Market Overview:

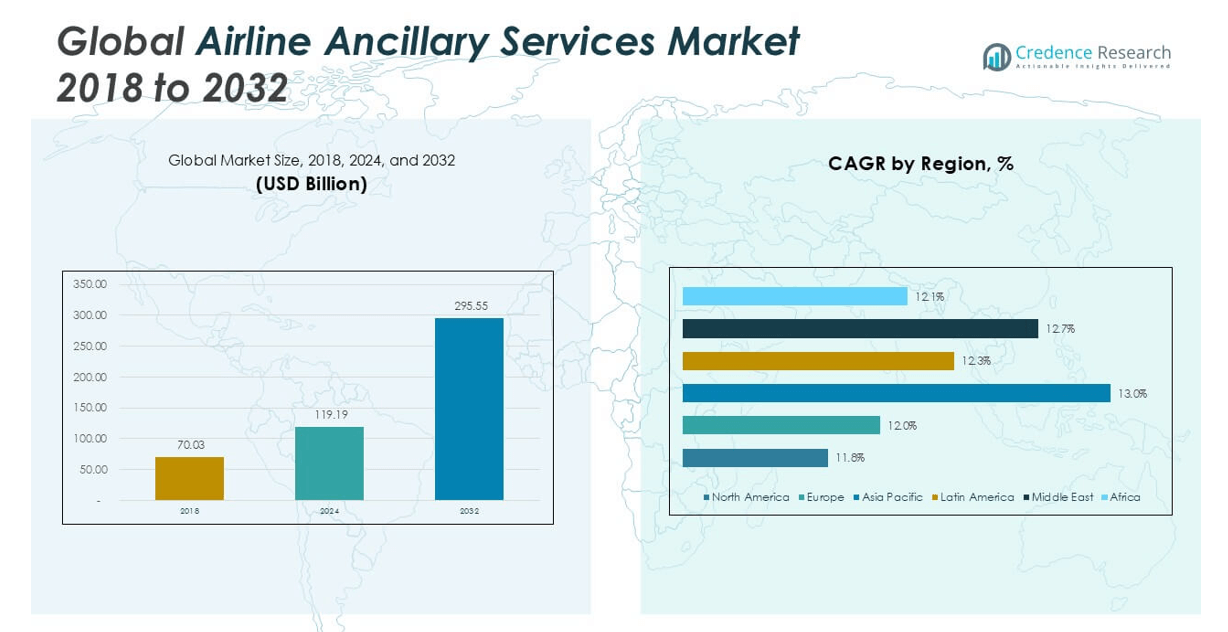

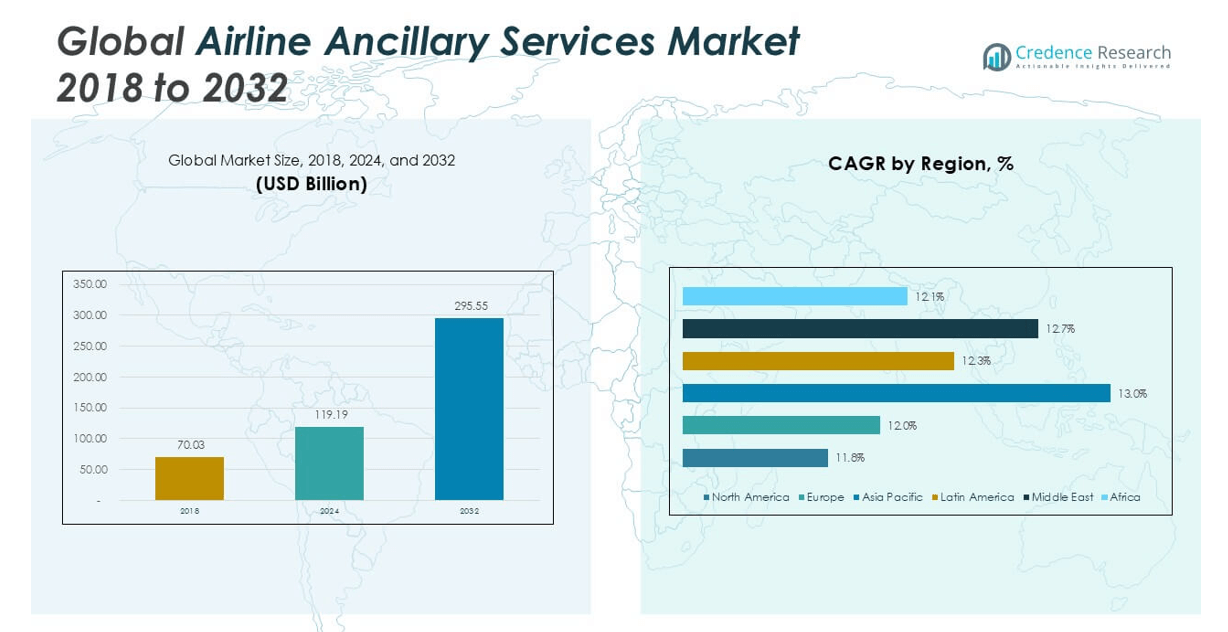

The Airline Ancillary Services market size was valued at USD 70.03 million in 2018, increased to USD 119.19 million in 2024, and is anticipated to reach USD 295.55 million by 2032, growing at a CAGR of 12.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airline Ancillary Services Market Size 2024 |

USD 119.19 million |

| Airline Ancillary Services Market, CAGR |

12.24% |

| Airline Ancillary Services Market Size 2032 |

USD 295.55 million |

The Airline Ancillary Services market is driven by key players such as American Airlines, Delta Air Lines, United Airlines, Southwest Airlines, Ryanair, easyJet, and Lufthansa, all of which generate substantial revenue through diversified ancillary offerings. These companies leverage loyalty programs, unbundled fare strategies, and digital platforms to enhance customer engagement and increase per-passenger revenue. Low-cost carriers like Ryanair and Spirit Airlines lead in aggressively monetizing services such as baggage fees and seat selection. Regionally, North America dominates the market with a 33.9% share in 2024, supported by high air traffic volumes, advanced digital infrastructure, and early adoption of ancillary revenue models. Europe and Asia Pacific follow as key growth regions, driven by expanding budget airline operations and increasing demand for customized travel experiences.

Market Insights

- The Airline Ancillary Services market was valued at USD 119.19 million in 2024 and is projected to reach USD 295.55 million by 2032, growing at a CAGR of 12.24% during the forecast period.

- Rising demand for low-cost air travel, unbundled fare models, and increasing passenger preference for personalized services are driving the market growth.

- Trends such as digitalization, mobile-based bookings, dynamic pricing, and the emergence of subscription-based travel services are reshaping ancillary revenue strategies.

- Major players including American Airlines, Delta Air Lines, Ryanair, and Lufthansa are expanding ancillary offerings, with low-cost carriers dominating through aggressive monetization strategies and full-service carriers focusing on loyalty and retail partnerships.

- North America leads with a 33.9% market share, followed by Europe (28.4%) and Asia Pacific (22.6%); by type, baggage fees represent the largest revenue-generating segment due to widespread adoption across airlines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Among the various ancillary service types, baggage fees emerged as the dominant sub-segment, accounting for a significant share of the Airline Ancillary Services market in 2024. This dominance is attributed to rising global travel volume, increasing airline cost-cutting measures, and widespread unbundling of services by airlines, particularly in economy travel. Baggage fees generate a consistent revenue stream for carriers, especially on international and long-haul routes. Furthermore, growing demand for budget travel has led to the standardization of charging separately for checked and carry-on luggage, further strengthening this segment’s market presence.

- For instance, in 2022, United Airlines generated USD 1.45 billion in baggage fee revenue alone, highlighting the segment’s revenue-generating strength.

By Carrier Type:

Low-cost carriers (LCCs) held the largest market share within the carrier-type segment, driven by their business model that emphasizes unbundled fares and revenue maximization through ancillary services. LCCs rely heavily on services like seat selection, baggage fees, and onboard sales to supplement their low base fares, contributing substantially to their profitability. Their rapid expansion in emerging markets and short-haul travel routes has further bolstered demand. In contrast, while full-service carriers also contribute to ancillary revenue, their share remains smaller due to more inclusive ticketing strategies and loyalty-based offerings.

- For instance, Ryanair reported EUR 3.84 billion in ancillary revenues in FY2023, accounting for nearly 43% of its total revenue, largely driven by baggage fees, seat reservations, and onboard sales.

Market Overview

Rising Demand for Low-Cost Air Travel

The growing preference for low-cost carriers (LCCs) globally has significantly driven the expansion of ancillary services. Budget airlines increasingly rely on unbundled fare models, where core ticket prices are kept low, and additional services such as baggage, seat selection, and food are charged separately. This approach encourages passengers to personalize their travel experience while generating steady revenue for airlines. The affordability and flexibility offered by LCCs have led to increased passenger volumes, especially in emerging markets, thereby fueling demand for ancillary revenue streams.

- For instance, Spirit Airlines reported USD 1.87 billion in non-ticket revenue in 2023, representing a major share of its total operating revenue.

Increasing Passenger Expectations for Customization

Modern travelers seek greater control and personalization in their flying experience, prompting airlines to expand their range of ancillary offerings. From premium seating and in-flight entertainment upgrades to priority boarding and meal selection, the desire for tailored services continues to rise. Airlines are capitalizing on this shift by using data analytics and loyalty programs to deliver targeted ancillary products. The ability to meet passenger preferences not only boosts satisfaction but also enhances revenue per customer, making customization a crucial driver of market growth.

- For instance, Delta Air Lines used its customer analytics platform to help boost revenue from premium seat upgrades by over USD 800 million in 2023.

Digital Transformation and Mobile Commerce

The adoption of advanced digital platforms and mobile applications has streamlined ancillary service booking and management. Airlines now offer seamless options for purchasing add-ons through websites, apps, and in-flight systems. Mobile check-ins, dynamic pricing algorithms, and AI-driven recommendations enhance customer engagement and increase conversion rates. The growing penetration of smartphones and e-commerce behavior among travelers has made mobile commerce a vital enabler for upselling ancillary services, significantly contributing to the market’s revenue potential.

Key Trends & Opportunities

Expansion of Subscription-Based Travel Services

Airlines are increasingly exploring subscription models for ancillary services, offering travelers bundled benefits like free baggage, lounge access, or priority boarding for a fixed monthly or annual fee. This approach boosts customer retention and ensures predictable revenue streams. Subscriptions appeal to frequent flyers seeking convenience and savings, especially in the business travel segment. As personalization becomes more central, this model presents an opportunity for carriers to lock in loyal customers and stabilize ancillary income.

- For instance, Alaska Airlines’ “Flight Pass” subscription launched in 2022 saw more than 18,000 subscribers within the first year, offering customers up to 24 roundtrip flights annually.

Growth of Loyalty Programs and Partnerships

The integration of Frequent Flyer Programs (FFPs) with co-branded credit cards, hotels, and retail networks is creating new revenue channels. Airlines are monetizing FFP mile sales through partnerships with banks and third-party vendors, significantly boosting ancillary revenue. As loyalty ecosystems grow more sophisticated, customers are encouraged to engage across multiple touchpoints, increasing the chances of cross-selling and upselling services. This trend reflects a broader shift toward ecosystem-based revenue models in aviation.

- For instance, American Airlines generated over USD 5.8 billion in 2022 from its AAdvantage program partnerships, primarily through the sale of miles to credit card issuers like Citi and Barclays.

Key Challenges

Regulatory Constraints and Transparency Issues

Stringent regulatory scrutiny over pricing transparency and consumer rights poses a challenge to ancillary service growth. In several regions, authorities have mandated clear disclosures of optional service costs during the booking process to protect consumers. Airlines must navigate complex compliance landscapes while maintaining competitive pricing strategies. These regulations can limit the flexibility of dynamic pricing models and affect profit margins if not managed effectively.

Passenger Resistance to A La Carte Pricing

Despite growing acceptance, some passengers remain resistant to the unbundling of services and perceive ancillary charges as hidden or excessive. This sentiment is particularly strong among infrequent or price-sensitive travelers who expect traditional inclusivity in ticket pricing. Negative perceptions can impact customer loyalty and influence booking decisions, particularly in markets where full-service carriers remain dominant. Airlines must balance revenue goals with customer satisfaction to mitigate this challenge.

Operational Complexity and IT Integration

The expansion of ancillary offerings requires robust IT infrastructure and seamless integration across sales channels, reservation systems, and customer touchpoints. Managing personalized offerings, dynamic pricing, and real-time inventory presents significant operational complexity. Smaller carriers or those with legacy systems may face implementation hurdles, limiting their ability to fully capitalize on ancillary revenue opportunities. Efficient back-end systems are critical for scaling ancillary services effectively.

Regional Analysis

North America:

North America held the largest share of the global Airline Ancillary Services market in 2024, accounting for approximately 33.9% of the total market. The regional market grew from USD 24.28 million in 2018 to USD 40.41 million in 2024 and is projected to reach USD 97.21 million by 2032, expanding at a CAGR of 11.8% during the forecast period. The dominance of the region is supported by the presence of major airlines with well-established ancillary revenue models, especially in the U.S. The strong adoption of low-cost carriers and widespread digitalization in air travel further fuel regional growth.

Europe:

Europe captured a significant 28.4% market share in the Airline Ancillary Services market in 2024. The market rose from USD 20.12 million in 2018 to USD 33.87 million in 2024, and it is forecasted to reach USD 82.75 million by 2032, registering a CAGR of 12.0%. Growth in this region is driven by the proliferation of budget airlines, increasing intra-European travel, and the evolving preferences of passengers seeking personalized travel experiences. European carriers have increasingly adopted unbundled pricing strategies, contributing to rising ancillary revenues across the region.

Asia Pacific:

Asia Pacific accounted for about 22.6% of the Airline Ancillary Services market in 2024, with the market expanding from USD 15.18 million in 2018 to USD 26.95 million in 2024. It is projected to grow significantly, reaching USD 70.55 million by 2032, at a CAGR of 13.0%, the highest among all regions. This growth is attributed to increasing air travel demand, rising middle-class population, and the rapid expansion of low-cost carriers across countries like India, China, and Southeast Asia. Digitally enabled services and mobile commerce adoption further drive ancillary revenues in the region.

Latin America:

Latin America held around 8.5% of the global Airline Ancillary Services market share in 2024. The regional market grew from USD 5.92 million in 2018 to USD 10.13 million in 2024, and it is expected to reach USD 25.30 million by 2032, progressing at a CAGR of 12.3%. Market growth in Latin America is supported by the increased penetration of low-cost carriers and growing regional connectivity. Airlines in the region are increasingly adopting unbundled fare models to enhance profitability, supported by improving digital infrastructure and changing consumer behavior favoring customizable services.

Middle East:

The Middle East contributed approximately 4.0% to the global Airline Ancillary Services market in 2024. The market increased from USD 2.71 million in 2018 to USD 4.73 million in 2024, and is projected to reach USD 12.12 million by 2032, growing at a CAGR of 12.7%. Growth is driven by rising air traffic, tourism investments, and strategic airline developments across Gulf countries. Regional carriers are leveraging ancillary services to diversify revenue sources amidst fluctuating oil prices and competitive pricing models. Premium services, including seat upgrades and loyalty programs, are gaining traction among both regional and international travelers.

Africa:

Africa accounted for a modest 2.6% of the Airline Ancillary Services market in 2024, with the market growing from USD 1.83 million in 2018 to USD 3.10 million in 2024. It is anticipated to reach USD 7.63 million by 2032, recording a CAGR of 12.1%. While the market is still emerging, growth is supported by increasing air travel penetration, regulatory reforms, and infrastructure development across key nations. Airlines are beginning to adopt digital tools and a la carte pricing to boost revenues. As air connectivity improves, especially in Sub-Saharan Africa, the ancillary services market is expected to gain further momentum.

Market Segmentations:

By Type

- Baggage Fees

- On-Board Retail and A La Carte Services

- Airline Retail

- FFP Mile Sales

- Others

By Carrier Type

- Full-Service Carriers

- Low-Cost Carriers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Airline Ancillary Services market is characterized by the active participation of both full-service and low-cost carriers striving to diversify revenue streams beyond core ticket sales. Leading players such as American Airlines, Delta Air Lines, and United Airlines leverage their global networks and loyalty programs to monetize services like seat upgrades, baggage fees, and branded fare bundles. Low-cost carriers including Ryanair, Spirit Airlines, and Wizz Air dominate in unbundled service models, aggressively promoting ancillary options to maintain profitability amid competitive pricing. Airlines are increasingly integrating digital platforms and AI-driven personalization to optimize ancillary revenue per passenger. Strategic partnerships with third-party vendors, credit card companies, and e-commerce platforms are expanding the scope of offerings, especially in retail and frequent flyer mile sales. The market also sees growing investments in mobile commerce, subscription services, and data analytics to enhance service delivery and customer experience. Innovation and dynamic pricing strategies remain key differentiators in this evolving space.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- American Airlines

- Delta Air Lines

- United Airlines

- Southwest Airlines

- Ryanair

- easyJet

- Lufthansa

- JetBlue Airways

- Alaska Airlines

- Air France-KLM

- Spirit Airlines

- Wizz Air

- Air Canada

- Qatar Airways

- Emirates

- Singapore Airlines

- British Airways

Recent Developments

- In February 2025, Delta Air Lines launched Delta Concierge, an AI-powered digital assistant within the Fly Delta app. This tool uses generative AI to personalize the customer journey, offering features like trip planning, real-time notifications (e.g., passport and visa information), wayfinding, and access to partner transportation (Uber/Joby). It aims to enhance the travel experience and create opportunities for cross-selling and premium services.

- In 2023, Lufthansa launched a custom pricing system for flight extras with the purpose of earning greater profits and giving passengers better product choices. This system uses advanced computing and instant data reviews to make service price changes based on passenger stats plus trip directions and booking timings.

- In 2023, AirAsia teamed up with Trip.com, which is an industry leader in online travel services, to enhance their package bundles. AirAsia teamed up with Trip.com to merge travel services like hotel stays and transportation during booking.

- In 2022, Delta Air Lines invested USD 100 million to enhance its digital platforms because they want to deliver better customer travels and generate additional revenue for the company. The company put its money into improving the mobile app and website systems to make an enhanced digital travel experience for their customers.

Market Concentration & Characteristics

The Airline Ancillary Services Market demonstrates a moderately concentrated structure, with a mix of full-service and low-cost carriers driving competition. Leading global airlines such as American Airlines, Delta Air Lines, Ryanair, and Lufthansa hold a significant portion of the market, supported by strong brand presence, route networks, and loyalty programs. It reflects a dynamic landscape where carriers actively pursue revenue diversification beyond ticket sales through unbundled services, seat upgrades, baggage fees, and retail offerings. The market is shaped by shifting consumer behavior toward customization and transparency in service selection. Low-cost carriers play a dominant role in monetizing ancillary services by offering low base fares and charging for each additional service, which strengthens their profitability. Full-service airlines are integrating ancillary products through digital platforms and partnerships to enhance customer value and drive incremental revenue. The market’s evolution is supported by digital innovation, mobile commerce, and regional growth in Asia Pacific and Latin America, where air travel adoption is increasing.

Report Coverage

The research report offers an in-depth analysis based on Type, Carrier Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, driven by increasing air travel demand and evolving passenger preferences.

- Low-cost carriers will further expand their share by offering unbundled, pay-per-service models.

- Full-service airlines will increasingly adopt digital tools to personalize and upsell ancillary services.

- Mobile commerce will become a primary channel for ancillary purchases, boosting real-time engagement.

- Subscription-based ancillary services will gain popularity among frequent travelers seeking convenience.

- Loyalty programs will evolve into broader ecosystems, integrating retail, banking, and travel partners.

- Dynamic pricing and AI-driven recommendations will optimize ancillary revenue per passenger.

- Asia Pacific and Latin America will emerge as high-growth regions due to rising middle-class air travel.

- Partnerships with fintech and e-commerce platforms will expand ancillary offerings beyond traditional services.

- Regulatory focus on pricing transparency will shape how airlines present and structure ancillary charges.