Market Overview:

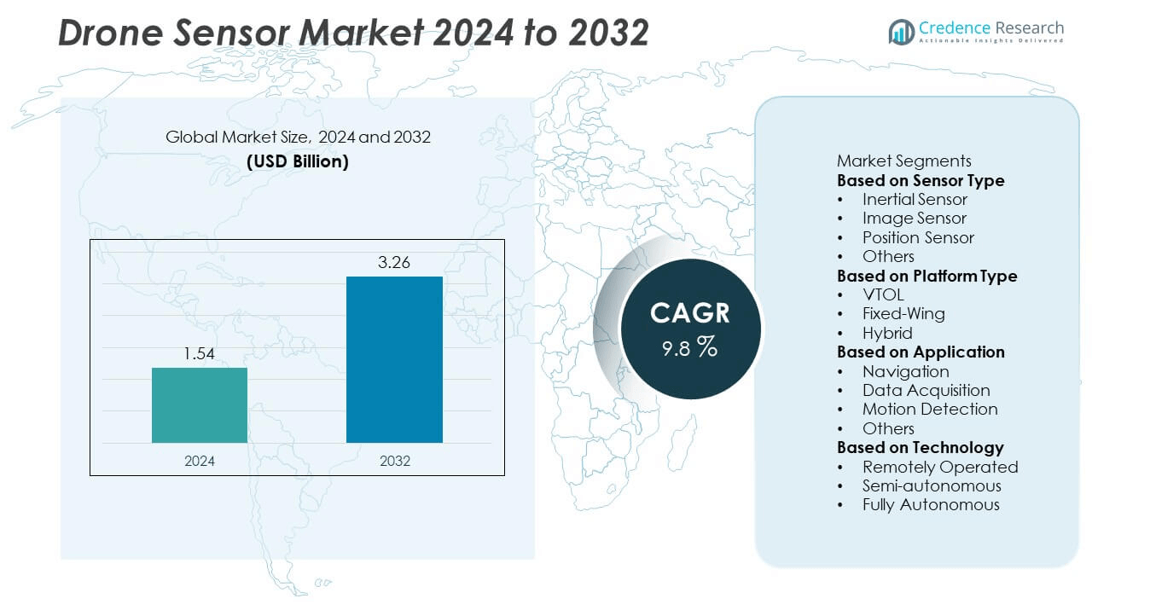

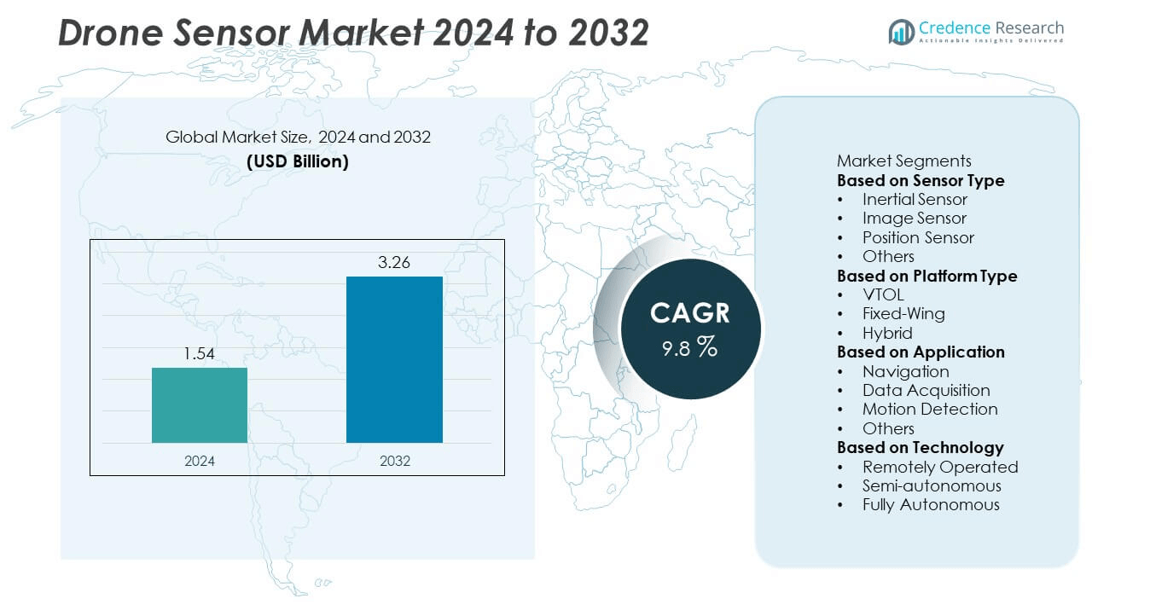

The drone sensor market was valued at USD 1.54 billion in 2024 and is projected to reach USD 3.26 billion by 2032, expanding at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Sensor Market Size 2024 |

USD 1.54 billion |

| Drone Sensor Market, CAGR |

9.8% |

| Drone Sensor Market Size 2032 |

USD 3.26 billion |

The drone sensor market is led by major players such as Bosch Sensortec GmbH, InvenSense, KVH Industries Inc., LeddarTech Holdings Inc., RTX, Sentera, Sony Semiconductor Solutions Group, Sparton, TE Connectivity, and Teledyne FLIR LLC. These companies dominate through advancements in imaging, inertial, and LiDAR-based sensing technologies that enhance drone navigation, obstacle detection, and data accuracy. North America held the leading 41% share in 2024, supported by high defense investments, commercial drone deployment, and strong technological innovation. Asia Pacific follows with rapid growth due to government initiatives promoting drone applications in agriculture, logistics, and infrastructure monitoring.

Market Insights

- The drone sensor market was valued at USD 1.54 billion in 2024 and is projected to reach USD 3.26 billion by 2032, expanding at a CAGR of 9.8% during the forecast period.

- Rising use of drones in agriculture, logistics, and defense operations drives strong demand for advanced sensors that improve navigation, imaging, and obstacle detection.

- Increasing adoption of LiDAR, hyperspectral, and AI-integrated sensors enhances mapping precision and supports data-driven decision-making across industrial and environmental applications.

- Key players such as Bosch Sensortec GmbH, InvenSense, RTX, and Teledyne FLIR LLC focus on innovation in MEMS-based sensors and AI-enabled solutions to strengthen their market presence.

- North America led the market with a 41% share in 2024, while Asia Pacific is the fastest-growing region; by sensor type, the image sensor segment dominated with a 39% share, supported by strong deployment in mapping and surveillance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sensor Type

The image sensor segment dominated the drone sensor market with a 39% share in 2024. This leadership is driven by the widespread use of high-resolution cameras and multispectral imaging systems in aerial photography, mapping, and surveillance. Image sensors are vital for real-time monitoring and data capture across industries such as agriculture, defense, and infrastructure inspection. Increasing adoption of CMOS and thermal imaging technologies enhances data accuracy and flight efficiency. Rising demand for visual intelligence in commercial drones continues to strengthen the image sensor segment’s position globally.

- For instance, Sony Semiconductor Solutions Group developed the IMX927 stacked CMOS image sensor featuring approximately 105 million effective pixels and a readout speed of 100 frames per second. The sensor’s high dynamic range and low noise performance enable detailed aerial mapping under diverse light conditions.

By Platform Type

The VTOL (Vertical Take-Off and Landing) segment held the largest share of 57% in 2024, attributed to its operational flexibility and capability to function in confined or rugged environments. VTOL drones rely heavily on advanced inertial and image sensors for stable hovering and precise positioning. Their ability to take off without runways makes them ideal for logistics, mapping, and military reconnaissance. Growing demand for hybrid-VTOL models integrating endurance and vertical mobility is further boosting segment growth across defense and commercial drone applications.

- For instance, RTX coordinates autonomous UAVs in flight missions, capable of scanning rugged terrain and identifying potential threats using RF signals. Another of its subsidiaries has also performed successful flight tests of a long-range missile and provides advanced AI-powered navigation systems for military aircraft, with capabilities for GPS-denied environments.

By Application

The navigation segment accounted for a 46% share in 2024, dominating the drone sensor market due to its critical role in maintaining flight stability and accurate positioning. Navigation systems use a combination of GPS, inertial, and magnetometer sensors to ensure autonomous operation and real-time control. Rising adoption of drones in logistics, agriculture, and infrastructure inspection is driving sensor demand for precise geolocation and obstacle avoidance. Technological advancements in GNSS-integrated navigation systems are further enhancing flight accuracy and reliability across commercial and industrial use cases.

Key Growth Drivers

Expanding Commercial Drone Applications

Growing use of drones in agriculture, logistics, and infrastructure inspection is fueling market expansion. Sensors play a critical role in capturing visual, positional, and environmental data to support efficient operations. In agriculture, image and LiDAR sensors enable precision farming and crop analysis. Construction and logistics sectors use drones for surveying, inspection, and delivery tracking. The rising demand for high-performance sensor systems in these industries continues to strengthen market adoption and application diversity.

- For instance, Sentera launched its 6X multispectral sensor capable of capturing five narrow spectral bands with a 3.2-megapixel resolution each and a 20-megapixel RGB image. The sensor provides data for vegetation health and nitrogen index mapping.

Technological Advancements in Sensor Design

Ongoing innovation in miniaturized and MEMS-based sensors has improved drone efficiency and performance. These lightweight sensors extend flight time while maintaining accuracy in navigation, imaging, and obstacle detection. Integration of AI and machine learning enhances autonomous control and data interpretation. The combination of compact hardware and smart processing is expanding drone usability across commercial, environmental, and industrial operations. Continuous advancements are positioning intelligent sensor systems at the center of drone technology development.

- For instance, Bosch Sensortec GmbH developed the BMI270 MEMS inertial measurement unit with integrated accelerometer and gyroscope optimized for wearable and hearable applications. The unit’s ultra-low power design consumes just 685 microamperes in full operation, extending battery life for applications like smartwatches.

Rising Defense and Security Deployment

Defense organizations are increasingly using drones with advanced sensing systems for surveillance, mapping, and reconnaissance. Infrared, radar, and thermal sensors enable accurate target detection and real-time situational awareness. Growing security concerns and the need for border and tactical monitoring drive investment in high-precision drone sensors. Upgrades in LiDAR and imaging technologies are further enhancing mission reliability and operational intelligence. Expanding defense budgets continue to boost sensor innovation and integration in unmanned aerial systems.

Key Trends & Opportunities

Integration of AI-Enabled Sensor Systems

AI-powered drone sensors are transforming flight control and data management by enabling autonomous operations. Machine learning algorithms support object recognition, adaptive navigation, and predictive analytics. These capabilities reduce human intervention while improving precision in complex environments. Growing use of AI-based sensing solutions in industrial inspection, agriculture, and disaster response highlights their expanding commercial value. The trend toward intelligent sensor networks is shaping the future of connected and automated drone ecosystems.

- For instance, LeddarTech Holdings Inc. integrated its LeddarVision™ sensor fusion and perception software into advanced driver assistance systems (ADAS) and off-road industrial vehicles, combining LiDAR, camera, and radar inputs to achieve a 360-degree environmental model.

Growth of LiDAR and Hyperspectral Sensing Technologies

LiDAR and hyperspectral sensors are gaining prominence in mapping, forestry, and mining due to their ability to provide detailed spatial and spectral information. These technologies enhance environmental monitoring, terrain modeling, and resource assessment accuracy. Falling hardware costs and faster data-processing capabilities are driving adoption among survey and infrastructure firms. Expanding applications in smart city development and ecological conservation create strong opportunities for advanced sensor integration across multiple industries.

- For instance, Teledyne FLIR LLC introduced the Hadron 640R dual-sensor module combining a 640 x 512 resolution radiometric thermal camera and a 64-megapixel visible camera in a compact 56-gram housing, which offers flexible 60 Hz video output.

Key Challenges

High Cost of Advanced Sensor Integration

Integrating multiple high-end sensors such as LiDAR and thermal imaging systems raises drone production costs. This limits adoption among small enterprises and individual operators. Ongoing maintenance, calibration, and software updates add to the financial burden. The high investment requirement delays large-scale implementation, especially in cost-sensitive regions. Manufacturers are focusing on developing affordable, energy-efficient sensors to address these constraints and expand accessibility across commercial drone markets.

Regulatory Restrictions and Airspace Limitations

Strict airspace regulations and operational restrictions continue to hinder drone sensor market growth. Limitations on altitude, range, and beyond-visual-line-of-sight operations restrict commercial usage. Privacy, data protection, and aviation safety compliance requirements create additional complexities for drone deployment. The absence of uniform international guidelines slows technological integration and innovation. Collaborative efforts between regulators and industry participants are essential to unlock the full potential of drones equipped with advanced sensors

Regional Analysis

North America

North America dominated the drone sensor market with a 41% share in 2024, driven by strong adoption across defense, agriculture, and infrastructure monitoring sectors. The United States leads the region with extensive investments in UAV-based surveillance, delivery systems, and mapping solutions. Companies are integrating AI and advanced sensor technologies to enhance precision and flight control. Supportive FAA regulations for commercial drone operations and increasing use in energy inspection and environmental monitoring continue to drive regional growth. Canada’s growing demand for drones in forestry and resource exploration also supports steady market expansion.

Europe

Europe accounted for a 27% share in 2024, supported by rapid adoption of drones in industrial automation, agriculture, and logistics. Countries such as Germany, France, and the United Kingdom are advancing drone-based inspection and mapping applications. The European Union’s unified drone regulations under EASA are fostering wider commercial deployment. Rising use of LiDAR and image sensors for urban planning and environmental protection is strengthening market performance. Defense modernization initiatives and research funding for sensor innovation are further enhancing the regional drone ecosystem.

Asia Pacific

Asia Pacific captured a 23% share in 2024 and is projected to witness the fastest growth driven by government initiatives promoting drone-based agriculture, logistics, and surveillance. China, Japan, and India are leading adopters due to rapid industrialization and smart infrastructure projects. Local manufacturers are investing in MEMS and hyperspectral sensor technologies to improve drone performance and cost efficiency. Expanding e-commerce logistics and agricultural automation in emerging economies are further accelerating adoption. Supportive policy frameworks and large-scale pilot programs in precision farming are shaping the region’s leadership in drone applications.

Latin America

Latin America held a 6% share in 2024, fueled by rising demand for drones in agriculture, mining, and forestry management. Countries such as Brazil and Mexico are adopting sensor-integrated UAVs for crop monitoring and land surveying. Growing interest in resource mapping and environmental conservation is encouraging drone deployment across remote areas. The presence of local drone manufacturers and gradual regulatory easing are improving market accessibility. Investment in LiDAR and thermal sensors for ecological monitoring and industrial safety applications continues to enhance regional market prospects.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share in 2024, supported by growing use of drones in oil and gas inspection, defense, and infrastructure development. The UAE and Saudi Arabia are leading in adopting high-precision sensors for urban planning and surveillance operations. African nations are increasingly deploying drones for agricultural monitoring and humanitarian logistics. Investments in smart city projects and aerial mapping are further driving sensor integration. Expanding government partnerships with drone technology providers continues to create new opportunities across commercial and industrial sectors.

Market Segmentations:

By Sensor Type

- Inertial Sensor

- Image Sensor

- Position Sensor

- Others

By Platform Type

By Application

- Navigation

- Data Acquisition

- Motion Detection

- Others

By Technology

- Remotely Operated

- Semi-autonomous

- Fully Autonomous

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drone sensor market is characterized by strong innovation and technological advancement among leading players such as Bosch Sensortec GmbH, InvenSense, KVH Industries Inc., LeddarTech Holdings Inc., RTX, Sentera, Sony Semiconductor Solutions Group, Sparton, TE Connectivity, and Teledyne FLIR LLC. These companies focus on developing compact, high-precision sensors that enhance flight stability, navigation, and imaging capabilities. Strategic initiatives include collaborations with drone manufacturers, mergers, and investments in AI-driven sensor technology. Key players are expanding product portfolios to meet rising demand across defense, agriculture, logistics, and infrastructure inspection sectors. Emphasis on MEMS-based sensor miniaturization and integration of LiDAR and thermal imaging systems supports market competitiveness. Additionally, growing partnerships for R&D in autonomous flight systems and 3D mapping are reshaping market dynamics. Continuous innovation and cost optimization remain central to maintaining market leadership amid intensifying global competition and evolving regulatory frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Sony Semiconductor Solutions Group announced the upcoming release of its IMX927 stacked CMOS image sensor offering approx. 105 effective megapixels and high-speed output at 100 fps.

- In September 2025, Bosch Sensortec GmbH highlighted its innovation milestone aiming for on-sensor intelligence in 90 % of its products by 2027, covering MEMS sensors and drone applications.

- In September 2025, Teledyne FLIR LLC unveiled its SkyCarrier drone-in-a-box deployment system for unmanned aerial systems launched from ground or maritime platforms

Report Coverage

The research report offers an in-depth analysis based on Sensor Type, Platform Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for miniaturized and lightweight sensors will increase to improve drone efficiency.

- Integration of AI and machine learning will enhance autonomous flight and decision-making.

- LiDAR and hyperspectral sensing technologies will gain wider use in mapping and agriculture.

- Growth in defense and security applications will drive adoption of advanced imaging sensors.

- Expansion of drone use in logistics and delivery services will create new market opportunities.

- Continuous improvement in MEMS technology will reduce costs and extend drone flight time.

- Collaboration between drone manufacturers and sensor developers will accelerate innovation.

- Regulatory advancements supporting commercial drone operations will expand sensor demand.

- Increased focus on precision farming and environmental monitoring will drive market penetration.

- Rising investment in 5G-enabled drone connectivity will support real-time data transmission and control.