CHAPTER NO. 1 : INTRODUCTION 27

1.1.1. Report Description 27

Purpose of the Report 27

USP & Key Offerings 27

1.1.2. Key Benefits for Stakeholders 27

1.1.3. Target Audience 28

1.1.4. Report Scope 28

1.1.5. Regional Scope 29

CHAPTER NO. 2 : EXECUTIVE SUMMARY 30

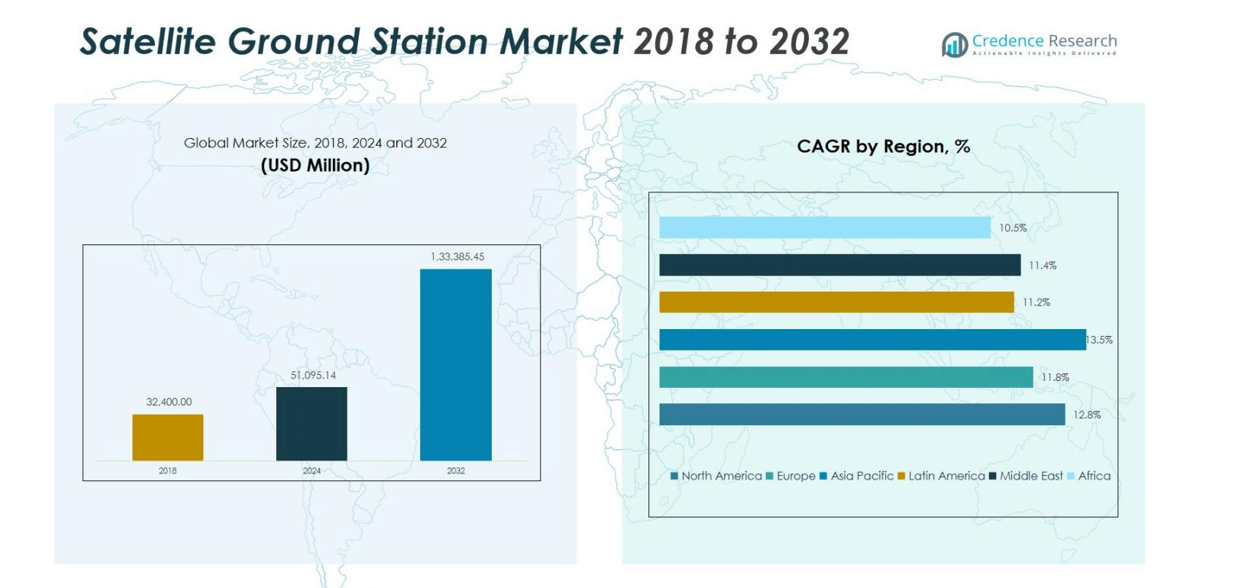

2.1. Satellite Ground Station Market Snapshot 30

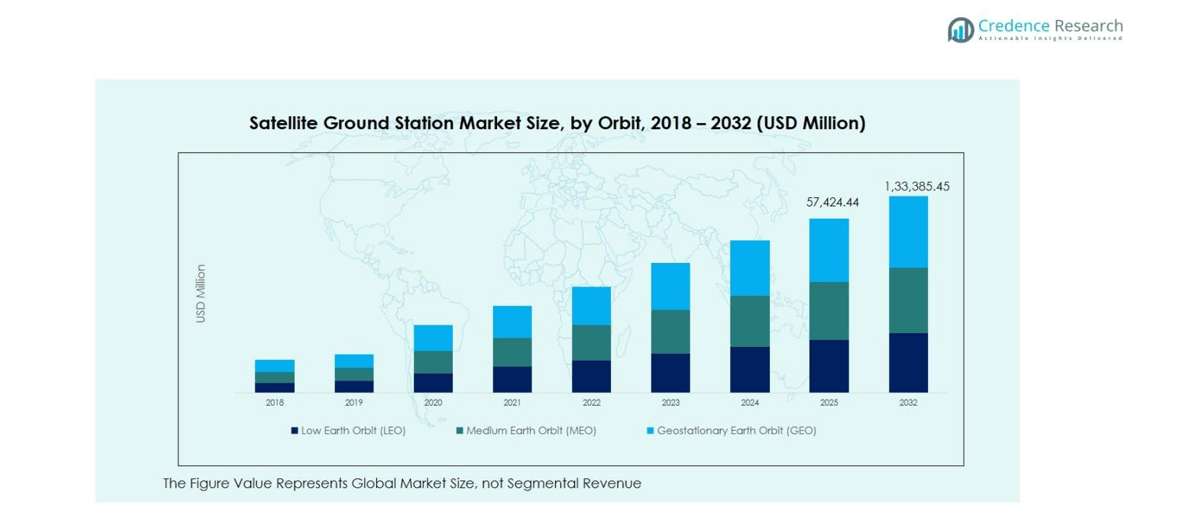

2.1.1. Global Satellite Ground Station Market, 2018 – 2032 (USD Million) 31

CHAPTER NO. 3 : GEOPOLITICAL CRISIS IMPACT ANALYSIS 32

3.1. Russia-Ukraine and Israel-Palestine War Impacts 32

CHAPTER NO. 4 : SATELLITE GROUND STATION MARKET – INDUSTRY ANALYSIS 33

4.1. Introduction 33

4.2. Market Drivers 34

4.2.1. Growing Demand for Satellite Services 34

4.2.2. Technological Advancements 35

4.3. Market Restraints 36

4.3.1. Cybersecurity threats 36

4.4. Market Opportunities 37

4.4.1. Market Opportunity Analysis 37

4.5. Porter’s Five Forces Analysis 38

CHAPTER NO. 5 : ANALYSIS COMPETITIVE LANDSCAPE 39

5.1. Company Market Share Analysis – 2024 39

5.1.1. Global Satellite Ground Station Market: Company Market Share, by Volume, 2024 39

5.1.2. Global Satellite Ground Station Market: Company Market Share, by Revenue, 2024 40

5.1.3. Global Satellite Ground Station Market: Top 6 Company Market Share, by Revenue, 2024 40

5.1.4. Global Satellite Ground Station Market: Top 3 Company Market Share, by Revenue, 2024 41

5.2. Global Satellite Ground Station Market Company Revenue Market Share, 2024 42

5.3. Company Assessment Metrics, 2023 43

5.3.1. Stars 43

5.3.2. Emerging Leaders 43

5.3.3. Pervasive Players 43

5.3.4. Participants 43

5.4. Start-ups /SMEs Assessment Metrics, 2023 43

5.4.1. Progressive Companies 43

5.4.2. Responsive Companies 43

5.4.3. Dynamic Companies 43

5.4.4. Starting Blocks 43

5.5. Strategic Developments 44

5.5.1. Acquisitions & Mergers 44

New Product Launch 44

Regional Expansion 44

5.6. Key Players Product Matrix 45

CHAPTER NO. 6 : PESTEL & ADJACENT MARKET ANALYSIS 46

6.1. PESTEL 46

6.1.1. Political Factors 46

6.1.2. Economic Factors 46

6.1.3. Social Factors 46

6.1.4. Technological Factors 46

6.1.5. Environmental Factors 46

6.1.6. Legal Factors 46

6.2. Adjacent Market Analysis 46

CHAPTER NO. 7 : SATELLITE GROUND STATION MARKET – BY PLATFORM SEGMENT ANALYSIS 47

7.1. Satellite Ground Station Market Overview, by Platform Segment 47

7.1.1. Satellite Ground Station Market Revenue Share, By Platform, 2023 & 2032 48

7.1.2. Satellite Ground Station Market Attractiveness Analysis, By Platform 49

7.1.3. Incremental Revenue Growth Opportunity, by Platform, 2024 – 2032 49

7.1.4. Satellite Ground Station Market Revenue, By Platform, 2018, 2023, 2027 & 2032 50

7.2. Fixed 51

7.2.1. Global Fixed Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 52

7.2.2. Global Fixed Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 52

7.3. Portable 53

7.3.1. Global Portable Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 54

7.3.2. Global Portable Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 54

7.4. Mobile 55

7.4.1. Global Mobile Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 56

7.4.2. Global Mobile Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 56

CHAPTER NO. 8 : SATELLITE GROUND STATION MARKET – BY FUNCTION SEGMENT ANALYSIS 57

8.1. Satellite Ground Station Market Overview, by Function Segment 57

8.1.1. Satellite Ground Station Market Revenue Share, By Function, 2023 & 2032 58

8.1.2. Satellite Ground Station Market Attractiveness Analysis, By Function 59

8.1.3. Incremental Revenue Growth Opportunity, by Function, 2024 – 2032 59

8.1.4. Satellite Ground Station Market Revenue, By Function, 2018, 2023, 2027 & 2032 60

8.2. Communication 61

8.2.1. Global Communication Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 62

8.2.2. Global Communication Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 62

8.3. Earth Observation 63

8.3.1. Global Earth Observation Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 64

8.3.2. Global Earth Observation Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 64

8.4. Space research 65

8.4.1. Global Space research Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 66

8.4.2. Global Space research Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 66

8.5. Navigation 67

8.5.1. Global Navigation Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 68

8.5.2. Global Navigation Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 68

8.6. Others 69

8.6.1. Global Others Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 70

8.6.2. Global Others Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 70

CHAPTER NO. 9 : SATELLITE GROUND STATION MARKET – BY END-USER SEGMENT ANALYSIS 71

9.1. Satellite Ground Station Market Overview, by End-user Segment 71

9.1.1. Satellite Ground Station Market Revenue Share, By End-user, 2023 & 2032 72

9.1.2. Satellite Ground Station Market Attractiveness Analysis, By End-user 73

9.1.3. Incremental Revenue Growth Opportunity, by End-user, 2024 – 2032 73

9.1.4. Satellite Ground Station Market Revenue, By End-user, 2018, 2023, 2027 & 2032 74

9.2. Commercial 75

9.2.1. Global Commercial Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 76

9.2.2. Global Commercial Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 76

9.3. Government 77

9.3.1. Global Government Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 78

9.3.2. Global Government Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 78

9.4. Defence 79

9.4.1. Global Defence Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 80

9.4.2. Global Defence Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 80

9.5. Others 81

9.5.1. Global Others Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 82

9.5.2. Global Others Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 82

CHAPTER NO. 10 : SATELLITE GROUND STATION MARKET – BY ORBIT SEGMENT ANALYSIS 83

10.1. Satellite Ground Station Market Overview, by Orbit Segment 83

10.1.1. Satellite Ground Station Market Revenue Share, By Orbit, 2023 & 2032 84

10.1.2. Satellite Ground Station Market Attractiveness Analysis, By Orbit 85

10.1.3. Incremental Revenue Growth Opportunity, by Orbit, 2024 – 2032 85

10.1.4. Satellite Ground Station Market Revenue, By Orbit, 2018, 2023, 2027 & 2032 86

10.2. Low Earth Orbit (LEO) 87

10.2.1. Global Low Earth Orbit (LEO) Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 88

10.2.2. Global Low Earth Orbit (LEO) Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 88

10.3. Medium Earth Orbit (MEO) 89

10.3.1. Global Medium Earth Orbit (MEO) Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 90

10.3.2. Global Medium Earth Orbit (MEO) Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 90

10.4. Geostationary Earth Orbit (GEO) 91

10.4.1. Global Geostationary Earth Orbit (GEO) Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 92

10.4.2. Global Geostationary Earth Orbit (GEO) Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 92

CHAPTER NO. 11 : SATELLITE GROUND STATION MARKET – REGIONAL ANALYSIS 93

11.1. Satellite Ground Station Market Overview, by Regional Segments 93

11.2. Region 94

11.2.1. Global Satellite Ground Station Market Revenue Share, By Region, 2023 & 2032 94

11.2.2. Satellite Ground Station Market Attractiveness Analysis, By Region 95

11.2.3. Incremental Revenue Growth Opportunity, by Region, 2024 – 2032 95

11.2.4. Satellite Ground Station Market Revenue, By Region, 2018, 2023, 2027 & 2032 96

11.2.5. Global Satellite Ground Station Market Revenue, By Region, 2018 – 2023 (USD Million) 97

11.2.6. Global Satellite Ground Station Market Revenue, By Region, 2024 – 2032 (USD Million) 97

11.3. Platform 98

11.3.1. Global Satellite Ground Station Market Revenue, By Platform, 2018 – 2023 (USD Million) 98

11.3.2. Global Satellite Ground Station Market Revenue, By Platform, 2024 – 2032 (USD Million) 98

11.4. Function 99

11.4.1. Global Satellite Ground Station Market Revenue, By Function, 2018 – 2023 (USD Million) 99

11.4.2. Global Satellite Ground Station Market Revenue, By Function, 2024 – 2032 (USD Million) 99

11.5. End-user 100

11.5.1. Global Satellite Ground Station Market Revenue, By End-user, 2018 – 2023 (USD Million) 100

11.5.2. Global Satellite Ground Station Market Revenue, By End-user, 2024 – 2032 (USD Million) 100

11.6. Orbit 101

11.6.1. Global Satellite Ground Station Market Revenue, By Orbit, 2018 – 2023 (USD Million) 101

11.6.2. Global Satellite Ground Station Market Revenue, By Orbit, 2024 – 2032 (USD Million) 101

CHAPTER NO. 12 : SATELLITE GROUND STATION MARKET – NORTH AMERICA 102

12.1. North America 102

12.1.1. Key Highlights 102

12.1.2. North America Satellite Ground Station Market Revenue, By Country, 2018 – 2023 (USD Million) 103

12.1.3. North America Satellite Ground Station Market Revenue, By Platform, 2018 – 2023 (USD Million) 104

12.1.4. North America Satellite Ground Station Market Revenue, By Function, 2018 – 2023 (USD Million) 105

12.1.5. North America Satellite Ground Station Market Revenue, By End-user, 2018 – 2023 (USD Million) 106

12.1.6. North America Satellite Ground Station Market Revenue, By Orbit, 2018 – 2023 (USD Million) 107

12.2. U.S. 108

12.3. Canada 108

12.4. Mexico 108

CHAPTER NO. 13 : SATELLITE GROUND STATION MARKET – EUROPE 109

13.1. Europe 109

13.1.1. Key Highlights 109

13.1.2. Europe Satellite Ground Station Market Revenue, By Country, 2018 – 2023 (USD Million) 110

13.1.3. Europe Satellite Ground Station Market Revenue, By Platform, 2018 – 2023 (USD Million) 111

13.1.4. Europe Satellite Ground Station Market Revenue, By Function, 2018 – 2023 (USD Million) 112

13.1.5. Europe Satellite Ground Station Market Revenue, By End-user, 2018 – 2023 (USD Million) 113

13.1.6. Europe Satellite Ground Station Market Revenue, By Orbit, 2018 – 2023 (USD Million) 114

13.2. UK 115

13.3. France 115

13.4. Germany 115

13.5. Italy 115

13.6. Spain 115

13.7. Russia 115

13.8. Belgium 115

13.9. Netherland 115

13.10. Austria 115

13.11. Sweden 115

13.12. Poland 115

13.13. Denmark 115

13.14. Switzerland 115

13.15. Rest of Europe 115

CHAPTER NO. 14 : SATELLITE GROUND STATION MARKET – ASIA PACIFIC 116

14.1. Asia Pacific 116

14.1.1. Key Highlights 116

14.1.2. Asia Pacific Satellite Ground Station Market Revenue, By Country, 2018 – 2023 (USD Million) 117

14.1.3. Asia Pacific Satellite Ground Station Market Revenue, By Platform, 2018 – 2023 (USD Million) 118

14.1.4. Asia Pacific Satellite Ground Station Market Revenue, By Function, 2018 – 2023 (USD Million) 119

14.1.5. Asia Pacific Satellite Ground Station Market Revenue, By End-user, 2018 – 2023 (USD Million) 120

14.1.6. Asia Pacific Satellite Ground Station Market Revenue, By Orbit, 2018 – 2023 (USD Million) 121

14.2. China 122

14.3. Japan 122

14.4. South Korea 122

14.5. India 122

14.6. Australia 122

14.7. Thailand 122

14.8. Indonesia 122

14.9. Vietnam 122

14.10. Malaysia 122

14.11. Philippines 122

14.12. Taiwan 122

14.13. Rest of Asia Pacific 122

CHAPTER NO. 15 : SATELLITE GROUND STATION MARKET – LATIN AMERICA 123

15.1. Latin America 123

15.1.1. Key Highlights 123

15.1.2. Latin America Satellite Ground Station Market Revenue, By Country, 2018 – 2023 (USD Million) 124

15.1.3. Latin America Satellite Ground Station Market Revenue, By Platform, 2018 – 2023 (USD Million) 125

15.1.4. Latin America Satellite Ground Station Market Revenue, By Function, 2018 – 2023 (USD Million) 126

15.1.5. Latin America Satellite Ground Station Market Revenue, By End-user, 2018 – 2023 (USD Million) 127

15.1.6. Latin America Satellite Ground Station Market Revenue, By Orbit, 2018 – 2023 (USD Million) 128

15.2. Brazil 129

15.3. Argentina 129

15.4. Peru 129

15.5. Chile 129

15.6. Colombia 129

15.7. Rest of Latin America 129

CHAPTER NO. 16 : SATELLITE GROUND STATION MARKET – MIDDLE EAST 130

16.1. Middle East 130

16.1.1. Key Highlights 130

16.1.2. Middle East Satellite Ground Station Market Revenue, By Country, 2018 – 2023 (USD Million) 131

16.1.3. Middle East Satellite Ground Station Market Revenue, By Platform, 2018 – 2023 (USD Million) 132

16.1.4. Middle East Satellite Ground Station Market Revenue, By Function, 2018 – 2023 (USD Million) 133

16.1.5. Middle East Satellite Ground Station Market Revenue, By End-user, 2018 – 2023 (USD Million) 134

16.1.6. Middle East Satellite Ground Station Market Revenue, By Orbit, 2018 – 2023 (USD Million) 135

16.2. UAE 136

16.3. KSA 136

16.4. Israel 136

16.5. Turkey 136

16.6. Iran 136

16.7. Rest of Middle East 136

CHAPTER NO. 17 : SATELLITE GROUND STATION MARKET – AFRICA 137

17.1. Africa 137

17.1.1. Key Highlights 137

17.1.2. Africa Satellite Ground Station Market Revenue, By Country, 2018 – 2023 (USD Million) 138

17.1.3. Africa Satellite Ground Station Market Revenue, By Platform, 2018 – 2023 (USD Million) 139

17.1.4. Africa Satellite Ground Station Market Revenue, By Function, 2018 – 2023 (USD Million) 140

17.1.5. Africa Satellite Ground Station Market Revenue, By End-user, 2018 – 2023 (USD Million) 141

17.1.6. Africa Satellite Ground Station Market Revenue, By Orbit, 2018 – 2023 (USD Million) 142

17.2. Egypt 143

17.3. Nigeria 143

17.4. Algeria 143

17.5. Morocco 143

17.6. Rest of Africa 143

CHAPTER NO. 18 : COMPANY PROFILES 144

18.1. Intelsat 144

18.1.1. Company Overview 144

18.1.2. Product Portfolio 144

18.1.3. Swot Analysis 144

18.1.4. Business Strategy 145

18.1.5. Financial Overview 145

18.2. Comtech Technologies Inc 146

18.3. General Dynamic Corporation 146

18.4. Kongsberg Gruppen ASA 146

18.5. Airbus SE 146

18.6. Eutelsat Communications 146

18.7. Viasat 146

18.8. Inmarsat 146

18.9. Iridium Communications 146

18.10. Globecast 146

18.11. Hughes Network Systems 146

18.12. Advantech Wireless 146

18.13. Optus Satellite 146

![Skip to main contentSkip to toolbar Dashboard Posts Posts All Posts Add Post Reports Reports All Reports Add New Report Media Media Library Add Media File Comments Profile Tools Tools Available Tools Yoast Redirects Yoast SEO About WordPress Credence Research Inc. 00 Comments in moderation New View Report Admin Notices 11 Howdy, Ankit Kumar Edit Report Satellite Ground Station Market · Report Ctrl+K Save Satellite Ground Station Market Frequently Asked Questions: What is the current market size for Satellite Ground Station Market, and what is its projected size in 2032? The Satellite Ground Station Market was valued at USD 51,095.14 million in 2024 and is projected to reach USD 1,33,385.45 million by 2032. At what Compound Annual Growth Rate is the Satellite Ground Station Market projected to grow between 2025 and 2032 The Satellite Ground Station Market is projected to grow at a CAGR of 12.79% during the forecast period from 2025 to 2032. Which Satellite Ground Station Market segment held the largest share in 2024? The Fixed platform segment dominated the Satellite Ground Station Market in 2024, accounting for 69.9% of the total market share. What are the primary factors fueling the growth of the Satellite Ground Station Market? Key drivers include demand for real-time data transmission, cloud-based GSaaS adoption, and defense communication needs. Who are the leading companies in the Satellite Ground Station Market? Major players include Airbus, L3Harris Technologies, Lockheed Martin, Kratos Defense & Security Solutions, and Raytheon Technologies. Which region commanded the largest share of the Satellite Ground Station Market in 2024? Which region commanded the largest share of the Satellite Ground Station Market in 2024? Add question Report Details Move upMove downToggle panel: Report Details Subtitle Satellite Ground Station Market By Platform (Fixed, Portable, Mobile); By Function (Communication, Earth Observation, Space Research, Navigation, Others); By End-User (Commercial, Government, Defence, Others); By Orbit (Low Earth Orbit [LEO], Medium Earth Orbit [MEO], Geostationary Earth Orbit [GEO]); By Region – Growth, Share, Opportunities & Competitive Analysis, 2024 – 2032 Report Insights Add MediaVisualText Summary Add MediaVisualText Paragraph p Table Of Content Add MediaVisualText Paragraph Competitive Intelligence Yoast SEO Premium Move upMove downToggle panel: Yoast SEO Premium SEO Readability Inclusive language Social Focus keyphraseHelp on choosing the perfect focus keyphrase(Opens in a new browser tab) Satellite Ground Station Market Get related keyphrases(Opens in a new browser tab) Search appearance Determine how your post should look in the search results. Preview as: Mobile resultDesktop result Url preview: Credence Research Inc. www.credenceresearch.com SEO title preview: Satellite Ground Station Market Size, Growth and Forecast 2032 Meta description preview: Nov 5, 2025 - The Satellite Ground Station Market size was valued at USD 32,400.00 million in 2018, increased to USD 51,095.14 million in 2024, and is anticipated to ... SEO title Generate SEO title Insert variable Satellite Ground Station Market Size, Growth and Forecast 2032 Slug satellite-ground-station-market Meta description Generate meta description Insert variable The Satellite Ground Station Market size was valued at USD 32,400.00 million in 2018, increased to USD 51,095.14 million in 2024, and is anticipated to reach USD 1,33,385.45 million by 2032, growing at a CAGR of 12.79% during the forecast period. Premium SEO analysisNeeds improvement Satellite Ground Station Market Add related keyphrase Content blocks New Internal linking suggestions Cornerstone content Insights Report Block Satellite Ground Station Market Current image: Aerospace & Defense Replace Remove The Satellite Ground Station Market size was valued at USD 32,400.00 million in 2018, increased to USD 51,095.14 million in 2024, and is anticipated to reach USD 1,33,385.45 million by 2032, growing at a CAGR of 12.79% during the forecast period. Edit excerpt 201 words, 1 minute read time. Last edited 3 hours ago. Status Published Publish Today at 3:12 pm Slug satellite-ground-station-market Template Single item: Report Discussion Closed Revisions 3 Parent None Yoast SEO Premium SEO analysis: Needs improvement Readability analysis: OK Inclusive language: Good Improve your post with Yoast SEO Tags Add Tag Separate with commas or the Enter key. Most Used TrendingChemical PricingsMarket Research BlogChemicals PricingEconomic Impact AnalysisCredence Researcmerger and acquisition Industry Search Industries Search Industries Aerospace & defense Global Reports Advanced Materials Agriculture Automation & Process Control Automotive & Transportation Banking & Financial Services Biotechnology Building & Construction Chemicals Consumer Goods Country Reports Energy Energy Utilities Oil & Gas Food & Beverage Healthcare Pharmaceuticals Industrial Goods Industry Updates Information and Communications Technology Cloud Computing Communications Devices and Infrastructure Cyber Security Data Center & Networking IoT, Bigdata & Digitalization IT & Telecom Networking and Communications Next-Generation Networking Technologies Software & Solutions Technology & Media Medical Devices Mining, Minerals and Metals Outsourcing Services Packaging Regional Reports Semiconductor & Electronics Travel & Tourism Select the primary industry Aerospace & defense Learn moreLearn more about the primary category.↗ Open save panel Report Hidden Notices2 Silenced Notices2 Admin Notices Close dialog Add media ActionsAdd media Create gallery Create audio playlist Create video playlist Featured Image Insert from URL Upload filesMedia Library Expand Details Filter mediaFilter by type All media items Filter by date All dates Search media Media list Deselect Showing 82 of 17786 media items Load more Attachment Details Satellite-Ground-Station-Market-share.png November 5, 2025 124 KB 1192 by 602 pixels Delete permanently Alt Text Learn how to describe the purpose of the image(opens in a new tab). Leave empty if the image is purely decorative.Title Satellite Ground Station Market share Caption Description File URL: https://www.credenceresearch.com/wp-content/uploads/2025/11/Satellite-Ground-Station-Market-share.png Copy URL to clipboard Attachment Display Settings Alignment None Link To None Size Full Size – 1192 × 602 Selected media actions 1 item selected Clear Insert into Report No file chosen](https://www.credenceresearch.com/wp-content/uploads/2025/11/Satellite-Ground-Station-Market-share.png)