Market Overview:

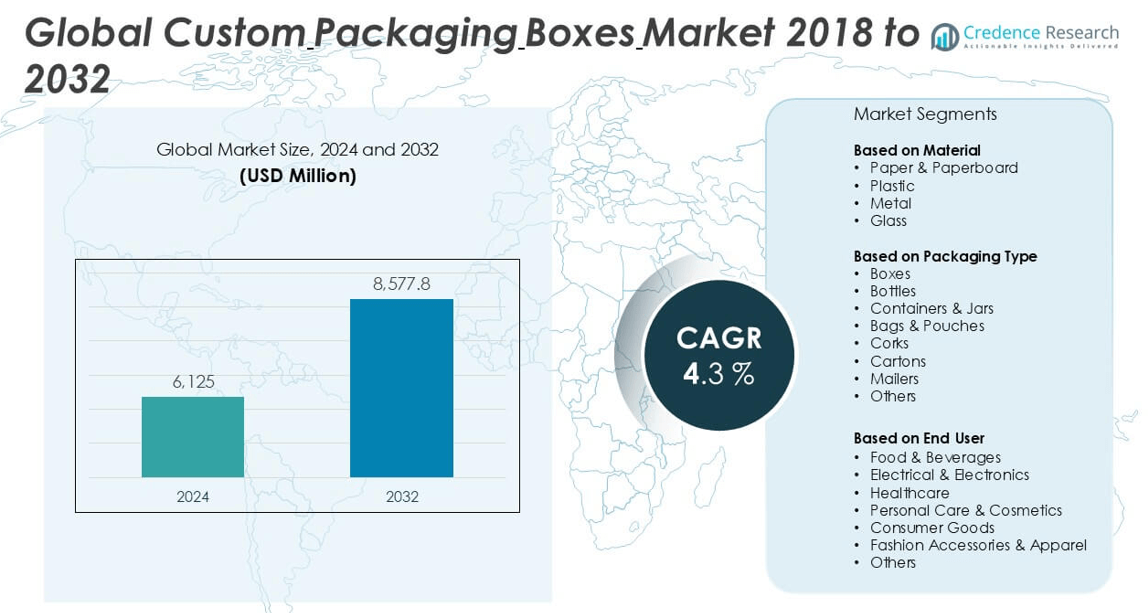

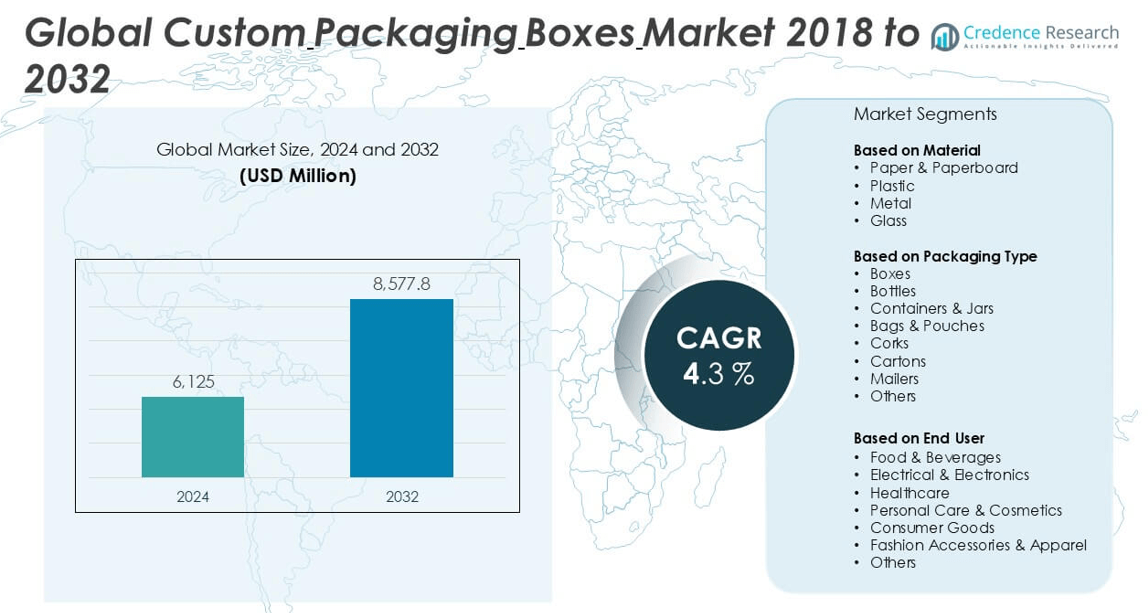

The Custom Packaging Boxes market size was valued at USD 6,125 million in 2024 and is anticipated to reach USD 8,577.8 million by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Custom Packaging Boxes Market Size 2024 |

USD 6,125 million |

| Custom Packaging Boxes Market, CAGR |

4.3% |

| Custom Packaging Boxes Market Size 2032 |

USD 8,577.8 million |

The Custom Packaging Boxes market is highly competitive, with key players including DS Smith, Smurfit Kappa Group, Westrock Company, Huhtamaki, ProAmpac, Glenroy Inc., Packlane, Owens Illinois, PakFactory, and International Custom Packaging. These companies lead the market through innovations in sustainable materials, digital printing technologies, and customizable packaging solutions tailored to diverse end-user needs. North America and Asia Pacific are the dominant regions, collectively accounting for over 60% of the global market share in 2024. Asia Pacific leads with a 32% share, driven by industrial growth and e-commerce expansion, while North America follows with 28%, supported by premium packaging demand and strong logistics infrastructure.

Market Insights

- The Custom Packaging Boxes market was valued at USD 6,125 million in 2024 and is projected to reach USD 8,577.8 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Growing demand for sustainable and eco-friendly packaging materials, coupled with the rise of e-commerce and direct-to-consumer brands, is driving market expansion globally.

- Trends such as the adoption of digital printing, interactive packaging technologies, and premium customization are shaping product innovation across industries including food, electronics, and cosmetics.

- The market is fragmented, with leading players like DS Smith, Smurfit Kappa Group, Westrock Company, Huhtamaki, and ProAmpac focusing on advanced design, regional expansion, and recyclable materials to gain a competitive edge.

- Asia Pacific leads the market with a 32% share, followed by North America at 28% and Europe at 26%; among segments, paper & paperboard remains dominant due to recyclability and regulatory support.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the Custom Packaging Boxes market, the Paper & Paperboard segment holds the dominant share, accounting for over 45% of the market in 2024. This material type remains the preferred choice due to its eco-friendliness, recyclability, and cost-effectiveness. The rising consumer demand for sustainable packaging and strict environmental regulations have significantly driven the adoption of paper-based materials across industries. Additionally, advancements in printing and coating technologies have enhanced the durability and aesthetic appeal of paper packaging, further strengthening its position against plastic and metal alternatives.

- For instance, Smurfit Kappa produced over 9.3 billion square meters of corrugated board in 2023 using recycled fiber-based paper, supported by its network of 350 production sites across 36 countries, demonstrating scale and sustainability leadership in paper-based packaging.

By Packaging Type:

Among various packaging types, Boxes emerged as the leading sub-segment with the largest market share in 2024, driven by their structural versatility and widespread application across retail, e-commerce, and logistics sectors. Their ability to be customized in terms of size, shape, and print design enhances brand visibility and consumer engagement. Increasing online shopping trends and the demand for durable, tamper-proof packaging have further supported box usage. While other types like containers & jars and bags & pouches are gaining traction, especially in food and cosmetics, boxes continue to dominate due to their practicality and branding potential.

- For instance, DS Smith delivered over 12 billion corrugated boxes in 2023 globally, with its UK packaging division alone fulfilling more than 25,000 custom design briefs per year using proprietary software tools like DISCS™ for performance simulation.

By End User:

The Food & Beverages sector led the market by end-user in 2024, contributing to over 30% of the total market share. This dominance stems from the high consumption of packaged foods and the increasing preference for personalized packaging in both retail and foodservice formats. Brands are leveraging custom packaging to enhance shelf appeal, ensure freshness, and communicate product quality. Moreover, regulatory compliance regarding food safety and labeling further boosts the demand for reliable and attractive packaging solutions in this segment. Growth in ready-to-eat meals and online food delivery services also plays a critical role in driving demand.

Market Overview

Rising Demand for E-commerce and Direct-to-Consumer Channels

The rapid expansion of e-commerce platforms and direct-to-consumer (D2C) brands has significantly boosted demand for custom packaging boxes. These businesses require packaging that is not only protective but also aesthetically appealing and brand-aligned. Custom boxes serve as a powerful marketing tool and help enhance customer unboxing experiences. The need for differentiated packaging that ensures safe delivery and strong brand recognition has led to widespread adoption, especially in fashion, cosmetics, and electronics sectors, thereby driving growth across global and regional markets.

- For instance, Packlane processed over 1.2 million custom packaging orders for D2C brands in the U.S. in 2023, offering 3D preview and real-time online customization with lead times as short as 10 business days for small batch runs.

Growing Consumer Preference for Sustainable Packaging

Increasing environmental awareness and regulatory pressure have shifted consumer and business preferences toward sustainable packaging materials. Custom packaging boxes made from recyclable and biodegradable materials such as paper and paperboard are gaining traction. Brands are investing in eco-friendly packaging as part of their corporate social responsibility strategies and to meet green labeling requirements. This demand for environmentally responsible packaging is not only strengthening the paper-based segment but also pushing innovation in material use and packaging design, further fueling market growth.

- For instance, ProAmpac launched its ProActive Recyclable® product line, which includes over 20 commercialized flexible and rigid packaging formats, reducing over 1,200 metric tons of virgin plastic in customer applications by the end of 2023.

Brand Differentiation and Premiumization Strategies

Custom packaging plays a crucial role in brand differentiation, particularly in highly competitive markets like food, cosmetics, and consumer electronics. Businesses are investing in premium packaging designs, embossing, foil stamping, and vibrant printing to create a memorable customer experience and build brand loyalty. This trend is particularly evident among luxury and lifestyle brands that seek to communicate exclusivity and quality. The rise of personalized and limited-edition packaging formats is also contributing to the premiumization of product offerings, serving as a strong growth catalyst for the custom packaging boxes market.

Key Trends & Opportunities

Integration of Smart and Interactive Packaging

A growing trend in the custom packaging boxes market is the integration of smart features such as QR codes, augmented reality (AR), and NFC technology. These additions enhance consumer engagement by enabling interactive experiences, product traceability, and authenticity verification. As brands look to offer added value and differentiate themselves in digital-savvy markets, interactive packaging creates opportunities for improved customer insights and loyalty. This trend is especially prominent in the healthcare, personal care, and premium goods segments, offering a competitive edge to early adopters.

- For instance, Huhtamaki collaborated with Digimarc to embed over 10 million scannable digital watermarks into its food packaging line in 2023, enabling traceability and enhanced recycling through automatic sorting systems.

Technological Advancements in Digital Printing and Design

Advancements in digital printing and 3D packaging design are reshaping the custom packaging industry. Digital printing enables faster turnaround, cost-effective short runs, and high-quality customization, which is ideal for small businesses and seasonal campaigns. It allows brands to create highly tailored packaging with minimal waste. Innovations in structural design and CAD-based solutions further support creative freedom in packaging formats. These technological improvements reduce lead times, lower inventory costs, and open up opportunities for personalized branding and mass customization in real time.

- For instance, WestRock’s digital print facility in Wakefield, UK, produced over 300 million digitally printed cartons in 2023, with short-run capabilities as low as 500-unit batches supported by their proprietary ColorBox® technology.

Key Challenges

High Cost of Customization for Small Businesses

While custom packaging offers significant branding advantages, the associated costs of design, printing, and tooling can be a barrier for small and medium-sized enterprises (SMEs). Unlike large corporations that benefit from economies of scale, SMEs often struggle with high per-unit costs and minimum order requirements. This financial constraint limits the ability of smaller brands to compete with larger players in packaging quality and innovation, potentially hindering market inclusivity and growth among emerging businesses.

Volatility in Raw Material Prices

The custom packaging boxes market is heavily impacted by fluctuations in the prices of raw materials, particularly paper, cardboard, and inks. Supply chain disruptions, energy costs, and geopolitical tensions contribute to this volatility, which in turn affects production costs and pricing strategies for packaging manufacturers. Unpredictable input costs make it challenging for businesses to maintain profitability and pricing consistency, especially for long-term contracts. This challenge is prompting many companies to explore alternative materials and adopt cost-optimization measures.

Environmental Regulations and Compliance Pressure

While sustainability drives demand for eco-friendly packaging, meeting diverse environmental regulations across regions poses compliance challenges for manufacturers. Adhering to evolving standards on recyclability, biodegradability, and emissions increases operational complexity and costs. Companies must invest in R&D to develop compliant materials and update manufacturing processes, which may not be feasible for all players. Navigating this regulatory landscape requires continuous innovation and adaptability, adding pressure to maintain competitiveness and environmental responsibility simultaneously.

Regional Analysis

North America:

North America held a significant share of approximately 28% in the global custom packaging boxes market in 2024, driven by the strong presence of e-commerce, premium consumer brands, and high demand for personalized packaging. The United States leads the region, supported by innovation in design, digital printing technologies, and rising sustainability initiatives. Consumer preference for recyclable and eco-friendly materials, especially in the food, cosmetics, and electronics sectors, is boosting paper-based packaging. Moreover, robust logistics infrastructure and brand competition contribute to increased demand for high-quality custom packaging solutions tailored to enhance brand identity and improve the customer experience.

Europe:

Europe accounted for around 26% of the global custom packaging boxes market in 2024, largely influenced by stringent environmental regulations and a mature consumer base that values sustainable packaging. Countries such as Germany, France, and the UK are leading the adoption of recyclable and biodegradable materials, particularly in food, healthcare, and luxury goods sectors. The European market benefits from advanced manufacturing technologies and a well-established printing industry. Rising demand for minimalist and eco-conscious designs is encouraging packaging producers to invest in innovation and green practices, solidifying Europe’s position as a sustainability-driven leader in the custom packaging space.

Asia Pacific:

Asia Pacific dominated the custom packaging boxes market in 2024 with a market share exceeding 32%, led by rapid industrialization, growing e-commerce penetration, and expanding middle-class populations. China, India, and Japan are the primary contributors to this growth, with increasing demand from food, electronics, and fashion industries. The region’s cost-effective manufacturing capabilities, along with rising investments in packaging automation and printing technologies, further support market expansion. Additionally, the growing influence of digital retail platforms and increased brand consciousness among consumers are driving the need for differentiated and visually appealing packaging across both domestic and export-oriented businesses.

Latin America:

Latin America captured approximately 7% of the global custom packaging boxes market in 2024, with Brazil and Mexico emerging as key contributors. Growth in the region is fueled by the expanding food and beverage industry, rising urbanization, and increased consumer spending on packaged goods. Local brands are increasingly turning to custom packaging to enhance brand recognition and meet evolving consumer preferences. Although the market faces challenges such as limited infrastructure and fluctuating raw material prices, the growing focus on sustainable packaging and regional manufacturing expansion presents new opportunities for custom packaging suppliers in Latin America.

Middle East & Africa:

The Middle East & Africa region held a modest share of about 7% in the global custom packaging boxes market in 2024. Countries like the UAE and South Africa are witnessing growing demand due to the rise of premium retail, cosmetics, and food delivery sectors. The adoption of custom packaging is being driven by increasing disposable incomes, modernization of retail infrastructure, and demand for aesthetically appealing and functional packaging. However, the region also faces barriers such as inconsistent supply chains and limited local production capabilities. Nonetheless, rising awareness of sustainable solutions is gradually fostering market development in this region.

Market Segmentations:

By Material:

- Paper & Paperboard

- Plastic

- Metal

- Glass

By Packaging Type:

- Boxes

- Bottles

- Containers & Jars

- Bags & Pouches

- Corks

- Cartons

- Mailers

- Others

By End User:

- Food & Beverages

- Electrical & Electronics

- Healthcare

- Personal Care & Cosmetics

- Consumer Goods

- Fashion Accessories & Apparel

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the custom packaging boxes market is characterized by the presence of both global and regional players actively engaged in innovation, sustainability, and customer-centric solutions. Key companies such as DS Smith, Smurfit Kappa Group, Westrock Company, Huhtamaki, and ProAmpac are leveraging advanced manufacturing technologies and digital printing capabilities to meet evolving client demands. These firms focus on product customization, eco-friendly materials, and integrated design services to strengthen brand identity and enhance customer experience. North American players like Packlane, Glenroy Inc., and International Custom Packaging emphasize quick turnaround, small-batch flexibility, and D2C support, while European companies are advancing sustainable solutions in response to regulatory mandates. Strategic partnerships, mergers, and expansions into emerging markets are common strategies aimed at broadening market reach and production capabilities. With increasing consumer demand for innovative and sustainable packaging, competition is intensifying, pushing companies to differentiate through design, functionality, and environmental responsibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DS Smith (U.K.)

- Huhtamaki (Finland)

- Westrock Company (U.S.)

- Smurfit Kappa Group (Ireland)

- ProAmpac (U.S.)

- Glenroy Inc. (U.S.)

- Packlane (U.S.)

- Owens Illinois (U.S.)

- PakFactory (Canada)

- International Custom Packaging (U.S.)

Recent Developments

- In March, 2024, UK-based packaging distributor Kite Packaging launched an advanced custom-size box tool, offering standard custom boxes and die-cut boxes. The tool provides customers with the option to specify board grade, color, and dimensions for their desired box, enhancing the overall customer experience.

- In July, 2024, Axiom Print unveiled its latest offering: custom printed subscription boxes. The new boxes featured premium quality printing, sustainable materials, and complete customization, providing businesses with a tool to increase brand recognition and customer satisfaction.

- In May, 2023, The Custom Boxes revolutionized custom packaging with affordable 4-color printing and sustainable solutions. The company offered a wide range of custom boxes made from 100% recyclable materials. It also aimed to meet diverse packaging needs and exceed customer expectations by providing efficient and eco-friendly solutions.

- In January 2023, BRANDMYDISPO, a packaging company, announced the launch of its custom Mylar bags design services at no additional cost. The company further stated that the custom Mylar bags have been designed by keeping durability and longevity in mind.

- In November 2022, Unico Packing declared the launch of a one-stop packaging solution for custom cardboard rigid gift boxes. The solution from UNICO mainly consists of custom drawer boxes, cosmetic boxes, magnetic close gift boxes, branded jewelry boxes, boxes with separated lids, collapsible rigid boxes, custom spiral notebooks, and various other printing services.

Market Concentration & Characteristics

The Custom Packaging Boxes Market demonstrates moderate market concentration, with a mix of global and regional players competing on innovation, material sustainability, and customer service. Large companies such as DS Smith, Smurfit Kappa Group, and Westrock Company maintain strong positions through integrated supply chains, advanced printing technologies, and scalable production capacities. It reflects characteristics of a fragmented industry, where customization requirements vary widely across end-use sectors such as food, personal care, and electronics. Entry barriers remain relatively low due to flexible printing and manufacturing technologies, but brand reputation, quality standards, and eco-certifications often determine long-term contracts. The market favors suppliers that offer tailored, sustainable solutions supported by responsive logistics and design capabilities. Strategic partnerships and investments in digital packaging platforms are strengthening competitiveness. It also sees high product differentiation, where aesthetic appeal, durability, and environmental compliance influence buyer decisions. Rapid shifts in consumer preference and packaging legislation continue to shape how companies position themselves.

Report Coverage

The research report offers an in-depth analysis based on Material, Packaging Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for eco-friendly and recyclable packaging materials will continue to rise, driven by consumer awareness and regulatory pressure.

- E-commerce and direct-to-consumer channels will further accelerate the need for customized, durable, and brand-centric packaging solutions.

- Digital printing technologies will gain wider adoption, enabling cost-effective personalization and faster production cycles.

- Companies will increasingly invest in smart packaging features such as QR codes and augmented reality to enhance customer engagement.

- Lightweight and compact packaging designs will gain popularity due to cost efficiency and sustainability goals.

- Small and medium-sized enterprises will explore custom packaging to build brand identity and improve consumer perception.

- Automation in packaging production will expand, improving output consistency, efficiency, and scalability.

- The food and beverage sector will remain a dominant end user, with rising demand for freshness-preserving and visually appealing packaging.

- Asia Pacific will retain its lead in market share, supported by industrial growth and cost-effective manufacturing.

- Strategic partnerships and regional expansions will play a key role in enhancing supply chains and competitive advantage.