Market Overview:

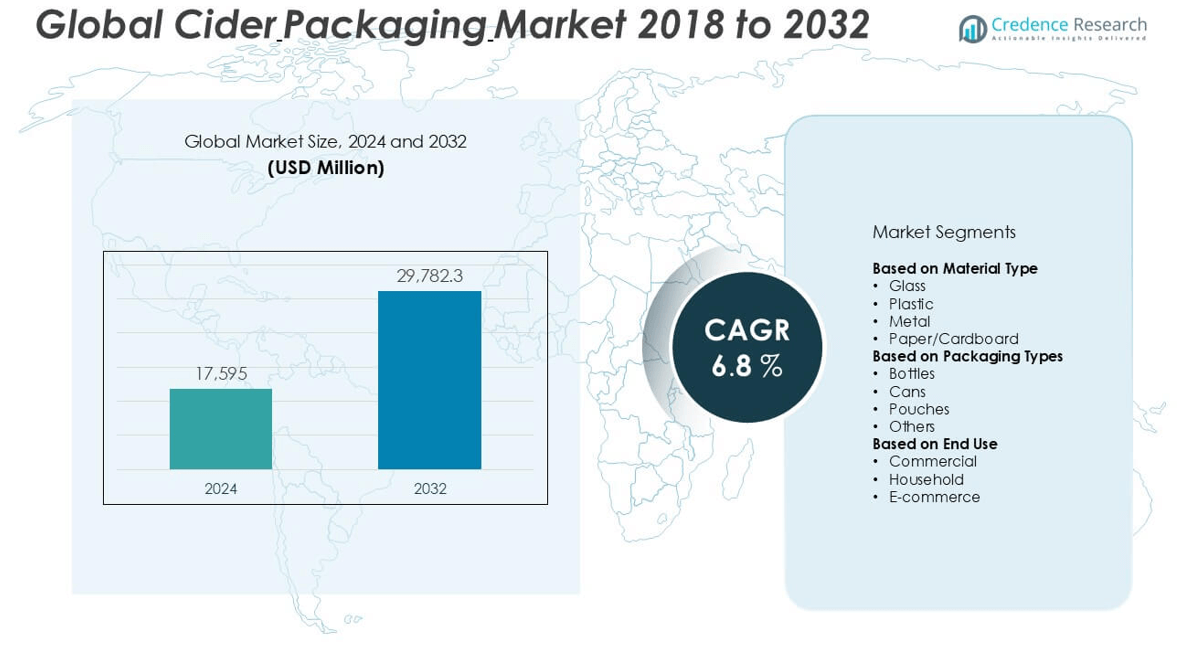

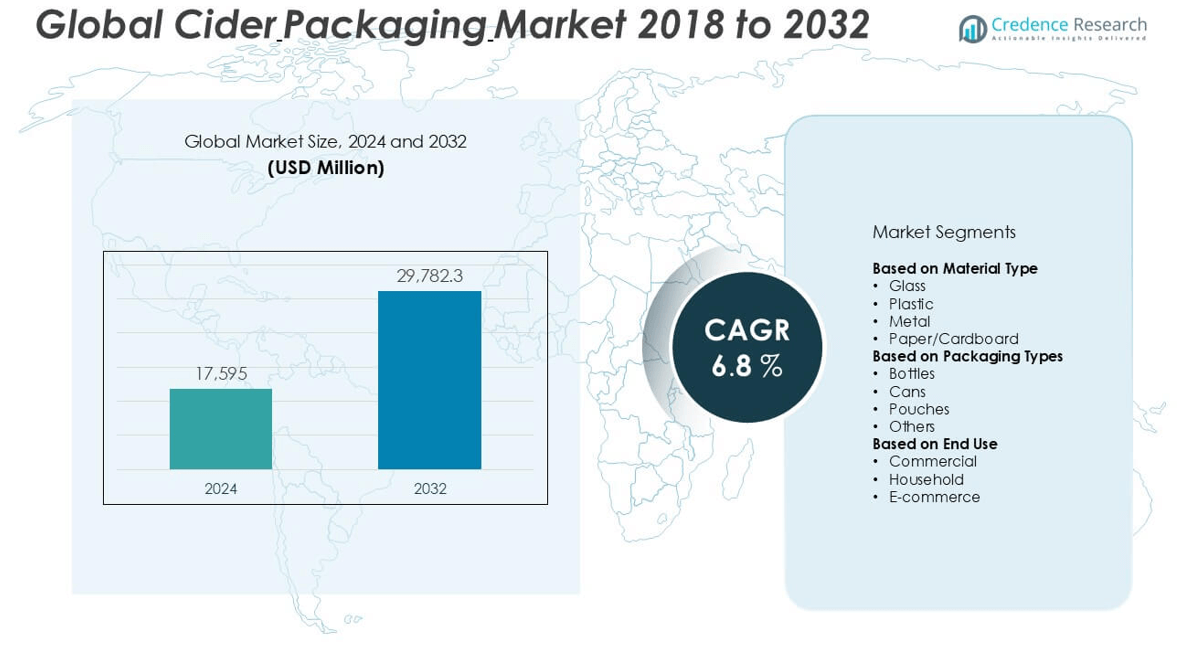

The Cider Packaging market size was valued at USD 17,595 million in 2024 and is anticipated to reach USD 29,782.3 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cider Packaging Market Size 2024 |

USD 17,595 million |

| Cider Packaging Market, CAGR |

6.8% |

| Cider Packaging Market Size 2032 |

USD 29,782.3 million |

The cider packaging market is highly competitive, with key players such as Ardagh Group, Ball Corporation, Owens-Illinois Inc. (O-I), Amcor plc, WestRock Company, Crown Holdings, Inc., and Smurfit Kappa Group leading the industry. These companies leverage advanced technologies and sustainable materials to meet growing consumer demand for eco-friendly and visually appealing packaging solutions. Europe emerged as the dominant region in 2024, capturing 35% of the global market share, driven by its strong cider consumption culture, stringent environmental regulations, and preference for premium packaging formats. Strategic partnerships and continuous innovation in packaging design remain central to maintaining a competitive edge in this evolving market.

Market Insights

- The cider packaging market was valued at USD 17,595 million in 2024 and is projected to reach USD 29,782.3 million by 2032, growing at a CAGR of 6.8% during the forecast period.

- Growth is driven by increasing global cider consumption, demand for sustainable packaging, and rising preference for premium, visually appealing formats like glass bottles.

- Trends such as premiumization, e-commerce growth, and innovative packaging formats (e.g., resealable pouches and lightweight cans) are reshaping consumer preferences and brand strategies.

- Leading players like Ardagh Group, Ball Corporation, Owens-Illinois Inc. (O-I), and Amcor plc focus on eco-friendly materials and regional expansion to stay competitive.

- Europe leads the market with a 35% share, followed by North America at 28% and Asia Pacific at 20%; the glass material segment dominates due to its premium appeal, while bottles are the most preferred packaging type across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type:

The glass segment dominates the Cider Packaging market, accounting for the largest market share in 2024 due to its premium appeal, superior barrier properties, and traditional association with alcoholic beverages. Glass bottles preserve the carbonation and flavor of cider effectively, making them the preferred choice among manufacturers targeting premium and artisanal brands. While plastic and metal materials are gaining traction for their lightweight and cost-effective benefits, they lag behind in sustainability and perception. Growing consumer preference for eco-friendly and recyclable packaging continues to support the dominance of glass in this segment.

- For instance, Ardagh Group produces over 12 billion glass containers annually in Europe alone, across 13 glassworks—including bespoke bottle designs tailored for premium beverage brands.

By Packaging Types:

Bottles emerged as the leading packaging type in the cider industry, capturing the highest market share in 2024, driven by their widespread use in both commercial and retail settings. Their ability to maintain cider quality, brand visibility through labeling, and compatibility with traditional bottling infrastructure makes them a popular choice. Cans are gaining momentum due to their portability, convenience, and rising popularity among younger consumers and outdoor events. Pouches and other flexible packaging formats are gradually entering the market, supported by innovation in lightweight, resealable designs, but remain a niche compared to bottles.

- For instance, Owens‑Illinois (O‑I), the largest container glass manufacturer globally, engineered bottle‑making machines capable of producing up to 240 bottles per minute, dramatically boosting output capacity.

By End Use:

The commercial segment held the dominant position in the Cider Packaging market in 2024, fueled by robust consumption in bars, pubs, restaurants, and retail chains. This dominance is attributed to the high-volume demand and brand differentiation strategies by beverage producers targeting on-premise consumption. Household consumption also contributes significantly, especially with the rising trend of at-home drinking and online grocery purchases. The e-commerce sub-segment, while smaller in share, is expanding steadily due to changing consumer buying patterns and increasing reliance on direct-to-consumer channels, supported by customized, protective packaging for home delivery.

Market Overview

Rising Global Cider Consumption

The increasing popularity of cider as a refreshing alcoholic alternative is significantly boosting demand for cider packaging. Health-conscious consumers are shifting from high-alcohol content beverages to lighter options like cider, which is often marketed as natural and fruit-based. Emerging markets in Asia Pacific and Latin America are witnessing growing interest, while established markets in Europe and North America continue to expand. This steady rise in consumption directly translates into higher packaging volumes, encouraging manufacturers to invest in advanced, sustainable, and visually appealing packaging solutions to cater to evolving consumer expectations.

- For instance, Ardagh’s Glass North America division delivers over 6 billion glass units annually across nine facilities, ensuring supply reliability for beverage customers expanding cider portfolios in North America.

Innovation in Packaging Formats

Advancements in packaging technology are driving the cider packaging market forward. Brands are exploring innovative formats like lightweight cans, resealable pouches, and eco-friendly bottles to enhance user convenience and reduce environmental impact. These innovations not only improve functionality and shelf appeal but also align with shifting consumer preferences for sustainable and user-friendly packaging. Smart packaging solutions integrating QR codes and NFC tags are also emerging, enabling better customer engagement and traceability. Such innovation is encouraging producers to differentiate their offerings in an increasingly competitive beverage market.

- For example, Ardagh Group’s South African facility (Nigel 3 expansion) added a new furnace that increased capacity by 50% and enables up to 90% recycled cullet usage in production of up to 130 bottle designs, supporting sustainable innovation in formats.

Sustainability and Regulatory Push

Growing environmental concerns and stringent government regulations are prompting cider producers to adopt recyclable and biodegradable packaging materials. Regulatory frameworks across the EU and other developed regions are pushing beverage companies to reduce plastic use and switch to eco-friendly alternatives such as glass and paper-based packaging. This shift is encouraging packaging manufacturers to invest in sustainable product development. Consumers are also favoring brands that demonstrate environmental responsibility, making sustainability not only a compliance requirement but also a major driver of market growth and brand loyalty.

Key Trends & Opportunities

Premiumization and Custom Branding

The trend toward premium and craft cider brands is creating opportunities for differentiated packaging designs. Producers are using high-quality glass bottles, embossed labels, and limited-edition packaging to appeal to consumers seeking artisanal and luxury experiences. This trend supports higher profit margins and strengthens brand identity. Custom branding elements such as vintage designs and storytelling labels are becoming essential marketing tools. As consumers increasingly associate packaging with product quality, this premiumization trend is likely to continue shaping demand for visually distinctive and value-added cider packaging solutions.

- For instance, Ardagh Glass offers nearly 20 color options and over 500 container configurations globally, enabling cider brands to adopt unique finishes and bespoke bottle shapes that strengthen brand identity and consumer appeal.

Growth of E-commerce and Direct-to-Consumer Channels

E-commerce is rapidly emerging as a key sales channel for cider, especially post-pandemic. This shift opens new opportunities for packaging formats designed specifically for shipping and convenience. Lightweight, durable, and protective materials that minimize breakage and preserve product quality during transit are gaining traction. Subscription-based cider boxes and customizable multi-pack formats are becoming popular, prompting the need for innovative structural designs and branding strategies suited for digital shelf display. The growth of online retail also allows brands to collect consumer data, refine targeting, and enhance product presentation through packaging.

- For instance, Ardagh Metal Packaging achieved full-year beverage can shipments of 4 billion units in 2024, reflecting a 3% increase over the prior year, supported by a 4% shipment rise in Europe and 2% in the Americas, ensuring consistent availability of e‑commerce‑ready packaging formats.

Key Challenges

High Cost of Sustainable Materials

While sustainability is a major driver, the high cost of eco-friendly materials like biodegradable plastics, recycled paper, and lightweight glass remains a significant challenge. These materials often come at a premium compared to conventional options, increasing production costs for cider brands. Small and mid-sized producers may find it difficult to absorb these costs or pass them on to consumers without affecting demand. This cost barrier can hinder widespread adoption of sustainable packaging, especially in price-sensitive markets, unless economies of scale or government incentives offset the expense.

Logistical Constraints and Breakage Risks

Glass, being the dominant material in cider packaging, presents logistical challenges due to its fragility and weight. Transportation and handling costs are higher, and breakage during shipping remains a persistent issue, especially in e-commerce and export scenarios. This not only leads to product loss but also affects customer satisfaction and brand reputation. While alternative materials like cans and pouches are gaining traction, they may not fully replicate the premium perception associated with glass, creating a trade-off between aesthetics and logistics.

Recycling Infrastructure Limitations

Despite the push for sustainable packaging, limited recycling infrastructure in many developing regions constrains the circular economy model. Consumers may not have access to proper recycling facilities, reducing the effectiveness of recyclable materials in addressing environmental goals. Additionally, inconsistencies in waste segregation and lack of awareness impede the lifecycle value of green packaging. This infrastructure gap creates challenges for global cider brands looking to standardize their sustainable packaging strategies across markets, highlighting the need for regional customization and broader waste management improvements.

Regional Analysis

North America

North America held a substantial share in the global cider packaging market in 2024, accounting for approximately 28% of the total market. The region benefits from a mature alcoholic beverage industry, with a growing preference for craft and flavored cider variants. Consumers increasingly demand sustainable and premium packaging, prompting producers to adopt glass bottles and recyclable materials. The rise of e-commerce and ready-to-drink packaging formats is also fueling innovation in design and logistics. The U.S. leads the market due to high consumption rates, established cider brands, and the presence of advanced packaging technology providers.

Europe

Europe dominated the cider packaging market in 2024, capturing around 35% of the global market share. The region has a strong cider-drinking culture, especially in the UK, France, and Spain, where cider is widely consumed across demographics. European consumers prioritize sustainability, which drives demand for glass and paper-based packaging. Strict environmental regulations further push the adoption of recyclable and low-impact materials. Premium packaging is particularly valued in Western Europe, encouraging brands to focus on aesthetic and functional design elements. The market continues to evolve through innovation in eco-friendly formats and regional craft cider production.

Asia Pacific

Asia Pacific accounted for roughly 20% of the cider packaging market in 2024 and is projected to witness the fastest growth during the forecast period. Rising urbanization, disposable incomes, and westernized drinking habits are boosting cider consumption, particularly in China, Japan, Australia, and South Korea. The expanding middle class and younger consumer base are drawn to convenient and visually appealing packaging formats such as cans and pouches. While glass remains prevalent for premium imports, local producers are increasingly experimenting with cost-effective and sustainable materials. Regional growth is also supported by the rise of online alcohol retail platforms.

Latin America

Latin America represented about 9% of the global cider packaging market in 2024. The region is gradually adopting cider as an alternative to beer and spirits, particularly among young adults in Brazil, Mexico, and Argentina. Cider producers are leveraging modern packaging formats like cans and PET bottles to meet cost and distribution challenges. However, the region’s packaging industry is still developing, and infrastructure limitations impact the widespread use of sustainable materials. Nevertheless, rising urban populations, increased marketing efforts, and the expansion of cider product lines are creating growth opportunities in both retail and commercial packaging segments.

Middle East & Africa

The Middle East & Africa held the smallest share in the cider packaging market in 2024, accounting for approximately 8% of the total. Cider consumption remains limited due to cultural and regulatory constraints on alcoholic beverages, particularly in the Middle East. However, growth is evident in markets such as South Africa and select North African countries, where cider is gaining popularity among younger consumers. Glass bottles dominate due to their premium image, though affordability and accessibility continue to drive interest in alternative materials like plastic and cans. Gradual market liberalization and urban lifestyle changes may support future demand.

Market Segmentations:

By Material Type

- Glass

- Plastic

- Metal

- Paper/Cardboard

By Packaging Types

- Bottles

- Cans

- Pouches

- Others

By End Use

- Commercial

- Household

- E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cider packaging market is characterized by the presence of several global and regional players actively competing on the basis of innovation, material sustainability, and packaging design. Key companies such as Ardagh Group, Ball Corporation, Owens-Illinois Inc. (O-I), and Amcor plc dominate the market with robust production capabilities and advanced packaging technologies. These players focus on offering eco-friendly, lightweight, and visually appealing solutions to cater to the rising demand for sustainable and premium cider packaging. Strategic collaborations with cider manufacturers, investments in recyclable materials, and expansion into emerging markets are common competitive strategies. Additionally, regional players like Nampak Ltd. and Consol Glass (Pty) Ltd. contribute to localized supply and customization. Continuous product innovation and compliance with evolving regulatory standards remain crucial for gaining market share. As consumer preferences shift toward convenience and aesthetics, competition intensifies around delivering differentiated and functional packaging solutions that align with brand identity and environmental goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Smurfit Kappa Group

- Plastipak Holdings, Inc.

- Owens-Illinois Inc. (O-I)

- Consol Glass (Pty) Ltd

- WestRock Company

- Ball Corporation

- Ardagh Group

- Silgan Holdings Inc.

- Crown Holdings, Inc.

- Nampak Ltd.

- Vidrala

- Amcor plc

Recent Developments

- In September 2023, WestRock and Smurfit Kappa announced a deal that would make Smurfit WestRock one of the world’s leaders in sustainable packaging. The merger will strengthen Smurfit Kappa and WestRock’s current offerings. Smurfit Kappa will become the go-to packaging partner of choice globally by combining Smurfit Kappa’s operational excellence and creativity as a one of the European leaders in corrugated and containerboard with its extensive pan-regional Americas existence that delivers best-in-class performance and returns, and WestRock’s leadership in the United States along with its substantial footprint in Brazil and Mexico, throughout corrugated and consumer packaging.

- In October 2022, Heineken UK introduced the latest sustainable packaging. The new design follows the Green Grip’s initial with a 100% recyclable cardboard topper. The green grip offers consumers the same ease of use as traditional plastic can rings.

- In April 2022, Aston Manor stopped using plastic ring carriers and started giving recyclable cider bottles instead.

- In March 2022, Heineken expanded its alcohol-free presence and Old Mout cider line.

Market Concentration & Characteristics

The Cider Packaging Market exhibits moderate to high market concentration, with a few key players such as Ardagh Group, Ball Corporation, Owens-Illinois Inc. (O-I), and Amcor plc holding significant market share. It is characterized by strong competition based on material innovation, sustainability, and cost efficiency. The industry relies heavily on glass packaging due to its premium perception and protective qualities, while metal cans and paper-based options are gaining preference in cost-sensitive and convenience-focused segments. Manufacturers prioritize eco-friendly packaging solutions in response to regulatory pressure and shifting consumer preferences. Regional dynamics influence packaging design, material choice, and volume demand. Europe remains the most mature and established regional market, driven by high cider consumption and strict environmental regulations. North America follows closely, showing increased demand for craft and flavored ciders that require distinctive and sustainable packaging formats. Asia Pacific presents strong growth potential, supported by rising disposable incomes and expanding alcoholic beverage consumption. Entry barriers are moderate due to capital investment requirements and supply chain complexities, which limit new entrants. The market continues to evolve through investments in lightweight materials, smart packaging technologies, and localized design strategies to meet regional demands and regulatory standards.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Packaging Types, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cider packaging market is expected to witness steady growth driven by increasing global cider consumption.

- Demand for sustainable and recyclable packaging materials will continue to rise due to environmental regulations and consumer awareness.

- Glass bottles will maintain dominance, but lightweight cans and paper-based packaging will gain traction for portability and convenience.

- E-commerce and direct-to-consumer sales channels will influence the development of durable and protective packaging formats.

- Premium and customized packaging designs will become more prominent to support brand differentiation in a competitive market.

- Technological advancements will enable smart packaging features such as traceability, freshness indicators, and digital engagement tools.

- Manufacturers will focus on reducing material costs and enhancing supply chain efficiency to remain competitive.

- Emerging markets in Asia Pacific and Latin America will present significant growth opportunities due to changing consumer lifestyles.

- Regulatory compliance related to material usage and waste management will shape packaging innovation and product strategies.

- Collaborations between cider producers and packaging firms will increase to develop tailored, sustainable, and market-specific solutions.