Market Overview:

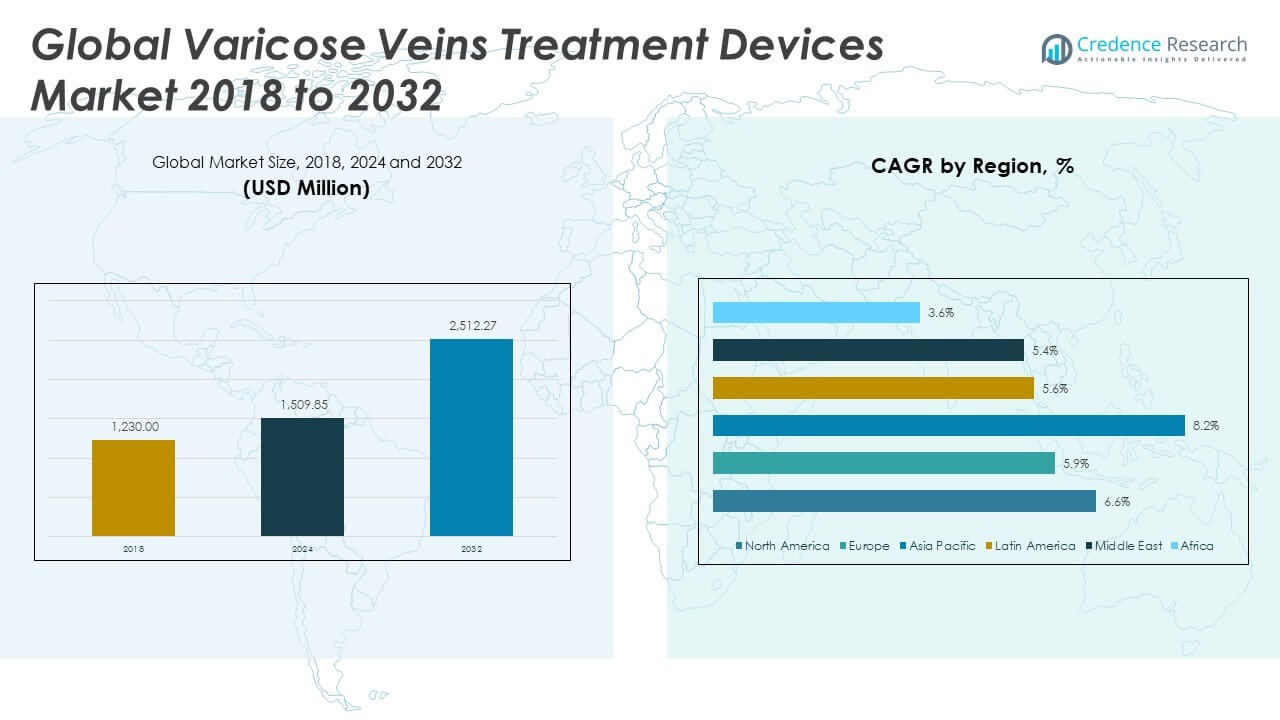

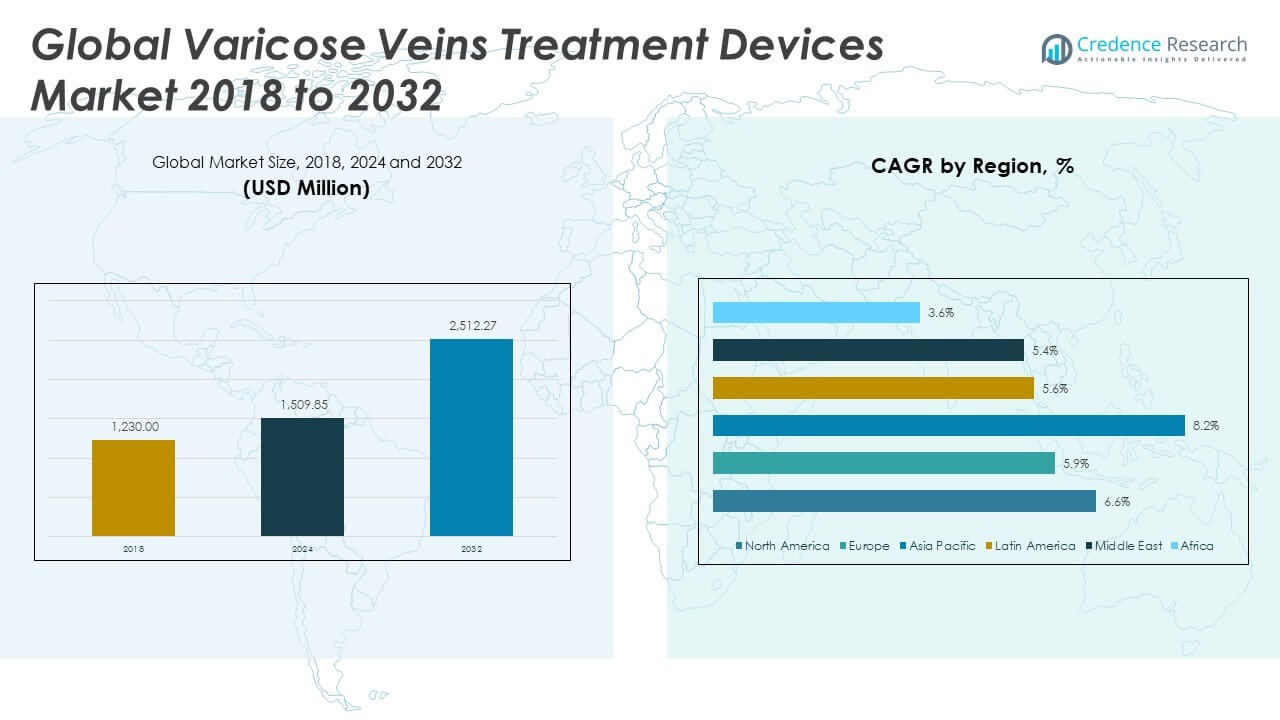

The Varicose Veins Treatment Devices Market size was valued at USD 1,230.00 million in 2018, increased to USD 1,509.85 million in 2024, and is anticipated to reach USD 2,512.27 million by 2032, at a CAGR of 6.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Varicose Veins Treatment Devices Market Size 2024 |

USD 1,509.85 Million |

| Varicose Veins Treatment Devices Market, CAGR |

6.62% |

| Varicose Veins Treatment Devices Market Size 2032 |

USD 2,512.27 Million |

Rising prevalence of varicose veins, driven by aging populations and sedentary lifestyles, has significantly increased the demand for minimally invasive treatment options. Technological advancements in laser and radiofrequency ablation, along with growing patient preference for outpatient procedures, are key factors propelling market growth. Additionally, increasing healthcare expenditure, awareness campaigns, and expanding insurance coverage for varicose veins procedures continue to boost the adoption of advanced treatment devices among both patients and healthcare providers.

North America leads the market due to strong healthcare infrastructure, early adoption of advanced technologies, and high awareness levels among patients. Europe follows closely, supported by favorable reimbursement policies and growing geriatric population. Emerging economies in Asia Pacific, particularly India and China, are witnessing rapid growth fueled by rising healthcare investments, expanding medical tourism, and increasing incidence of venous disorders. Latin America and the Middle East & Africa are gradually gaining traction due to improving access to vascular care and evolving treatment capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Varicose Veins Treatment Devices Market was valued at USD 1,509.85 million in 2024 and is expected to reach USD 2,512.27 million by 2032, growing at a CAGR of 6.62%.

- Rising demand for minimally invasive procedures like endovenous and radiofrequency ablation is accelerating global adoption.

- Increasing aging population and sedentary lifestyles are driving the incidence of chronic venous disorders.

- High procedure costs and limited insurance coverage in developing regions restrict patient access to advanced treatments.

- North America leads the market with over 40% share, supported by strong healthcare infrastructure and early technology adoption.

- Asia Pacific is the fastest-growing region due to rapid urbanization, expanding healthcare access, and medical tourism.

- Market growth is further fueled by expanding vein clinics and ambulatory centers offering outpatient treatment options.

Market Drivers:

Growing Aging Population and Prevalence of Chronic Venous Diseases is Accelerating Demand for Effective Treatments

The steady rise in the global aging population contributes significantly to the demand for varicose veins treatments. Older adults are more susceptible to chronic venous insufficiency, which often results in varicose veins. Sedentary lifestyles and increased obesity rates across demographics further compound the condition’s prevalence. The Varicose Veins Treatment Devices Market benefits from the widespread need for minimally invasive solutions that offer faster recovery and fewer complications. It reflects growing patient preference for outpatient settings and procedures with minimal downtime. The demand is particularly strong in urban centers where lifestyle-induced vascular issues are more common. Governments and private institutions are investing in vascular health awareness, encouraging early diagnosis and treatment. These factors collectively increase the procedural volume and adoption of advanced treatment devices.

- For example, according to Medtronic’s official data, the ClosureFast™ radiofrequency ablation catheter has been used in over 2 million procedures globally. The device offers a minimally invasive alternative to surgical vein stripping, with faster recovery and less post-procedural pain, though specific recovery time comparisons are not publicly quantified.

Technological Advancements in Minimally Invasive Procedures are Driving Clinical Adoption

Technological innovations such as radiofrequency ablation, endovenous laser treatment, and mechanochemical ablation are enhancing treatment outcomes. These advancements reduce post-operative discomfort, shorten recovery periods, and eliminate the need for general anesthesia. The Varicose Veins Treatment Devices Market is increasingly benefiting from compact and portable systems that improve accessibility across healthcare facilities. Hospitals and specialized vascular clinics are upgrading their equipment to align with global best practices. It supports a consistent rise in patient throughput while maintaining clinical efficacy. Training programs for physicians are expanding rapidly, enabling safe use of new-generation devices. Healthcare providers prioritize devices with fewer complications and consistent results. Reimbursement policies are evolving to accommodate these procedures, further encouraging their use.

- For example, AngioDynamics’ VenaCure EVLT™ system using a 1470 nm laser and NeverTouch fiber shows clinically validated vein closure rates of approximately 98% at 12 months

Increased Awareness and Screening Initiatives are Boosting Early Diagnosis Rates

Public and private health organizations are launching awareness campaigns on the risks of untreated varicose veins. These initiatives aim to reduce stigma and encourage individuals to seek timely evaluation. Patients are more informed about treatment options than in the past, prompting proactive consultations. The Varicose Veins Treatment Devices Market gains from this trend through increased demand for diagnostic tools and early-stage interventions. Screening programs at community health centers and primary care facilities help in identifying cases earlier. This increases the adoption of less aggressive procedures and raises overall patient satisfaction. Social media, online platforms, and digital consultations also contribute to information dissemination. Insurance coverage and employer wellness programs are playing a role in promoting preventive care.

Rising Healthcare Infrastructure and Investments Across Emerging Markets are Enabling Wider Access

Emerging economies in Asia Pacific, Latin America, and the Middle East are witnessing significant growth in vascular care infrastructure. Governments are prioritizing non-communicable disease management, expanding public sector capabilities. Private hospitals and specialty clinics are equipping themselves with varicose veins treatment devices to serve an increasing urban population. The Varicose Veins Treatment Devices Market is expanding into secondary cities, driven by increased affordability and accessibility. It benefits from localized manufacturing, supply chain efficiencies, and regulatory approvals that support market entry. Public-private partnerships are enabling subsidized care, improving access in underserved regions. Telemedicine is extending consultation services to remote patients, guiding them toward treatment facilities. Local distributors and medical device companies are establishing strong networks to meet growing demand.

Market Trends

Rising Preference for Outpatient Vascular Procedures is Shaping Market Delivery Models

Healthcare systems are shifting towards outpatient care to improve cost efficiency and patient convenience. Many varicose vein procedures now take place in ambulatory surgical centers or physician offices. The Varicose Veins Treatment Devices Market is responding with compact, user-friendly systems tailored for such settings. These trends support broader treatment access in both developed and developing regions. It enables a shift from traditional hospital-based interventions to quicker, more personalized procedures. The move helps reduce hospital stay durations and increases procedural volume. Device makers are targeting this segment with innovations focused on portability and ease of use. Regulatory bodies are also adjusting compliance frameworks to support outpatient delivery.

Integration of AI-Powered Imaging and Diagnostics is Transforming Pre-Treatment Assessment

Artificial intelligence is improving the accuracy of venous disease detection and mapping. AI-driven ultrasound systems and imaging software enhance treatment planning by offering clearer anatomical visualization. The Varicose Veins Treatment Devices Market is incorporating these tools to improve clinical outcomes and reduce complications. Physicians can now rely on real-time diagnostics to determine optimal catheter paths and energy delivery points. It supports personalized treatment strategies that align with individual patient anatomy. These systems also enable automated documentation, improving workflow efficiency. As AI integration expands, device compatibility with digital health platforms is becoming a competitive differentiator. Investment in R&D for smart diagnostics is rising globally.

- For example, the Philips EPIQ CVx ultrasound platform leverages AI and automation to standardize vascular image acquisition and interpretation, ensuring consistent results across operators. Company documentation highlights automated measurement tools that reduce manual steps, help standardize interpretation, and improve reproducibility.

Growing Demand for Cosmetic and Aesthetic Vein Treatments is Influencing Product Development

Cosmetic concerns related to varicose and spider veins are influencing patient behavior across age groups. Many individuals seek treatment to improve leg appearance and boost confidence. The Varicose Veins Treatment Devices Market is seeing increased demand for low-risk procedures with minimal scarring and fast cosmetic recovery. Manufacturers are focusing on devices that offer precision energy delivery and aesthetic consistency. It drives development in mechanochemical and non-thermal modalities suited for smaller veins. Dermatology clinics and aesthetic centers are emerging as new customer segments. Marketing strategies are increasingly targeting lifestyle-focused consumers. Patient-friendly financing and package-based services are supporting market expansion.

- For example, Medtronic’s VenaSeal™ cyanoacrylate closure system, used for treating chronic venous insufficiency and advanced varicose veins, demonstrated promising outcomes in the 2025 Spectrum Venous Leg Ulcer (VLU) study. In patients with CEAP Class 6 disease (active venous ulcers due to severe varicose veins), the system achieved an 3% ulcer healing rate, 82.7% vein closure rate, and 83% freedom from ulcer recurrence at one year post-treatment.

Collaborations Between Hospitals and Device Manufacturers are Accelerating Innovation Cycles

Partnerships between healthcare providers and device companies are facilitating faster validation and adoption of new technologies. Hospitals provide real-world testing environments for prototype systems. The Varicose Veins Treatment Devices Market benefits from this feedback loop to refine design and usability. It accelerates regulatory approvals and shortens time to market. These collaborations also support joint training programs and technical support for clinicians. Global players are entering strategic agreements with regional providers to adapt technologies for local clinical needs. Co-branding initiatives and data-sharing agreements are becoming more common. These alliances ensure that emerging innovations align with both clinical efficiency and patient experience.

Market Challenges Analysis

High Treatment Costs and Limited Reimbursement in Developing Regions are Restricting Adoption

In many lower- and middle-income countries, high costs of varicose veins procedures remain a major barrier. Advanced technologies like endovenous ablation systems and laser devices require significant capital investment. The Varicose Veins Treatment Devices Market faces slow penetration in these markets due to limited health insurance coverage and low public awareness. It affects affordability for both public hospitals and private practitioners. Reimbursement remains inconsistent even in some high-income countries, especially for procedures categorized under aesthetics. Patients often delay treatment due to out-of-pocket expenses. This delay leads to complications and lowers the efficacy of minimally invasive interventions. Local governments are yet to prioritize vascular disorders in their health financing strategies.

Lack of Skilled Vascular Specialists and Inconsistent Training Standards are Hindering Market Growth

Effective use of varicose veins treatment devices requires trained vascular surgeons or interventional radiologists. In several regions, a shortage of such professionals limits patient access to safe and effective care. The Varicose Veins Treatment Devices Market faces a bottleneck in procedural volume due to workforce limitations. It also affects outcomes, increasing the risk of complications in inexperienced hands. Training opportunities for newer technologies remain fragmented and concentrated in urban areas. The absence of global standardization in skill certification further complicates adoption. Smaller clinics often avoid adopting newer devices due to fear of operational errors. Industry efforts to expand training programs have yet to bridge this skills gap.

Market Opportunities

Expansion of Medical Tourism and Cross-Border Treatment is Opening Growth Avenues

Several emerging countries are gaining popularity as medical tourism destinations for vascular treatments. Competitive pricing, experienced clinicians, and improving infrastructure attract patients from Europe, North America, and the Middle East. The Varicose Veins Treatment Devices Market can capitalize on this by partnering with hospitals offering bundled treatment packages. It helps device manufacturers scale faster and diversify across regions. Streamlined regulatory pathways in these markets also support quicker product approvals.

Increased Penetration of Telehealth and Remote Consultations is Creating New Entry Points

The adoption of telehealth is enabling early diagnosis and follow-ups for patients with varicose veins. Virtual care models allow specialists to guide local physicians or refer patients to advanced centers. The Varicose Veins Treatment Devices Market can tap into this network by aligning devices with teleconsultation workflows. It supports long-term patient engagement and drives recurring device usage in both urban and rural areas.

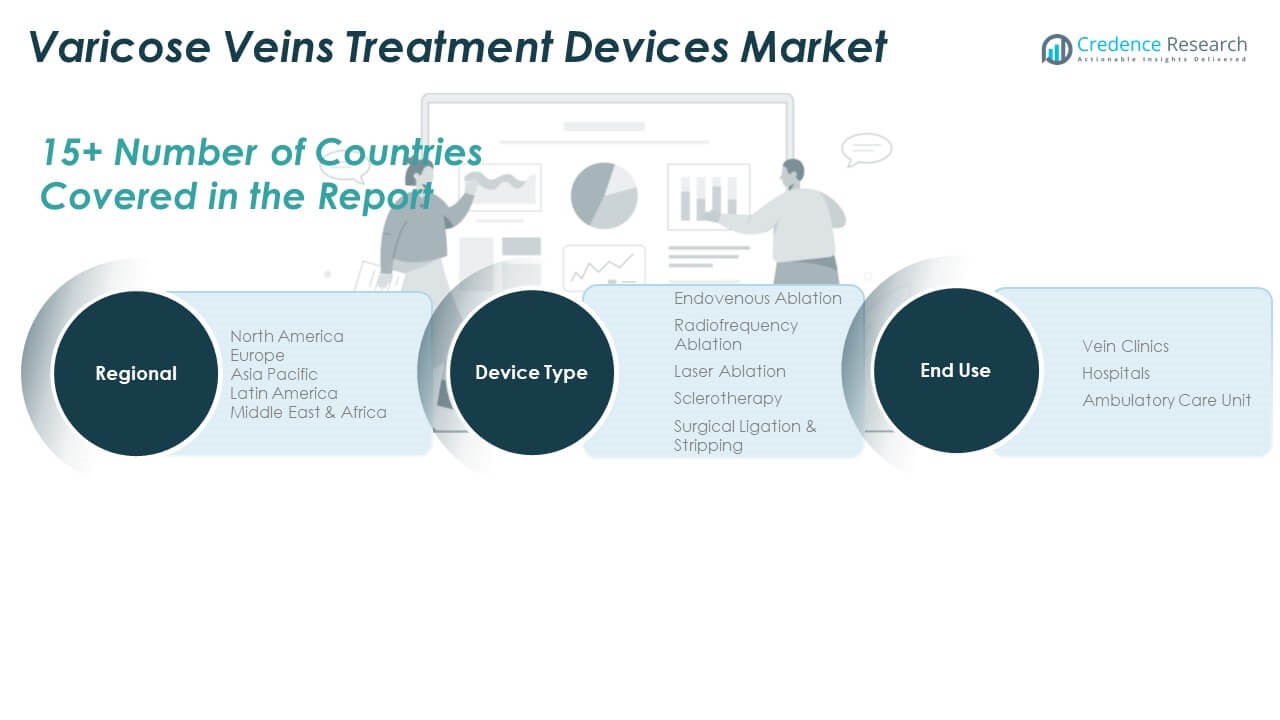

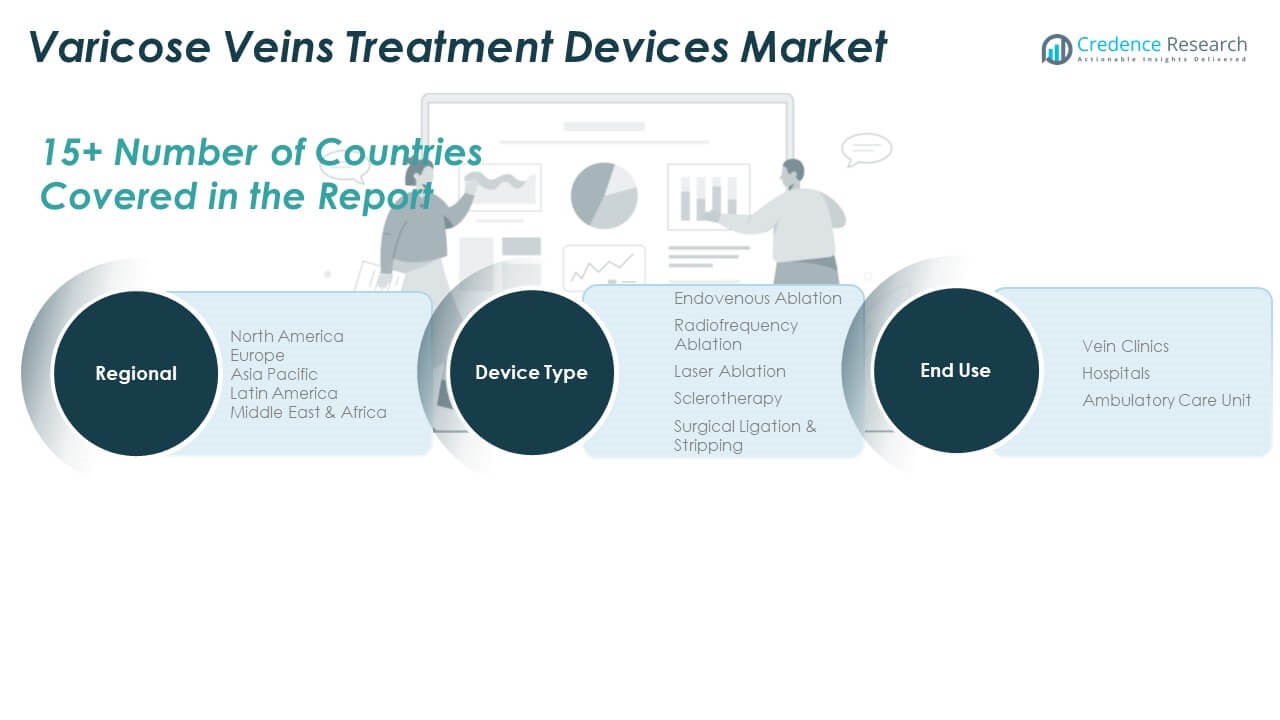

Market Segmentation Analysis:

The Varicose Veins Treatment Devices Market is segmented

By Type

Into endovenous ablation, radiofrequency ablation, laser ablation, sclerotherapy, and surgical ligation & stripping. Endovenous ablation holds a dominant share due to its high efficacy and preference for minimally invasive treatment. Radiofrequency ablation is gaining traction for its reduced post-operative pain and faster recovery compared to surgery. Laser ablation continues to be widely adopted in outpatient settings owing to its precision and lower risk profile. Sclerotherapy remains a cost-effective method for smaller veins, particularly in cosmetic cases. Surgical ligation and stripping are declining in usage, primarily reserved for complex or recurrent cases due to higher invasiveness.

- For instance, BTG’s Varithena® (polidocanol injectable foam) achieved a statistically significant improvement in vein appearance in 85% of treated patients at 12 weeks, as reported in BTG’s FDA submission data, with a complication rate under 1%.

By end use

The market is divided into vein clinics, hospitals, and ambulatory care units. Vein clinics lead the segment due to specialization, rapid procedures, and increased demand for cosmetic outcomes. Hospitals retain a significant share for treating advanced cases and complications. Ambulatory care units are emerging as viable settings due to growing outpatient procedural volumes and reduced healthcare costs. The segmentation reflects a shift toward outpatient, patient-friendly treatment environments across global regions.

- For example, USA Vein Clinics, the largest network of vein clinics in the United States with over 160 locations nationwide, provides minimally invasive vein treatments that typically allow patients to resume normal activities within a day, according to the clinic’s official patient care guidance.

Segmentation:

By Type

- Endovenous Ablation

- Radiofrequency Ablation

- Laser Ablation

- Sclerotherapy

- Surgical Ligation & Stripping

By End Use

- Vein Clinics

- Hospitals

- Ambulatory Care Units

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Varicose Veins Treatment Devices Market size was valued at USD 498.89 million in 2018, reached USD 605.74 million in 2024, and is anticipated to reach USD 1,006.67 million by 2032, at a CAGR of 6.6% during the forecast period. North America holds the largest market share of 40.2% in the global Varicose Veins Treatment Devices Market. It benefits from advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of minimally invasive technologies. High awareness among patients and healthcare providers supports increased diagnosis and timely intervention. Leading manufacturers are based in the U.S., supporting innovation and streamlined regulatory approvals. Outpatient clinics and ambulatory surgical centers are widely available, accelerating procedural volumes. Rising obesity and aging populations contribute to the growing patient base. Strong presence of board-certified vascular specialists ensures high procedural efficacy and demand for advanced devices. Investment in training and education further strengthens regional capabilities.

Europe

The Europe Varicose Veins Treatment Devices Market size was valued at USD 339.48 million in 2018, increased to USD 401.28 million in 2024, and is projected to reach USD 632.47 million by 2032, at a CAGR of 5.9% during the forecast period. Europe accounts for 26.3% of the global market share. It is supported by favorable reimbursement policies, public health initiatives, and wide availability of vein treatment clinics. Countries like Germany, France, and the UK lead in technology adoption and procedural volumes. The region has a well-structured network of vascular care units offering endovenous and laser-based treatments. Demand is driven by aging demographics and lifestyle-related venous disorders. Clinical trials and academic research centers promote continued innovation. Health-conscious consumers in Europe also drive demand for cosmetic vein procedures. Manufacturers focus on expanding distribution and clinician training across Central and Eastern Europe to tap growth opportunities.

Asia Pacific

The Asia Pacific Varicose Veins Treatment Devices Market size was valued at USD 249.94 million in 2018, reached USD 323.18 million in 2024, and is anticipated to reach USD 604.20 million by 2032, at a CAGR of 8.2% during the forecast period. Asia Pacific contributes 24.0% to the global market share. Rapid urbanization, increasing disposable income, and improved healthcare infrastructure are key factors driving growth. Countries like China, India, Japan, and South Korea show strong demand for minimally invasive procedures. Rising prevalence of varicose veins due to sedentary lifestyles and expanding medical tourism are creating favorable conditions. Local players are entering the market with cost-effective devices to meet regional needs. Government programs are improving awareness about venous disorders and encouraging early diagnosis. The market is also witnessing growing partnerships between hospitals and international device makers. Training programs and workshops for vascular specialists are expanding regionally.

Latin America

The Latin America Varicose Veins Treatment Devices Market size was valued at USD 71.34 million in 2018, rose to USD 86.65 million in 2024, and is forecast to reach USD 132.82 million by 2032, at a CAGR of 5.6% during the forecast period. The region represents 5.3% of the global market. Brazil and Mexico are the primary markets, supported by a growing middle-class population and private healthcare investments. Awareness about varicose veins treatment is increasing, especially in urban areas. Cosmetic concerns and demand for non-surgical treatments are rising among younger populations. Clinics are investing in energy-based devices to offer competitive procedures. Challenges include uneven access to care and inconsistent reimbursement across countries. Public-private partnerships are helping bridge infrastructure gaps. Regional distributors play a crucial role in increasing product availability and adoption.

Middle East

The Middle East Varicose Veins Treatment Devices Market size was valued at USD 50.68 million in 2018, reached USD 58.57 million in 2024, and is anticipated to hit USD 88.70 million by 2032, at a CAGR of 5.4% during the forecast period. It holds a 3.5% share of the global market. Demand is supported by rising chronic venous diseases and improved access to vascular care in countries like the UAE and Saudi Arabia. Medical tourism is also fueling adoption of advanced treatment technologies. Hospitals are upgrading to minimally invasive platforms to reduce patient recovery times. The region benefits from collaborations with global manufacturers and clinical training initiatives. Patient preference for non-invasive procedures is shaping treatment offerings in private clinics. Market expansion is influenced by increased healthcare investments in Gulf Cooperation Council countries. Device manufacturers are targeting the region with localized support and product customization.

Africa

The Africa Varicose Veins Treatment Devices Market size was valued at USD 19.68 million in 2018, increased to USD 34.43 million in 2024, and is projected to reach USD 47.40 million by 2032, at a CAGR of 3.6% during the forecast period. The region represents 1.9% of the global market share. Growth is modest due to limited access to specialized vascular care and high device costs. South Africa leads in terms of adoption, driven by private healthcare networks. Awareness about varicose vein treatment remains low in many countries. Multinational organizations and NGOs are promoting venous health education in underserved regions. Opportunities exist in urban centers where healthcare spending is rising. The market is gradually opening to global players through distributor partnerships. Public sector initiatives focused on non-communicable diseases may create long-term demand for treatment infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AngioDynamics

- Medtronic

- Teleflex Incorporated

- Sciton, Inc.

- Dornier Medtech

- Merit Medical Systems

- Alma Lasers

- Biolitec AG

- Boston Scientific Corporation

Competitive Analysis:

The Varicose Veins Treatment Devices Market features intense competition among well-established global vendors and emerging innovators. Medtronic, AngioDynamics, Biolitec, Teleflex, Boston Scientific, Sciton, Alma Lasers, and Energist command leading positions with extensive product ranges covering laser, radiofrequency, and ablation systems. It benefits from continuous product development and strategic collaborations between manufacturers and vascular clinics to refine device performance. Innovators target enhanced safety and efficiency to differentiate from mature competitors. It sees increasing patient preference for compact, minimally invasive platforms that facilitate office-based procedures. Geographic expansion into emerging markets represents a critical growth strategy. Regulatory approvals, clinician training support, and distributor partnerships shape competitive dynamics. Partnerships with medical centers support validation of new technologies. Price-competitive local entrants challenge global players in cost-sensitive regions. Market leaders continue to invest in R&D and clinician support to secure long-term growth.

Recent Developments:

- In July 2025, Teleflex Incorporated completed the acquisition of the Vascular Intervention business of Biotronik for €760 million. This acquisition significantly expands Teleflex’s portfolio of peripheral and coronary vascular intervention products, strengthening its position in the interventional market, including tools relevant to varicose veins treatment.

- In June 2023, Biolitec AG introduced the Elves Radial 2ring Pro laser fiber and the Leonardo 1940 laser, designed for minimally invasive varicose veins therapy. These products provide versatile laser solutions for treating both complex and smaller venous presentations, promising improved procedure outcomes and rapid convalescence.

Market Concentration & Characteristics

The Varicose Veins Treatment Devices Market remains moderately concentrated among key multinational manufacturers that control major market share and influence pricing and innovation dynamics. Medtronic, AngioDynamics, Biolitec, Lumenis, Teleflex, and Sciton dominate due to broad device portfolios and global distribution networks. It exhibits a tiered structure: Tier‑1 players maintain scale and brand recognition, while Tier‑2 and local firms compete on affordability and niche applications. It demands strong regulatory compliance, clinical validation, and post‑market clinician training, which favor established firms. Smaller regional players face barriers to entry including capital constraints and certification timelines. It sees specialization by device type—endovenous laser, radiofrequency, sclerotherapy—where manufacturers compete on efficacy and user interface. Strength of partnerships with clinics and training institutions plays a strategic role. Price sensitivity in emerging markets drives demand for lower‑cost systems. Market concentration remains stable but evolving as new device modalities enter the field.

Report Coverage:

The research report offers an in-depth analysis based on Type and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for minimally invasive varicose veins treatments will continue to rise due to growing patient preference for outpatient care.

- Technological advancements in ablation and imaging devices will enhance treatment precision and safety.

- Expansion of medical tourism in emerging regions will increase cross-border procedures and device demand.

- Integration of AI and diagnostic platforms will support better clinical decision-making and personalized treatment plans.

- Growing investments in vascular health infrastructure will widen access to advanced treatment options.

- Cosmetic awareness among younger demographics will boost adoption of aesthetic-focused vein therapies.

- Collaborations between hospitals and device manufacturers will accelerate clinical training and product innovation.

- Reimbursement policy improvements in developing countries will support broader market penetration.

- Local manufacturing and distribution partnerships will help address affordability and regulatory challenges.

- Increasing awareness campaigns and preventive screenings will drive early diagnosis and long-term market sustainability.