Market Overview:

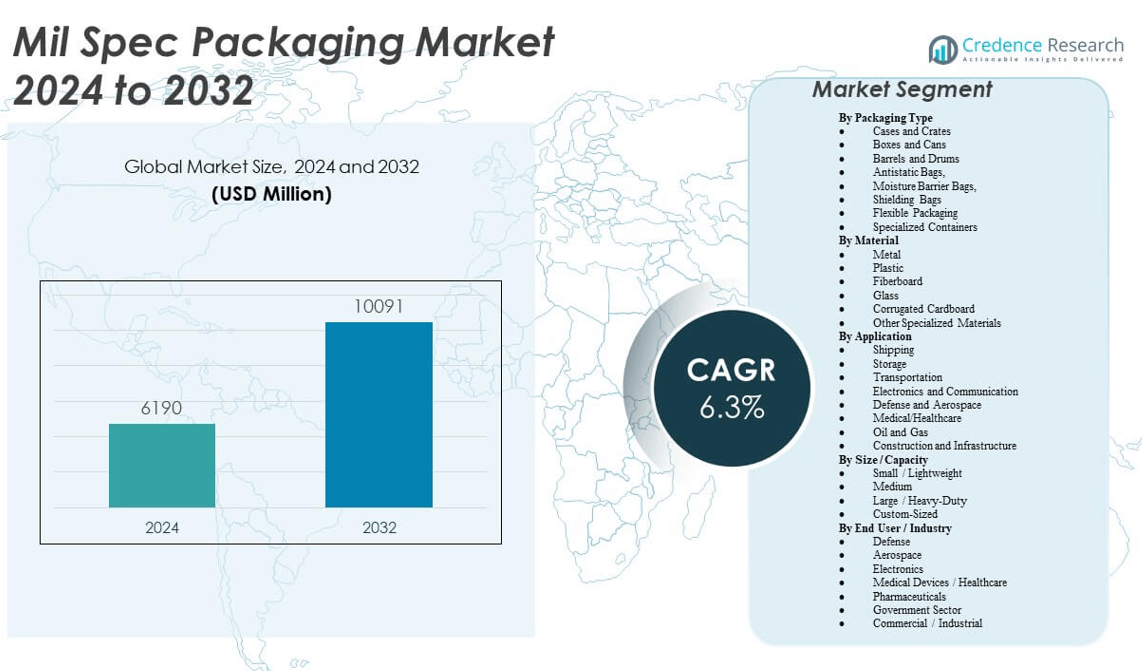

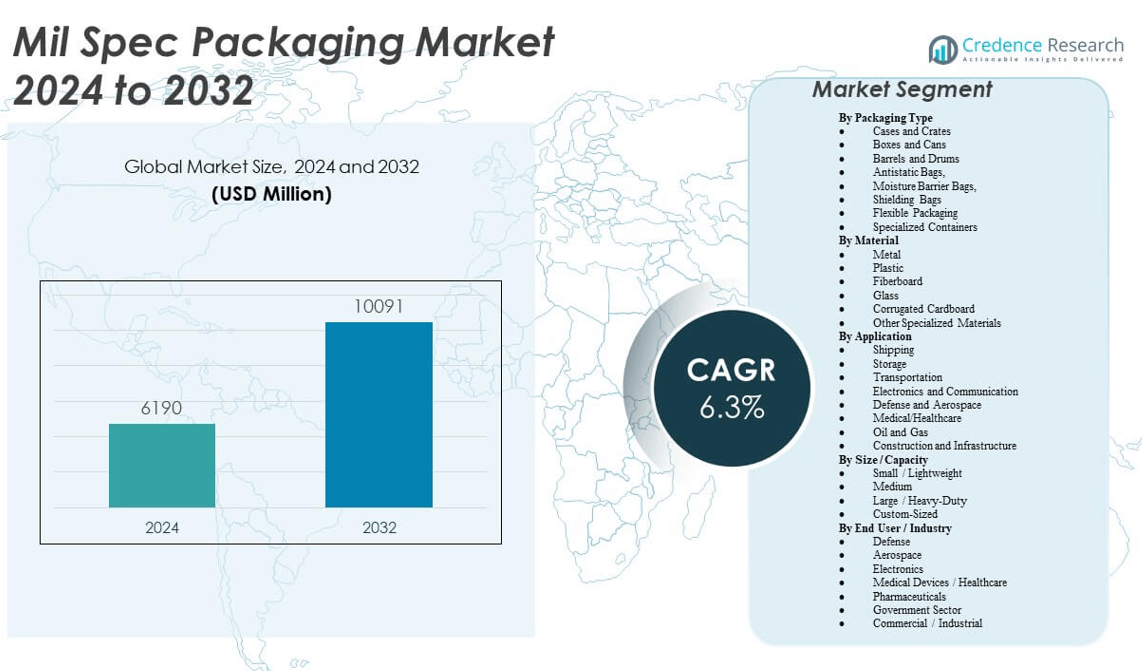

The Mil Spec Packaging Market is projected to grow from USD 6,190 million in 2024 to an estimated USD 10,091 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mil Spec Packaging Market Size 2024 |

USD 6,190 million |

| Mil Spec Packaging Market CAGR |

6.3% |

| Mil Spec Packaging Market Size 2032 |

USD 10,091 million |

This market is driven by increasing global defense spending, heightened focus on safeguarding sensitive military equipment, and stringent regulatory standards for packaging durability and compliance. Military forces worldwide demand robust, moisture-resistant, and anti-corrosive packaging materials to ensure the safe transport and storage of mission-critical assets. The rising need for long-term storage solutions and secure logistics for defense electronics, ammunition, and medical supplies continues to elevate the adoption of Mil Spec packaging across land, air, and naval operations.

North America leads the Mil Spec Packaging Market, supported by strong defense investments in the United States and the presence of established military packaging manufacturers. Europe follows, with countries like Germany and the UK modernizing their defense logistics infrastructure. Meanwhile, Asia-Pacific is emerging as a fast-growing region due to increased defense procurement in China, India, and South Korea, driven by geopolitical tensions and efforts to enhance military readiness. The Middle East also shows steady growth, fueled by rising defense budgets in countries like Saudi Arabia and the UAE.

Market Insights:

- The Mil Spec Packaging Market is projected to grow from USD 6,190 million in 2024 to USD 10,091 million by 2032, at a CAGR of 6.3% during the forecast period.

- Rising global defense spending and increasing demand for durable, compliant packaging solutions continue to drive market growth.

- Growing complexity in military electronics and communication systems fuels the need for advanced antistatic and shielding packaging.

- High cost of specialized materials and compliance with stringent military packaging standards restrain adoption, especially among smaller vendors.

- North America leads the market due to strong defense logistics infrastructure and consistent military procurement in the United States.

- Asia-Pacific is the fastest-growing region, driven by expanding defense capabilities in China, India, and South Korea.

- Increasing use of RFID-enabled smart packaging and modular, reusable formats highlights the market’s shift toward digitized, efficient logistics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Defense Expenditure Drives Demand for Military-Grade Packaging

Countries across the globe continue to increase defense budgets, prioritizing modernization and equipment readiness. This shift directly supports the growth of the Mil Spec Packaging Market, where durable packaging ensures safe handling of sensitive military assets. Governments are procuring advanced weapons, surveillance systems, and electronics that require compliant packaging for transport and storage. Military-grade packaging solutions must meet stringent specifications such as moisture resistance, pressure resistance, and thermal insulation. It enables extended shelf life of critical components even in harsh environments. The market benefits from high military logistics activity in the U.S., NATO, and Asia-Pacific defense corridors. Frequent deployment of troops and equipment accelerates packaging demand across sea, land, and air channels. It reflects the vital role of packaging in operational efficiency and asset preservation.

Increased Focus on Lifecycle Management of Military Assets

Military logistics now prioritize asset sustainability and service lifecycle management. The Mil Spec Packaging Market supports this strategy by providing packaging solutions that enable equipment reuse and prevent degradation. Forces worldwide are implementing systems for repair, return, and refurbish models where packaging must ensure damage-free transit. It allows storage of critical spare parts for extended periods without performance loss. This trend aligns with the shift toward resource efficiency and cost control in defense logistics. Packaging acts as a protective interface that shields high-value gear from humidity, corrosion, and UV exposure. Standardized containers and reusable packaging formats gain popularity for logistics optimization. It helps align packaging processes with modern defense supply chain automation.

- For instance, Nefab Group supplies reusable ExPak and ShockWatch packaging solutions to global defense manufacturers, including support for long-term storage of avionics and control systems. Their wood-free collapsible packaging formats integrate humidity and tilt indicators, enabling extended lifecycle tracking and damage prevention during returns, maintenance, and multi-year warehousing in accordance with NATO codification practices.

Growing Complexity in Military Equipment and Electronics

Modern military operations deploy advanced electronics, sensors, and communication systems, demanding specialized packaging. The Mil Spec Packaging Market addresses the need for static-safe, shock-absorbing, and temperature-controlled packaging formats. Sensitive instruments like satellite components, radars, and night vision devices require high-grade packaging to prevent malfunctions. It supports customized foam inserts, tamper-proof seals, and vacuum-sealed pouches that preserve product integrity. Defense organizations mandate detailed documentation, traceability, and labeling protocols for each packaged unit. Packaging suppliers must innovate to meet changing specifications for electronics protection. It fosters development of hybrid material solutions like polymer-metal blends. The growing need to shield systems from electromagnetic interference (EMI) reinforces market demand.

Rising Deployment in Unpredictable Environments

Military operations in extreme and unpredictable terrains continue to grow, from deserts to the Arctic. The Mil Spec Packaging Market supports such deployments by offering robust solutions resistant to environmental stress. It includes water-proof, pressure-proof, and sand-resistant packaging formats critical to preserving operational equipment. Defense teams require reliable packaging that performs without failure during long-haul airlifts or naval missions. It contributes to mission success by eliminating equipment damage risks during transit. Suppliers are aligning product innovations with battlefield deployment protocols. The push for lightweight yet durable materials is intensifying due to mobility concerns. This dynamic field environment drives packaging specifications for enhanced ruggedness and adaptability.

- For instance, Pelican‑Hardigg manufactures robust roto-molded cases used extensively by military and government clients. These cases are engineered to meet MIL‑STD‑810 (including G-level protocols)—covering environmental stress tests such as sand and dust, water immersion, altitude, and impact resistance. They are made from polyethylene resins and temperature-tested in Pelican’s chambers over ranges from at least –55 °C to +70 °C, as published in their certifications documentation, ensuring protective performance in extreme climates.

Market Trends

Shift Toward Sustainable and Reusable Military Packaging Solutions

Defense organizations are emphasizing sustainable packaging practices without compromising performance. The Mil Spec Packaging Market reflects this trend through increased demand for recyclable and reusable materials. Manufacturers are developing ruggedized containers that support multiple deployment cycles. It helps reduce procurement costs and environmental impact. Biodegradable materials and recyclable polymers are gaining traction in non-combat supply chains. Governments are incorporating sustainability KPIs into military procurement frameworks. Packaging vendors must align with these green mandates while meeting durability standards. It enhances the market’s alignment with broader ESG goals within the defense sector.

- For instance, TriEnda manufactures reusable pallets and bulk containers from thermoformed high-density polyethylene (HDPE), designed for long-term use in rugged supply chain environments. Their Tough Pallet series and BigPak® sleeve packs are engineered for durability and sustainability, offering collapsible designs that reduce return shipping volume and support circular logistics models across industrial and government sectors.

Integration of Smart Labels and RFID for Real-Time Asset Tracking

Digital transformation in defense logistics is boosting demand for smart packaging solutions. The Mil Spec Packaging Market is adopting technologies like RFID tagging, QR coding, and NFC sensors. It enables real-time tracking of high-value assets across global supply chains. Armed forces leverage these tools to monitor condition, tampering, and transit status of critical gear. Smart packaging enhances traceability, accountability, and operational coordination. Vendors are embedding data chips within containers to automate inventory updates. This integration supports mission-critical logistics and improves warehouse-to-battlefield transparency. The market benefits from government investment in smart supply chain technologies.

- For instance, Avery Dennison Smartrac’s UHF RFID inlays such as the AD‑232 series have been used extensively for item-level tracking in industries like retail, healthcare, and logistics. Their labels have demonstrated better than 99.5% read accuracy in high-volume distribution environments, such as warehouses handling mixed substrates including plastic and metal, enhancing traceability and inventory management.

Customization of Packaging for Mission-Specific Requirements

The need for tailored packaging solutions based on mission profiles is growing rapidly. The Mil Spec Packaging Market sees increased demand for modular designs that can adapt to specific cargo types. Packaging must meet payload size, deployment time, and handling protocol variations across missions. It supports custom foam inserts, variable wall thicknesses, and detachable compartments. Vendors are working closely with defense contractors to design packaging that integrates with larger logistics systems. This trend reduces packaging waste and enhances load optimization. The modular packaging approach aligns with rapid deployment logistics and evolving battlefield needs.

Adoption of Lightweight Composite Materials in Packaging Design

The push for operational agility is encouraging the use of lightweight packaging materials. The Mil Spec Packaging Market is shifting toward composites like carbon fiber blends, aluminum alloys, and advanced plastics. It helps reduce the overall logistical burden on transport fleets. Lightweight materials also contribute to fuel efficiency and improved soldier mobility during manual handling. Defense units prefer packaging that meets strength-to-weight benchmarks without sacrificing protection. This trend supports rapid air mobility operations where load weight is tightly regulated. The rise in drone-based supply delivery further accelerates the demand for ultra-light packaging formats.

Market Challenges Analysis

Compliance with Evolving Military Standards and Contract Protocols

The Mil Spec Packaging Market faces regulatory complexity due to varying standards across different defense organizations. Each country or agency mandates unique packaging formats, test procedures, and documentation norms. Vendors must align with MIL-STD protocols while adapting to NATO, DoD, and other regional military codes. It increases R&D and administrative overhead. Failing to meet audit-ready documentation or test certifications often disqualifies vendors from procurement programs. Rapidly evolving military technologies introduce new packaging compatibility challenges. It limits scalability and increases custom engineering costs. Smaller manufacturers struggle to meet evolving compliance requirements under tight defense timelines.

High Cost of Advanced Packaging Materials and Manufacturing Processes

Cost barriers continue to challenge the adoption of high-performance packaging materials. The Mil Spec Packaging Market requires corrosion-proof metals, anti-static polymers, and multi-layer insulation foils that raise unit costs. Complex fabrication processes such as thermoforming, injection molding, and vacuum sealing increase operational expenses. It limits cost-effectiveness for small-scale or short-term missions. Budget constraints in certain defense programs discourage adoption of premium packaging solutions. Achieving the balance between performance, durability, and affordability remains difficult. Vendors must navigate trade-offs between ruggedness and cost, particularly during competitive bidding for government tenders.

Market Opportunities

Rising Defense Modernization Programs in Emerging Economies

Emerging countries are expanding military infrastructure and procurement budgets. The Mil Spec Packaging Market is well-positioned to support this transition by offering compliant packaging for new defense assets. Countries like India, Brazil, and Indonesia are acquiring advanced surveillance systems, missile platforms, and protective gear. These products require specialized packaging for secure delivery and storage. Vendors can tap into partnerships with local defense OEMs and logistics firms. It offers opportunities for product localization and technology transfers. The growing geopolitical tensions and cross-border skirmishes in Asia-Pacific and Latin America further drive demand for mission-ready packaging formats.

Growth in Military Medical and Humanitarian Missions

Defense forces are increasingly involved in medical relief, disaster response, and peacekeeping missions. The Mil Spec Packaging Market can serve these operations by supplying sterile, temperature-controlled, and crush-resistant packaging. Medical devices, vaccines, and surgical kits require protection during airlifts or conflict-area deployment. The packaging must support sterile integrity and easy access in emergencies. It creates a demand for single-use, modular, and color-coded packaging systems. Humanitarian missions often involve multi-agency coordination, which increases the need for standardized and scalable packaging formats. Vendors that develop solutions for both combat and civil missions gain strategic growth potential.

Market Segmentation Analysis:

By Packaging Type

The Mil Spec Packaging Market features a diverse range of packaging types tailored to military and industrial requirements. Cases and crates dominate due to their high strength and ability to secure heavy or delicate equipment during transit. Boxes and cans are widely used for standard issue items and small components. Barrels and drums are preferred for bulk liquids and chemical storage. Flexible packaging, including pouches and liners, offers space efficiency and lightweight handling benefits. Specialized formats such as antistatic bags, moisture barrier bags, shielding bags, and custom containers serve critical roles in protecting sensitive electronics and mission-critical assets from environmental hazards.

By Material

Material selection in the Mil Spec Packaging Market plays a vital role in meeting performance and compliance standards. Metal and plastic packaging remain dominant for their ruggedness, impact resistance, and moisture control capabilities. Fiberboard and corrugated cardboard are commonly used in secondary and short-term applications. Glass is applied sparingly, primarily for secure chemical containment. Other specialized materials, including advanced barrier films and composite laminates, are gaining traction for their lightweight structure and enhanced protection against corrosion, static, and temperature fluctuations.

- For instance, several suppliers including MAC Packaging, Correct Products, and API Storage Bags manufacture heat-sealable MIL‑DTL‑117H Type I, Class E, Style I barrier bags, using MIL‑PRF‑131K multi‑layer laminates (film/foil/poly) that deliver moisture‑proof and grease‑proof protection. Some variants, like Class F Style I, are engineered with MIL‑PRF‑81705 Type I static/EMI shielding materials, providing both moisture vapor barrier and electrostatic shielding for storing electronics and precision devices in corrosive or humid conditions

By Application

Applications within the Mil Spec Packaging Market span several critical use cases, with defense and aerospace leading overall demand. Packaging designed for electronics and communication ensures protection from electromagnetic interference and mechanical shocks. Shipping, storage, and transportation remain essential applications, supporting operational readiness and efficient distribution. Medical and healthcare packaging ensures the sterility and integrity of sensitive supplies during field deployments. The market also supports oil and gas, construction, and infrastructure sectors, where rugged and certified packaging is required to meet harsh environmental conditions.

- For instance, ECS Composites provides Loadmaster® rackmount and transit cases used across military and aerospace sectors (including for communications infrastructure, servers, and tactical gear). Their products are constructed with composite materials and meet MIL‑STD‑810H environmental testing (covering shock, vibration, temperature extremes from –65 °F to +185 °F), and are designed to resist fuels, oils, and chemical decontamination offering rugged protection for critical electronics in deployment and storage environments.

By Size / Capacity

Packaging size and capacity segmentation is central to addressing a wide range of equipment dimensions and handling requirements. Small and lightweight packaging serves components and field kits where portability is essential. Medium-sized formats support modular systems and standard equipment. Large and heavy-duty packaging accommodates oversized machinery, weaponry, and sensitive electronics. Custom-sized packaging offers tailored solutions for irregular or uniquely dimensioned assets, supporting secure and compliant transportation under mission-specific conditions.

By End User / Industry

The defense sector is the largest end user of the Mil Spec Packaging Market, driven by global procurement, long-term storage needs, and active deployments. Aerospace follows closely, requiring high-precision packaging for avionics and mechanical systems. The electronics industry demands packaging that ensures safety against static and vibration. Medical devices and pharmaceuticals rely on sterile and protective packaging for field use. Government agencies and industrial sectors use military-grade packaging for infrastructure, public safety, and high-value asset management. It underlines the market’s role across both military and civilian operations.

Segmentation:

By Packaging Type

- Cases and Crates

- Boxes and Cans

- Barrels and Drums

- Antistatic Bags,

- Moisture Barrier Bags,

- Shielding Bags

- Flexible Packaging

- Specialized Containers

By Material

- Metal

- Plastic

- Fiberboard

- Glass

- Corrugated Cardboard

- Other Specialized Materials

By Application

- Shipping

- Storage

- Transportation

- Electronics and Communication

- Defense and Aerospace

- Medical/Healthcare

- Oil and Gas

- Construction and Infrastructure

By Size / Capacity

- Small / Lightweight

- Medium

- Large / Heavy-Duty

- Custom-Sized

By End User / Industry

- Defense

- Aerospace

- Electronics

- Medical Devices / Healthcare

- Pharmaceuticals

- Government Sector

- Commercial / Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America dominates the Mil Spec Packaging Market with a market share of 41%. The region benefits from extensive military spending, strong defense infrastructure, and a well-established network of packaging suppliers. The United States leads global defense procurement, which drives demand for advanced packaging solutions to support air, land, and naval operations. It consistently invests in modernizing logistics and maintaining long-term equipment readiness. Canada also contributes through defense support contracts and compliance with NATO packaging requirements. The presence of leading companies and high product standardization further strengthens regional leadership.

Europe holds the second-largest share in the Mil Spec Packaging Market, accounting for 28% of the global revenue. Countries such as Germany, the United Kingdom, and France are enhancing their defense logistics capabilities through increased procurement and modernization programs. It supports regional demand for compliant packaging to protect high-value systems such as drones, communication equipment, and ammunition. NATO’s standardization mandates and joint missions have increased packaging complexity, prompting suppliers to deliver solutions compatible across member states. The growth in Eastern Europe, particularly in Poland and the Baltics, is linked to heightened defense alertness and collaborative procurement.

The Asia-Pacific region captures 21% of the Mil Spec Packaging Market and is the fastest-growing segment. China, India, Japan, and South Korea are driving regional growth by expanding military operations and investing in modern equipment. It fuels demand for specialized packaging to support electronics, munitions, and sensitive instruments. Increased cross-border tensions and modernization of logistics in maritime and aerospace sectors push packaging innovations. Local manufacturers are aligning with global military standards to meet export requirements and defense procurement protocols. Southeast Asia is emerging as a new market due to rising defense partnerships and regional security strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Edco Supply Corporation

- Royco Packaging, Inc.

- Mil-Spec Packaging of Georgia

- Adsorbents & Desiccants Corporation of America

- Protective Packaging Corporation

- Accuspec Packaging Corporation

- Reid Packaging

- IMPAK Corporation

- MAC Packaging

- ProtoPak Engineering Corporation

Competitive Analysis:

The Mil Spec Packaging Market features a competitive landscape marked by specialized players focused on defense-grade packaging solutions. Key companies such as Edco Supply Corporation, Mil-Spec Packaging of Georgia, and Royco Packaging, Inc. hold significant positions due to their long-standing experience and adherence to military specifications. It is driven by innovation in moisture-barrier materials, corrosion protection, and smart tracking technologies. Companies compete by offering customized solutions aligned with MIL-STD protocols, rapid delivery schedules, and contract compliance. Strategic partnerships with defense agencies and OEMs help maintain competitive positioning. Smaller firms are entering the market by focusing on niche services like desiccant integration and RFID labeling. Continuous investment in manufacturing automation and compliance testing further intensifies competition across all tiers.

Market Concentration & Characteristics

The Mil Spec Packaging Market demonstrates moderate to high market concentration, with several established companies supplying to both domestic and international defense sectors. It is characterized by stringent regulatory compliance, long product validation cycles, and technical documentation requirements. Entry barriers remain high due to defense certification needs and contract-based procurement. The market favors suppliers with vertically integrated capabilities, in-house testing, and consistent quality assurance systems. Demand is primarily driven by long-term military contracts and government tenders. It supports innovation in packaging technologies tailored for shock resistance, moisture control, and EMI shielding. The market also exhibits a strong preference for suppliers offering rapid prototyping and mission-specific packaging formats.

Report Coverage:

The research report offers an in-depth analysis based on Packaging Type, Material, Application, Size, and End User Industry, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Defense modernization efforts will continue to drive demand for advanced and compliant military packaging solutions across global procurement programs.

- Lifecycle asset management strategies will boost the need for long-term storage and reusable packaging systems to reduce operational costs.

- Integration of RFID tags, NFC chips, and smart sensors will improve asset traceability and condition monitoring throughout defense logistics chains.

- Lightweight, durable composite materials will gain traction to support increased mobility in land, air, and maritime operations.

- Expanding defense budgets in Asia-Pacific and the Middle East will open new opportunities for both regional and international packaging suppliers.

- Automation and precision manufacturing will become central to meeting military compliance, documentation, and volume requirements.

- Customized packaging for specialized systems like UAVs, military electronics, and field medical supplies will see significant growth.

- Sustainability goals and regulatory pressures will lead to innovation in recyclable, reusable, and low-impact military packaging formats.

- Long-term supplier partnerships with defense contractors will become essential for securing repeat contracts and driving product development.

- Rising geopolitical tensions and rapid deployments will increase demand for tamper-evident, impact-resistant, and weather-proof packaging systems.