Market Overview

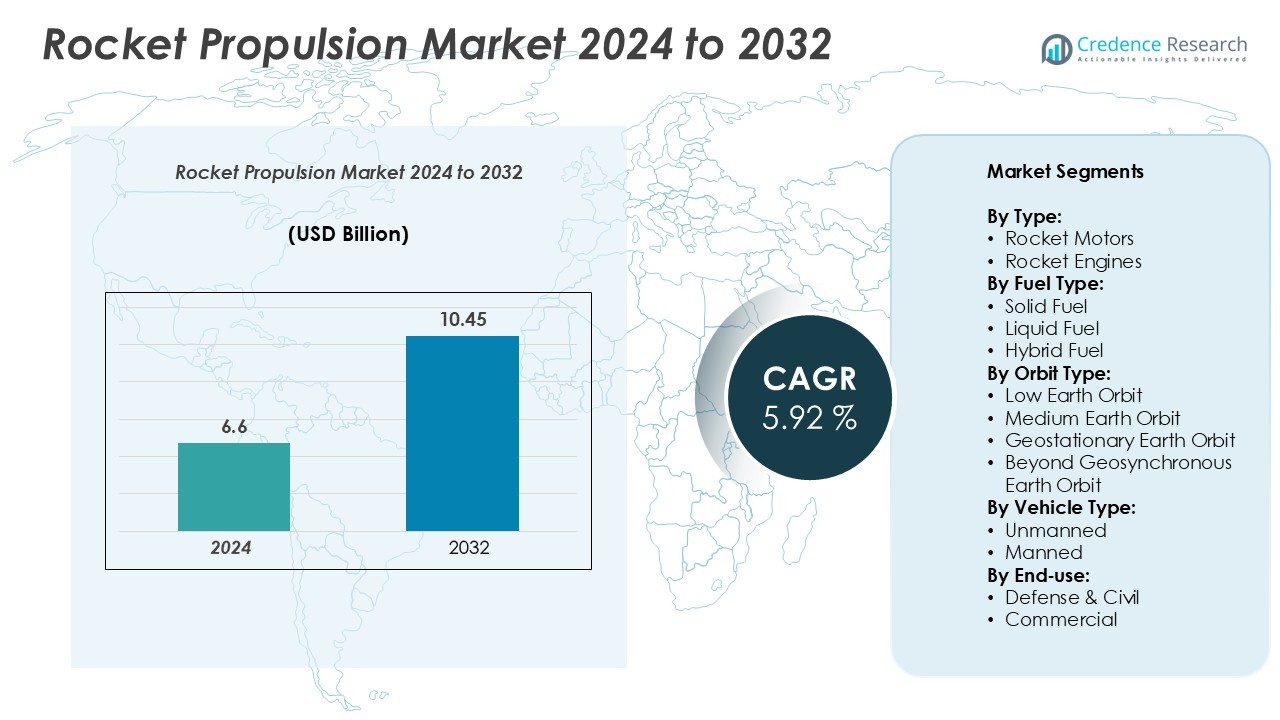

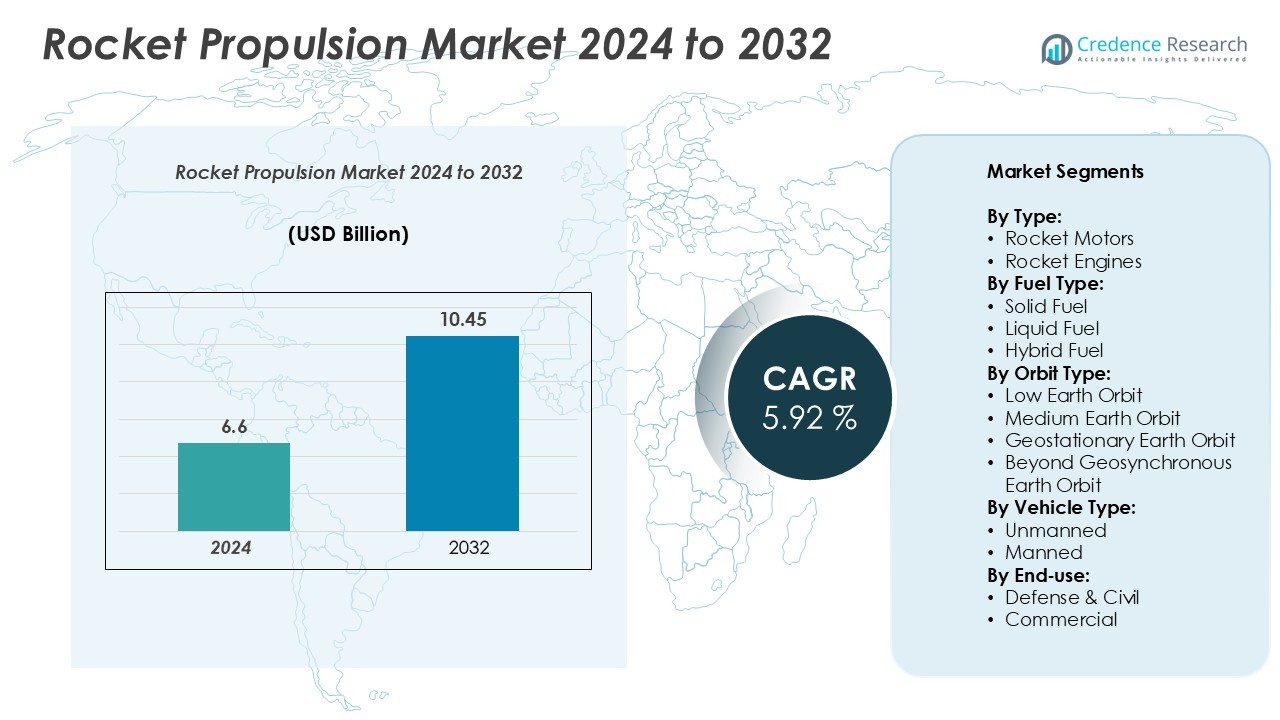

The Rocket Propulsion Market size was valued at USD 6.6 billion in 2024 and is anticipated to reach USD 10.45 billion by 2032, growing at a CAGR of 5.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rocket Propulsion Market Size 2024 |

USD 6.6 Billion |

| Rocket Propulsion Market, CAGR |

5.92% |

| Rocket Propulsion Market Size 2032 |

USD 10.45 Billion |

The rocket propulsion market is led by prominent companies such as SpaceX, Lockheed Martin, Blue Origin, The Boeing Company, Airbus Defence and Space, Hanwha Aerospace, and Korea Aerospace Industries. These firms drive innovation through reusable propulsion systems, hybrid fuel technologies, and advanced manufacturing methods. SpaceX leads with high-performance methane-based engines, while Lockheed Martin and Boeing emphasize precision and defense propulsion programs. North America remains the leading region with a 38% market share, supported by strong commercial and government investments in space exploration and reusable launch technologies, positioning it as the global hub for propulsion innovation and development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rocket propulsion market was valued at USD 6.6 billion in 2024 and is projected to reach USD 10.45 billion by 2032, expanding at a CAGR of 5.92%.

- Market growth is driven by the increasing number of satellites launches, deep-space missions, and defense modernization programs, which boost demand for advanced propulsion systems and reusable engines.

- Trends include rapid adoption of additive manufacturing, hybrid propulsion, and green propellants that enhance fuel efficiency and reduce environmental impact across commercial and government missions.

- Competition intensifies among leaders such as SpaceX, Lockheed Martin, Blue Origin, Boeing, Airbus Defence and Space, Hanwha Aerospace, and Korea Aerospace Industries, all focusing on reusable and high-thrust technologies.

- Regionally, North America holds 38%, followed by Europe at 25% and Asia-Pacific at 22%, with the rocket engines segment leading by type due to its superior efficiency and reusability.

Market Segmentation Analysis:

By Type

The rocket engines segment dominates the market with a significant share, driven by higher thrust efficiency and reusability. These engines power both orbital and deep-space missions, supporting commercial launches and government programs. Technological advancements in liquid and cryogenic propulsion systems enhance performance, reducing operational costs. For instance, SpaceX’s Raptor engine delivers a chamber pressure of 330 bar, improving fuel efficiency and reliability. Growing demand for reusable rockets and heavy-lift vehicles further strengthens the segment’s leadership, while solid rocket motors continue serving defense and short-range missions efficiently.

- For instance, SpaceX’s Raptor 3 engine delivers a chamber pressure exceeding 350 bar and achieves a sea-level thrust of 2,800 kN (280 metric tons-force), using liquid methane and liquid oxygen. The engine’s design, fueled by clean-burning “methalox,” is fundamental to SpaceX’s reusable Starship system and enables multiple flights without major refurbishment.

By Fuel Type

The liquid fuel segment holds the largest market share due to superior controllability and higher specific impulse. It supports reusable launch systems and precise orbital maneuvers in commercial and defense applications. For instance, Blue Origin’s BE-4 engine uses liquefied natural gas, achieving 2,400 kN thrust for next-generation heavy-lift rockets. The growing preference for cryogenic and semi-cryogenic fuels enhances mission flexibility and payload capacity. Hybrid fuels, offering a balance of safety and performance, are gaining traction in experimental and small-satellite launch vehicles, reflecting innovation in sustainable rocket propulsion technologies.

- For instance, Blue Origin’s BE-4 engine operates on liquefied natural gas (methane) and liquid oxygen, generates approximately 2,400 kN of thrust, and is used on both the Vulcan Centaur and New Glenn rockets. The use of these propellants is noted for enhancing reusability and performance efficiency compared to traditional kerosene-based engines.

By Orbit Type

Low Earth Orbit (LEO) dominates the market with the highest share, driven by rising satellite constellations and small satellite launches. This orbit supports communication, Earth observation, and defense applications requiring rapid data transmission. For instance, Rocket Lab’s Electron rocket targets payloads up to 300 kg for LEO missions, optimizing cost per launch. The demand for reusable launch systems and miniaturized satellites further fuels LEO growth. Meanwhile, Geostationary and Beyond Geosynchronous Earth Orbits remain vital for deep-space exploration and high-capacity communication satellites, expanding overall market opportunities.

Key Growth Drivers

Rising Demand for Satellite Launches and Space Exploration

The increasing demand for communication, navigation, and Earth observation satellites is a key growth driver for the rocket propulsion market. Governments and private firms are expanding launch capabilities to deploy large satellite constellations in Low Earth Orbit (LEO). For instance, SpaceX’s Starlink program targets over 12,000 satellites, accelerating launch frequency and propulsion system utilization. Additionally, agencies like NASA and ESA are advancing lunar and Mars missions, requiring high-performance propulsion technologies. Growing investments in reusable rockets and interplanetary exploration programs further propel market expansion, with significant focus on improving engine efficiency, payload capacity, and cost-effectiveness across global launch systems.

- For instance, SpaceX’s Starlink program targets deployment of 12,000 satellites using Falcon 9 and Falcon Heavy rockets, each powered by nine Merlin engines producing 845 kN of thrust per engine.

Increasing Investments in Reusable and Green Propulsion Technologies

Reusable propulsion systems are revolutionizing launch economics, offering lower costs and sustainable operations. Companies such as SpaceX, Rocket Lab, and Blue Origin are developing engines capable of multiple launches with minimal refurbishment. For instance, Rocket Lab’s Rutherford engine employs electric pump-fed propulsion, enabling enhanced reliability and cost savings. Simultaneously, green propellants like liquid methane and hydrogen peroxide are gaining traction due to reduced environmental impact and storage benefits. This shift aligns with international sustainability goals and supports commercial operators seeking eco-efficient alternatives. Government-funded research and private sector collaborations continue to accelerate innovation in clean, reusable, and high-thrust propulsion technologies, strengthening long-term market growth.

- For instance, Rocket Lab’s Rutherford engines use 3D-printed electric turbopumps. The vacuum-optimized version of the engine delivers 25.8 kN of thrust and has precise engine restart capability, which aids the Electron rocket’s first-stage recovery missions.

Expansion of Commercial Space Enterprises and Defense Programs

The rapid growth of private space companies and defense modernization initiatives drives propulsion system demand. Commercial enterprises are investing in cost-effective small satellite launchers and heavy-lift vehicles to support telecommunications and remote sensing. For instance, Relativity Space’s Terran R uses 3D-printed Aeon R engines to achieve high scalability and reduced production time. Defense agencies worldwide are enhancing missile and surveillance programs, creating steady demand for solid and hybrid propulsion technologies. Government contracts and public-private partnerships further boost technological progress and industrial capacity. This convergence of commercial innovation and defense investment significantly strengthens the global rocket propulsion ecosystem.

Key Trends & Opportunities

Integration of Additive Manufacturing and Advanced Materials

Additive manufacturing is transforming propulsion system design, enabling faster production, cost reduction, and improved performance. Companies use 3D printing to fabricate complex engine components with lightweight alloys and heat-resistant materials. For instance, Aerojet Rocketdyne applies 3D-printed copper alloys in its RL10C-X engine, enhancing thermal conductivity and reducing part count by 90%. Advanced composites and ceramics also improve combustion efficiency and durability under extreme temperatures. The trend supports rapid prototyping and customized designs for commercial and defense applications. As production scalability increases, additive manufacturing offers a major opportunity to optimize propulsion efficiency and reduce turnaround time.

- For instance, Aerojet Rocketdyne utilizes 3D-printed copper-alloy thrust chambers in its upgraded RL10 engine (the RL10E-1, formerly designated RL10C-X). This process allows the company to consolidate over 300 parts and brazed joints from the previous design into just a few 3D-printed components, which dramatically reduces manufacturing time and cost.

Growing Focus on Electric and Hybrid Propulsion Systems

Electric and hybrid propulsion technologies are emerging as key opportunities for next-generation space missions. These systems enable long-duration deep-space travel with reduced fuel mass and improved thrust control. For instance, NASA’s Solar Electric Propulsion (SEP) system delivers up to 13 kW of power for the upcoming Gateway lunar platform. Hybrid propulsion, combining solid and liquid propellants, offers improved safety and controllability for small launch vehicles. As agencies emphasize cost reduction and sustainability, electric and hybrid propulsion adoption is accelerating in scientific exploration, cargo transfer, and orbital maneuvering missions, creating lucrative avenues for innovation and commercialization.

- For instance, NASA’s Advanced Electric Propulsion System (AEPS) on the Gateway lunar platform utilizes Hall-effect thrusters to provide highly efficient propulsion. The system includes three AEPS thrusters, each capable of operating at up to 12.5 kilowatts (kW) of electrical power. At this power level, each thruster generates over 0.58 N of thrust, or 580 mN. The higher efficiency of this electric propulsion system is critical for maneuvering Gateway in lunar orbit and enabling missions for the Artemis program.

Key Challenges

High Development and Launch Costs

Developing rocket propulsion systems involves significant R&D investment, precision engineering, and rigorous testing, leading to high capital requirements. Each engine design must undergo multiple qualification stages, increasing costs and timelines. For instance, developing SpaceX’s Raptor engine reportedly exceeded USD 1 billion in cumulative investment due to complex cryogenic operations and material testing. Smaller companies face barriers to entry due to these financial constraints. Launch failures also pose economic risks and discourage new entrants. Managing costs while maintaining safety, performance, and reliability remains one of the most critical challenges limiting broader market accessibility.

Stringent Regulatory Framework and Environmental Concerns

Rocket propulsion activities face strict regulatory controls related to launch safety, emissions, and fuel handling. Environmental concerns over carbon emissions and chemical residues from solid propellants have prompted stricter global standards. For instance, international agencies like the FAA and ESA require extensive environmental assessments before launch approvals, delaying project timelines. Additionally, noise pollution and debris management further complicate operations. Transitioning to green propellants and adopting sustainable manufacturing practices involve high costs and technology shifts. Compliance with evolving safety norms and sustainability regulations continues to challenge both established and emerging propulsion system manufacturers.

Regional Analysis

North America

North America dominates the rocket propulsion market with a 38% share, driven by strong investments in space exploration and defense programs. The United States leads through agencies such as NASA and private firms including SpaceX and Blue Origin. Continuous R&D in reusable engines and high-thrust propulsion enhances launch efficiency. For instance, SpaceX’s Raptor engines demonstrate superior reusability and thrust-to-weight performance for interplanetary missions. The region benefits from robust government funding, commercial partnerships, and advanced testing facilities, positioning it as the global hub for innovation in orbital and suborbital propulsion technologies.

Europe

Europe holds a 25% market share, supported by growing collaboration among space agencies and private aerospace firms. The European Space Agency (ESA) and companies like ArianeGroup focus on next-generation cryogenic and hybrid propulsion systems. For instance, ArianeGroup’s Vinci engine provides restartable cryogenic propulsion, improving flexibility for orbital insertion missions. The region’s emphasis on sustainability and green fuel development aligns with climate goals. Expanding satellite communication programs and cross-border research initiatives continue to strengthen Europe’s position in advanced propulsion technologies and commercial launch capabilities.

Asia-Pacific

Asia-Pacific accounts for 22% of the rocket propulsion market, led by rapid expansion in national space programs across China, India, and Japan. The Indian Space Research Organisation (ISRO) and China’s CASC are investing heavily in reusable and hybrid propulsion systems. For instance, ISRO’s CE-20 cryogenic engine supports the GSLV Mk III with 200 kN thrust for heavy payloads. Growing satellite launch frequency, defense modernization, and commercial space startups contribute to regional growth. Government-backed initiatives and international collaborations are enhancing Asia-Pacific’s global competitiveness in launch vehicle development and propulsion innovation.

Latin America

Latin America captures an 8% share of the rocket propulsion market, driven by increasing investments in satellite and research missions. Brazil leads regional activities through the Alcântara Launch Center and partnerships with international aerospace firms. For instance, Brazil’s collaboration with the German Aerospace Center supports hybrid propulsion development for suborbital vehicles. Rising interest in space tourism and educational research further supports demand for small launch vehicles. Although infrastructure development is gradual, growing regional participation in global space alliances strengthens Latin America’s role in the global propulsion ecosystem.

Middle East & Africa

The Middle East & Africa region holds a 7% market share, supported by emerging government-led space programs and defense initiatives. The United Arab Emirates leads with its Mars Mission and satellite deployment projects, leveraging advanced propulsion systems. For instance, the UAE’s MBRSC is investing in hybrid engine research for sustainable space exploration. Increasing defense spending and regional collaboration with European and U.S. aerospace firms foster market growth. Continued focus on knowledge transfer, R&D investments, and commercial partnerships positions the region as an evolving contributor to global rocket propulsion advancements.

Market Segmentations:

By Type:

- Rocket Motors

- Rocket Engines

By Fuel Type:

- Solid Fuel

- Liquid Fuel

- Hybrid Fuel

By Orbit Type:

- Low Earth Orbit

- Medium Earth Orbit

- Geostationary Earth Orbit

- Beyond Geosynchronous Earth Orbit

By Vehicle Type:

By End-use:

- Defense & Civil

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rocket propulsion market is highly competitive, with major players focusing on technological innovation, cost efficiency, and strategic partnerships to expand their global footprint. Key companies such as Lockheed Martin, Blue Origin, Hanwha Aerospace, The Boeing Company, Korea Aerospace Industries, Airbus Defence and Space, and SpaceX lead the market through continuous R&D in reusable and high-thrust propulsion systems. For instance, SpaceX’s Raptor engine demonstrates advanced methane-based propulsion with high reusability and thrust efficiency, reshaping launch economics. Blue Origin’s BE-4 engine and Hanwha Aerospace’s solid propulsion technology further strengthen commercial and defense applications. Collaborative ventures with space agencies, investments in green propellants, and advancements in additive manufacturing are defining competitive differentiation. Companies also prioritize scalability, reliability, and modular designs to serve evolving satellite and exploration missions, ensuring sustained growth in both government and private launch programs worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Anduril opened a solid rocket motor plant in Mississippi, becoming the third major US supplier and expanding domestic capacity for defense programs.

- In April 2024, L3Harris unveiled the In-Space Engine family of 3D-printed bipropellant thrusters ranging from 5–900 lb thrust.

- In January 2024, RocketStar, Inc. secured USD 2 million seed investment for acquiring Miles Space, Inc., a space propulsion and spacecraft manufacturer. Miles Space has developed a revolutionary electric thruster and is working on a nuclear-fusion enhanced version. RocketStar aims to explore fusion propulsion and advanced aeronautics. Additionally, Miles Space brings distinctive digital signal processing software capabilities for deep space communications and passive radar.

Report Coverage

The research report offers an in-depth analysis based on Type, Fuel Type, Orbit Type, Vehicle Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Advancements in reusable propulsion systems will continue reducing launch costs and turnaround time.

- Growing satellite constellations will drive consistent demand for high-efficiency propulsion technologies.

- Electric and hybrid propulsion systems will gain wider adoption in long-duration missions.

- Development of green propellants will strengthen sustainability across commercial and defense applications.

- Increased collaboration between private firms and government agencies will accelerate innovation cycles.

- Additive manufacturing will enhance production efficiency and reduce engine development time.

- Emerging space programs in Asia-Pacific and the Middle East will boost global competition.

- Defense modernization initiatives will expand applications of solid and hybrid propulsion systems.

- Integration of AI and digital simulations will improve propulsion design and testing accuracy.

- Expansion of deep-space exploration missions will create long-term opportunities for advanced propulsion solutions.