Market overview

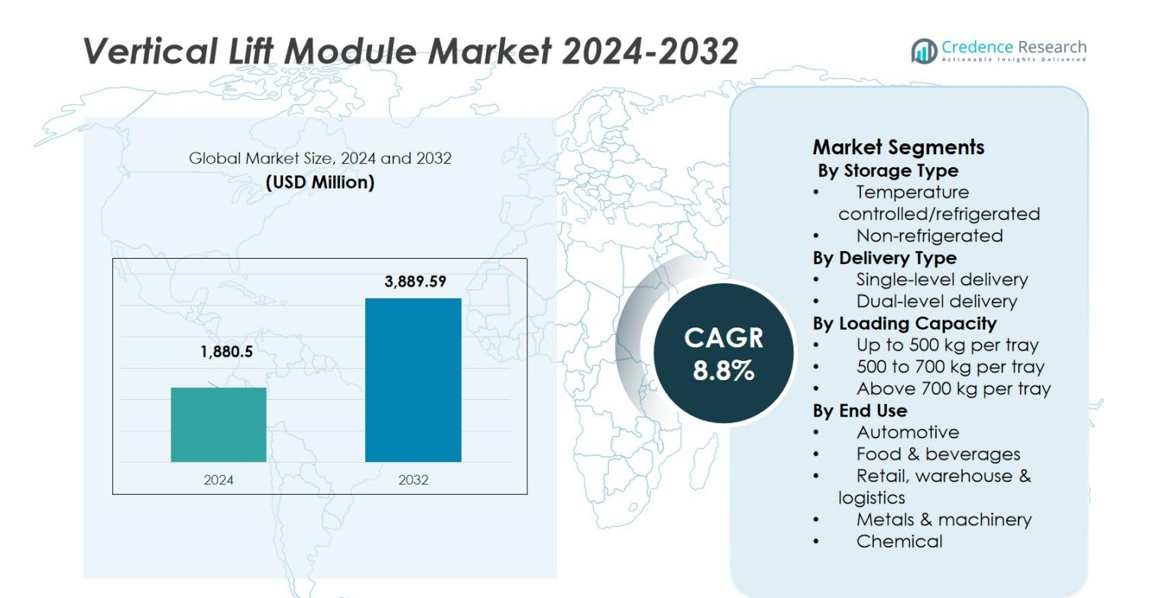

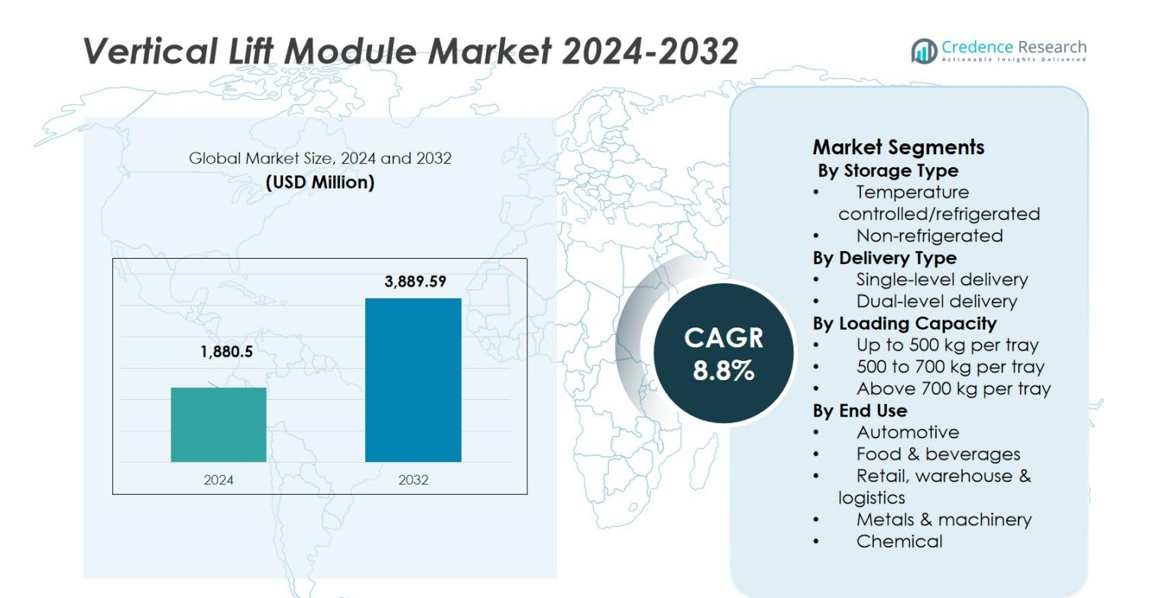

The Vertical Lift Module (VLM) Market was valued at USD 1,880.5 million in 2024 and is anticipated to reach USD 3,889.59 million by 2032, growing at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vertical Lift Module Market Size 2024 |

USD 1,880.5 million |

| Vertical Lift Module Market, CAGR |

8.8% |

| Vertical Lift Module Market Size 2032 |

USD 3,889.59 million |

The Vertical Lift Module (VLM) Market is driven by prominent players such as Kardex Holding AG, Hänel GmbH & Co. KG, Ferretto Group S.p.A., AutoCrib Inc., and Modula GROUP. These companies are focused on advancing their VLM systems with integrated smart technologies, automation features, and modular designs to meet the increasing demand for space optimization and efficiency in warehousing and manufacturing. North America leads the market with a 53.0% share, supported by high industrialization, labor costs driving automation, and extensive use of VLM systems in logistics and e-commerce. Europe holds 33.0% of the market share, with Germany and the UK being key players due to their strong manufacturing sectors. The Asia-Pacific region, growing rapidly, contributes 25.0% to the market share, driven by expanding e-commerce, manufacturing hubs in China and India, and automation initiatives in industrial and logistics operations.

Market Insights

- The global Vertical Lift Module (VLM) market was valued at USD 1,880.5 million in 2024 and is projected to reach USD 3,889.59 million by 2032, at a CAGR of 8%.

- Increasing demand for space‑optimization solutions and labour‑saving automation is driving significant investment in VLM systems, particularly across non‑refrigerated storage (which held 6% share in 2024) and single‑level delivery systems (which held 63.8% share in 2024).

- Trends such as integration of IoT, AI and real‑time analytics into VLM systems, and the surge of e‑commerce fulfilment applications are expanding opportunities in smart, connected storage modules.

- Market restraints include the high upfront capital cost of VLM installation and the technical complexity of maintenance, which limit adoption especially among small and medium‑sized enterprises.

- Regionally, North America commands a 0% share, Europe holds 33.0%, and Asia‑Pacific contributes 25.0%, while Emerging Regions (MEA & Latin America) account for 12.0%, reflecting varying levels of automation maturity and infrastructure investment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Storage Type

In the storage‑type segmentation of the Vertical Lift Module Market, the non‑refrigerated sub‑segment holds the dominant position with 65.6% share in 2024. This segment leads because non‑refrigerated VLM systems address a broad range of applications across automotive manufacturing, electronics assembly, and general industrial sectors where temperature control is not required. Non‑refrigerated modules offer cost efficiency, simpler design, and lower energy consumption compared to refrigerated models. Key drivers include warehouse space constraints, labor savings, and increasing demand for automated solutions.

- For instance, the Kardex Shuttle VLM is widely used in manufacturing and electronics assembly for its modular design that maximizes vertical capacity with minimal footprint, offering fast, ergonomic item delivery while maintaining energy efficiency.

By Delivery Type

In the delivery‑type segmentation, the single‑level delivery sub‑segment captured 63.8% of the market share in 2024. This is primarily due to the ergonomic advantages and cost-effectiveness it offers, especially in industries that require high throughput and consistent, efficient handling of goods. Single‑level systems allow for easy access to trays at a single height, minimizing operator strain. Growth drivers include automation in warehousing, labor shortages, and the need for space‑saving, flexible solutions in manufacturing, e‑commerce, and distribution centers.

By Loading Capacity

In the loading‑capacity segment, the up to 500 kg per tray sub‑segment holds the largest share at 59.2% in 2024. This class dominates due to its widespread use in storing smaller, lighter components across various industries such as automotive, electronics, and healthcare. It balances cost-effectiveness, efficiency, and ease of use for a range of applications. Key drivers include the demand for space optimization in warehouse environments, increasing adoption of goods‑to‑person automation, and the continued growth of e‑commerce and manufacturing industries handling smaller items.

- For instance, SEW-Eurodrive’s MAXOLUTION® mobile transportation vehicle supports up to 500 kg, facilitating the flexible internal transport of goods, trays, and boxes in industrial settings.

Key Growth Drivers

Rising Demand for Space Optimization

The growing demand for space optimization in warehouses, distribution centers, and manufacturing plants is a significant driver for the Vertical Lift Module (VLM) market. With increasing urbanization and limited real estate availability, businesses are focusing on maximizing storage efficiency within existing floor plans. VLM systems enable vertical storage of goods, significantly reducing the footprint required for inventory. By offering a compact, high-density solution, VLMs are ideal for industries like e-commerce, automotive, and healthcare, where space constraints are critical. This trend is expected to drive sustained market growth as companies adopt VLM systems to optimize storage and improve operational efficiency.

- For instance, Vidir’s Vertical Lift Module can reclaim up to 85% of floor space by utilizing vertical storage towers, enabling efficient management of heavy or bulky items like automotive components while improving picking accuracy and inventory control.

Increasing Automation in Warehouses

Automation is rapidly transforming the logistics and manufacturing sectors, and this shift is driving the demand for Vertical Lift Modules. As businesses seek to enhance productivity and reduce human labor costs, the adoption of automated solutions, including VLMs, has surged. These systems offer the advantage of integrating seamlessly with automated workflows, providing efficient goods-to-person solutions. The reduction in manual handling not only improves accuracy and speed but also helps reduce workplace injuries. As automation continues to expand, VLM systems will become a core component of modern, high-efficiency warehouses and factories.

- For instance, Komatsu implemented Modula VLMs in its parts warehouse and reduced floor space usage by up to 85%, cut overall picking time by up to 60%, and improved inventory accuracy by minimizing manual search and handling errors.

Labor Shortages and Rising Labor Costs

Labor shortages and rising labor costs are compelling businesses to invest in automated solutions like Vertical Lift Modules. With a shortage of skilled workers, especially in industries like manufacturing and warehousing, companies are increasingly turning to automation to maintain productivity. VLMs reduce the need for manual labor by enabling automated retrieval and storage of goods. By enhancing productivity and minimizing the dependency on human labor, VLM systems help companies mitigate the challenges of high labor costs, making them an attractive investment for businesses across industries.

Key Trends & Opportunities

Integration of IoT and Smart Technologies

The integration of Internet of Things (IoT) and smart technologies into Vertical Lift Modules presents a significant opportunity for market expansion. By incorporating sensors, real-time tracking, and automated alerts, VLM systems can provide valuable insights into inventory levels, system performance, and maintenance needs. These advancements improve operational efficiency by enabling predictive maintenance, reducing downtime, and optimizing storage usage. As the demand for connected, intelligent automation grows, VLMs equipped with IoT capabilities are set to play a central role in modern, data-driven warehouses and distribution centers.

- For instance, Vanderlande combines automation and IoT to improve efficiency and seamless system integration, enabling smarter warehouse management.

Growth of E-commerce and Online Retail

The rapid growth of e-commerce and online retail presents a significant opportunity for the Vertical Lift Module market. As online shopping continues to expand, there is increasing pressure on logistics and fulfillment centers to process large volumes of goods efficiently. VLMs offer the ideal solution by streamlining the storage and retrieval of products in high-demand environments. With their ability to reduce storage space requirements while improving pick-and-place speed, VLMs enable e-commerce companies to meet rising consumer expectations for fast and accurate order fulfillment. The continued rise of e-commerce will drive the adoption of VLMs in warehouses worldwide.

- For instance, cosmetics and nutraceutical firm Solimè integrated three Modula vertical lift modules to consolidate inventory, optimize storage density, and speed up order processing times, directly supporting its growing e-commerce channel with faster, more accurate picking.

Key Challenges

High Initial Investment Costs

Despite their benefits, the high initial investment costs of Vertical Lift Modules present a significant challenge for many businesses, particularly small and medium-sized enterprises. The cost of purchasing and installing VLM systems can be prohibitive, especially when coupled with the need for integration with existing warehouse infrastructure. While VLMs offer long-term operational savings, the upfront capital required can deter some businesses from adopting this technology. As such, reducing the cost of VLM systems and providing more flexible financing options will be key to overcoming this challenge and driving broader market adoption.

Maintenance and Technical Complexity

The maintenance and technical complexity of Vertical Lift Modules can pose challenges to businesses looking to implement these systems. VLMs, being sophisticated automated storage solutions, require regular maintenance and periodic technical support to ensure optimal performance. The complexity of these systems means that specialized training and skilled technicians are needed for troubleshooting and repairs. Downtime due to system malfunctions can result in significant disruptions to operations, which is a concern for businesses considering the long-term reliability of VLM solutions.

Regional Analysis

North America

The North America region holds an approximate market share of 53.0% in the global Vertical Lift Module (VLM) market. This dominance arises from a well‑developed industrial base, high labour costs driving automation, and extensive deployment of VLM systems in warehousing, automotive, aerospace, and e‑commerce sectors. Manufacturers benefit from advanced digital infrastructure and integration of VLMs with warehouse management systems, enabling improved inventory accuracy and operational efficiency. The region’s strong presence of key equipment suppliers and retrofit markets further reinforces VLM adoption across the United States and Canada.

Europe

The Europe region accounts for 33.0% of the global VLM market share. Growth is driven by the region’s strong manufacturing base in automotive, aerospace, and precision engineering, stringent occupational and space‑optimization regulations, and early adoption of Industry 4.0 automation. VLM systems are increasingly used to maximize vertical space in compact facilities while supporting high‑volume, high‑accuracy parts handling. Germany and the U.K. are key markets, with suppliers focused on energy‑efficient and modular VLM designs to meet sustainability mandates and retrofit deployments.

Asia-Pacific

In the Asia-Pacific region, the market holds about 25.0% share and demonstrates the fastest growth rate. This region’s growth stems from the rapid expansion of e‑commerce fulfilment centers, automotive and electronics manufacturing, industrial corridor development in China and India, and acute labour shortage pressures. VLM adoption is rising in smart factories and logistics automation initiatives aimed at high‑density storage and rapid parts retrieval. The combination of growing demand and improving infrastructure positions Asia-Pacific as a critical future growth engine.

Middle East & Africa (MEA) and South America (Rest of World)

The combined MEA and South America region contributes the remaining share, estimated at 12.0% of the global VLM market. Adoption in these regions is driven by investments in logistics hubs, free‑trade zones, and industrial parks in Gulf countries, and automotive/parts distribution growth in Latin America. However, uptake is constrained by limited automation maturity, lower capital spending, and a shortage of skilled service infrastructure. Growth potential exists where regulatory and infrastructure reforms support warehouse modernization and automation.

Market Segmentations:

By Storage Type

- Temperature controlled/refrigerated

- Non-refrigerated

By Delivery Type

- Single-level delivery

- Dual-level delivery

By Loading Capacity

- Up to 500 kg per tray

- 500 to 700 kg per tray

- Above 700 kg per tray

By End Use

- Automotive

- Food & beverages

- Retail, warehouse & logistics

- Metals & machinery

- Chemical

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Vertical Lift Module (VLM) market features prominent players such as Kardex Holding AG, Hänel GmbH & Co. KG, Ferretto Group S.p.A., AutoCrib Inc. and Modula GROUP, among others. These firms consistently invest in research & development to introduce advanced VLM systems featuring smart‑controls and integration with Warehouse Management Systems (WMS). They also engage in strategic partnerships and expansions into emerging regions to bolster geographic reach and service presence. Battle for differentiation centres on enabling higher tray loads, dual‑level delivery options and temperature‑controlled modules. Manufacturers placing emphasis on after‑sales service, modular upgrades and sustainability credentials gain competitive edge. This evolving landscape fosters consolidation, as smaller players either specialise in niche applications or align with global firms to scale.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LISTA

- Kardex

- Ferretto SpA

- Mecalux S.A.

- Modula GROUP

- ICAM S.p.A.

- Hänel Büro

- ELF Automation

- Conveyor Handling Company

- AutoCrib

Recent Developments

- In April 2024, Modula Inc. launched “Modula Next” in the U.S., combining its VLM platform with industrial‑vending style security and precision.

- In January 2025, Kardex Holding AG introduced an upgraded VLM, the “Kardex Shuttle” featuring their new Total Intelligence Concept (TIC) control system globally (excluding North America initially).

- In June 2025, Modula announced the expansion of its Franklin, Ohio facility to triple production capacity to up to 1,600 VLMs annually

Report Coverage

The research report offers an in-depth analysis based on Storage Type, Delivery Type, Loading Capacity, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing automation across warehousing and manufacturing will drive greater adoption of VLM systems as companies seek high‑density storage and improved operational efficiency.

- Expansion of e‑commerce and omni‑channel fulfilment will lead logistics operators to deploy VLMs to reduce order‑picking time and improve throughput.

- Growing emphasis on space optimisation—especially in urban and high‑rent locations—will motivate businesses to replace horizontal shelving with vertical lift modules.

- Rising labour costs and ongoing labour shortages will push firms toward automated goods‑to‑person solutions, making VLMs more attractive.

- Integration of IoT, AI and real‑time analytics into VLM systems will create smarter storage solutions that offer predictive maintenance and inventory transparency.

- Sustainability and energy‑efficiency mandates will lead suppliers to develop VLMs with reduced power consumption and environmentally‑friendly components.

- Increased retrofitting of existing warehouses with VLM systems will open opportunities for modular and upgrade‑friendly product offerings.

- Emerging markets (Asia‑Pacific, Latin America, Middle East) will experience accelerated VLM adoption as industrial infrastructure and logistics networks expand.

- Service providers will bundle VLM installations with value‑added services such as remote monitoring, maintenance contracts and software upgrades, driving aftermarket revenue.

- The proliferation of dual‑level delivery systems and higher‑load‑capacity trays will enable VLMs to address heavier and more complex storage applications, broadening the end‑use scope.