| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Triflic Acid Market Size 2024 |

USD 104.6 Million |

| Triflic Acid Market, CAGR |

5.70% |

| Triflic Acid Market Size 2032 |

USD 163.0 Million |

Market Overview:

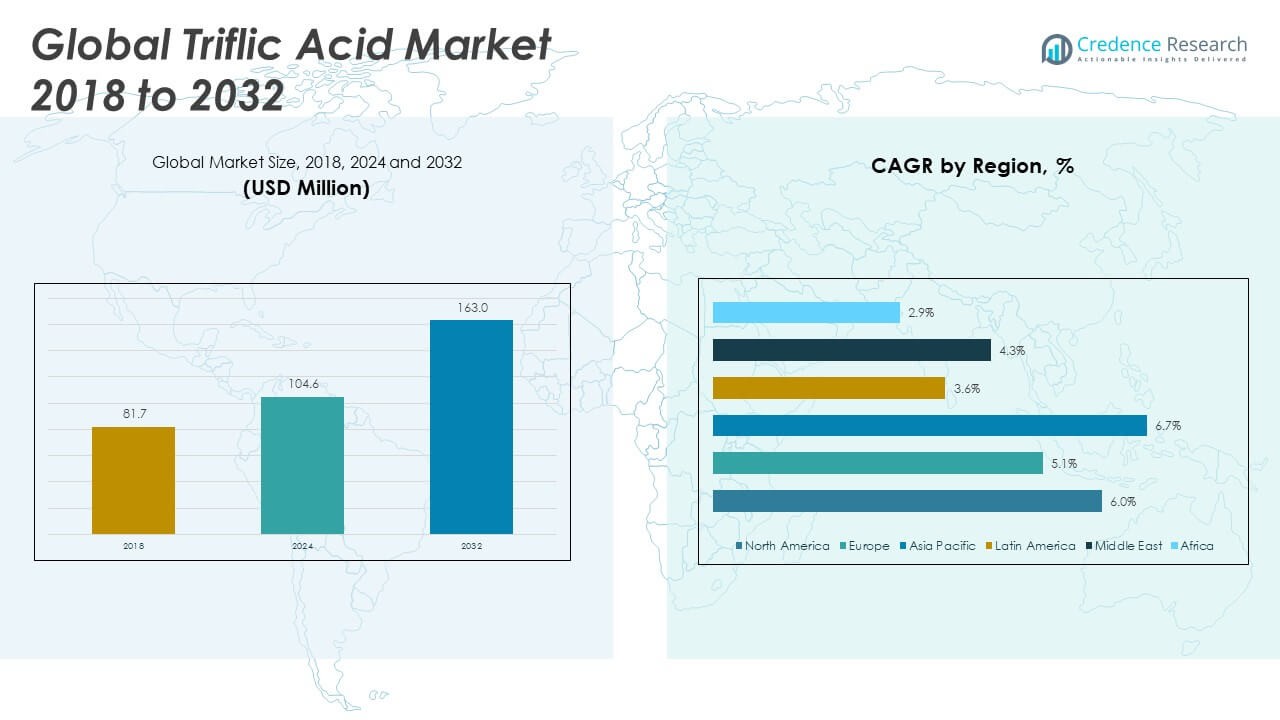

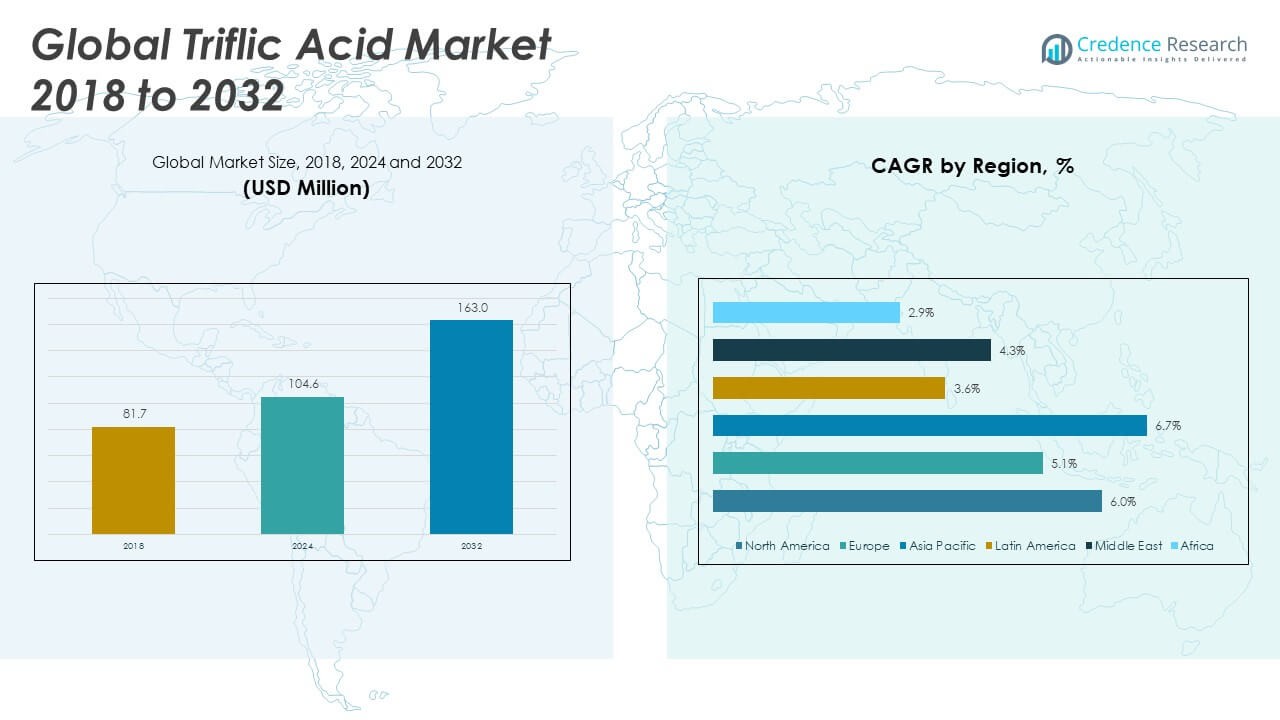

The Triflic Acid Market size was valued at USD 81.7 million in 2018 to USD 104.6 million in 2024 and is anticipated to reach USD 163.0 million by 2032, at a CAGR of 5.70% during the forecast period.

The Triflic Acid market is witnessing growth driven by its increasing adoption in the pharmaceutical and specialty chemicals industries. It serves as a powerful acid catalyst in the synthesis of complex molecules, enabling high reaction efficiency and selectivity. The rising demand for high-purity materials in electronics, particularly in semiconductor and battery applications, further supports market expansion. Additionally, the shift toward sustainable and green chemistry practices has amplified interest in triflic acid due to its non-oxidizing nature and thermal stability, which align with low-waste and energy-efficient production processes. Advancements in manufacturing processes have improved production yields and reduced costs, enhancing its commercial viability across sectors.

North America holds a significant share of the Triflic Acid market, driven by a strong presence of pharmaceutical companies and robust investment in chemical R&D. Europe follows closely, supported by advanced chemical manufacturing infrastructure and stringent environmental regulations encouraging the use of high-performance reagents. Asia-Pacific is the fastest-growing region, fueled by rapid industrialization in China, India, and South Korea, where demand for triflic acid is rising across electronics, pharmaceuticals, and chemical production. Latin America and the Middle East & Africa remain emerging markets, with gradual growth tied to expanding industrial capabilities and increased focus on sustainable production technologies. Strategic collaborations between local manufacturers and global chemical companies are enhancing regional supply chains. Moreover, government support for high-tech industries in Asia-Pacific is expected to solidify the region’s leadership in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Triflic Acid Market was valued at USD 104.6 million in 2024 and is projected to reach USD 163.0 million by 2032, growing at a CAGR of 5.70%.

- Strong demand from the pharmaceutical and specialty chemical industries is driving market growth due to triflic acid’s role as a powerful, non-oxidizing acid catalyst.

- The electronics sector, particularly in semiconductors and battery technologies, is fueling demand for high-purity triflic acid in etching and advanced material synthesis.

- The market is benefiting from the shift toward sustainable and green chemistry practices, with triflic acid supporting low-waste, energy-efficient production processes.

- Innovations in manufacturing, including flow chemistry and optimized purification, are improving yield, reducing cost, and expanding global supply capabilities.

- High production costs and stringent safety handling requirements limit broader adoption, especially among small and mid-sized enterprises.

- Asia-Pacific is the fastest-growing region, while North America and Europe remain mature markets supported by pharmaceutical demand and chemical R&D investments.

Market Drivers:

Rising Demand for High-Performance Acid Catalysts in Pharmaceuticals and Specialty Chemicals

The pharmaceutical and specialty chemical industries are primary drivers for the Triflic Acid Market. Triflic acid is used as a strong, non-oxidizing acid catalyst that enables efficient and selective transformations in drug synthesis and fine chemical production. It supports reactions under mild conditions while delivering high yields and product purity. The increase in complex drug formulations and advanced synthesis routes has amplified the need for such high-performance catalysts. Triflic acid is particularly valuable in processes where conventional acids fail to provide the desired selectivity or stability. The Triflic Acid Market benefits from ongoing innovation in active pharmaceutical ingredients (APIs), where it plays a critical role in streamlining reaction mechanisms.

Expansion of the Electronics Sector and Growing Need for Ultra-Pure Chemical Agents

The electronics industry is increasingly driving the growth of the Triflic Acid Market. It is widely used in microelectronics for etching, doping, and as a reagent in the synthesis of specialty fluorinated compounds. These applications require ultra-pure and stable acids that do not introduce impurities or cause material degradation. The rise in semiconductor manufacturing and the global demand for high-performance electronic components fuel this demand. Triflic acid meets the stringent purity and performance criteria required in the production of advanced electronic materials. Its integration into electronics-grade processes positions it as a strategic input for high-tech applications.

Adoption of Sustainable Chemistry and Environmentally Stable Reagents

The global shift toward sustainable industrial practices is pushing manufacturers to adopt safer, more efficient chemical agents. Triflic acid, with its thermal stability and low volatility, aligns with these objectives. It is preferred for processes that minimize hazardous waste generation and energy consumption. Regulatory bodies and environmental standards are influencing industries to reduce their ecological footprint, and this is prompting the adoption of cleaner chemical alternatives. The Triflic Acid Market is benefiting from this transition, especially in sectors seeking to improve their environmental compliance without compromising on process efficiency. It supports the development of greener production routes in both large-scale and niche applications.

- For example, BASF SE emphasizes its commitment to sustainable chemistry in its 2023 sustainability initiatives, highlighting the development and application of advanced catalytic processes aimed at reducing hazardous waste and improving energy efficiency in chemical manufacturing.

Advancements in Manufacturing Processes and Global Supply Chain Optimization

Recent advancements in synthesis and purification techniques have improved the cost-efficiency and scalability of triflic acid production. Manufacturers are implementing continuous flow processes and optimized reaction conditions to enhance throughput and product consistency. This progress enables broader adoption of triflic acid, even in cost-sensitive applications. The Triflic Acid Market is also supported by the expansion of global distribution networks and strategic partnerships between suppliers and end-use industries. It allows reliable access to high-purity triflic acid across multiple regions. These developments ensure stable supply, meet growing demand, and contribute to long-term market growth.

- For instance, in July 2023, Global Fluorine Chemical Factory (GFCF) announced the launch of a new production facility in Abu Dhabi’s KEZAD zone, tripling its overall capacity for fluorine-based chemicals. The facility incorporates continuous flow production and advanced purification systems to enhance scalability and ensure consistent product quality.

Market Trends:

Growing Integration of Triflic Acid in Sustainable and Green Synthesis Processes

Industries are actively seeking alternatives to hazardous and energy-intensive chemical processes, leading to the integration of triflic acid in green synthesis routes. Its strong acidity, thermal stability, and non-oxidizing nature make it suitable for sustainable manufacturing applications. It supports reactions under mild conditions, helping reduce energy usage and waste generation. In the pharmaceutical and agrochemical sectors, triflic acid enables selective transformations without producing corrosive by-products. The Triflic Acid Market reflects this shift, with companies promoting it as a cleaner catalyst aligned with environmental regulations. Demand is increasing in response to stricter emissions controls and a global push for greener chemical technologies.

Rising Use of Triflic Acid in Semiconductor and Electronics Manufacturing

The electronics industry continues to adopt triflic acid for high-purity processing applications. It plays a role in etching, surface treatment, and doping steps where impurity control is critical. The growing production of microchips, printed circuit boards, and specialty electronics is increasing the demand for ultrapure reagents. The Triflic Acid Market is gaining momentum as electronics manufacturers look for reliable materials that maintain performance and consistency. Companies are scaling up their use of high-performance acids that meet international quality and safety standards. Triflic acid’s compatibility with sensitive processes and materials positions it as a key input in this sector.

- For instance, Sigma-Aldrich offers trifluoromethanesulfonic acid-d with 98 atom % isotopic purity for mass spectrometry and high-throughput screening, supporting advanced analytical and semiconductor applications

Expansion of Research and Development Activities Across Multiple End-Use Industries

Increased R&D investments across pharmaceuticals, polymers, and specialty chemicals are accelerating the application scope of triflic acid. Researchers are leveraging its catalytic properties to explore new reaction mechanisms and synthesis pathways. It is gaining attention for its role in fluorination reactions and functional group conversions, which are critical for the development of advanced materials and drugs. The Triflic Acid Market is supported by academic collaborations and private sector funding aimed at innovation and formulation design. It continues to emerge as a versatile tool in modern chemistry labs. The trend reflects a broader movement toward precision chemistry and process optimization.

- For example, Sagar Life Sciences has established a dedicated R&D division equipped with gram-level research laboratories and pilot plant facilities capable of producing quantities ranging from 1 to 10 kilograms. The company focuses on process optimization and custom synthesis, supporting both small-scale and pilot-scale production.

Shifting Focus Toward High-Purity Grades and Custom Formulations

Demand for high-purity and application-specific variants of triflic acid is increasing across industrial segments. Manufacturers are responding by offering customized grades that align with distinct quality specifications and handling requirements. The shift is particularly evident in electronics and life sciences, where product purity directly influences final performance. The Triflic Acid Market is evolving toward more refined and targeted offerings, catering to niche but high-value applications. It promotes greater efficiency and reliability in end-user operations. This trend is reshaping supplier strategies and encouraging further innovation in product formulation and distribution.

Market Challenges Analysis:

High Production Costs and Handling Complexity Limit Broader Adoption

The Triflic Acid Market faces challenges due to the high cost of production and complex handling requirements. Manufacturing triflic acid involves the use of fluorinated raw materials and specialized synthesis processes, which significantly raise production expenses. It demands strict environmental and safety controls due to its corrosive and reactive nature, increasing operational overhead for end users. These factors restrict its usage to high-value applications where cost is justified by performance. Small and mid-sized enterprises often hesitate to adopt it due to the investment needed for safe storage, transportation, and usage. This cost and compliance burden narrows its accessibility, slowing wider market penetration.

Stringent Regulatory and Environmental Compliance Constraints

Triflic acid is classified as a hazardous chemical, and its use is tightly regulated by occupational safety and environmental protection bodies across major regions. Industries must meet stringent guidelines for handling, disposal, and worker safety, which adds complexity to its adoption. The Triflic Acid Market must navigate these regulations while maintaining supply chain reliability and product purity. Regulatory shifts or tightened restrictions can disrupt availability or require reformulation of existing processes. It creates uncertainty for manufacturers and users who rely on consistent access. Compliance demands continue to shape production, distribution, and end-user decisions, posing a significant barrier to unregulated expansion.

Market Opportunities:

Emerging Applications in Advanced Materials and Battery Technologies

The growing focus on next-generation materials and energy storage technologies presents strong opportunities for the Triflic Acid Market. Triflic acid plays a critical role in the synthesis of fluorinated compounds used in specialty polymers and advanced battery electrolytes. Its stability and high acidity enable precision in chemical modification, making it valuable in the development of solid-state batteries and lithium-based systems. It can support cleaner, more efficient production of high-performance materials in electronics and energy sectors. The market stands to benefit from increasing investments in electric mobility and renewable energy infrastructure. It aligns with the demand for specialized chemicals that improve energy density, thermal stability, and cycle life in modern batteries.

Increased Demand from Emerging Economies and Regional Manufacturing Growth

Expanding chemical and pharmaceutical manufacturing capabilities in emerging economies offer new growth avenues for the Triflic Acid Market. Countries such as China, India, and Brazil are increasing domestic production of active pharmaceutical ingredients and specialty intermediates. This growth creates a need for efficient, high-purity acid catalysts like triflic acid. It allows regional manufacturers to improve synthesis efficiency and meet global quality standards. Favorable government policies supporting local production and reduced reliance on imports can boost adoption. The market is positioned to benefit from strategic collaborations and regional supply chain development in fast-industrializing countries.

Market Segmentation Analysis:

By type, the Triflic Acid Market is segmented into the chemical industry, pharmaceutical The Triflic Acid Market is segmented by type into 99.5% type, 99.9% type, and others. The 99.5% type holds a significant share due to its widespread use in general industrial processes where ultra-high purity is not critical. It is favored in cost-sensitive applications across chemical synthesis and material processing. The 99.9% type dominates high-performance segments that demand exceptional purity, such as pharmaceuticals, semiconductors, and fine chemical production. Its high reactivity and low contamination levels make it essential for controlled and selective transformations. The “others” category includes customized or intermediate grades used in experimental or pilot-scale applications.

- For example, Sigma‑Aldrich (MilliporeSigma) sells its ReagentPlus® triflic acid at ≥99% purity (often used in pharmaceutical and electronics labs)

By application, the Triflic Acid Market is segmented into the chemical industry, pharmaceutical industry, electronics industry, and others. The chemical industry leads in volume consumption due to triflic acid’s role as a strong acid catalyst in various reactions. The pharmaceutical industry contributes significantly in value, leveraging its selectivity and compatibility with sensitive active ingredients. The electronics industry continues to grow, using triflic acid in etching and material modification processes where purity is essential. The “others” segment includes niche applications such as academic research and advanced material development.

- For instance, Solvay’s industrial-scale triflic acid product is explicitly marketed for electronic applications such as liquid crystal and battery production. Additionally, distributors like Wego Chemical Group list electronics among end-use markets for its triflic acid portfolio, confirming the chemical’s relevance in semiconductor and battery supply chains.

Segmentation:

By Type

By Application

- Chemical Industry

- Pharmaceutical Industry

- Electronics Industry

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

The North America Triflic Acid Market size was valued at USD 19.4 million in 2018 to USD 23.5 million in 2024 and is anticipated to reach USD 34.2 million by 2032, at a CAGR of 6.0% during the forecast period. North America holds a notable 21% share of the global Triflic Acid Market, driven by its robust pharmaceutical and specialty chemicals industries. The presence of leading R&D facilities and established regulatory compliance standards enhances the adoption of high-purity catalysts. It is extensively used across drug synthesis, electronics, and laboratory applications in the United States and Canada. Demand continues to grow due to increased investment in sustainable chemical processes and advanced materials. Regional manufacturers benefit from a well-developed supply chain and access to advanced infrastructure. The market remains stable, supported by consistent demand from healthcare and high-tech sectors.

The Europe Triflic Acid Market size was valued at USD 22.5 million in 2018 to USD 27.4 million in 2024 and is anticipated to reach USD 39.9 million by 2032, at a CAGR of 5.1% during the forecast period. Europe commands approximately 25% of the global Triflic Acid Market, backed by a mature chemical manufacturing base and strong environmental policies. The region relies on triflic acid in pharmaceutical innovation, high-value specialty chemicals, and regulated laboratory applications. It maintains strict guidelines for chemical usage and waste management, which aligns with the controlled use of triflic acid. Germany, France, and the UK are key contributors, supporting market growth through industrial-scale adoption. European manufacturers focus on eco-efficient synthesis, which further increases the relevance of triflic acid. It continues to play a vital role in developing sustainable industrial chemistry.

The Asia Pacific Triflic Acid Market size was valued at USD 28.8 million in 2018 to USD 39.3 million in 2024 and is anticipated to reach USD 67.6 million by 2032, at a CAGR of 6.7% during the forecast period. Asia Pacific holds the largest share of the Triflic Acid Market at 39%, supported by rapid industrialization and expansion in electronics and pharmaceutical sectors. China, India, South Korea, and Japan are leading consumers, utilizing triflic acid in semiconductor manufacturing, API production, and chemical synthesis. The region’s low-cost manufacturing base and supportive government policies are encouraging adoption. It benefits from increasing domestic production capacity and international partnerships. With rising demand for high-purity reagents, manufacturers in Asia Pacific are scaling up capabilities. The market continues to grow rapidly, establishing the region as the global growth engine.

The Latin America Triflic Acid Market size was valued at USD 3.5 million in 2018 to USD 4.8 million in 2024 and is anticipated to reach USD 8.0 million by 2032, at a CAGR of 3.6% during the forecast period. Latin America accounts for roughly 5% of the Triflic Acid Market and shows steady demand driven by pharmaceutical and agrochemical industries. Brazil and Mexico are key markets, focusing on expanding chemical manufacturing and API production. It is gradually adopted in industrial applications that require selective and efficient acid catalysis. Limited local production poses a challenge, but regional players are exploring imports and joint ventures. The market shows potential for growth as industrialization progresses. Increasing regulatory alignment with global standards may support wider usage in the coming years.

The Middle East Triflic Acid Market size was valued at USD 5.1 million in 2018 to USD 6.7 million in 2024 and is anticipated to reach USD 11.1 million by 2032, at a CAGR of 4.3% during the forecast period. The Middle East holds a 7% share of the Triflic Acid Market, with demand stemming from the region’s developing pharmaceutical and petrochemical sectors. The United Arab Emirates and Saudi Arabia are emerging hubs for specialty chemicals and industrial R&D. It supports clean synthesis processes that align with the region’s goals for diversification and green manufacturing. Growing interest in advanced electronics and energy storage materials contributes to demand. Regional players are exploring technology transfers and international supply agreements. The market is building momentum, supported by national industrial strategies.

The Africa Triflic Acid Market size was valued at USD 2.4 million in 2018 to USD 2.8 million in 2024 and is anticipated to reach USD 2.1 million by 2032, at a CAGR of 2.9% during the forecast period. Africa represents the smallest share in the Triflic Acid Market, at less than 3%, with usage concentrated in academic research and select pharmaceutical activities. Countries such as South Africa, Nigeria, and Egypt are gradually adopting advanced chemical inputs to modernize local industries. It faces limitations in terms of infrastructure, supply chain access, and skilled workforce. Despite these challenges, academic and government initiatives to develop chemical research may increase awareness and adoption. The market remains in an early stage, with potential for long-term growth as industrial capacity expands. Efforts to enhance regional manufacturing and education in applied sciences may support future development.

Key Player Analysis:

- Merck KGaA

- SynQuest Laboratories, Inc.

- TCI Chemicals

- Alfa Aesar (Thermo Fisher Scientific)

- Sigma-Aldrich (Merck Group)

- ABCR GmbH

- Tokyo Chemical Industry Co., Ltd.

- Oakwood Chemical

- Ark Pharm, Inc.

- Matrix Scientific

- BASF SE

- Solvay SA

- Zhejiang Haili Chemical Co., Ltd.

- Daejung Chemicals & Metals Co., Ltd.

Competitive Analysis:

The Triflic Acid Market features a concentrated competitive landscape with a few key global players dominating production and distribution. Companies such as Central Glass Co., Ltd., Solvay S.A., Merck KGaA, and TCI Chemicals play a significant role in supplying high-purity triflic acid for critical applications. It remains capital-intensive due to the complexity of synthesis and stringent purity standards, limiting new entrants. Established players invest in R&D to develop advanced grades and ensure regulatory compliance across diverse end-use sectors. Strategic partnerships, capacity expansions, and geographic diversification are common strategies to maintain market presence. The Triflic Acid Market is shaped by performance consistency, technical support, and reliable delivery, giving established suppliers a competitive edge. It continues to evolve with growing demand from pharmaceuticals, electronics, and specialty chemicals, prompting manufacturers to refine production technologies and enhance supply chain resilience. Competitive dynamics are expected to intensify with rising demand for customized and sustainable chemical solutions.

Recent Developments:

- In April 2025, Merck KGaA announced a significant acquisition, entering into a definitive agreement to acquire SpringWorks Therapeutics, Inc., a U.S.-based biopharmaceutical company specializing in treatments for severe rare diseases and cancer. The deal, valued at approximately $3.9 billion, is designed to sharpen Merck’s focus on rare tumors, accelerate growth, and strengthen its presence in the U.S. healthcare market.

- In January 2025, Merck KGaA also launched the beta version of M-Trust™, a first-to-market cyber-physical trust platform. This platform enables the creation of digital twins for enhanced product quality and authenticity, aiming to address challenges related to product safety, traceability, and counterfeiting. The launch took place at CES 2025, with the platform immediately available for B2B users globally, reflecting Merck’s commitment to digital innovation in the chemical and life sciences industries.

- In July 2023, the Khalifa Economic Zones Abu Dhabi (KEZAD Group), the UAE’s largest operator of integrated and purpose-built economic zones, announced a significant partnership with Global Fluorine Chemical Factory LLC (GFCF). The agreement enables GFCF to establish phase two of its operations in KEZAD Mussafah, which will allow the company to triple its production capacity.

Market Concentration & Characteristics:

The Triflic Acid Market exhibits a high degree of concentration, with a limited number of specialized manufacturers controlling a majority of global supply. It is characterized by high entry barriers due to complex production processes, stringent safety regulations, and the need for advanced purification technologies. The market emphasizes product quality, consistency, and compliance with international standards, making supplier reliability critical. It serves niche but high-value sectors such as pharmaceuticals, electronics, and specialty chemicals, where demand for ultrapure acid catalysts is strong. Long-term contracts and technical expertise often define supplier-client relationships. It remains innovation-driven, with a focus on developing customized formulations and sustainable production methods.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for triflic acid will rise with increased pharmaceutical R&D focused on complex molecule synthesis.

- Growth in the semiconductor industry will drive adoption of high-purity acid for microfabrication processes.

- Expansion of electric vehicle production will boost use in battery electrolyte development.

- Sustainable chemistry initiatives will support wider use of triflic acid in green synthesis pathways.

- Emerging economies will increase consumption due to industrialization and domestic API manufacturing.

- Technological advances in production will improve yield, reduce cost, and enhance scalability.

- Custom-grade formulations will gain traction in specialty applications requiring precise performance.

- Strategic partnerships between global suppliers and regional distributors will strengthen market access.

- Regulatory compliance and environmental safety will shape innovation in handling and waste management.

- Digitalization in chemical manufacturing will improve traceability and process control in triflic acid applications.