Market Overview

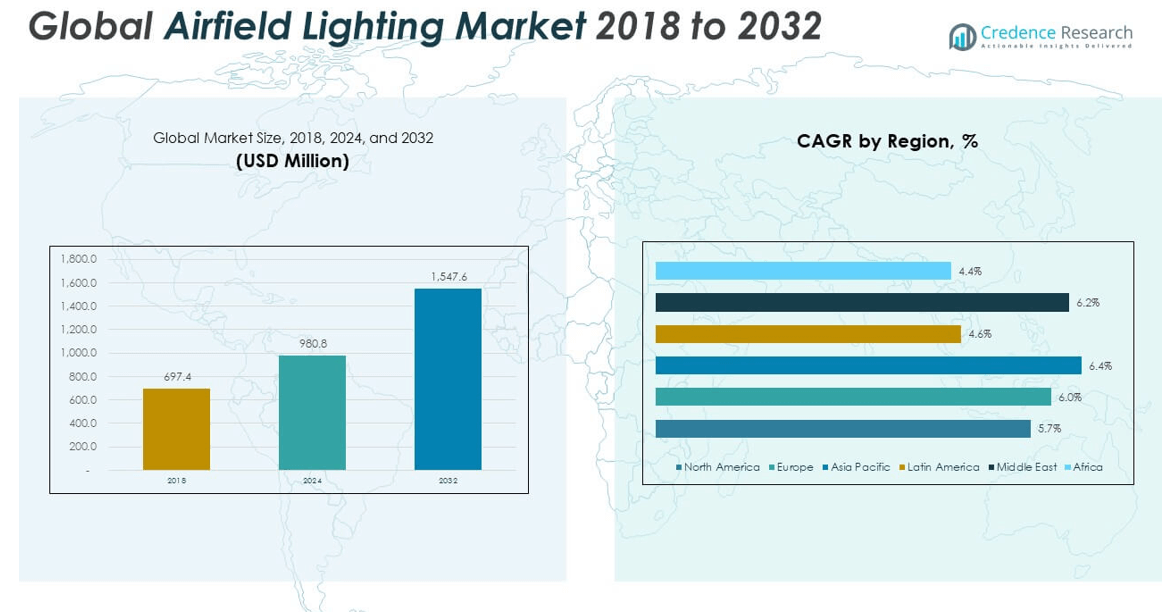

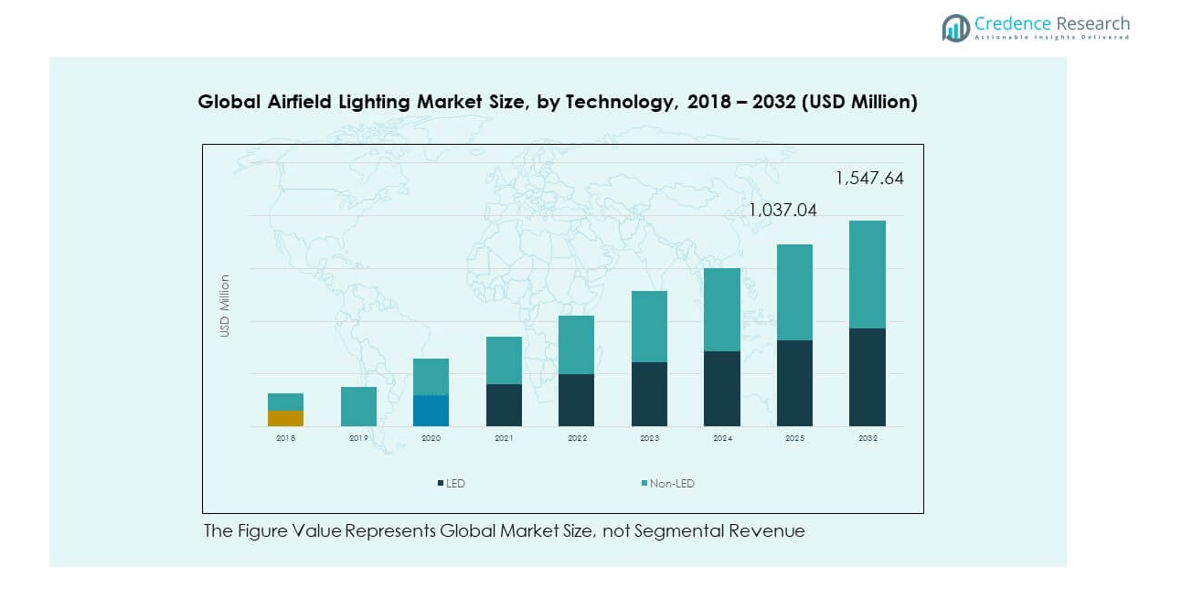

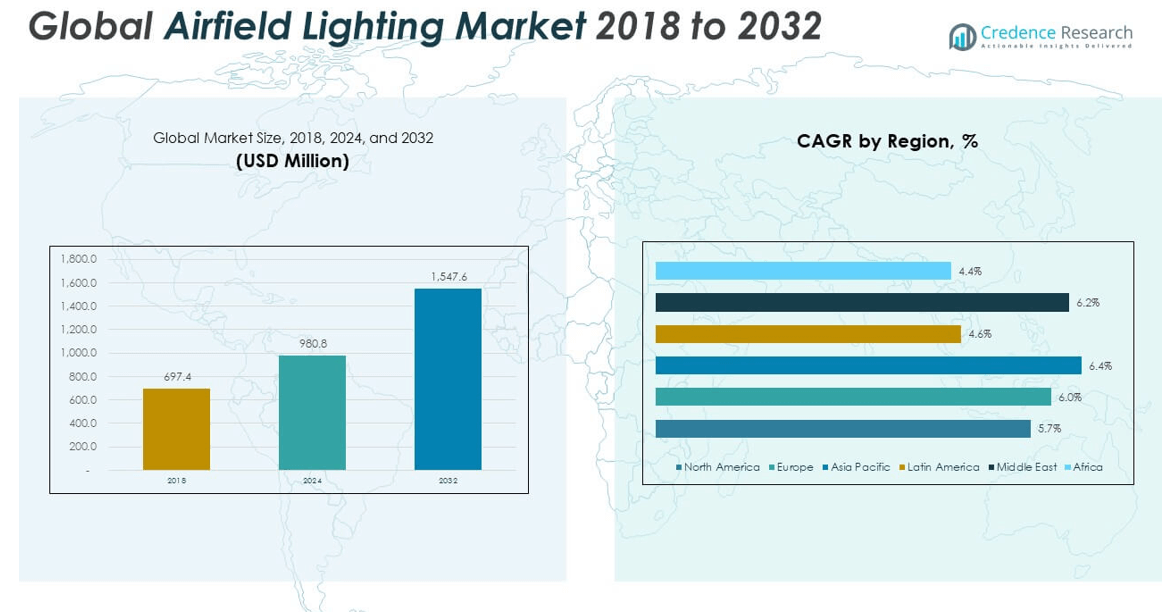

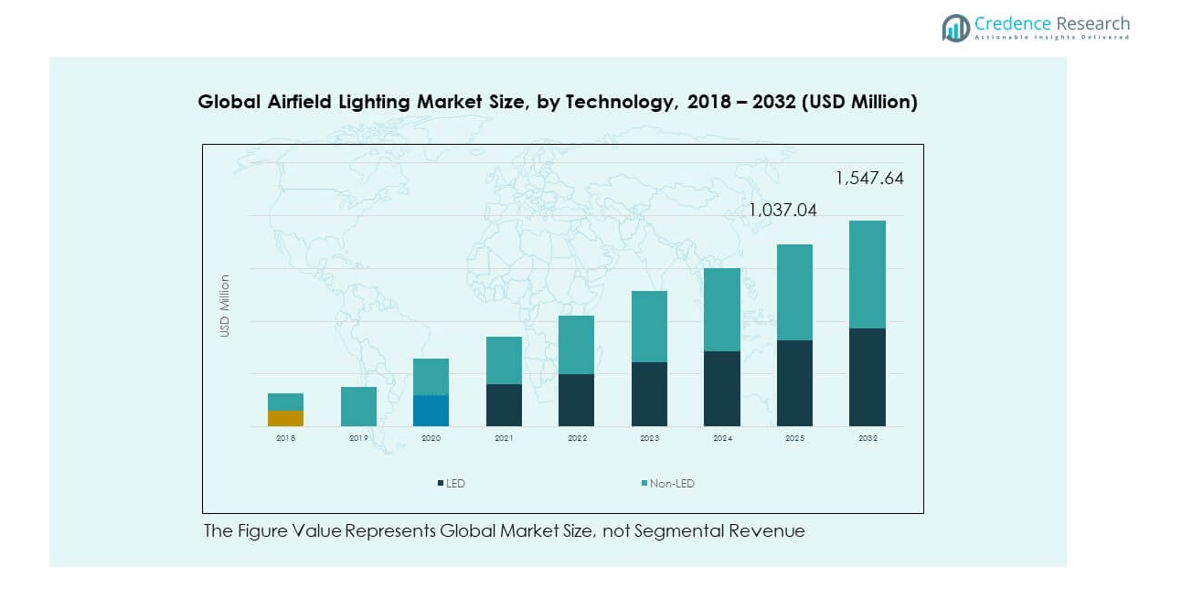

The Airfield Lighting Market size was valued at USD 697.4 million in 2018 to USD 980.8 million in 2024 and is anticipated to reach USD 1,547.6 million by 2032, at a CAGR of 5.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airfield Lighting Market Size 2024 |

USD 980.8 million |

| Airfield Lighting Market, CAGR |

5.89% |

| Airfield Lighting Market Size 2032 |

USD 1,547.6 million |

The market growth is primarily driven by the rising demand for safe and efficient airport operations. As global air traffic continues to increase, both commercial and military airports are investing in advanced lighting systems to enhance runway visibility and improve operational reliability under various weather conditions. Government initiatives to modernize aging airport infrastructure, combined with rising investments in smart airport development, are also contributing significantly. Technological advancements, such as LED-based lighting and solar-powered systems, further enhance energy efficiency and reduce maintenance costs, making them favorable among airport authorities.

Regionally, North America leads the Airfield Lighting Market due to the presence of major airports and continuous infrastructure upgrades across the U.S. and Canada. Europe follows closely, driven by regulatory mandates on airport safety and modernization efforts. Asia-Pacific is emerging as the fastest-growing region, supported by increasing airport construction in countries like China and India, driven by rising passenger traffic and economic development. The Middle East and Africa are also seeing a gradual rise in adoption, particularly in nations investing heavily in aviation and tourism infrastructure.

Market Insights:

- The Airfield Lighting Market was valued at USD 980.8 million in 2024 and is projected to reach USD 1,547.6 million by 2032, growing at a CAGR of 5.89%.

- Rising global air traffic and increased airport construction are fueling consistent demand for advanced airfield lighting systems.

- Government-funded airport modernization programs are accelerating the adoption of energy-efficient and compliant lighting solutions.

- High initial installation costs and long return-on-investment cycles limit adoption in smaller and budget-constrained airports.

- North America and Europe maintain steady growth through infrastructure upgrades and safety compliance investments.

- Asia Pacific leads the market due to rapid airport expansion and rising aviation activity in China, India, and Southeast Asia.

- LED-based lighting systems dominate the market, driven by lower maintenance needs and alignment with sustainability goals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Global air traffic growth driving demand for modern and reliable airfield lighting systems

The continuous surge in global air traffic has directly influenced the need for more efficient and safer airfield infrastructure. Airports across regions are facing increasing pressure to accommodate higher volumes of aircraft, passengers, and cargo. This demand has created the need for advanced airfield lighting systems that support smooth and safe aircraft operations, especially during night or adverse weather conditions. The Airfield Lighting Market benefits significantly from this requirement, as stakeholders prioritize runway visibility and operational safety. New airports are being constructed while existing facilities undergo upgrades to meet international safety standards. These projects rely heavily on high-performance lighting systems for runways, taxiways, and aprons. Governments and airport authorities allocate substantial budgets to lighting modernization projects. This strategic alignment between infrastructure development and air traffic expansion sustains the market’s growth trajectory.

Government-led airport modernization programs supporting large-scale airfield lighting upgrades

Public sector investments have played a critical role in transforming airport infrastructure in both developed and developing economies. Many governments have introduced long-term modernization plans to upgrade airport facilities and expand capacity to meet future aviation needs. These plans include comprehensive runway lighting upgrades to comply with safety mandates and international aviation regulations. The Airfield Lighting Market finds strong momentum in these public initiatives, with funding directed toward energy-efficient lighting and integrated control systems. These programs often target secondary and regional airports, leading to widespread adoption of standardized airfield lighting solutions. Authorities are also working closely with regulatory bodies to enhance lighting quality for aircraft safety and operational efficiency. Increased focus on international connectivity and tourism growth further drives such investments. Public-private partnerships are helping accelerate implementation timelines across several countries.

- For instance, in 2023, the U.S. Federal Aviation Administration awarded over $201 million in Bipartisan Infrastructure Law funding to enhance airfield lighting and safety systems at 82 airports. Denver International Airport received $30.6 million to reconstruct Runway 17L/35R and modernize taxiway lighting. Rogue Valley International–Medford Airport was granted $3.4 million to upgrade its visual aid lighting systems and reconstruct lighting on Runway 14/32 to meet FAA standards.

Adoption of LED and solar-powered lighting technologies reducing maintenance and energy costs

Technological shifts in lighting systems have significantly impacted market dynamics by introducing cost-efficient and sustainable alternatives. The industry is witnessing a shift from conventional incandescent and halogen systems to LED and solar-powered solutions. These systems offer longer service life, lower maintenance frequency, and better energy performance, making them economically viable over time. The Airfield Lighting Market leverages this transition to promote environmentally friendly and cost-saving solutions across commercial and military airports. LEDs provide higher brightness, quicker response times, and better visibility in challenging conditions. Solar-powered lighting enhances deployment in remote or low-infrastructure areas, reducing reliance on electrical grids. Manufacturers are aligning R&D efforts to advance these technologies further. Regulatory support for energy efficiency is also encouraging airport operators to switch to advanced lighting technologies.

- For example, Honeywell’s LED runway lighting systems deliver up to 70% lower maintenance costs and extend operational life to 50,000 hours, far surpassing the 50–75 hours typical of halogen lights. Flash Technology has deployed over 150,000 solar airfield lights across more than 750 airports and military bases worldwide, offering reliable, off-grid lighting compliant with FAA and ICAO standards.

Rising military airbase investments contributing to stable market demand

Military aviation requires specialized airfield lighting systems that support operations under extreme and tactical conditions. Governments across multiple regions are consistently upgrading military airbases to enhance their defense readiness and logistical capabilities. These upgrades involve installing durable, low-visibility-compatible lighting systems capable of withstanding harsh environmental conditions. The Airfield Lighting Market benefits from consistent defense spending directed at airfield infrastructure. Military projects prioritize portable, rapid-deployment lighting solutions for forward-operating bases and emergency airstrips. Night vision-compatible lighting and infrared systems are increasingly being procured. Defense modernization programs in Asia-Pacific, the Middle East, and North America have played a major role in sustaining market demand. Suppliers catering to this segment are developing ruggedized systems tailored to military specifications, ensuring long-term contract stability.

Market Trends

Integration of smart airfield lighting systems into airport digital transformation plans

Airports are advancing toward digital and smart infrastructure models to enhance operational efficiency and service delivery. A major trend involves the integration of smart airfield lighting systems with centralized airport control platforms. These systems feature automated brightness adjustment, real-time monitoring, and fault detection capabilities. The Airfield Lighting Market is benefiting from this technological trend, which improves response time and supports proactive maintenance. Smart lighting enables data sharing between airside and landside operations, optimizing runway usage and reducing delays. Airports in Europe and Asia are leading the adoption of such systems. The trend aligns with airport digitization strategies focused on reducing human error and improving safety margins. Vendors are offering plug-and-play modules that are easy to install and integrate. Future systems may incorporate AI and IoT for predictive analytics and adaptive lighting.

Growing preference for modular lighting units supporting flexible airport expansion

Airports are increasingly demanding modular airfield lighting units to facilitate flexible and cost-effective expansions. These units allow operators to upgrade or reconfigure lighting systems without major overhauls or downtime. The Airfield Lighting Market is responding to this need by offering scalable and pre-engineered lighting components. Modular systems enhance the agility of airport operations and reduce installation complexity. This trend is particularly relevant in developing countries where phased airport development is common. Suppliers are customizing modular solutions to align with regional infrastructure limitations. These products also help airports quickly meet evolving safety and compliance standards. The modular approach supports quick repair, upgrades, and system reconfiguration, ensuring continuity in high-traffic environments. Global demand for future-ready airports continues to push this trend forward.

- For instance, S4GA provides modular, portable airfield lighting systems that can be rapidly deployed using trailer-based solutions. These systems have been implemented at private and regional airfields in Poland and can be installed in about 20 minutes, offering up to 15 days of autonomous operation without recharging. Designed for flexibility and off-grid use, the systems require no trenching or permanent infrastructure.

Increased focus on climate-resilient lighting infrastructure at airports

Climate change has intensified the frequency and severity of extreme weather events, prompting airports to strengthen infrastructure resilience. Airfield lighting systems now need to withstand flooding, high winds, and extreme temperature variations without performance disruption. The Airfield Lighting Market is adapting by providing weather-resistant, IP-rated enclosures, and corrosion-resistant materials. These systems maintain consistent performance across temperature extremes and environmental stress. Airports located in coastal and high-altitude regions are leading adopters of such solutions. The emphasis on climate adaptation aligns with global aviation sustainability frameworks. Lighting components undergo rigorous durability testing before deployment in critical environments. Design upgrades also include improved drainage, grounding, and impact resistance. This trend is expected to grow as airports adopt comprehensive climate-resilient infrastructure strategies.

Standardization of lighting systems driven by international aviation safety protocols

International Civil Aviation Organization (ICAO) and Federal Aviation Administration (FAA) regulations continue to shape airfield lighting design and performance standards. These bodies have enforced strict compliance norms to ensure uniformity and safety across global airports. The Airfield Lighting Market aligns its product development strategies to meet these evolving standards. Manufacturers are increasingly certifying their systems for global applicability, reducing approval time and increasing export potential. Standardized lighting simplifies maintenance, spare parts inventory, and training across airport networks. This trend supports rapid global deployment and improves cross-border compatibility. Emerging economies are adopting these standards in line with global aviation integration. The harmonization of protocols also fosters joint ventures and cross-national collaborations in airport development. Regulatory-driven standardization remains a central theme in market evolution.

- For example, major manufacturers such as ADB SAFEGATE and Honeywell offer airfield lighting systems that comply with ICAO Annex 14 and FAA AC 150/5345 standards. These certifications ensure global interoperability, support regulatory compliance, and simplify maintenance and training processes across international airport operations.

Market Challenges Analysis

High capital expenditure and long ROI cycles limiting adoption in smaller airports

Airfield lighting installations require significant upfront capital investments, particularly for large-scale, modern LED or smart systems. Smaller regional and municipal airports often struggle to secure the financial resources necessary for comprehensive lighting upgrades. These budget constraints result in prolonged use of outdated or inefficient systems, affecting safety and efficiency. The Airfield Lighting Market faces limited penetration in cost-sensitive regions due to this barrier. Long return-on-investment cycles further discourage rapid adoption, especially when funding is reliant on local government approvals. Financing hurdles can delay procurement and project execution, creating operational gaps. Some airport authorities lack access to international aid or public-private partnerships that support infrastructure modernization. The challenge remains particularly acute in Latin America and parts of Africa, where financial limitations slow down modernization projects.

Limited availability of technical expertise and complex installation requirements

Installing and maintaining modern airfield lighting systems demands specialized technical knowledge and compliance with regulatory standards. Many airports in emerging economies face shortages of skilled labor or certified contractors capable of handling complex lighting deployments. This shortage increases reliance on international suppliers, extending timelines and raising overall costs. The Airfield Lighting Market often faces implementation delays in regions where training infrastructure and technical awareness are lacking. Improper installation can lead to performance issues, safety risks, and increased maintenance costs. Equipment downtime further affects airport operations and passenger throughput. Ensuring compatibility with existing systems adds complexity to upgrades. The need for coordination between lighting engineers, airport planners, and regulatory bodies adds layers of challenge, especially in high-traffic or sensitive airside environments.

Market Opportunities

Expanding airport infrastructure in Asia-Pacific and Middle East driving new demand

Asia-Pacific and the Middle East are witnessing large-scale investments in airport infrastructure to accommodate growing air travel demand and tourism. Countries like China, India, Saudi Arabia, and the UAE are building new international airports and expanding existing ones. This rapid infrastructure development presents significant opportunities for the Airfield Lighting Market. It can meet the rising demand for runway, taxiway, and apron lighting systems across new projects. Suppliers are actively partnering with regional authorities and EPC contractors. The trend supports both high-volume orders and long-term service contracts. Regional policies promoting aviation growth will continue to open new avenues for lighting system providers.

Rising demand for sustainable lighting aligning with global emission goals

Sustainability goals are reshaping procurement policies in aviation, with airport authorities prioritizing energy-efficient and low-emission systems. LED and solar-based lighting solutions are gaining strong traction as they align with these priorities. The Airfield Lighting Market can capture new revenue streams by offering eco-friendly and cost-efficient products. Stakeholders prefer vendors that comply with green building certifications and environmental standards. This shift in buyer behavior is creating a competitive edge for manufacturers investing in sustainable technologies. Airport operators also aim to reduce operating costs through energy savings. Future growth will depend on product innovation aligned with net-zero objectives.

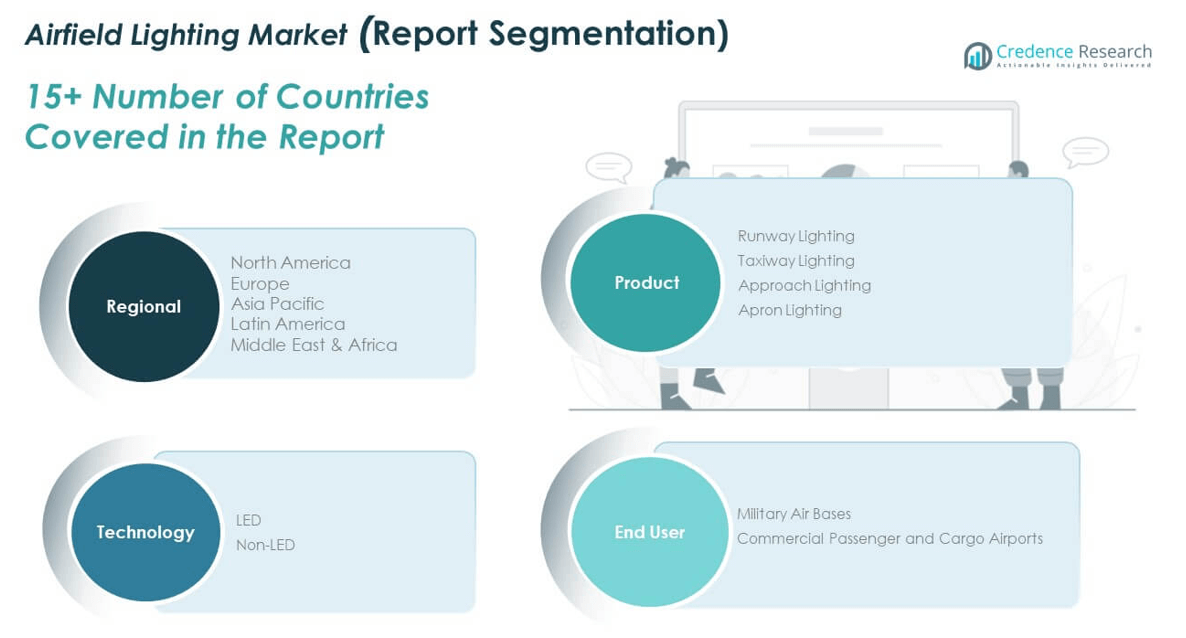

Market Segmentation Analysis:

The Airfield Lighting Market is segmented by product, technology, and end user, each influencing market dynamics based on functionality and operational requirements.

By product, runway lighting holds the largest share due to its critical role in aircraft takeoff and landing operations, especially in low-visibility conditions. Taxiway lighting follows closely, supporting safe ground movement of aircraft. Approach lighting systems enhance pilot guidance during final descent, while apron lighting ensures visibility and safety in aircraft parking and servicing zones.

- For instance, ADB SAFEGATE’s AXON elevated runway lights feature onboard diagnostics and have been deployed at major airports, supporting operational safety through real-time fault detection and ICAO compliance in all weather conditions.

By technology, LED dominates the market due to its superior energy efficiency, lower maintenance, and long operational life. It supports sustainability goals and aligns with modern airport infrastructure. Non-LED systems continue to serve in legacy installations but are steadily being replaced by LED solutions during upgrades.

By end user, commercial passenger and cargo airports lead in adoption, driven by high traffic volume and regulatory compliance needs. Military air bases contribute steadily, demanding ruggedized, tactical lighting systems tailored to defense-specific requirements. The Airfield Lighting Market continues to evolve with rising investments across all segments.

- For instance, Flash Technology has deployed over 150,000 solar-powered airfield lights across 750 airports and military bases worldwide, offering off-grid functionality ideal for tactical and remote military operations.

Segmentation:

By Product:

- Runway Lighting

- Taxiway Lighting

- Approach Lighting

- Apron Lighting

By Technology:

By End User:

- Military Air Bases

- Commercial Passenger and Cargo Airports

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Airfield Lighting Market size was valued at USD 192.20 million in 2018 to USD 266.81 million in 2024 and is anticipated to reach USD 413.69 million by 2032, at a CAGR of 5.7% during the forecast period. North America holds a market share of approximately 27.2%. The region maintains a strong position due to robust airport infrastructure and consistent investments in modernization programs. The United States leads in implementing LED-based airfield lighting, backed by federal aviation grants. Canada follows with ongoing upgrades at key international and regional airports. The demand is driven by safety regulations, high passenger traffic, and active airport expansion projects. Integration of smart lighting systems is gaining ground across major U.S. airports. The defense sector also fuels adoption, particularly in military airbases and dual-use facilities. Strong presence of established manufacturers supports technological innovation and product deployment. The market continues to benefit from strategic collaborations and regulatory enforcement.

Europe

The Europe Airfield Lighting Market size was valued at USD 165.07 million in 2018 to USD 233.12 million in 2024 and is anticipated to reach USD 369.89 million by 2032, at a CAGR of 6.0% during the forecast period. Europe accounts for approximately 23.9% of the global market share. The region shows steady growth driven by regulatory compliance with ICAO and EASA standards. Countries such as Germany, France, and the UK are investing in lighting upgrades to improve operational efficiency and reduce environmental impact. The focus is shifting toward sustainable and energy-efficient technologies like LED and solar-powered lighting. The modernization of regional airports and expansion of low-cost carrier networks stimulate further demand. European airports are also implementing smart lighting control systems to support automation and data integration. Government funding programs and EU-level aviation initiatives accelerate regional development. The presence of specialized technology providers fosters competitive innovation. Strategic partnerships and public-private collaborations support continued progress.

Asia Pacific

The Asia Pacific Airfield Lighting Market size was valued at USD 219.33 million in 2018 to USD 318.16 million in 2024 and is anticipated to reach USD 522.48 million by 2032, at a CAGR of 6.4% during the forecast period. Asia Pacific represents the largest regional share at approximately 33.7%. The region’s dominance stems from large-scale airport construction in countries such as China, India, and Southeast Asian nations. Rapid growth in air travel and tourism boosts the need for advanced lighting infrastructure. Governments are allocating substantial investments toward aviation modernization and safety upgrades. New greenfield airport projects and expansion of existing terminals are driving system installations. Domestic and international airport operators are emphasizing energy efficiency and low maintenance solutions. Emerging economies are aligning airfield lighting systems with global safety protocols. Local manufacturing capabilities and international collaborations support fast-paced deployment.

Latin America

The Latin America Airfield Lighting Market size was valued at USD 71.20 million in 2018 to USD 93.66 million in 2024 and is anticipated to reach USD 134.18 million by 2032, at a CAGR of 4.6% during the forecast period. Latin America holds a market share of around 8.7%. The region shows moderate growth due to gradual infrastructure upgrades and limited budget allocations in some countries. Brazil, Mexico, and Colombia are key contributors to market activity, driven by ongoing airport modernization and expansion efforts. Government-led aviation development programs aim to improve operational efficiency and air traffic management. Adoption of LED lighting is increasing, although cost constraints still hinder rapid adoption. The private sector is participating in airport development through concession models. Regulatory reforms and international air service agreements stimulate further investment. While challenges exist, regional growth prospects remain favorable with rising passenger volumes and safety requirements.

Middle East

The Middle East Airfield Lighting Market size was valued at USD 33.34 million in 2018 to USD 47.81 million in 2024 and is anticipated to reach USD 77.38 million by 2032, at a CAGR of 6.2% during the forecast period. The region represents approximately 5.0% of the global market share. The Middle East shows strong momentum due to large-scale airport infrastructure investments in the UAE, Saudi Arabia, and Qatar. Mega airport projects and national tourism strategies are driving demand for high-performance airfield lighting systems. Governments prioritize advanced technologies and energy-efficient solutions for new terminals and runways. LED and smart lighting systems are increasingly implemented in flagship airport developments. Strategic positioning as global aviation hubs fuels continuous investment. Regulatory compliance and focus on international safety benchmarks guide system specifications. The defense sector also contributes to the market through military base upgrades.

Africa

The Africa Airfield Lighting Market size was valued at USD 16.25 million in 2018 to USD 21.21 million in 2024 and is anticipated to reach USD 30.02 million by 2032, at a CAGR of 4.4% during the forecast period. Africa accounts for approximately 1.9% of the global market share. The region is gradually adopting modern airfield lighting systems to support growing aviation activity and safety requirements. South Africa, Nigeria, and Kenya are leading in terms of infrastructure investment and international connectivity improvements. Market growth is supported by aviation policy reforms and international funding assistance. Deployment remains limited in remote areas due to budget and resource constraints. Renewable energy-based lighting systems are gaining traction in off-grid or energy-challenged airports. The market is witnessing increased participation from foreign contractors and donors. Pilot training centers and regional airport upgrades contribute to demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ADB SAFEGATE

- Honeywell International Inc.

- OCEM Airfield Technology

- TKH Airport Solutions

- Flash Technology, LLC

- Vosla GmbH

- Youyang Airport Lighting Equipment Inc.

- AMA Private Limited

- ABB Ltd

- My Airfield Ground Lighting

- Other Key Players

Competitive Analysis:

The Airfield Lighting Market features a moderately consolidated landscape, with key players focusing on product innovation, strategic partnerships, and global expansion to maintain competitiveness. Leading companies such as ADB SAFEGATE, Honeywell International Inc., Eaton Corporation, and Hella GmbH control significant market shares due to their strong technological capabilities and established airport portfolios. It attracts both global and regional manufacturers aiming to deliver cost-effective, durable, and compliant lighting solutions. Companies actively invest in R&D to develop energy-efficient, smart, and solar-powered systems tailored to evolving airport infrastructure needs. Competitive dynamics are shaped by regulatory standards, large-scale government tenders, and long-term service agreements. Vendors strengthen their positions through certifications, customized offerings, and after-sales support. Emerging players focus on regional opportunities and niche applications, while established firms expand their footprint in high-growth regions such as Asia-Pacific and the Middle East. The market continues to evolve through acquisitions, joint ventures, and supply chain enhancements.

Recent Developments:

- In May 2025, Honeywell International Inc. announced a definitive agreement to acquire Johnson Matthey’s Catalyst Technologies business for £1.8 billion, allowing Honeywell to integrate the acquired technologies into its Energy and Sustainability Solutions portfolio. This supports strategic growth in refining, petrochemicals, and renewable fuels. The deal exemplifies Honeywell’s focus on expanding its technological leadership and advancing sustainability in aviation and related sectors.

- In March 2025, Avlite Systems announced the launch of LCAMS™ (Lighting Control and Monitoring System), an intelligent and scalable solution designed to optimize airfield lighting operations across both commercial and military airports. This product highlights the company’s focus on sustainability and smart airfield management.

Market Concentration & Characteristics:

The Airfield Lighting Market is characterized by a mix of global dominance and regional competitiveness. It maintains moderate concentration, with a few key players holding substantial market shares, while local suppliers cater to specific geographies and low-cost installations. Product quality, regulatory compliance, and energy efficiency define the competitive landscape. The market supports steady demand across commercial, military, and private airports, driven by infrastructure upgrades and safety mandates. High entry barriers exist due to certification requirements and complex specifications. Innovation centers around LED integration, smart control systems, and ruggedized designs. The market favors long-term contracts and recurring maintenance revenues, making service capabilities a crucial differentiator. Strategic pricing and compliance with international standards remain essential for sustained market positioning.

Report Coverage:

The research report offers an in-depth analysis based on Product, Technology and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing airport infrastructure projects worldwide will continue to drive demand for advanced airfield lighting systems.

- Integration of smart and automated lighting solutions will enhance safety and operational efficiency.

- LED and solar-powered lighting will gain wider adoption due to energy-saving benefits and low maintenance needs.

- Regulatory alignment with ICAO and FAA standards will shape product development and procurement decisions.

- Increasing defense investments will boost deployment of rugged and tactical airfield lighting systems.

- Emerging markets in Asia-Pacific and the Middle East will lead new installations and technology upgrades.

- Public-private partnerships will play a key role in funding modernization projects across regional airports.

- Demand for climate-resilient lighting systems will rise due to increased focus on infrastructure durability.

- Advancements in wireless control and real-time monitoring will support intelligent airfield operations.

- Vendor competition will intensify with a focus on turnkey solutions and long-term service contracts.