Market Overview

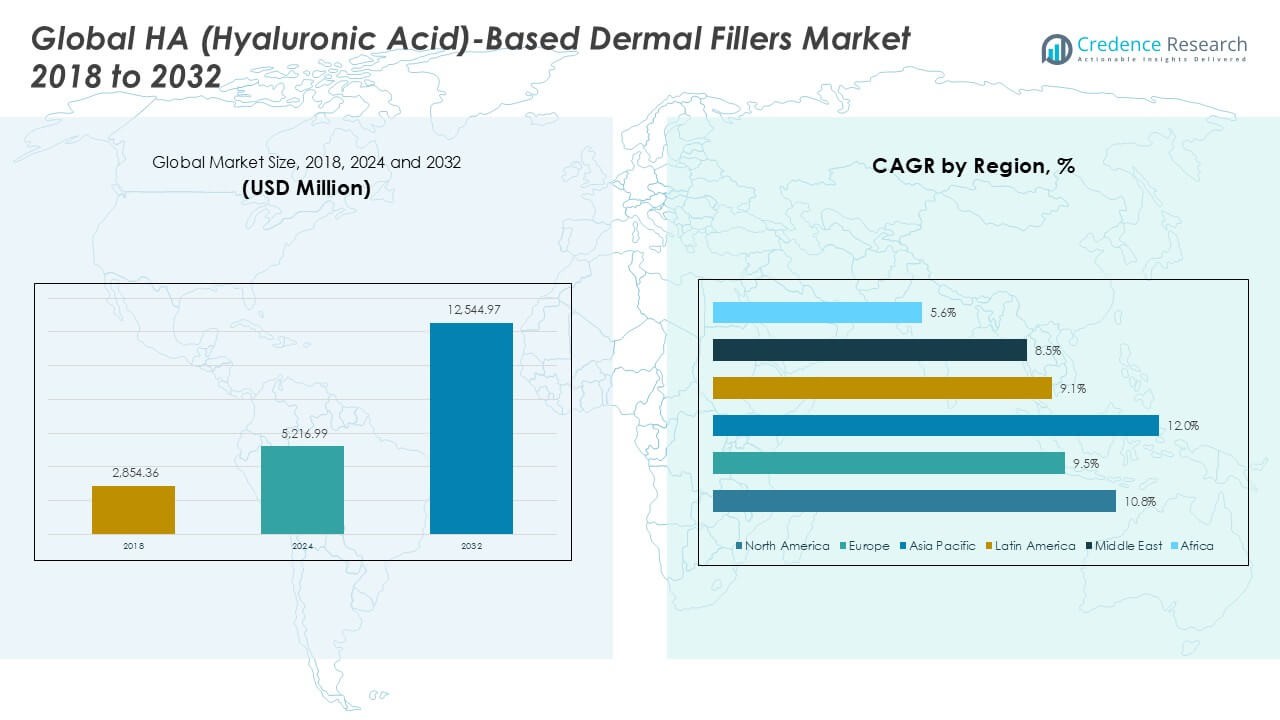

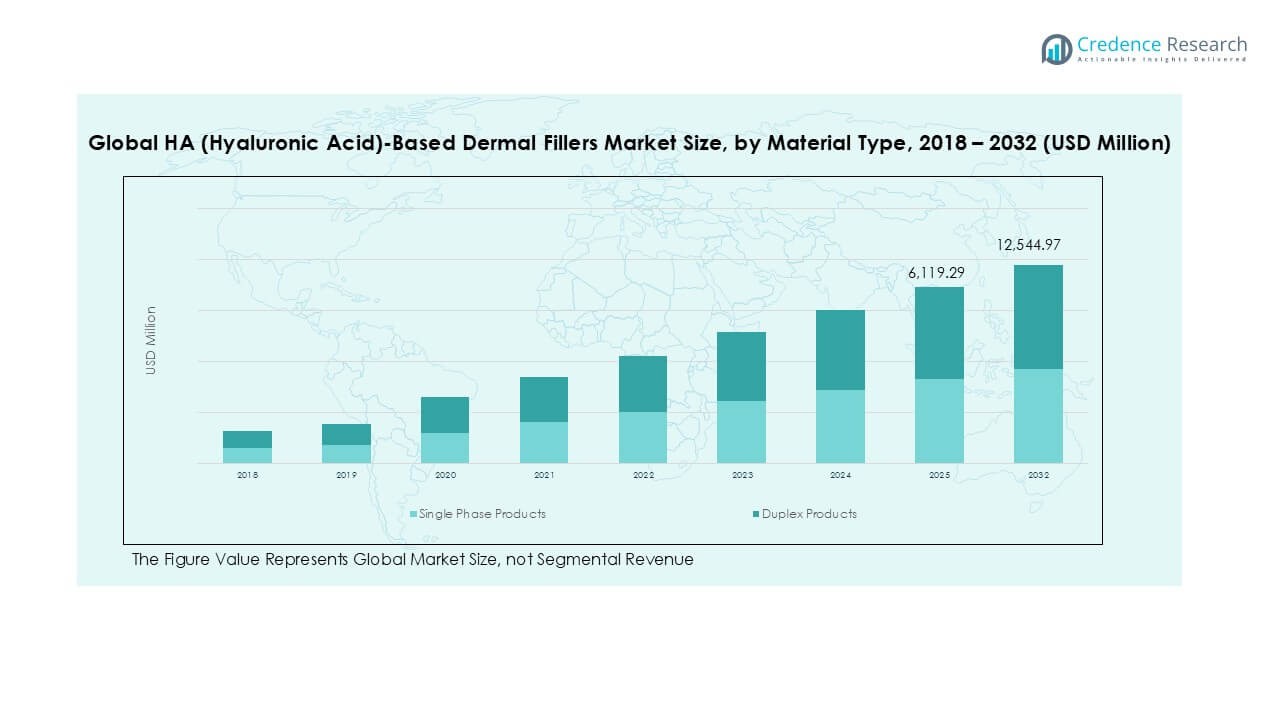

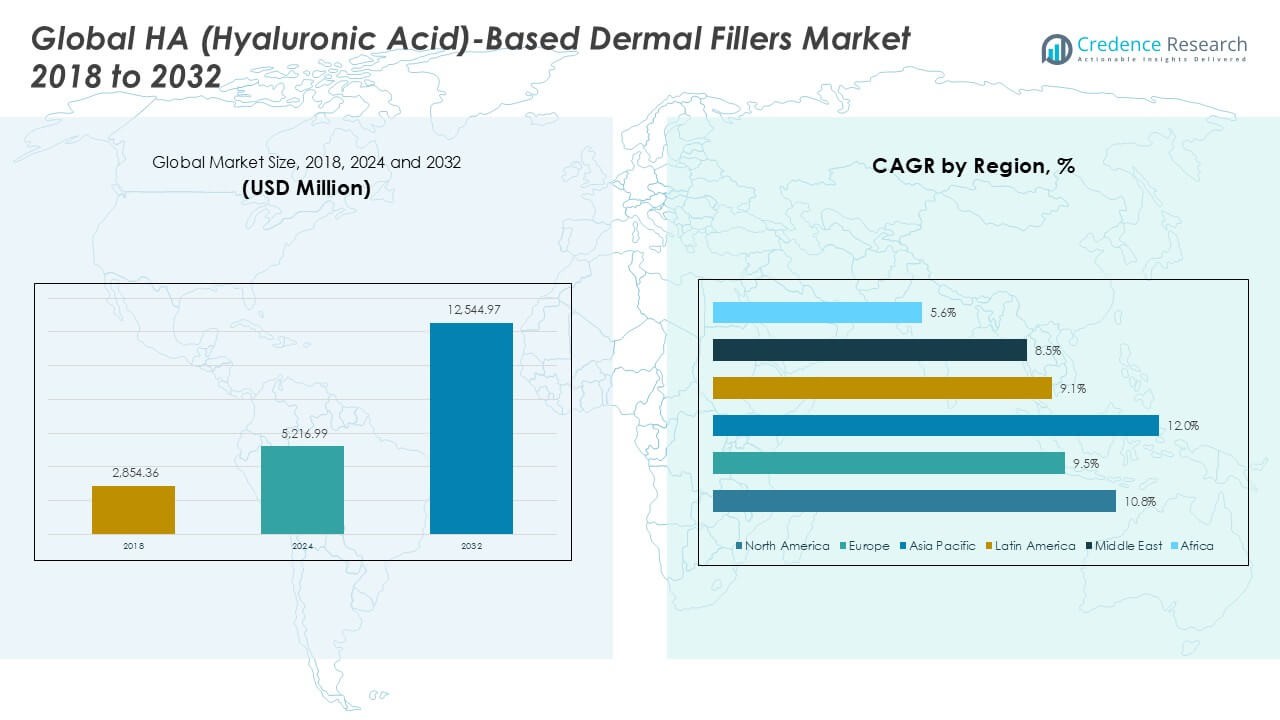

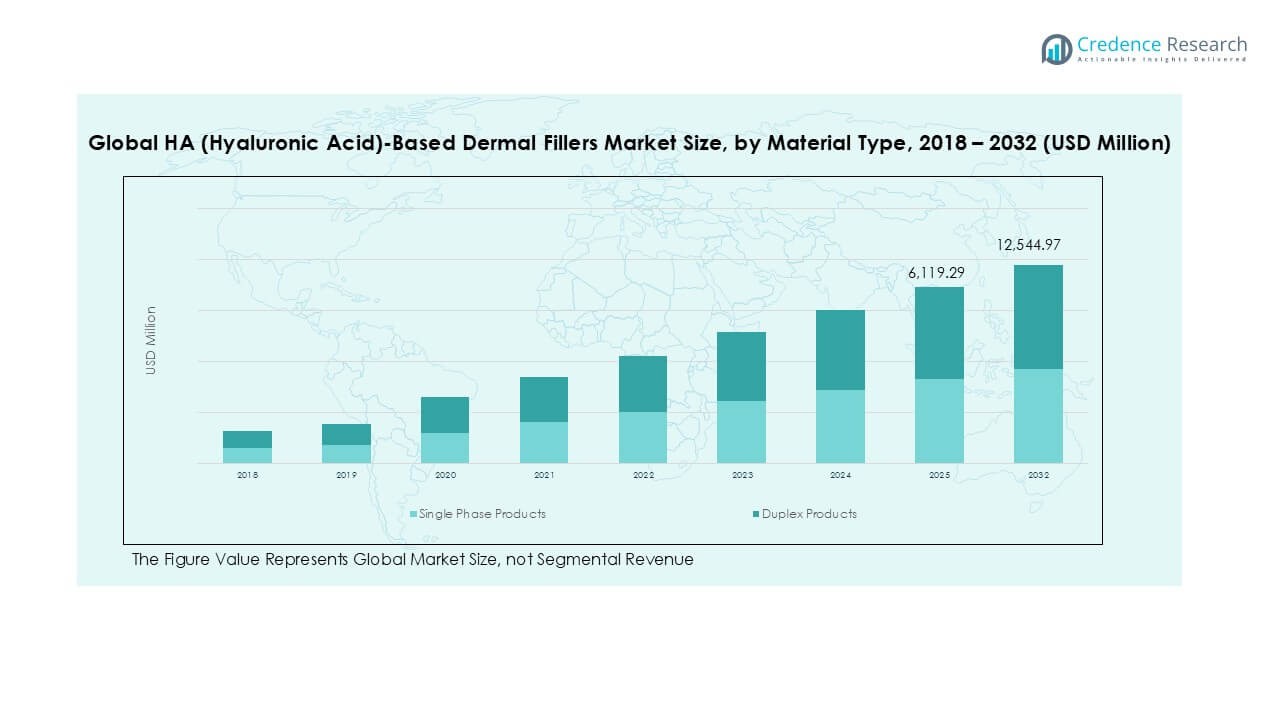

The Hyaluronic Acid-Based Dermal Fillers Market size was valued at USD 2,854.36 million in 2018 and reached USD 5,216.99 million in 2024. It is anticipated to grow significantly, reaching USD 12,544.97 million by 2032, expanding at a CAGR of 10.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyaluronic Acid-Based Dermal Fillers Market Size 2024 |

USD 5,216.99 Million |

| Hyaluronic Acid-Based Dermal Fillers Market , CAGR |

10.80% |

| Hyaluronic Acid-Based Dermal Fillers Market Size 2032 |

USD 12,544.97 Million |

The HA (Hyaluronic Acid)-based dermal fillers market is led by key players such as Allergan, Galderma Laboratories, Merz Pharmaceuticals, LG Chem, and Anika Therapeutics, each offering a broad portfolio of advanced aesthetic products. These companies maintain strong market positions through continuous innovation, global distribution networks, and physician-focused marketing strategies. Allergan and Galderma, in particular, dominate with established flagship brands and widespread practitioner adoption. North America emerges as the leading region, accounting for 43.3% of the global market share in 2024, driven by high consumer awareness, demand for minimally invasive procedures, and the strong presence of certified dermatology clinics. Europe and Asia Pacific follow, with Asia Pacific registering the fastest growth due to rising aesthetic consciousness and expanding healthcare infrastructure. The market’s competitive dynamics are shaped by technological advancement, regulatory approvals, and strategic partnerships aimed at expanding both product capabilities and regional footprints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The HA-based dermal fillers market was valued at USD 5,216.99 million in 2024 and is projected to reach USD 12,544.97 million by 2032, growing at a CAGR of 10.80% during the forecast period.

- Market growth is driven by the rising demand for minimally invasive aesthetic procedures, aging populations seeking anti-aging solutions, and increasing awareness of facial aesthetics globally.

- A key trend includes the growing preference for personalized treatment plans and combination therapies, along with technological advancements in filler formulations offering longer-lasting and natural-looking results.

- The competitive landscape features dominant players such as Allergan, Galderma Laboratories, and Merz Pharmaceuticals, while new entrants are focusing on niche innovations; however, market growth is restrained by high treatment costs, regulatory complexities, and safety concerns with untrained practitioners.

- North America holds the largest regional share at 43.3%, while the Single Phase Products and Wrinkle Removal segments lead by product and application, respectively, due to their wide usage and patient preference.

Market Segmentation Analysis:

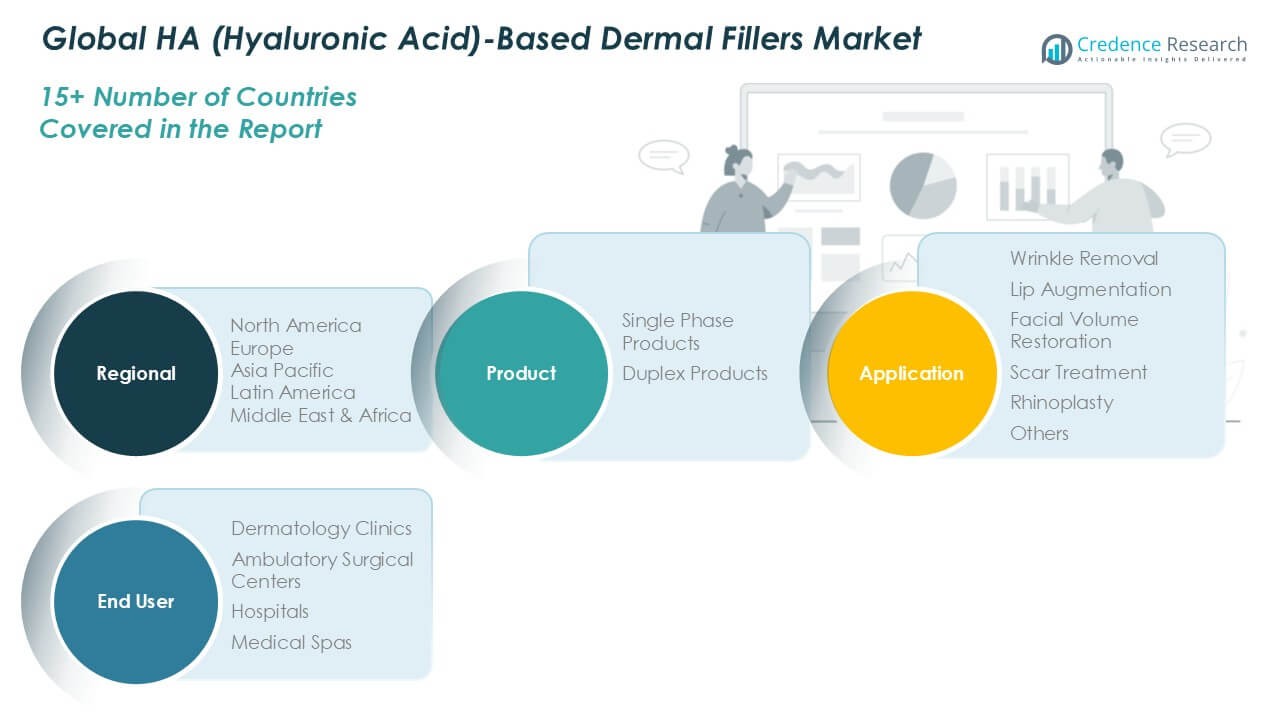

By Product

In the HA-based dermal fillers market, Single Phase Products dominate the product segment, accounting for the largest market share in 2024. These fillers offer smoother consistency and easier injection properties, making them highly preferred by dermatologists and aesthetic practitioners. The demand for single-phase fillers is further driven by their extended durability, reduced risk of allergic reactions, and natural-looking results. Moreover, the increasing adoption of minimally invasive cosmetic procedures and technological advancements in filler formulations continue to support the growth of this sub-segment over duplex products, which are still gaining traction.

- For instance, Galderma’s Restylane® Kysse utilizes XpresHAn Technology™, enabling enhanced tissue integration with over 95% patient satisfaction reported in clinical trials.

By Application:

Wrinkle Removal holds the dominant share within the application segment of the HA-based dermal fillers market. This dominance is attributed to the rising aging population and the growing demand for non-surgical solutions to address facial lines and wrinkles. Consumers increasingly seek safe, effective, and quick recovery options to maintain youthful appearances, which has boosted the use of HA fillers in wrinkle treatment. Additionally, strong marketing campaigns, growing social acceptance of aesthetic enhancements, and innovations in filler technologies have contributed to the expanding use of HA-based fillers in wrinkle correction over other applications like lip augmentation or scar treatment.

- For instance, Allergan’s Juvéderm® Ultra XC demonstrated significant wrinkle improvement in over 80% of patients at the 24-week clinical evaluation mark.

By End User:

Dermatology Clinics represent the leading end-user segment in the HA-based dermal fillers market, capturing the highest revenue share in 2024. This dominance is driven by the accessibility, specialization, and trusted expertise these clinics provide in cosmetic dermatology. Patients often prefer clinics for personalized consultations and skilled professionals capable of performing advanced aesthetic procedures. The rise in outpatient aesthetic treatments, coupled with the growing number of certified dermatology clinics globally, further supports this segment’s growth. In comparison, medical spas and ambulatory surgical centers are emerging but have yet to match the procedural volume and patient trust associated with dermatology clinics.

Key Growth Drivers

Rising Demand for Minimally Invasive Aesthetic Procedures

The growing consumer inclination toward non-surgical and minimally invasive aesthetic treatments significantly drives the HA-based dermal fillers market. These procedures offer shorter recovery times, lower risks, and cost-effective alternatives to traditional plastic surgeries. With increasing awareness of facial aesthetics and advancements in injection techniques, demand has surged globally. Millennials and Gen Z populations, influenced by social media and beauty standards, are increasingly opting for these treatments to enhance appearance, thereby boosting the adoption of HA-based fillers across clinics and medical spas.

- For instance, Merz Aesthetics launched Belotero Revive in over 20 countries within two years of CE mark approval, reflecting swift procedural uptake among younger demographics.

Aging Population and Growing Focus on Anti-Aging Solutions

Global demographic shifts, especially in developed nations, have led to a rapidly aging population seeking effective anti-aging treatments. HA-based dermal fillers help restore volume, reduce wrinkles, and rejuvenate skin, making them highly popular among individuals aged 40 and above. As longevity increases and older populations remain socially and professionally active, the demand for non-invasive aesthetic enhancements is accelerating. The preference for natural-looking, temporary yet effective results positions HA-based fillers as a leading solution in age-related cosmetic correction.

- For instance, LG Chem’s Yvoire Volume S achieved over 1.2 million annual syringes sold globally, largely driven by patients aged 45 and above seeking volume restoration.

Advancements in Filler Technology and Product Customization

Technological innovations in filler formulation and delivery methods have improved product performance, safety, and longevity. Cross-linking technologies have extended filler durability and enhanced their elasticity and integration into skin tissues. Moreover, manufacturers are introducing tailored solutions for specific facial areas—such as lips, cheeks, and under-eyes—offering practitioners better precision and results. The availability of customized, targeted fillers catering to varied aesthetic goals has broadened the consumer base and enhanced patient satisfaction, driving further market penetration.

Key Trends & Opportunities

Expansion of Aesthetic Procedures in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing a surge in demand for aesthetic procedures, including HA-based dermal fillers. Rising disposable income, increased awareness of cosmetic enhancements, and growing access to aesthetic clinics have contributed to this expansion. Medical tourism, particularly in countries like South Korea, Thailand, and Brazil, also plays a pivotal role. Global brands are investing in local partnerships and marketing strategies to tap into these high-growth regions, unlocking significant opportunities for future market expansion.

- For instance, BioPlus Co. Ltd. increased its overseas shipments of Dermalax® fillers by 48,721 units to Southeast Asian clinics within a single fiscal year.

Integration of Combination Therapies and Personalized Treatments

A growing trend in aesthetic medicine is the integration of dermal fillers with other cosmetic treatments such as botulinum toxin injections, laser resurfacing, and skin tightening procedures. This multimodal approach delivers more comprehensive and long-lasting results, attracting consumers seeking holistic rejuvenation. Additionally, there is rising demand for personalized treatment plans tailored to individual facial anatomy and aesthetic goals. This trend encourages practitioners to use data-driven assessments and targeted product selections, improving patient outcomes and satisfaction levels.

Key Challenges

Stringent Regulatory Requirements and Approval Delays

HA-based dermal fillers fall under medical device regulations in many countries, requiring thorough safety and efficacy evaluations before market approval. Varying regulatory frameworks across regions often lead to delayed product launches and increased compliance costs. Additionally, obtaining clinical trial data and securing approvals from regulatory agencies such as the U.S. FDA or the European Medicines Agency can be time-consuming. These hurdles limit rapid innovation and global expansion, especially for smaller or new market entrants.

- For instance, Anika Therapeutics faced a 13-month delay in U.S. market entry for its HA-based filler due to extended FDA review and additional post-market surveillance requirements.

Concerns Over Adverse Effects and Practitioner Expertise

While HA-based fillers are generally considered safe, concerns over side effects such as allergic reactions, vascular complications, or improper placement continue to affect consumer confidence. The outcome of filler treatments is highly dependent on practitioner expertise, and unqualified or poorly trained professionals can lead to suboptimal or harmful results. This risk underlines the need for proper training, certification, and patient education. As a result, regulatory bodies are placing increasing emphasis on safety protocols and practitioner qualifications.

High Treatment Costs and Limited Insurance Coverage

Despite growing demand, the relatively high cost of HA-based dermal filler treatments can restrict accessibility, particularly in cost-sensitive or uninsured populations. Most aesthetic procedures are considered elective and thus not covered by health insurance plans, requiring full out-of-pocket payment by patients. This financial barrier limits the frequency and adoption rate of such procedures, especially in developing markets. Providers must strike a balance between quality, affordability, and value to broaden patient reach and market adoption.

Regional Analysis

North America:

North America held the largest share of the HA-based dermal fillers market in 2024, accounting for approximately 43.3% of the global market with a value of USD 2,257.94 million, up from USD 1,248.33 million in 2018. This dominance is driven by the widespread adoption of minimally invasive cosmetic procedures, high consumer spending on aesthetics, and strong presence of key market players. With a projected CAGR of 10.8%, the market is expected to reach USD 5,444.58 million by 2032, supported by continuous product innovations, regulatory approvals, and growing demand for anti-aging solutions across dermatology clinics and medical spas.

- For instance, Allergan’s U.S.-based training network supported over 39,000 aesthetic professionals through the Allergan Medical Institute, significantly strengthening product application expertise in the region.

Europe:

Europe captured a significant market share of 17.5% in 2024, with the HA-based dermal fillers market reaching USD 913.01 million, up from USD 528.72 million in 2018. The region is marked by high awareness of aesthetic enhancements and an aging population seeking non-surgical rejuvenation treatments. With a CAGR of 9.5%, the market is projected to grow to USD 1,994.73 million by 2032. European countries such as Germany, France, and the UK are leading contributors, driven by robust healthcare infrastructure, favorable reimbursement scenarios in selective cases, and growing demand for facial enhancement procedures.

- For instance, Teoxane Laboratories, headquartered in Switzerland, reported distribution of over 2.4 million syringes across 90 European clinics in a single year through its Teosyal® range.

Asia Pacific:

Asia Pacific is the fastest-growing regional market, registering a CAGR of 12.0%. In 2024, it reached USD 1,609.89 million, rising from USD 834.76 million in 2018, and is projected to reach USD 4,217.93 million by 2032, holding a 30.9% share of the global market. Growth is propelled by rising disposable incomes, increasing popularity of aesthetic treatments, and the influence of social media beauty trends, especially in countries like South Korea, China, and Japan. Additionally, the expansion of medical tourism and affordable cosmetic procedures in the region continue to attract both local and international consumers.

Latin America:

Latin America accounted for 4.7% of the HA-based dermal fillers market in 2024, with a value of USD 243.94 million, growing from USD 135.14 million in 2018. The region is expected to expand at a CAGR of 9.1%, reaching USD 519.33 million by 2032. The market is primarily driven by increasing urbanization, rising awareness about aesthetic procedures, and the growth of cosmetic medical tourism, particularly in Brazil and Mexico. Improved access to skilled professionals and the rising influence of Western beauty standards are further fueling the adoption of HA-based dermal fillers across the region.

Middle East:

The Middle East region captured a 2.6% market share in 2024, with the market reaching USD 134.15 million, up from USD 80.26 million in 2018. Projected to grow at a CAGR of 8.5%, the market is expected to attain USD 272.40 million by 2032. The rising interest in cosmetic procedures among affluent consumers, increasing investment in aesthetic clinics, and cultural acceptance of aesthetic enhancement contribute to regional growth. Countries such as the UAE and Saudi Arabia are witnessing a surge in demand due to improved healthcare infrastructure and growing medical tourism in cosmetic dermatology.

Africa:

Africa accounted for a modest 1.1% share of the global HA-based dermal fillers market in 2024, with the market valued at USD 58.08 million, increasing from USD 27.15 million in 2018. The region is forecasted to grow at a CAGR of 5.6%, reaching USD 95.99 million by 2032. Growth is gradually improving due to rising urbanization, increasing awareness of aesthetic procedures, and expanding access to cosmetic treatments in urban centers. However, limited healthcare infrastructure, affordability issues, and lower disposable income continue to pose challenges for rapid market penetration across the continent.

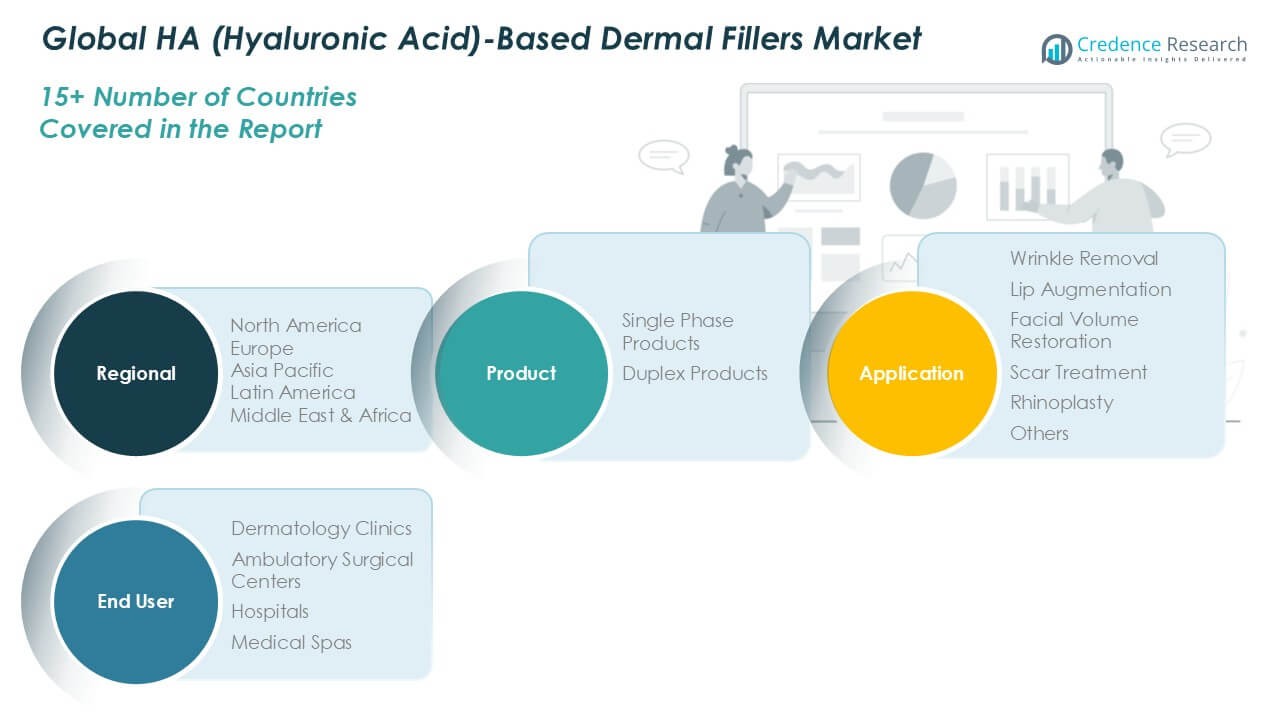

Market Segmentations:

By Product:

- Single Phase Products

- Duplex Products

By Application:

- Wrinkle Removal

- Lip Augmentation

- Facial Volume Restoration

- Scar Treatment

- Rhinoplasty

- Others

By End User:

- Dermatology Clinics

- Ambulatory Surgical Centers

- Hospitals

- Medical Spas

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the HA (Hyaluronic Acid)-based dermal fillers market is characterized by the presence of several prominent players focused on innovation, global expansion, and product differentiation. Key companies such as Allergan, Galderma Laboratories, Merz Pharmaceuticals, and LG Chem dominate the market with extensive product portfolios, robust distribution networks, and strong brand recognition. These firms continually invest in R&D to develop advanced formulations that offer longer-lasting effects, improved safety profiles, and targeted applications for facial aesthetics. Strategic collaborations, mergers, and acquisitions are frequently employed to enhance market presence and expand geographic reach. New entrants and smaller companies, including Bioxis Pharmaceutical and Anika Therapeutics, are leveraging niche innovations and localized strategies to gain traction. Additionally, companies are focusing on physician training and awareness campaigns to strengthen customer loyalty and procedure adoption. As consumer demand for minimally invasive aesthetic treatments grows, competition is expected to intensify, driving further advancements and pricing strategies across global markets.

- For instance, Galderma conducted over 3,800 clinical workshops globally under its AART program to ensure standardized injection techniques and physician proficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Allergan

- Galderma Laboratories

- Genzyme Corporation

- Anika Therapeutics Inc.

- Sculpt Luxury

- Dermal Fillers Ltd.

- Bioxis Pharmaceutical

- Merz Pharmaceuticals

- LG Life Sciences

- LTD (LG Chem)

- Bio plus Co. Ltd.

Recent Developments

- In June 2025, Allergan’s SKINVIVE by JUVÉDERM received FDA review for neck appearance improvement, potentially becoming the first hyaluronic acid (HA) microdroplet injectable approved for this specific use in the U.S.

- In June 2023, Galderma Laboratories launched Restylane Eyelight, a hyaluronic acid dermal filler utilizing NASHA Technology specifically designed for treating undereye hollows. This filler is intended to reduce shadows and improve the overall appearance of the under-eye area, with results potentially lasting up to 18 months. It’s the first and only product in the U.S. to use NASHA Technology for this purpose.

- In August 2022, AbbVie received FDA approval for JUVÉDERM VOLUX XC, as a hyaluronic acid based filler to improve jawline definition. It is the first product to receive this certification.

- In June 2022, Prollenium Medical Technologies acquired SoftFil for an undisclosed amount. SoftFil is a France-based aesthetic medicine company.

- In April 2022, Sinclair Company introduced Perfectha Lidocaine, a hyaluronic acid-based dermal filler for wrinkle removal, facial contouring, and facial volume restoration.

Market Concentration & Characteristics

The HA (Hyaluronic Acid)-Based Dermal Fillers Market demonstrates a moderately concentrated structure, with a few key players holding a significant share of global revenue. Companies such as Allergan, Galderma Laboratories, and Merz Pharmaceuticals lead the market through established product lines, widespread physician adoption, and strong geographic reach. It reflects high brand loyalty among dermatologists and end users, largely due to clinical performance, safety profiles, and practitioner support. The market favors companies that invest in research and development to create advanced formulations with improved longevity and targeted applications. Entry barriers remain high due to regulatory requirements, product approval timelines, and the need for medical expertise in administration. It shows a strong preference for products that deliver natural-looking results with minimal downtime. Consumer trust in practitioner skill and product quality shapes purchasing behavior. Established regions like North America and Europe contribute the most to global revenues, while Asia Pacific shows the fastest growth in procedure volumes and product adoption.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily driven by rising demand for non-surgical aesthetic procedures.

- Aging populations across developed regions will increase the use of HA-based fillers for wrinkle reduction and facial volume restoration.

- Technological advancements will lead to the development of longer-lasting and more natural-looking dermal filler products.

- North America will maintain its leading market position due to strong consumer spending and high practitioner expertise.

- Asia Pacific will experience the fastest growth due to expanding medical tourism, increasing awareness, and growing disposable income.

- Single phase products will remain the preferred choice among practitioners due to ease of use and consistent outcomes.

- Wrinkle removal will continue to lead among applications, supported by broad consumer demand across age groups.

- Dermatology clinics will retain dominance among end users due to trusted expertise and growing procedural volumes.

- Companies will increase focus on physician training and safety protocols to enhance treatment outcomes and brand loyalty.

- Regulatory clarity and market expansion into underserved regions will shape long-term industry growth strategies.