Market Overview:

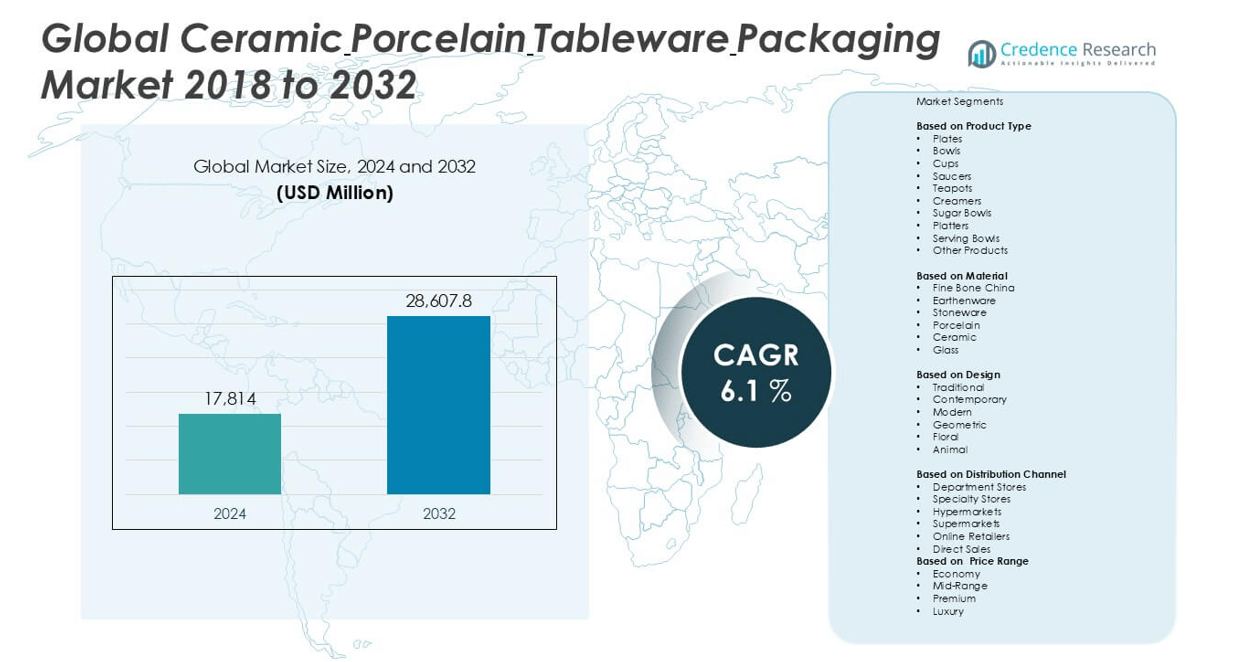

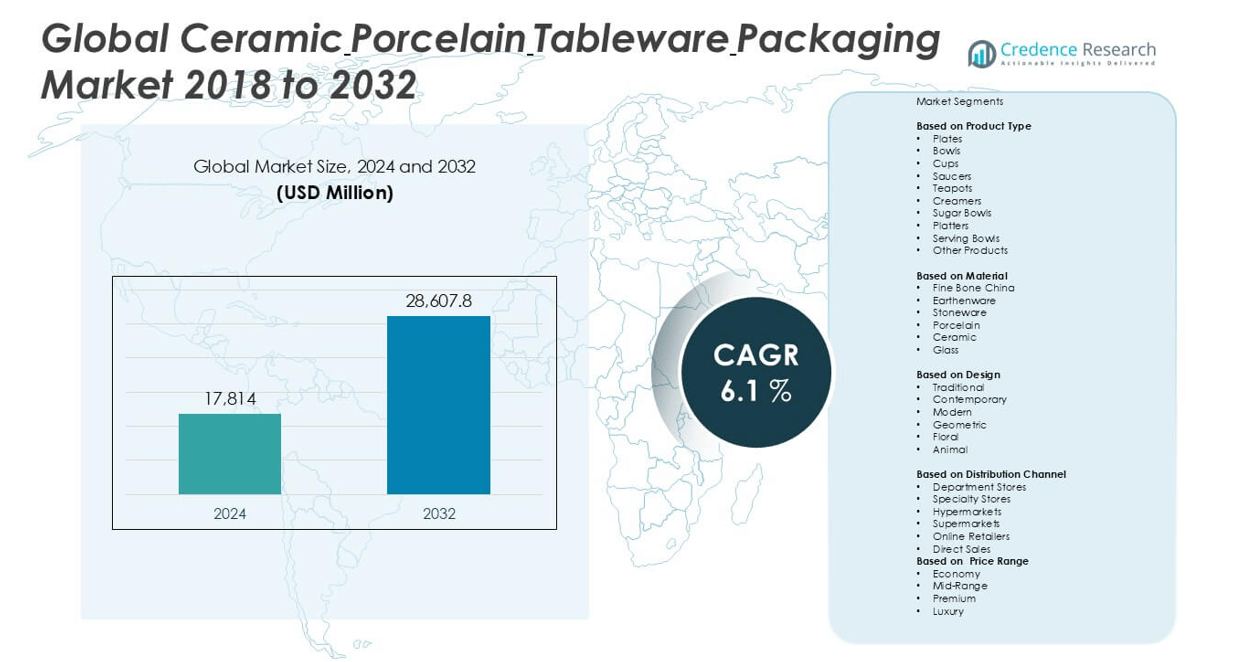

The Ceramic Porcelain Tableware Packaging market size was valued at USD 17,814 million in 2024 and is anticipated to reach USD 28,607.8 million by 2032, growing at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Porcelain Tableware Packaging Market Size 2024 |

USD 17,814 million |

| Ceramic Porcelain Tableware Packaging Market, CAGR |

6.1% |

| Ceramic Porcelain Tableware Packaging Market Size 2032 |

USD 28,607.8 million |

The ceramic porcelain tableware packaging market is led by prominent players such as Churchill, Noritake, Bernardaud, Versace Home, Royal Worcester, Rosenthal, Lenox, Johnson Brothers, Spode, Wedgwood, Royal Albert, Villeroy & Boch, Herend, Royal Doulton, and Haviland. These companies focus on offering premium and customized packaging solutions that align with their high-end tableware products, emphasizing aesthetics, protection, and sustainability. Asia Pacific dominates the global market with a 31% share in 2024, driven by large-scale production and export activities in countries like China and India. Europe follows with a 24% share, supported by strong demand for traditional and artisanal tableware. North America holds 27% of the market, propelled by consumer preference for premium dining experiences and eco-friendly packaging innovations. The strategic focus among key players includes enhancing product visibility, integrating eco-conscious materials, and meeting the growing needs of e-commerce and international distribution.

Market Insights

- The ceramic porcelain tableware packaging market was valued at USD 17,814 million in 2024 and is projected to reach USD 28,607.8 million by 2032, growing at a CAGR of 6.1% during the forecast period.

- Market growth is driven by rising demand for premium dining experiences, increased adoption of ceramic tableware in hospitality sectors, and growing e-commerce sales requiring protective packaging.

- A key trend is the shift toward sustainable and customizable packaging solutions, with brands increasingly using biodegradable materials and innovative designs to enhance consumer engagement.

- The market is highly competitive, with major players such as Noritake, Villeroy & Boch, Rosenthal, and Churchill focusing on strategic partnerships and packaging innovations to maintain brand value and reduce breakage risks.

- Asia Pacific leads with 31% market share due to large-scale production, followed by North America (27%) and Europe (24%); plates represent the dominant product segment owing to their widespread use and high packaging needs.Market Segmentation Analysis:

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

By Type

In the Ceramic Porcelain Tableware Packaging market, plates represent the dominant sub-segment, accounting for the largest market share due to their high consumption in both domestic and commercial settings. Plates are a staple in tableware sets and are frequently purchased in bulk for restaurants, hotels, and catering services, driving packaging demand. The increasing global preference for aesthetic and functional dinnerware boosts this segment’s growth. Additionally, the growing trend of gifting ceramic plate sets during festive seasons and special occasions continues to support the packaging industry’s expansion in this category.

- For instance, Churchill China produced over 68 million ceramic tableware units in 2022, with a substantial portion requiring durable packaging solutions for hotel and catering sectors.

By Material and Design:

Porcelain holds the leading position within the material segment, capturing a substantial share owing to its durability, refined appearance, and heat resistance. It is widely preferred in both household and hospitality sectors, necessitating premium and protective packaging solutions. In terms of design, the traditional sub-segment dominates the market, driven by strong consumer affinity for timeless aesthetics and cultural patterns, particularly in Asia and Europe. These designs are often used in heritage or ceremonial settings, increasing the need for careful packaging to preserve intricate detailing and craftsmanship during transportation and display.

- For instance, Villeroy & Boch reported that 72% of its dinnerware product line in 2023 consisted of fine porcelain collections with traditional patterns, requiring customized foam and corrugated packaging across 45 countries.

By Distribution Channel:

Online retailers have emerged as the dominant distribution channel in the Ceramic Porcelain Tableware Packaging market, holding the largest market share. The surge in e-commerce adoption, driven by convenience, wider product availability, and competitive pricing, fuels this segment’s growth. The demand for secure, eco-friendly, and visually appealing packaging has increased as fragile ceramic products require protective solutions for safe home deliveries. Additionally, innovative packaging that enhances unboxing experiences is gaining traction among online shoppers, further boosting the need for tailored packaging designs in this rapidly expanding distribution segment.

Market Overview

Rising Demand for Premium Dining Experiences

The growing global inclination toward fine dining and premium culinary experiences is significantly boosting demand for ceramic porcelain tableware, thereby driving the need for high-quality and protective packaging solutions. Hospitality and food service sectors, including luxury hotels and upscale restaurants, are increasingly adopting elegant tableware to enhance guest experiences. This demand for aesthetically appealing and fragile products necessitates specialized, durable packaging that ensures safe handling and transport. Consequently, packaging providers are innovating with robust and visually appealing solutions to cater to this premium market segment.

- For instance, Lenox Corporation supplies over 4,000 hospitality clients in the U.S., each requiring double-walled corrugated packaging with foam inserts to meet fine-dining handling standards.

Expansion of E-commerce and Online Retail Channels

The rapid growth of e-commerce platforms and direct-to-consumer sales channels has reshaped the ceramic porcelain tableware industry. With more consumers purchasing tableware online, manufacturers and sellers require secure, tamper-resistant, and sustainable packaging to ensure product safety during transit. The rise in online sales also fuels demand for packaging designs that enhance unboxing experiences and brand presentation. This trend is prompting packaging providers to develop advanced, protective solutions with a focus on minimizing breakage, optimizing logistics, and improving customer satisfaction through attractive and functional packaging.

- For instance, Royal Doulton reported a 34% increase in direct-to-consumer online sales in 2023, leading to the deployment of over 1.2 million eco-friendly molded pulp trays and recyclable mailer boxes.

Sustainability-Driven Consumer Preferences

Increasing consumer awareness about environmental sustainability is pushing brands to adopt eco-friendly packaging solutions for ceramic porcelain tableware. Buyers now seek biodegradable, recyclable, or reusable packaging that aligns with their eco-conscious values. Regulatory pressure on single-use plastics further compels manufacturers to adopt green packaging alternatives. As a result, packaging providers are investing in sustainable materials like molded pulp, corrugated cardboard, and plant-based films. This shift not only enhances brand reputation but also supports long-term market growth by meeting evolving consumer expectations and complying with environmental standards.

Key Trends & Opportunities

Innovative and Customizable Packaging Designs

Customization and innovation in packaging are gaining traction as brands aim to create a strong shelf presence and enhance customer engagement. Personalized packaging, such as printed logos, brand-themed graphics, and creative box designs, is becoming a popular strategy to differentiate products in a competitive market. Additionally, smart packaging with QR codes and interactive elements is being explored to improve post-sale consumer interaction. These advancements present opportunities for packaging providers to offer value-added services that go beyond protection and contribute to the overall brand experience.

- For instance, Rosenthal GmbH introduced NFC-enabled smart packaging across 250,000 premium tableware units in 2023 to allow customers instant product authentication and care instructions.

Integration of Smart and Protective Packaging Solutions

As fragile ceramic tableware becomes more frequently shipped through online channels, there is a growing need for smart packaging solutions that combine durability with convenience. Developments in shock-absorbing materials, tamper-evident seals, and temperature-resistant barriers are enabling safer transport and longer shelf-life. In addition, embedded tracking features and sensor-integrated packaging are being introduced to improve logistics transparency. These solutions cater to the increasing demand for safety, traceability, and functionality, offering packaging providers opportunities to stand out with advanced and intelligent packaging technologies.

- For instance, Spode partnered with a logistics firm in 2023 to implement RFID-enabled packaging across 180,000 outbound shipments, reducing damage rates by 23%.

Key Challenges

High Cost of Sustainable and Protective Packaging

Despite the growing preference for eco-friendly materials, the high cost associated with sustainable and high-performance protective packaging poses a significant challenge. Biodegradable and recyclable materials often come at a premium, which can increase the overall product cost—especially for brands targeting budget-conscious consumers. Furthermore, achieving the necessary strength and shock resistance with green materials can be technically complex and expensive. This cost factor may limit adoption, particularly among small and medium-sized enterprises operating under tight margins.

Logistics and Breakage Concerns in Supply Chain

Ceramic porcelain tableware is inherently fragile, making it highly susceptible to damage during transportation and handling. Managing logistics for such breakable items requires additional precautions, including multi-layered or cushioned packaging, which can increase shipping costs and packaging waste. Inadequate handling practices in logistics networks further raise the risk of breakage, leading to customer dissatisfaction and return costs. Addressing these challenges demands consistent investment in packaging innovation, staff training, and supply chain coordination.

Intensifying Market Competition and Brand Differentiation

The ceramic tableware industry is witnessing increased competition, with both established and emerging players vying for market share. In such a crowded space, packaging becomes a critical tool for brand differentiation. However, developing unique and memorable packaging that aligns with brand identity without inflating costs is a complex task. Many brands struggle to balance creativity with practicality, particularly when catering to diverse consumer segments across geographies. This challenge pushes packaging providers to constantly evolve design strategies while maintaining efficiency and affordability.

Regional Analysis

North America

North America holds a significant share of the ceramic porcelain tableware packaging market, accounting for approximately 27% of the global revenue in 2024. The region’s strong presence in the hospitality and home décor sectors, combined with high consumer spending on premium dining products, drives market growth. The U.S. leads regional demand, with increased adoption of sustainable packaging solutions due to stringent environmental regulations. E-commerce expansion further fuels the need for protective and innovative packaging. Packaging companies are investing in recyclable materials and smart packaging technologies to meet rising consumer expectations and regulatory compliance across the region.

Europe

Europe commands around 24% of the global ceramic porcelain tableware packaging market in 2024, supported by its long-standing ceramic production heritage and strong demand for artisanal tableware. Countries like Germany, France, and Italy are key contributors due to their thriving luxury dining culture and growing focus on eco-friendly packaging. EU policies promoting sustainability encourage the adoption of biodegradable and recyclable packaging materials. Moreover, the region sees rising consumer demand for aesthetically designed packaging that complements traditional and modern tableware. Growth is further stimulated by well-established retail distribution networks and increasing penetration of online shopping across European markets.

Asia Pacific

Asia Pacific dominates the ceramic porcelain tableware packaging market with a market share of over 31% in 2024. The region benefits from high production volumes of ceramic tableware, particularly in China, India, and Japan. Rising disposable incomes, urbanization, and a growing middle class are driving demand for premium tableware and, subsequently, high-quality packaging. China is the largest exporter of ceramic tableware globally, increasing the demand for durable and export-friendly packaging solutions. The region also witnesses a rapid rise in e-commerce, prompting further innovation in packaging designs focused on protection and consumer appeal. Local manufacturers are increasingly adopting sustainable practices to align with global trends.

Latin America

Latin America accounts for nearly 9% of the global ceramic porcelain tableware packaging market in 2024, driven by growing consumer interest in aesthetic tableware and improving retail infrastructure. Brazil and Mexico lead the market, supported by increasing middle-class consumption and the hospitality sector’s gradual modernization. Though still developing, e-commerce growth is boosting demand for secure packaging solutions. However, the adoption of sustainable packaging remains limited due to cost constraints and lower regulatory enforcement compared to developed regions. Despite this, regional manufacturers are exploring recyclable materials and localized packaging innovations to gain competitive advantage.

Middle East & Africa

The Middle East & Africa region holds a modest 6% share in the ceramic porcelain tableware packaging market in 2024. Market growth is led by expanding hospitality and tourism sectors in countries like the UAE and Saudi Arabia, where luxury dining experiences drive demand for high-end ceramic tableware. This creates opportunities for protective and elegant packaging formats. While infrastructure and logistics challenges persist in parts of Africa, increasing urbanization and rising disposable incomes support gradual market development. Regional packaging providers are beginning to explore eco-friendly materials and localized solutions tailored to climatic and logistical conditions.

Market Segmentations:

By Product Type:

- Plates

- Bowls

- Cups

- Saucers

- Teapots

- Creamers

- Sugar Bowls

- Platters

- Serving Bowls

- Other Products

By Material:

- Fine Bone China

- Earthenware

- Stoneware

- Porcelain

- Ceramic

- Glass

By Design:

- Traditional

- Contemporary

- Modern

- Geometric

- Floral

- Animal

By Distribution Channel:

- Department Stores

- Specialty Stores

- Hypermarkets

- Supermarkets

- Online Retailers

- Direct Sales

By Price Range:

- Economy

- Mid-Range

- Premium

- Luxury

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ceramic porcelain tableware packaging market is characterized by the presence of both global and regional players striving to offer innovative, sustainable, and protective packaging solutions. Key packaging providers focus on enhancing product safety, visual appeal, and environmental compliance to meet the evolving demands of ceramic tableware manufacturers. With rising consumer preference for eco-friendly packaging, companies are increasingly investing in biodegradable materials, smart packaging technologies, and custom-designed solutions to differentiate themselves. Collaborations with premium tableware brands such as Noritake, Villeroy & Boch, and Royal Doulton further intensify competition, as packaging becomes a critical element of brand presentation and logistics efficiency. Moreover, e-commerce growth has pushed market players to optimize packaging for durability, cost-effectiveness, and customer experience. Regional companies are also gaining traction by offering localized solutions tailored to specific cultural and logistical needs. Continuous innovation, sustainability, and strategic partnerships are key to maintaining a competitive edge in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Royal Worcester

- Herend

- Bernardaud

- Royal Albert

- Noritake

- Villeroy Boch

- Churchill

- Wedgwood

- Johnson Brothers

- Versace Home

- Rosenthal

- Spode

- Lenox

- Royal Doulton

- Haviland

Recent Developments

- In July 2022, Lenox Corporation, America’s leading tabletop, giftware, and home entertaining company, announced the acquisition of Cambridge Silversmiths, Ltd., Inc.

- In January 2022, Hollowick, Inc., a food warming and table lighting company based in the United States, has been acquired by Steelite International plc.

- In January 2022, Villeroy & Boch introduced their signature product line, Avarua, inspired by the captivating beauty of the Cook Islands. This exclusive collection of fine porcelain crockery embodies the spirit of adventure and offers an exotic dining experience at home.

- In 2022, RAK Ceramics PJSC announced large expenditures in cutting-edge production technology and environmental initiatives totaling around AED 4.5 million. RAK Ceramics has placed a greater focus on sustainable production in response to the growing demand for unique and environmentally friendly ceramic floor tiles.

Market Concentration & Characteristics

The Ceramic Porcelain Tableware Packaging Market shows a moderately fragmented structure with the presence of both global and regional players competing on product design, sustainability, and protective capabilities. It reflects a mix of traditional packaging manufacturers and specialized suppliers who cater to premium tableware brands. The market features strong demand for customized and high-strength packaging to prevent damage during shipping and enhance product presentation. Companies prioritize cost-effective and eco-friendly solutions that align with consumer preferences and regulatory norms. Innovation plays a key role in shaping competitive advantage, particularly with the rise of e-commerce and direct-to-consumer sales channels. Brand alignment through tailored packaging remains a critical factor, especially for luxury tableware segments. Regional manufacturers in Asia Pacific and Europe contribute significantly to supply, while North America emphasizes innovation and sustainability in packaging materials. The market continues to respond to shifts in consumer behavior, retail patterns, and environmental awareness, encouraging companies to focus on both functionality and visual appeal.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Design, Distribution Channel, Price Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for premium and durable tableware packaging.

- E-commerce expansion will increase the need for protective and tamper-resistant packaging solutions.

- Sustainability will remain a key focus, encouraging the adoption of biodegradable and recyclable materials.

- Customized and branded packaging designs will gain popularity to enhance consumer engagement.

- Asia Pacific will continue to dominate market share due to large-scale production and export activities.

- Europe will see rising demand for eco-friendly packaging aligned with regulatory standards.

- North America will invest in innovative packaging technologies to reduce breakage and enhance presentation.

- Technological integration such as smart packaging and QR-based tracking will support logistics and brand transparency.

- Competitive intensity will increase as companies focus on product differentiation and sustainability.

- Demand for packaging tailored to plates and premium gift sets will continue to drive innovation and design investments.