Market Overview

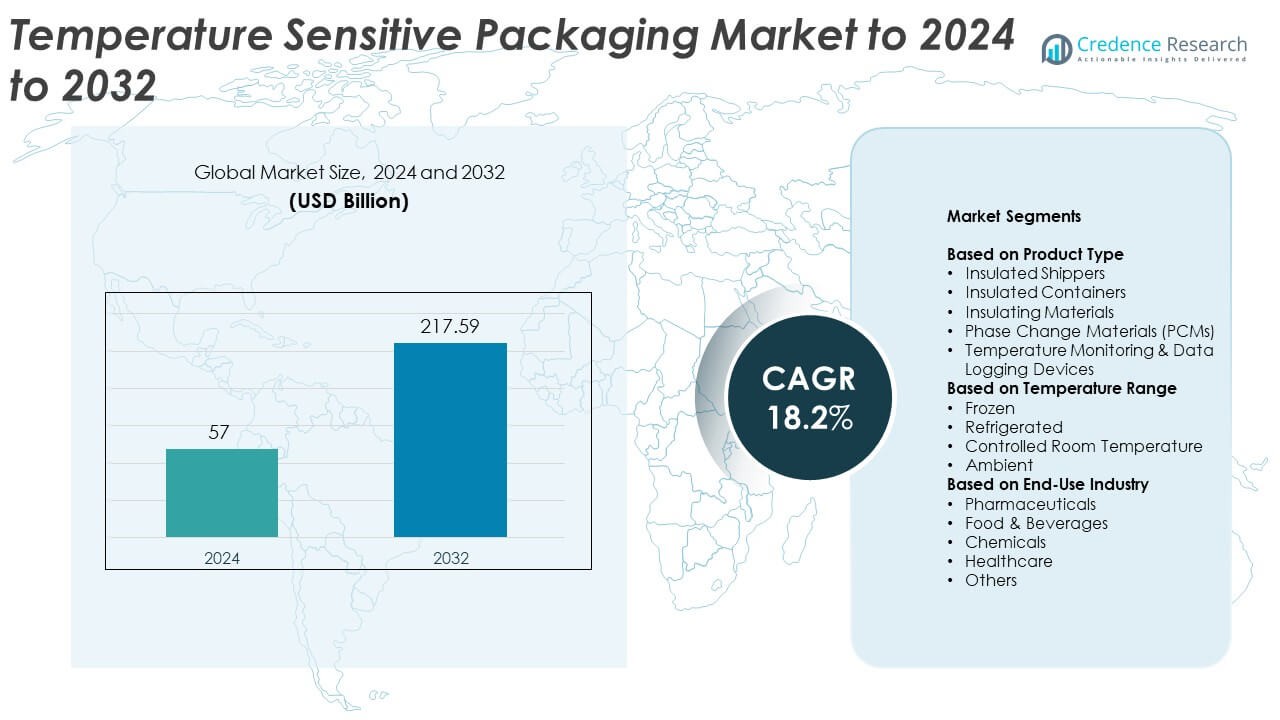

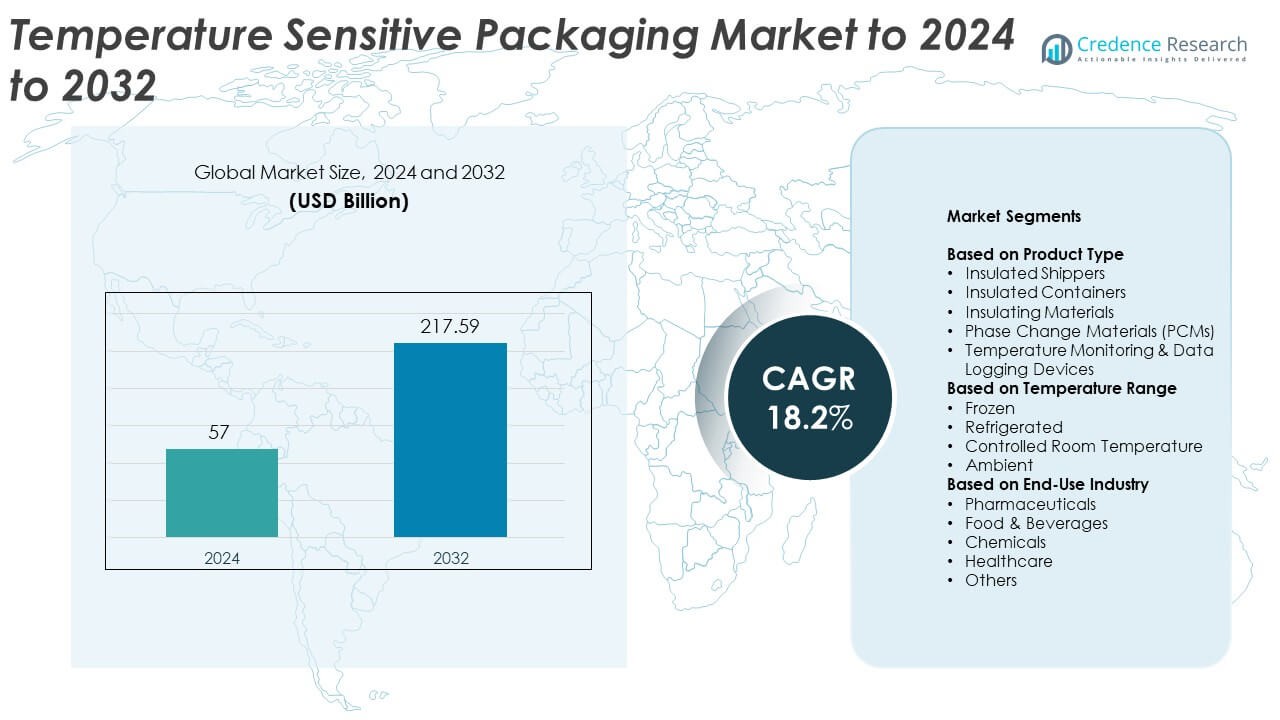

Temperature Sensitive Packaging Market size was valued USD 57 Billion in 2024 and is anticipated to reach USD 217.59 Billion by 2032, at a CAGR of 18.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Temperature Sensitive Packaging Market Size 2024 |

USD 57 Billion |

| Temperature Sensitive Packaging Market, CAGR |

18.2% |

| Temperature Sensitive Packaging Market Size 2032 |

USD 217.59 Billion |

Cryopak, Pelican BioThermal, Envirotainer, Sonoco Products Company, va-Q-tec AG, DGP Intelsius, Softbox Systems Ltd., Tempack Packaging Solutions, Inmark Packaging, and Cold Chain Technologies lead the Temperature Sensitive Packaging Market. These companies focus on developing advanced insulated shippers, phase change materials, and temperature monitoring devices to meet stringent cold-chain requirements. North America dominates the market with a 35% share, driven by strong pharmaceutical, biologics, and food sectors. Europe follows with a 28% share, supported by regulatory compliance and robust cold-chain infrastructure. Asia Pacific accounts for 25% of the market, fueled by rapid expansion of e-commerce and perishable goods logistics. Latin America holds 7%, and the Middle East & Africa represents 5%, with growing healthcare and food distribution demands. Strategic innovation, global distribution networks, and technological integration position these players competitively across leading regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Temperature Sensitive Packaging Market size was valued at USD 57 Billion in 2024 and is anticipated to reach USD 217.59 Billion by 2032, growing at a CAGR of 18.2%. North America leads with 35% share, followed by Europe at 28% and Asia Pacific at 25%. Pharmaceuticals dominate the end-use segment with 42% share.

- Rising demand from pharmaceuticals, biologics, and perishable food products drives the market. Expansion of cold-chain logistics and regulatory compliance further accelerate adoption of temperature-sensitive packaging solutions.

- Key trends include integration of smart and IoT-enabled packaging, adoption of eco-friendly materials, and technological advancements in phase change materials and insulating containers. Multi-temperature hybrid solutions are also gaining traction.

- The market is highly competitive with major players focusing on product innovation, partnerships with logistics providers, and global distribution networks to strengthen market position.

- High cost of advanced packaging and complexity in maintaining cold-chain integrity restrain market growth. Emerging markets show opportunities due to increasing healthcare and food logistics demands.

Market Segmentation Analysis:

By Product Type

Insulated Shippers lead the Temperature Sensitive Packaging Market with a 32% share due to strong demand from pharmaceutical and food sectors for secure cold chain transport. These products maintain temperature stability during transit, reduce spoilage, and ensure regulatory compliance for sensitive goods. Growth is fueled by rising shipments of vaccines, biologics, and perishable foods across global supply chains. Phase Change Materials and Insulating Containers show steady adoption as companies seek reusable, eco-friendly solutions. Increasing integration of temperature monitoring devices further enhances shipment reliability, driving broader acceptance of advanced product types across logistics and distribution networks.

- For instance, the Pelican BioThermal’s Crēdo Cube Series 4, which includes the 8L model, provides 2°C–8°C temperature stability for a duration of 96 hours, qualified to ISTA 7D testing profiles, ensuring reliable protection for biologics shipments.

By Temperature Range

Refrigerated packaging dominates the market with a 38% share, driven by the need to preserve perishable foods, pharmaceuticals, and biologics during storage and transportation. Rising vaccine distribution, cold-chain logistics expansion, and consumer demand for fresh products accelerate adoption. Frozen packaging follows closely, supported by global frozen food trade and long-distance supply chains. Controlled Room Temperature solutions gain traction as biopharma products like monoclonal antibodies and diagnostic reagents require stable environments. Increasing regulatory standards and cold-chain awareness encourage companies to adopt advanced temperature-specific packaging solutions across industries.

- For instance, Cold Chain Technologies’ KoolTemp EcoFlex 96 product maintains 2°C–8°C for 96+ hours(or up to 5+ days) against ISTA 7D testing profiles, ensuring regulatory-grade stability.

By End-Use Industry

Pharmaceuticals hold the largest market share at 42%, propelled by global biologics, vaccines, and temperature-sensitive drug shipments. Stringent regulatory requirements, high-value products, and the need for safe delivery drive demand for insulated shippers, PCMs, and data loggers. Food & Beverages follow with growing cold-chain logistics for dairy, fresh produce, and ready-to-eat meals. Chemicals and healthcare industries also contribute to adoption, emphasizing safety, product integrity, and compliance. Rising e-commerce in perishable products and expansion of global supply networks further reinforce the pharmaceutical sector’s dominance in the Temperature Sensitive Packaging Market.

Key Growth Drivers

Rising Demand from Pharmaceutical and Biologics Industry

The growing shipment of vaccines, biologics, and temperature-sensitive drugs drives the Temperature Sensitive Packaging Market. Strict regulatory standards for cold-chain logistics compel manufacturers and distributors to adopt advanced packaging solutions such as insulated shippers, phase change materials, and temperature monitoring devices. Increasing global healthcare expenditure and expansion of biologics production enhance demand for reliable packaging. The rise in e-commerce of temperature-sensitive medicines and personalized therapies further reinforces the need for safe, efficient, and compliant cold-chain transportation solutions worldwide.

- For instance, Pfizer’s specialized, temperature-controlled thermal shippers for the mRNA vaccine were designed to maintain temperatures around –70°C for approximately 10 days (240 hours) when shipped.

Expansion of Cold-Chain Logistics for Food & Beverages

The surge in demand for fresh, frozen, and ready-to-eat food products globally promotes adoption of temperature-sensitive packaging solutions. Retailers and distributors focus on maintaining food quality and safety from production to delivery. Investment in refrigerated transport, insulated containers, and monitoring systems ensures compliance with food safety regulations. Urbanization, rising disposable income, and consumer preference for fresh products accelerate cold-chain infrastructure expansion. This trend enables manufacturers to reduce spoilage, extend shelf life, and strengthen supply chain reliability, positioning food and beverage logistics as a key growth driver.

- For instance, The Maersk logistics center in the Port of Barcelona (ZAL Port) is an 8,168 square meter facility with an 11-meter-high storage area.

Technological Advancements in Packaging Solutions

Innovation in materials and smart monitoring technologies enhances temperature control and shipment safety, propelling market growth. Advanced phase change materials, insulating containers, and IoT-enabled data loggers allow real-time tracking and regulatory compliance. Reusable and eco-friendly designs support sustainability while reducing operational costs. Companies integrating AI-based temperature monitoring improve predictive logistics and minimize product loss. Hybrid solutions for multi-temperature shipments further boost adoption across pharmaceuticals, food, and chemicals, making technology-driven innovation a critical growth driver in the Temperature Sensitive Packaging Market.

Key Trends and Opportunities

Integration of Smart and IoT-Enabled Packaging

The shift toward digital transformation in cold-chain logistics drives adoption of smart packaging solutions. IoT-enabled devices and sensors allow real-time temperature tracking, predictive alerts, and enhanced supply chain transparency. This trend ensures compliance with stringent regulatory requirements and improves operational efficiency. Growing awareness of product integrity encourages investment in connected packaging systems. The ability to monitor conditions remotely and generate actionable insights creates opportunities for market participants to offer value-added solutions and strengthen their position in temperature-sensitive supply chains.

- For instance, the Controlant real-time monitoring platform was selected to track the Pfizer-BioNTech COVID-19 vaccines and used its IoT devices to capture environmental information, including temperature and light events, and sent the information in real-time to a proprietary cloud-enabled software and analytics platform.

Sustainability and Eco-Friendly Packaging Solutions

Rising environmental concerns increase demand for reusable, biodegradable, and recyclable temperature-sensitive packaging materials. Companies invest in eco-friendly phase change materials, insulating containers, and renewable options to reduce carbon footprint. Sustainable practices align with global regulations and corporate social responsibility initiatives. Adoption of lightweight, durable materials lowers energy consumption during transportation. This trend presents opportunities for manufacturers to innovate, differentiate products, and capture market share while addressing growing consumer and regulatory demand for environmentally responsible packaging solutions.

- For instance, proQIAGEN, reported that switching to ClimaCell liners resulted in a 63% reduction in CO2 emissions during manufacturing compared to the EPS foam they previously used.

Key Challenges

High Cost of Advanced Temperature-Sensitive Packaging

Premium prices of insulated shippers, phase change materials, and smart monitoring devices limit widespread adoption. Small and medium-sized enterprises often struggle to justify the investment, especially in cost-sensitive food and beverage sectors. High initial costs combined with maintenance and replacement expenses can restrict deployment in emerging markets. Balancing affordability with regulatory compliance and product safety is critical. Companies must optimize cost-efficiency through reusable designs, material innovations, and scalable solutions to overcome pricing-related barriers in the market.

Complexity in Maintaining Cold-Chain Integrity

Maintaining consistent temperature control across multi-stage logistics networks remains a challenge. Variations in storage, transport conditions, and handling practices can compromise product quality, particularly for biologics, pharmaceuticals, and perishable foods. Integration of monitoring systems requires specialized training, robust infrastructure, and continuous oversight. Inadequate cold-chain management can lead to product loss, regulatory penalties, and reputational damage. Addressing operational complexities, improving supply chain coordination, and implementing standardized protocols are critical for overcoming this challenge in the Temperature Sensitive Packaging Market.

Regional Analysis

North America

North America leads the Temperature Sensitive Packaging Market with a 35% share, driven by high adoption in pharmaceuticals, biologics, and food logistics. Advanced cold-chain infrastructure, stringent regulatory standards, and rapid vaccine distribution fuel demand for insulated shippers, phase change materials, and temperature monitoring devices. Expansion of e-commerce for perishable foods and growth in biotechnology manufacturing further support market growth. Strong presence of key market players and continuous technological innovations enhance supply chain efficiency. Rising awareness of product safety and quality among healthcare and food industries maintains North America’s dominant position in the global temperature-sensitive packaging landscape.

Europe

Europe holds a 28% share in the Temperature Sensitive Packaging Market, supported by robust pharmaceutical and food industries. Strict regulatory compliance and high-quality standards for cold-chain logistics drive adoption of insulated containers, smart monitoring systems, and phase change materials. Growing e-commerce in perishable foods and biologics distribution further accelerates market growth. Sustainability initiatives and demand for eco-friendly packaging solutions influence material selection and innovation. The presence of established logistics networks and technological advancements in temperature monitoring strengthen Europe’s market position. Increased investment in biologics and vaccine distribution reinforces regional demand for reliable temperature-sensitive packaging solutions.

Asia Pacific

Asia Pacific commands a 25% share, led by rapid growth in pharmaceuticals, food exports, and e-commerce. Expansion of cold-chain logistics, rising vaccine distribution, and increasing demand for perishable goods drive the adoption of temperature-sensitive packaging. Investments in smart monitoring systems and advanced insulating materials enhance shipment safety and efficiency. Emerging economies focus on building robust supply chains to reduce spoilage and maintain product integrity. Growing urbanization, rising disposable income, and regional manufacturing hubs for pharmaceuticals and food products support sustained market growth. The region shows significant potential for technological integration and increased adoption of eco-friendly packaging.

Latin America

Latin America holds a 7% share in the Temperature Sensitive Packaging Market, fueled by rising pharmaceutical production and perishable food distribution. Expansion of cold-chain infrastructure and logistics networks improves product safety during transport. Demand for insulated shippers, phase change materials, and temperature monitoring devices grows with vaccine distribution and rising consumer preference for fresh food products. Regulatory frameworks and investment in modern storage facilities further support market growth. Market penetration remains moderate, yet increasing awareness of cold-chain requirements and supply chain optimization presents growth opportunities for temperature-sensitive packaging providers across the region.

Middle East & Africa

Middle East & Africa accounts for a 5% share, driven by growing pharmaceutical, food, and chemical industries. Investment in refrigerated transport, insulated packaging solutions, and temperature monitoring devices supports safe distribution of sensitive products. Expansion of cold-chain logistics in urban centers and rising healthcare demands fuel adoption. Regulatory compliance and quality assurance measures further promote the use of advanced temperature-sensitive packaging. Market growth is gradual due to infrastructure challenges, but increasing investment in supply chain modernization and international trade of perishable goods creates opportunities for market expansion across the region.

Market Segmentations:

By Product Type

- Insulated Shippers

- Insulated Containers

- Insulating Materials

- Phase Change Materials (PCMs)

- Temperature Monitoring & Data Logging Devices

By Temperature Range

- Frozen

- Refrigerated

- Controlled Room Temperature

- Ambient

By End-Use Industry

- Pharmaceuticals

- Food & Beverages

- Chemicals

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Cryopak, Pelican BioThermal, Envirotainer, Sonoco Products Company, va-Q-tec AG, DGP Intelsius, Softbox Systems Ltd., Tempack Packaging Solutions, Inmark Packaging, and Cold Chain Technologies are prominent players shaping the competitive landscape of the Temperature Sensitive Packaging Market. These companies compete through continuous innovation in insulated shippers, phase change materials, and smart temperature monitoring solutions. They focus on enhancing cold-chain efficiency, ensuring regulatory compliance, and improving shipment safety across pharmaceuticals, biologics, and perishable food sectors. Strategic initiatives such as product portfolio expansion, partnerships with logistics providers, and investment in eco-friendly and reusable packaging reinforce market positioning. Companies also leverage technological advancements like IoT-enabled tracking, AI-driven predictive monitoring, and multi-temperature hybrid solutions to differentiate offerings. Strong emphasis on global distribution networks and after-sales support further strengthens competitiveness. Continuous research and development, combined with growing demand for secure and sustainable cold-chain solutions, drives market growth and intensifies rivalry among industry participants.

Key Player Analysis

- Cryopak

- Pelican BioThermal

- Envirotainer

- Sonoco Products Company

- va-Q-tec AG

- DGP Intelsius

- Softbox Systems Ltd.

- Tempack Packaging Solutions

- Inmark Packaging

- Cold Chain Technologies

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In 2025, Cold Chain Technologies launched the CCT Tower Elite passive pallet shipper for large pharmaceutical loads. The system uses reusable components and is designed for extended-duration cold-chain missions.

- In 2024, Pelican BioThermal launched the Crēdo Vault™, an advanced bulk shipper for pharmaceutical shipments.

- In 2024, va-Q-tec announced a strategic realignment focusing on five main business areas including food logistics and pharmacy deliveries, integrating thermal packaging solutions made with vacuum insulation panels (VIPs) and phase change materials (PCMs).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Temperature Range, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart and IoT-enabled packaging will expand across pharmaceuticals and food sectors.

- Growth in biologics and vaccine distribution will drive demand for advanced cold-chain solutions.

- Sustainable and eco-friendly packaging materials will gain increased market preference.

- Expansion of refrigerated logistics networks will support global supply chain efficiency.

- Rising e-commerce of perishable products will boost temperature-sensitive packaging adoption.

- Integration of AI and predictive monitoring will enhance shipment safety and reduce losses.

- Emerging markets will witness higher demand due to infrastructure development and regulatory alignment.

- Multi-temperature and hybrid packaging solutions will become more widely adopted.

- Technological innovations in phase change materials and insulating containers will accelerate.

- Collaboration between packaging providers and logistics companies will strengthen supply chain reliability.