Market Overview

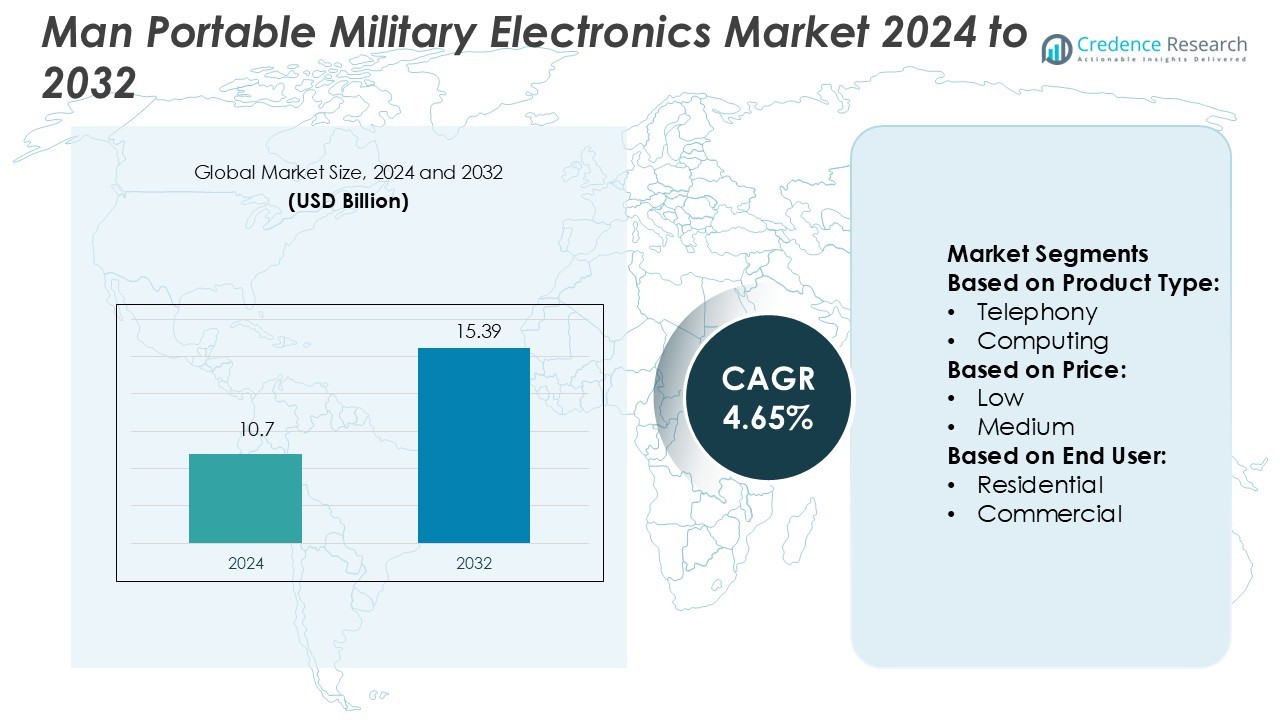

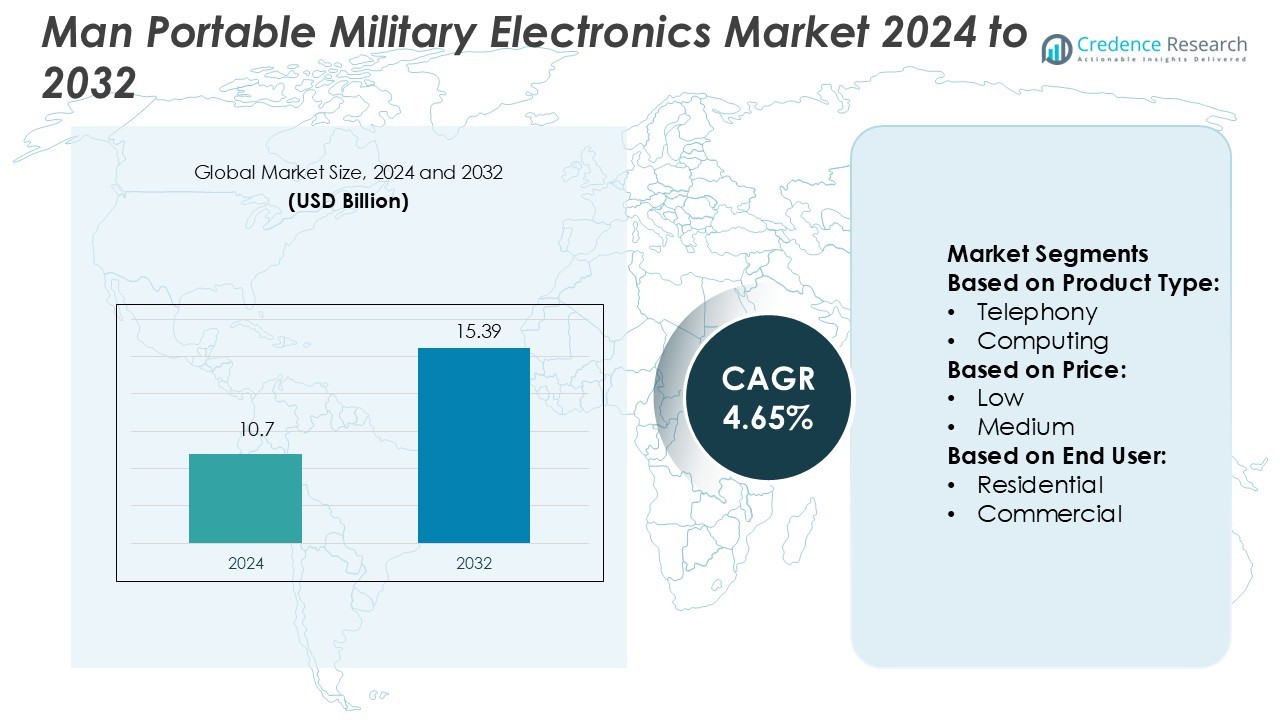

Man Portable Military Electronics Market size was valued USD 10.7 billion in 2024 and is anticipated to reach USD 15.39 billion by 2032, at a CAGR of 4.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Man Portable Military Electronics Market Size 2024 |

USD 10.7 Billion |

| Man Portable Military Electronics Market, CAGR |

4.65% |

| Man Portable Military Electronics Market Size 2032 |

USD 15.39 Billion |

The man-portable military electronics market is led by prominent players such as Indra Sistemas S.A., Honeywell International Inc., Bharat Electronics Limited, Hensoldt, Israel Aerospace Industries (IAI), Curtiss-Wright Corporation, Elbit Systems Ltd., Aselsan A.S., General Dynamics Corporation, and BAE Systems PLC. These companies dominate through continuous innovation in communication, surveillance, and navigation technologies tailored for modern warfare. Their focus on miniaturization, durability, and AI-driven systems strengthens their competitive positions globally. North America leads the market with a 38% share, driven by extensive defense spending, rapid adoption of advanced soldier systems, and ongoing modernization programs supporting battlefield connectivity and situational awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The man-portable military electronics market was valued at USD 10.7 billion in 2024 and is projected to reach USD 15.39 billion by 2032, growing at a CAGR of 4.65%.

- Rising demand for lightweight, portable communication and surveillance systems drives market expansion across defense sectors.

- Technological advancements such as AI integration, miniaturization, and real-time data connectivity are shaping market trends.

- The market faces restraints from high production costs, cybersecurity concerns, and complex maintenance requirements of advanced systems.

- North America dominates with a 38% share, while the telephony segment leads with 32%, supported by growing defense modernization programs and battlefield digitization initiatives.Top of Form

Market Segmentation Analysis:

By Product Type

The telephony segment dominates the man-portable military electronics market with a 32% share. This dominance stems from the growing demand for secure and real-time battlefield communication systems. Portable communication units, including encrypted radios and satellite phones, provide critical data sharing and coordination capabilities for ground troops. Advancements in lightweight and ruggedized telephony systems enhance operational mobility and reliability in combat zones. Increasing adoption of software-defined radios and network-centric communication further boosts segment growth.

- For instance, Indra Sistemas, S.A. signed an agreement with Bittium Corporation in July 2025 to cooperate in development of a tactical Software-Defined Radio (SDR) solution, leveraging 15 years of Indra’s SDR waveform expertise and 40 years of Bittium’s tactical radio technology.

By Price

The medium-priced segment holds the largest share of 46%, driven by balanced cost-effectiveness and performance. These products offer advanced communication, surveillance, and navigation capabilities without the high costs of premium systems. Defense agencies in emerging economies prefer medium-tier solutions to modernize infantry systems within limited budgets. Growing procurement of mid-range rugged laptops, portable sensors, and drones for tactical operations reinforces this dominance. The segment’s reliability and versatility make it suitable for both training and field deployment.

- For instance, Honeywell offers the TALIN Marine Inertial Navigation System (MINS) featuring ring-laser gyros and accelerometers. More than 15,000 units are deployed across land, air and sea applications.

By End User

The commercial segment leads the market with a 57% share, fueled by technological adaptation for defense contracts and private security operations. Commercial entities develop and supply advanced handheld systems, surveillance drones, and communication tools to military clients. Dual-use technologies, such as ruggedized tablets and autonomous drones, are increasingly integrated into defense applications. Collaboration between defense departments and private companies enhances innovation speed and operational efficiency. The growing use of commercial off-the-shelf (COTS) products further strengthens market expansion.

Key Growth Drivers

Rising Demand for Portable Communication Systems

The increasing need for real-time communication and situational awareness drives demand for portable communication devices. Advanced radios, satellite phones, and secure telephony systems enable seamless coordination among forces in remote or hostile terrains. Modern troops rely on lightweight and durable devices supporting high-speed data transfer and encrypted channels. Growing defense modernization programs and investments in battlefield digitization further strengthen this segment’s adoption, enhancing tactical responsiveness and mission success rates across defense forces globally.

- For instance, BEL has developed a high-frequency man-pack version of a Software Defined Radio (HF SDR) operating in the 1.5–30 MHz band, with maximum transmit power of 20 W.

Advancements in Miniaturization and Battery Technology

Technological progress in compact electronics and efficient power systems accelerates the growth of man-portable devices. Lightweight components with extended battery life improve soldier mobility and endurance during missions. Enhanced lithium-ion and solid-state battery solutions ensure longer operation times without frequent recharging. Continuous innovation in energy efficiency allows integration of computing, surveillance, and navigation tools into smaller form factors. These developments enable multi-functionality and portability, aligning with modern warfare requirements emphasizing agility and sustained field operations.

- For instance, HENSOLDT’s GMJ9500 man-portable RCIED jammer family offers full-spectrum jamming from 20 MHz to 6000 MHz. The system is described as “lightweight, modular and man-portable”, enabling infantry or EOD teams to deploy it in the field.

Government Investments and Modernization Programs

Increasing defense spending and government-backed modernization initiatives fuel market expansion. Military forces worldwide are upgrading outdated systems with network-enabled and interoperable man-portable electronics. Programs focusing on communication, intelligence, and surveillance modernization drive procurement of advanced tactical gear. Nations such as the U.S., China, and India are emphasizing soldier digitalization projects integrating real-time data and command systems. These efforts enhance battlefield efficiency and security, propelling steady demand for next-generation portable electronic solutions.

Key Trends & Opportunities

Integration of Artificial Intelligence and IoT

AI and IoT are transforming the capabilities of man-portable electronics by enabling predictive analytics and autonomous operations. Smart sensors and AI-driven decision systems enhance target identification, terrain mapping, and data interpretation. IoT connectivity allows seamless communication between devices, optimizing mission coordination and logistics. Defense agencies increasingly deploy intelligent drones and wearables to improve real-time monitoring and response. This trend opens opportunities for innovation in connected soldier ecosystems and AI-embedded tactical solutions.

- For instance, CW’s DuraCOR 312 ultra-small form factor mission computer features six Armv8 processor cores and a 256-core Pascal/CUDA GPU, delivering up to 1.5 TFLOPS (FP16) of performance.

Expansion of Commercial and Dual-Use Technologies

Commercial off-the-shelf (COTS) technology adoption is expanding, reducing costs and development timelines. Manufacturers integrate advanced commercial components into military systems to improve performance and scalability. Dual-use applications, including drones, computing tablets, and imaging devices, serve both defense and civilian markets. Collaboration between private firms and defense agencies promotes faster innovation and customization. This crossover encourages efficient supply chains and greater flexibility in field operations, driving market competitiveness and accessibility.

- For instance, ASELSAN’s “CATS – Common Aperture Targeting System” electro-optical product uses a 220 mm diameter aperture and supports HDTV resolution of 1920 × 1080 pixels, LL-NIR of 800 × 600, and an IR camera of 640 × 512, based on updated product specifications.

Key Challenges

High Procurement and Maintenance Costs

The cost of developing and maintaining advanced man-portable electronic systems remains a major barrier. Devices with integrated AI, encryption, and communication modules demand significant R&D investment. Budget constraints in developing nations restrict large-scale deployment. Additionally, repair and upgrade costs for field-deployed systems increase operational expenses. Balancing performance, durability, and affordability continues to challenge manufacturers and defense procurement agencies.

Cybersecurity and Data Vulnerability Risks

Growing connectivity across devices heightens risks of cyberattacks and data breaches. Unauthorized access to communication systems can compromise mission integrity and soldier safety. Portable systems must maintain strong encryption, authentication, and real-time threat detection capabilities. However, ensuring security in resource-limited, remote environments remains difficult. Continuous cybersecurity upgrades are essential but often strain defense budgets and complicate system interoperability across platforms.

Regional Analysis

North America

North America dominates the man-portable military electronics market with a 38% share. The region benefits from strong defense spending by the U.S. Department of Defense and Canada’s modernization initiatives. High investments in tactical communication, surveillance, and soldier systems drive growth. Advanced programs like the Integrated Visual Augmentation System (IVAS) by Microsoft and AI-based battlefield solutions enhance operational capabilities. Continuous R&D by key players such as L3Harris Technologies and Raytheon supports innovation in portable command and control devices, reinforcing North America’s leadership in military-grade communication and computing technologies.

Europe

Europe holds a 27% market share, driven by rising defense budgets and cross-border security collaborations. NATO initiatives and national modernization programs support demand for secure communication and battlefield monitoring systems. Countries such as Germany, the U.K., and France focus on equipping soldiers with advanced handheld electronics to strengthen interoperability in joint missions. The European Defense Fund’s investment in research enhances technology development across member states. Companies like Thales Group and BAE Systems lead innovation in ruggedized portable computing and intelligence systems for military operations across varied terrains.

Asia Pacific

Asia Pacific accounts for a 23% share, supported by rapid defense modernization and territorial security initiatives. Nations such as China, India, Japan, and South Korea are investing heavily in portable communication, computing, and drone systems to enhance border defense. Government programs like India’s “Make in India” encourage domestic production of military electronics, reducing reliance on imports. The adoption of AI and miniaturized systems is expanding across regional defense agencies. Collaboration between local manufacturers and global defense firms accelerates product development and deployment efficiency in the region.

Latin America

Latin America holds a 5% share, reflecting steady growth in defense modernization and homeland security programs. Nations such as Brazil, Mexico, and Colombia are investing in portable electronic systems to enhance border surveillance and tactical coordination. Limited budgets restrict large-scale deployments; however, partnerships with international defense suppliers are expanding access to advanced technologies. Growing use of drones and communication systems for counter-narcotics and peacekeeping missions supports market expansion. Regional emphasis on upgrading defense infrastructure and interoperability continues to create long-term opportunities for technology integration.

Middle East & Africa

The Middle East & Africa region captures a 7% market share, primarily driven by defense digitization efforts and counter-terrorism initiatives. Countries including Saudi Arabia, the UAE, and Israel invest in man-portable systems for intelligence, surveillance, and border security. Local manufacturing programs aim to develop indigenous capabilities while reducing foreign dependency. The rising focus on battlefield connectivity and situational awareness strengthens market adoption. Strategic defense collaborations with Western technology providers further accelerate technological upgrades and modernization of portable communication and computing devices.

Market Segmentations:

By Product Type:

By Price:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The man-portable military electronics market is highly competitive, with key players including Indra Sistemas S.A., Honeywell International Inc., Bharat Electronics Limited, Hensoldt, Israel Aerospace Industries (IAI), Curtiss-Wright Corporation, Elbit Systems Ltd., Aselsan A.S., General Dynamics Corporation, and BAE Systems PLC. The man-portable military electronics market is characterized by intense competition and rapid technological innovation. Manufacturers are focusing on developing lightweight, energy-efficient, and durable systems to enhance soldier mobility and mission effectiveness. Advancements in miniaturized sensors, secure communication modules, and AI-based situational awareness tools are transforming battlefield operations. Companies are increasingly investing in R&D to integrate IoT, real-time data analytics, and augmented reality into portable systems. Strategic collaborations with defense agencies and modernization programs across major economies further drive product development. The market’s competitive edge lies in continuous innovation, system interoperability, and meeting stringent defense performance standards.

Key Player Analysis

- Indra Sistemas, S.A.

- Honeywell International Inc.

- Bharat Electronics Limited

- Hensoldt

- Israel Aerospace Industries (IAI)

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- Aselsan A.S.

- General Dynamics Corporation

- BAE Systems PLC

Recent Developments

- In January 2025, Samsung Electronics America unveiled its latest innovation, Samsung Vision AI1, at the CES First Look 2025 event. This advanced AI technology showcases groundbreaking applications designed to deliver exceptional picture quality and serve as adaptive, intelligent companions that simplify and enhance daily life.

- In June 2024, Honeywell announced an agreement to acquire CAES Systems Holdings for in an all-cash deal. The acquisition was completed in September 2024 and expanded Honeywell’s portfolio to include work on the SPY-6 naval radar, drone, and counter-drone technologies.

- In May 2024, DARPA awarded BAE Systems’ FAST Labs a contract for the THREADS program to address thermal management challenges in defense electronics. The program aims to overcome temperature limitations in power-amplifying functions, specifically in monolithic microwave integrated circuits (MMICs) that use gallium nitride (GaN) devices.

- In April 2024, Raytheon, a business unit of RTX, received a contract to produce two missile variants: the SM-2 Block IIICU and SM-6 Block IU. The missiles will share common components, including the guidance section, target detection device, flight termination system, and electronics unit, allowing for unified production line manufacturing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Price, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for compact and multi-functional soldier systems.

- Integration of AI and IoT will enhance real-time battlefield data and decision-making.

- Growth in defense modernization programs will boost adoption of portable electronics.

- Development of lightweight, energy-efficient devices will improve soldier mobility and endurance.

- Increased investment in R&D will drive innovation in secure communication systems.

- Rising geopolitical tensions will accelerate procurement of advanced tactical equipment.

- Collaboration between defense agencies and private firms will strengthen product development.

- Miniaturization of sensors and processors will enhance operational efficiency and accuracy.

- Expansion of autonomous and unmanned systems will create new growth opportunities.

- Focus on cybersecurity and encrypted communication will remain a top industry priority.