Market Overview:

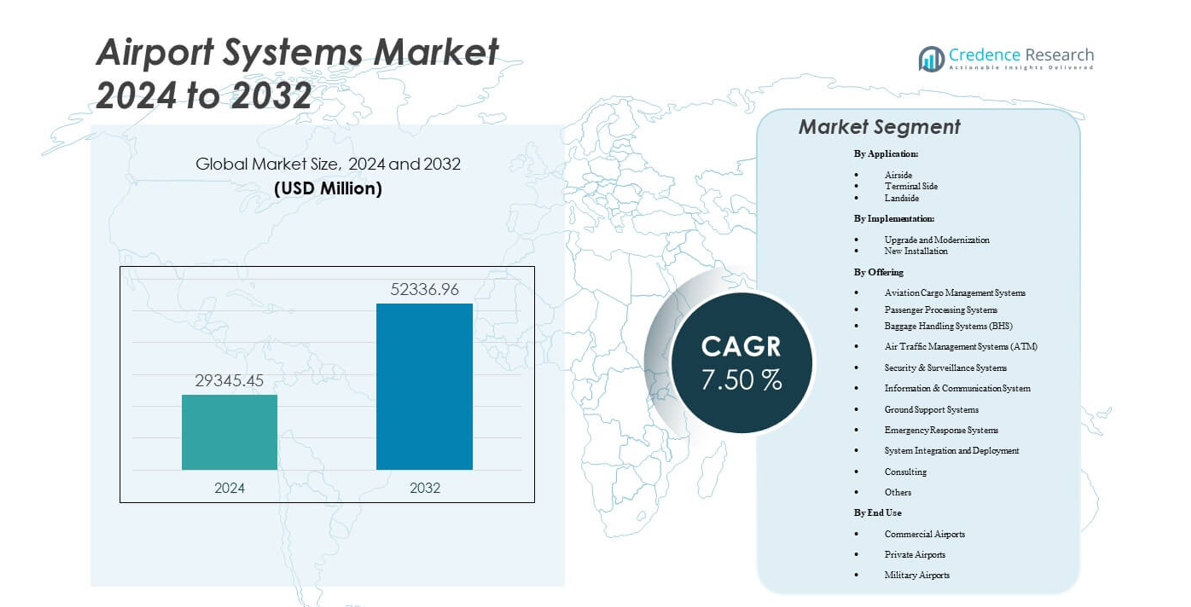

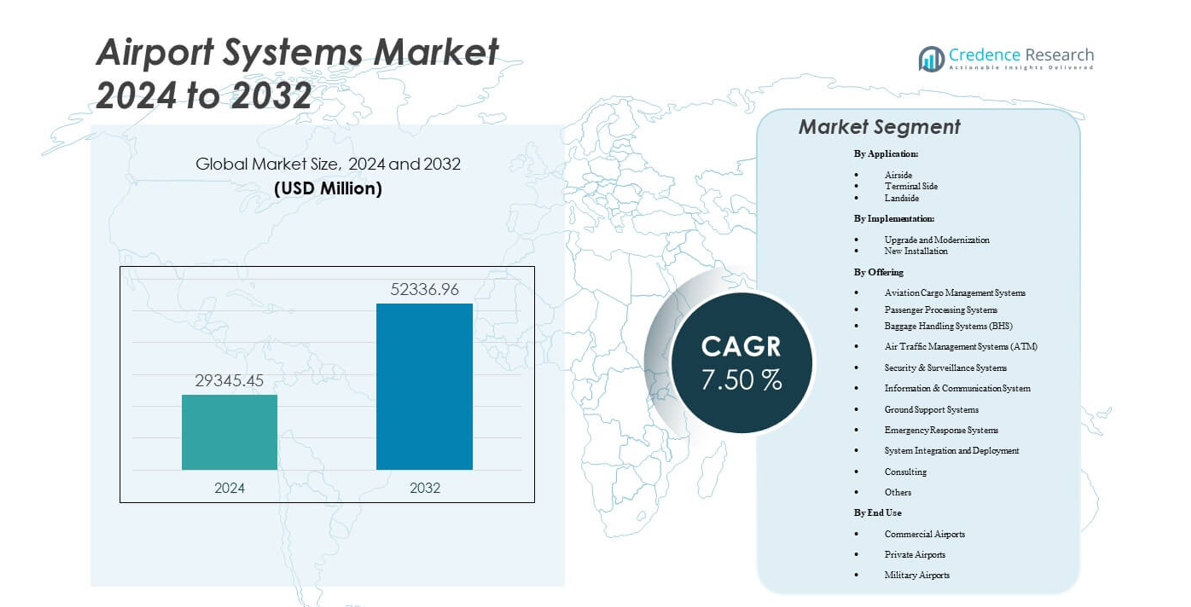

The Airport Systems Market is projected to grow from USD 29,345.45 million in 2024 to an estimated USD 52,336.96 million by 2032, with a compound annual growth rate (CAGR) of 7.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Systems Market Size 2024 |

SD 29,345.45 million |

| Airport Systems Market, CAGR |

7.5% |

| Airport Systems Market Size 2032 |

USD 52,336.96 million |

The market growth is driven by rapid digital transformation across global airports. Increasing adoption of smart technologies, automation, and predictive analytics improves operational coordination, safety, and passenger convenience. Governments are investing in modernizing existing airports, while private players develop smart terminals and ground support systems. The growing need for real-time data exchange, efficient air traffic control, and seamless passenger processing continues to fuel technology demand across airport operations.

North America dominates the Airport Systems Market due to its advanced infrastructure, large passenger base, and early adoption of automation technologies. Europe follows with strong emphasis on sustainable and digitized airport systems, supported by smart energy initiatives and advanced air traffic management. The Asia-Pacific region is the fastest-growing, driven by major expansion projects in China, India, and Southeast Asia. The Middle East is emerging rapidly with massive airport investments, while Latin America and Africa are upgrading infrastructure to enhance regional connectivity and efficiency.

Market Insights:

- The Airport Systems Market is projected to grow from USD 29,345.45 million in 2024 to USD 52,336.96 million by 2032, registering a CAGR of 7.5%.

- Growing global air traffic and increasing airport modernization projects are driving significant market expansion.

- Adoption of automation, IoT, and predictive analytics enhances passenger experience and operational efficiency.

- High implementation costs and integration challenges with legacy systems act as key market restraints.

- North America leads the market due to strong infrastructure and early adoption of smart airport technologies.

- Asia-Pacific is the fastest-growing region, supported by rapid infrastructure expansion and digital transformation.

- Europe focuses on sustainable airport operations, emphasizing energy-efficient systems and advanced air traffic management solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Air Traffic and Expanding Airport Infrastructure Development

The Airport Systems Market is witnessing strong momentum due to the rapid growth of global air travel. Increasing passenger volumes are encouraging airports to upgrade operational systems for better efficiency. Governments and private investors are funding large-scale airport expansion and modernization programs worldwide. These projects include the installation of advanced communication, navigation, and security systems. Modern airport terminals now rely on automated systems to handle passenger flow, baggage management, and airside operations. The integration of real-time data platforms improves decision-making and flight management. Demand for enhanced airside efficiency is driving the replacement of legacy systems. Continuous investments in smart airports reflect the sector’s need for greater safety and reliability.

- For instance, Siemens Logistics piloted its VarioTip automated baggage system at Munich Airport, processing up to 800 items of luggage per hour from 20 unit load devices (ULDs) with a 99% automation rate in live operation, minimizing manual handling and improving operational efficiency.

Adoption of Automation, AI, and IoT in Modern Airport Operations

Automation technologies are transforming the way airports manage daily operations. The integration of artificial intelligence, Internet of Things (IoT), and analytics enables airports to optimize passenger handling, resource allocation, and predictive maintenance. AI-based video analytics strengthen surveillance and crowd management in busy terminals. Smart sensors assist in energy management and maintenance scheduling, improving operational continuity. It helps reduce delays and human error through automated data exchange and system interconnectivity. IoT-based baggage and cargo tracking enhance visibility and accuracy throughout the airport ecosystem. The Airport Systems Market benefits from the trend toward fully connected and intelligent infrastructure. Continuous R&D investment by system providers supports the creation of adaptive and resilient platforms.

- For instance, SITA completed a Smart Path biometric passenger processing trial at Istanbul Airport resulting in a 30% reduction in boarding times across the six-month pilot in collaboration with Turkish Airlines, demonstrating measurable improvements in passenger flow and touchless processing.

Government Initiatives Supporting Aviation Safety and Security Modernization

Global aviation authorities are prioritizing airspace safety and operational reliability through digital transformation. Governments are enforcing regulations that require advanced air traffic management and communication systems. Airports are adopting secure, compliant technologies that align with international aviation safety standards. Cybersecurity upgrades are becoming critical to protect real-time control systems and sensitive passenger data. It ensures compliance while maintaining operational integrity across digital platforms. The implementation of biometric identification and automated border control systems strengthens national security. Funding programs and public-private partnerships are accelerating technology adoption across regions. Such policy-driven investments position the Airport Systems Market for sustained long-term expansion.

Increasing Demand for Seamless Passenger Experience and Service Efficiency

Passenger expectations for speed, comfort, and safety are reshaping airport management strategies. Airports are integrating smart technologies to deliver frictionless check-in, security, and boarding experiences. Self-service kiosks, e-gates, and automated baggage handling streamline passenger movement. It enhances satisfaction while reducing congestion and operational costs. Predictive analytics and passenger flow monitoring help improve queue management and on-time performance. Airlines and airports are focusing on personalization through mobile integration and digital wayfinding systems. Service efficiency now extends beyond airside operations to retail, hospitality, and logistics. Continuous innovation supports competitive positioning and customer loyalty across global airports.

Market Trends

Shift Toward Smart and Sustainable Airport Infrastructure Development

The Airport Systems Market is evolving through the deployment of intelligent, eco-efficient technologies. Airports are adopting energy-efficient lighting, HVAC automation, and renewable energy integration to minimize environmental impact. Smart grid and building management systems improve power distribution and reduce emissions. It supports global commitments to sustainability while enhancing long-term cost savings. Modular designs and digital twins are being used to predict maintenance needs and reduce downtime. Integration of AI-powered control systems allows airports to monitor performance across multiple terminals. The shift toward green infrastructure is transforming how airports manage environmental compliance. Sustainability has become a key differentiator for leading global airports.

- For instance, Changi Airport Group is developing one of Singapore’s largest rooftop solar photovoltaic systems, targeting a total capacity of 38 MWp across its terminals and airfield buildings by 2025. The project aims to significantly reduce carbon emissions and enhance the airport’s long-term energy sustainability.

Expansion of Cloud-Based and Centralized Data Management Platforms

Cloud technologies are gaining strong traction across airport operations. Airports are adopting centralized data platforms for enhanced scalability and interoperability. Cloud-based solutions allow real-time sharing of flight, passenger, and logistics data across stakeholders. It strengthens situational awareness and operational coordination among ground crews, airlines, and authorities. The adoption of hybrid cloud models ensures flexibility in scaling operations during peak demand. Data analytics and machine learning algorithms improve resource utilization and security surveillance. Vendors are developing modular platforms to align with global aviation standards. The transition to cloud infrastructure supports a future-ready and connected airport ecosystem.

- For instance, British Airways invested in advanced AI-driven operational technologies to enhance punctuality and efficiency at London Heathrow, achieving a reduction of more than 160,000 minutes in flight delays within a year, according to official company reports published in 2025.

Integration of Contactless and Biometric Passenger Processing Systems

Airports are rapidly moving toward touchless travel solutions to ensure safety and convenience. Biometric systems are replacing manual verification at check-in, boarding, and immigration points. Facial recognition, iris scanning, and e-passport systems enhance throughput and accuracy. It helps reduce waiting time while improving identity verification standards. Airlines are collaborating with airports to create unified biometric journeys. The technology ensures secure passenger flow while minimizing physical contact. The Airport Systems Market benefits from increasing consumer confidence in automated travel processes. Widespread deployment of contactless systems reflects the industry’s focus on health, security, and efficiency.

Adoption of Predictive Maintenance and Real-Time Monitoring Solutions

Predictive maintenance technologies are becoming vital for optimizing airport assets. Airports are using AI and IoT sensors to predict equipment failures before they occur. Real-time monitoring of runways, lighting systems, and baggage conveyors enhances uptime. It allows operators to plan maintenance proactively and minimize disruptions. Advanced analytics tools process continuous data streams from multiple sources. These systems ensure consistent performance and regulatory compliance across airport facilities. Integration of drone-based inspection systems accelerates visual assessments of infrastructure. Continuous monitoring supports cost savings and asset longevity across airport networks.

Market Challenges Analysis

High Implementation Costs and Integration Complexities Across Legacy Infrastructure

The Airport Systems Market faces financial and technical hurdles during modernization. The integration of advanced digital systems with existing airport frameworks often requires high upfront investment. Legacy infrastructure limits compatibility with new automation technologies. It increases the complexity of migration and operational downtime risks. Many airports, especially in developing nations, struggle to allocate sufficient capital for system upgrades. Vendor coordination and compliance with aviation standards further extend project timelines. Limited interoperability between equipment suppliers adds to deployment delays. High maintenance costs also challenge long-term system sustainability and scalability.

Cybersecurity Risks and Shortage of Skilled Workforce in System Management

Airports are becoming prime targets for cyber threats due to extensive data exchange and connected systems. Growing digitalization increases exposure to malware and data breaches. It creates significant risks to passenger safety and operational integrity. Cybersecurity protocols require constant updates and investment in threat detection systems. The lack of skilled IT and cybersecurity professionals hampers system monitoring. Smaller airports often depend on outsourced services, which raise security concerns. Employee training and awareness programs remain insufficient to counter sophisticated attacks. The continuous evolution of threats demands proactive defense mechanisms across digital airport ecosystems.

Market Opportunities

Growing Investments in Next-Generation Smart Airport Projects Worldwide

The Airport Systems Market is positioned for expansion through major smart airport development initiatives. Governments and private players are investing heavily in digital transformation and automation. Large-scale construction projects are integrating smart control, communication, and security systems. It enables airports to achieve higher capacity utilization and safety efficiency. Emerging economies are focusing on upgrading regional airports to global standards. Demand for AI-driven traffic management and automated check-in systems is expanding rapidly. Vendors offering integrated and modular system solutions are gaining strategic advantages. Long-term modernization programs promise steady revenue opportunities for technology providers.

Emerging Demand for Cloud, AI, and 5G-Enabled Airport Management Platforms

Advancements in connectivity are opening new business models in aviation technology. Cloud, AI, and 5G are driving digital innovation across airport networks. It enables instant data transfer, seamless communication, and improved decision-making. AI-driven predictive tools optimize scheduling, asset performance, and energy usage. 5G networks support high-speed, low-latency communication for safety-critical applications. Cloud-based platforms simplify multi-airport coordination and regulatory reporting. Vendors focusing on digital transformation services are expanding their footprint in this sector. The adoption of these technologies accelerates airport modernization and global market competitiveness.

Market Segmentation Analysis:

By Application

The Airport Systems Market is segmented by application into airside, terminal side, and landside. Airside systems dominate due to their critical role in managing air traffic, ground handling, and runway safety. Terminal side applications focus on passenger processing, including check-in, boarding, and baggage management, supported by digital platforms and automation. Landside systems handle vehicle access, parking management, and logistics coordination to improve airport connectivity. It ensures smooth integration between passenger and cargo movement while enhancing operational reliability and safety standards across airport zones.

- For instance, Indra’s iCAS air traffic management system was commissioned by DFS Deutsche Flugsicherung at its Munich Control Center in early 2023, introducing next-generation 4D trajectory management to enhance flight efficiency, capacity, and safety across German airspace.

By Implementation

The market by implementation is divided into upgrade and modernization, and new installation. The upgrade and modernization segment holds a significant share due to the ongoing digital transformation of existing airports. Modernization focuses on integrating AI, IoT, and cloud-based systems to improve operational efficiency. New installation is driven by the construction of new airports in developing economies to meet rising passenger demand. It supports infrastructure expansion and adoption of next-generation communication and surveillance systems. Both segments reflect a strong commitment to sustainability and technological advancement.

- For instance, Siemens Logistics launched its Baggage360 software suite, leveraging cloud tech and AI pilot tests showed up to 22% fewer mishandled bags and improved baggage journey times by 9 minutes on average for clients including Singapore’s Changi Airport.

By Offering

The offering segment includes aviation cargo management systems, passenger processing systems, baggage handling systems (BHS), air traffic management systems (ATM), security and surveillance systems, information and communication systems, ground support systems, emergency response systems, system integration and deployment, consulting, and others. Passenger processing and BHS dominate due to their direct impact on service efficiency. Air traffic management and security systems are key for safety and control. It strengthens coordination between terminals and airside operations through advanced digital platforms and automation tools.

By End Use

The market by end use is categorized into commercial airports, private airports, and military airports. Commercial airports lead due to heavy passenger traffic and continuous infrastructure investment. Private airports are expanding with the growth of business aviation and charter services. Military airports focus on secure communication and surveillance technologies for defense operations. It highlights the diverse operational requirements of each category while emphasizing automation and safety compliance across all airport environments.

Segmentation:

By Application:

- Airside

- Terminal Side

- Landside

By Implementation:

- Upgrade and Modernization

- New Installation

By Offering

- Aviation Cargo Management Systems

- Passenger Processing Systems

- Baggage Handling Systems (BHS)

- Air Traffic Management Systems (ATM)

- Security & Surveillance Systems

- Information & Communication System

- Ground Support Systems

- Emergency Response Systems

- System Integration and Deployment

- Consulting

- Others

By End Use

- Commercial Airports

- Private Airports

- Military Airports

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the Airport Systems Market with a 36% share, driven by its advanced aviation infrastructure and early adoption of smart technologies. The United States dominates the region due to strong investments in airport automation, cybersecurity, and air traffic management systems. Major airports, such as Hartsfield-Jackson Atlanta and Los Angeles International, continue to deploy digital platforms for passenger handling and baggage management. Canada and Mexico are upgrading airport facilities to improve operational capacity and safety compliance. It benefits from strong collaboration between technology providers and airport authorities to enhance system integration. Continuous government funding supports modernization projects focused on sustainability and efficiency across major hubs.

Europe

Europe holds a 29% share in the Airport Systems Market, supported by the region’s emphasis on digitalization, automation, and environmental sustainability. The United Kingdom, Germany, and France are major contributors, adopting advanced airside and terminal systems. The European Union’s Green Airport initiative encourages smart energy management and emission control technologies. It promotes digital transformation through investments in AI, IoT, and integrated airport management solutions. Growing air passenger volumes and cross-border traffic demand efficient data-driven operations. Leading European airports are deploying biometric check-in, autonomous ground handling systems, and predictive maintenance solutions to strengthen performance. The region maintains a balanced approach between innovation and regulatory compliance.

Asia-Pacific, Middle East & Africa, and Latin America

Asia-Pacific accounts for 27% of the market and is the fastest-growing regional segment. China, India, Japan, and South Korea are investing in large-scale airport expansion projects and smart infrastructure. It experiences rising air travel demand and government initiatives supporting airport digitalization. The Middle East and Africa hold 5% share, driven by infrastructure upgrades in the UAE, Saudi Arabia, and South Africa. The region focuses on smart air traffic systems and sustainable airport operations to attract international connectivity. Latin America represents 3% of the market, with Brazil and Mexico leading modernization efforts to enhance safety and capacity. Rapid urbanization and tourism growth continue to support global expansion of airport system deployments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SITA

- Amadeus IT Group SA

- Thales Group

- Honeywell International Inc.

- Vanderlande Industries B.V.

- TAV Technologies

- ADB SAFEGATE

- Indra

- NEC Corporation

- Siemens AG

Competitive Analysis:

The Airport Systems Market features strong competition among global technology providers and infrastructure solution companies. Key players include SITA, Amadeus IT Group SA, Thales Group, Honeywell International Inc., Vanderlande Industries B.V., TAV Technologies, ADB SAFEGATE, Indra, NEC Corporation, and Siemens AG. These companies focus on expanding their portfolios through automation, digitalization, and AI-driven platforms. It emphasizes partnerships with airport authorities and government agencies to deliver integrated management and control systems. Players invest in R&D to enhance cybersecurity, energy efficiency, and predictive analytics capabilities. The market shows high consolidation, with leading firms holding strong regional influence through long-term contracts and service agreements. Competitive differentiation depends on system reliability, scalability, and compliance with aviation safety standards.

Recent Developments:

- In October 2025, SITA partnered with EasyJet to launch the SITA Agent App, a mobile solution enabling airport ground staff to assist and process passengers anywhere in the terminal, streamlining services and improving operational efficiency for the Airport Systems Market. Additionally, SITA signed a seven-year agreement with Kaohsiung International Airport in Taiwan to deploy next-generation passenger processing systems, making check-in and boarding more efficient and resilient as air travel surges in Asia.

- In October 2025, Adani Airports announced a new partnership with AIONOS to deploy the IntelliMate agentic AI platform across their airports, highlighting a major step towards AI-powered operations and passenger experience enhancements.

- In May 2025, Amadeus IT Group SA entered a strategic partnership with Google to propel cloud-based operations and AI innovation for airports and travel industry clients. This collaboration leverages Google Cloud’s AI hardware and Vertex AI platform, aiming to boost multicloud strategy and advanced digital services in global airport operations.

Report Coverage:

The research report offers an in-depth analysis based on Application, Implementation, Offering and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continuous expansion of air travel networks will strengthen global demand for integrated airport systems.

- Digital transformation and automation will remain central to future airport modernization strategies.

- Artificial intelligence and IoT technologies will advance predictive maintenance and operational precision.

- Expansion of smart airports will accelerate adoption of unified communication and control platforms.

- Sustainability goals will drive investments in energy-efficient airport infrastructure and green technologies.

- Cloud-based data systems will enhance scalability and coordination across global airport networks.

- Biometric verification and contactless processing will redefine passenger safety and convenience.

- Increased government funding will support large-scale modernization and regulatory compliance initiatives.

- Emerging economies will invest heavily in new airport infrastructure to support tourism and trade.

- Strategic collaborations between technology providers and airport authorities will shape future innovation pathways.