Market Overview

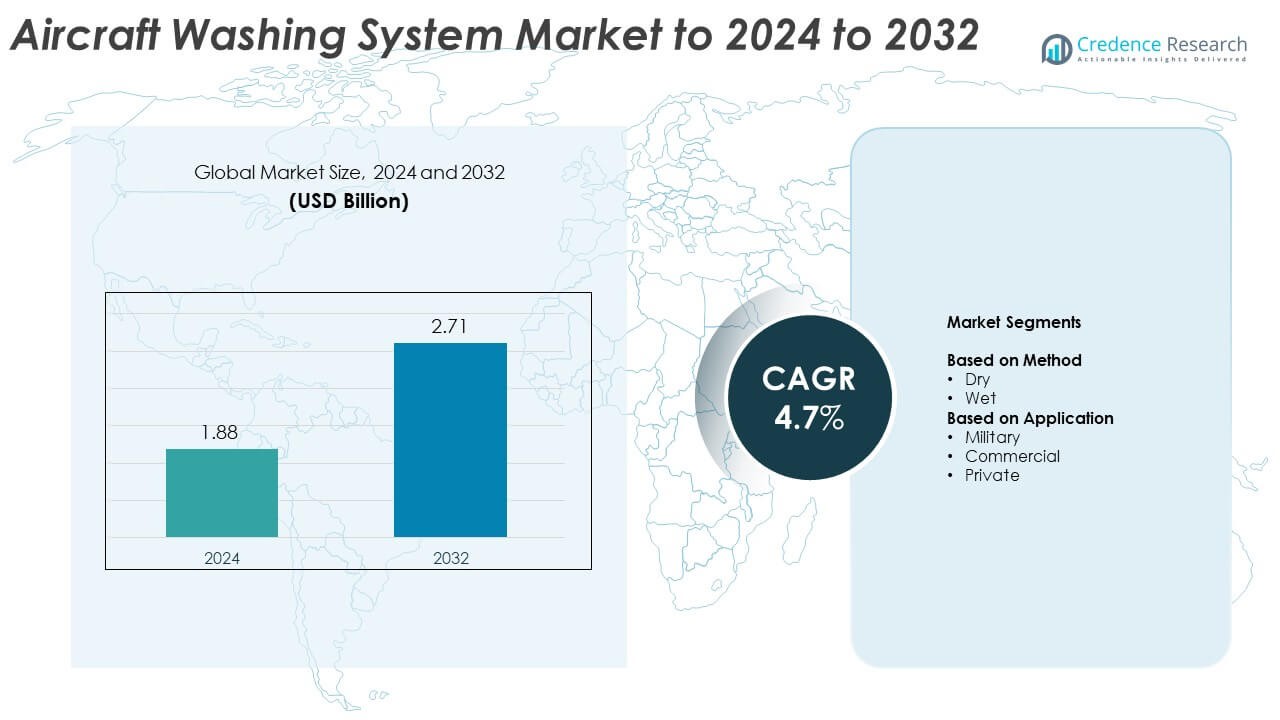

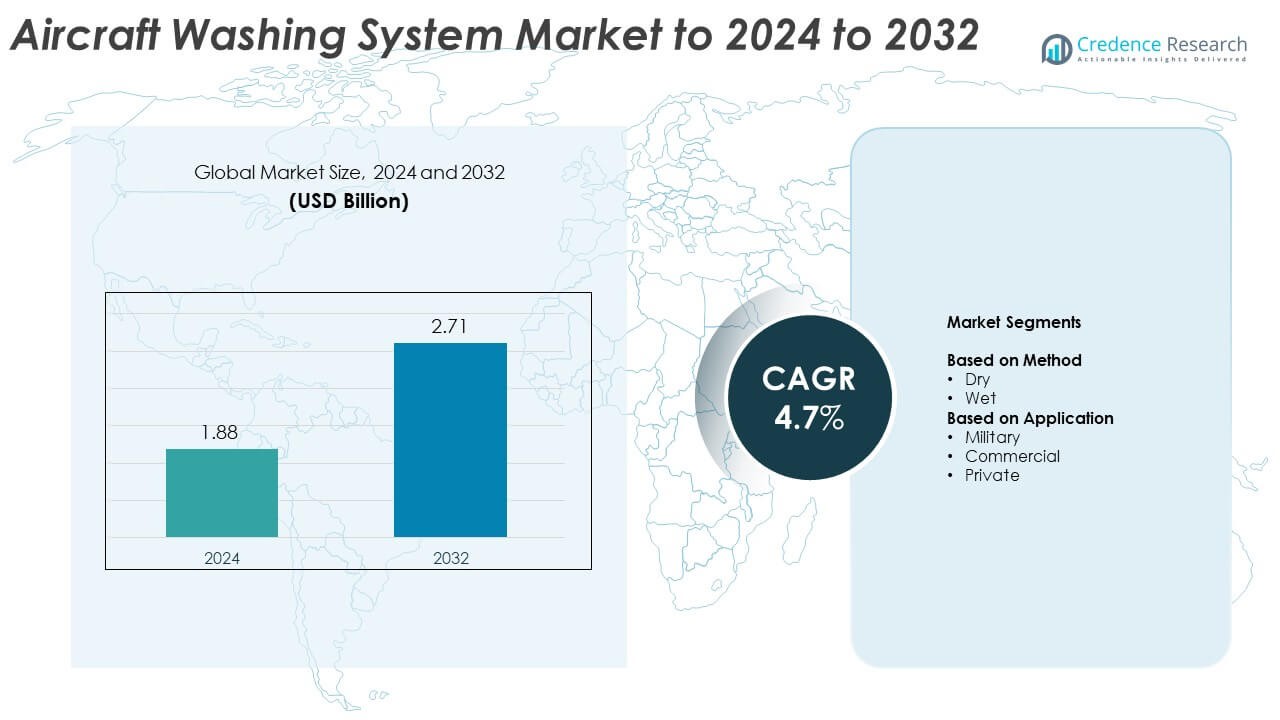

The Aircraft Washing System Market size was valued at USD 1.88 billion in 2024 and is anticipated to reach USD 2.71 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Washing System Market Size 2024 |

USD 1.88 Billion |

| Aircraft Washing System Market, CAGR |

4.7% |

| Aircraft Washing System Market Size 2032 |

USD 2.71 Billion |

The Aircraft Washing System Market is led by prominent players including Kärcher Aviation, Riveer, JRI Industries, Hydro Engineered Inc., Daimler Industries Inc., Ultrasonic Power Corporation, Ransohoff Cincinnati, Encon Evaporators, Jensen Fabricating Engineers Inc., and KMT Aqua Dyne Inc. These companies maintain a competitive edge through innovation in automated, eco-friendly, and water-efficient cleaning technologies. Strategic collaborations with airlines and MRO facilities enhance their global footprint and service efficiency. North America dominated the market in 2024 with a 36.9% share, supported by advanced aviation infrastructure, frequent fleet maintenance, and high adoption of robotic and water-recycling washing systems across both commercial and military sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Aircraft Washing System Market was valued at USD 1.88 billion in 2024 and is projected to reach USD 2.71 billion by 2032, growing at a CAGR of 4.7%.

- Growth is driven by increasing fleet expansion, rising maintenance requirements, and the shift toward automated and eco-friendly cleaning systems.

- The market is witnessing trends such as adoption of robotic washing systems, AI-integrated monitoring, and sustainable dry wash technologies.

- Competition remains strong among key players focusing on innovation, product efficiency, and partnerships with airlines and MRO facilities to enhance operational performance.

- North America led the market with a 36.9% share in 2024, followed by Europe with 28.4% and Asia Pacific with 22.6%, while the wet washing segment dominated globally with 61.7% market share.

Market Segmentation Analysis:

By Method

The wet washing segment dominated the aircraft washing system market in 2024 with a 61.7% share. This dominance is due to its superior cleaning efficiency for large commercial and military aircraft. Wet washing uses water and specialized detergents to remove contaminants such as grease, oil, and carbon residues. The process helps maintain aerodynamic performance and extend paint life. Increasing airline focus on aircraft appearance and corrosion prevention continues to support this segment’s growth. Meanwhile, dry washing is gaining attention for its water-saving potential and eco-friendly operation.

- For instance, Emirates reports conventional A380 wet washes use 11,300 litres, and 777 washes use 9,500 litres.

By Application

The commercial aircraft segment led the market in 2024 with a 52.4% share. This segment benefits from frequent cleaning schedules and large fleet operations by airlines to ensure fuel efficiency and regulatory compliance. Airlines adopt automated and semi-automated washing systems to minimize turnaround times and labor costs. The growing emphasis on sustainability encourages the use of biodegradable cleaning agents and water reclamation systems. Military and private aircraft segments also show growth due to maintenance modernization and enhanced aircraft protection protocols.

- For instance, United Airlines projected saving 3,000,000 gallons of fuel annually using EcoPower engine washes.

Key Growth Drivers

Rising Emphasis on Aircraft Maintenance and Efficiency

demand for fuel efficiency and reduced drag is driving the adoption of aircraft washing systems. Regular exterior cleaning minimizes debris accumulation, improving aerodynamics and performance. Airlines are increasingly implementing scheduled cleaning programs to enhance fuel savings and extend component lifespan. As fleets expand globally, maintenance operations are prioritizing automated washing systems to reduce downtime and improve operational reliability, strengthening the market’s growth trajectory.

- For instance, Lufthansa Technik’s Cyclean engine wash completes in 45 minutes with no post-wash engine run.

Expansion of Commercial Airline Fleets

Rapid air travel growth and increasing passenger traffic have led to larger commercial aircraft fleets worldwide. Airlines are investing in automated and semi-automated washing systems to handle frequent cleaning cycles efficiently. These systems reduce labor costs, save time, and ensure consistent surface maintenance across large fleets. The expansion of low-cost carriers and regional routes further accelerates the need for high-capacity cleaning solutions to maintain aircraft safety and aesthetics.

- For instance, Air India conducted over 205 EcoPower washes, saving 880,000 gallons of fuel.

Increasing Focus on Sustainability and Water Conservation

Environmental regulations and sustainability goals are encouraging the adoption of water-efficient washing technologies. Airlines and service providers are shifting toward dry wash and water-recycling systems that minimize resource use. Manufacturers are developing biodegradable detergents and eco-friendly solutions that meet global environmental standards. The aviation sector’s commitment to reducing carbon footprints and operational waste supports steady demand for sustainable aircraft cleaning systems, making this a key growth driver.

Key Trends & Opportunities

Adoption of Automated and Robotic Washing Systems

Automation is emerging as a major trend, improving speed, precision, and safety in aircraft cleaning. Robotic washing systems can operate under all weather conditions and reduce manual labor. Airports and maintenance facilities are integrating IoT and AI-based technologies to monitor wash cycles and optimize resource usage. These innovations are increasing operational efficiency and reducing maintenance costs, creating strong opportunities for technology providers in the global market.

- For instance, Aerowash AW12 carries a 500-litre main tank and a 90-litre spray tank, handling aircraft up to the 747.

Rising Investment in Military and Defense Fleet Maintenance

Defense organizations are adopting advanced washing systems to maintain aircraft readiness and corrosion control. Modern military aircraft require specialized maintenance solutions to preserve coatings and structural integrity. Governments are investing in automated systems capable of handling large aircraft, ensuring consistent cleaning under strict environmental guidelines. This rising focus on defense fleet maintenance provides lucrative opportunities for system suppliers targeting military aviation sectors.

- For instance, Pratt & Whitney’s EcoPower wash takes approximately 30 to 60 minutes per engine and can lower engine temperature by up to 30 °C (or up to 15 °C depending on the specific engine type and source)

Key Challenges

High Initial Investment and Maintenance Costs

The installation and maintenance of automated aircraft washing systems involve substantial capital expenditure. Smaller operators and regional service providers often face financial barriers to adopting these technologies. Regular maintenance, water treatment equipment, and detergent management add recurring costs. These expenses limit widespread adoption among cost-sensitive operators, posing a major challenge to market growth in emerging regions.

Stringent Regulatory Compliance Requirements

Aircraft washing activities must comply with strict environmental and aviation safety regulations. Managing wastewater discharge, chemical handling, and surface residue control requires adherence to multiple national and international standards. Non-compliance can result in operational penalties and service delays. Manufacturers must continuously innovate to meet evolving compliance norms, increasing development complexity and restraining market expansion.

Regional Analysis

North America

North America dominated the aircraft washing system market in 2024 with a 36.9% share. The region’s leadership is driven by the strong presence of major airlines, MRO facilities, and aircraft manufacturers. The U.S. continues to lead adoption due to large commercial and defense fleets requiring regular maintenance. High emphasis on automated cleaning technologies and sustainable water management solutions supports market expansion. Canada and Mexico also contribute to regional growth through increased airport infrastructure investments and fleet modernization efforts, enhancing the adoption of advanced washing systems across civil and defense aviation sectors.

Europe

Europe held a 28.4% share of the aircraft washing system market in 2024. The region benefits from stringent environmental regulations encouraging water-efficient and eco-friendly cleaning technologies. Countries such as Germany, France, and the United Kingdom are adopting dry wash and water recycling systems to comply with sustainability goals. The presence of leading aircraft manufacturers and maintenance centers drives demand for advanced cleaning solutions. Ongoing innovation in automation and robotic systems, along with rising passenger traffic across regional airlines, further strengthens Europe’s market position during the forecast period.

Asia Pacific

Asia Pacific accounted for 22.6% of the aircraft washing system market in 2024. Rapid expansion of commercial aviation, particularly in China, India, and Japan, drives market demand. The region’s airlines are increasingly investing in efficient washing technologies to reduce maintenance time and operational costs. Growing emphasis on fleet safety and appearance, along with government initiatives for airport modernization, supports adoption. Rising low-cost carrier activity and expanding defense budgets further contribute to the region’s strong growth potential in automated and eco-friendly washing systems.

Latin America

Latin America captured a 6.8% share of the aircraft washing system market in 2024. Regional growth is driven by expanding commercial aviation networks and improving airport infrastructure in Brazil and Mexico. Airlines are increasingly focusing on cost-efficient and sustainable maintenance practices to enhance fleet longevity. Adoption of semi-automated washing systems is gaining traction as operators aim to reduce manual labor and resource usage. Government efforts to modernize airports and promote environmental compliance further support the regional market’s steady development in the forecast period.

Middle East & Africa

The Middle East & Africa region held a 5.3% share of the aircraft washing system market in 2024. The Middle East’s growth is supported by major aviation hubs such as the UAE, Qatar, and Saudi Arabia investing in automated cleaning technologies for large fleets. Africa is gradually adopting advanced systems as regional air traffic increases. Strong focus on maintaining premium fleet aesthetics and expanding MRO capabilities contributes to rising adoption. Sustainability goals and water conservation initiatives are encouraging the transition toward dry wash and water-recycling technologies across key operators.

Market Segmentations:

By Method

By Application

- Military

- Commercial

- Private

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Aircraft Washing System Market is driven by leading players such as Kärcher Aviation, Riveer, JRI Industries, Hydro Engineered Inc., Cleaning Deburring Finishing Inc., Daimler Industries Inc., Ultrasonic Power Corporation, Ransohoff Cincinnati, Encon Evaporators, Wanner Engineering Inc., Jensen Fabricating Engineers Inc., KMT Aqua Dyne Inc., Stoelting Cleaning Equipment, and Nordic Aerowash Equipment. The market is highly competitive, characterized by strong focus on automation, eco-friendly technologies, and water-efficient systems. Companies are investing in advanced cleaning solutions that improve efficiency while meeting environmental standards. Strategic collaborations with airlines and MRO facilities enhance service delivery and market reach. Manufacturers are also emphasizing R&D to develop biodegradable cleaning agents and low-maintenance systems. Growing adoption of robotic systems and digital monitoring tools further intensifies competition. Continuous innovation, energy-efficient equipment design, and expansion into emerging markets remain central to maintaining competitive advantage in this evolving global landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kärcher Aviation

- Riveer

- JRI Industries

- Hydro Engineered Inc.

- Cleaning Deburring Finishing Inc.

- Daimler Industries Inc.

- Ultrasonic Power Corporation

- Ransohoff Cincinnati

- Encon Evaporators

- Wanner Engineering Inc.

- Jensen Fabricating Engineers Inc.

- KMT Aqua Dyne Inc.

- Stoelting Cleaning Equipment

- Nordic Aerowash Equipment

Recent Developments

- In 2024, Nordic Dino continued to provide its fully automated aircraft washing robots to existing customers, including major airports and airlines globally, some of which are located in the Middle East.

- In 2024, Kärcher Aviation Solutions launched a new eco-wash system, designed for regional jets and turboprop aircraft, which boasts 85% water savings.

- In 2023, Riveer continued to offer its established line of closed-loop aircraft and vehicle washing systems for military applications, which are capable of capturing and recycling a high percentage of wash water (up to 100% in some systems) to meet strict environmental and operational requirements.

Report Coverage

The research report offers an in-depth analysis based on Method, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of automated and robotic washing systems will improve cleaning speed and safety.

- Airlines will invest more in eco-friendly and water-efficient cleaning technologies.

- Rising air traffic and fleet expansion will increase maintenance and washing frequency.

- Dry wash systems will gain traction due to water conservation and environmental regulations.

- Integration of IoT and AI technologies will optimize maintenance scheduling and resource usage.

- Defense and private aviation sectors will adopt customized cleaning systems for fleet upkeep.

- Partnerships between airlines and MROs will enhance service efficiency and compliance.

- Manufacturers will focus on developing biodegradable detergents and low-toxicity cleaning agents.

- Emerging economies will witness strong demand with airport modernization and fleet expansion.

- Continuous innovation in sustainable washing solutions will shape the future market landscape.