Market Overview

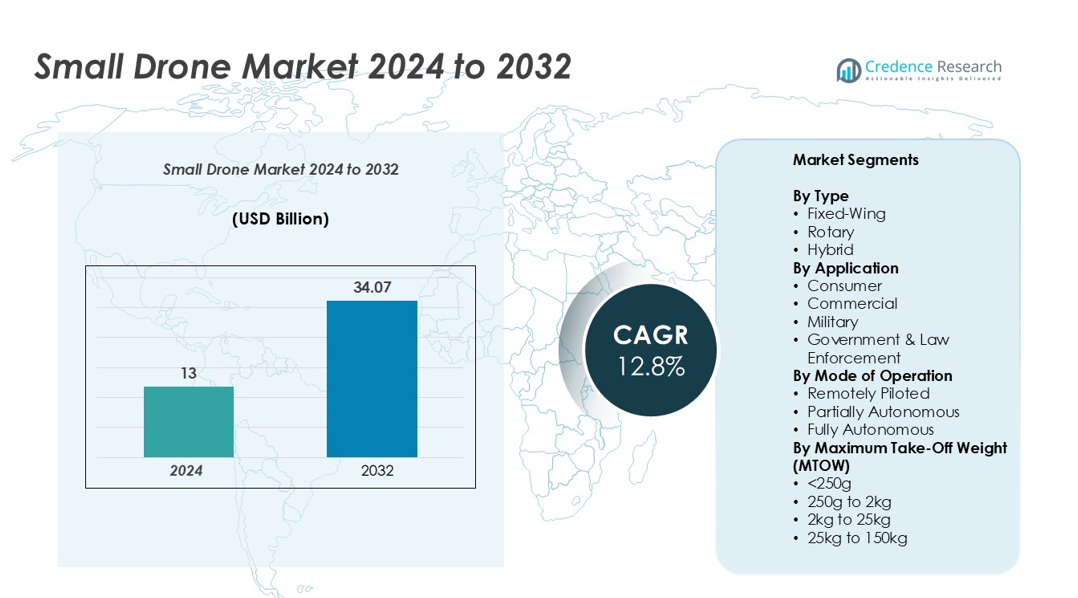

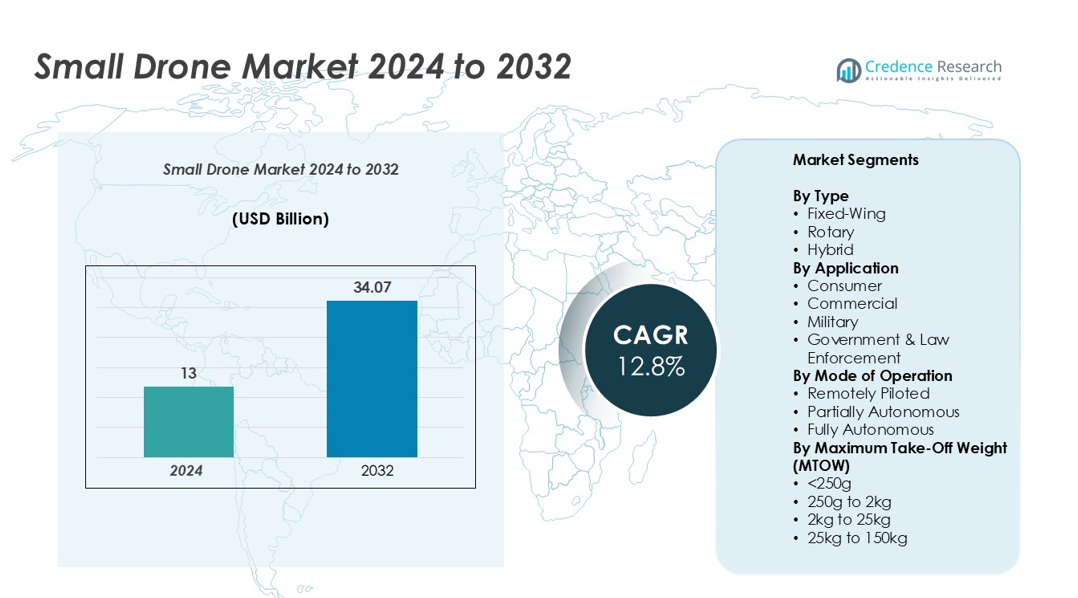

The Small Drone market size was valued at USD 13 billion in 2024 and is anticipated to reach USD 34.07 billion by 2032, at a CAGR of 12.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Drone market Size 2024 |

USD 13 billion |

| Small Drone market, CAGR |

12.8% |

| Small Drone market Size 2032 |

USD 34.07 billion |

The Small Drone market is led by key players such as AeroVironment Inc., DELAIR SAS, Parrot Drone SAS, Skydio Inc., Northrop Grumman Corporation, Autel Robotics Co. Ltd., Draganfly Innovations Inc., 3DR Inc., Yuneec – ATL Drone, SZ DJI Technology Co., Ltd., BAE Systems plc, Teledyne Technologies Incorporated, and Guangzhou EHang Intelligent Technology Co. Ltd. These companies focus on technological innovation, product diversification, and strategic partnerships to strengthen their global presence. North America dominates the market with a 34% share, supported by strong defense investment and advanced commercial applications. Asia Pacific follows with 29%, driven by large-scale manufacturing and rapid technology adoption. Europe, with 27%, benefits from regulatory alignment and infrastructure development, positioning these regions as the key revenue centers in the industry.

Market Insights

- The Small Drone market was valued at USD 13 Billion in 2024 and is projected to reach USD 34.07 Billion by 2032, at a CAGR of 12.8% during the forecast period.

- Strong demand from commercial and defense sectors drives market growth, supported by increasing applications in logistics, agriculture, and surveillance. Rotary drones lead the market with the largest segment share due to their flexibility and ease of deployment.

- Advancements in AI, autonomous navigation, and 5G connectivity are reshaping operational capabilities, creating new business models like Drone-as-a-Service (DaaS).

- North America dominates with a 34% share, followed by Asia Pacific with 29% and Europe with 27%, supported by strong infrastructure and regulatory frameworks.

- Regulatory restrictions, airspace limitations, and short battery life remain key restraints, challenging scalability while creating opportunities for innovation in battery technology and regulatory harmonization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The rotary segment holds the largest share of the Small Drone market. Rotary drones dominate due to their high maneuverability, vertical take-off and landing capability, and compact design. These features make them suitable for various applications, including surveillance, aerial photography, and inspection tasks. Fixed-wing drones are gaining traction for long-range missions and agricultural mapping, while hybrid drones offer improved endurance and flexibility. Growing demand from commercial and defense sectors continues to drive investments in rotary technology, making it the preferred choice for operational efficiency and cost-effective deployment.

- For instance, DJI’s Mavic 3 has a maximum flight time of up to 46 minutes under specific, ideal test conditions. Its top horizontal speed is 21 m/s (47 mph) in Sport mode, though it is limited to 19 m/s in EU regions to comply with regulations.

By Application

The commercial segment accounts for the largest market share among applications. Small drones are increasingly used in logistics, agriculture, media, energy, and infrastructure inspection. Their ability to capture real-time data and reduce operational costs drives adoption across industries. Consumer drones maintain steady growth due to rising recreational use, while government and law enforcement applications focus on border security and emergency response. The military segment benefits from advanced surveillance and reconnaissance capabilities. Expanding use in industrial and commercial operations strengthens the commercial segment’s leading position.

- For instance, Skydio X10 drones can cover a wireless range of up to 12 km (7.5 miles) and are compatible with modular sensor packages, including a 64 MP optical camera and a thermal camera with a 640×512 resolution, which enhances precision in commercial inspections.

By Mode of Operation

The remotely piloted segment leads the Small Drone market with the highest market share. These drones are widely used across consumer and commercial applications due to ease of operation, regulatory acceptance, and cost-effectiveness. Partially autonomous drones are gaining popularity in precision agriculture and industrial monitoring, enhancing operational efficiency with minimal human intervention. Fully autonomous drones are advancing rapidly through AI and sensor integration, driving future growth in surveillance and logistics. The strong adoption of remotely piloted drones is supported by their flexibility, lower training needs, and broad regulatory approval.

Key Growth Drivers

Rising Adoption in Commercial and Industrial Applications

Small drones are increasingly used in logistics, agriculture, infrastructure inspection, and energy sectors, driving strong market expansion. Businesses deploy these drones for real-time data collection, aerial mapping, and asset monitoring to improve operational efficiency. Logistics companies use drones to accelerate last-mile delivery, while farmers rely on precision agriculture to optimize crop yields. Construction and energy sectors leverage drones for structural inspection and site monitoring. The ability to lower costs, reduce labor dependency, and increase speed of operations makes drones a valuable asset. This expanding role across industries positions commercial and industrial use as a key growth driver for the market.

- For instance, the Wingcopter 198 can carry payloads of up to 6 kg over a maximum range of 75 km, with its total range increasing as the payload weight is reduced.

Advancements in Autonomous and AI-Enabled Flight Systems

The integration of AI, machine learning, and advanced navigation systems has improved drone capabilities significantly. These technologies support real-time decision-making, autonomous flight paths, and obstacle avoidance. Fully autonomous drones enhance operational accuracy in challenging terrains, making them ideal for surveillance, disaster response, and logistics. AI-driven flight control also reduces reliance on skilled pilots, enabling broader adoption. Enhanced battery efficiency and payload capacity further extend operational range and mission duration. This rapid advancement in autonomous technologies fuels the growing preference for intelligent drone systems, creating strong demand across both commercial and defense applications.

- For instance, Skydio X10 is equipped with six 4K navigation cameras and supports autonomous flight at speeds up to 16 m/s, ensuring high-precision obstacle detection and advanced autonomous mission planning.

Increasing Defense and Security Deployment

Small drones play a crucial role in modern defense and homeland security strategies. Governments and military forces adopt drones for surveillance, reconnaissance, and tactical operations due to their mobility and cost efficiency. Law enforcement agencies use them for crowd monitoring, border security, and emergency response. Their ability to collect live intelligence without risking personnel makes them ideal for security-sensitive missions. Technological enhancements like encrypted communication and night-vision systems increase their operational value. Rising global security concerns and defense modernization programs continue to drive large-scale procurement of small drones for defense and security applications.

Key Trends & Opportunities

Integration of 5G and Advanced Connectivity Solutions

The integration of 5G networks is transforming the capabilities of small drones. High-speed, low-latency connectivity enables seamless data transfer, real-time video streaming, and precise remote control over longer distances. This connectivity supports advanced applications like automated fleet management and synchronized drone swarms. Industries such as logistics, construction, and agriculture benefit from faster response and enhanced coordination. 5G also improves the safety and reliability of beyond-visual-line-of-sight (BVLOS) operations, expanding commercial applications. As telecom infrastructure grows globally, 5G integration is expected to create new opportunities for drone manufacturers and service providers.

- For instance, Qualcomm announced the Flight RB5 5G Platform, a 5G- and AI-enabled drone platform designed for high-performance, low-power drones. The company has since demonstrated various capabilities with its robotics platforms, including controlling a drone from over 100km away during a field demonstration in 2023 at the Hannover Messe.

Expansion of Drone-as-a-Service (DaaS) Models

Drone-as-a-Service models are gaining strong traction, offering businesses access to drone technology without high upfront investment. Companies can rent fleets for aerial surveying, security monitoring, and delivery operations on demand. This model reduces operational costs and lowers barriers for small and medium-sized enterprises. It also accelerates adoption in industries like agriculture, construction, and public safety. Service providers bundle drones with AI analytics platforms, delivering real-time insights. As demand grows for cost-effective and flexible solutions, DaaS models present a strong opportunity for market growth and service diversification.

- For instance, Zipline operates a global network of autonomous drones using an AI-driven navigation system. The company announced its one-millionth commercial delivery in April 2024 and has set a goal of reaching one million deliveries a day in the future.

Key Challenges

Stringent Regulatory Frameworks and Airspace Restrictions

Strict government regulations on drone operations limit widespread deployment across industries. Many regions impose restrictions on altitude, flight range, and airspace access, slowing down large-scale adoption. Certification requirements and pilot licensing add complexity for commercial operators. Regulatory hurdles also affect cross-border logistics and autonomous flight operations. While safety concerns justify these measures, inconsistent regulations across countries create operational challenges for global players. Achieving regulatory harmonization and enabling secure BVLOS operations are critical to unlocking the full potential of the small drone market.

Limitations in Battery Life and Payload Capacity

Short battery life and limited payload capacity remain major barriers to drone scalability. Current battery technologies restrict flight duration, reducing operational range and efficiency. Payload constraints limit the use of drones in heavy-duty applications like cargo delivery or industrial transport. Extended flight missions require frequent recharging or battery swaps, adding logistical complexity. Although advancements in battery density and hybrid propulsion are emerging, progress remains gradual. Addressing these technical limitations through next-generation energy storage solutions and lightweight designs is essential for supporting larger-scale, long-range drone operations.

Regional Analysis

North America

North America leads the Small Drone market with a 34% market share, driven by strong commercial and defense adoption. The U.S. dominates due to early regulatory support, high R&D spending, and advanced defense programs. Industries such as agriculture, logistics, and construction rely on drones for precision mapping and delivery operations. The presence of leading manufacturers and favorable FAA guidelines further boost market penetration. Increasing investments in 5G integration and autonomous systems strengthen the region’s leadership position, while growing public safety and homeland security applications drive sustained demand across both government and private sectors.

Europe

Europe holds a 27% market share, supported by rising commercial drone deployments and evolving regulatory frameworks. Countries like Germany, France, and the U.K. invest heavily in drone infrastructure, smart city development, and defense modernization. The region benefits from strong industrial automation and cross-border logistics initiatives. EU regulations encourage safe drone integration into controlled airspace, accelerating adoption. Energy, agriculture, and construction industries are key demand drivers. Collaborative R&D programs and the growing focus on sustainable aviation technologies further strengthen Europe’s market position, with advanced drone applications expanding steadily across multiple industries.

Asia Pacific

Asia Pacific accounts for a 29% market share, fueled by rapid urbanization, agricultural modernization, and strong government support. China and Japan lead with large-scale manufacturing capabilities and high commercial usage. India and South Korea are emerging as major growth hubs, focusing on drone applications in delivery, defense, and infrastructure inspection. Government investments in drone corridors and regulatory reforms accelerate regional adoption. Expanding 5G infrastructure and growing interest in autonomous operations further boost market growth. Asia Pacific’s cost-efficient production capabilities also make it a global export hub for small drones.

Latin America

Latin America represents a 6% market share, with growing adoption across agriculture, energy, and security sectors. Brazil and Mexico lead regional growth due to supportive regulations and increasing commercial drone deployments. Agricultural applications, including crop monitoring and precision spraying, are key demand drivers. Infrastructure inspection and environmental monitoring are also expanding rapidly. However, regulatory fragmentation and limited technical infrastructure pose challenges. Rising private investments and pilot training initiatives are improving operational capabilities, gradually increasing the market’s maturity level across the region.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, with increasing use of small drones in security, oil and gas, and infrastructure inspection. The UAE and Saudi Arabia are leading adopters, supported by smart city initiatives and defense modernization. In Africa, agricultural and environmental monitoring applications are growing steadily. Investments in 5G networks and autonomous drone solutions are emerging as key enablers. However, limited regulatory clarity and lower technology penetration still restrict wider adoption. Gradual policy reforms and increased public-private partnerships are expected to drive future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

By Application

- Consumer

- Commercial

- Military

- Government & Law Enforcement

By Mode of Operation

- Remotely Piloted

- Partially Autonomous

- Fully Autonomous

By Maximum Take-Off Weight (MTOW)

- <250g

- 250g to 2kg

- 2kg to 25kg

- 25kg to 150kg

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Small Drone market is characterized by intense competition among established global players and emerging technology innovators. Key companies include AeroVironment Inc., DELAIR SAS, Parrot Drone SAS, Skydio Inc., Northrop Grumman Corporation, Autel Robotics Co. Ltd., Draganfly Innovations Inc., 3DR Inc., Yuneec – ATL Drone, SZ DJI Technology Co., Ltd., BAE Systems plc, Teledyne Technologies Incorporated, and Guangzhou EHang Intelligent Technology Co. Ltd. Market leaders focus on expanding their product portfolios through advanced flight technologies, AI integration, and enhanced payload capabilities. Strategic alliances with defense agencies, commercial industries, and logistics firms strengthen their market position. Companies also invest heavily in R&D to enhance autonomous navigation, endurance, and connectivity features. Additionally, expanding drone-as-a-service offerings and strengthening after-sales support play a key role in retaining competitive advantage. Mergers, acquisitions, and regional expansions remain central strategies to increase market share and maintain technological leadership in this rapidly evolving industry.

Key Player Analysis

- AeroVironment Inc.

- DELAIR SAS

- Parrot Drone SAS

- Skydio, Inc.

- Northrop Grumman Corporation

- Autel Robotics Co., Ltd.

- Draganfly Innovations Inc.

- 3DR, Inc.

- Yuneec – ATL Drone

- SZ DJI Technology Co., Ltd.

- BAE Systems plc

- Teledyne Technologies Incorporated

- Guangzhou EHang Intelligent Technology Co. Ltd

Recent Developments

- In February 2025, EHang partnered with JAC Motors and Guoxian Holdings to establish a dedicated eVTOL factory in Hefei, China.

- In January 2025, EHang’s EH216-S executed its first downtown-Shanghai flight, showcasing controlled urban air-taxi operations.

- In May 2024, EASA published Easy Access Rules for U-space, formalizing automated drone-traffic management across the EU.

- In April 2024, Zipline surpassed one million autonomous deliveries and forged new US retail and healthcare partnerships.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Mode of Operation, Maximum Take-Off Weight (MTOW) and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of small drones will increase in logistics, agriculture, and infrastructure inspection.

- AI and autonomous navigation will enhance operational precision and flight safety.

- Defense and security applications will expand with improved surveillance and reconnaissance capabilities.

- 5G integration will enable faster data transfer and wider operational range.

- Drone-as-a-Service models will gain strong traction among commercial users.

- Battery and propulsion innovations will extend flight duration and payload capacity.

- Regulatory frameworks will gradually harmonize, enabling more BVLOS operations.

- Asia Pacific will emerge as a key production and export hub.

- Partnerships between drone manufacturers and end-use industries will accelerate market expansion.

- Investment in R&D will drive advancements in autonomous fleets and smart drone systems.