Market Overview

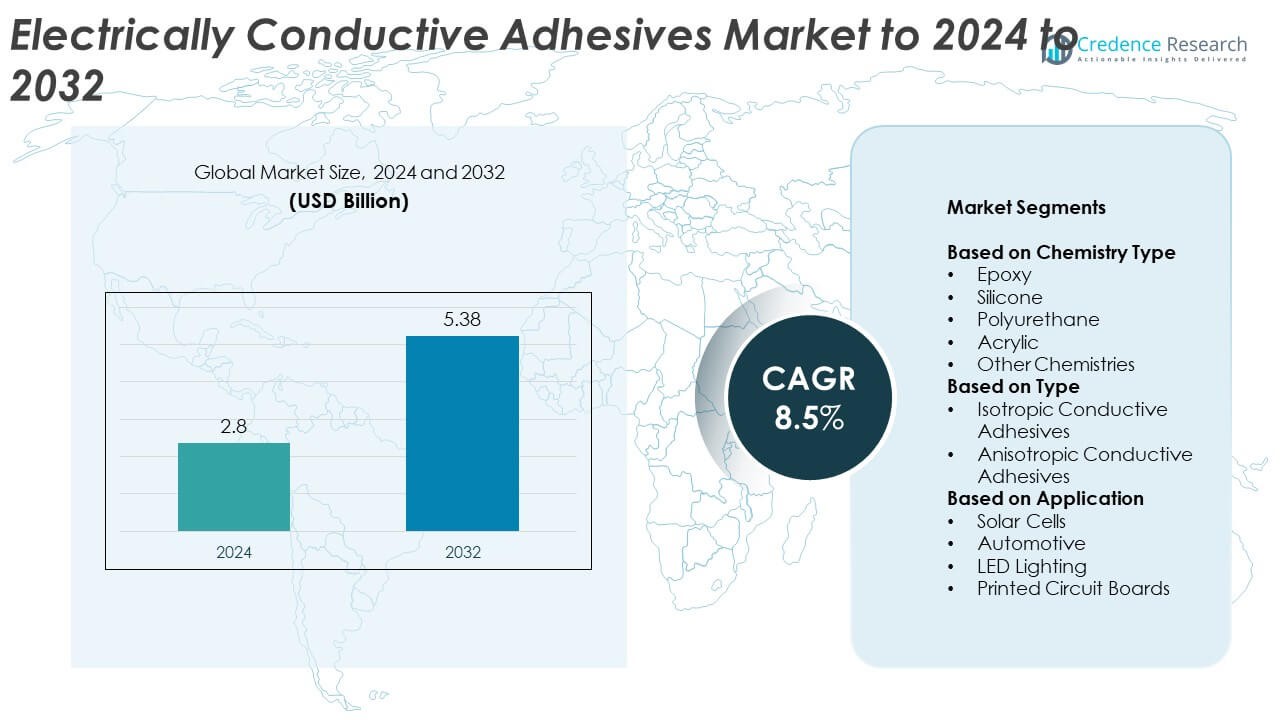

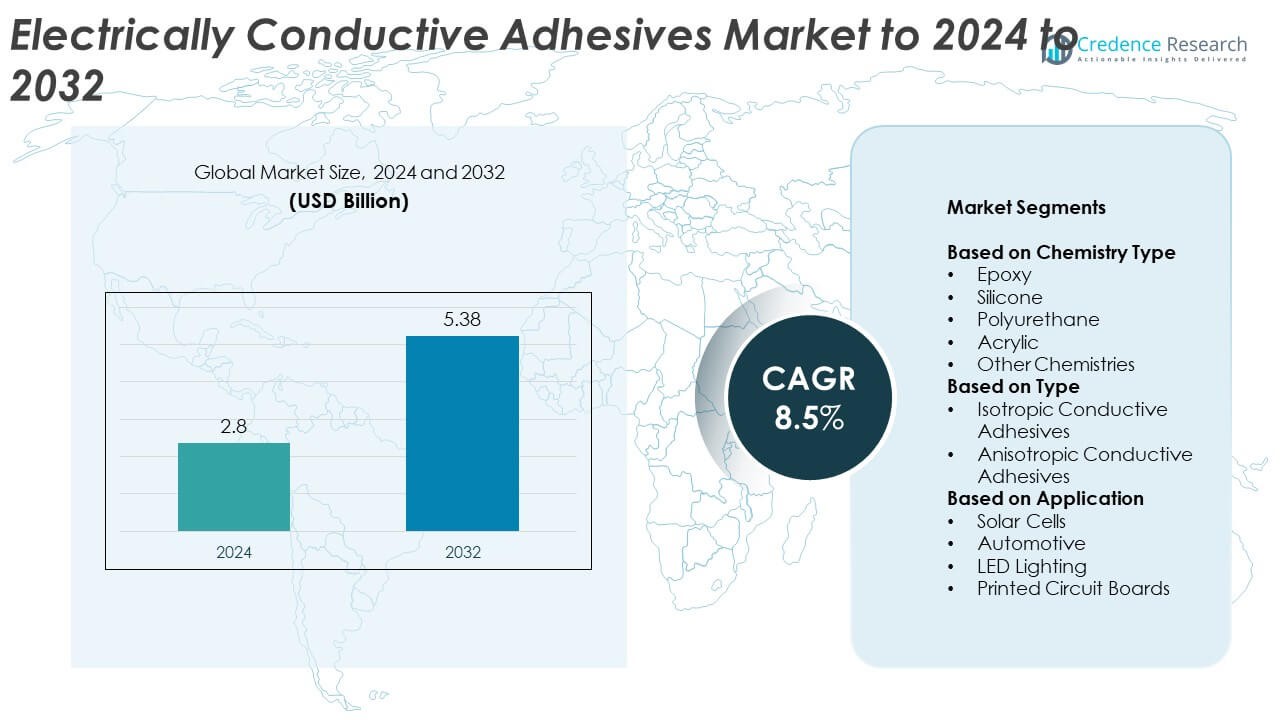

Electrically Conductive Adhesives Market size was valued at USD 2.8 Billion in 2024 and is anticipated to reach USD 5.38 Billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrically Conductive Adhesives Market Size 2024 |

USD 2.8 Billion |

| Electrically Conductive Adhesives Market, CAGR |

8.5% |

| Electrically Conductive Adhesives Market Size 2032 |

USD 5.38 Billion |

The electrically conductive adhesives market is driven by key players such as DuPont, Henkel AG & Co, H.B. Fuller Company, Bostik, Panacol-Elosol GmbH, Master Bond Inc., and Ellsworth Adhesives. These companies focus on developing high-performance, lead-free, and nanotechnology-based adhesives to meet growing demand across electronics, automotive, and renewable energy sectors. Strategic collaborations and R&D initiatives support innovations that enhance conductivity and durability in miniaturized devices. Regionally, Asia-Pacific leads the global market with a 31% share in 2024, supported by strong manufacturing bases in China, Japan, and South Korea, followed by North America and Europe as key contributors to market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electrically conductive adhesives market was valued at USD 2.8 Billion in 2024 and is projected to reach USD 5.38 Billion by 2032, expanding at a CAGR of 8.5%.

- Rising adoption in automotive electronics, renewable energy, and flexible devices is driving market growth, supported by demand for lead-free and sustainable adhesive solutions.

- Trends include advancements in nanotechnology-based formulations, growing use in wearable electronics, and increased integration of eco-friendly conductive materials.

- The market is moderately consolidated, with leading players focusing on R&D, product innovation, and strategic partnerships to strengthen global presence.

- Asia-Pacific leads with a 31% share, followed by North America at 34% and Europe at 27%, while the epoxy segment dominates the market with a 42% share due to its superior conductivity and mechanical strength.

Market Segmentation Analysis:

By Chemistry Type

The epoxy segment dominated the electrically conductive adhesives market in 2024 with a 42% share. Epoxy-based adhesives offer strong mechanical strength, excellent electrical conductivity, and superior heat resistance, making them ideal for electronics and automotive applications. Their low shrinkage and high adhesion to metals and composites enhance reliability in harsh environments. Rising demand for miniaturized electronic components and durable bonding materials in PCBs and LED assemblies continues to drive segment growth. Increasing usage in electric vehicles for battery and sensor connections further strengthens epoxy’s leadership in this category.

- For instance, Henkel LOCTITE ABLESTIK ICP 2120, a silver-filled, moisture-curing silicone modified MS polymer, lists a thermal conductivity of 7.0 W/m·K, a volume resistivity of \(1\times 10^{-4}\) Ω·cm, and a contact resistance of 0.03 Ω on gold (Au) pads. These metrics support high reliability in electronics, particularly for assembling heat-sensitive components in devices such as camera modules.

By Type

Isotropic conductive adhesives held the largest share of 63% in 2024 within the electrically conductive adhesives market. Their uniform conductivity in all directions makes them suitable for interconnecting electronic components, such as semiconductor chips and flexible circuits. These adhesives are widely adopted in the production of LEDs, displays, and automotive electronics. Growing miniaturization in consumer electronics and the need for reliable, lead-free interconnection solutions are major drivers. Continuous innovation in silver-based formulations enhances their conductivity, supporting their dominance over anisotropic conductive types.

- For instance, Creative Materials 124-08 A/B is a two-part, isotropic silver epoxy with a 1:1 mix ratio by weight, achieving \(0.00020.0004\) Ω·cm resistivity and \(6.5\) W/m·K thermal conductivity upon curing.

By Application

The printed circuit boards segment accounted for the highest market share of 48% in 2024. Electrically conductive adhesives are used extensively in PCBs to replace soldering, providing better flexibility and compatibility with heat-sensitive components. The growing use of lightweight, compact, and environmentally friendly devices boosts PCB adoption. Expansion of the electronics manufacturing sector in Asia-Pacific, along with increasing demand for wearable and smart devices, accelerates the need for conductive adhesives. Their reliability in maintaining electrical connectivity under thermal stress continues to reinforce their dominance in the market.

Key Growth Drivers

Rising Adoption in Automotive Electronics

The increasing integration of sensors, touch displays, and battery systems in vehicles is driving demand for electrically conductive adhesives. These materials offer lightweight, flexible, and heat-resistant bonding for advanced electronic assemblies. Growing adoption of electric vehicles and autonomous systems accelerates the need for adhesives with high conductivity and thermal stability. The shift toward replacing traditional soldering with adhesives to improve reliability and design flexibility further boosts growth across automotive applications.

- For instance, the Tesla Model Y was the world’s best-selling car in 2023, with global sales increasing by 64% to 1.22 million units.

Expanding Use in Consumer and Industrial Electronics

Electrically conductive adhesives are increasingly used in smartphones, wearables, and flexible circuits. Manufacturers prefer these adhesives due to their superior conductivity and compatibility with miniaturized devices. The expanding consumer electronics market in Asia-Pacific and advancements in surface-mount technology significantly drive adoption. The rising trend of flexible and printed electronics in smart packaging, sensors, and displays further enhances market growth.

- For instance, display market research firms like Display Supply Chain Consultants (DSCC) reported that total foldable OLED panel shipments reached a record high of 9.8 million units in Q2 2024, a 126% increase year-over-year.

Shift Toward Lead-Free and Eco-Friendly Materials

Regulatory restrictions on lead-based materials are accelerating the adoption of conductive adhesives as eco-friendly alternatives. Manufacturers are focusing on silver, carbon, and graphene-based adhesives that offer excellent performance without environmental hazards. Growing awareness of sustainability in electronics manufacturing and the push for RoHS and REACH compliance drive this transition. These adhesives reduce toxic emissions and improve recyclability, aligning with global green manufacturing trends.

Key Trends and Opportunities

Emergence of Flexible and Wearable Electronics

The rapid growth of flexible and wearable devices is creating strong opportunities for conductive adhesives. These materials offer excellent flexibility, low curing temperatures, and compatibility with polymer substrates. Their application in stretchable circuits, medical sensors, and smart textiles enhances performance and user comfort. As wearable technology becomes mainstream, demand for lightweight and high-conductivity adhesives continues to rise globally.

- For instance, Dycotec Materials reports DM-SIP-2006 stretchable silver paste with 170% maximum elongation for wearables and textiles.

Advancements in Nanotechnology-Based Formulations

Nanomaterials such as silver nanoparticles and graphene are being integrated into conductive adhesives to enhance conductivity and thermal properties. These advanced formulations enable thinner, more efficient connections for next-generation electronics. Continuous research in nanotechnology is expanding their applications in 5G communication devices, aerospace systems, and miniaturized medical equipment. This trend supports innovation and performance optimization in high-reliability electronics manufacturing.

- For instance, Asbury Carbons reports graphene-epoxy adhesives with a 0.58 vol% percolation threshold and 2.13 W/m·K thermal conductivity at 6 vol% loading.

Increasing Penetration in Renewable Energy Systems

Conductive adhesives are gaining traction in solar panel assembly and energy storage systems. They provide stable electrical contact, improve energy efficiency, and reduce assembly costs. The growing investment in renewable energy projects worldwide drives adoption. Their ability to withstand high temperatures and harsh environments makes them ideal for photovoltaic applications and smart grid components.

Key Challenges

High Cost of Raw Materials

Silver-based fillers used in conductive adhesives contribute significantly to production costs. This limits adoption among cost-sensitive manufacturers, especially in developing markets. Volatility in raw material prices also affects pricing stability and profit margins. Companies are exploring alternative materials like carbon black and copper, but achieving comparable conductivity remains challenging.

Performance Limitations in Extreme Conditions

Conductive adhesives face challenges in maintaining stability under high thermal and mechanical stress. Repeated thermal cycling and exposure to humidity can degrade conductivity and bond strength. This limits their use in certain high-performance electronic and aerospace applications. Manufacturers are investing in research to improve reliability and durability under extreme operational conditions.

Regional Analysis

North America

North America held a 34% share of the electrically conductive adhesives market in 2024, driven by strong demand across the electronics, automotive, and aerospace industries. The United States dominates the regional market due to its advanced manufacturing infrastructure and high adoption of electric vehicles. Growth in semiconductor production and renewable energy installations also supports regional expansion. Major companies are investing in advanced epoxy and silver-based adhesives to enhance product reliability and efficiency, further boosting North America’s leading position in the global market.

Europe

accounted for 27% of the electrically conductive adhesives market in 2024, supported by the region’s strong focus on sustainability and regulatory compliance. Demand is high in Germany, the United Kingdom, and France due to the expansion of electric mobility and renewable energy projects. The presence of established electronics manufacturers and research initiatives for lead-free adhesives strengthens growth. Rising adoption in flexible electronics and LED lighting applications continues to drive regional development, making Europe a key hub for technological innovation and eco-friendly material adoption.

Asia-Pacific

Asia-Pacific dominated the global electrically conductive adhesives market with a 31% share in 2024. China, Japan, and South Korea are leading contributors, supported by robust electronics manufacturing and rapid industrialization. The region’s growth is fueled by expanding smartphone production, automotive electronics, and renewable energy applications. Government initiatives promoting semiconductor and electric vehicle industries further accelerate adoption. Increasing investments in nanotechnology-based adhesives and low-cost manufacturing capabilities continue to position Asia-Pacific as the most dynamic and rapidly evolving regional market.

Latin America

Latin America captured a 5% share of the electrically conductive adhesives market in 2024, with growing adoption in Brazil and Mexico. Expansion in automotive component manufacturing and consumer electronics assembly is boosting regional demand. Local producers are focusing on cost-efficient formulations to meet increasing industrial needs. Supportive trade policies and investments in renewable energy infrastructure are creating new growth opportunities. However, limited R&D capabilities and dependency on imported raw materials slightly constrain large-scale development across Latin American markets.

Middle East & Africa

The Middle East and Africa region held a 3% share of the electrically conductive adhesives market in 2024. Growth is driven by increasing demand from renewable energy, telecommunications, and automotive industries. Countries like the UAE and South Africa are investing in advanced electronic assembly and solar energy projects. The region’s gradual shift toward digital infrastructure and energy diversification supports steady market expansion. Although adoption remains moderate, ongoing industrialization and infrastructure investments are expected to strengthen the region’s position in the coming years.

Market Segmentations:

By Chemistry Type

- Epoxy

- Silicone

- Polyurethane

- Acrylic

- Other Chemistries

By Type

- Isotropic Conductive Adhesives

- Anisotropic Conductive Adhesives

By Application

- Solar Cells

- Automotive

- LED Lighting

- Printed Circuit Boards

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The electrically conductive adhesives market is led by major players such as DuPont, Henkel AG & Co, H.B. Fuller Company, Bostik, Panacol-Elosol GmbH, Master Bond Inc., Ellsworth Adhesives, Aremco Products Inc., Stockwell Elastomerics Inc., United Resin Corp., Applied Technologies Inc., and PCR Technologies Inc. These companies focus on expanding product portfolios through advanced formulations that enhance conductivity, flexibility, and heat resistance. Strategic investments in R&D support the development of nanotechnology-based adhesives tailored for next-generation electronics and electric vehicles. Market leaders emphasize sustainable manufacturing by adopting eco-friendly, lead-free materials to meet global regulatory standards. Partnerships with automotive, semiconductor, and renewable energy sectors are increasing to deliver customized bonding solutions. Additionally, mergers and acquisitions remain central strategies to strengthen regional presence and technological expertise. Continuous innovation in polymer chemistry and filler technologies positions these companies to maintain a competitive edge in the evolving high-performance adhesives industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont

- Henkel AG & Co

- B. Fuller Company

- Bostik

- Panacol-Elosol GmbH

- Master Bond Inc.

- Ellsworth Adhesives

- Aremco Products Inc.

- Stockwell Elastomerics Inc.

- United Resin Corp.

- Applied Technologies Inc.

- PCR Technologies Inc.

Recent Developments

- In May 2023, Henkel launched Loctite TLB 9300 APSi, an injectable thermally conductive adhesive for EV battery systems.

- In 2023, Bostik collaborated with Polytec PT to introduce a new line of thermal conductive adhesives (TCAs).

- In 2023, DuPont has launched DuPont™Liveo™Soft Skin Conductive Tape 1-3150, a silicone-based thermoset adhesive for electrical biosignal sensing and transfer.

Report Coverage

The research report offers an in-depth analysis based on Chemistry Type, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with the expansion of electric vehicles and smart mobility solutions.

- Manufacturers will invest in advanced silver and graphene-based adhesive formulations.

- Adoption of lead-free, eco-friendly materials will accelerate due to stricter regulations.

- Growth in flexible and wearable electronics will create new market opportunities.

- Asia-Pacific will remain the fastest-growing region with strong manufacturing capacity.

- Integration of conductive adhesives in solar panels will boost renewable energy applications.

- Miniaturization of electronic components will increase the need for precision bonding materials.

- Companies will focus on improving thermal stability and long-term conductivity.

- Technological partnerships will expand to develop high-performance nanocomposite adhesives.

- Increasing automation in electronics manufacturing will drive large-scale adhesive adoption.