Market Overview

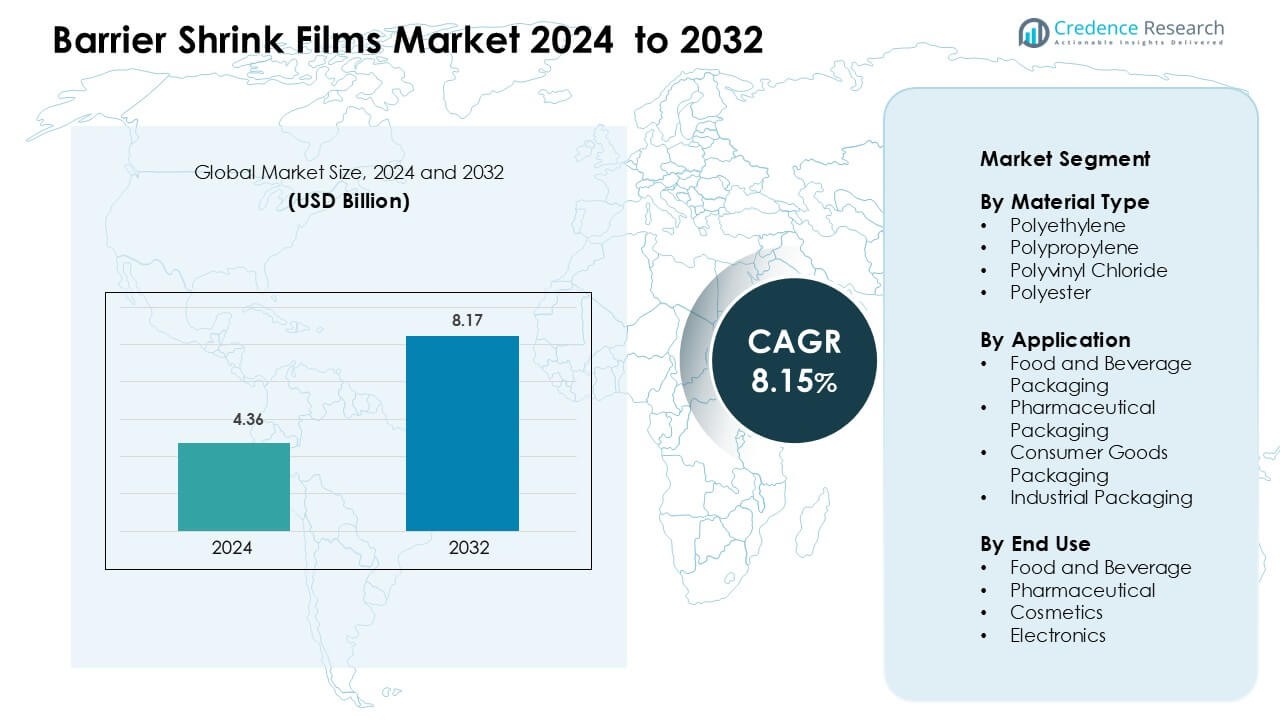

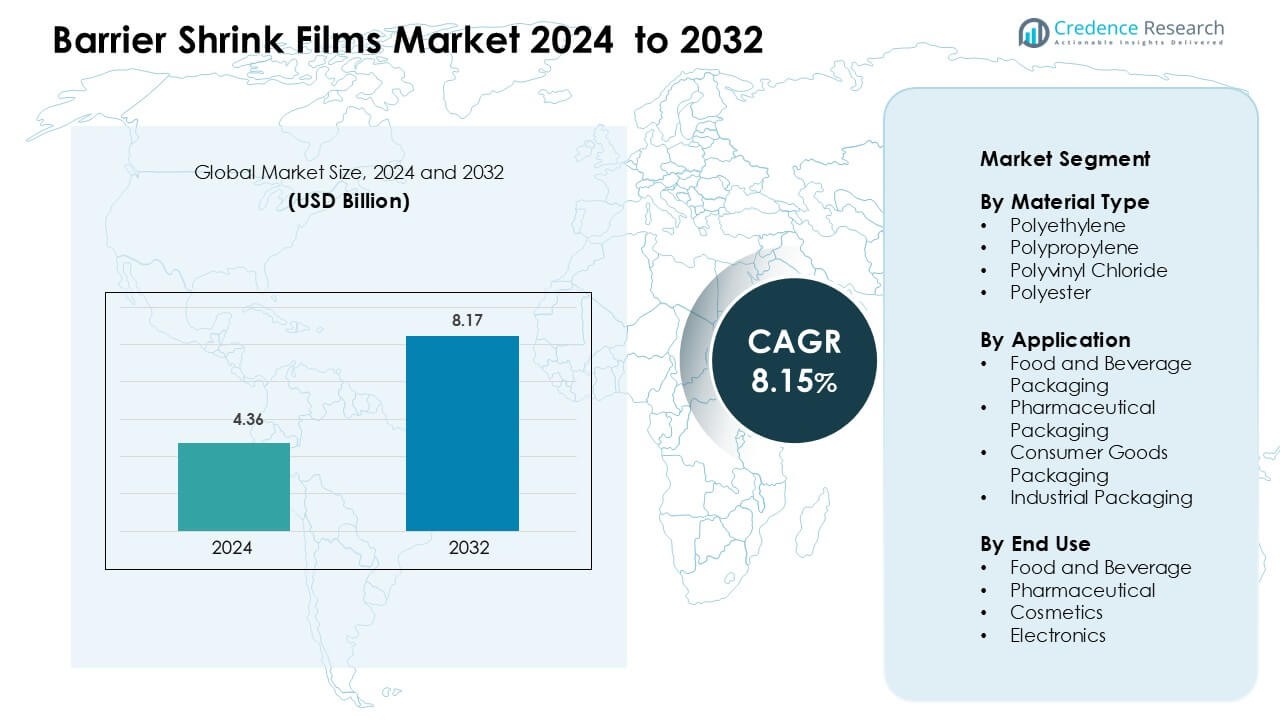

Barrier Shrink Films Market was valued at USD 4.36 billion in 2024 and is anticipated to reach USD 8.17 billion by 2032, growing at a CAGR of 8.15 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Barrier Shrink Films Market Size 2024 |

USD 4.36 Billion |

| Barrier Shrink Films Market, CAGR |

8.15% |

| Barrier Shrink Films Market Size 2032 |

USD 8.17 Billion |

The Barrier Shrink Films Market is driven by major players including Berry Global Inc., Mondi, Wipak, Coveris, Sealed Air, Constantia Flexibles, Amcor plc, Sonoco Product Company, Huhtamaki, and Klockner Pentaplast. These companies focus on sustainable packaging innovation, advanced co-extrusion technology, and recyclable material development to meet evolving industry standards. Asia-Pacific leads the global market with a 36.5% share, supported by strong growth in food packaging, retail distribution, and industrial applications. The region’s rapid industrialization, expanding consumer base, and increasing adoption of eco-friendly packaging solutions reinforce its dominance, while global players continue to expand operations and partnerships within this high-potential region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Barrier Shrink Films Market was valued at USD 4.36 billion in 2024 and is projected to reach USD 8.17 billion by 2032, growing at a CAGR of 8.15%.

- Rising demand from the food and beverage segment, which holds a 55% share, drives market growth due to increasing need for product safety and extended shelf life.

- Sustainability trends are shaping the market, with manufacturers focusing on recyclable and bio-based shrink films to reduce environmental impact.

- Intense competition among major players such as Berry Global, Amcor, Mondi, and Sealed Air promote innovation in multilayer and high-barrier film technologies.

- Asia-Pacific dominates the market with a 36.5% regional share, supported by strong industrialization, expanding retail packaging demand, and government initiatives promoting eco-friendly materials.

Market Segmentation Analysis

By Material Type

Polyethylene dominates the Barrier Shrink Films Market with a market share of 42% in 2024. Its superior flexibility, durability, and high moisture resistance make it ideal for protecting perishable goods. The material’s compatibility with multi-layer co-extrusion technology enhances barrier performance against oxygen and contaminants. Growing adoption in food packaging and beverage bottling sectors further drives polyethylene demand. Polypropylene and polyester follow closely, supported by rising use in high-clarity and eco-friendly packaging applications, while polyvinyl chloride usage is gradually declining due to environmental regulations and sustainability concerns.

- For instance, Amcor Flexibles developed its AmPrima PE Plus mono-PE high-barrier film for dry-mix packaging that achieved a WVTR of 0.5 g/m²/day in lab-controlled tests, illustrating polyethylene s ability to deliver real barrier performance.

By Application

Food and beverage packaging holds the largest market share of 58% in 2024 within the Barrier Shrink Films Market. This dominance is driven by the sector’s need for extended shelf life, superior sealing strength, and clear visibility for retail presentation. Rising consumption of ready-to-eat meals and frozen foods has fueled demand for advanced shrink film technologies. Pharmaceutical packaging is the second-fastest growing segment, supported by strict contamination control standards and tamper-evident features, while industrial and consumer goods packaging benefit from increasing logistics and e-commerce penetration.

- For instance, Amcor does offer an Omni® film (also Omni® Xtra+) used for in-store wrapping of bakery, cheese, and deli items, designed for hand and semi-automatic wrappers.

By End Use

The food and beverage segment leads the Barrier Shrink Films Market with a 55% market share in 2024. It benefits from high product demand across meat, dairy, and beverage packaging applications requiring strong oxygen and moisture barriers. Growing focus on freshness preservation and hygienic wrapping drives material innovation. The pharmaceutical sector is witnessing steady growth due to strict regulatory norms for drug safety and protection. Cosmetics and electronics industries are also adopting barrier shrink films for aesthetic appeal, durability, and protection from dust and humidity.

Key Growth Drivers

Rising Demand from the Food and Beverage Industry

The growing need for product safety, shelf-life extension, and aesthetic appeal in the food and beverage industry is a primary driver for the Barrier Shrink Films Market. These films offer strong protection against oxygen, moisture, and UV exposure, maintaining product freshness during storage and transportation. The surge in packaged and frozen food consumption, especially across urban areas, has increased the use of high-barrier multilayer films. Manufacturers are investing in advanced co-extrusion and vacuum packaging technologies to improve sealing strength and transparency. For instance, global brands in meat, dairy, and beverage sectors are shifting toward sustainable shrink packaging solutions to meet evolving consumer and retailer demands for eco-friendly and visually appealing packaging formats.

- For instance, global brands in meat, dairy, and beverage sectors are shifting toward sustainable shrink-packaging solutions to meet evolving consumer and retailer demands for eco-friendly and visually appealing packaging formats.

Advancements in Multi-Layer Film Technology

Technological progress in multilayer co-extrusion processes is fueling market growth by enhancing the functional performance of barrier shrink films. These innovations allow the combination of polymers like polyethylene, polypropylene, and EVOH to achieve superior oxygen and moisture resistance while maintaining flexibility. The improved thermal stability and seal integrity of modern shrink films make them ideal for automated packaging systems in the food, pharmaceutical, and consumer goods industries. Manufacturers are also incorporating nanocomposite layers to strengthen barrier efficiency without increasing film thickness. Such innovations reduce material consumption, minimize waste, and lower overall packaging costs, aligning with sustainability goals. This trend encourages major packaging players to adopt advanced extrusion lines and film formulations tailored for diverse end-use applications.

- For instance, Multilayer co-extrusion films with EVOH (Ethylene Vinyl Alcohol) are a standard method to achieve high oxygen barrier properties.

Growing Shift Toward Sustainable Packaging Solutions

Sustainability initiatives are reshaping the packaging landscape, driving strong demand for recyclable and bio-based shrink films. Companies are developing films using low-density polyethylene and biodegradable materials to minimize environmental impact. Governments across regions are enforcing strict regulations on non-recyclable plastics, prompting manufacturers to innovate eco-friendly alternatives. Leading packaging producers are introducing thinner, lightweight films that reduce material usage without compromising protection or performance. For instance, food packaging firms are integrating post-consumer recycled (PCR) content to meet circular economy targets. The growing consumer preference for environmentally responsible packaging, coupled with brand commitments to carbon footprint reduction, is accelerating the adoption of sustainable barrier shrink film technologies worldwide.

Key Trends & Opportunities

Integration of Smart and Functional Packaging

The integration of smart packaging technologies represents a major trend in the Barrier Shrink Films Market. Manufacturers are incorporating printed sensors, QR codes, and temperature indicators into shrink film layers to improve product traceability and consumer engagement. This approach enhances supply chain visibility, helping brands ensure authenticity and freshness during transportation. Food and pharmaceutical industries are particularly benefiting from this innovation, as it enables real-time condition monitoring and product tracking. Furthermore, demand for interactive packaging experiences is increasing, with brands leveraging smart labeling for transparency and consumer trust. These advancements create lucrative opportunities for packaging converters and technology providers to collaborate and develop data-driven packaging systems.

- For instance, Scantrust’s secure QR-code platform embedded on packaging achieved over 4 million unique scans in a single global campaign for a major FMCG brand, enabling real-time verification of product authenticity and supply-chain traceability.

Expansion in Pharmaceutical and Healthcare Applications

The pharmaceutical and healthcare sectors are emerging as key opportunity areas for barrier shrink films due to stringent packaging standards and safety regulations. These films ensure protection against moisture, air, and microbial contamination, critical for maintaining the efficacy of medicines and diagnostic devices. The rise in biologics, vaccines, and temperature-sensitive drugs has increased the need for high-performance shrink films. Companies are focusing on sterile, tamper-evident, and customizable barrier packaging formats. With growing healthcare infrastructure in developing economies, demand for advanced barrier solutions is expanding rapidly. Packaging manufacturers that invest in regulatory-compliant and high-barrier materials stand to gain significant competitive advantage in this sector.

- For instance, Amcor launched AmLite Ultra (and later AmLite Ultra Recyclable) as a high-barrier, metal-free, transparent packaging solution.

Key Challenges

Environmental Concerns and Regulatory Pressure

Stringent environmental regulations pose a major challenge for the Barrier Shrink Films Market. Conventional shrink films made from non-recyclable plastics face growing scrutiny due to their contribution to plastic waste and pollution. Governments worldwide are enforcing bans or restrictions on single-use plastics, compelling manufacturers to redesign products and shift toward recyclable or biodegradable materials. However, developing cost-effective and high-performance sustainable alternatives remains complex. Recycling infrastructure limitations in emerging markets further hinder adoption. Meeting evolving sustainability standards while maintaining the protective and optical properties of shrink films continues to challenge producers globally.

High Production and Raw Material Costs

Volatility in polymer prices and the high cost of advanced manufacturing processes present another major challenge. The production of multi-layer barrier shrink films requires precision extrusion technology and premium resins like EVOH and polyamide, which increase operational expenses. Fluctuations in crude oil prices directly affect raw material availability and pricing. Smaller packaging firms often struggle to adopt high-end machinery or develop custom film structures due to capital constraints. Additionally, the transition toward bio-based and recyclable films involves significant R&D investment. Balancing cost-efficiency with performance and sustainability goals remains a key hurdle for market participants in both developed and developing regions.

Regional Analysis

North America

North America holds a 33.4% market share in the Barrier Shrink Films Market, driven by strong demand from food, beverage, and pharmaceutical sectors. The region’s advanced packaging infrastructure and focus on sustainable, high-barrier materials support steady growth. The U.S. leads the market due to high consumption of packaged foods and expanding retail distribution networks. Manufacturers are investing in recyclable multilayer films to comply with environmental regulations. Canada’s pharmaceutical and cold-chain packaging industries further boost demand. Rising e-commerce and logistics applications also contribute to the region’s increasing adoption of durable and tamper-resistant shrink films.

Europe

Europe accounts for 28.1% of the Barrier Shrink Films Market, supported by robust sustainability initiatives and advanced manufacturing capabilities. Strict EU regulations promoting recyclable and biodegradable packaging materials encourage innovation among regional producers. Countries such as Germany, France, and the U.K. lead in adopting eco-friendly shrink films for food and beverage packaging. Growing use in ready-to-eat and frozen food applications strengthens the market. European manufacturers focus on lightweight, high-clarity barrier films that reduce material waste. The rising shift toward circular economy practices continues to shape the region’s competitive packaging landscape.

Asia-Pacific

Asia-Pacific dominates the Barrier Shrink Films Market with a 36.5% market share, led by rapid industrialization and growing packaged food consumption. China, India, and Japan are the key contributors, driven by expanding retail, e-commerce, and pharmaceutical sectors. Rising disposable incomes and urbanization fuel demand for flexible and protective packaging materials. Local manufacturers are investing in co-extrusion and recyclable polymer technologies to meet sustainability goals. The strong presence of food processing industries and large-scale exports of consumer goods further support market expansion. Increasing adoption of advanced packaging machinery also enhances regional production efficiency.

Latin America

Latin America holds a 6.2% market share in the Barrier Shrink Films Market, primarily driven by growing food and beverage packaging needs in Brazil, Mexico, and Argentina. The rise in frozen and processed food consumption supports market growth. Regional producers are gradually shifting toward cost-effective polyethylene-based shrink films to ensure durability and transparency. Government efforts promoting sustainable packaging further encourage innovation. Despite economic fluctuations, investments in logistics and retail packaging strengthen demand. The pharmaceutical industry’s expanding footprint in the region also increases the adoption of high-barrier shrink films for product protection.

Middle East & Africa

The Middle East & Africa account for 5.8% of the Barrier Shrink Films Market, with growth driven by expanding food processing and consumer goods industries. The UAE and Saudi Arabia lead regional adoption due to strong retail and export packaging activities. Investments in industrial infrastructure and modern distribution systems accelerate market penetration. Manufacturers focus on developing cost-effective and durable packaging materials to withstand high temperatures. The pharmaceutical and electronics sectors also contribute to demand for advanced protective films. Growing sustainability awareness and rising import of packaged foods further support regional market development.

Market Segmentations

By Material Type

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polyester

By Application

- Food and Beverage Packaging

- Pharmaceutical Packaging

- Consumer Goods Packaging

- Industrial Packaging

By End Use

- Food and Beverage

- Pharmaceutical

- Cosmetics

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Barrier Shrink Films Market is characterized by intense competition among key players such as Berry Global Inc., Mondi, Wipak, Coveris, Sealed Air, Constantia Flexibles, Amcor plc, Sonoco Product Company, Huhtamaki, and Klockner Pentaplast. These companies focus on product innovation, material optimization, and sustainability-driven packaging solutions to strengthen their market presence. Strategic initiatives include expanding production capacity, forming supply chain partnerships, and developing recyclable multilayer film technologies. Amcor plc and Sealed Air emphasize eco-efficient shrink packaging for food and beverage applications, while Mondi and Berry Global invest in circular packaging systems. Wipak and Constantia Flexibles are advancing high-barrier, lightweight films that enhance performance and reduce environmental impact. The growing demand for recyclable and bio-based materials is driving R&D investments across the competitive landscape. Companies are also adopting digital printing and automation to improve packaging flexibility, efficiency, and brand differentiation in global markets.

Key Player Analysis

- Berry Global Inc.

- Mondi

- Wipak

- Coveris

- Sealed Air

- Constantia Flexibles

- Amcor plc

- Sonoco Product Company

- Huhtamaki

- Klockner Pentaplast

Recent Developments

- In August 2025, Mondi announced ramp‑up of this Functional Barrier Paper Ultimate to meet growing demand for sustainable high‑barrier packaging.

- In October 2024, Wipak announced major multi‑million‑euro investments in its Nastola, Walsrode and Iberica sites to expand capacity in recyclable films (including barrier and thermoforming) aligned with regulatory trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased adoption of recyclable and bio-based shrink films.

- Technological advancements in co-extrusion will enhance film durability and transparency.

- Demand from food and beverage packaging will continue to dominate global usage.

- Pharmaceutical applications will grow due to rising safety and hygiene standards.

- Manufacturers will focus on lightweight films to reduce material consumption.

- Integration of smart and interactive packaging features will expand rapidly.

- Asia-Pacific will remain the leading regional market, driven by industrial expansion.

- Sustainability regulations will accelerate innovation in eco-friendly film production.

- Automation and advanced machinery will improve packaging speed and efficiency.

- Strategic partnerships among resin producers and converters will strengthen global supply chains.