Market Overview

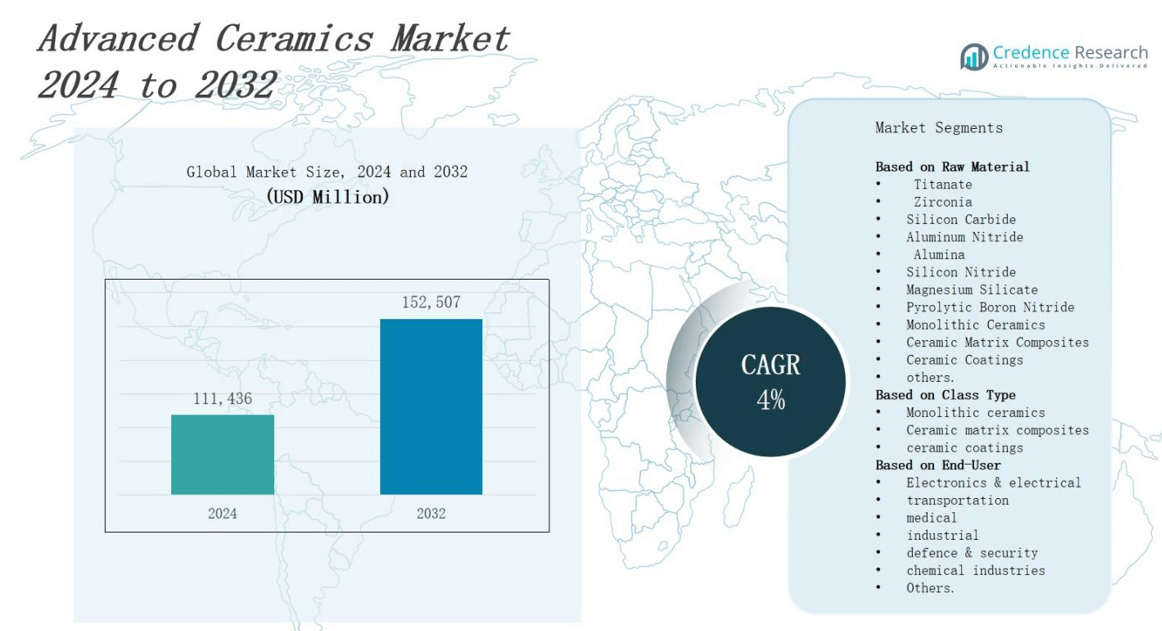

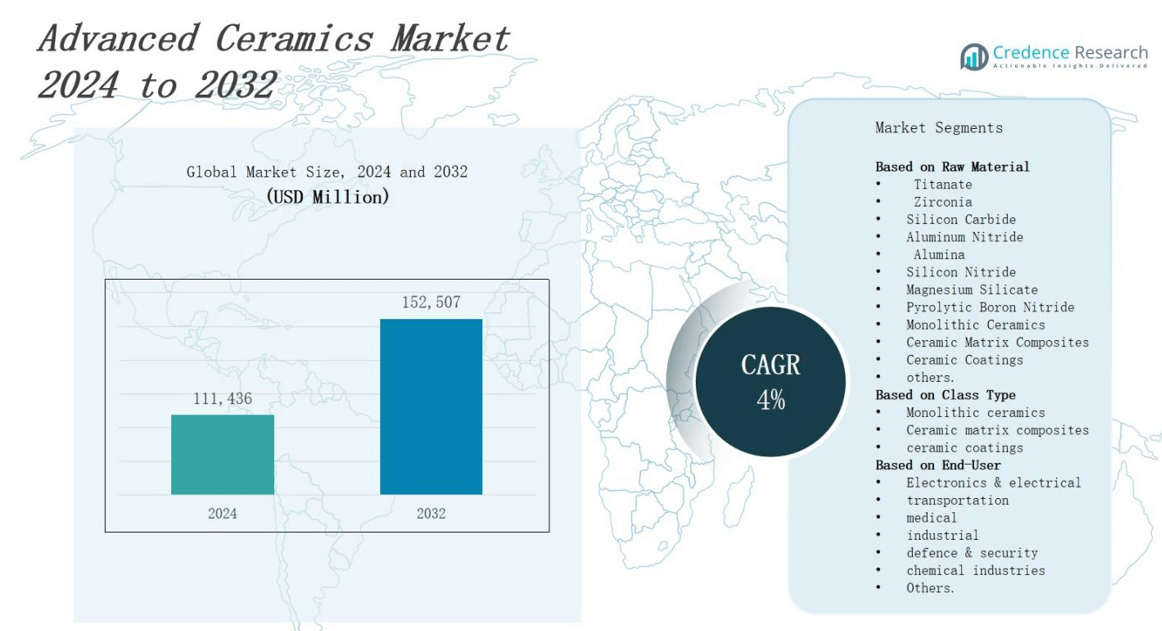

The advanced ceramics market is projected to grow from USD 111,436 million in 2024 to USD 152,507 million by 2032, registering a compound annual growth rate (CAGR) of 4%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Ceramics Market Size 2024 |

USD 111,436 million |

| Advanced Ceramics Market, CAGR |

4% |

| Advanced Ceramics Market Size 2032 |

USD 152,507 million |

‘

The advanced ceramics market experiences growth driven by increasing demand across electronics, automotive, aerospace, and healthcare sectors due to their superior mechanical, thermal, and chemical properties. Innovations in material science enhance product performance, expanding applications in energy storage, medical implants, and semiconductor devices. Rising adoption of lightweight and durable components in electric vehicles and industrial machinery further fuels market expansion. Additionally, advancements in manufacturing technologies, such as additive manufacturing and nanotechnology, improve production efficiency and cost-effectiveness. Growing emphasis on sustainability and the need for high-performance materials in extreme environments continue to shape market trends, positioning advanced ceramics as critical enablers of technological progress.

The advanced ceramics market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World, with Asia-Pacific leading in market share due to rapid industrial growth. North America and Europe maintain strong positions driven by technological innovation and established industries. The Rest of the World shows emerging potential through infrastructure development. Leading companies such as Materion Corporation, Morgan Advanced Materials, Murata Manufacturing Co. Ltd, Saint-Gobain, MARWA Co. Ltd, McDanel Advanced Ceramic Technologies, and Wonik QnC Corporation compete globally, focusing on innovation and expanding regional presence to capture diverse market opportunities.

Market Insights

- The advanced ceramics market is projected to grow from USD 111,436 million in 2024 to USD 152,507 million by 2032, registering a CAGR of 4%.

- Demand rises across electronics, automotive, aerospace, and healthcare sectors due to superior mechanical, thermal, and chemical properties of advanced ceramics.

- Innovations in material science and manufacturing technologies, including nanotechnology and additive manufacturing, enhance product performance and cost-efficiency.

- Asia-Pacific leads with a 35% market share, driven by rapid industrialization, infrastructure investment, and expanding electric vehicle markets.

- North America holds 28% share with strong R&D, established electronics and aerospace industries, and focus on lightweight materials for sustainable applications.

- Europe commands 24%, emphasizing sustainable manufacturing, additive manufacturing adoption, and strict environmental regulations supporting advanced ceramics use.

- Rest of the World accounts for 13%, showing growth potential through infrastructure development and emerging industries despite technological and supply chain challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Electronics and Automotive Industries

The advanced ceramics market benefits significantly from rising demand in the electronics and automotive sectors. These industries require materials that offer high durability, thermal stability, and electrical insulation. Advanced ceramics fulfill these needs in components such as sensors, insulators, and capacitors. Automotive manufacturers increasingly use ceramics for engine parts and braking systems to enhance efficiency and reduce weight. It supports the shift toward electric vehicles by providing heat-resistant and lightweight solutions. This expanding application base continues to drive consistent market growth.

- For instance, KYOCERA Corporation (Japan) manufactures ceramic packages used in automotive electronic systems that provide reliable electrical insulation and heat resistance, enhancing the performance of sensors and capacitors.

Technological Innovations Enhancing Product Performance

Technological advancements in material science boost the advanced ceramics market by improving product performance and broadening applications. Innovations in nanotechnology and additive manufacturing allow precise control over microstructures, leading to enhanced mechanical strength and thermal resistance. These improvements enable ceramics to meet stringent requirements in aerospace, medical implants, and semiconductor devices. It results in better reliability and longer service life. Companies invest heavily in research and development to deliver customized ceramic solutions, reinforcing market competitiveness.

- For instance, CoorsTek, a leading U.S. company, has made significant investments in R&D to expand its ceramic product range specifically designed for aerospace applications, enhancing thermal resistance and mechanical strength for critical aerospace components.

Increasing Adoption in Energy and Healthcare Sectors

The energy and healthcare sectors contribute significantly to the advanced ceramics market expansion due to their demand for high-performance, biocompatible materials. Ceramics serve in fuel cells, batteries, and nuclear reactors for energy applications requiring chemical stability and durability. In healthcare, they provide materials for dental implants, prosthetics, and surgical tools because of their biocompatibility and wear resistance. It supports sustainable energy solutions and advanced medical treatments. The market continues to expand as these industries prioritize efficiency and innovation.

Advancements in Manufacturing and Sustainability Focus

The advanced ceramics market grows through improvements in manufacturing processes that reduce costs and enhance scalability. Techniques such as 3D printing and improved sintering methods enable faster production with better quality control. This efficiency allows wider adoption in various end-use industries. It aligns with global trends emphasizing sustainability by reducing waste and energy consumption during production. Manufacturers increasingly prioritize eco-friendly materials and processes, which strengthens the market’s position in environmentally conscious sectors.

Market Trends

Expansion of Applications in Electric Vehicles and Renewable Energy

The advanced ceramics market increasingly penetrates the electric vehicle (EV) and renewable energy sectors due to ceramics’ ability to withstand high temperatures and harsh conditions. It enables critical components such as battery separators, fuel cells, and power electronics modules, improving EV efficiency and durability. Growth in solar and wind energy drives demand for ceramics in insulators and sensors. This diversification into clean energy technologies accelerates market adoption and fosters long-term growth prospects.

Integration of Additive Manufacturing for Customized Solutions

Additive manufacturing revolutionizes the advanced ceramics market by allowing rapid production of complex, customized components with high precision. It reduces material waste and shortens lead times compared to traditional manufacturing methods. Companies use 3D printing technologies to fabricate intricate parts for aerospace, healthcare, and electronics applications. It supports innovation by enabling tailored designs that meet specific functional requirements. This trend fosters flexibility and cost efficiency throughout the supply chain.

- For instance, General Electric produces jet engine fuel nozzles as a single 3D-printed piece, significantly reducing weight and improving durability.

Focus on Lightweight and High-Strength Materials in Aerospace

Demand for lightweight, high-strength materials in aerospace fuels growth in the advanced ceramics market. Ceramics offer exceptional heat resistance and structural integrity, making them ideal for turbine blades, engine components, and thermal protection systems. It helps reduce overall aircraft weight, enhancing fuel efficiency and lowering emissions. Aerospace manufacturers continue to adopt ceramic composites to meet strict safety and performance standards, driving ongoing innovation and expanded market opportunities.

- For instance, Boeing’s use of carbon fiber reinforced polymers (CFRP) in the 787 Dreamliner fuselage and wings, which significantly reduces weight compared to traditional metals while providing greater strength.

Rising Emphasis on Sustainable and Environmentally Friendly Production

The advanced ceramics market responds to growing environmental concerns by prioritizing sustainable manufacturing processes. Companies invest in energy-efficient production techniques and use eco-friendly raw materials to minimize environmental impact. It focuses on reducing carbon footprint and waste generation while maintaining product quality. Regulatory pressures and consumer demand for green technologies push manufacturers toward greener operations. This trend strengthens the market’s appeal in sectors committed to sustainability and corporate responsibility.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes

The advanced ceramics market faces significant challenges due to the high costs associated with raw materials and complex manufacturing processes. Producing ceramics requires specialized equipment and precise control over temperature and environment, increasing operational expenses. It often involves multiple stages such as powder preparation, shaping, and sintering, which extend production time and limit scalability. These factors create barriers for widespread adoption, particularly in cost-sensitive industries. Companies must balance quality with affordability to maintain competitiveness. The market experiences pressure to innovate more efficient and cost-effective production techniques to overcome these limitations.

Material Brittleness and Design Limitations

Material brittleness presents another key challenge in the advanced ceramics market, restricting its application in certain high-impact or dynamic environments. Ceramics possess excellent hardness and thermal resistance but tend to fracture under sudden stress or shock. It complicates integration into components requiring flexibility or toughness. Engineers must carefully design ceramic parts to mitigate these weaknesses, often combining ceramics with other materials to improve performance. This constraint limits the scope of ceramic use in some industrial sectors. Overcoming brittleness through advanced composites or novel formulations remains a critical focus for market growth.

Market Opportunities

Rising Demand for Advanced Ceramics in Healthcare and Biomedical Applications

The advanced ceramics market presents significant opportunities through expanding applications in healthcare and biomedical fields. Ceramics offer excellent biocompatibility, wear resistance, and corrosion resistance, making them ideal for implants, prosthetics, and dental materials. It enables the development of innovative medical devices that improve patient outcomes and durability. Growing geriatric populations and increasing healthcare expenditures worldwide drive demand for these high-performance materials. Investments in research focused on bioactive and multifunctional ceramics further open avenues for market expansion.

Growth Potential in Energy Storage and Electronics Industries

The advanced ceramics market benefits from increasing opportunities in energy storage and electronics due to the need for materials that provide thermal stability and electrical insulation. Ceramics support next-generation batteries, capacitors, and semiconductor devices with improved efficiency and longevity. It facilitates innovations in electric vehicles, renewable energy systems, and consumer electronics. The rise of IoT and smart technologies accelerates demand for miniaturized, high-performance ceramic components. Expanding investment in these sectors propels growth and encourages continuous development of advanced ceramic materials.

Market Segmentation Analysis:

By Raw Material

The advanced ceramics market segments by raw material into titanate, zirconia, silicon carbide, aluminum nitride, alumina, silicon nitride, magnesium silicate, pyrolytic boron nitride, monolithic ceramics, ceramic matrix composites, ceramic coatings, and others. Alumina dominates due to its excellent mechanical strength, electrical insulation, and cost-effectiveness. Zirconia and silicon carbide gain traction for high-temperature and wear-resistant applications. Ceramic matrix composites and coatings serve specialized functions requiring enhanced toughness and surface protection. Material selection depends on application-specific performance demands, driving diverse growth across these categories.

- For instance, LithaCon’s 3Y 230 zirconia ceramic produced via stereolithography offers high mechanical strength and fine microstructure control, critical for medical and aerospace applications.

By Class Type

The market categorizes advanced ceramics into monolithic ceramics, ceramic matrix composites, and ceramic coatings. Monolithic ceramics hold the largest share due to broad applicability and established manufacturing processes. Ceramic matrix composites find growing use in aerospace and defense sectors for improved fracture toughness. Ceramic coatings protect surfaces against corrosion, wear, and thermal degradation, expanding usage in industrial applications. It reflects the market’s adaptation to evolving performance requirements by offering materials tailored to specific operational challenges.

- For instance, Hypersonix is developing a ceramic matrix composite combustion chamber using C/SiC material able to withstand temperatures up to 1,400°C for scramjet engines, demonstrating high thermal resistance and complex geometry capabilities for hypersonic flight applications.

By End-User

The advanced ceramics market serves diverse end-user industries, including electronics and electrical, transportation, medical, industrial, defense and security, chemical industries, and others. Electronics and electrical sectors represent the largest demand due to ceramics’ insulating and thermal properties. The transportation industry utilizes ceramics for lightweight, heat-resistant components in automotive and aerospace applications. Medical applications benefit from biocompatibility for implants and devices. Defense and chemical industries require durable, high-performance materials for harsh environments. This broad industrial base supports steady market expansion.

Segments:

Based on Raw Material

- Titanate

- Zirconia

- Silicon Carbide

- Aluminum Nitride

- Alumina

- Silicon Nitride

- Magnesium Silicate

- Pyrolytic Boron Nitride

- Monolithic Ceramics

- Ceramic Matrix Composites

- Ceramic Coatings

- others.

Based on Class Type

- Monolithic ceramics

- Ceramic matrix composites

- ceramic coatings

Based on End-User

- Electronics & electrical

- transportation

- medical

- industrial

- defence & security

- chemical industries

- Others.

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of 28% in the advanced ceramics market due to its strong industrial base and technological advancements. The region benefits from well-established electronics, aerospace, and healthcare sectors that drive demand for high-performance ceramics. It supports extensive research and development activities, fostering innovation in material properties and manufacturing processes. The presence of leading market players and favorable regulatory frameworks further stimulate growth. North America focuses on lightweight materials for electric vehicles and sustainable energy applications, strengthening its market position.

Europe

Europe commands 24% of the advanced ceramics market, driven by the automotive, aerospace, and defense industries. The region emphasizes sustainable manufacturing and energy-efficient materials, promoting advanced ceramics use in various applications. It invests in next-generation technologies such as additive manufacturing, enhancing product customization and quality. The European Union’s strict environmental regulations encourage adoption of eco-friendly ceramics. Strong collaborations between industry and research institutions facilitate continuous innovation, sustaining market expansion across key countries like Germany, France, and the UK.

Asia-Pacific

Asia-Pacific dominates the advanced ceramics market with a 35% share due to rapid industrialization and urbanization. The region experiences high demand from electronics, transportation, and medical sectors, supported by growing manufacturing hubs in China, Japan, South Korea, and India. It benefits from increasing investments in infrastructure and renewable energy projects that require advanced ceramic materials. The expanding electric vehicle market in this region drives ceramics adoption for batteries and power electronics. Competitive labor costs and government incentives further attract manufacturers and boost market growth.

Rest of the World

The Rest of the World region accounts for 13% of the advanced ceramics market, including Latin America, the Middle East, and Africa. Emerging industries and increasing infrastructure development in these areas create new opportunities for ceramics in energy, healthcare, and transportation applications. It faces challenges such as limited technological capabilities and supply chain constraints but shows potential for growth through international collaborations and investments. Growing awareness of advanced material benefits gradually expands market penetration in these developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The advanced ceramics market remains highly competitive with key players focusing on innovation, product quality, and strategic collaborations to strengthen their market position. Companies such as Materion Corporation, Morgan Advanced Materials, Murata Manufacturing Co. Ltd, Saint-Gobain, and MARWA Co. Ltd lead the industry by investing heavily in research and development. It drives the creation of advanced materials that meet specific industry requirements across electronics, aerospace, and healthcare sectors. Market leaders prioritize expanding their product portfolios to cater to diverse applications while improving manufacturing efficiency to reduce costs. Strategic partnerships and acquisitions help these companies enhance their technological capabilities and global footprint. Emerging players like McDanel Advanced Ceramic Technologies and Wonik QnC Corporation focus on niche segments, offering specialized ceramic solutions to gain market share. The competitive landscape demands continuous innovation, superior customer service, and sustainable practices. It pressures companies to differentiate themselves through high-performance materials and tailored solutions, ensuring resilience amid evolving market demands.

Recent Developments

- On July 10, 2025, Murata began the world’s first mass production of a 47µF multilayer ceramic capacitor in the 0402-inch size, marking a significant advancement in miniaturization and capacitance.

- In February 2025, Roland launched new ceramic Binder Jetting Additive Manufacturing products named PB-600 and PB-400, enhancing capabilities in advanced ceramics 3D printing technology.

- In April 2025, Murata entered into a collaboration with QuantumScape to explore high-volume manufacturing of ceramic films for solid-state battery technology, indicating a strategic move into energy storage solutions.

Market Concentration & Characteristics

The advanced ceramics market exhibits a moderately concentrated structure with several leading companies holding significant market shares while numerous smaller players serve niche segments. It is characterized by continuous innovation and high capital intensity due to the complexity of raw materials and manufacturing processes. Market leaders such as Materion Corporation, Morgan Advanced Materials, Murata Manufacturing Co. Ltd, and Saint-Gobain invest heavily in research and development to enhance material properties and expand application areas. The industry demands stringent quality control and technological expertise, limiting entry barriers for new competitors. It also shows strong regional diversification, with Asia-Pacific dominating production and consumption due to rapid industrialization. The market favors companies that can offer customized, high-performance solutions tailored to sectors like electronics, aerospace, healthcare, and automotive. Sustained focus on sustainability and efficiency further shapes competitive dynamics, driving players to adopt eco-friendly processes and advanced manufacturing techniques

Report Coverage

The research report offers an in-depth analysis based on Raw Material, ClassType, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The advanced ceramics market will expand due to rising demand from electronics and automotive sectors.

- Innovations in material science will enable new applications in aerospace and healthcare industries.

- Adoption of additive manufacturing will improve production efficiency and customization.

- Growth in electric vehicles will increase the use of lightweight, heat-resistant ceramic components.

- Energy storage technologies will rely more on advanced ceramics for improved performance.

- Sustainable manufacturing processes will gain prominence across the industry.

- Emerging markets will offer new opportunities through infrastructure development and industrialization.

- Companies will focus on developing ceramics with enhanced toughness to overcome brittleness challenges.

- Collaboration between research institutions and industry players will accelerate innovation.

- Increased regulatory emphasis on environmental standards will drive demand for eco-friendly ceramics.