Market Overview

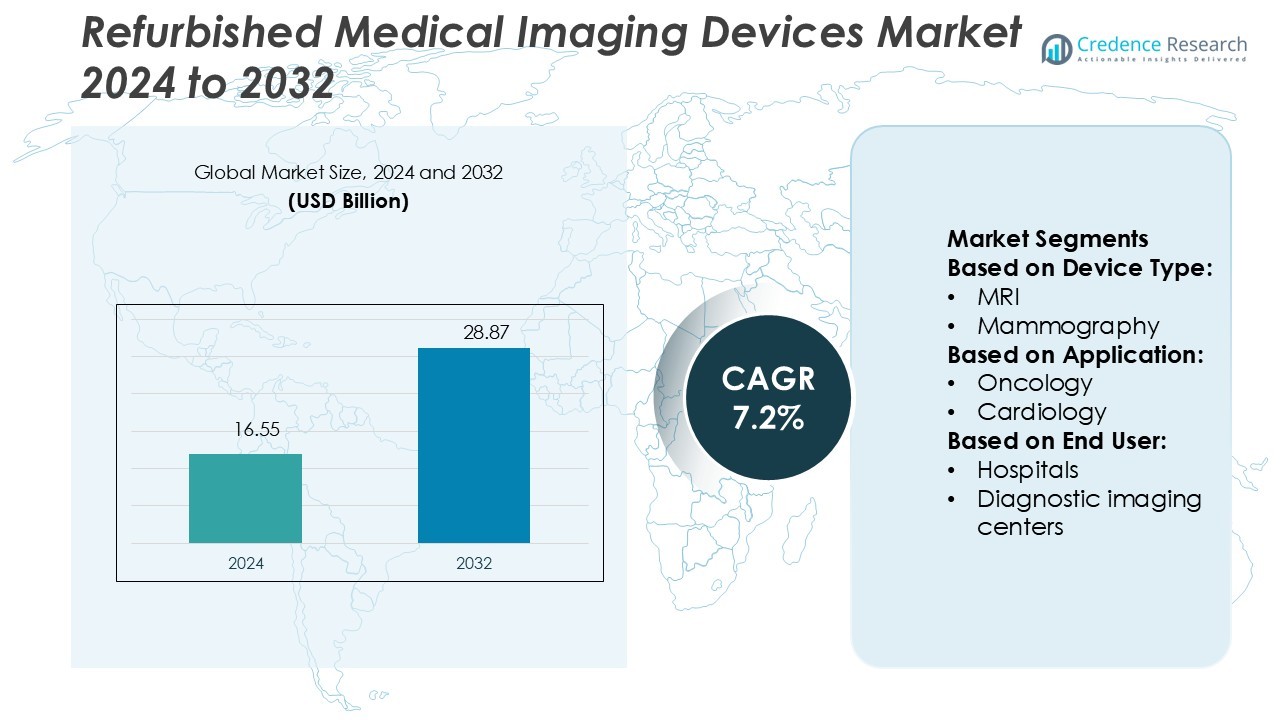

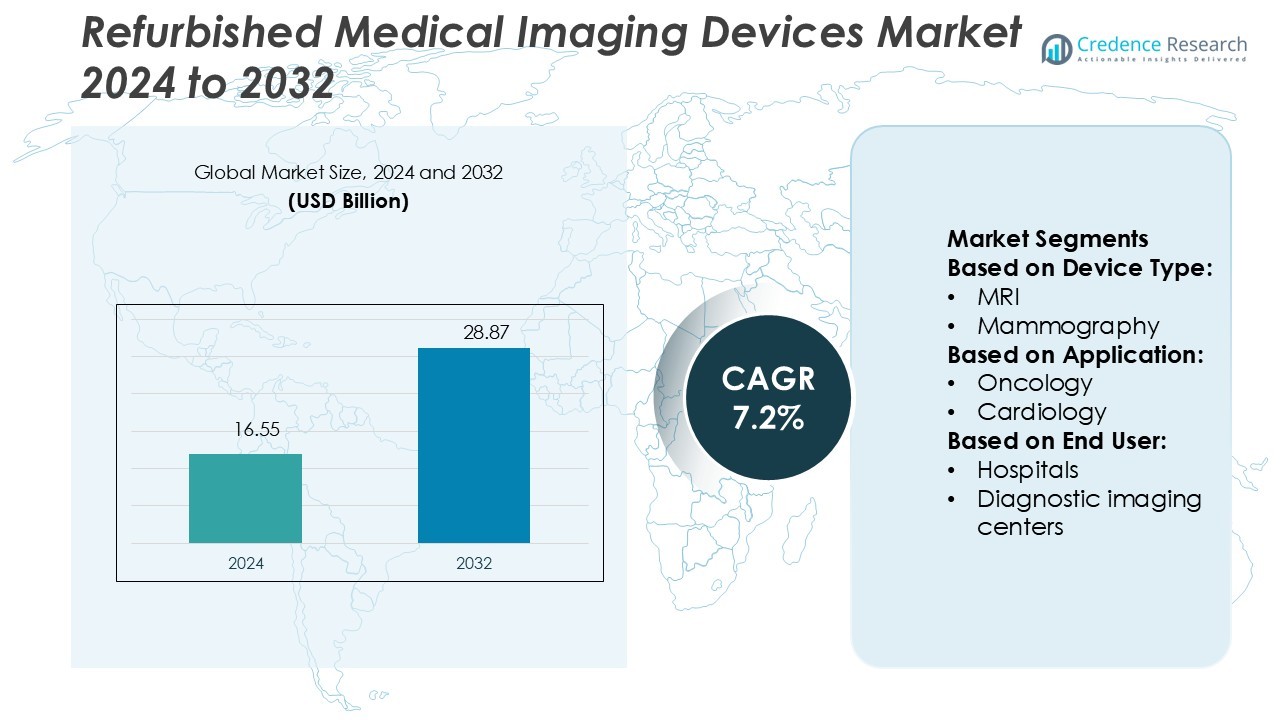

Refurbished Medical Imaging Devices Market size was valued USD 16.55 billion in 2024 and is anticipated to reach USD 28.87 billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refurbished Medical Imaging Devices Market Size 2024 |

USD 16.55 Billion |

| Refurbished Medical Imaging Devices Market, CAGR |

7.2% |

| Refurbished Medical Imaging Devices Market Size 2032 |

USD 28.87 Billion |

The refurbished medical imaging devices market is shaped by prominent players such as Hologic, Inc., Canon Medical Systems Corporation, Materialise, Siemens Healthineers, Esaote S.p.A, Hitachi, Ltd., TeraRecon, Samsung Medison, GE Healthcare, and Philips Healthcare. These companies focus on expanding their refurbished portfolios across X-ray, ultrasound, CT, and MRI systems while emphasizing quality assurance, sustainability, and service support. North America leads the global market with a 36% share, driven by well-established refurbishment standards, advanced healthcare infrastructure, and high adoption rates among hospitals and diagnostic centers. The region’s strong regulatory framework and significant presence of major refurbishers further reinforce its dominant position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The refurbished medical imaging devices market was valued at USD 16.55 billion in 2024 and is projected to reach USD 28.87 billion by 2032, growing at a CAGR of 7.2%.

- Rising demand for cost-effective diagnostic solutions and increasing chronic disease prevalence are driving adoption of refurbished X-ray, ultrasound, CT, and MRI systems across hospitals and diagnostic centers.

- Sustainability trends and technological advancements in refurbishment practices are reshaping the market, with companies focusing on circular economy models, quality assurance, and extended service support.

- The market faces restraints from regulatory variations and competition with advanced new imaging devices, though certifications and warranties are helping strengthen buyer confidence.

- North America dominates with 36% share due to strong refurbishment standards and healthcare infrastructure, while hardware remains the leading segment, particularly X-ray devices, supported by cost savings and widespread clinical applications across developed and emerging regions.

Market Segmentation Analysis:

By Device Type

The hardware segment dominates the refurbished medical imaging devices market, accounting for the largest share due to the high demand for cost-effective imaging systems. Within hardware, X-ray devices hold the leading position, supported by their widespread use in diagnostics, orthopedics, and emergency care. Hospitals and diagnostic centers increasingly adopt refurbished X-ray and ultrasound machines to reduce capital expenses while maintaining quality care. Drivers include affordability, shorter installation timelines, and technological upgrades by refurbishing companies, which extend equipment life cycles and ensure compliance with international safety standards.

- For instance, Hologic, Inc. has integrated its 3Dimensions™ mammography system into refurbishment programs, where the Clarity HD high-resolution detector captures images at 70-micron pixel size, improving lesion visibility while reducing patient dose—these upgrades extend clinical performance without requiring full replacement.

By Application

Oncology represents the largest application segment, capturing a dominant share as cancer detection and monitoring require advanced imaging solutions. Refurbished CT and MRI systems are particularly in demand, as they provide high-resolution scans at reduced costs, making them accessible for mid-sized hospitals and diagnostic centers. Rising cancer incidence and the need for frequent imaging drive demand, while cost efficiency allows facilities to expand screening programs. Drivers include government-backed cancer care initiatives, growing reliance on early diagnosis, and increased preference for refurbished solutions to manage long-term patient monitoring economically.

- For instance, Canon Medical Systems Corporation introduced its Aquilion ONE/GENESIS Edition CT, which features a 16 cm wide detector covering the entire heart in a single rotation with 640 slices and performs scans at 0.275-second rotation speed.

By End-user

Hospitals lead the end-user segment, holding the largest market share due to their large patient base and continuous need for diagnostic imaging. Budget constraints in small and mid-tier hospitals encourage adoption of refurbished systems, particularly X-ray, CT, and ultrasound devices. Drivers include cost savings of up to 30–40% compared to new equipment, reduced procurement lead times, and access to certified refurbished devices that meet international standards. Hospitals benefit from multi-modality installations, maintenance services, and warranty support offered by refurbishers, ensuring operational efficiency while addressing rising diagnostic demand.

Key Growth Drivers

Rising Demand for Cost-Effective Imaging Solutions

Healthcare providers increasingly turn to refurbished medical imaging devices as a cost-effective alternative to new equipment. Hospitals and diagnostic centers, particularly in emerging markets, face budget constraints that limit investment in advanced imaging technologies. Refurbished systems offer significant cost savings, often 30–50% less than new devices, without compromising diagnostic quality. This affordability allows wider adoption across small and mid-sized facilities. The growing demand for accessible diagnostic solutions drives strong market growth, making refurbished imaging equipment a strategic choice for expanding care services.

- For instance, Materialise developed its Mimics Innovation Suite, which generates precise 3D anatomical models by processing CT and MRI image data. While its speed depends on the dataset and hardware.

Expansion of Diagnostic Imaging Needs

The global rise in chronic diseases such as cancer, cardiovascular conditions, and neurological disorders has increased the need for advanced diagnostic imaging. Frequent imaging requirements for disease detection, monitoring, and follow-up fuel demand for accessible solutions. Refurbished CT, MRI, and ultrasound systems provide reliable imaging at reduced costs, enabling healthcare providers to handle growing patient volumes efficiently. This expansion of diagnostic imaging needs aligns with government-backed health programs and private healthcare investments, strengthening the role of refurbished devices in meeting clinical demand while ensuring operational efficiency.

- For instance, Siemens Healthineers’ MAGNETOM Free.Max MRI system operates at 0.55 Tesla with a 80 cm bore and supports whole-body imaging with helium-free cooling technology, reducing helium consumption to 0 liters compared to traditional systems requiring up to 1,500 liters.

Technological Advancements in Refurbishment Practices

Advancements in refurbishment technology enhance device performance, safety, and compliance with regulatory standards. Leading refurbishers adopt structured processes that include component replacement, calibration, and software upgrades, ensuring systems perform on par with new devices. Certifications and warranties improve buyer confidence, further driving adoption. Integration of AI-driven diagnostics and updated imaging software also extends device relevance in clinical settings. These advancements not only improve the reliability of refurbished systems but also make them attractive for healthcare facilities aiming to balance cost savings with high-quality diagnostic performance.

Key Trends & Opportunities

Growing Adoption in Emerging Markets

Emerging economies present strong opportunities for the refurbished medical imaging devices market due to limited healthcare budgets and increasing demand for affordable diagnostic care. Countries in Asia, Africa, and Latin America are investing in healthcare infrastructure while seeking cost-efficient solutions. Refurbished devices bridge the affordability gap, enabling wider access to imaging technologies like X-ray and ultrasound. This trend supports improved patient care in underserved regions, creating growth opportunities for refurbishers to expand distribution networks and partnerships with local healthcare providers.

- For instance, Hitachi’s Oasis MRI system uses a 1.2 Tesla superconducting magnet, with gradient performance of 33 mT/m amplitude and 100 T/m/s slew rate. The system supports 8 independent receiver channels as standard, with some later versions and specific coil configurations supporting up to 16 channels.

Shift Toward Sustainable Healthcare Practices

Sustainability is becoming a key trend in medical device procurement. Refurbished imaging systems support waste reduction and resource efficiency by extending equipment lifecycles and reducing e-waste. Hospitals and clinics increasingly recognize the environmental benefits of choosing refurbished devices alongside financial advantages. Governments and healthcare organizations promote circular economy practices, further encouraging adoption. This shift toward sustainable healthcare aligns with global efforts to reduce carbon footprints and positions refurbished medical imaging devices as both an economically and environmentally responsible solution for healthcare facilities worldwide.

- For instance, GE just launched its SIGNA Sprint 1.5T MRI system with gradient strength of 65 mT/m and slew rate of 200 T/m/s per axis, plus a 70 cm wide bore, enabling faster scans even of larger patients.

Key Challenges

Regulatory and Quality Concerns

Variability in refurbishment standards across regions creates challenges in ensuring consistent quality and compliance. Some markets lack clear regulations, leading to uncertainty among buyers regarding device safety and performance. Concerns about warranty coverage, certification, and after-sales service also limit adoption in certain geographies. Healthcare providers remain cautious when purchasing refurbished systems without robust regulatory oversight. This challenge emphasizes the need for standardized frameworks, third-party certifications, and transparent processes to build trust and expand market acceptance globally.

Competition with New Medical Imaging Devices

The rapid introduction of technologically advanced imaging devices poses a significant challenge for refurbished systems. Healthcare providers with higher budgets prefer investing in new equipment offering cutting-edge features, such as AI-powered imaging, faster scan times, and advanced visualization. This technological gap creates pressure on refurbishers to continuously upgrade and validate older systems. Additionally, manufacturers of new devices often promote financing and leasing models that reduce cost barriers, further intensifying competition. This challenge requires refurbishers to highlight cost advantages and continuous technology upgrades to remain competitive.

Regional Analysis

North America

North America leads the refurbished medical imaging devices market with a 36% share, driven by strong healthcare infrastructure and high adoption of advanced diagnostic systems. Hospitals and diagnostic centers benefit from established refurbishment standards and warranty-backed products, which enhance buyer confidence. Rising healthcare costs and favorable reimbursement frameworks further accelerate adoption of cost-effective solutions. The U.S. dominates the regional market, supported by the presence of major refurbishers and regulatory clarity. Canada also contributes significantly, with increased demand for refurbished ultrasound and X-ray systems in mid-sized healthcare facilities focusing on budget optimization.

Europe

Europe holds a 28% share of the refurbished medical imaging devices market, supported by robust healthcare policies and a growing emphasis on sustainability. Countries such as Germany, the UK, and France lead adoption, driven by stringent quality standards and well-regulated refurbishment practices. Hospitals and diagnostic centers prioritize refurbished CT and MRI devices to balance affordability with clinical performance. The European Union’s focus on circular economy initiatives further encourages the uptake of refurbished systems. Eastern Europe represents an emerging sub-market, with increasing healthcare investments and rising demand for affordable imaging equipment across expanding diagnostic networks.

Asia Pacific

Asia Pacific accounts for 22% of the market, representing one of the fastest-growing regions due to rapid healthcare infrastructure development and growing diagnostic needs. Countries like China, India, and Japan drive demand with rising patient volumes and budget-conscious healthcare facilities. Refurbished ultrasound and X-ray devices dominate adoption, enabling smaller hospitals and diagnostic centers to expand imaging services affordably. Supportive government programs for affordable healthcare create favorable opportunities. Increasing partnerships between global refurbishers and local distributors enhance market penetration, positioning Asia Pacific as a strategic growth hub in the global refurbished medical imaging devices market.

Latin America

Latin America captures a 9% market share, with Brazil and Mexico emerging as leading countries in refurbished medical imaging adoption. Limited healthcare budgets and a growing burden of chronic diseases drive demand for cost-effective diagnostic solutions. Refurbished X-ray and ultrasound devices are widely utilized in public hospitals and private diagnostic centers to expand imaging capabilities. Regulatory frameworks are gradually strengthening, improving buyer confidence and market growth. Regional players collaborate with global refurbishers to expand product availability, while increasing investments in healthcare infrastructure further boost adoption of refurbished devices across underserved areas.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the refurbished medical imaging devices market, primarily driven by affordability challenges and the need to expand diagnostic capabilities. Countries such as South Africa, Saudi Arabia, and the UAE are leading adopters, with refurbished systems filling the gap in resource-limited healthcare environments. Ultrasound and X-ray devices dominate due to their broad diagnostic applications and cost efficiency. Growth is supported by increasing government and private investments in healthcare infrastructure, along with partnerships between refurbishers and regional distributors to improve accessibility and service support.

Market Segmentations:

By Device Type:

By Application:

By End User:

- Hospitals

- Diagnostic imaging centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The refurbished medical imaging devices market is highly competitive, with key players including Hologic, Inc., Canon Medical Systems Corporation, Materialise, Siemens Healthineers, Esaote S.p.A, Hitachi, Ltd., TeraRecon, Samsung Medison, GE Healthcare, and Philips Healthcare. The refurbished medical imaging devices market features strong competition, shaped by certified refurbishment programs, advanced quality assurance, and strategic global distribution networks. Companies in this space focus on delivering affordable yet reliable solutions across modalities such as X-ray, ultrasound, CT, and MRI to meet the growing diagnostic demand in hospitals and imaging centers. Market players emphasize sustainability by extending equipment lifecycles and integrating circular economy practices, while also offering extended warranties and after-sales services to strengthen customer confidence. Additionally, advancements in imaging software, AI-driven diagnostics, and 3D visualization tools further enhance refurbished systems, ensuring their continued relevance and competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hologic, Inc.

- Canon Medical Systems Corporation

- Materialise

- Siemens Healthineers

- Esaote S.p.A

- Hitachi, Ltd.

- TeraRecon

- Samsung Medison

- GE Healthcare

- Philips Healthcare

Recent Developments

- In April 2025, Master Medical Equipment announced its membership with the Health Industry Distributors Association (HIDA), a strategic partnership aimed at enhancing their commitment to healthcare distribution excellence and strengthening their position in the refurbished medical equipment market.

- In January 2025, Henry Schein reported a strategic investment from KKR, which acquired a 12% stake in the company to support strategic growth and operational excellence in healthcare distribution and services.

- In March 2024, GE Healthcare developed its latest research model, SonoSAMTrack1, utilizing NVIDIA technology. This innovative model is built upon a promptable foundational model known as SonoSAM1, which is designed for object segmentation in ultrasound imagery.

- In January 2024, Canon introduced Aplio me, a cutting-edge shared-service ultrasound system engineered to address the varied needs of everyday users in a broad range of medical environments.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as healthcare providers continue seeking cost-effective imaging solutions.

- Refurbished X-ray and ultrasound devices will remain the most widely adopted modalities.

- Advancements in refurbishment technology will enhance reliability and extend equipment lifecycles.

- Increased adoption in emerging economies will drive significant growth opportunities.

- Sustainability initiatives will strengthen the role of refurbished systems in circular healthcare models.

- Partnerships between global refurbishers and local distributors will improve market penetration.

- Software upgrades and AI integration will boost the value of refurbished imaging systems.

- Hospitals will continue to dominate demand due to large patient bases and budget constraints.

- Regulatory standardization across regions will improve buyer confidence and adoption rates.

- Competitive pricing and service packages will remain key strategies for market players.