Market Overview

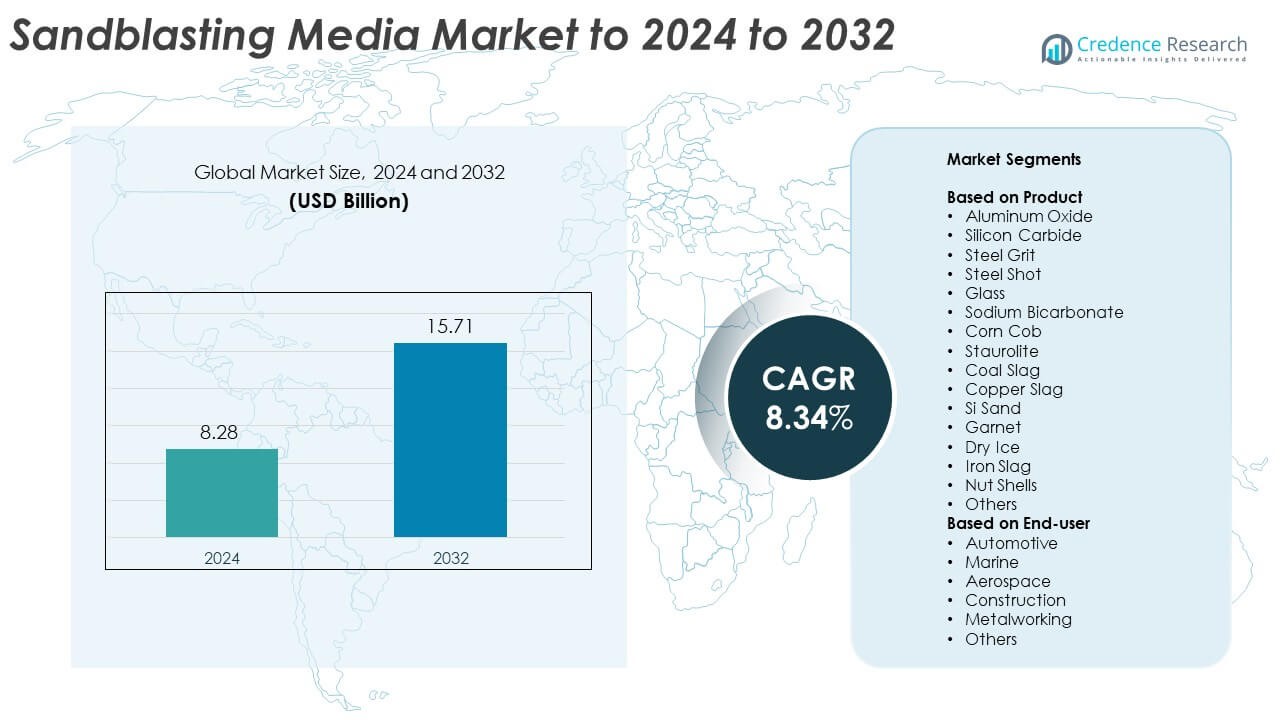

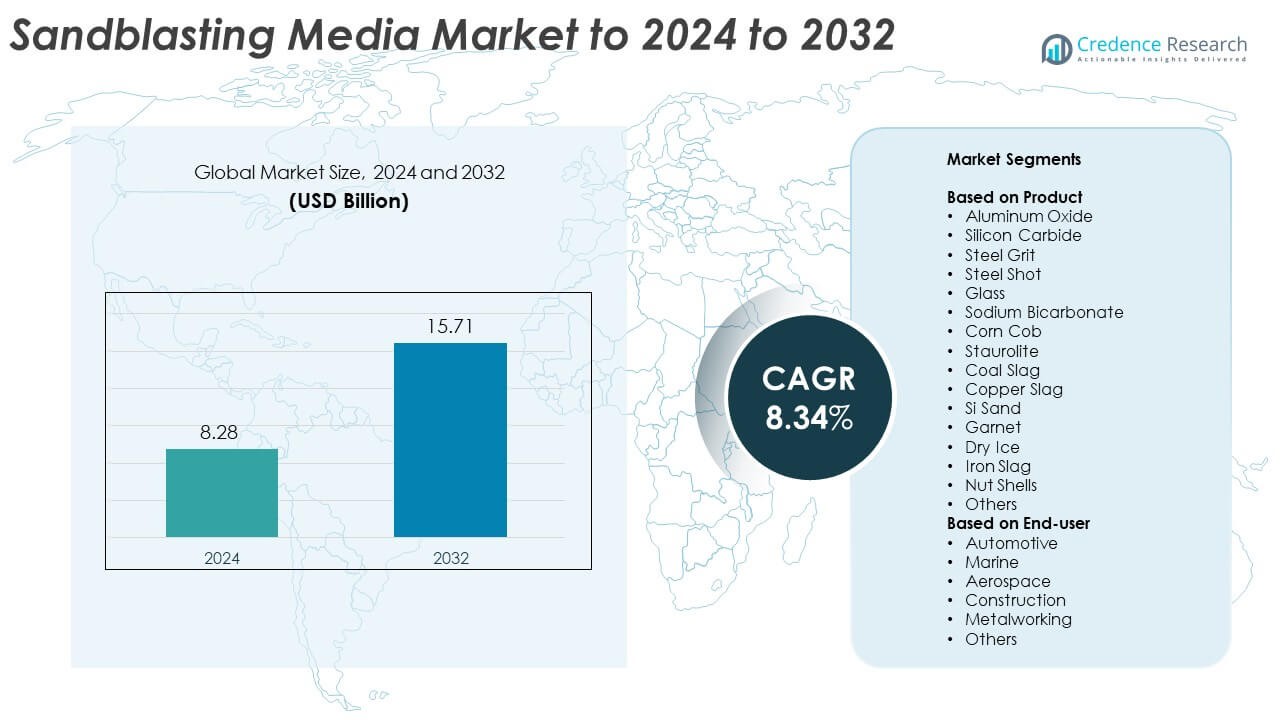

The sandblasting media market size was valued at USD 8.28 billion in 2024 and is anticipated to reach USD 15.71 billion by 2032, at a CAGR of 8.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sandblasting Media Market Size 2024 |

USD 8.28 Billion |

| Sandblasting Media Market, CAGR |

8.34% |

| Sandblasting Media Market Size 2032 |

USD 15.71 Billion |

The sandblasting media market is characterized by strong competition among global manufacturers such as Saint-Gobain, Harsco Metals & Minerals, GMA Garnet, The Chemours Company, and Prince Minerals LLC. These companies focus on product innovation, eco-friendly abrasive solutions, and expansion into emerging markets to strengthen their global presence. Advancements in high-performance, recyclable media and automated surface treatment technologies are driving competitive differentiation. Regionally, North America led the market in 2024 with a 33.4% share, supported by established automotive, aerospace, and metal fabrication industries. Asia-Pacific followed closely, driven by rapid industrialization and infrastructure development across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sandblasting media market was valued at USD 8.28 billion in 2024 and is projected to reach USD 15.71 billion by 2032, expanding at a CAGR of 8.34%.

- Growing demand from metal fabrication, automotive, and construction industries is driving market growth globally.

- Rising adoption of eco-friendly, recyclable, and dust-free abrasives reflects a strong sustainability trend across industrial applications.

- The market is moderately fragmented, with leading players investing in product innovation, capacity expansion, and advanced abrasive technologies to strengthen competitiveness.

- North America led the market with a 33.4% share in 2024, followed by Asia-Pacific with 29.5% and Europe with 27.1%, while aluminum oxide remained the dominant product segment with a 26.8% share.

Market Segmentation Analysis:

By Product

The aluminum oxide segment dominated the sandblasting media market in 2024, accounting for a 26.8% share. Its dominance is due to high hardness, long reuse life, and suitability for aggressive surface cleaning. Aluminum oxide is widely used in industrial and automotive applications where precision and surface finish are critical. Its growing use in deburring, etching, and rust removal across manufacturing sectors further supports its demand. Rising adoption of recyclable abrasives to reduce operational waste and comply with safety standards continues to drive aluminum oxide consumption globally.

- For instance, 3M’s Cubitron™ II abrasives, featuring proprietary Precision-Shaped Grain (PSG) technology, are engineered to outperform conventional ceramic abrasives. Specifically, these abrasives are designed to cut approximately 30% faster and last up to 2 times longer than conventional ceramic grain.

By End-user

The metalworking segment held the largest share of 34.2% in 2024, driven by strong demand for surface preparation, cleaning, and finishing in foundries and fabrication units. Sandblasting media enhances surface adhesion for coatings, welding, and painting, improving end-product durability. Expanding use in precision component manufacturing and tool maintenance reinforces its dominance in industrial operations. Increasing automation in metal finishing and the need for consistent surface quality across machinery parts continue to boost market growth in the metalworking segment worldwide.

- For instance, Winoa, which has been in business since 1961, is a global leader in steel abrasives. In 2022 alone, the company reported producing 300 kilotons of steel abrasives

Key Growth Drivers

Rising Demand from Metal Fabrication and Automotive Industries

Growing use of sandblasting media in automotive and metal fabrication is driving market expansion. It ensures effective rust removal, surface cleaning, and coating preparation for precision parts. Expanding automotive manufacturing and refurbishment activities, especially in Asia-Pacific, continue to increase abrasive consumption. The shift toward lightweight and high-performance materials further fuels demand for efficient surface treatment solutions.

- For instance, Clemco’s Model 2452 holds 6 cu ft (about 600 lb) and enables ~30 minutes of blasting at 100 psi with a No. 6 nozzle.

Technological Advancements in Abrasive Materials

Innovations in abrasive materials, such as eco-friendly and reusable media, are boosting adoption across industries. Manufacturers are developing high-durability abrasives like garnet and aluminum oxide to enhance performance and lower operational costs. The move toward advanced, recyclable abrasives aligns with global sustainability goals, reducing waste and environmental hazards.

- For instance, a February 2020 report from the United States International Trade Commission (USITC) referenced U.S. Geological Survey (USGS) estimates for 2018, noting U.S. production of crude fused aluminum oxide was 10,000 tonnes.

Expansion in Construction and Infrastructure Projects

Rising infrastructure spending and industrial construction are fueling the need for surface preparation applications. Sandblasting media plays a crucial role in cleaning steel structures, bridges, and pipelines before coating. Increasing government investments in urban development and industrial renovation projects strengthen market opportunities worldwide.

Key Trends & Opportunities

Adoption of Eco-Friendly and Non-Toxic Media

Environmental regulations and workplace safety standards are encouraging the use of biodegradable abrasives. Alternatives like crushed glass, dry ice, and organic media are gaining traction for dust-free and non-toxic operations. Growing emphasis on green manufacturing supports the shift from silica-based abrasives toward sustainable solutions.

- For instance, GMA says its garnet can be recycled up to 5 times, reducing waste generation.

Automation and Integration of Robotic Blasting Systems

The integration of automated blasting systems is enhancing precision, efficiency, and worker safety. Industries are adopting robotic solutions for uniform surface treatment in large-scale operations. This automation trend improves productivity while minimizing material waste and process downtime across manufacturing and marine applications.

- For instance, Cold Jet reports a global installed base of more than 25,000 dry-ice systems used for non-abrasive, residue-free surface preparation.

Key Challenges

High Equipment and Maintenance Costs

Initial setup and maintenance costs for sandblasting systems remain significant barriers to adoption. Small and mid-sized enterprises often face financial constraints in acquiring advanced abrasive blasting equipment. Continuous maintenance, dust control systems, and energy consumption further increase overall operating expenses.

Health and Environmental Concerns

Exposure to airborne silica dust and abrasive residues poses occupational health risks. Stringent environmental norms limit the use of hazardous materials such as silica sand and slag abrasives. Manufacturers must invest in safer media alternatives and dust extraction systems to ensure regulatory compliance and worker safety.

Regional Analysis

North America

North America dominated the sandblasting media market in 2024, accounting for a 33.4% share. The region’s strong presence of automotive, aerospace, and metal fabrication industries supports steady demand. The United States leads due to high adoption of advanced abrasive technologies and strict surface quality standards. Ongoing infrastructure modernization and refurbishment projects further contribute to regional growth. Rising investment in eco-friendly abrasive materials and automated blasting systems continues to enhance efficiency and safety across industrial applications, reinforcing North America’s position as a key market.

Europe

Europe held a 27.1% share of the global sandblasting media market in 2024, driven by robust demand across manufacturing and marine maintenance sectors. Countries such as Germany, Italy, and the United Kingdom lead due to well-established automotive and shipbuilding industries. Stringent environmental regulations in the European Union have accelerated the shift toward recyclable and low-dust abrasive media. Advancements in robotic blasting systems and surface treatment technologies further support regional adoption. Continuous focus on sustainability and precision engineering ensures consistent market growth across major European economies.

Asia-Pacific

Asia-Pacific accounted for a 29.5% share of the sandblasting media market in 2024, supported by rapid industrialization and infrastructure development. China, India, and Japan lead the market due to expanding automotive, construction, and metalworking sectors. The region benefits from low production costs, rising industrial output, and growing adoption of modern manufacturing technologies. Increasing government investments in transportation and urban infrastructure projects are driving large-scale demand for surface preparation applications. Strong growth in shipbuilding and energy industries continues to position Asia-Pacific as a rapidly expanding regional market.

Latin America

Latin America captured a 6.3% share of the sandblasting media market in 2024, primarily driven by the expansion of oil and gas, construction, and metal fabrication industries. Brazil and Mexico remain key contributors, supported by growing industrial refurbishment and offshore maintenance activities. The adoption of modern blasting technologies is gradually increasing, improving operational efficiency and safety. Despite economic fluctuations, rising infrastructure development and regional industrialization are creating steady demand for abrasive media. The ongoing transition toward eco-friendly abrasives is expected to further support long-term market growth.

Middle East & Africa

The Middle East & Africa region held a 3.7% share of the sandblasting media market in 2024, with growth driven by construction, energy, and marine applications. The Gulf countries lead demand due to large-scale industrial projects and oilfield maintenance activities. Rapid infrastructure development in Saudi Arabia and the UAE continues to boost abrasive consumption. In Africa, growing mining and transportation sectors are expanding surface treatment requirements. Increasing awareness of dust-free and sustainable blasting solutions is encouraging regional adoption of advanced, environment-compliant abrasive materials.

Market Segmentations:

By Product

- Aluminum Oxide

- Silicon Carbide

- Steel Grit

- Steel Shot

- Glass

- Sodium Bicarbonate

- Corn Cob

- Staurolite

- Coal Slag

- Copper Slag

- Si Sand

- Garnet

- Dry Ice

- Iron Slag

- Nut Shells

- Others

By End-user

- Automotive

- Marine

- Aerospace

- Construction

- Metalworking

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sandblasting media market features strong competition among key players such as Saint-Gobain, Harsco Metals & Minerals, GMA Garnet, The Chemours Company, Prince Minerals LLC, ATI Black Diamond Granules Inc., Husqvarna, Barton International, Opta Minerals Inc., Abrasives Inc., Eisenwerk Würth GmbH, Crystal Mark Inc., Cym Materiales S.A., MFT, Blastech, and U.S. Minerals Inc. Companies are focusing on product innovation, strategic collaborations, and capacity expansion to strengthen their market positions. Continuous investment in advanced abrasive materials and sustainable production technologies is reshaping competitive dynamics. Manufacturers emphasize dust-free, reusable, and eco-friendly media to comply with global safety and environmental standards. The shift toward automation and digitalized surface treatment solutions enhances operational efficiency and process precision. Increasing partnerships with construction, automotive, and aerospace industries help suppliers diversify applications and expand global reach. Overall, competition remains intense as companies pursue technological leadership and sustainable growth in surface preparation solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saint-Gobain

- Harsco Metals & Minerals

- GMA Garnet

- The Chemours Company

- Prince Minerals LLC

- ATI Black Diamond Granules Inc.

- Husqvarna

- Barton International

- Opta Minerals Inc.

- Abrasives Inc.

- Eisenwerk Würth GmbH

- Crystal Mark Inc.

- Cym Materiales S.A.

- MFT

- Blastech

- S. Minerals Inc.

Recent Developments

- In 2024, Saint-Gobain launched a new line of eco-friendly sandblasting media, aimed at reducing environmental impact while maintaining performance.

- In 2024, Husqvarna launched the Blastrac 2-48 DSP, a large-scale shot blaster designed specifically for steel blasting on large monopiles.

- In 2024, MFT acquired Aqua Blasting Corp. to expand and diversify its surface treatment offerings, particularly for the aerospace, defense, medical, and semiconductor markets.

Report Coverage

The research report offers an in-depth analysis based on Product, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recyclable and eco-friendly abrasives will continue to rise globally.

- Automation and robotic blasting systems will enhance surface finishing precision.

- Growth in automotive refurbishing and aerospace maintenance will boost abrasive use.

- Infrastructure and industrial expansion in Asia-Pacific will drive large-scale demand.

- Technological innovation will improve media durability and reduce operational waste.

- Stringent safety and environmental regulations will promote silica-free alternatives.

- Marine and oilfield maintenance activities will support steady abrasive consumption.

- Advancements in dust-free blasting technologies will improve worker safety standards.

- Increasing investment in smart manufacturing will expand surface preparation applications.

- Sustainable production practices and green certifications will shape competitive strategies.