Market Overview

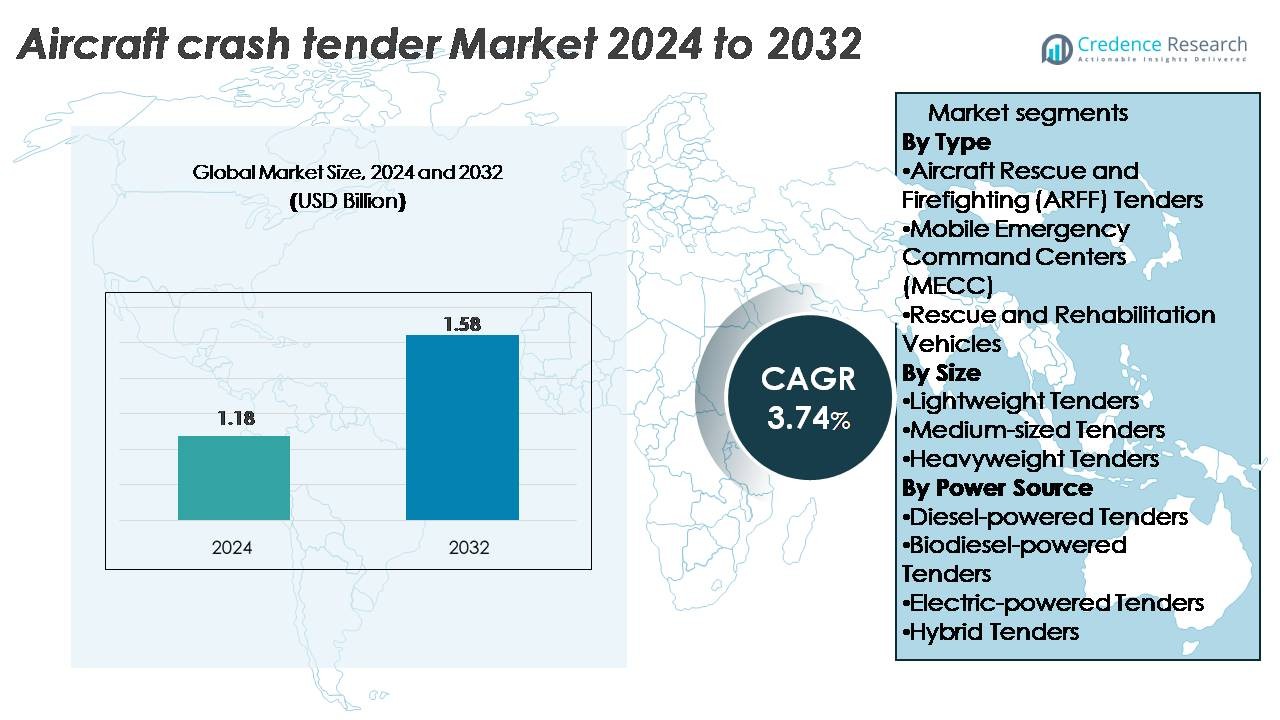

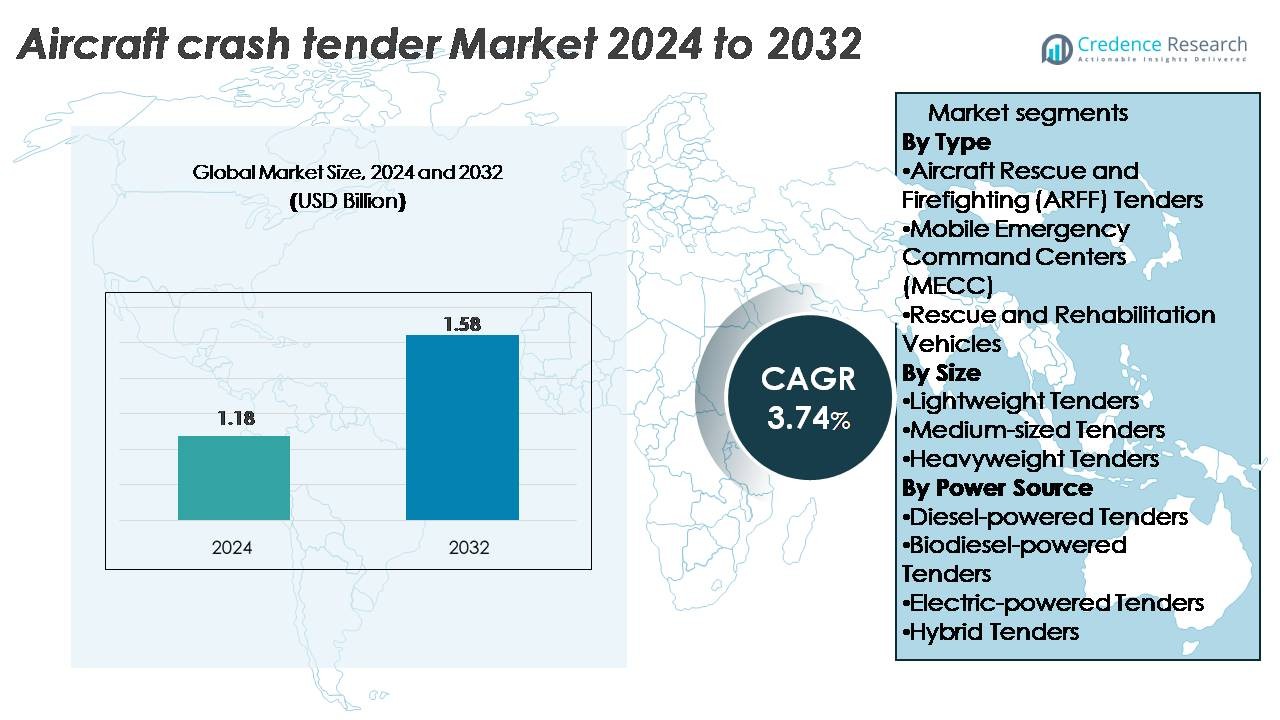

The Aircraft Crash Tender Market was valued at USD 1.18 billion in 2024 and is projected to reach USD 1.58 billion by 2032, growing at a CAGR of 3.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Crash Tender Market Size 2024 |

USD 1.18 Billion |

| Aircraft Crash Tender Market, CAGR |

3.74% |

| Aircraft Crash Tender Market Size 2032 |

USD 1.58 Billion |

The aircraft crash tender market is led by major players such as Rosenbauer International AG, Oshkosh Corporation, NAFFCO, MAGIRUS GmbH, and Morita Holdings Corporation, which collectively hold a strong global presence through advanced ARFF vehicle portfolios and continuous product innovation. These companies focus on rapid-response technologies, hybrid propulsion systems, and digital monitoring solutions to enhance operational efficiency and meet ICAO standards. North America remains the leading region, accounting for 36% of the global market share in 2024, supported by stringent FAA safety regulations and large-scale airport modernization projects, while Europe and Asia-Pacific follow with expanding adoption of sustainable and connected firefighting fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aircraft Crash Tender Market was valued at USD 1.18 billion in 2024 and is projected to reach USD 1.58 billion by 2032, growing at a CAGR of 3.74% during the forecast period.

- Market growth is driven by expanding global airport infrastructure, stricter aviation safety regulations, and rising demand for advanced ARFF tenders with high-performance firefighting systems.

- Key trends include increasing adoption of hybrid and electric-powered tenders, integration of IoT-based monitoring, and a strong shift toward sustainable, low-emission airport operations.

- The market is moderately consolidated, with Rosenbauer, Oshkosh, NAFFCO, MAGIRUS, and Morita Holdings leading through innovation, fleet modernization, and long-term service partnerships.

- North America leads with 36% market share, followed by Europe (28%) and Asia-Pacific (25%); by type, ARFF tenders hold 61% share, while diesel-powered tenders dominate the power source segment with 68% share, supported by robust infrastructure and regulatory compliance.

Market Segmentation Analysis:

By Type

The Aircraft Rescue and Firefighting (ARFF) tenders segment dominates the market with a 61% share in 2024. These vehicles are essential for immediate response during runway and in-flight emergencies, offering high-performance foam systems and rapid deployment capabilities. Growth in global air traffic and stricter aviation safety regulations drive adoption across both commercial and military airports. Mobile Emergency Command Centers (MECC) and Rescue and Rehabilitation Vehicles follow, gaining traction for their role in post-incident coordination and victim support, especially in large international airports with integrated emergency management systems.

- For instance, Oshkosh Corporation’s Striker® ARFF series delivers water and foam discharge rates of up to 8,000 liters per minute, equipped with a 17-meter Snozzle® high-reach extendable turret system for precision firefighting, while Rosenbauer’s Panther 6×6 model integrates a 700-horsepower engine and thermal imaging cameras to enhance visibility and safety during night operations.

By Size

Medium-sized tenders lead the segment with a 54% share in 2024, favored for their balance between capacity, maneuverability, and cost-efficiency. They are widely used in regional and municipal airports due to their operational flexibility in mixed terrain conditions. Lightweight tenders are expanding in smaller airfields and heliports for rapid deployment, while heavyweight tenders are preferred at major international airports for large-capacity firefighting and advanced suppression systems. Increased airport modernization projects and replacement of aging fleets continue to fuel demand for medium and heavyweight models.

- For instance, Magirus GmbH’s Super Dragon X8 offers a top speed of 135 km/h with a water capacity of 12,500 liters and a foam tank of 1,500 liters, enabling rapid response across large airfields.

By Power Source

Diesel-powered tenders dominate the market with a 68% share in 2024, supported by robust engine performance, reliability, and established fueling infrastructure. However, biodiesel and hybrid tenders are gaining momentum due to sustainability mandates and emission reduction goals across major aviation hubs. Electric-powered models, though emerging, are expected to see strong growth as battery efficiency and range improve. Manufacturers are investing in low-emission hybrid propulsion systems to comply with green airport initiatives and reduce operational costs, signaling a gradual transition toward cleaner power sources in the coming decade.

Key Growth Drivers

Expansion of Global Airport Infrastructure

The rapid expansion of airport infrastructure is a key driver in the aircraft crash tender market. Rising passenger traffic and increased cargo operations have prompted governments and private operators to invest in new airports and upgrade existing ones with advanced firefighting equipment. Emerging economies in Asia-Pacific and the Middle East are leading airport development projects, demanding modern tenders equipped with high-capacity water tanks, advanced foam systems, and thermal imaging technologies. The focus on meeting ICAO and NFPA safety standards further boosts procurement across international and regional airports. As airport networks expand globally, the demand for reliable, quick-response tenders continues to grow, strengthening the market outlook.

- For instance, Rosenbauer International AG supplied its Panther 8×8 models to Dubai International Airport, each equipped with a 14,000-liter water tank, 1,800-liter foam tank, and capable of discharging 9,000 liters per minute through twin roof monitors—meeting ICAO Category 10 requirements for large international airports.

Increasing Emphasis on Aviation Safety Regulations

Stringent safety and operational mandates by global aviation authorities significantly drive the adoption of modern aircraft crash tenders. Organizations such as ICAO, FAA, and EASA require airports to maintain minimum response times and equip facilities with high-performance ARFF vehicles. These regulations have compelled airport operators to replace outdated fleets with technologically advanced tenders featuring rapid acceleration, enhanced foam discharge rates, and superior off-road mobility. Regular safety audits and certification programs also influence airport procurement cycles. The growing number of commercial and military airbases complying with international fire safety codes further accelerates the integration of intelligent control systems, operator training modules, and predictive maintenance technologies in firefighting fleets.

- For instance, Oshkosh Corporation’s Striker® 8×8 meets FAA Index E standards with an acceleration rate from 0 to 80 km/h in under 25 seconds and a foam discharge capacity of 8,000 liters per minute, incorporating the TAK-4® independent suspension system to ensure stability and mobility across varied terrains during emergency response operations.

Advancements in Firefighting Technology

Technological innovation plays a vital role in enhancing the performance and efficiency of aircraft crash tenders. Modern tenders integrate real-time thermal imaging cameras, automatic foam proportioning systems, and remote-controlled turrets for greater precision in emergency response. Manufacturers are introducing digital monitoring systems for diagnostics and maintenance tracking, reducing operational downtime. Electric and hybrid powertrains are being developed to meet emission targets while maintaining performance standards. Furthermore, sensor-based systems and IoT-enabled connectivity are enabling predictive analytics for early fault detection. These innovations not only improve firefighting capabilities but also support sustainability and operational efficiency goals across airports worldwide.

Key Trends & Opportunities

Transition Toward Sustainable and Hybrid Powertrains

The aviation sector’s shift toward sustainability has opened significant opportunities for eco-friendly aircraft crash tenders. Manufacturers are increasingly focusing on hybrid and biodiesel-powered models to align with global emission reduction policies. Hybrid propulsion systems offer lower fuel consumption, reduced maintenance costs, and improved efficiency during idle or low-load operations. Several major airports have adopted sustainability targets that include the deployment of green rescue vehicles within airside operations. This transition supports both environmental compliance and brand reputation for airport authorities. As fuel technology advances, the long-term opportunity lies in developing fully electric firefighting fleets capable of matching the performance of traditional diesel-powered units.

- For instance, the vehicle is designed to feature dual electric motors delivering a system output of 720 kW, with a maximum “Boost Mode” output of up to 880 kW (approximately 1,180 hp), which is significantly higher than the figure mentioned in the original claim.

Integration of Smart Systems and IoT Connectivity

Digitalization is transforming the aircraft crash tender market through IoT connectivity and smart operational systems. Integrated telematics enable real-time data monitoring of vehicle health, fluid levels, and engine performance. AI-driven predictive maintenance reduces downtime and enhances equipment reliability during emergencies. The adoption of digital dashboards, GPS navigation, and autonomous control systems supports faster response times and precision in rescue operations. Additionally, cloud-based fleet management allows airport authorities to track multiple tenders simultaneously, improving coordination during large-scale incidents. The rising adoption of Industry 4.0 technologies provides long-term opportunities for intelligent, connected firefighting solutions in airport operations.

- For instance, E-ONE Inc. integrates its AXIS® Smart Truck Technology into its Titan ARFF and other vehicles, which uses CAN-bus data communication to connect to various onboard components.

Key Challenges

High Procurement and Maintenance Costs

The high cost of aircraft crash tenders poses a major challenge for market growth, especially in developing regions. Advanced ARFF vehicles equipped with cutting-edge systems such as remote turrets, multi-agent suppression, and high-capacity foam tanks demand significant investment. In addition to initial procurement, maintenance and training costs add further financial strain to airport authorities. Smaller regional airports often struggle to justify the expenditure required to meet international fire safety standards. Manufacturers face pressure to develop cost-effective models without compromising safety or compliance, balancing affordability and performance for a diverse customer base.

Limited Charging and Refueling Infrastructure for Next-Gen Models

The adoption of electric and hybrid crash tenders faces infrastructure-related challenges, particularly at airports with limited energy capacity. Establishing high-voltage charging systems and maintaining fuel compatibility for biodiesel-powered fleets require additional investment and planning. The downtime associated with recharging electric vehicles during emergencies can hinder operational readiness. Moreover, standardization issues across regions delay the implementation of uniform green vehicle technologies. Without coordinated government support and infrastructure upgrades, widespread deployment of next-generation tenders remains constrained, slowing the transition toward sustainable firefighting operations across the aviation industry.

Regional Analysis

North America

North America dominates the aircraft crash tender market with a 36% share in 2024, driven by stringent FAA safety regulations and continuous investments in airport modernization. The U.S. leads regional demand with extensive deployment of ARFF vehicles across major international and regional airports. Canada’s focus on upgrading mid-sized airports further supports market expansion. The presence of leading manufacturers, strong technological adoption, and robust maintenance infrastructure contribute to regional dominance. Ongoing fleet renewal programs and increased procurement of hybrid-powered tenders reflect the region’s commitment to sustainable aviation operations and advanced firefighting standards.

Europe

Europe accounts for a 28% market share in 2024, supported by strict EASA regulations and strong emphasis on green airport initiatives. Germany, France, and the UK lead adoption due to advanced airport networks and consistent safety compliance measures. The region is witnessing accelerated investment in hybrid and biodiesel-powered tenders as part of emission-reduction commitments. Manufacturers are focusing on lightweight and digitalized tenders to improve operational efficiency. Growing airport expansion projects in Eastern Europe, combined with rising aircraft traffic, continue to sustain market growth, reinforcing Europe’s position as a leader in sustainable aviation safety infrastructure.

Asia-Pacific

Asia-Pacific holds a 25% share of the global market in 2024, emerging as the fastest-growing region due to rapid airport construction and fleet modernization across China, India, and Southeast Asia. Increasing passenger volumes, government-backed aviation safety programs, and rising defense expenditure drive demand for ARFF tenders. Regional governments are investing heavily in airport infrastructure under long-term aviation growth strategies. Japan, South Korea, and Australia also contribute through advanced technological integration and safety compliance. Growing emphasis on electric and hybrid tenders supports the region’s transition toward sustainable airport operations, ensuring steady market expansion through 2032.

Middle East & Africa

The Middle East & Africa region captures an 8% market share in 2024, with steady growth fueled by large-scale airport development projects in the UAE, Saudi Arabia, and Qatar. These countries prioritize high-capacity tenders with advanced response technologies to meet ICAO safety requirements. Africa shows gradual adoption supported by international funding and public-private partnerships for airport safety enhancement. The growing establishment of new airports and national carrier expansions across Gulf nations continues to create consistent procurement opportunities for firefighting tenders, positioning the region as a developing hub for aviation safety infrastructure.

Latin America

Latin America accounts for a 6% share in 2024, driven by modernization initiatives across Brazil, Mexico, and Colombia. Expanding commercial aviation routes and increasing tourism are prompting governments to invest in advanced firefighting fleets. Airport authorities are upgrading ARFF units to comply with international safety norms and improve emergency response readiness. Regional growth is further supported by partnerships with global manufacturers and the introduction of cost-efficient tender models. Despite budget constraints, continued efforts toward improving airport infrastructure and operational safety standards sustain the market’s upward trajectory in Latin America.

Market Segmentations:

By Type

- Aircraft Rescue and Firefighting (ARFF) Tenders

- Mobile Emergency Command Centers (MECC)

- Rescue and Rehabilitation Vehicles

By Size

- Lightweight Tenders

- Medium-sized Tenders

- Heavyweight Tenders

By Power Source

- Diesel-powered Tenders

- Biodiesel-powered Tenders

- Electric-powered Tenders

- Hybrid Tenders

By Application

- Emergency Response Operations

- Training and Simulation

- Maintenance and Repair Services

- Public Safety Awareness Campaigns

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The aircraft crash tender market is moderately consolidated, with leading players focusing on innovation, fleet modernization, and sustainability. Prominent companies such as Rosenbauer International AG, Oshkosh Corporation, NAFFCO, MAGIRUS GmbH, and Morita Holdings Corporation dominate global sales through advanced ARFF vehicle portfolios. These manufacturers emphasize integrating smart technologies, including thermal imaging, remote-controlled turrets, and digital monitoring systems to enhance operational efficiency. Strategic partnerships with airport authorities and defense agencies support their long-term contracts and aftersales service networks. Emerging players from Asia-Pacific are also entering the market with cost-competitive and fuel-efficient models. Continuous R&D investments target hybrid propulsion, lightweight composite materials, and IoT-based diagnostics to align with evolving safety standards and environmental mandates. The competition remains focused on reliability, rapid response capabilities, and compliance with global aviation safety regulations, ensuring sustained technological progress across the aircraft crash tender industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rosenbauer International AG

- NAFFCO FZCO

- S. Darley & Co.

- Magirus GmbH

- KME Fire Apparatus

- Simon-Carmichael International Group

- E-ONE Inc.

- Ziegler Firefighting

- Oshkosh Corporation

- Morita Holdings Corporation

Recent Developments

- In October 2025, Airports Authority of India floated a public tender for insurance services related to newly procured NAFFCO Aircraft Crash Fire Tender Vehicles, with two new vehicles becoming operational in Jabalpur, Madhya Pradesh.

- In October 2025, Magirus signed an agreement to acquire Achleitner Fahrzeugbau GmbH, expanding its product range to include highly customized special-purpose firefighting vehicles, which may further enhance their aircraft crash tender offerings.

Report Coverage

The research report offers an in-depth analysis based on Type, Size, Power source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by expanding airport infrastructure worldwide.

- Adoption of hybrid and electric-powered crash tenders will accelerate with sustainability goals.

- Manufacturers will focus on developing lightweight, fuel-efficient, and digitally connected vehicles.

- Increasing air traffic and stricter ICAO safety standards will boost demand for ARFF tenders.

- Integration of IoT and AI technologies will enhance predictive maintenance and real-time response.

- North America will continue leading, while Asia-Pacific will emerge as the fastest-growing region.

- Collaboration between manufacturers and airport authorities will strengthen service and training networks.

- Defense and military airbases will increasingly adopt advanced rescue and firefighting vehicles.

- Investment in smart airport programs will drive procurement of automated response systems.

- The shift toward green aviation and emission control policies will redefine product innovation and design.