Market Overview

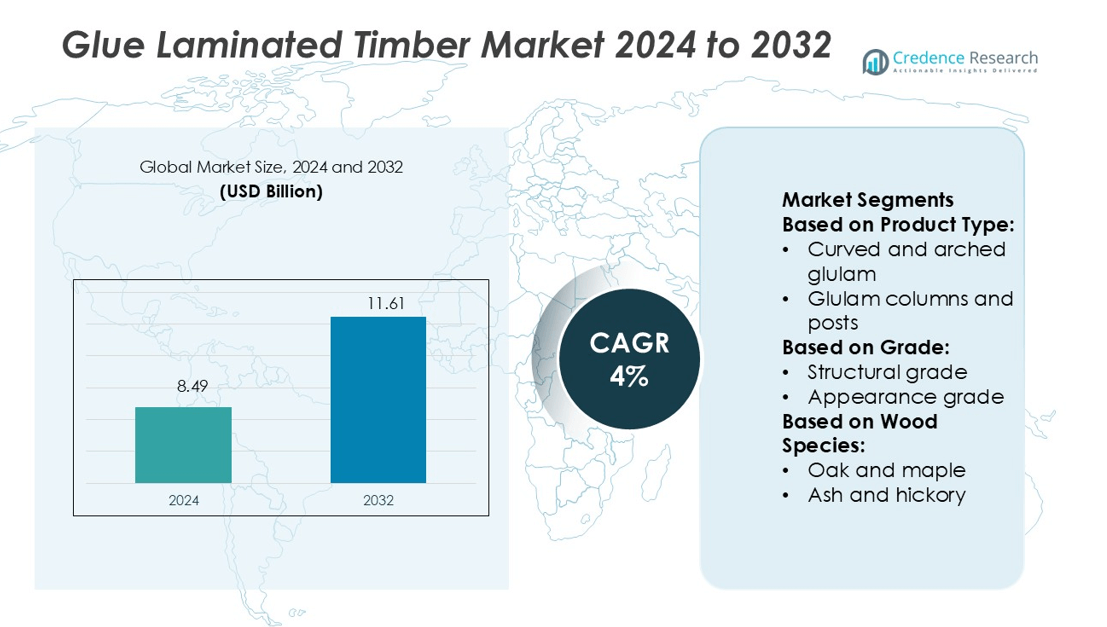

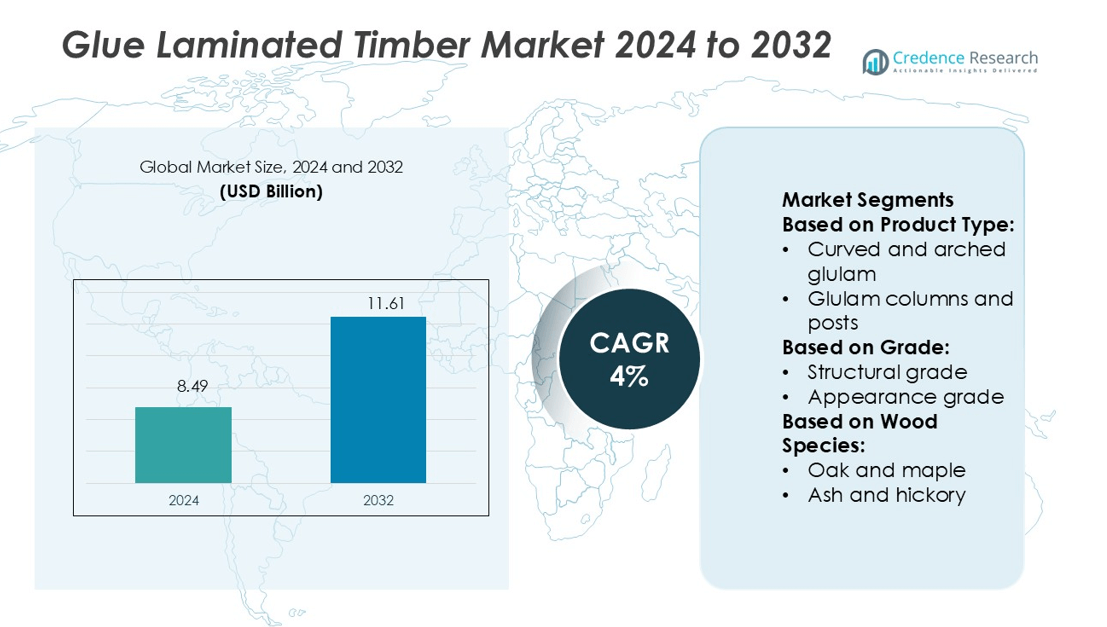

Glue Laminated Timber Market size was valued USD 8.49 billion in 2024 and is anticipated to reach USD 11.61 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glue Laminated Timber Market Size 2024 |

USD 8.49 billion |

| Glue Laminated Timber Market, CAGR |

4% |

| Glue Laminated Timber Market Size 2032 |

USD 11.61 billion |

The Glue Laminated Timber Market is led by major companies such as Martinsons Trä AB, Glulam Ltd (UK), Boise Cascade Company, Rosboro, Binderholz GmbH, Element5 Co., Hundegger, Calvert Co. Inc., Mayr-Melnhof Holz Holding AG, and Hasslacher Norica Timber. These players focus on expanding production capacities, integrating advanced timber processing technologies, and strengthening global distribution networks to meet rising construction demand. Europe dominates the market with a 34% share, driven by strong environmental regulations, advanced manufacturing infrastructure, and widespread adoption of sustainable construction practices. Strategic investments in prefabrication and hybrid timber solutions further reinforce the region’s leadership position in the global glulam industry.

Market Insights

- The Glue Laminated Timber Market was valued at USD 8.49 billion in 2024 and is projected to reach USD 11.61 billion by 2032, growing at a CAGR of 4%.

- Rising demand for sustainable and low-carbon construction materials is a key driver supporting market expansion.

- Advanced manufacturing, prefabrication, and hybrid construction trends are shaping industry growth and improving project efficiency.

- Major companies focus on capacity expansion, technology integration, and stronger distribution networks, while high production costs and limited awareness remain key restraints.

- Europe leads with a 34% share, followed by North America and Asia Pacific, with structural grade segments holding a dominant share due to their wide use in commercial and infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Straight glulam beams dominate the market with a 34% share in 2024. These beams are widely used in residential and commercial construction due to their high strength, dimensional stability, and cost-effectiveness. Their versatility in structural applications makes them a preferred choice for load-bearing frameworks and long-span structures. Curved and arched glulam products are also gaining traction in modern architectural designs, offering aesthetic appeal and structural performance. Glulam columns, trusses, and panels support broader adoption in public infrastructure, sports arenas, and commercial buildings. Specialty and custom products cater to niche, high-end architectural projects.

- For instance, Glulam Ltd keeps standard straight beams in 12 metre lengths in stock and can cut, drill, and finish them to specification in 5 working days.

By Grade

Structural grade holds the dominant share of 41% in the market. Its popularity stems from high load-bearing capacity and reliability in large-scale construction projects, including bridges, stadiums, and commercial buildings. Structural-grade glulam meets stringent performance standards, ensuring durability and compliance with building codes. Appearance grade is gaining demand in high-end residential and aesthetic-focused commercial structures. Industrial-grade products are used in manufacturing and storage facilities, where cost efficiency matters most. Specialty and high-performance grades address advanced engineering requirements like seismic resistance and moisture control.

- For instance, Boise Cascade’s King Beam 3000 30F-E4 structural glulam is built with a proprietary layup combining Douglas fir-Larch outer laminations and Southern pine core laminations, achieving design bending stresses of 2400 psi (tension zone) and 1850 psi (compression zone) under ANSI A190.1 standards.

By Wood Species

Softwood species lead with a 48% market share, supported by their cost efficiency, lightweight properties, and wide availability. Douglas fir and spruce-pine-fir (SPF) are the most preferred due to their strength-to-weight ratio and adaptability to structural applications. Southern pine is widely used in North America, while western hemlock and cedar offer excellent workability and durability. Hardwood species such as oak and maple cater to premium applications requiring high strength and aesthetics. Exotic and specialty hardwoods are adopted in luxury architecture. Mixed species combinations enhance performance and sustainability in modern construction.

Key Growth Drivers

Rising Demand for Sustainable Construction Materials

Growing environmental concerns are driving the use of glue laminated timber in green building projects. Glulam reduces carbon emissions compared to steel and concrete, which helps meet net-zero targets. Its renewable sourcing and long service life also support eco-friendly construction standards. Many builders are shifting toward certified sustainable wood to comply with stricter green regulations. Countries in Europe and North America lead these initiatives. This demand accelerates the adoption of glulam in commercial and residential buildings, fueling steady market expansion worldwide.

- For instance, Rosboro glulam beams under its GR-L251 program qualify for green construction according to APA’s Green Verification Report, and Rosboro’s products are eligible to carry the USDA BioPreferred label, showing measurable biobased content.

Growing Infrastructure Development and Urbanization

Rapid urbanization and infrastructure projects are increasing the need for durable and flexible structural materials. Glue laminated timber offers high strength-to-weight ratios, making it suitable for large-span structures like bridges, halls, and arenas. Governments are supporting timber construction to promote sustainable urban planning. Large public and private investments in modular and prefabricated buildings further boost demand. The material’s versatility and quick installation benefits support project timelines. These factors strongly position glulam as a preferred structural solution in infrastructure development.

- For instance, Element5 designs and fabricates modern glulam and mass timber components using advanced digital tools. Their factory uses 5-axis CNC machining and 3D modelling software to produce glulam members to tolerances of ± 2 mm over lengths up to 16 m.

Technological Advancements in Timber Processing

Advanced manufacturing technologies are improving the performance and quality of glue laminated timber. Modern bonding systems enhance moisture resistance and structural stability. CNC machining enables precise shaping for complex designs and architectural flexibility. Prefabrication methods shorten construction time and reduce labor costs. These advancements make glulam competitive with steel and concrete in large-scale projects. Innovative surface treatments also improve durability and fire resistance. Such progress strengthens market adoption across industrial, commercial, and residential construction segments.

Key Trends & Opportunities

Increasing Use in Hybrid Construction Projects

Hybrid building designs that combine glulam with steel or concrete are gaining traction. These structures offer strength, energy efficiency, and aesthetic appeal. Developers use hybrid models to reduce costs while achieving sustainability targets. Such integration allows architects to build taller timber structures with improved performance. Hybrid systems also support large-scale commercial projects and public infrastructure developments, opening new opportunities for glulam producers and construction firms.

- For instance, Hybrid building designs combine glulam with steel or concrete for strength and aesthetics. Hundegger’s PBA-Industry machine can mill glulam or CLT elements up to 3,660 mm wide, 400 mm thick, and 16.5 m long, making integration with steel beams or concrete slabs precisely interfaced.

Expanding Role in Prefabrication and Modular Construction

The prefabricated construction trend is growing due to labor shortages and the need for faster delivery. Glue laminated timber fits well in modular structures due to its light weight, precision, and durability. Prefab buildings reduce waste and offer consistent quality control. Many builders use glulam components in schools, offices, and residential projects. This trend is creating strong demand from construction firms seeking efficient and sustainable material solutions.

- For instance, GL 3000 has allowable bending stress (Fb) of 3000 psi and a 2.1E modulus (i.e. modulus of elasticity ~2.1 million psi) per Calvert’s GL 3000 Product Report.

Supportive Regulatory and Green Certification Programs

Government policies promoting sustainable construction are creating favorable conditions for glulam adoption. Green building certifications such as LEED and BREEAM highlight wood products for their carbon benefits. Incentives for using low-emission materials encourage developers to adopt engineered timber. Several regions also update building codes to allow taller wooden structures. This regulatory support boosts market growth by increasing glulam’s acceptance in mainstream construction.

Key Challenges

High Production Costs and Price Volatility

Glue laminated timber requires advanced manufacturing and high-quality raw materials, increasing overall costs. Fluctuating timber prices and adhesive costs create pricing uncertainty for builders. Transporting large timber beams adds further expense. Competing materials like steel and concrete remain cheaper in some markets. These factors limit adoption in cost-sensitive projects. Companies must balance pricing strategies with quality and innovation to stay competitive.

Limited Awareness and Structural Design Constraints

Many regions still have limited technical knowledge of glulam’s capabilities. Engineers and builders may hesitate to use timber in large or complex structures due to code restrictions or lack of training. Design limitations in fire safety and load-bearing standards can slow adoption. In some markets, outdated regulations restrict high-rise timber buildings. Addressing these knowledge and policy gaps is crucial to expanding the glulam market.

Regional Analysis

North America

North America holds a 29% share of the global Glue Laminated Timber Market in 2025. The region benefits from strong green building initiatives, especially in the U.S. and Canada. Builders increasingly use glulam in commercial and public projects like schools, arenas, and civic structures. Favorable building codes and tax incentives support timber construction adoption. The presence of advanced manufacturing facilities ensures a stable supply chain. Demand is rising for prefabricated and hybrid structures. Strategic collaborations between timber producers and construction firms continue to strengthen regional market growth.

Europe

Europe dominates the Glue Laminated Timber Market with a 34% share in 2025. The region leads in sustainable construction, supported by strict environmental regulations and building codes. Countries such as Germany, Austria, and the Nordics have a strong tradition of engineered wood use. EU policies promoting carbon reduction and energy efficiency accelerate glulam adoption in public infrastructure and commercial buildings. Technological innovation and well-established supply chains enhance competitiveness. European firms are also expanding exports to meet global demand. High architectural flexibility and design advancements further reinforce Europe’s leadership position in the market.

Asia Pacific

Asia Pacific accounts for a 25% share of the Glue Laminated Timber Market in 2025. The region is witnessing rapid infrastructure development and urbanization, especially in China, Japan, and Australia. Governments are promoting low-carbon construction methods to meet sustainability goals. Glulam’s light weight and high strength support its use in bridges, stations, and commercial buildings. Rising adoption in modular and prefabricated construction adds further momentum. Local manufacturing capacity is improving, reducing reliance on imports. The combination of policy support, cost efficiency, and growing green awareness positions Asia Pacific as a strong growth region.

Latin America

Latin America captures a 7% share of the Glue Laminated Timber Market in 2025. The region is steadily increasing the use of sustainable construction materials. Brazil and Chile are key contributors due to abundant forest resources and active timber processing industries. Glulam adoption is growing in commercial and institutional building projects. Rising investments in eco-friendly infrastructure also support demand. However, limited awareness and higher costs compared to traditional materials slow broader adoption. Partnerships between local producers and global firms are helping build capacity and accelerate regional market expansion.

Middle East & Africa

The Middle East & Africa holds a 5% share of the Glue Laminated Timber Market in 2025. Adoption is gradually increasing, mainly in premium commercial and hospitality projects. Countries such as the UAE and Saudi Arabia are investing in sustainable building solutions to meet environmental goals. The region imports a significant volume of engineered timber due to limited local production. High construction spending and smart city initiatives offer new opportunities for glulam suppliers. However, regulatory gaps and limited technical expertise still pose challenges to rapid expansion in this region.

Market Segmentations:

By Product Type:

- Curved and arched glulam

- Glulam columns and posts

By Grade:

- Structural grade

- Appearance grade

By Wood Species:

- Oak and maple

- Ash and hickory

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Glue Laminated Timber Market is shaped by key players including Martinsons Trä AB, Glulam Ltd (UK), Boise Cascade Company, Rosboro, Binderholz GmbH, Element5 Co., Hundegger, Calvert Co. Inc., Mayr-Melnhof Holz Holding AG, and Hasslacher Norica Timber. The Glue Laminated Timber Market is highly competitive, driven by continuous innovation and sustainability initiatives. Companies are focusing on advanced processing technologies, including CNC machining and improved bonding methods, to enhance strength, precision, and durability. Many firms are expanding production capacities to meet growing demand from green building and infrastructure projects. Strategic partnerships and regional expansions strengthen distribution networks and support global market presence. Emphasis on eco-certifications and regulatory compliance enhances their competitive advantage. Increased investment in prefabrication and hybrid construction solutions further strengthens market positioning, enabling wider application in commercial and large-scale infrastructure developments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Stora Enso Oyj announced that it divested 12.4% of its Swedish forest holdings, as well as a wood supply agreement, which secured the material for the company to carry out its operations. This divestment provided Stora Enso with additional balance sheet strength, plus a stable wood supply, which would also help to reinforce its competitive position in glulam production.

- In March 2025, Setra Group AB adapted to market conditions by restructuring its Långshyttan facility from continuous to periodic production of CLT and wood components. The level of CLT production capacity was decreased, but the same digital glulam production capacity was maintained in order to continue to supply the construction market.

- In May 2024, H.B. Fuller, the world’s largest pure play adhesives company, announced the acquisition of ND Industries Inc., a U.S.-based leader in specialty adhesives and fastener locking and sealing solutions. This strategic move enhances H.B. Fuller’s product portfolio, especially in high-growth, high-margin segments like automotive, electronics, and aerospace, and adds ND’s Vibra-Tite brand to its range of epoxy, cyanoacrylate, UV-curable, and anaerobic technologies.

- In January 2023, Avery Dennison has signed an agreement to acquire Thermopatch, a key player in textile labeling, heat transfers, and embellishments, particularly for the sports, workwear, and industrial laundry sectors. This acquisition aligns with Avery Dennison’s strategy to expand its presence in external embellishments and branded solutions, which are closely tied to adhesive and sealant technologies used in heat transfer labels and textile bonding.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Grade, Wood Species and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and low-carbon construction materials will continue to grow.

- Hybrid timber structures will gain wider acceptance in commercial and public projects.

- Prefabrication and modular construction will drive faster adoption of glulam.

- Technological advancements will enhance structural strength and fire resistance.

- Supportive building codes and green certifications will accelerate market expansion.

- Investment in local manufacturing facilities will reduce dependency on imports.

- Urban infrastructure development will create strong opportunities in emerging economies.

- Digital design tools and automation will improve construction efficiency.

- Strategic collaborations will strengthen global supply chains and distribution networks.

- Rising awareness of sustainable construction will boost long-term market growth.