Market Overview:

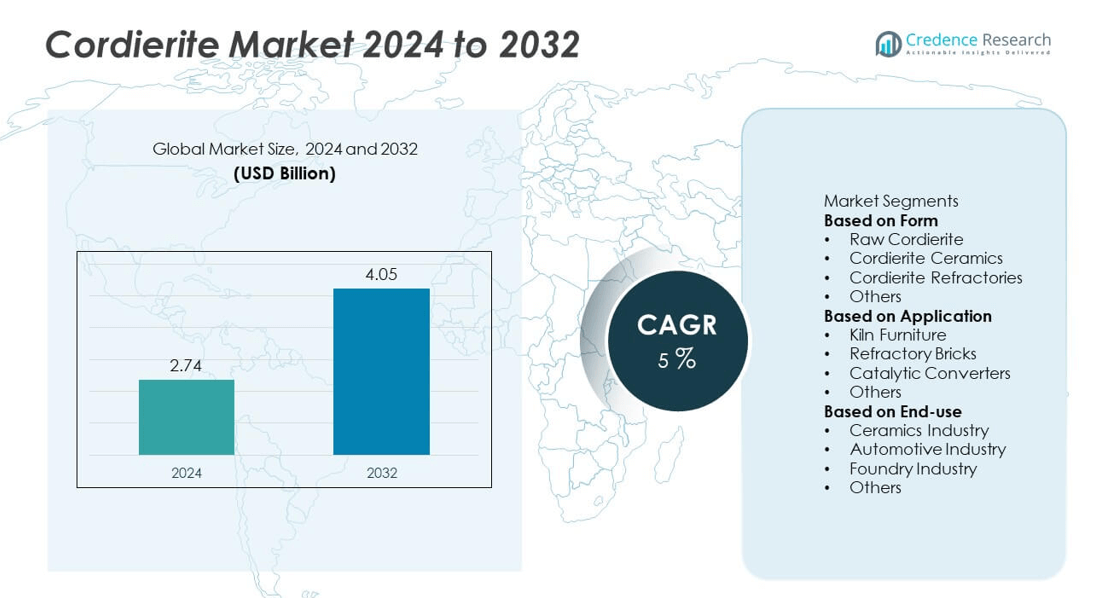

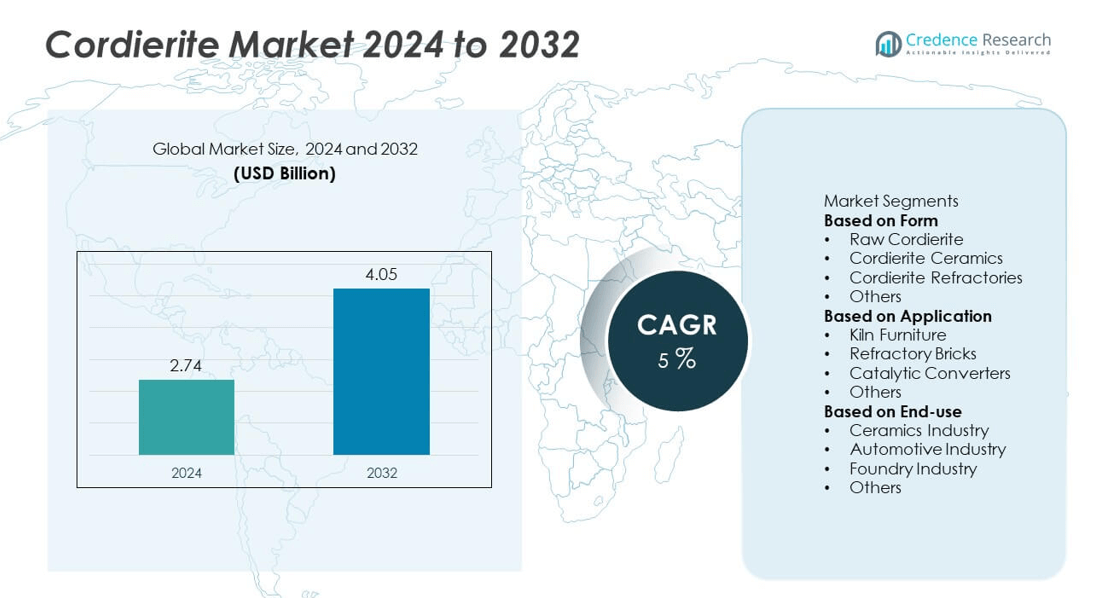

The global cordierite market was valued at USD 2.74 billion in 2024 and is projected to reach USD 4.05 billion by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cordierite Market Size 2024 |

USD 2.74 billion |

| Cordierite Market, CAGR |

5% |

| Cordierite Market Size 2032 |

USD 4.05 billion |

The cordierite market is led by major companies such as NGK Insulators, Ltd, Saint-Gobain, CoorsTek Inc., Dyson Technical Ceramics, Kyocera Corporation, IBIDEN Co., Ltd, Vesuvius plc, Corning Incorporated, Morgan Advanced Materials plc, and Denki Kagaku Kogyo Kabushiki Kaisha (DENKA). These players dominate through extensive product portfolios, R&D expertise, and global distribution networks. NGK Insulators and Corning hold strong positions in catalytic converter substrates, while Saint-Gobain and CoorsTek lead in industrial and refractory ceramics. Asia Pacific emerged as the leading region with a 33% market share in 2024, driven by expanding automotive production, industrial ceramics manufacturing, and strong investment in clean technology solutions.

Market Insights

- The global cordierite market was valued at USD 2.74 billion in 2024 and is projected to reach USD 4.05 billion by 2032, growing at a CAGR of 5%.

- Rising demand for cordierite ceramics and catalytic converter substrates drives growth, supported by expanding automotive and industrial manufacturing sectors.

- Key trends include increasing adoption of lightweight and thermally stable materials, along with advancements in 3D printing and sintering technologies for high-precision ceramic components.

- The market is competitive, with leading players such as NGK Insulators, Saint-Gobain, CoorsTek, and Corning focusing on R&D and sustainable production processes.

- Asia Pacific led the market with a 33% share in 2024, followed by North America with 29% and Europe with 26%, while the cordierite ceramics segment dominated by form with a 46% share, driven by high usage in catalytic converters and kiln furniture applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Cordierite ceramics dominated the market with a 46% share in 2024. Their dominance is driven by high thermal stability, low thermal expansion, and excellent resistance to thermal shock, making them ideal for kiln furniture, catalytic substrates, and electronic components. The growing demand for lightweight and high-performance materials in automotive and industrial applications further boosts adoption. Raw cordierite and cordierite refractories follow, supported by expanding use in insulation linings and furnace parts across foundries and metal industries. Rising investments in ceramic manufacturing and green technologies enhance the segment’s growth.

- For instance, KYOCERA Corporation developed its “Fine Cordierite” ceramic mirror with a coefficient of linear thermal expansion reported as “extremely small” (used on the International Space Station experiment) and mechanical strength 1.5 to 2 times that of low-expansion glass.

By Application

The catalytic converters segment held the leading 38% share in 2024, owing to cordierite’s superior thermal endurance and chemical inertness that enable efficient exhaust gas treatment. Increasing automotive emission regulations in Europe and North America have accelerated demand for cordierite substrates in both gasoline and diesel vehicles. Kiln furniture and refractory bricks also contributed significantly, driven by high-temperature resistance and mechanical strength. Continuous advancements in emission control technologies and expanding electric vehicle hybrid production further support this segment’s growth trajectory.

- For instance, NGK Insulators, Ltd. produces its HONEYCERAM cordierite catalyst carrier with wall thickness as low as 0.05 mm, leveraging its honeycomb structure for high surface area in a compact size.

By End-use

The automotive industry dominated the cordierite market with a 41% share in 2024. This dominance results from widespread use of cordierite-based catalytic converter substrates that improve thermal durability and reduce emissions. The ceramics industry followed, driven by rising adoption in kiln furniture and electronic ceramics. Growing production of lightweight and heat-resistant components in foundries and metallurgical applications also supports market expansion. Increasing focus on sustainable materials and stringent emission standards across global automotive manufacturing continue to strengthen demand for cordierite products.

Key Growth Drivers

Rising Demand from Automotive Emission Control Systems

The growing enforcement of vehicle emission regulations globally drives strong demand for cordierite substrates used in catalytic converters. Cordierite’s high thermal shock resistance and low expansion coefficient make it ideal for reducing NOx, CO, and hydrocarbon emissions. Automakers increasingly rely on cordierite honeycomb structures for durable exhaust treatment. The rapid shift toward cleaner combustion systems, especially in Europe and Asia Pacific, supports this trend. Expanding hybrid vehicle production further enhances market growth for cordierite-based emission control components.

- For instance, Corning Incorporated developed its CELCOR® substrates, with later versions featuring increased cell density and thinner walls, to improve conversion efficiency in catalytic converters for gasoline direct-injection engines.

Expansion of the Ceramics and Industrial Manufacturing Sector

The global ceramics industry’s expansion significantly contributes to cordierite demand. Cordierite’s thermal stability and low dielectric constant make it ideal for kiln furniture, refractory linings, and electronic ceramics. Rising construction and industrial activity in Asia Pacific and the Middle East fuels production of high-performance ceramics. Manufacturers invest in advanced sintering and extrusion technologies to enhance efficiency. Growing adoption in electrical insulators and furnace components strengthens market prospects, supported by consistent infrastructure development and rapid industrialization.

- For instance, CoorsTek, a leading manufacturer of advanced ceramics, uses a variety of firing methods, including specialized pressure-assisted techniques and pressureless sintering, in the production of high-performance components for applications in electronics, refractories, and other industries.

Adoption of Lightweight and Energy-Efficient Materials

Increasing preference for lightweight, energy-efficient materials in automotive and industrial sectors drives cordierite market growth. Cordierite’s low density, coupled with superior heat and corrosion resistance, improves fuel efficiency and reduces operational costs. Manufacturers in transportation and energy industries adopt cordierite composites to meet stricter sustainability standards. The shift toward low-emission, durable materials aligns with global decarbonization goals. Technological innovation in porous and composite cordierite structures further enhances product performance across diverse high-temperature applications.

Key Trends & Opportunities

Development of Advanced Manufacturing Processes

Emerging manufacturing methods such as 3D printing and precision extrusion enable the production of complex cordierite geometries with improved mechanical strength. These innovations enhance product uniformity and reduce waste. Companies are integrating digital monitoring and AI-based process control to optimize sintering conditions. The trend supports customized designs for catalytic converters and refractories. Continuous research on material formulation and energy-efficient production processes opens opportunities for cost reduction and improved environmental performance.

- For instance, Saint-Gobain utilizes 3D printing for various technical ceramic applications, including research and development for materials like silicon carbide. Cordierite is also a technical ceramic with excellent thermal shock resistance, and it can be fabricated with specific pore structures using 3D printing.

Growing Use in Renewable and Clean Energy Applications

Cordierite materials find increasing use in renewable energy systems such as biomass furnaces, fuel cells, and solar thermal components. Their ability to withstand high operational temperatures ensures stability and efficiency in energy conversion processes. Governments promoting low-carbon technologies create opportunities for cordierite adoption in sustainable energy infrastructure. Rising investment in hydrogen and bioenergy facilities strengthens the market outlook. Manufacturers focusing on eco-friendly cordierite refractories gain a competitive edge in this emerging segment.

- For instance, Morgan Advanced Materials manufactures various thermal insulation systems, including cordierite-based ceramics with high thermal stability and resistance to thermal shock, for high-temperature industrial applications.

Key Challenges

High Production Costs and Raw Material Constraints

Cordierite manufacturing requires high-purity raw materials such as alumina, silica, and magnesia, which face price fluctuations and supply limitations. The energy-intensive sintering and firing processes further elevate production costs. Small and medium producers struggle with cost competitiveness against large-scale ceramic manufacturers. Additionally, limited recycling options and high capital investment in production equipment hinder new market entrants. Addressing these cost and sourcing issues remains essential for ensuring steady supply and profitability.

Competition from Substitute Materials

Alternative materials like silicon carbide, mullite, and alumina-based ceramics pose a challenge due to comparable heat resistance and mechanical properties. These substitutes often offer higher strength or lower production costs in specific applications. Automotive and industrial manufacturers may prefer alternatives for specialized environments or cost-sensitive markets. Continuous R&D investment is necessary to improve cordierite’s mechanical durability and surface characteristics. Enhancing performance while maintaining affordability is critical to retain competitiveness in high-temperature material markets.

Regional Analysis

North America

North America held a 29% share of the global cordierite market in 2024. Growth is driven by the strong presence of automotive and aerospace manufacturing, where cordierite is widely used in catalytic converters and heat-resistant components. The U.S. leads regional demand due to strict emission standards set by the EPA and rising adoption of advanced ceramic technologies. Expanding renewable energy projects and industrial furnace applications further support market growth. Continuous R&D by local producers enhances performance and durability, ensuring steady consumption across high-temperature processing industries.

Europe

Europe accounted for a 26% share of the global cordierite market in 2024. Stringent environmental regulations under the Euro 6 emission standards and increasing electric vehicle production drive regional demand. Germany, the U.K., and France dominate consumption due to their robust automotive and ceramics industries. Technological innovations in catalytic substrates and refractory products strengthen market penetration. The region’s focus on energy efficiency and industrial decarbonization also boosts adoption. Investments in advanced ceramic research and sustainable manufacturing processes continue to enhance Europe’s competitive position in the global cordierite landscape.

Asia Pacific

Asia Pacific dominated the cordierite market with a 33% share in 2024. Rapid industrialization, expanding automotive production, and strong growth in the ceramics industry drive market leadership. China, Japan, South Korea, and India are key contributors due to large-scale manufacturing and favorable government policies supporting clean technologies. Increasing demand for catalytic converters, kiln furniture, and insulation materials boosts adoption. Regional players invest heavily in process automation and cost-efficient production technologies. Rising infrastructure projects and sustainable energy initiatives further position Asia Pacific as the fastest-growing market for cordierite products.

Latin America

Latin America captured a 7% share of the cordierite market in 2024. Brazil and Mexico are major contributors, supported by expanding automotive manufacturing and industrial activities. The region benefits from growing adoption of emission control devices and high-temperature ceramics in foundries and furnaces. Government initiatives promoting cleaner energy sources and local production encourage investment in advanced materials. However, limited technological infrastructure and high import dependency slightly restrain growth. Increasing collaboration with international manufacturers is expected to strengthen regional capabilities and enhance the availability of high-performance cordierite products.

Middle East & Africa

The Middle East & Africa accounted for a 5% share of the global cordierite market in 2024. Rising investments in industrial manufacturing, metal processing, and renewable energy projects are driving demand. The Gulf countries show increasing adoption of refractory ceramics in high-temperature applications and catalytic converters. South Africa leads in the region’s foundry industry, contributing to cordierite consumption. However, limited local production and dependence on imports constrain expansion. Ongoing infrastructure development and diversification of non-oil industries are expected to support moderate growth in the coming years.

Market Segmentations:

By Form

- Raw Cordierite

- Cordierite Ceramics

- Cordierite Refractories

- Others

By Application

- Kiln Furniture

- Refractory Bricks

- Catalytic Converters

- Others

By End-use

- Ceramics Industry

- Automotive Industry

- Foundry Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cordierite market is characterized by the presence of major players such as NGK Insulators, Ltd, Saint-Gobain, CoorsTek Inc., Dyson Technical Ceramics, Kyocera Corporation, IBIDEN Co., Ltd, Vesuvius plc, Corning Incorporated, Morgan Advanced Materials plc, and Denki Kagaku Kogyo Kabushiki Kaisha (DENKA). These companies compete through product innovation, process optimization, and strong distribution networks across global markets. NGK Insulators and Corning lead in catalytic converter substrates due to advanced ceramic technologies. Saint-Gobain and CoorsTek focus on high-performance refractory and industrial ceramics. Regional players emphasize cost-effective production and material customization to strengthen local competitiveness. Strategic mergers, partnerships, and technological investments enhance production efficiency and environmental performance. Continuous R&D in lightweight cordierite composites and advanced sintering methods positions key manufacturers to cater to evolving demands in automotive, electronics, and renewable energy sectors, consolidating their global market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NGK Insulators, Ltd

- Saint-Gobain

- CoorsTek Inc.

- Dyson Technical Ceramics

- Kyocera Corporation

- IBIDEN Co., Ltd

- Vesuvius plc

- Corning Incorporated

- Morgan Advanced Materials plc

- Denki Kagaku Kogyo Kabushiki Kaisha (DENKA)

Recent Developments

- In January 2025, Kyocera Fineceramics Europe became a member of the first Mannheim Energy Efficiency & Sustainability Network.

- In 2025, Morgan Advanced Materials plc completed real-time X-ray diffraction research on ceramic sintering, using beam-time sessions at the Diamond Light Source facility.

- In June 2024, Kyocera Corporation had its Fine Cordierite ceramic mirror chosen for use aboard the International Space Station as part of a mobile-optical link experiment

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cordierite market will witness steady growth driven by rising demand in automotive applications.

- Expanding adoption in catalytic converters will continue supporting emission control initiatives.

- Technological advancements in sintering and 3D printing will improve material performance and precision.

- Increasing focus on lightweight and energy-efficient materials will enhance product demand.

- Growth in the ceramics and electronics industries will create new application opportunities.

- Manufacturers will invest more in sustainable production and recycling processes.

- Asia Pacific will remain the dominant regional market, supported by industrial expansion.

- Strategic collaborations and mergers will strengthen the competitive positioning of key players.

- Rising investment in renewable energy systems will boost use in high-temperature components.

- Development of cost-effective cordierite composites will improve affordability and expand global adoption.