Market Overview

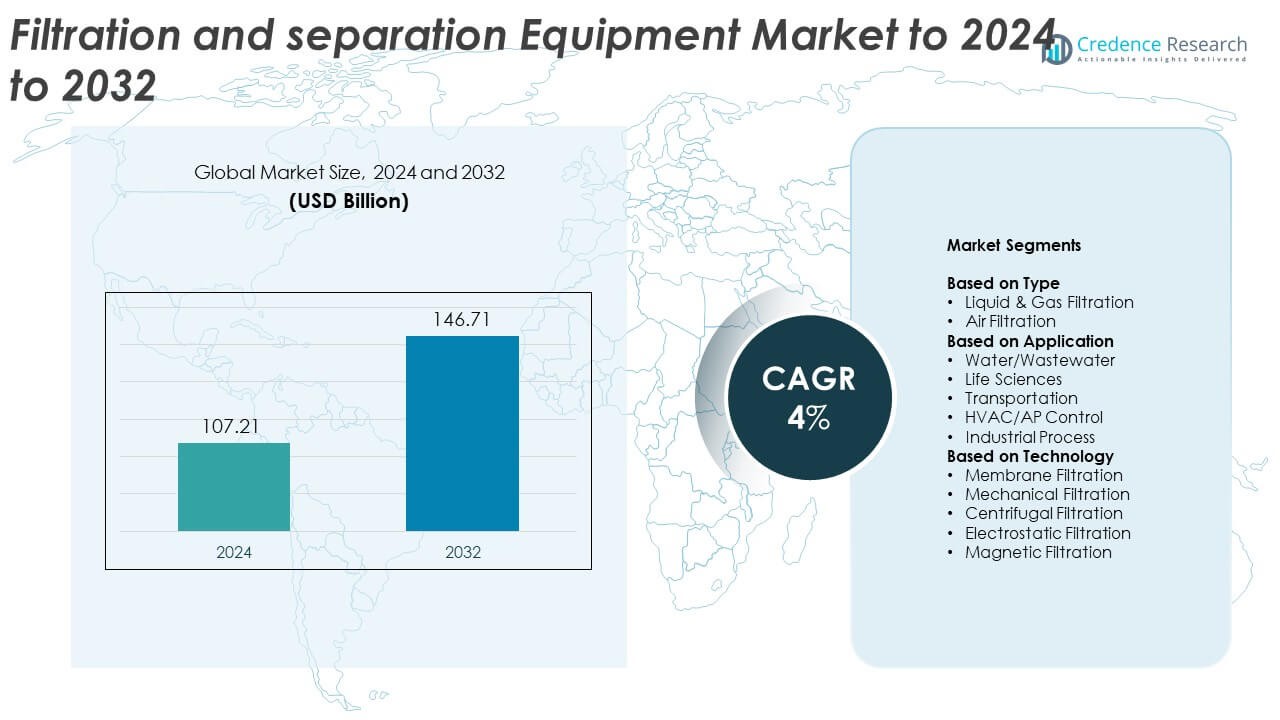

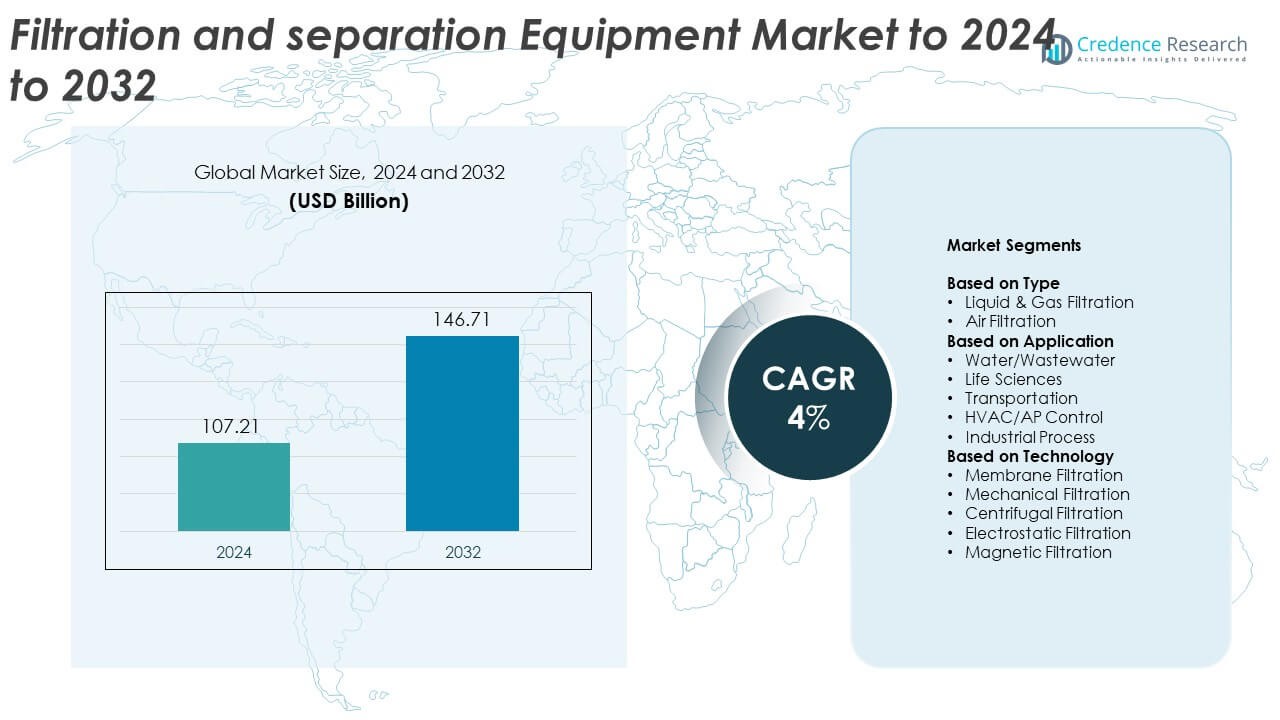

Filtration and separation equipment market size was valued at USD 107.21 billion in 2024 and is anticipated to reach USD 146.71 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Filtration and Separation Equipment Market Size 2024 |

USD 107.21 Billion |

| Filtration and Separation Equipment Market, CAGR |

4% |

| Filtration and Separation Equipment Market Size 2032 |

USD 146.71 Billion |

The filtration and separation equipment market is highly competitive, with major players including Donaldson Company, Inc., Pall Corporation (Danaher Corporation), MANN+HUMMEL, Suez Water Technologies & Solutions, and Alfa Laval AB leading global operations. These companies focus on technological advancements, energy-efficient systems, and sustainability-driven filtration solutions to meet diverse industrial needs. Continuous investments in R&D, strategic mergers, and expanded product portfolios strengthen their market presence across key sectors. North America emerged as the leading region, commanding 34% of the total market share in 2024, driven by strict environmental regulations, growing industrial modernization, and widespread adoption of advanced air and water filtration technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The filtration and separation equipment market was valued at USD 107.21 billion in 2024 and is projected to reach USD 146.71 billion by 2032, growing at a CAGR of 4%.

- Growing industrialization, stricter emission regulations, and expanding water and wastewater treatment projects are driving global demand for advanced filtration systems.

- Smart and energy-efficient filtration technologies, including IoT-enabled monitoring and membrane innovations, are shaping market trends toward sustainability and operational efficiency.

- The market is competitive, with global players focusing on mergers, product innovation, and strategic expansions to strengthen their technological and regional presence.

- North America leads with a 34% market share, followed by Europe at 28% and Asia Pacific at 25%, while the liquid and gas filtration segment dominates globally with a 61% share.

Market Segmentation Analysis:

By Type

The liquid and gas filtration segment dominated the filtration and separation equipment market in 2024, accounting for 61% of the total share. This segment’s leadership stems from its wide use across industries such as food processing, chemicals, and power generation. The demand for high-performance liquid filters and gas purifiers is growing due to stricter emission norms and process safety requirements. Rising industrialization and the need for efficient contaminant removal are driving adoption, supported by advancements in multi-stage filter systems and corrosion-resistant materials.

- For instance, Pall Ultipleat High Flow elements handle up to 113 m³/hour per 60-inch cartridge.

By Application

The industrial process segment held the largest market share of 45% in 2024, driven by high filtration needs in manufacturing, oil and gas, and chemical processing. Continuous demand for product purity, equipment protection, and process efficiency supports strong adoption. The rising use of fine particle filters and membrane-based units enhances operational reliability in critical production environments. Industries are focusing on compliance with environmental standards and cost-effective wastewater reuse, further stimulating demand for advanced filtration systems.

- For instance, Pentair X-Flow at Kungälv ran at 17,000 m³/day design capacity during testing

By Technology

Membrane filtration led the market with a 38% share in 2024, supported by growing usage in water treatment, pharmaceuticals, and food industries. This technology’s dominance is due to its high filtration precision, scalability, and compatibility with diverse fluids. Increasing demand for ultrafiltration and reverse osmosis systems enhances product efficiency and sustainability. Continuous R&D investments in nanomembrane and polymeric filter materials are improving throughput, reducing energy consumption, and expanding the technology’s role in industrial and municipal filtration applications.

Key Growth Drivers

Rising Industrial and Environmental Regulations

Stringent environmental norms and workplace safety regulations are driving strong demand for advanced filtration systems. Industries such as oil and gas, chemicals, and pharmaceuticals are adopting filtration and separation equipment to comply with air and water quality standards. Governments worldwide are enforcing stricter emissions and wastewater discharge limits, leading to widespread modernization of industrial filtration infrastructure. This regulatory pressure encourages the adoption of high-efficiency filters and separation technologies that improve sustainability and reduce pollutant levels in industrial operations.

- For instance, Parker cites ISO 8573-1 Class 1 oil limit of 0.01 mg/m³ and a PDP of −40 °C for Class 2 water.

Expansion of Water and Wastewater Treatment Facilities

Rapid urbanization and population growth are increasing global water consumption, boosting investment in treatment infrastructure. The need for clean water supply and safe wastewater disposal is leading to the deployment of high-capacity filtration and separation systems. Municipal and industrial sectors are focusing on water reuse, sludge management, and membrane filtration upgrades. Technological advancements in ultrafiltration and reverse osmosis are enhancing system performance, helping reduce contaminants and operational costs, thus making filtration essential for sustainable water management.

- For instance, ACCIONA’s Jubail-3B RO plant is designed for 570,000 m³/day potable water output.

Growth in Life Sciences and Food Processing Industries

The life sciences and food sectors are major contributors to filtration market growth, driven by stringent hygiene and quality standards. Biopharmaceutical production, fermentation processes, and sterile packaging require precise contamination control. Filtration ensures product purity, process reliability, and regulatory compliance. The rising production of biologics, vaccines, and processed foods is increasing demand for sterile, high-efficiency membrane and air filtration systems. Manufacturers are also investing in single-use filtration units that enhance flexibility and reduce cross-contamination risks.

Key Trends and Opportunities

Integration of Smart Monitoring Technologies

Digitalization is reshaping the filtration and separation landscape through smart sensors and IoT-enabled monitoring. These systems provide real-time data on filter performance, pressure drops, and maintenance needs, helping operators reduce downtime. Predictive maintenance supported by AI analytics enhances system efficiency and lifespan. Industries are shifting toward automated filtration solutions to optimize energy usage and ensure compliance with environmental standards, creating new opportunities for smart filtration equipment providers focused on industrial automation and process optimization.

- For instance, Camfil reports GT air-filter upgrades that cut compressor efficiency degradation by 80% in operation.

Rising Adoption of Sustainable and Energy-Efficient Systems

Sustainability has become a central focus, encouraging the development of eco-friendly and low-energy filtration solutions. Manufacturers are producing recyclable filter media and energy-efficient designs that minimize carbon emissions. The push toward circular economy practices and renewable energy projects supports demand for clean separation technologies. Companies investing in green filtration innovations, such as bio-based filter membranes or regenerative filtration units, are capturing new opportunities in sectors emphasizing environmental responsibility and operational cost reduction.

- For instance, Veolia’s Hassyan RO project targets 2.9 kWh/m³ specific energy and 818,000 m³/day capacity.

Key Challenges

High Initial Costs and Maintenance Requirements

Advanced filtration systems require substantial capital investment and regular maintenance, posing challenges for small and medium enterprises. Equipment such as membrane units and high-pressure filters involve costly components and skilled operation. The need for frequent replacement of filter elements and periodic system cleaning increases operational expenditure. These cost barriers slow adoption, particularly in developing regions where industrial budgets are limited, restraining market penetration despite rising environmental awareness and regulatory pressures.

Complexity in Handling Hazardous and Diverse Contaminants

Filtration and separation processes must adapt to varied contaminants, including microplastics, volatile compounds, and biological waste. Designing universal solutions remains difficult due to differing chemical properties and operational environments. Certain applications, such as nuclear or pharmaceutical filtration, demand highly specific materials and precise control systems. Handling hazardous substances also raises safety and disposal challenges, increasing compliance costs. The complexity of managing diverse contaminants continues to hinder the efficiency and scalability of existing filtration systems.

Regional Analysis

North America

North America dominated the filtration and separation equipment market in 2024 with a 34% share. The region’s growth is supported by strong demand from industries such as oil and gas, pharmaceuticals, and food processing. The United States leads with major investments in advanced air and water filtration technologies to meet environmental regulations. Ongoing infrastructure modernization and the presence of leading equipment manufacturers are further strengthening market adoption. Canada’s focus on wastewater recycling and air quality improvement initiatives continues to drive system upgrades and innovation across industrial and municipal sectors.

Europe

Europe accounted for a 28% share of the global filtration and separation equipment market in 2024. The region’s market is driven by strict emission norms, circular economy goals, and strong industrial automation trends. Germany, the UK, and France are key contributors, emphasizing energy-efficient and sustainable filtration technologies. The growing pharmaceutical and food processing industries are fueling adoption of membrane and air filtration systems. European manufacturers are integrating smart monitoring technologies into filtration units to enhance process efficiency, while EU policies promoting green technology investments are further accelerating market expansion.

Asia Pacific

Asia Pacific held a 25% share of the global market in 2024 and is expected to grow rapidly during the forecast period. The region’s expansion is driven by industrialization, urbanization, and large-scale water and wastewater projects in China, India, and Japan. Increasing environmental regulations and industrial waste management initiatives are promoting the use of high-efficiency filtration systems. Rising investments in power generation, semiconductor production, and life sciences manufacturing are enhancing demand for precision filtration. Strong government support for sustainable infrastructure continues to position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America captured an 8% share of the filtration and separation equipment market in 2024. The region’s market growth is supported by rising industrial activities in Brazil and Mexico, particularly in mining, chemical processing, and food industries. Governments are prioritizing water conservation and air pollution control, driving investments in membrane and air filtration technologies. The growing manufacturing sector and infrastructure modernization projects are also contributing to system demand. However, limited technological adoption and cost constraints among small enterprises continue to restrain faster market penetration across the region.

Middle East and Africa

The Middle East and Africa accounted for a 5% share of the filtration and separation equipment market in 2024. Market expansion is led by increasing demand for water desalination, oil and gas refining, and power generation applications. Countries such as Saudi Arabia, the UAE, and South Africa are investing in high-performance filtration systems to support industrial growth and environmental protection goals. Growing awareness of air quality management and the need for efficient process filtration in petrochemical industries are driving adoption. Despite infrastructure challenges, ongoing industrial diversification supports steady market growth in the region.

Market Segmentations:

By Type

- Liquid & Gas Filtration

- Air Filtration

By Application

- Water/Wastewater

- Life Sciences

- Transportation

- HVAC/AP Control

- Industrial Process

By Technology

- Membrane Filtration

- Mechanical Filtration

- Centrifugal Filtration

- Electrostatic Filtration

- Magnetic Filtration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The filtration and separation equipment market features strong competition among key players such as Donaldson Company, Inc., Pall Corporation (Danaher Corporation), MANN+HUMMEL, Suez Water Technologies & Solutions, Alfa Laval AB, Eaton Corporation, SPX Flow, Inc., Pentair Plc, Lydall, Inc., Parker-Hannifin Corporation, Porvair Filtration Group, GEA Group AG, Hydac International GmbH, 3M Company, and Graver Technologies. The market is driven by technological advancements, product innovation, and strategic partnerships aimed at expanding global presence. Companies are investing heavily in R&D to enhance filter efficiency, durability, and energy savings. Focus on automation, smart monitoring, and eco-friendly materials is increasing to meet regulatory and environmental standards. Strategic acquisitions and collaborations are helping companies strengthen product portfolios and improve service capabilities across key sectors such as water treatment, industrial processing, and healthcare. Continuous innovation and regional expansion remain central to maintaining a competitive edge in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Donaldson Company, Inc.

- Pall Corporation (Danaher Corporation)

- MANN+HUMMEL

- Suez Water Technologies & Solutions

- Alfa Laval AB

- Eaton Corporation

- SPX Flow, Inc.

- Pentair Plc

- Lydall, Inc.

- Parker-Hannifin Corporation

- Porvair Filtration Group

- GEA Group AG

- Hydac International GmbH

- 3M Company

- Graver Technologies

Recent Developments

- In 2025, Mann+Hummel Group Developed an innovative CO₂-reduced air filter using plant-based raw materials, reducing CO₂ footprint by up to 5% and crude oil usage by approximately 27%. The company also introduced a new fuel filter with a modular, future-ready design for optimal protection.

- In 2024, Pall Corporation (Danaher Corporation) Officially opened its state-of-the-art Singapore manufacturing facility in June, focusing on lithography and wet-etch filtration solutions for the global semiconductor industry.

- In 2024, Eaton Corporation plc Exhibited numerous new filtration solutions at the ACHEMA trade show, including specialty filter bags with increased dirt-holding and oil absorption capacity and bypass-free basket strainers for chemical and petrochemical applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of automated and smart filtration systems for real-time monitoring.

- Increasing use of membrane filtration technologies will enhance efficiency in industrial and municipal applications.

- Demand for eco-friendly and energy-efficient filtration equipment will strengthen due to sustainability goals.

- Advancements in nanofiber and polymer materials will improve filter performance and lifespan.

- Growth in biopharmaceutical and food sectors will drive demand for sterile and precision filtration systems.

- Expansion of water reuse and desalination projects will boost the need for high-capacity filtration units.

- Integration of IoT and AI will enable predictive maintenance and process optimization.

- Emerging economies will invest more in industrial air and water quality improvement systems.

- Stricter global emission and wastewater standards will accelerate equipment modernization.

- Collaboration between equipment manufacturers and digital solution providers will shape future market competitiveness.