Market Overview

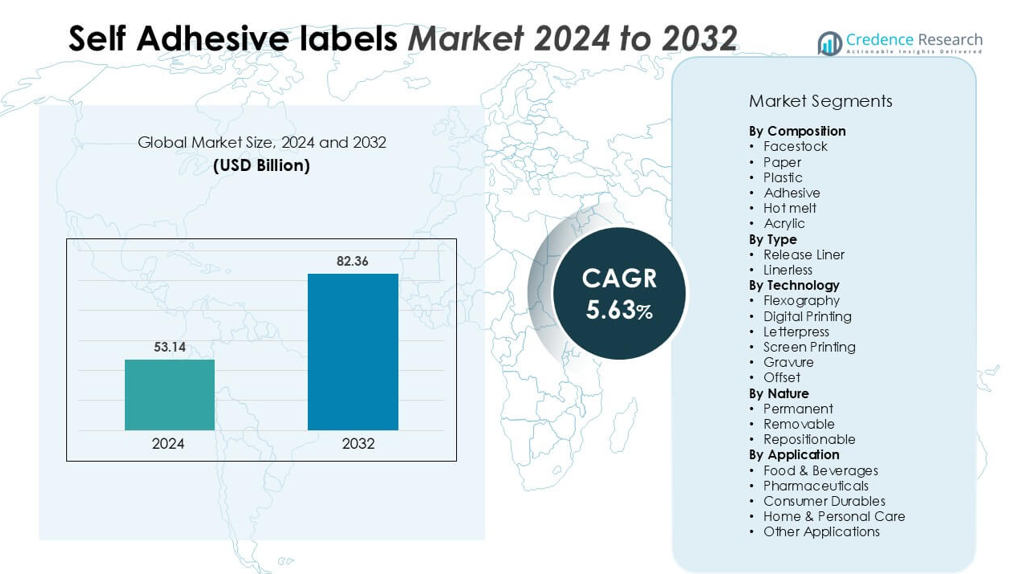

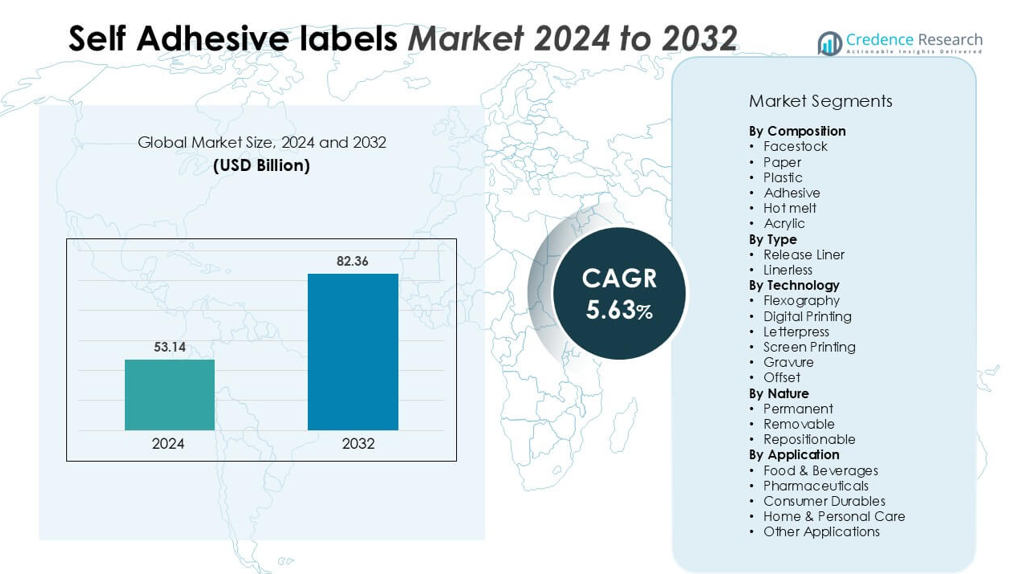

Self-Adhesive labels market size was valued USD 53.14 billion in 2024 and is anticipated to reach USD 82.36 billion by 2032, at a CAGR of 5.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self-Adhesive labels market Size 2024 |

USD 53.14 billion |

| Self-Adhesive labels market, CAGR |

5.63% |

| Self-Adhesive labels market Size 2032 |

USD 82.36 billion |

The self-adhesive labels market is highly competitive, with key players such as 3M, Avery Dennison Corporation, UPM, LINTEC Corporation, Mondi, HERMA, Optimum Group, AKO Group, and Advance Marks & Labels Pvt. Ltd. leading global operations. These companies focus on product innovation, sustainability, and expansion of digital printing technologies to strengthen market presence. Avery Dennison and UPM hold significant influence through their extensive product portfolios and advanced adhesive technologies. Among regions, Asia-Pacific dominates the global market with a commanding share of approximately 35%, driven by rapid industrialization, strong packaging demand, and increasing investments in manufacturing and e-commerce sectors, making it the most dynamic and rapidly expanding regional market.

Market Insights

- The global self-adhesive labels market is projected to reach multi-billion valuation by 2032, expanding at a CAGR of around 5.63%, driven by the growing demand for efficient and sustainable labeling solutions across industries.

- Rising consumption of packaged food, beverages, pharmaceuticals, and personal care products is a major driver, increasing the need for durable, cost-effective, and regulatory-compliant labeling materials.

- Key market trends include the adoption of digital printing, eco-friendly materials, and linerless labels, along with the integration of smart and RFID-enabled labeling technologies.

- The market is moderately consolidated, with leading players such as Avery Dennison, 3M, UPM, Mondi, and LINTEC Corporation focusing on innovation, sustainability, and strategic acquisitions to maintain competitive advantage.

- Regionally, Asia-Pacific leads the market with about 35% share, followed by Europe at 30%, while the facestock segment dominates by composition due to its versatility and superior printability across diverse applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Composition

The facestock segment dominates the self-adhesive labels market, accounting for the largest share due to its crucial role in providing printability, durability, and aesthetic appeal. Within facestock materials, plastic-based substrates hold a significant portion, driven by their superior resistance to moisture, chemicals, and tearing, making them ideal for industrial and consumer goods applications. Paper-based facestock continues to find use in cost-sensitive and eco-friendly labeling solutions. Growing demand for premium packaging, coupled with technological advancements in film-based facestock, is driving market growth across diverse end-use industries.

- For instance, Avery Dennison Corporation’s Fasson® 78599 film facestock for tamper-evident labels achieves a tensile strength of 2,390 kg / sq.cm in the cross-direction and a caliper of 50.8 µm (2.0 mil) for the film layer.

By Type and Technology

Among types, release liner labels lead the market, supported by their widespread application across food, beverage, and logistics sectors due to ease of use and high-quality print results. However, linerless labels are gaining traction for their sustainability benefits and reduced material waste. In terms of technology, flexography remains the dominant printing method, capturing a substantial share because of its efficiency, speed, and ability to print on various substrates. Digital printing is rapidly expanding, driven by increasing demand for customization, shorter print runs, and improved turnaround times in packaging operations.

- For instance, UPM Raflatac’s product catalog lists a variety of PET film liners. The company frequently promotes the benefits of thinner film liners, such as increasing the number of labels per roll and reducing material use.

By Nature and Application

The permanent segment holds the largest share in the self-adhesive labels market, attributed to its strong bonding properties and extensive use in packaging where long-lasting adhesion is critical, such as food, beverages, and logistics. Removable and repositionable labels cater to specialized needs like promotional and temporary applications. By application, food and beverages dominate, fueled by stringent labeling regulations, growing packaged food consumption, and brand differentiation needs. The pharmaceuticals and personal care sectors are also expanding, supported by regulatory compliance requirements and rising demand for tamper-evident and informative labeling solutions.

Key Growth Drivers

Expanding Packaging Industry and Branding Needs

The rapid growth of the global packaging industry is a primary driver for the self-adhesive labels market. Increasing demand for packaged food, beverages, pharmaceuticals, and personal care products has significantly raised the need for high-quality, durable labeling solutions. Self-adhesive labels offer flexibility, cost efficiency, and superior aesthetic appeal, supporting brand differentiation and product traceability. The trend toward premium and customized packaging, coupled with evolving consumer preferences for visually appealing and informative labels, further accelerates market adoption. Additionally, advancements in packaging automation and logistics systems are promoting the use of self-adhesive labels for efficient inventory tracking and regulatory compliance.

- For instance, Mercian Labels in the UK automated its converting line such that a short-run digital job of 117,600 labels across 102 SKUs (112 rolls, 1,050 labels per roll) was processed in 1 hour 46 minutes, having previously taken just under 6 hours.

Advancements in Printing and Labeling Technologies

Continuous innovation in printing technologies such as digital, flexographic, and UV inkjet printing is reshaping the self-adhesive labels market. These technologies enable high-resolution graphics, variable data printing, and quick design modifications, aligning with the rising demand for short-run and personalized packaging. Digital printing, in particular, supports faster production turnaround with minimal waste, enhancing supply chain efficiency. The integration of RFID and smart labeling technologies is also transforming traditional labeling into multifunctional solutions, improving product authentication and consumer engagement. These technological advancements not only enhance label functionality but also reduce production costs, boosting overall market competitiveness and scalability across industries.

- For instance, Buskro Ltd.’s DLP125-M digital label press accommodates labels up to 125 mm wide on roll diameters up to 482 mm, and runs at speeds up to 60 m/min, enabling late-stage variable data printing onto self-adhesive label stocks.

Rising Regulatory Emphasis on Product Information and Traceability

Increasing global regulations regarding product labeling and consumer safety are fueling the demand for self-adhesive labels. Governments and regulatory bodies mandate clear labeling for nutritional facts, ingredients, expiration dates, and traceability details, particularly in the food, beverage, and pharmaceutical sectors. Self-adhesive labels provide an ideal medium for compliant, durable, and tamper-evident information display. The adoption of serialization and track-and-trace systems in regulated industries further boosts label demand. Moreover, growing consumer awareness about product authenticity and sustainability is encouraging manufacturers to adopt eco-friendly and transparent labeling practices, reinforcing compliance-driven market growth.

Key Trends

Shift Toward Sustainable and Recyclable Label Materials

Sustainability has emerged as a major trend in the self-adhesive labels market, with increasing adoption of recyclable, biodegradable, and linerless label materials. Manufacturers are investing in water-based adhesives, recycled paper facestock, and bio-based plastics to minimize environmental impact. The growing emphasis on circular economy practices and stricter environmental regulations is pushing companies to innovate sustainable labeling solutions. Linerless labels, which eliminate the need for backing paper, offer cost savings and reduce landfill waste. This transition not only aligns with corporate sustainability goals but also opens new market opportunities among eco-conscious brands and consumers seeking responsible packaging alternatives.

- For instance, Avery Dennison Corporation offers a facestock that contains up to 30 % recycled PP resin and a liner made of only 23 µm thickness in its rPET-liner series.

Growing Demand for Smart and Functional Labels

The integration of smart technologies into self-adhesive labels presents significant growth opportunities. Smart labels equipped with RFID, NFC, or QR codes enable real-time tracking, authentication, and consumer interaction. These features are gaining traction in logistics, pharmaceuticals, and retail sectors, where traceability and brand protection are critical. Enhanced functionalities such as temperature indicators and tamper evidence add value to perishable and high-value goods. As the Internet of Things (IoT) expands, the adoption of smart labeling solutions will continue to grow, bridging the gap between physical packaging and digital data for improved supply chain transparency and consumer engagement.

- For instance, Avery Dennison Corporation’s AD-192 M730 UHF RFID inlay offers an antenna dimension of 22 × 12.50 mm and supports an EPC memory of 128 bits with a 96-bit TID and 48-bit unique serial number.

Key Challenge

Fluctuating Raw Material Costs

Volatility in the prices of raw materials such as paper, films, and adhesives poses a major challenge to the self-adhesive labels market. Rising costs of petroleum-based resins and specialty chemicals directly affect production expenses and profit margins. Supply chain disruptions, geopolitical uncertainties, and inflationary pressures further exacerbate cost instability. Manufacturers face difficulties in maintaining price competitiveness while ensuring consistent product quality. To mitigate this challenge, companies are exploring material optimization, alternative sourcing, and long-term supplier partnerships. However, ongoing fluctuations continue to pressure label converters and end-users, particularly in cost-sensitive market segments.

Environmental Concerns and Waste Management Issues

The environmental impact of label waste, particularly from release liners and non-recyclable adhesives, remains a significant barrier to market growth. Traditional self-adhesive labels often contribute to landfill accumulation and recycling inefficiencies. Regulatory pressures and consumer expectations for sustainable packaging are compelling manufacturers to redesign label structures and adopt greener materials. However, transitioning to eco-friendly alternatives involves high R&D costs and potential compromises in performance. Developing cost-effective, fully recyclable labeling systems that meet performance standards continues to be a complex challenge, slowing widespread adoption in some regions and applications.

Regional Analysis

North America

North America holds a substantial share of the global self-adhesive labels market, accounting for around 25–28% of total revenue. The region’s growth is driven by strong demand from the food and beverage, pharmaceuticals, and logistics sectors. The U.S. leads the market due to high adoption of advanced labeling technologies, regulatory compliance requirements, and focus on sustainable packaging solutions. Increasing investments in digital printing and RFID-enabled labels are further boosting market expansion. The growing e-commerce industry and consumer preference for premium packaging continue to enhance the region’s market competitiveness.

Europe

Europe captures approximately 30% of the global self-adhesive labels market, supported by stringent labeling regulations and the region’s emphasis on sustainability. Countries such as Germany, the U.K., and France are leading contributors, driven by robust packaging and manufacturing industries. The demand for recyclable and linerless labels is rising rapidly in line with the EU’s circular economy initiatives. Technological advancements in digital printing and strong presence of key label manufacturers further strengthen Europe’s position. Increasing demand from the pharmaceutical and personal care sectors also contributes to consistent market growth across the region.

Asia-Pacific

Asia-Pacific dominates the global self-adhesive labels market, commanding over 35% of total market share, driven by rapid industrialization and expanding packaging demand. China, India, and Japan lead regional growth due to increasing consumption of packaged goods and rising retail activity. The growing middle-class population, coupled with advancements in printing technologies, supports high label production volumes. Additionally, government initiatives promoting manufacturing and export-oriented industries have accelerated market penetration. The region’s strong economic outlook, coupled with the shift toward smart and eco-friendly labeling, positions Asia-Pacific as the fastest-growing market globally.

Latin America

Latin America accounts for around 7–9% of the global self-adhesive labels market, with steady growth driven by the food and beverage and pharmaceutical sectors. Brazil and Mexico are the key markets, supported by rising consumer spending and industrial expansion. Increasing urbanization and adoption of modern retail formats are boosting demand for flexible and attractive labeling solutions. However, economic fluctuations and limited technological adoption slightly restrain growth. Nevertheless, ongoing investments in packaging modernization and sustainable labeling are expected to create new opportunities for market development in the region.

Middle East & Africa (MEA)

The Middle East and Africa region holds a smaller yet growing share of approximately 5–7% in the global self-adhesive labels market. Market expansion is driven by the growth of the food processing, healthcare, and logistics sectors, particularly in the UAE, Saudi Arabia, and South Africa. Rising consumer awareness, along with increasing demand for packaged goods, supports steady growth. Although high production costs and limited local manufacturing capacity pose challenges, the region is witnessing increased investment in packaging and printing infrastructure, which is expected to enhance market potential over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Composition

- Facestock

- Paper

- Plastic

- Adhesive

- Hot melt

- Acrylic

By Type

By Technology

- Flexography

- Digital Printing

- Letterpress

- Screen Printing

- Gravure

- Offset

By Nature

- Permanent

- Removable

- Repositionable

By Application

- Food & Beverages

- Pharmaceuticals

- Consumer Durables

- Home & Personal Care

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the self-adhesive labels market is characterized by the strong presence of global and regional players focusing on innovation, sustainability, and technological advancement. Major companies such as 3M, Avery Dennison Corporation, UPM, LINTEC Corporation, and Mondi lead the market through extensive product portfolios, advanced printing technologies, and strong global distribution networks. These players emphasize eco-friendly materials, linerless label solutions, and digital printing integration to meet evolving environmental and customer demands. Regional manufacturers like HERMA, Optimum Group, and Advance Marks & Labels Pvt. Ltd. strengthen market diversity with customized and cost-effective solutions catering to niche applications. Competitive strategies revolve around mergers, acquisitions, and strategic partnerships to expand production capabilities and market presence. Furthermore, the growing demand for sustainable, high-performance labeling solutions is encouraging companies to invest in R&D and adopt circular economy practices, ensuring competitiveness and long-term growth in an increasingly regulated and innovation-driven market environment.

Key Player Analysis

Recent Developments

- In May 2024, Beontag launched self-adhesive labels in the Latin America wine market. These new self-adhesive labels comprise of 40% of grass fiber which is combined with FSC certified cellulose.

- In February 2024, Coveris acquired Czech Republic based self-adhesive label producer, S&K LABEL. Since Coveris is also engaged in manufacturing of self-adhesive labels, this strategic acquisition will provide Coveris to expand its geographical presence in Central & Eastern Europe.

- In November 2023, UK based premium self-adhesive labels manufacturer, Royston Labels, was acquired by Autajon Group which is engaged in manufacturing of labels, set-up boxes, and folding cartons. This acquisition is a part of Autajon Group’s expansion plan to grow is presence in the UK market.

Report Coverage

The research report offers an in-depth analysis based on Composition, Type, Technology Nature, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The self-adhesive labels market will continue to grow steadily, driven by rising demand from the packaging and logistics industries.

- Increasing adoption of digital and smart labeling technologies will enhance customization and traceability.

- Sustainability initiatives will accelerate the shift toward recyclable, biodegradable, and linerless label materials.

- The food and beverage sector will remain the dominant application area due to evolving labeling regulations and branding needs.

- Growth in e-commerce and retail sectors will boost the use of durable and high-performance labels.

- Asia-Pacific will maintain its leadership position, supported by industrial expansion and high packaging consumption.

- Manufacturers will invest more in automation and high-speed printing technologies to improve production efficiency.

- Rising regulatory emphasis on safety, authenticity, and transparency will drive innovation in labeling formats.

- Collaboration between material suppliers and converters will strengthen product innovation and market reach.

- Smart packaging integration with IoT-enabled labels will create new opportunities for consumer engagement and supply chain management.