Market Overview

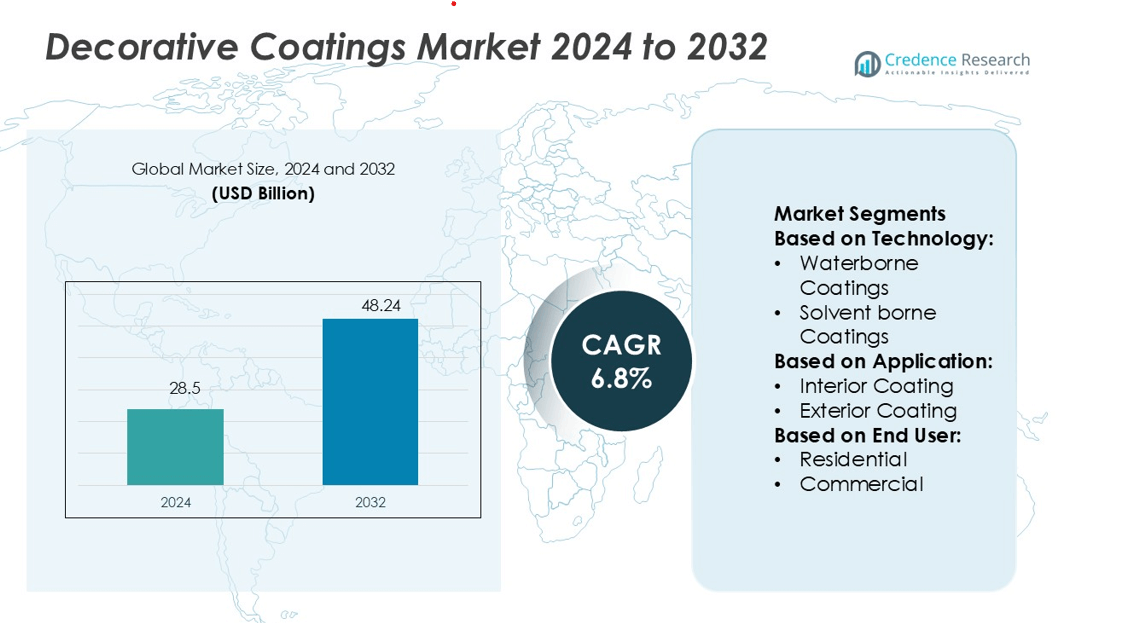

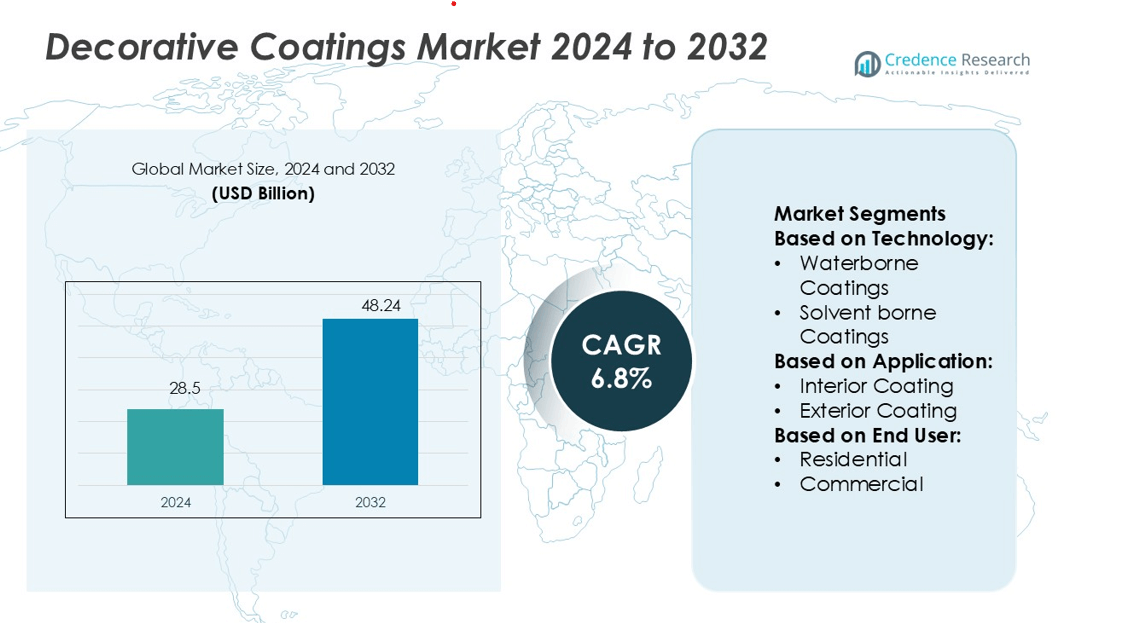

Decorative Coatings Market size was valued USD 28.5 billion in 2024 and is anticipated to reach USD 48.24 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decorative Coatings Market Size 2024 |

USD 28.5 billion |

| Decorative Coatings Market, CAGR |

6.8% |

| Decorative Coatings Market Size 2032 |

USD 48.24 billion |

The decorative coatings market is driven by major players such as Axalta Coating Systems Ltd., Hempel A/S, RPM International Inc., Asian Paints Limited, Sherwin-Williams Company, BASF SE, PPG Industries, Inc., Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., and Akzo Nobel N.V. These companies focus on product innovation, sustainable coating solutions, and expanding their global distribution networks to strengthen market positions. Asia Pacific leads the global decorative coatings market with a 36.7% share, supported by rapid urbanization, large-scale infrastructure projects, and rising disposable incomes. Strong manufacturing capabilities and increasing demand for eco-friendly coatings make the region a strategic hub for both production and consumption. Key players continue to invest heavily in R&D, capacity expansion, and strategic partnerships to capture growing opportunities in this high-demand region.

Market Insights

- The Decorative Coatings Market was valued at USD 28.5 billion in 2024 and is expected to reach USD 48.24 billion by 2032, growing at a CAGR of 6.8% during the forecast period.

- Rising construction and renovation activities, along with growing demand for eco-friendly and low-VOC coatings, are driving strong market expansion globally.

- Asia Pacific leads the market with a 36.7% share, supported by rapid urbanization, infrastructure investments, and increasing disposable incomes, while waterborne coatings hold the largest segment share.

- Leading companies focus on product innovation, sustainable coating solutions, and expanding their distribution networks to strengthen market positioning and gain a competitive edge.

- High raw material price volatility and strict regulatory requirements pose market restraints, but strong R&D investments and capacity expansion by key players support future growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Waterborne coatings lead the Decorative Coatings Market with a 52.6% share. Their dominance stems from low VOC content, quick drying, and strong environmental compliance. These coatings offer excellent adhesion and durability, making them suitable for both residential and commercial applications. Stricter emission regulations and rising eco-consciousness are accelerating their use. Solvent-borne coatings maintain relevance due to their superior performance in harsh conditions, while powder and UV-cured coatings are growing in niche applications like furniture and high-performance finishes.

- For instance, Axalta’s AquaEC 6100 cathodic electrocoat (a waterborne system) delivers high throw power and edge protection, with a typical film thickness of 15–30 µm on steel and measured corrosion resistance in salt spray tests exceeding 1,000 hours without red rust.

By Application

Interior coatings account for 48.3% of the market, making them the leading application segment. Their growth is driven by demand for washable, low-odor, and durable finishes in homes and offices. Interior coatings offer better coverage and smooth aesthetics, making them popular among consumers. Exterior coatings follow, supported by rising investments in building facades and weather-resistant paints. Furniture coatings are gaining traction due to their use in decorative finishes and protective layers for wood and engineered surfaces.

- For instance, Hempel’s Interior System for yachts uses a high-solids epoxy primer that reduces paint consumption by about 0.12 L per m² compared to conventional primers and yields over 250 µm of dry film thickness in two coats while satisfying surface spread of flame certification.

By End User

The residential segment holds 43.5% of the Decorative Coatings Market, dominating end-user demand. Urbanization, rising disposable incomes, and home renovation trends strongly support this growth. Consumers prefer waterborne decorative paints for their aesthetic appeal and low environmental impact. Commercial spaces such as offices, hotels, and retail buildings also contribute significantly, driven by large-scale infrastructure projects. Industrial use, though smaller, focuses on protective decorative finishes for equipment and structural elements.

Key Growth Drivers

Rising Construction and Renovation Activities

Rapid urbanization and infrastructure development are major drivers of decorative coatings demand. Residential and commercial construction projects are increasing globally, especially in Asia Pacific and North America. Renovation and remodeling activities in mature markets also boost product use for both interior and exterior applications. Decorative coatings offer enhanced aesthetics, surface protection, and weather resistance. Strong government investments in smart cities and green buildings further accelerate market growth. These factors together create consistent demand across various building segments.

- For instance, RPM subsidiary Carboline manufactures Carbomastic 615, a high-performance epoxy for corrosion protection, commonly used in demanding industrial and marine environments, including bridge and highway applications.

Growing Preference for Eco-Friendly Solutions

Stricter environmental regulations and rising consumer awareness are shifting the market toward low-VOC and waterborne coatings. These coatings reduce harmful emissions and support green building certifications. Manufacturers are developing advanced waterborne formulations that match or exceed the performance of solvent-borne coatings. This transition aligns with sustainability goals and drives adoption across residential and commercial projects. Enhanced indoor air quality and compliance with regulatory standards make eco-friendly decorative coatings an attractive choice for both developers and consumers.

- For instance, Asian Paints reported using 28,763 metric tons of wash water across its waterborne paint operations, which helped avoid freshwater use and reduce waste sludge.

Rising Disposable Incomes and Lifestyle Upgrades

Increasing income levels in emerging economies are driving demand for premium decorative coatings. Homeowners and commercial property developers are investing in aesthetic improvements and modern finishes. Decorative coatings with advanced features like stain resistance, easy washability, and smooth textures are gaining popularity. Expanding middle-class populations in countries such as India, China, and Brazil further support this trend. Retail expansion, modern housing, and improved living standards create strong long-term growth opportunities for premium and mid-range product categories.

Key Trends & Opportunities

Expansion of Smart Coatings and Functional Finishes

The market is witnessing rising adoption of smart decorative coatings that offer self-cleaning, anti-bacterial, and thermal insulation properties. These advanced coatings enhance both performance and aesthetics, addressing growing consumer demand for multi-functional solutions. Manufacturers are investing in nanotechnology and hybrid resin systems to boost product capabilities. Functional coatings are increasingly used in hospitals, educational buildings, and high-end residential spaces. This shift toward performance-driven decorative solutions creates new revenue streams for key market players.

- For instance, Sherwin-Williams developed PaintShield®, the first EPA-registered microbicidal paint, which was shown to reduce Staphylococcus aureus CFU/ml counts by over 99.9 % within two hours on painted surfaces.

Digital Color Customization and DIY Adoption

The rise of digital visualization tools and DIY trends is transforming the decorative coatings market. Consumers increasingly use apps and online platforms to preview colors and finishes before purchase. This improves buying decisions and encourages personalized interior and exterior design. Easy-to-apply coatings and ready-to-use products support the growing DIY segment, especially in developed markets. Retailers and manufacturers are capitalizing on this trend by expanding e-commerce channels and offering virtual consultation services.

- For instance, BASF’s cloud platform Refinity has introduced ScanR, a next-generation spectrophotometer that captures 5 precise color measurements in 30 seconds and supports automated vehicle identification (VIN) and license plate recognition.

Growing Demand for Sustainable Raw Materials

Manufacturers are integrating bio-based resins, recycled pigments, and low-carbon materials into decorative coatings. This trend aligns with global sustainability goals and responds to stricter environmental regulations. Eco-friendly raw materials lower emissions and improve the product’s environmental footprint. Companies investing in sustainable innovation gain a competitive edge and meet customer expectations. The adoption of sustainable solutions is particularly strong in Europe and North America, where green building standards are well established.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the cost of titanium dioxide, resins, and solvents pose a significant challenge for decorative coating manufacturers. Supply chain disruptions and geopolitical tensions amplify these cost pressures. Rising raw material expenses directly affect production costs and profit margins. Price volatility also limits manufacturers’ ability to offer stable pricing to customers. To address this issue, companies are diversifying supplier networks and investing in alternative raw materials, but the challenge remains critical for market stability.

Stringent Environmental and Regulatory Standards

Tightening regulations on VOC emissions and chemical content increase compliance costs for coating manufacturers. Companies must invest in R&D to reformulate products and meet evolving environmental standards. These changes can slow product launches and raise operational expenses, especially for smaller players. Non-compliance risks penalties and loss of market access in regions with strict regulations, such as the EU and North America. Adapting to these standards while maintaining product performance remains a key industry challenge.Top of Form

Regional Analysis

North America

North America holds a 26.4% share of the global decorative coatings market, driven by steady residential construction and renovation activities. The U.S. leads the region with strong demand for eco-friendly and premium coatings supported by advanced building standards. Rising investment in commercial infrastructure, particularly in offices and retail spaces, further boosts adoption. High consumer awareness of low-VOC products strengthens the shift toward waterborne coatings. Canada contributes significantly through green building initiatives and sustainable construction. Mature distribution networks and strong brand presence of global manufacturers support stable market growth across both interior and exterior applications.

Europe

Europe accounts for 22.8% of the decorative coatings market, supported by stringent environmental regulations and rapid adoption of waterborne formulations. Germany, the UK, France, and Italy are key contributors with strong renovation and refurbishment trends. The region’s focus on sustainability and energy-efficient buildings encourages demand for low-VOC and bio-based coatings. Growing investment in urban redevelopment projects strengthens the market outlook. DIY trends and digital color customization platforms also support consumer-driven demand. Robust regulatory frameworks and established manufacturing infrastructure give Europe a competitive edge in producing advanced decorative coating solutions.

Asia Pacific

Asia Pacific dominates the decorative coatings market with a 36.7% share, led by China, India, and Japan. Rapid urbanization, large-scale residential construction, and commercial infrastructure investments are key growth drivers. Rising disposable incomes and lifestyle upgrades accelerate demand for premium decorative finishes. Government-backed housing programs and smart city projects further strengthen market expansion. Manufacturers benefit from cost-efficient production, wide distribution networks, and growing DIY culture in urban centers. Strong economic growth, coupled with increasing renovation activity, ensures Asia Pacific remains the most dynamic and influential region in the global decorative coatings industry.

Latin America

Latin America represents a 7.5% share of the global decorative coatings market, with Brazil and Mexico leading regional demand. Growing residential construction and renovation projects in urban centers drive market growth. Rising middle-class incomes and increased spending on home improvement enhance product adoption. Manufacturers are expanding distribution networks to improve access to affordable decorative solutions. The demand for durable, weather-resistant coatings is increasing, particularly in exterior applications. While regulatory frameworks are less strict than in Europe, the gradual shift toward sustainable coatings is gaining momentum, presenting future opportunities for eco-friendly product portfolios.

Middle East & Africa

The Middle East & Africa holds a 6.6% share of the decorative coatings market, driven by large-scale infrastructure and real estate developments. The UAE and Saudi Arabia dominate regional demand due to ongoing megaprojects and luxury residential projects. Rising investments in commercial complexes, tourism facilities, and smart cities boost coating usage. Harsh climatic conditions increase demand for high-performance exterior coatings with superior UV and moisture resistance. Although market penetration of sustainable products remains lower than in developed regions, growing environmental awareness is creating opportunities for green and advanced decorative coatings.

Market Segmentations:

By Technology:

- Waterborne Coatings

- Solvent borne Coatings

By Application:

- Interior Coating

- Exterior Coating

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the decorative coatings market is shaped by major players such as Axalta Coating Systems Ltd., Hempel A/S, RPM International Inc., Asian Paints Limited, Sherwin-Williams Company, BASF SE, PPG Industries, Inc., Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., and Akzo Nobel N.V. The competitive landscape of the decorative coatings market is defined by rapid innovation, sustainability goals, and expanding global footprints. Leading companies are focusing on developing advanced waterborne and low-VOC formulations to meet rising regulatory and consumer demands for eco-friendly solutions. Strategic investments in R&D are driving the creation of coatings with enhanced durability, stain resistance, and self-cleaning properties. Digital color visualization tools and online customization platforms are improving customer engagement and brand differentiation. Expansion into emerging economies through localized production facilities and distribution networks strengthens market presence. Continuous mergers, acquisitions, and strategic partnerships are intensifying competition and enabling companies to broaden their product portfolios and global reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Axalta Coating Systems Ltd.

- Hempel A/S

- RPM International Inc.

- Asian Paints Limited

- Sherwin-Williams Company

- BASF SE

- PPG Industries, Inc.

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Akzo Nobel N.V.

Recent Developments

- In May 2025, PPG introduced PPG EnviroLuxe Plus powder coatings, featuring up to 18% post-industrial recycled plastic and PFAS-free formulation, offering a versatile solution for various application needs.

- In April 2025, Interpon D2000 Stone Effect powder coating launched for North American architects, followed by the hyperdurable D3000 variant for challenging climates and applications.

- In July 2023, BASF SE entered a partnership with Zhejiang Guanghua Technology Co., Ltd. (KHUA), which states that BASF SE will supply KHUA with Neopentyl Glycol (NPG). KHUA manufactures polyester resins used for powder coatings. The partnership is expected to help meet the growing demand from China and other Asia Pacific countries.

- In April 2023, Sherwin-Williams signed an agreement to sell its China architectural paint business to Nippon Paint Holdings Co., Ltd. The divestiture allows Sherwin-Williams to focus on its core business and growth opportunities in other markets

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising construction and renovation activities.

- Eco-friendly and low-VOC coatings will see increased adoption across regions.

- Waterborne coatings will strengthen their dominance due to stricter environmental regulations.

- Digital tools and color visualization platforms will enhance consumer engagement.

- Smart coatings with self-cleaning and anti-bacterial properties will gain traction.

- Companies will expand production capacity in emerging economies to reduce costs.

- Strategic mergers and acquisitions will drive market consolidation and innovation.

- Sustainable raw materials will become a key focus in product development.

- Demand for premium decorative finishes will rise with lifestyle upgrades.

- Green building initiatives will continue to create new growth opportunities.