Market Overview

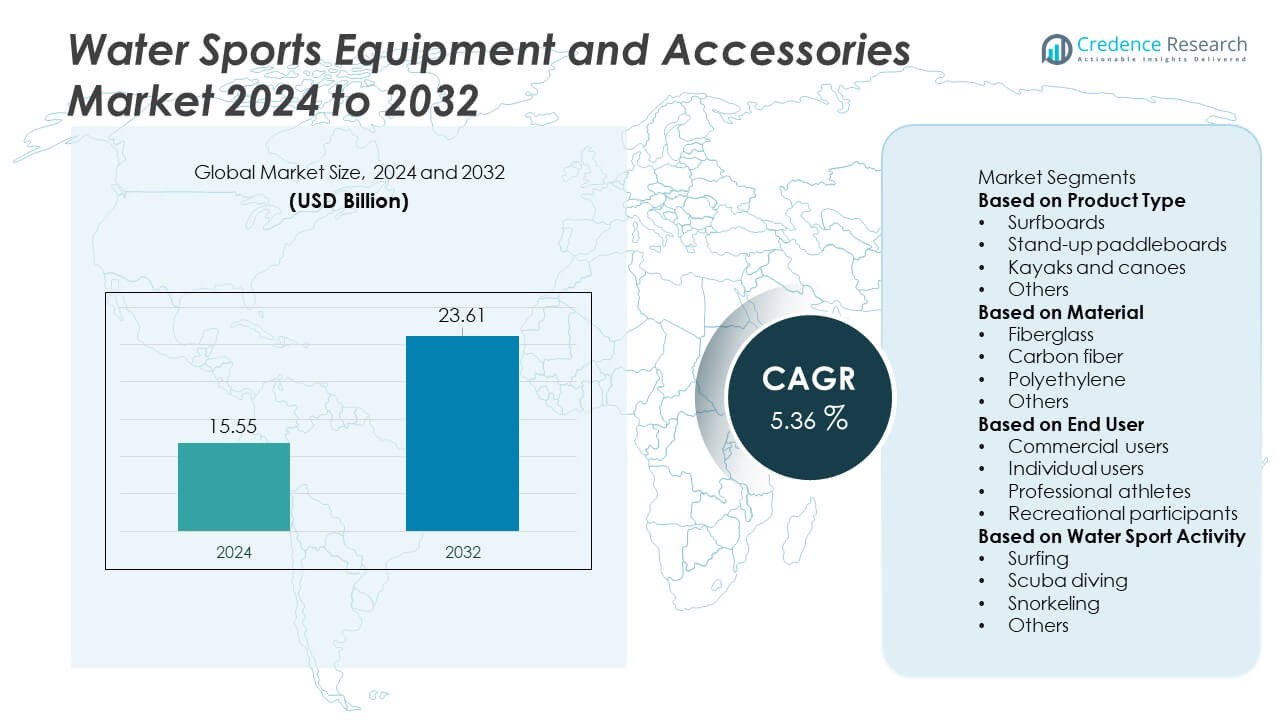

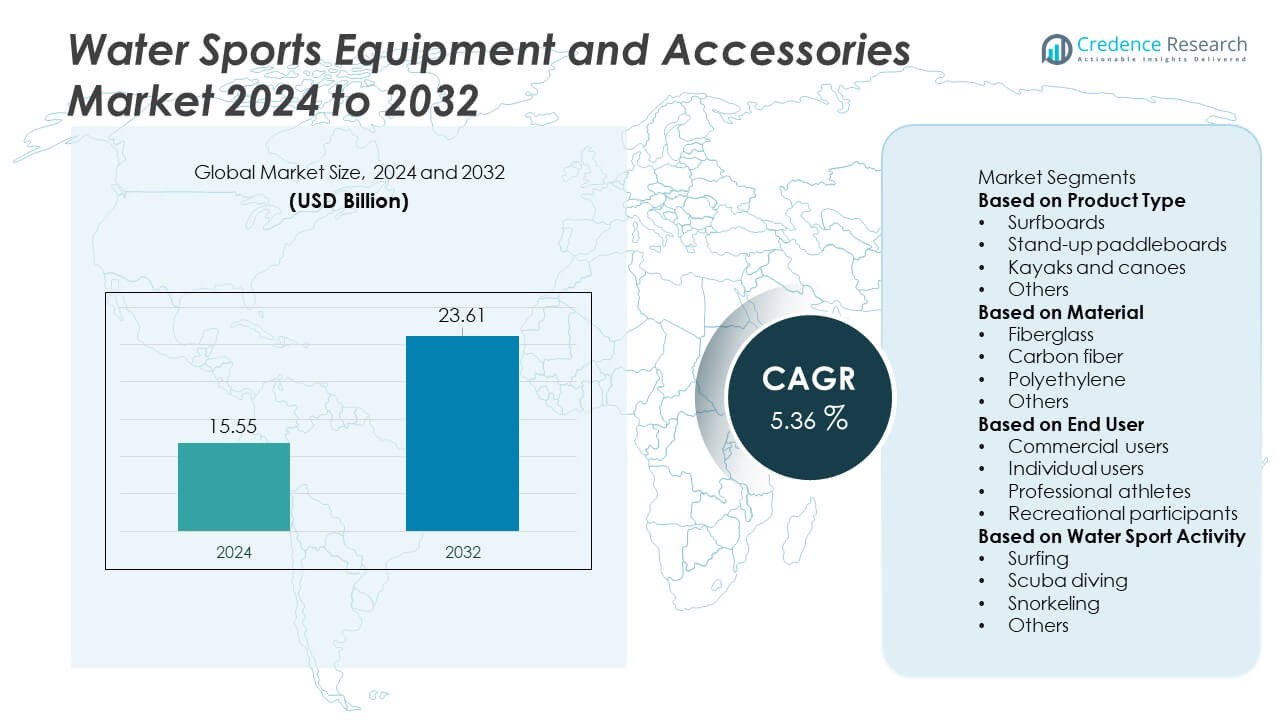

The Water Sports Equipment and Accessories Market reached USD 15.55 billion in 2024 and is projected to hit USD 23.61 billion by 2032. The market expands at a CAGR of 5.36% through the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Sports Equipment and Accessories Market Size 2024 |

USD 15.55 Billion |

| Water Sports Equipment and Accessories Market, CAGR |

5.36% |

| Water Sports Equipment and Accessories Market Size 2032 |

USD 23.61 Billion |

Top players in the Water Sports Equipment and Accessories market include Decathlon S.A., Speedo International, Sea-Doo (BRP Inc.), Naish International, Jobe Sports, Johnson Outdoors Inc., O’Neill, Cressi Sub, Aqua Lung International, and Starboard WindSUP. These companies strengthen their positions through advanced materials, wider product lines, and strong retail networks. North America leads the global market with a 38% share, supported by high consumer spending, strong participation rates, and a well-established water-sport ecosystem. Europe follows with a 29% share driven by coastal tourism, structured training programs, and rising interest in sustainable equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 15.55 billion in 2024 and will grow at a CAGR of 5.36 %, driven by rising global participation in water-based recreation.

- Strong demand comes from surfboards holding a 32 % share and fiberglass materials leading with a 41 % share, supported by fitness interest and durable product designs.

- Key trends include adoption of eco-friendly materials, lightweight composites, and digital features that improve performance tracking and user safety across multiple water-sport categories.

- Competition intensifies as Decathlon, Sea-Doo, Speedo, Johnson Outdoors, and Cressi Sub expand portfolios and invest in premium designs, while high equipment costs remain a restraint in price-sensitive regions.

- North America leads with a 38 % share, followed by Europe at 29 % and Asia Pacific at 24 %, reflecting strong tourism, rental ecosystems, and expanding youth participation.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Surfboards lead this segment with a 32% share, supported by strong coastal tourism and rising surf schools. Stand-up paddleboards gain wide use due to fitness activities and calm-water recreation. Kayaks and canoes grow as adventure travel expands in rivers and lake regions. The “others” group covers water scooters, life jackets, and inflatables that support rental operators. Surf schools invest in durable boards to cut maintenance costs. Rising interest in structured training programs brings more beginners into the market. This broad user base strengthens long-term demand for water-sport equipment.

- For instance, Decathlon improved the durability of its Olaian range of surfboards, which use an Expanded Polystyrene (EPS) core, making them more resistant to dings and suitable for heavy use scenarios like rental fleets.

By Material

Fiberglass holds a 41% share, driven by its durability, stable performance, and cost efficiency. Carbon fiber grows fast because professional athletes want lightweight, high-strength gear. Polyethylene attracts recreational users who need impact-resistant and budget-friendly equipment. The “others” category includes neoprene, PVC, and rubber used for accessories and safety products. Fiberglass designs withstand frequent rental use with minimal wear. Carbon fiber supports high-speed performance. Polyethylene offers easy handling for new participants. Material innovation continues to improve safety and extend product lifespan across water-sport categories.

- For instance, BIC Sport utilized multi-axial fiberglass layups to improve board rigidity for frequent-use conditions. The tensile strength of such composite materials is generally in the range of 480 MPa to 1,600 MPa, depending on specific manufacturing processes and fiber type.

By End User

Individual users dominate this segment with a 46% share, pushed by growing interest in recreation, fitness, and weekend travel. Commercial users, including rental shops and training centers, prefer durable gear to handle heavy usage. Professional athletes choose premium materials to enhance stability and speed in competitive settings. Recreational participants add volume through entry-level gear purchases. Weekend tourism boosts personal gear ownership. Rental operators expand fleets to meet seasonal demand. Athletes drive growth in high-performance boards and accessories. Broad participation across age groups supports consistent market expansion.

Key Growth Drivers

Rising Participation in Recreational Water Activities

Growing interest in outdoor leisure and fitness strengthens demand for water sports equipment. Families, youth groups, and tourists increasingly choose activities such as paddleboarding, kayaking, and snorkeling. Coastal tourism promotes structured training programs that attract first-time participants. Resorts and rental operators expand fleets to meet rising footfall during peak seasons. Brands introduce beginner-friendly gear that supports safer entry into the sport. Growth in weekend travel and beach tourism widens the user base. This broader participation directly pushes consistent demand for both premium and entry-level equipment.

- For instance, Aqua Lung enhanced its snorkeling sets using tempered-glass lenses which are a highly durable, “shatterproof” safety glass designed to break into small, blunt pieces if impacted.

Advancements in Material and Equipment Technology

Innovations in lightweight composites, hydrodynamic designs, and impact-resistant materials support higher adoption across user groups. Fiberglass and carbon fiber upgrades improve durability and performance, helping athletes achieve better speed and balance. Polyethylene-based designs attract recreational users due to easy handling and low maintenance. Smart features such as integrated sensors and stability aids boost user confidence. Manufacturers invest in improved safety accessories, expanding product portfolios. These technological advancements encourage professionals and beginners to upgrade equipment more frequently, driving steady market growth.

- For instance, Starboard WindSUP boards use advanced Carbon Sandwich construction, integrating layers of high-grade biaxial and unidirectional carbon fibers with a high-density PVC foam core to create a structure known for its stiffness, light weight, and responsiveness, thereby enhancing board acceleration for advanced riders.

Expansion of Rental Ecosystems and Water Sports Tourism

Tourism-driven regions upgrade rental fleets to support rising demand for adventure activities. Resorts, cruise lines, and coastal operators invest in durable boards, kayaks, and life jackets to serve high traffic. The rental model increases accessibility for travelers who prefer short-term use instead of ownership. Market players collaborate with tour operators to offer guided water-sport experiences. Growth in beach festivals and adventure tourism events strengthens visibility for premium brands. This rising ecosystem of rentals, training schools, and tourism activities boosts long-term equipment consumption.

Key Trends & Opportunities

Growth of Eco-Friendly and Sustainable Water Sports Gear

Manufacturers adopt recycled polymers, bio-based resins, and low-impact production methods to align with sustainability goals. Consumers prefer eco-friendly boards, wetsuits, and accessories that reduce environmental harm. Brands invest in circular design processes that extend equipment life and cut waste. Rental operators also choose durable, recyclable materials for frequent use. Growing awareness of marine pollution encourages responsible gear choices. This shift provides strong opportunities for companies offering sustainable alternatives while meeting regulatory expectations for cleaner production.

- For instance, Patagonia developed its Yulex natural rubber wetsuits using a bio-based polymer with 85% plant-derived content, cutting reliance on petrochemical neoprene.

Integration of Digital and Fitness-Oriented Features

Water sports equipment increasingly includes digital enhancements such as GPS tracking, performance metrics, and stability sensors. Users monitor speed, balance, and distance on mobile apps, improving training efficiency. Fitness-focused paddleboarding and kayaking bring more health-conscious consumers to the market. Smart equipment helps beginners gain confidence through guided learning. Professional athletes use advanced analytics to refine techniques. This growing link between fitness technology and water activities creates attractive opportunities for premium, connected equipment lines.

- For instance, Garmin expanded its Surfline Sessions integration, enabling users wearing a compatible Garmin smartwatch to log riding speed (along with wave count and distance) and receive video clips of their waves ridden in front of a Surfline camera.

Key Challenges

High Equipment Costs Limiting Wider Adoption

Premium boards, carbon fiber components, and advanced accessories remain costly for many new users. High purchase prices push consumers toward rentals instead of ownership. Professional-grade gear requires significant investment, which limits penetration in price-sensitive markets. Import duties and seasonal demand further raise retail prices. This cost barrier slows growth in emerging regions where income levels restrict adoption. Manufacturers must balance innovation with affordability to expand user reach. The challenge remains significant for companies targeting mass-market segments.

Seasonal Demand Fluctuations Impacting Sales Stability

Water sports participation depends heavily on weather patterns and tourism cycles. Sales decline during off-seasons in colder regions, reducing yearly revenue stability. Rental operators struggle with long idle periods, affecting return on investment. Climate events, storms, and uneven monsoon cycles disrupt coastal tourism and reduce equipment use. Manufacturers face production planning issues due to unpredictable seasonal peaks. These fluctuating demand patterns make long-term forecasting challenging. Brands need diversified distribution and indoor water-sport solutions to reduce seasonal impact.

Regional Analysis

North America

North America holds a 38% share due to strong participation in recreational water activities and high consumer spending on premium gear. The U.S. leads demand with widespread adoption of surfing, paddleboarding, and kayaking across coastal and lake regions. Canada supports growth through expanding adventure tourism and rental services. Brands launch durable, lightweight boards to serve fitness-focused consumers. Training schools and community water-sport programs attract new participants each year. Strong retail presence and online distribution strengthen product availability, ensuring steady regional expansion.

Europe

Europe accounts for a 29% share, supported by well-developed coastal tourism and rising interest in sustainable equipment. Countries such as France, Spain, and the U.K. record strong participation in surfing and sailing. Mediterranean resorts expand rental fleets to meet tourist demand, boosting sales of boards, life jackets, and accessories. Eco-friendly materials gain traction as Europe pushes strict environmental standards. Water-sport competitions and training centers encourage higher adoption among youth. Broad government support for outdoor recreation continues to strengthen long-term market potential across the region.

Asia Pacific

Asia Pacific captures a 24% share, driven by rapid coastal tourism growth and expanding middle-class participation. China, Japan, Indonesia, and Australia show rising interest in paddleboarding, diving, and surfing. Adventure travel increases equipment demand across island destinations. Manufacturers introduce cost-effective gear to attract first-time users. Training schools and water-sport clubs expand in popular beach cities. Growing youth participation and social media influence boost visibility for global brands. Rising investment in coastal recreation infrastructure continues to enhance market opportunities across the region.

Latin America

Latin America holds a 6% share, supported by growing tourism in Brazil, Mexico, and Costa Rica. Surfing culture drives strong interest in boards and accessories, while calm-water regions promote paddleboarding and kayaking. Local rental operators expand, improving access for new users. Manufacturers focus on durable and affordable materials to serve a diverse customer base. Adventure sports events attract international participants, boosting regional brand exposure. Rising urban interest in recreational fitness activities strengthens long-term adoption. Wider promotion of beach tourism continues to support steady market growth.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, driven by rising coastal development and growing participation in premium water activities. The UAE and South Africa lead demand with strong tourism inflows and expanding water-sport training hubs. Resorts invest in high-end boards, snorkel gear, and safety equipment to serve international visitors. Warmer climates support year-round activity, especially in Gulf regions. Local distributors expand partnerships with global brands to increase availability. Growth in adventure travel and youth participation gradually strengthens market presence across the region.

Market Segmentations:

By Product Type

- Surfboards

- Stand-up paddleboards

- Kayaks and canoes

- Others

By Material

- Fiberglass

- Carbon fiber

- Polyethylene

- Others

By End User

- Commercial users

- Individual users

- Professional athletes

- Recreational participants

By Water Sport Activity

- Surfing

- Scuba diving

- Snorkeling

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features Decathlon S.A., Speedo International, Sea-Doo (BRP Inc.), Naish International, Jobe Sports, Johnson Outdoors Inc., O’Neill, Cressi Sub, Aqua Lung International, and Starboard WindSUP as leading participants shaping market performance. These companies expand portfolios across surfing, paddleboarding, snorkeling, and kayaking, offering products that suit beginners and advanced users. Brands invest in lightweight materials, advanced hydrodynamic designs, and sustainable components to improve durability and user comfort. Rental operators partner with manufacturers to secure high-volume, long-life equipment, supporting recurring revenue. E-commerce platforms help brands reach wider audiences, while targeted marketing boosts visibility among younger consumers. Continuous product upgrades, athlete endorsements, and region-specific product launches strengthen competitive positioning in both premium and budget segments.

Key Player Analysis

- Decathlon S.A.

- Speedo International

- Sea-Doo (BRP Inc.)

- Naish International

- Jobe Sports

- Johnson Outdoors Inc.

- O’Neill

- Cressi Sub

- Aqua Lung International

- Starboard WindSUP

Recent Developments

- In May 2025, BRP Inc.’s watercraft brand Sea-Doo launched the “Water 101” module of its Responsible Rider Masterclass to promote safe and eco-conscious riding among PWC users.

- In April 2024, Aqualung Group successfully sold its historic snorkeling brand, US Divers, to a California-based company, Aqua Master Sporting Technology Co LLC.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End User, Water Sport Activity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more consumers adopt outdoor recreation and fitness-focused water activities.

- Manufacturers will expand eco-friendly product lines using recycled and bio-based materials.

- Lightweight composites will gain traction as users prefer high-performance and durable equipment.

- Digital features such as GPS tracking and performance metrics will enhance user engagement.

- Rental ecosystems in coastal and island regions will scale to support growing tourist inflows.

- Training schools and beginner programs will widen the entry-level user base across key regions.

- Premium gear adoption will increase as professional athletes influence product innovation.

- Online retail channels will strengthen reach, improving accessibility in emerging markets.

- Product customization will grow as users seek tailored designs and improved safety features.

- Material innovation will continue to extend product lifespan and reduce overall maintenance costs.

Market Segmentation Analysis:

Market Segmentation Analysis: