Market Overview:

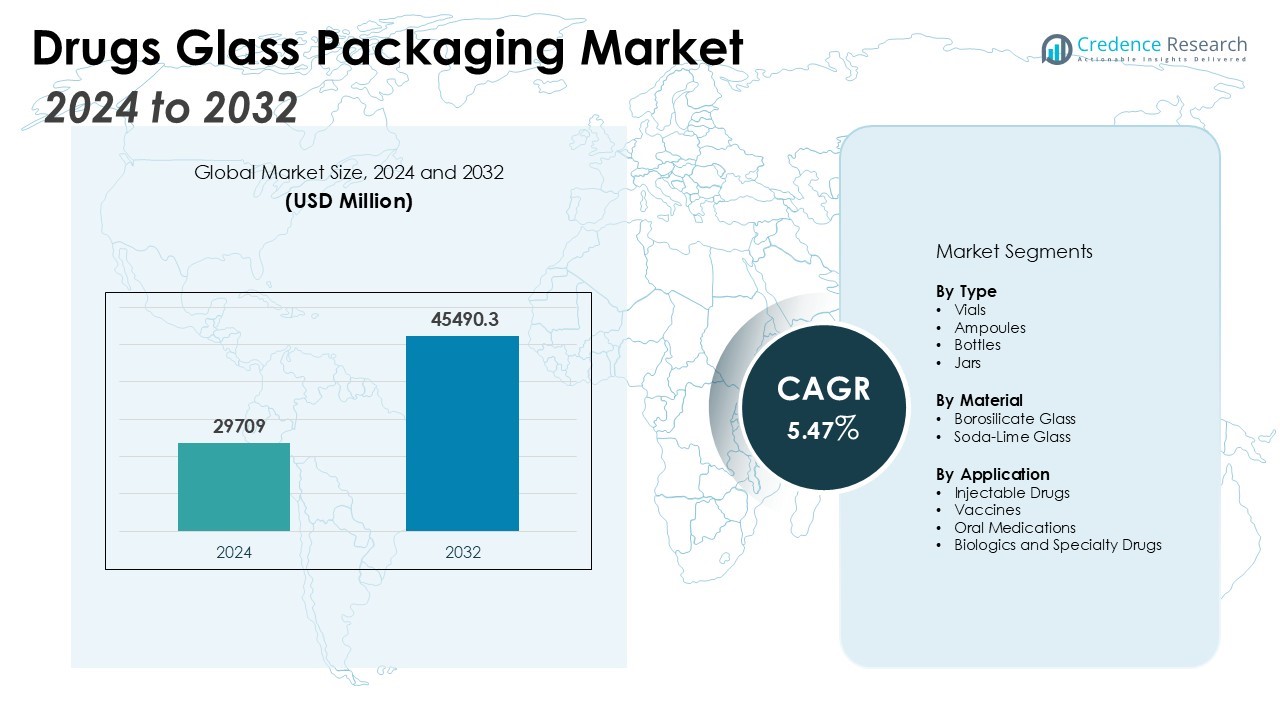

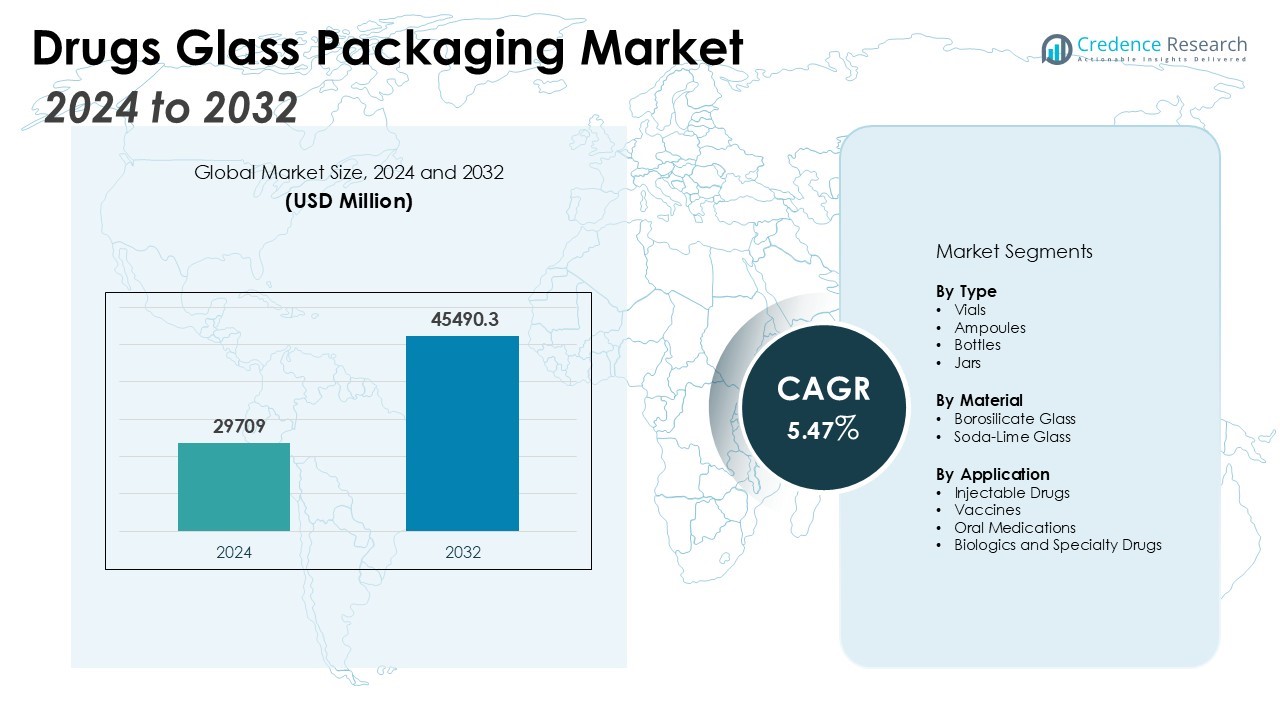

The Drugs Glass Packaging Market size was valued at USD 29709 million in 2024 and is anticipated to reach USD 45490.3 million by 2032, at a CAGR of 5.47% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drugs Glass Packaging Market Size 2024 |

USD 29709 Million |

| Drugs Glass Packaging Market, CAGR |

5.47% |

| Drugs Glass Packaging Market Size 2032 |

USD 45490.3 Million |

Key market drivers include the increasing global consumption of pharmaceutical products, the growing trend towards sustainable packaging solutions, and advancements in glass packaging technologies. Glass is widely preferred for drug packaging due to its superior chemical resistance, impermeability, and ability to maintain product integrity. Moreover, the rising awareness of health and safety standards in the pharmaceutical industry is propelling the demand for high-quality, tamper-evident, and eco-friendly packaging options. Additionally, the increasing adoption of biologics and specialty drugs is further boosting the demand for reliable glass packaging.

Regionally, North America holds the largest market share, driven by the high demand for pharmaceutical packaging solutions in the U.S. and Canada. Europe follows closely, with Germany, France, and the UK being major contributors due to the strong pharmaceutical industry in these countries. The Asia Pacific region is expected to witness the highest growth rate during the forecast period, owing to the expansion of the pharmaceutical sector in emerging economies like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market size was valued at USD 29,709 million in 2024 and is projected to reach USD 45,490.3 million by 2032, growing at a CAGR of 5.47%.

- Increasing global pharmaceutical consumption and the rising demand for biologics and specialty drugs drive the market for reliable glass packaging.

- The growing trend for sustainable, recyclable packaging is boosting the demand for eco-friendly glass solutions in the pharmaceutical industry.

- Advancements in glass packaging technologies, including lightweight designs and enhanced barrier properties, are improving durability and cost-efficiency.

- Stringent health and safety regulations encourage the adoption of glass packaging due to its inert properties and ability to ensure product safety.

- High production and transportation costs, along with glass’s fragility, pose challenges for its broader use in pharmaceutical packaging.

- North America leads the market with a 35% share, followed by Europe at 30%, while Asia Pacific is set to experience the highest growth rate.

Market Drivers:

Rising Demand for Pharmaceutical Products

The increasing consumption of pharmaceutical products globally is a primary driver for the Drugs Glass Packaging Market. As the healthcare industry expands, the demand for various medicines, vaccines, and biologics has surged. The packaging of these products requires materials that preserve their efficacy and safety. Glass packaging, known for its superior chemical resistance, is widely used to maintain the integrity of sensitive pharmaceuticals. It ensures that the product remains uncontaminated and retains its potency over time. The growing healthcare awareness and aging populations contribute to the higher consumption of pharmaceutical goods, further increasing the demand for reliable packaging.

Preference for Sustainable and Eco-Friendly Packaging Solutions

The growing emphasis on sustainability in the packaging industry significantly influences the Drugs Glass Packaging Market. Glass is a recyclable material, making it an attractive option for pharmaceutical packaging, especially with increasing consumer preference for eco-friendly products. Unlike plastic, glass does not release harmful chemicals into the environment, aligning with global sustainability goals. Pharmaceutical companies are opting for glass packaging solutions that comply with environmental regulations and demonstrate commitment to reducing their carbon footprint. This shift to sustainable packaging is fostering market growth and attracting more environmentally-conscious consumers.

- For instance, Corning’s Viridian™ vials eliminate 9 tons of glass from landfill for every 10 million vials used by lowering vial weight from 4.4g to 3.5g per 2mL vial, supporting substantial waste reduction without compromising quality.

Advancements in Glass Packaging Technologies

Technological advancements in glass packaging are enhancing its functionality and appeal in the pharmaceutical industry. The development of tamper-evident and child-resistant packaging designs provides added safety and security, which is crucial for pharmaceuticals. Innovations such as lightweight glass and enhanced barrier properties are improving the durability and cost-efficiency of glass packaging. These improvements make glass a competitive option for pharmaceutical manufacturers looking to ensure product safety while managing costs. The continual innovation in packaging technology is expected to sustain market growth by offering solutions that meet the evolving needs of the pharmaceutical sector.

- For instance, SGD Pharma produces over 8 million vials and bottles per day across its five ISO 15378-certified manufacturing plants in Europe and Asia, offering advanced internal treatments for enhanced vial durability and regulatory compliance.

Stringent Health and Safety Regulations

The increasing focus on health and safety standards within the pharmaceutical industry is another key driver for the Drugs Glass Packaging Market. Governments and regulatory bodies worldwide impose strict guidelines to ensure that medicines are properly stored and packaged. Glass packaging meets these standards due to its inert nature, providing a safe and effective way to store a wide range of pharmaceutical products. These regulatory requirements push pharmaceutical companies to adopt glass packaging, which ensures compliance while protecting the product from external contaminants. As the regulatory landscape continues to evolve, glass packaging remains a reliable solution for meeting these stringent demands.

Market Trends:

Growing Demand for Biologics and Specialty Drugs

A notable trend in the Drugs Glass Packaging Market is the increasing demand for biologics and specialty drugs. Biologics, which are large, complex molecules derived from living organisms, require packaging that preserves their stability and effectiveness. Glass packaging is ideal for these products due to its inert properties, ensuring that these sensitive drugs remain uncontaminated and stable during transportation and storage. The rise of personalized medicine and biologic treatments is accelerating this trend, as the demand for high-quality, safe, and reliable packaging solutions intensifies. Pharmaceutical companies are turning to glass to meet the rigorous demands of biologic drug storage, which drives market growth in this segment.

- For instance, Humira (adalimumab) is provided in a single-use glass prefilled syringe containing 1mL of solution.

Shift Toward Sustainable and Innovative Packaging Solutions

Another significant trend in the Drugs Glass Packaging Market is the shift toward more sustainable and innovative packaging solutions. The pharmaceutical industry is increasingly focusing on reducing its environmental impact, and glass packaging aligns well with these efforts due to its recyclability. Companies are exploring new glass formulations and design innovations that improve the strength, functionality, and sustainability of packaging. Lightweight glass is gaining popularity, reducing material usage and shipping costs. Additionally, the rise of eco-conscious consumers and stricter regulations on plastic usage are encouraging pharmaceutical manufacturers to opt for glass packaging. This trend toward sustainability is expected to drive further demand for glass solutions across the pharmaceutical sector.

- For example, Phase 2 of Michigan State University’s Pharma End-to-End RFID Pilot achieved full (100%) traceability of glass-packaged pharmaceuticals across a real-world supply chain, demonstrating innovation that both meets new supply chain regulations and supports sustainability goals.

Market Challenges Analysis:

High Cost and Fragility of Glass Packaging

One of the primary challenges in the Drugs Glass Packaging Market is the high cost associated with glass packaging materials. Glass is a more expensive option compared to alternatives like plastic, especially when considering production and transportation costs. The material’s weight adds to the overall shipping expenses, particularly for bulk shipments. Its fragility is another significant issue. Glass packaging is prone to breakage during handling and transportation, which can lead to product loss and additional costs for pharmaceutical companies. These factors often lead companies to seek alternative packaging solutions, limiting the growth potential of the glass packaging market.

Limited Flexibility in Design and Customization

The limited flexibility in design and customization of glass packaging poses another challenge in the Drugs Glass Packaging Market. Unlike plastic, glass offers fewer opportunities for intricate shapes or varied sizes, which can hinder its application in certain drug packaging needs. The rigid nature of glass makes it difficult to adapt to the evolving needs of pharmaceutical companies that require customized packaging solutions. This limits innovation and customization options, especially for emerging pharmaceutical products. Manufacturers are thus exploring alternatives to glass that offer greater design versatility while balancing safety and cost concerns.

Market Opportunities:

Rising Demand for Eco-Friendly Packaging Solutions

The growing demand for eco-friendly packaging presents a significant opportunity for the Drugs Glass Packaging Market. As sustainability becomes a central focus for the pharmaceutical industry, glass packaging, being 100% recyclable, stands out as a preferred solution. Governments and regulatory bodies are implementing stricter rules to reduce plastic use, encouraging pharmaceutical companies to adopt more sustainable materials. Glass packaging offers a compelling alternative due to its long-standing reputation for environmental friendliness. This trend supports the growing adoption of glass in packaging solutions, allowing companies to meet both consumer demand and regulatory requirements for sustainable practices.

Advancements in Glass Packaging Technology

Advancements in glass packaging technology create valuable opportunities in the Drugs Glass Packaging Market. Innovations such as lightweight glass, tamper-evident designs, and improved barrier properties are increasing the functionality and efficiency of glass packaging. These developments enable pharmaceutical companies to store and transport drugs more effectively, particularly for biologics and specialty drugs. Additionally, emerging technologies that enhance production processes and reduce costs may increase the competitiveness of glass packaging against alternative materials. As technology improves, the market has the potential to expand in new applications, especially for high-value, sensitive pharmaceutical products.

Market Segmentation Analysis:

By Type

The Drugs Glass Packaging Market is segmented into vials, ampoules, bottles, and jars. Vials hold the largest market share due to their extensive use in packaging injectable drugs, vaccines, and biologics. Bottles are commonly used for oral medications and over-the-counter products, while ampoules are preferred for single-dose, sterile pharmaceutical products. The demand for these packaging types continues to grow due to their ability to maintain product stability and protect against contamination.

- For instance, Novartis’ Simulect (basiliximab) injectable biologic is supplied in glass ampoules with each ampoule containing 5mL of water for injection, and each regimen includes two ampoules per 10mg or 20mg pack.

By Material

The market is primarily segmented by material into borosilicate glass and soda-lime glass. Borosilicate glass dominates the market due to its superior resistance to thermal shock and chemical stability, making it ideal for packaging high-value pharmaceuticals. Soda-lime glass is more commonly used for products that do not require stringent resistance to temperature and chemicals. The increasing preference for borosilicate glass, especially for biologics and injectables, contributes to the material segment’s growth.

- For instance, Corning’s Valor® Glass became the first new glass composition to receive FDA approval for use as a primary pharmaceutical package for a marketed drug product in over 100 years as of October 2019.

By Application

The Drugs Glass Packaging Market finds its largest application in the pharmaceutical industry, including injectable drugs, vaccines, and oral medications. The increasing adoption of biologics and specialty drugs boosts the demand for reliable packaging solutions. Glass packaging is preferred for its superior protection of sensitive products, which require safe storage and transportation. As healthcare needs evolve globally, the demand for glass packaging continues to grow across various pharmaceutical applications.

Segmentations:

By Type

- Vials

- Ampoules

- Bottles

- Jars

By Material

- Borosilicate Glass

- Soda-Lime Glass

By Application

- Injectable Drugs

- Vaccines

- Oral Medications

- Biologics and Specialty Drugs

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading Market with High Demand for Pharmaceutical Packaging

North America holds a dominant share of 35% in the Drugs Glass Packaging Market, driven primarily by the United States and Canada. The region’s well-established pharmaceutical industry creates strong demand for high-quality packaging solutions. The U.S. is one of the largest consumers of pharmaceutical products globally, leading to significant growth in packaging needs, including glass solutions. Stringent regulatory requirements for pharmaceutical packaging also drive the preference for glass, known for its safety and compliance with health and safety standards. The increasing focus on biologics and specialty drugs further boosts the demand for reliable and protective glass packaging solutions in North America.

Europe: Strong Pharmaceutical Industry and Regulatory Support

Europe accounts for 30% of the Drugs Glass Packaging Market, with countries like Germany, France, and the United Kingdom being major contributors. The region is home to some of the largest pharmaceutical companies, which continue to demand high-quality packaging solutions for their products. Regulatory support in the region, aimed at ensuring patient safety and product integrity, drives the preference for glass packaging. The region’s increasing adoption of sustainable packaging solutions also encourages the use of glass, as it is recyclable and environmentally friendly. Strong manufacturing capabilities and the presence of key packaging suppliers further support market growth in Europe.

Asia Pacific: Rapid Growth Driven by Emerging Economies

Asia Pacific holds a 25% share of the Drugs Glass Packaging Market and is expected to experience the highest growth rate during the forecast period. This growth is driven by the rapid expansion of the pharmaceutical sector in emerging economies such as China, India, and Southeast Asia. These countries are witnessing a surge in healthcare spending, leading to higher demand for pharmaceutical products and, consequently, packaging solutions. The growing focus on improving healthcare infrastructure and regulatory frameworks also encourages the adoption of high-quality glass packaging. As the region continues to industrialize and urbanize, the demand for safe, sustainable, and reliable drug packaging solutions is set to increase significantly.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Schott AG

- Gerresheimer AG

- Owens-Illinois, Inc.

- Ardagh Group S.A.

- Nipro Corporation

- West Pharmaceutical Services, Inc.

- Stevanato Group (Ompi)

- Sisecam Group

- DWK Life Sciences GmbH

- Beatson Clark Ltd.

- Piramal Glass Limited

- Acme Vial and Glass Company, LLC

Competitive Analysis:

The competitive landscape of the Drugs Glass Packaging Market is characterized by the presence of both established players and emerging companies. Key players include Schott AG, Corning Inc., Gerresheimer AG, and Nipro Corporation, which dominate the market due to their advanced technology, extensive product portfolios, and strong distribution networks. These companies focus on innovation in glass packaging, such as tamper-evident designs, lightweight solutions, and enhanced barrier properties. Their investments in sustainability and eco-friendly packaging also drive their market position. New entrants are increasingly focusing on cost-effective, customized packaging solutions to cater to the growing demand from the pharmaceutical industry. The competitive rivalry is intense, with companies continuously exploring collaborations, mergers, and acquisitions to expand their market presence. The growing focus on biologics and specialty drugs also encourages innovation and improved offerings in the glass packaging segment.

Recent Developments:

- In May 2025, Schott Pharma and Serum Institute of India announced the entry of TPG as a new strategic partner, with TPG acquiring a 35% stake in SCHOTT Poonawalla to drive the next growth phase for their joint venture in injectable drug packaging.

- In June 2024, Owens-Illinois, Inc. (O-I) Glass announced a $65 million investment in electrification and decarbonization at its plant in Veauche, France, aiming to improve sustainability and serve premium market demand.

- In April 2025, Ardagh Group announced a new long-term partnership with CAP Glass to further invest in glass recycling and sustainability initiatives.

Market Concentration & Characteristics:

The Drugs Glass Packaging Market is moderately concentrated, with a few dominant players controlling the majority of the market share. Companies like Schott AG, Gerresheimer AG, Corning Inc., and Nipro Corporation lead the market due to their advanced manufacturing capabilities and established global presence. These key players invest heavily in research and development to innovate and maintain their competitive edge, focusing on enhancing glass quality, safety features, and sustainability. The market is characterized by high barriers to entry, such as significant capital investment and compliance with stringent regulatory standards. Despite this, smaller players are emerging with cost-effective solutions and niche offerings to cater to specific pharmaceutical packaging needs. The market’s dynamics reflect a balance between established leaders and growing competition from new entrants aiming to capture market share through innovation and flexibility.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Material and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for injectable drugs is driving the need for high-quality glass packaging solutions.

- The expansion of biologics and specialty drugs is propelling the demand for reliable and protective glass packaging.

- Innovations such as lightweight glass and enhanced barrier properties are improving the durability and cost-efficiency of glass packaging.

- The growing emphasis on sustainability is encouraging the adoption of recyclable and eco-friendly glass packaging solutions.

- Stringent health and safety regulations are pushing pharmaceutical companies to adopt glass packaging to ensure product safety and compliance.

- Advancements in glass production techniques are leading to higher-quality, more reliable packaging solutions.

- Growing pharmaceutical industries in emerging economies are increasing the demand for glass packaging.

- The preference for pre-sterilized, ready-to-use glass packaging solutions is rising among pharmaceutical companies.

- The incorporation of smart packaging technologies, such as RFID and NFC, is enhancing the functionality of glass packaging.

- Intense competition among key players is fostering innovation and advancements in glass packaging solutions.