Market Overview

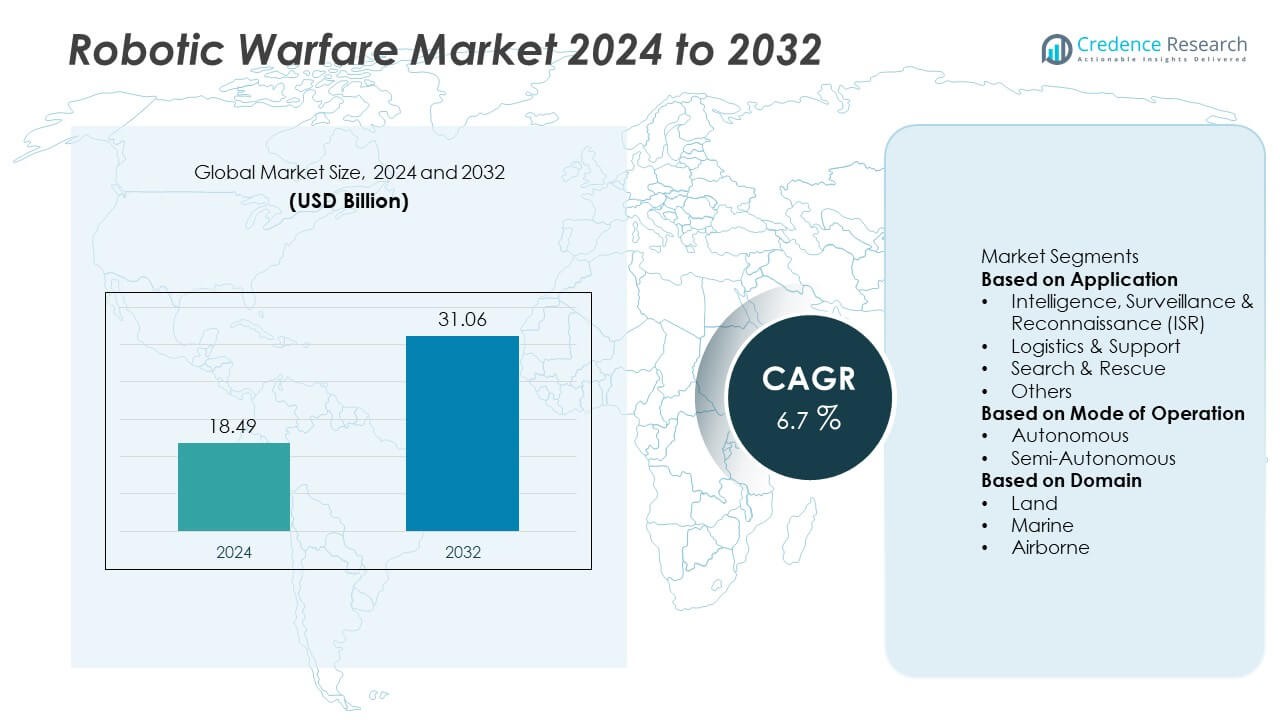

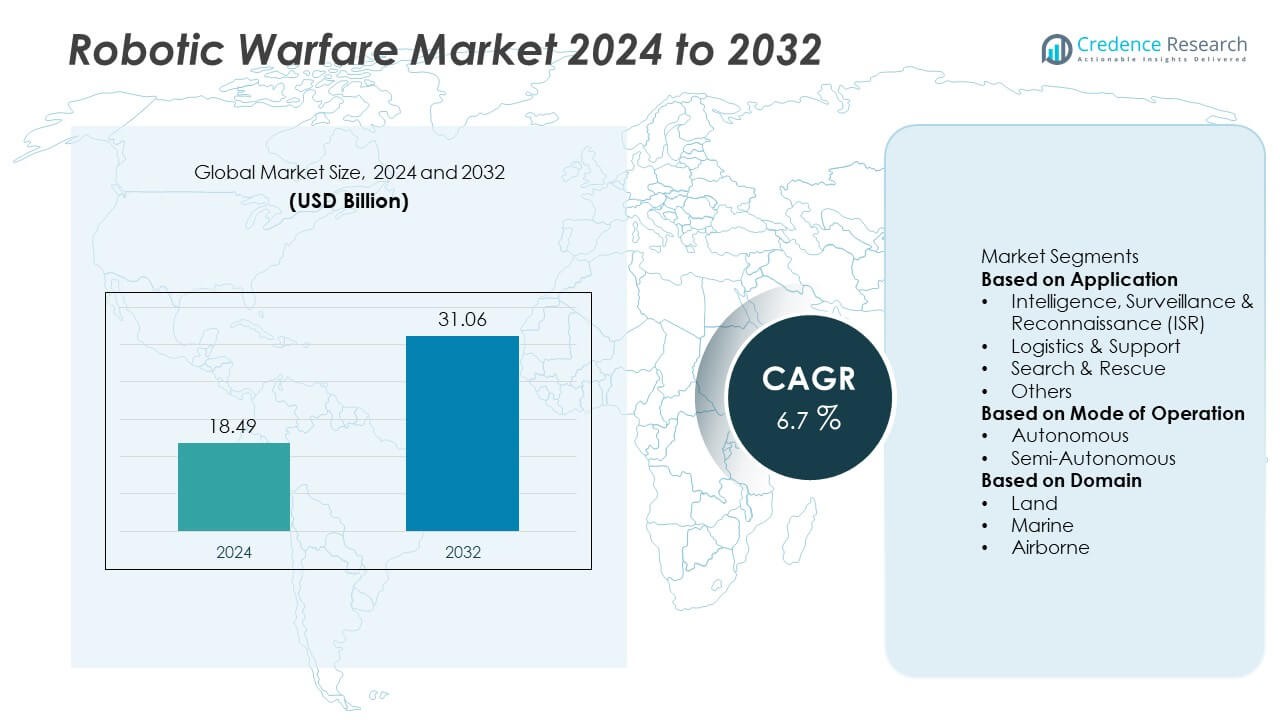

The global robotic warfare market was valued at USD 18.49 billion in 2024 and is projected to reach USD 31.06 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Warfare Market Size 2024 |

USD 18.49 Billion |

| Robotic Warfare Market, CAGR |

6.7% |

| Robotic Warfare Market Size 2032 |

USD 31.06 Billion |

The robotic warfare market is led by key players including Dassault Group, Cobham plc, General Atomics, Lockheed Martin Corporation, BAE Systems plc, Boeing, Elbit Systems Ltd., AeroVironment, Inc., Northrop Grumman Corporation, and Autonomous Solutions, Inc. (ASI). These companies lead through innovation in AI-enabled unmanned systems, autonomous drones, and multi-domain robotic platforms. North America dominated the global market with a 41% share in 2024, supported by high defense spending and advanced R&D infrastructure. Asia-Pacific followed with a 26% share, driven by increasing military modernization and adoption of autonomous systems in China, India, and Japan. Continuous innovation and government collaboration enhance market competitiveness globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global robotic warfare market was valued at USD 18.49 billion in 2024 and is projected to reach USD 31.06 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

- Market growth is driven by increasing investments in autonomous defense technologies, expanding use of unmanned ground and aerial vehicles, and rising demand for AI-driven combat systems.

- Key trends include the integration of swarm robotics, machine learning-based targeting, and hybrid multi-domain platforms enhancing tactical efficiency.

- The competitive landscape is led by Lockheed Martin, BAE Systems, Boeing, Northrop Grumman, and General Atomics, focusing on advanced autonomy, cross-domain coordination, and real-time intelligence capabilities.

- North America held 41%, Asia-Pacific 26%, and Europe 28% shares in 2024, while the Intelligence, Surveillance & Reconnaissance (ISR) segment dominated with a 46% share, supported by its widespread application in threat detection and battlefield monitoring.

Market Segmentation Analysis:

By Application

The Intelligence, Surveillance & Reconnaissance (ISR) segment dominated the robotic warfare market with a 46% share in 2024. This dominance is driven by the growing adoption of unmanned systems for real-time data collection, threat detection, and battlefield monitoring. Defense forces increasingly rely on ISR robots to enhance situational awareness and minimize human exposure in high-risk zones. Advancements in AI, high-resolution imaging, and communication systems are improving reconnaissance precision. Expanding deployment of autonomous drones and ground robots for border security and tactical missions continues to strengthen this segment’s leadership globally.

- For instance, Northrop Grumman developed the RQ-4B Global Hawk Block 40, equipped with the AN/ZPY-2 Multi-Platform Radar Technology Insertion Program (MP-RTIP) sensor capable of scanning 100,000 km² per mission.

By Mode of Operation

The semi-autonomous segment held a 59% share in 2024, supported by its balance between human oversight and autonomous functionality. Semi-autonomous systems are widely used in surveillance, logistics, and combat support due to their reliability and controlled decision-making. They offer enhanced safety, precision, and adaptability under dynamic battlefield conditions. Military agencies favor semi-autonomous robots for missions requiring partial human intervention to ensure compliance with combat rules and ethical considerations. The integration of AI-driven navigation and remote-control systems further boosts adoption across land and aerial defense platforms.

- For instance, L3Harris Technologies developed the T7 multi-mission robotic platform, which has a total weight of 322 kilograms and is equipped with an intuitive haptic feedback arm that provides human-like dexterity and enables precision control. Its arm can lift over 113 kilograms near the chassis or more than 27 kilograms at full extension.

By Domain

The land domain segment accounted for a 52% share in 2024, emerging as the dominant category in robotic warfare. Land-based robots are extensively used for reconnaissance, bomb disposal, logistics support, and combat operations. Increasing demand for unmanned ground vehicles (UGVs) enhances troop protection and operational efficiency. Major defense organizations are investing in advanced ground robots equipped with autonomous mobility, AI vision, and weapon systems. Rising deployment of robotic tanks, surveillance rovers, and logistics carriers across conflict zones and border patrol operations continues to drive growth within this segment.

Key Growth Drivers

Increasing Defense Modernization Programs

Global defense forces are rapidly adopting robotic systems to enhance combat readiness and reduce human casualties. Modernization initiatives in the U.S., China, and European nations are focusing on integrating unmanned ground, air, and marine platforms. These systems improve mission accuracy, endurance, and intelligence-gathering capabilities. Governments are investing heavily in AI-driven robotic systems and autonomous weapon technologies to strengthen surveillance and battlefield decision-making, fueling consistent growth in robotic warfare adoption.

- For instance, QinetiQ Group and Pratt Miller Defence developed the RCV-L (Robotic Combat Vehicle-Light) prototype, a diesel-electric hybrid capable of reaching a top speed of 64 km/h.

Rising Adoption of Unmanned Systems for ISR Operations

The growing use of unmanned systems for Intelligence, Surveillance, and Reconnaissance (ISR) missions is a major growth driver. Defense organizations are deploying robotic drones and ground vehicles for real-time data collection and situational analysis. These systems enhance decision-making efficiency while minimizing risks to soldiers. Continuous advancements in imaging sensors, AI-based analytics, and autonomous control technologies further improve ISR accuracy. Expanding use of ISR robotics across border patrols, reconnaissance missions, and urban warfare drives sustained market growth.

- For instance, Elbit Systems developed the Hermes 900 StarLiner UAV equipped with a 450 kg payload capacity and a flight endurance of up to 36 hours. The platform carries EO/IR sensors, SAR/GMTI radar, and SIGINT modules, transmitting real-time data through encrypted satellite links.

Integration of Artificial Intelligence and Machine Learning

AI and machine learning integration is transforming the effectiveness of robotic warfare systems. These technologies enable autonomous navigation, real-time threat assessment, and adaptive combat responses. Defense contractors are developing smart robots capable of self-learning and multi-domain coordination. AI-based algorithms improve decision-making accuracy, enabling robots to analyze complex data and execute missions with minimal human input. The growing need for faster response systems and autonomous defense operations continues to strengthen market expansion globally.

Key Trends & Opportunities

Emergence of Swarm Robotics in Military Operations

Swarm robotics is emerging as a transformative trend in robotic warfare. It involves deploying multiple coordinated robotic units that operate autonomously to achieve shared objectives. Defense agencies are experimenting with swarm drones for surveillance, electronic warfare, and coordinated strikes. This technology enhances coverage, adaptability, and redundancy on the battlefield. Ongoing R&D investments in swarm intelligence and communication systems are expected to open new opportunities for cost-effective and scalable robotic warfare solutions.

- For instance, Boeing demonstrated its MQ-28 Ghost Bat drone system, which can operate alongside crewed aircraft in multi-ship missions controlled by a single operator. Each autonomous drone measures 11.7 meters in length and carries a modular payload of up to 500 kilograms for missions such as ISR and electronic warfare.

Development of Hybrid and Multi-Domain Robotic Platforms

The industry is witnessing a shift toward hybrid robotic platforms capable of operating across land, air, and marine domains. These multi-domain robots offer flexibility in reconnaissance, logistics, and tactical missions. Defense contractors are designing modular systems that can transition between terrains and communication environments. Such developments support joint-force operations and interoperability among military branches. The growing demand for versatile and rapid-response robotic units presents new opportunities for innovation in hybrid warfare technologies.

- For instance, Northrop Grumman developed the MQ-8C Fire Scout, an unmanned helicopter designed for both naval and land-based operations with an endurance of 12 hours and operational range exceeding 278 kilometers.

Key Challenges

High Cost of Development and Deployment

Developing advanced robotic warfare systems requires significant investment in research, testing, and integration of AI and sensor technologies. The high procurement and maintenance costs limit adoption, especially among developing nations. Complex defense procurement procedures and long development cycles also delay deployment. Despite potential for long-term cost savings, the initial financial burden remains a key barrier to large-scale adoption. Manufacturers are focusing on modular and cost-optimized designs to overcome these economic challenges.

Ethical and Regulatory Concerns Over Autonomous Weapons

The growing use of autonomous robots in combat raises ethical and legal concerns. International regulations regarding lethal autonomous weapon systems (LAWS) remain inconsistent, creating operational uncertainty. The potential for unintended engagements or lack of human accountability intensifies debate on deployment ethics. Many nations are balancing technological progress with strict oversight to ensure compliance with humanitarian laws. Establishing clear frameworks for human-in-the-loop control and accountability remains essential to address public and regulatory concerns.

Regional Analysis

North America

North America held a 41% share in 2024, driven by strong investments in defense modernization and advanced autonomous technologies. The United States leads the region with extensive use of unmanned ground and aerial systems for surveillance, reconnaissance, and combat operations. High defense spending by the U.S. Department of Defense and collaborations with companies such as Lockheed Martin and Northrop Grumman strengthen regional dominance. The integration of AI, robotics, and cybersecurity solutions in warfare systems further enhances operational capability. Continuous R&D in autonomous weapon systems and swarm robotics reinforces North America’s leadership in robotic warfare technologies.

Europe

Europe accounted for a 28% share in 2024, supported by growing defense budgets and collaborative military projects under the European Defence Fund. Countries such as the United Kingdom, France, and Germany are investing heavily in autonomous ground and aerial combat systems to enhance security capabilities. The region’s focus on ethical AI deployment and interoperability across NATO allies encourages innovation. European defense companies are developing advanced robotic systems for reconnaissance, logistics, and border protection. The increasing integration of robotic platforms into military modernization programs continues to strengthen Europe’s position in the global market.

Asia-Pacific

Asia-Pacific captured a 26% share in 2024, propelled by expanding defense programs and rapid technological adoption in countries like China, India, Japan, and South Korea. Governments are prioritizing the development of unmanned combat vehicles, surveillance drones, and robotic naval systems. China’s investment in AI-driven defense systems and India’s modernization under the “Make in India” initiative drive significant market growth. Regional tensions and border disputes are accelerating adoption of autonomous and semi-autonomous systems for surveillance and combat. Continuous funding for R&D and domestic production capabilities enhances Asia-Pacific’s growing influence in the global robotic warfare market.

Middle East & Africa

The Middle East & Africa held a 3% share in 2024, driven by increasing military expenditure and defense diversification efforts. Countries such as Israel, Saudi Arabia, and the UAE are adopting advanced robotic systems for surveillance, border control, and counter-terrorism operations. Israel leads regional innovation with extensive deployment of autonomous vehicles and drones in defense missions. Ongoing geopolitical instability and cross-border security challenges are fueling investments in AI-enabled warfare systems. Partnerships with global defense manufacturers and technology providers further support regional adoption and modernization of military robotics infrastructure.

Latin America

Latin America represented a 2% share in 2024, with growth driven by modernization initiatives in Brazil, Mexico, and Colombia. The region is adopting robotic systems for border surveillance, counter-narcotics, and disaster response operations. Defense agencies are exploring unmanned ground and aerial systems to enhance situational awareness and mission efficiency. Limited defense budgets constrain large-scale deployment, but collaborations with U.S. and European defense firms are facilitating technology transfer. Increasing focus on upgrading national security infrastructure and integrating autonomous surveillance technologies supports gradual market growth across the region.

Market Segmentations:

By Application

- Intelligence, Surveillance & Reconnaissance (ISR)

- Logistics & Support

- Search & Rescue

- Others

By Mode of Operation

- Autonomous

- Semi-Autonomous

By Domain

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the robotic warfare market includes major players such as Dassault Group, Cobham plc, General Atomics, Lockheed Martin Corporation, BAE Systems plc, Boeing, Elbit Systems Ltd., AeroVironment, Inc., Northrop Grumman Corporation, and Autonomous Solutions, Inc. (ASI). These companies dominate through advanced robotics platforms, AI integration, and strong defense partnerships. Leading manufacturers focus on developing autonomous drones, unmanned ground vehicles, and intelligent combat systems equipped with advanced sensors and control algorithms. Strategic collaborations between defense contractors and governments drive innovation and deployment across air, land, and marine domains. Firms are also investing in next-generation swarm robotics, real-time communication systems, and autonomous decision-making technologies to enhance combat efficiency. Increasing R&D spending and a shift toward hybrid and AI-enabled robotic systems continue to intensify global competition while supporting modernization efforts across defense forces worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dassault Group

- Cobham plc

- General Atomics

- Lockheed Martin Corporation

- BAE Systems plc

- Boeing

- Elbit Systems Ltd.

- AeroVironment, Inc.

- Northrop Grumman Corporation

- Autonomous Solutions, Inc. (ASI)

Recent Developments

- In October 2025, General Atomics Aeronautical Systems signed a deal with Hanwha Aerospace to jointly develop a STOL (short-takeoff and landing) variant of the “Gray Eagle” drone. The agreement targets first flight in 2027 and local production in South Korea.

- In September 2025, Lockheed Martin and BAE Systems plc announced a strategic partnership to develop a new range of modular uncrewed air systems for attack and electronic warfare roles, designed for flexible launch from air, land or sea platforms.

- In September 2025, BAE Systems revealed it is aiming to bring its autonomous submarine platform “Herne” to market by the end of 2026.

- In June 2025, General Atomics demonstrated its MQ‑20 Avenger unmanned jet using the latest autonomous mission software, engaging both live and virtual aircraft in the exercise.

Report Coverage

The research report offers an in-depth analysis based on Application, Mode of Operation, Domain and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing defense modernization and increased use of unmanned systems.

- AI and machine learning integration will enhance autonomous decision-making and targeting accuracy.

- Swarm robotics will play a key role in surveillance and coordinated combat operations.

- Demand for semi-autonomous systems will rise due to balance between control and autonomy.

- Governments will increase funding for R&D in AI-enabled combat and reconnaissance robots.

- Hybrid platforms capable of operating across air, land, and marine domains will gain traction.

- Ethical and regulatory frameworks will shape deployment of lethal autonomous systems.

- Partnerships between defense contractors and governments will accelerate innovation.

- Asia-Pacific will experience strong growth due to expanding military programs in China and India.

- Continuous advancements in communication, navigation, and sensor technologies will redefine future battlefield strategies.