Market Overview

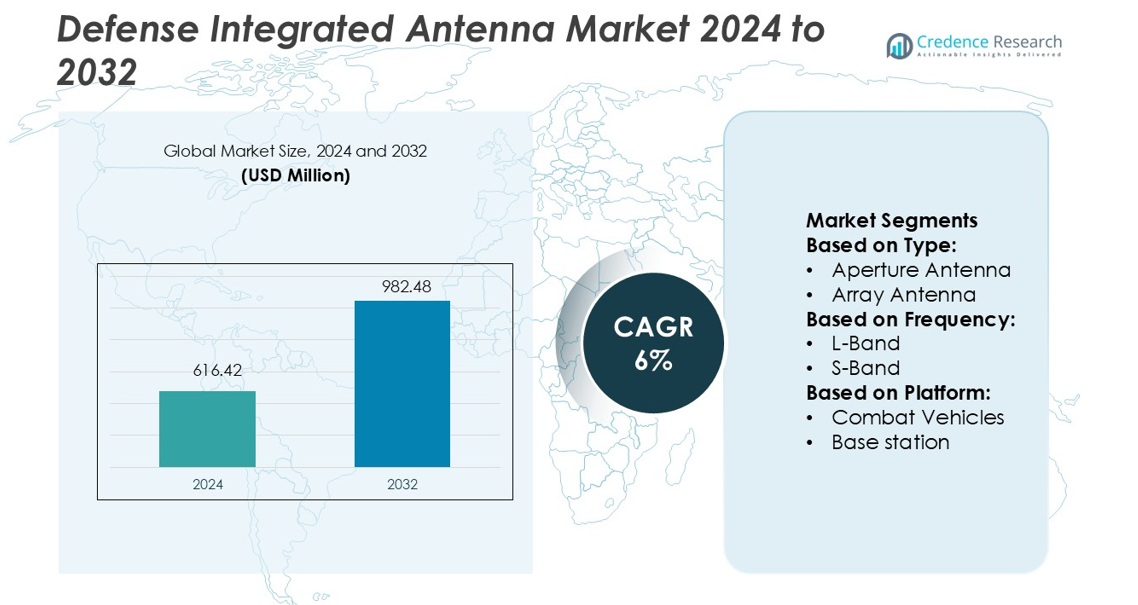

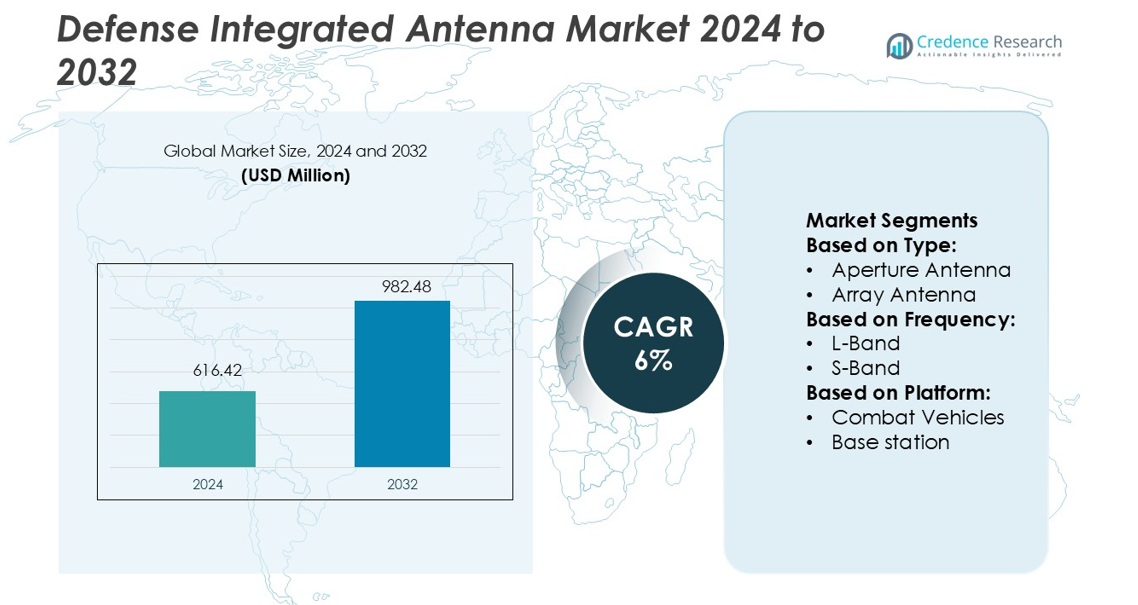

Defense Integrated Antenna Market size was valued USD 616.42 million in 2024 and is anticipated to reach USD 982.48 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Defense Integrated Antenna Market Size 2024 |

USD 616.42 million |

| Defense Integrated Antenna Market, CAGR |

6% |

| Defense Integrated Antenna Market Size 2032 |

USD 982.48 million |

The Defense Integrated Antenna Market is driven by strong competition among top players such as Radio Frequency Systems, Mobi Antenna, Ericsson, ACE Technologies, Nokia, ZTE, Shenzhen Sunway Communication, CommScope, Huawei, and Amphenol. These companies focus on advanced phased-array, conformal, and SATCOM antenna solutions to strengthen defense communication systems. Strategic investments in 5G integration, AI-enabled signal processing, and lightweight ruggedized designs enhance operational performance. Strong collaborations with defense agencies and global supply chain expansions support market penetration. North America leads the market with a 36% share, supported by early technology adoption, robust defense infrastructure, and large-scale modernization programs. This leadership is reinforced by high defense spending and advanced R&D capabilities.

Market Insights

- The Defense Integrated Antenna Market was valued at USD 616.42 million in 2024 and is expected to reach USD 982.48 million by 2032, growing at a CAGR of 6%.

- Rising demand for phased-array and SATCOM antennas is driving growth, supported by defense modernization and secure communication needs.

- Ongoing trends include 5G integration, AI-based signal processing, and the adoption of lightweight, ruggedized antenna designs across platforms.

- The market remains competitive with strong participation from major players focusing on R&D, strategic alliances, and expanding manufacturing capacity.

- North America leads with a 36% share, driven by advanced defense infrastructure and spending, while phased-array antennas dominate the segment share due to their wide use in naval, aerial, and ground systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Array antenna leads the Defense Integrated Antenna Market with a dominant market share. Its strong performance in beamforming and direction-finding supports advanced radar and communication systems. The technology enables multi-target tracking, increased gain, and high precision for surveillance and defense missions. Array antennas are widely used in airborne and ground platforms due to their compact structure and electronic steering capabilities. Defense modernization programs and growing adoption of advanced radar systems are driving segment growth. Microstrip antennas are also gaining attention for their lightweight and flexible design in next-generation applications.

- For instance, Lockheed Martin’s AN/SPY‑1 phased array antenna tracks more than 100 targets automatically while operating simultaneously in search and track modes. The technology enables multi-target tracking, increased gain, and high precision for surveillance and defence missions.

By Frequency

X-Band dominates the frequency segment with a significant market share, supported by its balance between resolution and range. X-Band antennas enable high-resolution imaging and precise target tracking, which are critical for radar and missile guidance systems. Defense agencies prefer this band for airborne early warning systems and precision targeting applications. High resistance to atmospheric interference further boosts its deployment across naval and airborne platforms. Meanwhile, Ka-Band is expanding rapidly due to its ability to support high-data-rate communication for satellite and UAV systems.

- For instance, EnduroSat offers a range of space-qualified X-Band patch antennas. For example, their X-Band Single Patch Antenna operates from 8,025 MHz to 8,400 MHz, has a realized gain of >6 dBi, and a form-factor mass of 2.2 g.

By Platform

The airborne platform segment, led by fighter aircraft, holds the largest share of the Defense Integrated Antenna Market. Fighter jets require advanced, lightweight, and high-frequency antennas to support secure communication, radar, and electronic warfare. The growing focus on network-centric warfare and stealth operations drives strong adoption in this segment. Modern fighter aircraft integrate multiple antenna types to enhance threat detection, situational awareness, and operational range. Ground platforms like combat vehicles and base stations are also evolving with advanced antenna systems to support mobile command and control operations.

Key Growth Drivers

Rising Demand for Advanced Communication Systems

The growing adoption of network-centric warfare is driving the defense integrated antenna market. Modern militaries need reliable, secure, and high-speed communication to support real-time decision-making. Integrated antennas enable seamless data transmission across ground, air, and naval platforms. For instance, phased array antennas allow multi-beam operations, improving data throughput and signal clarity. Governments are investing in tactical communication modernization to support these needs. This demand is fueling the integration of antennas in ISR systems, satellite communications, and electronic warfare applications across major defense programs.

- For instance, Ericsson’s Ultra Compact Core (UCC), which enables deployment of a full 5G core network in minutes at a mobile command centre, supports thousands of connected devices concurrently.

Expansion of Unmanned Systems and Autonomous Platforms

The rapid deployment of unmanned aerial, ground, and underwater vehicles is creating strong growth opportunities. These platforms require lightweight, high-performance antennas for secure, low-latency data links. Integrated antennas support surveillance, target acquisition, and remote control operations. For instance, conformal antennas enhance aerodynamics and reduce radar cross-sections, improving mission stealth and range. Defense agencies are scaling autonomous capabilities, boosting demand for compact, multi-band antenna solutions. This trend aligns with investments in advanced ISR and battlefield automation initiatives.

- For instance, Nokia’s tactical communication solutions exemplify this: the “Banshee Flex Radio” delivers private dual 5G/LTE connectivity using full 100 MHz carriers and supports deployment in a 516 mm × 400 mm × 525 mm enclosure weighing ~52 kg.

Increasing Investments in Next-Generation Radar and EW Systems

The rising focus on modernizing radar and electronic warfare systems is a major growth driver. Integrated antennas support high-frequency operations, beam steering, and electronic countermeasures. These features enhance situational awareness and survivability in contested environments. For instance, active electronically scanned array (AESA) antennas enable rapid target tracking and simultaneous multi-mission functionality. Governments are prioritizing radar upgrades to counter evolving threats, including hypersonic weapons and stealth aircraft. These initiatives are expanding the deployment of integrated antennas in critical defense infrastructure.

Key Trends & Opportunities

Adoption of AESA and Conformal Antennas

The defense sector is shifting toward advanced AESA and conformal antennas for enhanced agility and performance. AESA systems enable faster beam steering, reduced interference, and simultaneous mission support. Conformal antennas improve platform aerodynamics and stealth, supporting next-generation aircraft and UAVs. For instance, several defense contractors are integrating AESA systems in fighter modernization programs. This trend is creating opportunities for antenna manufacturers to offer lighter, scalable, and multi-function designs that meet multi-domain operational needs.

- For instance, ZTE’s 5G Active Antenna Unit “A9651A S26” integrates 64T/64R elements, outputs up to 320 W, and features beam-forming with antenna gain of 24.5 dBi in a 945 mm × 475 mm × 135 mm enclosure weighing 28 kg.

Integration with AI and Software-Defined Technologies

AI-enabled and software-defined antennas are emerging as a key innovation trend. These systems dynamically adapt frequency, direction, and power to counter jamming and optimize performance. For instance, AI algorithms enhance spectrum management and signal clarity, improving resilience in electronic warfare environments. Defense agencies are investing in smart antenna solutions to strengthen interoperability across platforms. This shift is opening opportunities for vendors focusing on intelligent, reconfigurable antenna technologies.

- For instance, Huawei’s antenna portfolio includes the model AMB4520R8v06 that operates in the 1 695-2 690 MHz band, weighs 20 kg, and delivers a gain of 19.1-20.3 dBi across sub-bands.

Rising Collaboration Between Defense and Private Sector

Public-private partnerships are accelerating innovation in integrated antenna solutions. Defense agencies are collaborating with technology firms to speed up development cycles and reduce costs. For instance, joint R&D programs support the rapid deployment of advanced communication and radar systems. Private sector advancements in miniaturization, materials, and AI integration are shaping next-generation antenna systems. These collaborations are creating opportunities for agile, dual-use technology solutions.Key Challenges

High Development and Integration Costs

The development of advanced integrated antennas involves high costs due to complex engineering and testing requirements. Integrating antennas into modern defense platforms requires extensive customization to meet performance and durability standards. For instance, phased array antennas involve costly semiconductor materials and advanced manufacturing. Budget constraints in some regions limit large-scale procurement and deployment. These financial pressures pose a significant challenge for manufacturers and defense agencies.

Regulatory and Interoperability Constraints

Defense communication systems operate under strict frequency regulations and interoperability standards. Integrating new antenna technologies with legacy platforms often faces technical barriers and compliance issues. For instance, spectrum allocation conflicts can delay deployment timelines. Ensuring compatibility across multinational defense operations further increases system complexity. These regulatory and operational hurdles may slow the market’s overall adoption pace.

Regional Analysis

North America

North America dominates the Defense Integrated Antenna Market with a 36% market share. The region’s growth is supported by advanced military modernization programs and strong investment in next-generation radar and communication systems. The U.S. Department of Defense prioritizes integrated antenna technologies to enhance secure, high-speed data transfer and resilient battlefield communication. Increasing demand for SATCOM and phased-array antennas in defense aircraft and naval platforms further strengthens market expansion. The presence of major defense contractors and research institutions accelerates innovation and deployment. Rising investments in AI-driven and 5G-enabled antenna systems sustain the region’s leadership in this sector.

Europe

Europe accounts for 28% of the Defense Integrated Antenna Market, supported by strong defense modernization initiatives across NATO member countries. Growing adoption of multi-band and electronically steered array antennas enhances surveillance and communication capabilities. Programs such as the European Defence Fund (EDF) encourage collaborative R&D to strengthen indigenous capabilities. Countries like Germany, France, and the U.K. are investing in satellite communication and electronic warfare systems. Integration of advanced radar antennas in land and naval platforms drives demand. Strategic partnerships with global defense suppliers and technology transfers support steady market expansion across the region.

Asia Pacific

Asia Pacific holds 24% of the Defense Integrated Antenna Market, driven by rising defense budgets in China, India, Japan, and South Korea. Regional militaries are modernizing communication networks to support network-centric warfare and intelligence operations. Growing investments in naval and aerospace platforms accelerate the adoption of phased-array and conformal antennas. Domestic production initiatives and technology partnerships boost manufacturing capabilities. Governments emphasize satellite communication for border surveillance and strategic command systems. Ongoing regional tensions and modernization plans further drive spending on integrated antenna solutions across military domains, strengthening the region’s position in the global market.

Latin America

Latin America accounts for 5% of the Defense Integrated Antenna Market, supported by growing investments in surveillance and communication modernization. Brazil leads regional adoption, focusing on advanced radar and SATCOM integration to enhance military communication capabilities. Governments prioritize modernization of naval and air defense systems to strengthen national security infrastructure. The region is witnessing gradual adoption of compact, multi-band antenna systems for cost-efficient defense applications. Collaborations with international defense technology providers facilitate capability building. Rising focus on counter-narcotics, border surveillance, and disaster response enhances the deployment of integrated antenna solutions.

Middle East & Africa

The Middle East & Africa region captures a 7% market share, with increasing investments in secure defense communication systems. Nations like Saudi Arabia, Israel, and the UAE are leading adopters of advanced radar and SATCOM technologies. Defense modernization programs prioritize enhancing surveillance and early-warning capabilities through integrated antenna systems. Regional defense forces are investing in air defense and UAV-based communication systems, driving steady demand. Strategic defense partnerships with the U.S. and European firms strengthen technology adoption. Expanding border security and counter-terrorism operations further support market growth in this region.

Market Segmentations:

By Type:

- Aperture Antenna

- Array Antenna

By Frequency:

By Platform:

- Combat Vehicles

- Base station

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Defense Integrated Antenna Market is shaped by leading players including Radio Frequency Systems, Mobi Antenna, Ericsson, ACE Technologies, Nokia, ZTE, Shenzhen Sunway Communication, CommScope, Huawei, and Amphenol. The Defense Integrated Antenna Market is highly competitive, driven by rapid technological innovation and strategic collaborations. Companies are focusing on developing advanced phased-array, conformal, and SATCOM antennas to enhance secure and high-speed communication across defense platforms. Investments in AI-driven signal processing, 5G integration, and multi-band frequency support are strengthening product capabilities. Manufacturers are also emphasizing lightweight, ruggedized designs to meet operational requirements in harsh military environments. Strategic alliances with defense agencies and expansion of global manufacturing facilities enable faster deployment of next-generation systems. This competitive environment accelerates innovation, improves interoperability, and supports evolving defense communication needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Intellian Technologies unveiled three new small flat panel antennas for satellite broadband service on the OneWeb constellation from Eutelsat Group. Fixed, land mobility, and maritime services are served by these active electronically scanned arrays (ESA) user terminals.

- In September 2024, Huawei introduced the Alpha series antenna, marking a breakthrough for mobile AI applications. This series integrates high efficiency, digital capabilities, and easy deployment, meeting the rising demands for greater bandwidth, lower latency, and efficient operations in the evolving mobile AI era.

- In July 2024, ZTE introduced its D³-ELAA (Dynamic, Distributed, and Deterministic Extremely Large Antenna Array) solution. It is a supreme mobile networking solution that promises futuristic unattainable results. The solution targets the improvement of the user experience for 5G-A networks and in addition to that, on the way of paving the transition to 6G networks.

- In March 2024, Hanwha Phasor has declared that the introduction of the Phasor L3300B land antenna for mobile communications. The active electronically steered antenna (AESA) Phasor L3300B was developed for both military and commercial use. Hanwha Phasor’s land antenna solution provides customers with constant communications in any location.

Report Coverage

The research report offers an in-depth analysis based on Type, Frequency, Platform and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced phased-array antennas will increase with rising defense modernization.

- Integration of 5G technology will enhance communication speed and network resilience.

- AI and machine learning will improve antenna performance and signal optimization.

- Defense forces will adopt lightweight and rugged antennas for mobile platforms.

- SATCOM systems will gain strong adoption for secure long-range communication.

- Joint ventures and technology partnerships will accelerate innovation.

- Increased investments in electronic warfare will drive advanced antenna development.

- Modular and scalable antenna designs will support multi-mission operations.

- Regional defense programs will boost domestic production capabilities.

- Growing use of UAVs and autonomous systems will expand antenna integration.