Market Overview

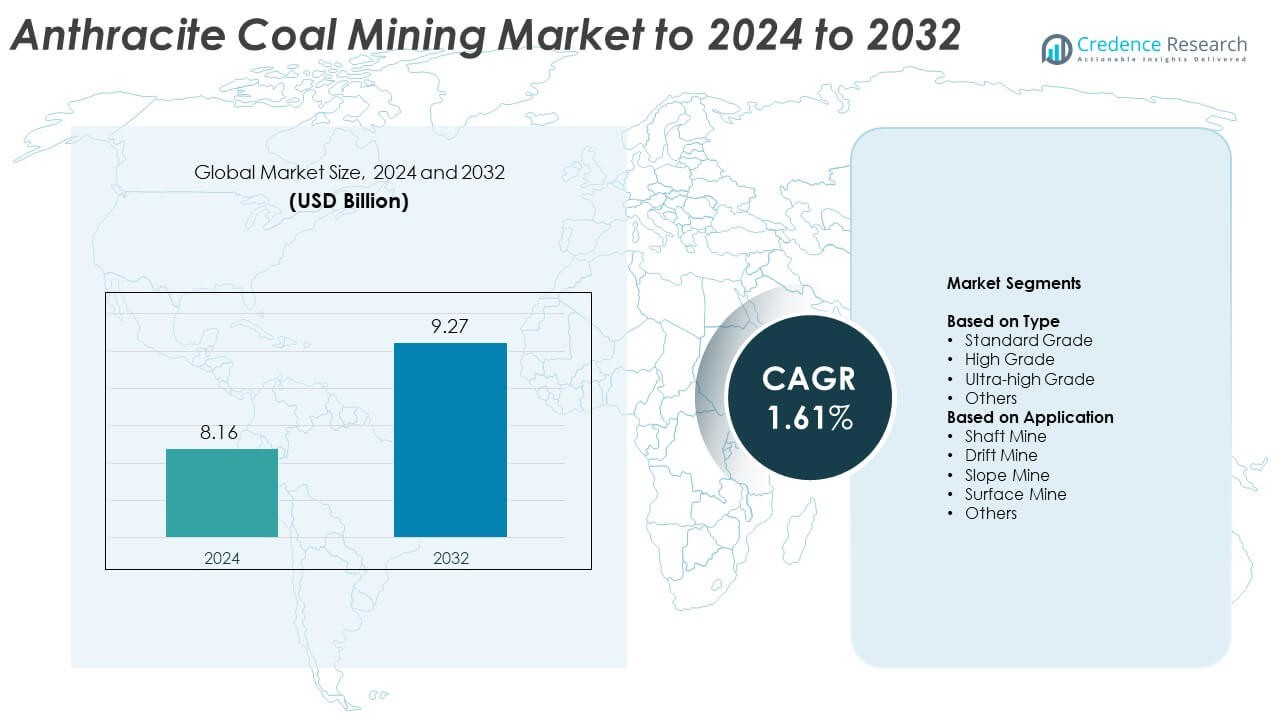

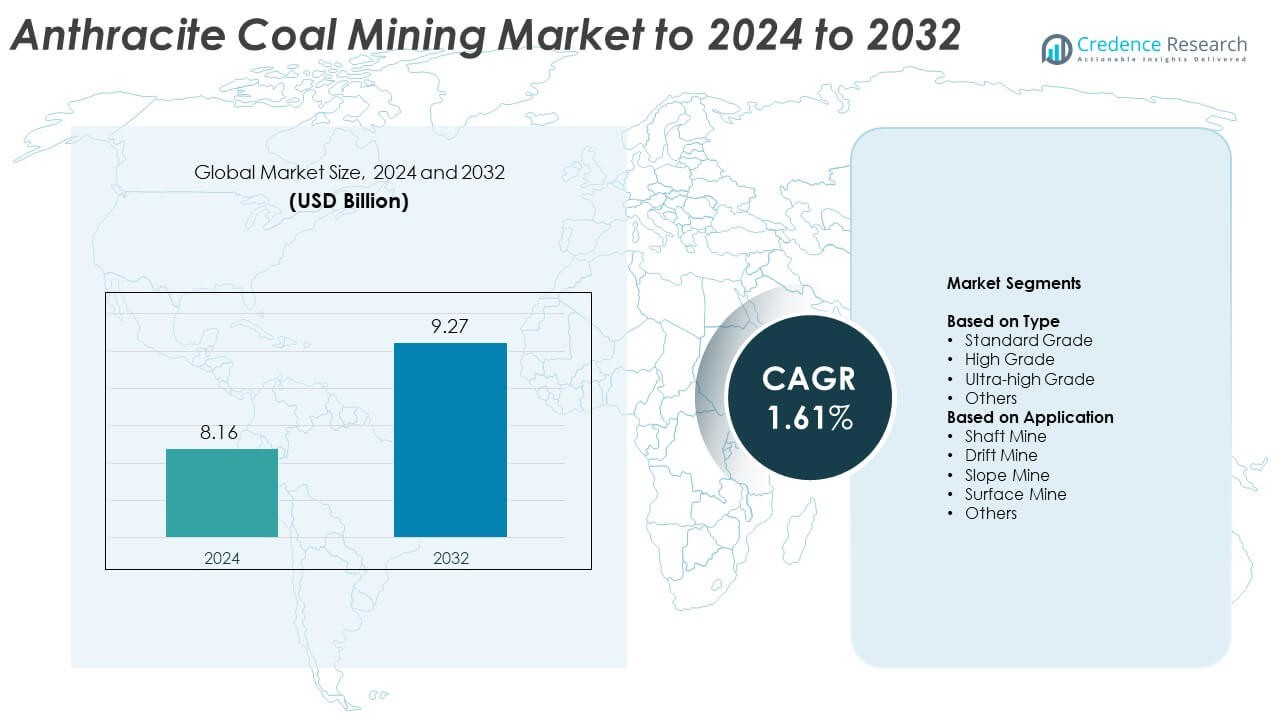

The Anthracite Coal Mining Market size was valued at USD 8.16 billion in 2024 and is anticipated to reach USD 9.27 billion by 2032, at a CAGR of 1.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anthracite Coal Mining Market Size 2024 |

USD 8.16 Billion |

| Anthracite Coal Mining Market, CAGR |

1.61% |

| Anthracite Coal Mining Market Size 2032 |

USD 9.27 Billion |

The Anthracite Coal Mining Market is shaped by key players such as Lehigh Anthracite, Arch Resources, Delta Dunia Group, Blaschak Coal Corp, Reading Anthracite Company, and Aspire Mining Limited. These companies focus on improving mining efficiency, expanding production capacities, and adopting sustainable extraction technologies. Strategic collaborations, modernization of equipment, and advancements in deep-seam mining are enhancing operational output. Asia-Pacific dominated the global market with a 42.1% share in 2024, supported by strong industrial demand in China, India, and Vietnam. North America followed, driven by consistent metallurgical and industrial applications in the United States and Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The anthracite coal mining market was valued at USD 8.16 billion in 2024 and is projected to reach USD 9.27 billion by 2032, growing at a CAGR of 1.61%.

- Rising demand from steel and metallurgical industries is driving market expansion, supported by increasing use of high-grade anthracite for energy-efficient production.

- Technological advancements in mining automation and cleaner extraction methods are improving productivity and environmental performance across key producing nations.

- The market remains moderately competitive, with global players focusing on capacity expansion, sustainability, and long-term supply contracts to strengthen their position.

- Asia-Pacific led the market with a 42.1% share in 2024, followed by North America at 26.4%; by type, the high-grade segment dominated with a 41.8% share due to its strong industrial demand.

Market Segmentation Analysis:

By Type

The high-grade segment dominated the anthracite coal mining market in 2024, accounting for a 41.8% share. Its dominance is driven by strong demand from steel production, power generation, and industrial heating sectors. High-grade anthracite offers superior carbon content, low volatility, and high calorific value, making it ideal for blast furnaces and metal refining. Industries prefer it for consistent combustion efficiency and reduced environmental impact. Increasing infrastructure and construction activities in Asia-Pacific further strengthen its demand, as steel manufacturers increasingly rely on high-grade coal for enhanced production quality and energy performance.

- For instance, ArcelorMittal shipped 54.3 million tonnes of steel and produced 57.9 million tonnes of crude steel in 2024. Higher steel output lifts demand for high-fixed-carbon anthracite.

By Application

The shaft mine segment held the largest share of 37.6% in 2024, owing to its ability to access deep-seated anthracite reserves with high purity levels. This method allows efficient extraction of premium coal grades with minimal surface disruption. Growing adoption of advanced ventilation systems and mechanized hoisting equipment has improved productivity and worker safety in shaft mining operations. Expanding industrial demand for high-quality metallurgical coal and strict environmental standards are driving companies to invest in modern underground mining technologies to ensure sustainable and high-yield extraction.

- For instance, According to a 2020 report by NS Energy, electrification sliced greenhouse gas emissions by 70% and cut ventilation costs in half.

Key Growth Drivers

Rising Demand from Steel and Metallurgical Industries

The expanding global steel industry is a major growth driver for the anthracite coal mining market. Anthracite’s high fixed carbon and low sulfur content make it ideal for metal smelting and sintering applications. Rapid industrialization in emerging economies and increased steel consumption in infrastructure, automotive, and construction sectors are boosting demand. Countries such as China and India continue to invest heavily in steel production, reinforcing the need for consistent, high-grade anthracite supplies to ensure energy efficiency and lower emissions in industrial operations.

- For instance, China Baowu, the world’s largest steelmaker, produced 130.77 million tonnes of crude steel in 2023.

Increasing Use in Power Generation

Anthracite coal’s high calorific value and clean-burning characteristics support its growing use in thermal power generation. Power plants prefer anthracite for its higher efficiency and reduced ash output compared to other coal types. The demand remains strong in regions where renewable energy infrastructure is still developing. Moreover, emerging economies rely on anthracite-based power generation to meet industrial and household energy needs, driving steady consumption levels and ensuring a stable supply-demand balance across global markets.

- For instance, in the first seven months of 2024, the Vietnam National Coal and Mineral Industries Group (Vinacomin) supplied 10.33 million tonnes of coal to thermal power plants operated by Vietnam Electricity (EVN) and its subsidiaries.

Technological Advancements in Mining Operations

Adoption of advanced mining technologies has improved operational efficiency and safety, contributing to market growth. Modern techniques such as automated drilling, real-time monitoring, and ventilation control have enhanced productivity while reducing labor dependency. Companies are focusing on low-emission and energy-efficient equipment to meet environmental standards. These innovations reduce operational costs and improve resource recovery, making anthracite extraction more sustainable. Continuous investments in mechanization and digitalization are expected to strengthen output capacity and enhance profitability for mining operators globally.

Key Trends & Opportunities

Shift Toward Clean and Efficient Energy Sources

The growing global emphasis on reducing carbon emissions is creating opportunities for anthracite coal due to its cleaner combustion profile. Governments are promoting high-grade coal as a transition fuel between conventional coal and renewable energy. This shift has increased demand for anthracite in industrial boilers and residential heating applications. Energy-efficient usage and low emission rates position anthracite as a preferred option for regions seeking stable yet environmentally compliant energy sources during the ongoing energy transition period.

- For instance, According to the U.S. Energy Information Administration (EIA), residential heating accounts for only a very small fraction of total U.S. coal consumption. In 2023, the total U.S. coal consumption was approximately 425.9 million short tons, with the vast majority (90.9%) used for electric power.

Expansion in Asia-Pacific Mining Investments

Asia-Pacific remains the leading region for anthracite production and consumption, with strong investment inflows. Countries such as China, Vietnam, and India are expanding underground and surface mining projects to secure energy independence. Growing infrastructure spending and rapid urbanization support regional demand. Increased public and private investments in mining technologies and resource exploration enhance production capabilities. These developments create significant opportunities for market expansion, ensuring steady growth and improved export potential for regional mining operators.

- For instance, ArcelorMittal Nippon Steel India secured land for a 7.3 MTPA plant. The JV is also expanding Hazira capacity from 9 to 15 MTPA. India targets 300 MTPA national crude steel capacity by 2030.

Key Challenges

Stringent Environmental Regulations

Strict global emission norms and environmental regulations pose major challenges to the anthracite coal mining market. Governments are enforcing tighter policies to curb carbon footprints, making compliance costly for producers. These restrictions lead to higher operating expenses and limit expansion opportunities in developed markets. The growing preference for renewable and low-carbon energy alternatives also threatens long-term demand. As a result, mining companies face pressure to invest in cleaner extraction methods and sustainable waste management practices to remain competitive.

Declining Availability of High-Grade Reserves

The depletion of easily accessible high-grade anthracite reserves presents a serious challenge for the industry. Deep-seated deposits require higher investments in exploration and extraction technologies, increasing operational costs. This scarcity also affects production volumes and market pricing. Companies must explore new mining regions and adopt enhanced geological mapping to maintain output stability. Without effective resource management and diversification, the industry risks facing supply shortages that could limit growth opportunities in the coming years.

Regional Analysis

North America

North America accounted for a 26.4% share of the anthracite coal mining market in 2024, driven by steady industrial consumption and robust steel production. The United States and Canada continue to utilize anthracite for metallurgical and heating applications. Advancements in underground mining and safety technologies have enhanced regional productivity. Demand remains strong in sectors requiring high-grade carbon inputs. Environmental regulations have encouraged producers to focus on cleaner extraction and energy-efficient combustion methods, ensuring sustainable operations while maintaining competitiveness against renewable energy sources and imported coal.

Europe

Europe held a 19.7% market share in 2024, supported by long-established mining operations in Ukraine, the United Kingdom, and Poland. The region’s demand is fueled by metallurgical, residential heating, and industrial applications. Energy transition policies encourage limited but efficient anthracite usage due to its lower emission profile compared to other coal types. Investments in automated mining and emission-reduction technologies are improving efficiency. Despite a gradual shift toward renewables, Europe continues to rely on anthracite for stable supply in energy-intensive sectors such as steel and cement manufacturing.

Asia-Pacific

Asia-Pacific dominated the anthracite coal mining market in 2024, commanding a 42.1% share. China, India, and Vietnam lead regional production and consumption due to strong industrial growth and rising steel demand. Expanding infrastructure projects and power generation needs further boost utilization. Governments are investing in mechanized extraction and deep-seam mining technologies to increase output and safety. Regional producers benefit from cost advantages and abundant reserves. Growing urbanization and manufacturing expansion are expected to sustain demand, positioning Asia-Pacific as the key growth hub for the global anthracite coal market.

Latin America

Latin America represented a 6.3% market share in 2024, with Brazil and Colombia as the primary contributors. The region’s growth is supported by increasing investments in steelmaking and industrial energy use. Anthracite demand is also expanding in local power generation and cement manufacturing. Efforts to modernize mining infrastructure and adopt cleaner extraction techniques are underway. Export opportunities are rising, particularly toward Asian markets. However, fluctuating commodity prices and limited technological capabilities challenge consistent output. Government-backed exploration programs aim to enhance production capacity and improve mining efficiency across the region.

Middle East & Africa

The Middle East and Africa accounted for a 5.5% share of the anthracite coal mining market in 2024. South Africa remains the key producer, serving both domestic industries and export markets. Demand stems from power generation, metallurgy, and industrial heating applications. Investments in resource exploration and modernized mining operations are improving regional output. African countries are enhancing export infrastructure to meet growing Asian demand. However, logistical constraints and environmental concerns pose operational challenges. Continued development of clean coal technologies and partnerships with global firms are expected to support market expansion.

Market Segmentations:

By Type

- Standard Grade

- High Grade

- Ultra-high Grade

- Others

By Application

- Shaft Mine

- Drift Mine

- Slope Mine

- Surface Mine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the anthracite coal mining market include Lehigh Anthracite, Jameson Resources, Delta Dunia Group, Jeddo Coal Company, Aberdeen International Inc., Arch Resources, Bathurst Resources, Reading Anthracite Company, Zinoju Coal, Atlantic Coal plc, Ministry of Coal (India), Aspire Mining Limited, Blaschak Coal Corp, Tigers Realm Coal Limited, Cokal Ltd, Attila Resources, and CONSOL. The market is characterized by a mix of established producers and emerging regional participants focusing on technological efficiency, safety, and sustainability. Companies are adopting advanced mining automation, real-time monitoring, and ventilation systems to improve productivity and environmental compliance. Strategic mergers, partnerships, and long-term supply contracts are strengthening global distribution networks. The shift toward high-grade anthracite production supports greater profitability and export potential. Industry participants continue to emphasize low-emission operations and cost optimization, aiming to balance resource utilization with rising global demand for cleaner, energy-efficient coal products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lehigh Anthracite

- Jameson Resources

- Delta Dunia Group

- Jeddo Coal Company

- Aberdeen International Inc.

- Arch Resources

- Bathurst Resources

- Reading Anthracite Company

- Zinoju Coal

- Atlantic Coal plc

- Ministry of Coal (India)

- Aspire Mining Limited

- Blaschak Coal Corp

- Tigers Realm Coal Limited

- Cokal Ltd

- Attila Resources

- CONSOL

Recent Developments

- In 2025, Arch Resources and Consol Energy completed a merger of equals to form a new North American coal mining company named Core Natural Resources, Inc. (NYSE: CNR)

- In 2024, Delta Dunia Group (BUMA) Completed the acquisition of Atlantic Carbon Group Inc. (ACG), a key ultra-high-grade anthracite producer based in the U.S.

- In 2024, the Ministry of Coal (India) launched the 11th round of commercial coal mine auctions in December, offering 27 coal blocks across several states.

- In 2023, CONSOL officially launched the Not So Fast public awareness campaign to advocate on behalf of the coal mining industry.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising steel production will continue to drive steady demand for high-grade anthracite coal.

- Asia-Pacific will remain the leading regional market, supported by rapid industrial growth.

- Technological upgrades in mining operations will improve productivity and worker safety.

- Growing investments in clean coal technologies will reduce environmental concerns.

- Increasing use in thermal power generation will sustain moderate market expansion.

- Companies will focus on resource efficiency and low-emission extraction processes.

- Supply diversification efforts will target new reserves across developing economies.

- Environmental regulations will encourage adoption of sustainable mining practices.

- Global trade flows will strengthen as export demand rises from industrial nations.

- Strategic mergers and automation investments will enhance competitiveness and cost efficiency.