancing affordability and accuracy remains a key challenge, particularly for emerging economies and smaller packaging producers.

Complexity in Testing Emerging Packaging Materials

The introduction of multi-layered, biodegradable, and nanotechnology-based packaging materials has increased testing complexity. Each new material requires customized testing protocols to evaluate migration, durability, and chemical interaction. Standardization across different materials and regulatory jurisdictions remains inconsistent, posing compliance challenges. Moreover, rapid innovation in packaging chemistry often outpaces regulatory updates. Establishing global harmonization of testing standards is essential to address these challenges and ensure consistent safety assessments across all packaging types.

Regional Analysis

North America

North America held the largest 37.9% share of the Food Packaging Testing market in 2024. The region’s leadership is driven by stringent food safety regulations enforced by the FDA and USDA, which mandate comprehensive testing of packaging materials. High consumption of packaged and processed foods, coupled with advanced testing technologies, fuels market growth. The United States dominates due to strong industrial infrastructure and widespread use of chromatography and spectroscopy testing. Increasing demand for sustainable and eco-friendly packaging further supports the region’s continued investment in safety and compliance verification.

Europe

Europe accounted for a 30.6% share of the Food Packaging Testing market in 2024, supported by robust regulatory frameworks established by the European Food Safety Authority (EFSA). Countries like Germany, France, and the United Kingdom are leading in adopting advanced analytical testing to detect chemical migration and contamination. Rising demand for sustainable and bio-based packaging drives innovation in testing solutions. The region’s strong focus on consumer health, strict labeling requirements, and increasing food exports continue to accelerate market growth across multiple food and beverage sectors.

Asia-Pacific

Asia-Pacific captured a 23.1% share of the Food Packaging Testing market in 2024, driven by rapid industrialization and growing awareness of food safety. Expanding urban populations in China, India, and Japan are increasing demand for processed and packaged food products. Governments are strengthening safety standards and certification systems, promoting greater adoption of testing technologies. The rise of e-commerce food delivery and convenience packaging fuels further demand for quality verification. Increasing investments in analytical laboratories and compliance systems are helping the region emerge as a fast-growing hub for food packaging testing.

Middle East & Africa

The Middle East and Africa region held a 5.1% share of the Food Packaging Testing market in 2024. Market growth is supported by rising government initiatives to improve food safety infrastructure and reduce contamination risks. The Gulf countries, including Saudi Arabia and the UAE, are leading regional adoption through modernized testing facilities and partnerships with international certification agencies. Africa’s market remains at an early stage, limited by testing capacity and technical expertise. However, increasing investments in food processing and regulatory development are expected to support gradual market expansion.

Latin America

Latin America accounted for a 3.3% share of the Food Packaging Testing market in 2024. Growth in the region is fueled by the expanding food and beverage industry in countries such as Brazil, Mexico, and Argentina. Governments are adopting stricter quality control policies to align with international food safety standards. Rising exports of packaged foods and beverages have increased the need for testing chemical migration and microbiological contamination. Despite infrastructure limitations, increasing foreign investment and modernization of testing laboratories are expected to strengthen market growth across the region.

Market Segmentations:

By Type

- Physical Testing

- Chemical Testing

- Microbiological

By Technology

- Physical Tests

- Spectroscopy and Photometric-based

- Chromatography-based

- Others

By End-use Industry

- Automotive

- Chemical

- Consumer Goods

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Food Packaging Testing market features leading players such as Eurofins Scientific, Intertek Group, ALS, Merieux NutriSciences, Bureau Veritas, Ametek, Element Materials Technology, Campden BRI, Measur, and DDL. These companies dominate the market through extensive laboratory networks, advanced analytical testing capabilities, and global regulatory expertise. Strategic partnerships and acquisitions are enabling them to expand service portfolios and strengthen regional presence. Continuous innovation in chromatography, spectroscopy, and microbiological testing enhances precision and turnaround time. The growing demand for compliance with FDA, EFSA, and ISO standards is prompting players to develop faster, automated, and more cost-effective testing methods. Additionally, increasing focus on sustainable packaging and chemical migration testing is driving investment in R&D. Overall, competition remains intense as firms leverage technological advancements and digital testing platforms to meet evolving industry safety and quality requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, AMETEK, Inc. announced the launch of its MOCON® small-volume modules for the Dansensor CheckMate 4 platform, enabling oxygen transmission rate (OTR) testing for sample volumes down to 100 cm³ and water vapour transmission rate (WVTR) testing for film specimens as thin as 15 µm.

- In August 2025, Intertek Group plc reported that within its Consumer Products division it delivered 7.9% like-for-like revenue growth in the first half of 2025, driven by increased demand in packaging and food contact materials testing services.

- In October 2024, Mérieux NutriSciences entered into a definitive agreement to acquire Bureau Veritas’s global food testing business, encompassing 34 laboratories and 1,900 technical staff across 15 countries, thereby significantly expanding its food contact material testing capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable packaging materials will increase testing requirements for safety and compliance.

- Advancements in spectroscopy and chromatography will enhance accuracy and reduce testing time.

- Automation and AI-based analytics will transform laboratory efficiency and data interpretation.

- Stricter global food safety regulations will continue to drive testing demand across supply chains.

- Integration of blockchain and traceability systems will improve transparency in packaging certification.

- Expansion of e-commerce and ready-to-eat foods will boost testing for durability and contamination control.

- Growing focus on eco-friendly materials will create opportunities for bio-based packaging validation.

- Investment in portable and rapid testing devices will support on-site quality verification.

- Strategic partnerships among laboratories and packaging manufacturers will strengthen market reach.

- North America, Europe, and Asia-Pacific will remain key contributors to revenue growth driven by technological and regulatory advancements.