Market Overview

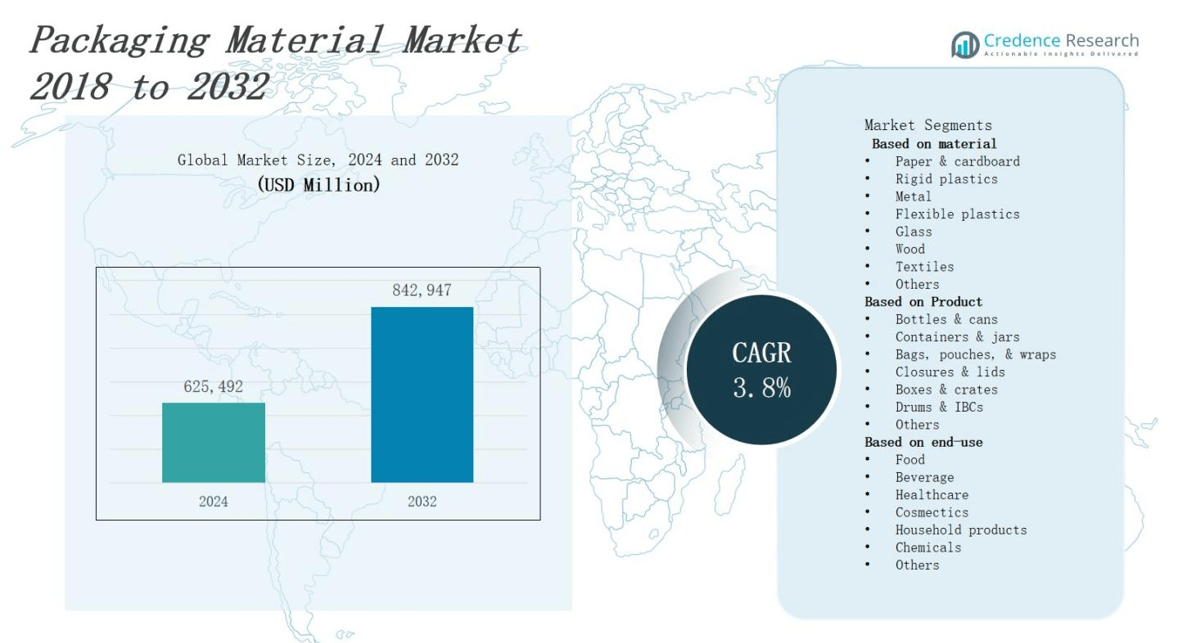

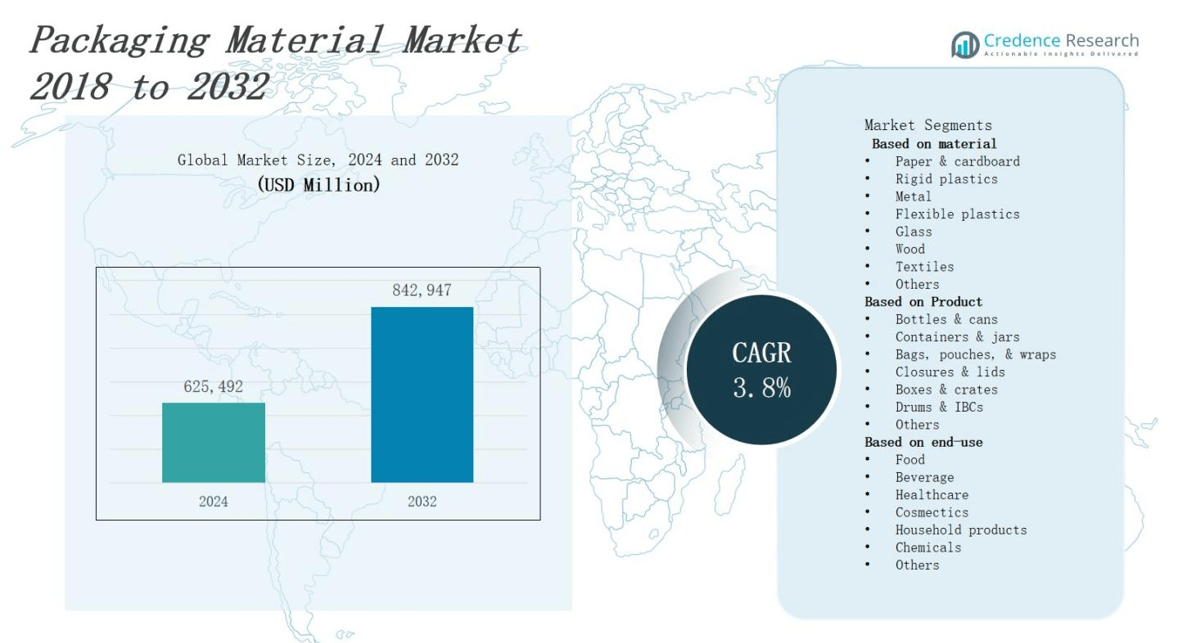

The Packaging Material Market is projected to expand from USD 625,492 million in 2024 to USD 842,947 million by 2032, registering a CAGR of 3.8%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Material Market Size 2024 |

USD 625,492 million |

| Packaging Material Market, CAGR |

3.8% |

| Packaging Material Market Size 2032 |

USD 842,947 million |

E‑commerce expansion and stringent environmental regulations drive significant demand for sustainable, cost‑effective, lightweight packaging materials that reduce costs and carbon footprints. Manufacturers invest in recyclable polymers, bio‑based substrates, and advanced barrier films to extend shelf life and meet regulatory requirements. They leverage digital printing and automation to accelerate customization and improve operational efficiency. Smart packaging trends, including RFID tags and IoT sensors, enhance traceability and consumer engagement. Collaboration between suppliers and brand owners fosters innovation in modular designs and closed‑loop recycling systems. Companies pursue multi‑material hybrids and circular economy solutions to stay competitive and achieve long‑term market growth.

Asia Pacific leads the Packaging Material Market with robust e‑commerce growth and manufacturing capacity. Europe follows through advanced recycling infrastructure and stringent sustainability mandates. North America drives demand via automation, smart packaging, and strong consumer goods sectors. Latin America benefits from expanding retail and food service industries, while Middle East & Africa grows through oil, chemical, and pharmaceutical applications. Major competitors include Stora Enso, Owens‑Illinois, Crown Holding, Berry Plastics, Amcor, Ball Corporation, Sealed Air, Mondi, International Paper Company, and Reynolds Group, all investing in innovation and regional expansion to capture market share.

Market Insights

- The Packaging Material Market will grow from USD 625,492 million in 2024 to USD 842,947 million by 2032, at a CAGR of 3.8%.

- E‑commerce expansion and strict environmental regulations drive demand for sustainable, lightweight packaging solutions.

- Manufacturers invest in recyclable polymers, bio‑based substrates, and advanced barrier films to extend shelf life and meet compliance.

- Companies deploy digital printing and automation to speed customization and boost operational efficiency.

- Smart packaging features—RFID tags, IoT sensors, active materials—enhance traceability and consumer engagement.

- Asia Pacific leads with 40% market share, followed by Europe (25%), North America (20%), Latin America (8%), and Middle East & Africa (7%).

- Stora Enso, Owens‑Illinois, Crown Holding, Berry Plastics, Amcor, Ball Corporation, Sealed Air, Mondi, International Paper Company, and Reynolds Group compete through sustainability and technological innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising E‑Commerce and Sustainability Innovations

E‑commerce expansion drives packaging demand and sparks innovation in lightweight, durable materials. The Packaging Material Market responds to stringent environmental regulations by shifting toward recyclable polymers and bio‑based substrates. It uses barrier films to extend shelf life without increasing thickness. Manufacturers adopt automation and digital printing to customize packaging. Companies invest in research to create compostable materials compliant with regulatory standards. Collaboration between brands and suppliers accelerates sustainable design adoption.

- For instance, companies like KWiiD provide reusable box systems designed for multiple shipping cycles, improving sustainability by reducing reliance on single-use materials.

Cost‑Effective Materials and Operational Efficiency

Supply chain pressures push companies to seek cost‑effective packaging solutions without compromising quality. The Packaging Material Market supports this need by offering lightweight polymers and optimized material blends. It relies on just‑in‑time production to reduce inventory waste and storage expenses. Manufacturers use analytics to forecast demand and optimize procurement. They apply lean manufacturing principles to cut cycle times and minimize scrap. Strategic partnerships with raw material suppliers ensure price stability.

- For instance, OCEANIUM, a UK-based startup, produces home-compostable bio-packaging from sustainably farmed seaweed, replacing traditional throwaway packaging while maintaining durability.

Technological Integration and Smart Packaging Deployment

Enhanced traceability drives incorporation of smart technologies into packaging. The Packaging Material Market embraces RFID tags and IoT sensors to monitor product conditions in real time. It deploys QR codes that verify authenticity. Manufacturers integrate sensor data with cloud platforms to analyze performance and reduce losses. They develop active packaging that interacts with environment to preserve freshness. Companies partner with tech firms to innovate supply chain visibility and quality control.

Circular Economy and Regulatory Compliance

Regulatory bodies enforce stricter waste reduction and recycling mandates. The Packaging Material Market adapts by offering materials designed for circular economy models. It facilitates closed‑loop recycling through polymer grades and collection systems. Manufacturers invest in renewable feedstocks to lower carbon footprints and meet compliance targets. They optimize packaging designs to minimize material use and simplify disassembly. Companies engage stakeholders to develop industry‑wide recycling infrastructure and frameworks that support environmental goals.

Market Trends

Growing Adoption of Bio-Based and Recyclable Polymers

The Packaging Material Market embraces sustainable feedstocks to meet regulatory demands and consumer preferences. It shifts toward bio-based polymers derived from plant waste and recycled plastics that maintain barrier performance. Companies invest in research to develop compostable films with high tensile strength. They incorporate recycled content to reduce dependency on virgin materials and lower carbon footprints. Suppliers collaborate on certification programs to standardize quality and verify recyclability across regions.

- For instance, Danimer Scientific has developed compostable films with high tensile strength using polyhydroxyalkanoates (PHA), a bio-based polymer derived from bacterial fermentation, which are used in packaging applications to replace traditional plastics.

Integration of Smart and Active Packaging Technologies

The Packaging Material Market leverages sensor-enabled materials to track product conditions in real time. It employs RFID tags and QR codes for authentication and supply chain transparency. Companies produce active packaging that releases preservatives in response to moisture changes. They integrate temperature indicators that alert handlers to deviations. Firms partner with technology providers to incorporate nano-materials that monitor freshness. This trend enhances safety and supports data-driven logistics decisions processes.

- For instance, BASF SE focuses on developing biodegradable, high-barrier coatings and nanotechnology-enhanced active packaging that extend shelf life and reduce food waste by monitoring freshness indicators.

Expansion of Digital Printing and Customization Capabilities

The Packaging Material Market benefits from advanced digital printing to deliver personalized designs and rapid prototyping. It reduces lead times and supports small batch runs. Brands request variable data printing for targeted promotions and seasonal campaigns. Manufacturers adopt UV-curable inks to ensure high-resolution graphics and durability. They integrate workflow software to automate color management and quality control. This trend strengthens brand engagement and increases market agility and operational efficiency.

Emergence of Hybrid Materials and Light-Weighting Solutions

The Packaging Material Market explores hybrid composites that combine paperboard and plastics for strength and recyclability. It designs thin-gauge films to cut material usage and reduce shipping costs. Companies assess life-cycle impact to guide material selection. They trial coatings that enhance barrier properties without adding weight. Suppliers collaborate on pilot lines to test multi-layer structures. This trend drives innovation and supports sustainability targets and operational cost optimization across industries.

Market Challenges Analysis

Stringent Regulatory Compliance and Material Cost Volatility

Tight environmental laws require continuous updates to material formulations and approval processes. The Packaging Material Market faces pressure to comply with varied regulations across jurisdictions and certification schemes. It must absorb increased testing costs without passing them entirely to consumers. Raw material price shifts force budgeting challenges for producers and brand owners. It demands supply chain flexibility to secure alternative sources under short notice. Companies struggle to synchronize regulatory timelines and commercial launches without delaying product rollout.

Balancing Performance Requirements and Circular Economy Goals

High barrier properties and durability remain critical for many sectors, but circular economy targets require easier recyclability. The Packaging Material Market must innovate composite structures that maintain performance without harm to recycling streams. It faces technical barriers when replacing plastic layers with bio‑based films that sometimes lack moisture resistance. Cost constraints hinder adoption of novel materials that meet both performance and sustainability benchmarks. It demands close collaboration between designers, material scientists, and waste management firms. Industry players must educate recycling facilities to handle new substrates effectively.

Market Opportunities

Expansion of E‑Commerce and Customization Services

Rising online retail volumes create demand for tailored packaging solutions that enhance consumer experience and reduce returns. The Packaging Material Market capitalizes on advanced digital printing and automation platforms to deliver personalized designs at scale. It offers variable data printing that supports targeted promotions and seasonal releases. Manufacturers integrate rapid prototyping workflows to shorten product launch cycles. Strategic investments in smart packaging enable real‑time tracking and interactive brand engagement. Collaboration with e‑tailers secures long‑term contracts and drives volume growth.

Growth in Circular Economy Collaborations and New Feedstocks

Global sustainability commitments open avenues for partnerships between material producers, recyclers, and brand owners. The Packaging Material Market leverages bio‑based polymers and mono‑material structures that facilitate efficient recycling streams. It pilots pilot programs with waste management firms to validate closed‑loop solutions. Companies explore agricultural residues and algae‑derived polymers to diversify feedstock sources. Joint ventures accelerate certification of compostable films in key regions. This trend reduces dependence on virgin plastics and aligns with corporate net‑zero targets.

Market Segmentation Analysis:

By Material

Paper & cardboard lead demand due to wide use and recyclability. Rigid plastics dominate volume in durable applications, while flexible plastics support lightweight, cost‑effective formats. Metal segments find use in premium and corrosion‑resistant solutions. Glass meets sustainability goals in beverages and pharmaceuticals. Wood and textiles serve niche markets requiring natural or biodegradable packaging. Others include hybrid composites tailored to specific performance needs. Packaging Material Market tracks material preferences to guide product development and investment strategies.

- For instance, Tetra Pak employs paperboard in its beverage cartons to enable recyclability while maintaining product safety.

By Product

Bottles & cans account for substantial share given beverage and consumer goods requirements. Containers & jars sustain growth in food and cosmetic segments. Bags, pouches, & wraps register rapid uptake due to convenience and minimal waste. Closures & lids deliver functional value by preserving quality and ensuring safety. Boxes & crates support logistics and bulk transport. Drums & IBCs handle industrial chemicals and large‑scale storage. Packaging Material Market analyzes product performance to optimize manufacturing and distribution.

By End‑Use

Food applications represent the largest revenue source, driven by fresh and processed goods demand. Beverage segment follows through stringent safety and shelf‑life requirements. Healthcare packaging demands sterile, tamper‑evident formats for pharmaceuticals and medical devices. Cosmetics grow on innovation in premium and sustainable solutions. Household products use diverse formats to balance functionality and cost. Chemical end‑use requires robust, corrosion‑resistant containers. Packaging Material Market evaluates end‑use trends to align material selection with industry requirements.

- For instance, Ball Corporation specializes in metal beverage containers with advanced tamper-evident features and a strong commitment to sustainability, alongside innovations in recyclable aluminum cans that preserve product freshness

Segments:

Based on material

- Paper & cardboard

- Rigid plastics

- Metal

- Flexible plastics

- Glass

- Wood

- Textiles

- Others

Based on Product

- Bottles & cans

- Containers & jars

- Bags, pouches, & wraps

- Closures & lids

- Boxes & crates

- Drums & IBCs

- Others

Based on end-use

- Food

- Beverage

- Healthcare

- Cosmectics

- Household products

- Chemicals

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

Asia Pacific

Asia Pacific holds a market share of 40%. Strong e‑commerce volumes drive high packaging demand. The Packaging Material Market taps into regional manufacturing hubs with robust polymer and paper production. It supports local brand growth through cost‑effective logistics. Governments enforce strict environmental standards. Suppliers participate in joint ventures to expand capacity. Rapid urbanization and rising disposable incomes further fuel demand for innovative sustainable packaging solutions across multiple industries.

Europe

Europe commands a market share of 25%. The Packaging Material Market leverages strong recycling infrastructure to boost sustainable materials. It serves diverse industries from food processors to pharmaceutical firms. Regional regulations require high recyclability standards. Manufacturers innovate through mono‑material structures and barrier coatings. Partnerships with research institutes enhance material performance. Private investment in circular economy initiatives and consumer demand for eco‑friendly designs reinforce market momentum and drive new product development.

North America

North America holds a market share of 20%. The Packaging Material Market benefits from advanced automation and digital printing capabilities. It meets demand from e‑commerce giants and consumer goods brands. Industry players invest in smart packaging features such as RFID and IoT sensors. Firms optimize supply chain through integrated analytics. Public and private sectors fund sustainability research. Consumer expectations for personalized packaging and stringent food safety requirements accelerate adoption of innovative barrier and active packaging technologies.

Latin America

Latin America accounts for a market share of 8%. The Packaging Material Market responds to growing retail and food service sectors. It adapts materials to tropical climates and humidity concerns. Local producers expand capacity for paper and flexible plastic formats. Governments support recycling programs to reduce waste. International brands partner with regional suppliers to strengthen distribution. Market liberalization and infrastructural improvements encourage foreign investment and introduce new high‑performance packaging solutions into emerging markets.

Middle East & Africa

Middle East & Africa holds a market share of 7%. The Packaging Material Market targets oil and chemical industries with specialized containers. It develops moisture‑resistant films for arid regions. Regional hubs invest in paperboard and metal packaging for consumer goods. Stakeholders focus on building recycling infrastructure. Trade agreements facilitate import of advanced polymers and barrier materials. Growing hospitality and pharmaceutical sectors create new opportunities for premium and sustainable packaging innovations across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stora Enso

- Owens‑Illinois

- Crown Holding

- Berry Plastics

- Amcor

- Ball Corporation

- Sealed Air

- Mondi

- International Paper Company

- Reynolds Group

Competitive Analysis

Competition in the Packaging Material Market intensifies as global leaders invest in sustainable materials and digital capabilities. Amcor, Ball Corporation, and Crown Holding expand production capacity to meet e‑commerce demand. International Paper Company and Mondi focus on mono‑material solutions to improve recyclability. Owens‑Illinois and Reynolds Group deploy lightweight glass and flexible packaging to reduce costs. Sealed Air and Berry Plastics differentiate through active and smart packaging technologies. Stora Enso strengthens partnerships in bio‑based polymers to support circular economy initiatives. It monitors raw material prices and regulatory shifts to adjust product portfolios quickly. Strategic alliances with technology firms and investments in automated manufacturing lines enable faster time‑to‑market. Regional diversification and customer‑centric service models help companies capture emerging market share in Asia Pacific and Latin America. Firms leverage data analytics to forecast demand and optimize supply chain efficiency. They pursue targeted acquisitions to enter niche segments.

Recent Developments

- On February 20, 2024, IntegraMaterials launched its new heat-sealable paper pouch Cycle Pack. The Cycle Pack features a paper base, incorporating a surface treatment with protective barrier properties. The heat-sealable solution provides robust protection against humidity, light, and oxygen.

- In February 2024, Yorkshire Packaging Systems (YPS) launched compostable shrink films. The compostable film will be teamed up with an l-sealer for a high-gloss finish and strong seal, ideal for display packaging. It is available from 12-38 microns, with excellent tensile strength and a bright, highly transparent finish.

- On June 16, 2025, Amcor develops a first‑of‑its‑kind more sustainable shrink bag that reduces material use while maintaining barrier performance.

- On February 24, 2025, Berry Global and Mars announce new packaging solutions made from 100% recycled content for select Mars confectionery products.

Market Concentration & Characteristics

High entry barriers and economies of scale shape concentration in the Packaging Material Market. Global leaders such as Amcor, Ball Corporation, and International Paper hold major revenue shares, leveraging their vast production facilities and distribution networks. It requires substantial capital investment in specialized extrusion and coating equipment and compliance testing. Mid‑tier firms differentiate through regional focus and niche materials, including compostable polymers and mono‑material structures. Suppliers forge partnerships with brand owners to secure long‑term contracts and share innovation costs. Consolidation through mergers and acquisitions further concentrates power among leading players. Technological advances in automation and digital printing accelerate time‑to‑market but raise investment thresholds for smaller entrants. Diverse customer requirements across food, beverage, healthcare, and industrial sectors demand flexible production capabilities. Competitive pressure drives continuous portfolio optimization and cost management to sustain profitability.

Report Coverage

The research report offers an in-depth analysis based on Material, Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mono-material packaging designs increase recycling efficiency by simplifying separation processes, reducing contamination of waste streams.

- AI-driven quality control systems detect manufacturing defects in realtime, minimizing waste while improving product consistency.

- Strategic alliances with bio-feedstock suppliers secure sustainable raw materials, supporting long-term resource availability for manufacturers.

- Smart packaging integrates temperature indicators and freshness sensors, improving transparency across supply chains, reducing spoilage.

- Automation investments increase production throughput and reduce labor expenses, improving operational scalability across packaging applications.

- Digital printing accelerates customization, supports small batch runs, enhancing brand differentiation through high-resolution packaging graphics.

- Hybrids combine strength and recyclability, enabling performance improvements, meeting circular economy requirements for packaging design.

- Collaborations between suppliers and brands foster innovation, accelerate product development, aligning packaging solutions with demand.

- Regulatory partnerships support streamlined approvals for novel materials, reducing time to market, ensuring jurisdictional compliance.

- Investment in closed-loop recycling infrastructure enables circular economy goals and lowers reliance on virgin feedstocks.