Market Overview:

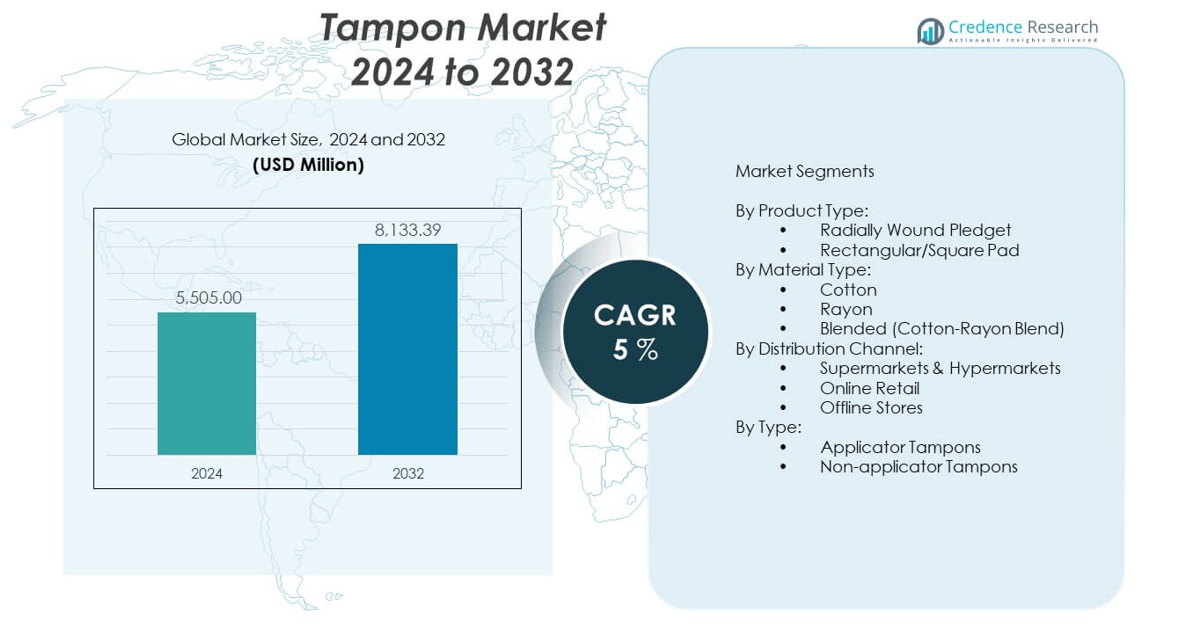

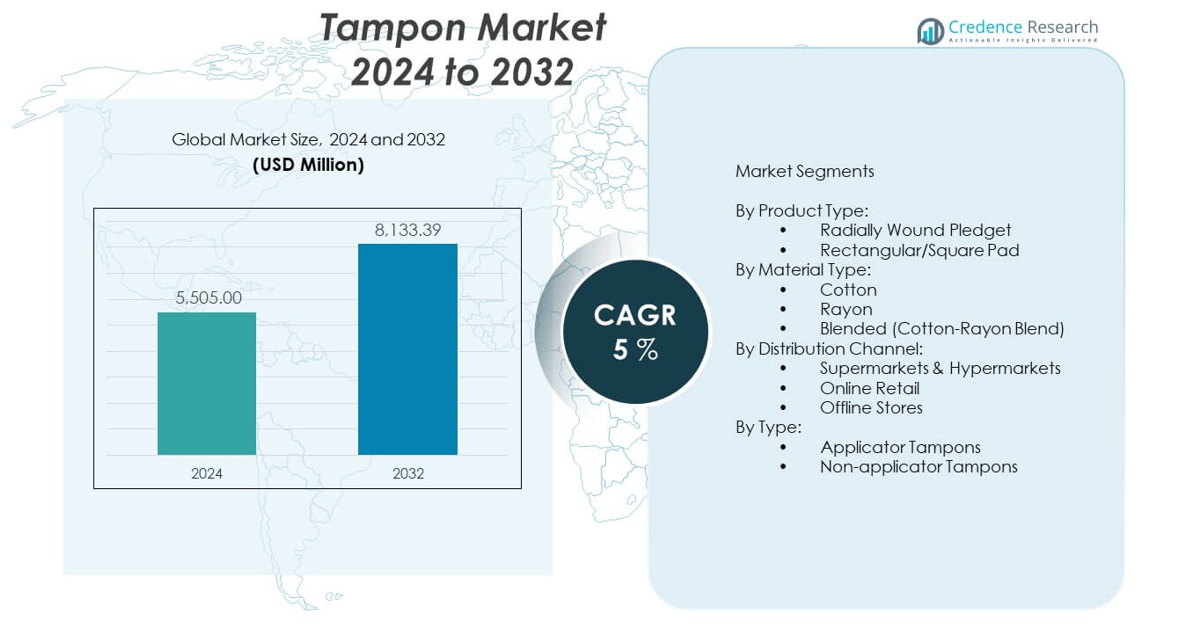

The Tampon market is projected to grow from USD 5,505 million in 2024 to an estimated USD 8,133.39 million by 2032, registering a compound annual growth rate (CAGR) of 5% during the forecast period. This growth reflects increasing consumer awareness around menstrual hygiene, the rising availability of tampons across both online and offline retail platforms, and a shift toward more convenient feminine hygiene products.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Tampon market Size 2024 |

USD 5,505 million |

| Tampon market, CAGR |

5% |

| Tampon market Size 2032 |

USD 8,133.39 million |

Market growth is primarily driven by rising health consciousness among women, urbanization, and the growing demand for compact and discreet menstrual solutions. The preference for tampons over traditional sanitary pads is increasing among younger demographics, especially in developed regions. Manufacturers are innovating with organic, biodegradable, and fragrance-free options to meet safety and sustainability expectations. Campaigns promoting menstrual health education and better accessibility are also contributing to higher product adoption globally.

North America leads the tampon market due to well-established product awareness, premium product offerings, and widespread retail availability. Europe follows closely, driven by strong demand for eco-friendly and reusable tampon products, particularly in Western countries. The Asia-Pacific region is witnessing rapid growth, propelled by rising disposable incomes, improved female hygiene education, and expanding urban populations in countries like India, China, and Indonesia. Meanwhile, Latin America and the Middle East & Africa are emerging markets where increased outreach efforts and NGO-led initiatives are helping reduce taboos and improve access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The tampon market was valued at USD 5,505 million in 2024 and is projected to reach USD 8,133.39 million by 2032, growing at a CAGR of 5% during the forecast period.

- Rising awareness of menstrual hygiene and increased female workforce participation are key factors driving tampon adoption across both developed and emerging markets.

- Demand for organic, chemical-free, and biodegradable tampons is growing, driven by consumer preferences for sustainable and safe feminine care products.

- Cultural taboos, lack of education, and limited product familiarity continue to restrict market penetration in developing countries.

- High price sensitivity in certain regions and the perception of tampons as premium products hinder adoption among lower-income groups.

- North America held the largest share of the tampon market in 2024 due to strong brand presence, retail infrastructure, and consumer awareness.

- Asia Pacific is the fastest-growing region, fueled by urbanization, digital retail expansion, and increasing menstrual health education initiatives.

Market Drivers

Rising Menstrual Health Awareness and Hygiene Education Propel Product Demand:

The tampon market is experiencing strong growth due to increased awareness around menstrual hygiene and reproductive health. Governments and non-profit organizations are promoting educational programs that destigmatize menstruation and encourage hygienic practices. These initiatives help women understand the advantages of tampons, especially in terms of comfort and convenience. Urban populations and younger generations show higher willingness to adopt tampon products over traditional options. Improved access to hygiene products through schools, healthcare centers, and retail programs has positively influenced adoption. Advertising campaigns by key players also normalize tampon use, making it more socially accepted. The inclusion of menstrual health in public health policies further boosts visibility. Product familiarity continues to rise across multiple income groups, strengthening long-term demand.

- The North America tampon market is projected to hold a 33.1% share in 2025, led by strong healthcare infrastructure, high consumer awareness, and established players like Procter & Gamble (Tampax) and Kimberly-Clark (Kotex) delivering innovative and diverse tampon products including organic and biodegradable options.

Growing Female Workforce Participation Increases the Need for Discreet and Mobile Solutions:

The expansion of the female working population is directly contributing to the growth of the tampon market. Women in active professions require menstrual hygiene products that offer comfort, discretion, and extended wear time during long shifts or travel. Tampons provide a hygienic solution without restricting mobility, making them highly suitable for modern lifestyles. Employers and institutions are beginning to offer feminine hygiene products as part of wellness programs. This social shift increases exposure and access to tampons in the workplace. Women pursuing education, sports, and outdoor careers also find tampons more practical than pads. Evolving lifestyles and time constraints further drive preferences for products that offer convenience and minimal maintenance. The working demographic continues to fuel consistent and predictable demand. It is a core driver of tampon adoption in both developed and developing markets.

Shift Toward Premium, Organic, and Chemical-Free Tampon Products Gains Momentum:

Consumer preferences are changing in favor of organic and chemical-free menstrual products, creating a strong growth driver for the tampon market. Health-conscious individuals are concerned about the ingredients used in conventional hygiene products. This awareness pushes them to opt for tampons made from 100% organic cotton and free from harmful dyes, bleaches, or synthetics. Several manufacturers have rebranded their offerings to meet these evolving expectations. Transparent labeling, clean manufacturing processes, and sustainability credentials influence purchasing decisions. Brands that invest in ethical sourcing and recyclable packaging gain customer loyalty. The shift aligns with broader consumer trends around clean beauty and personal care. Premium tampons with dermatologically tested and hypoallergenic features are also commanding higher margins. It helps position tampons not just as hygiene essentials but as wellness products.

Increased Availability Through E-Commerce and Subscription Models Drives Volume Growth:

The tampon market benefits from improved access through online platforms and direct-to-consumer subscription models. Digital retail enables discreet purchasing, wide product comparisons, and doorstep delivery—factors that significantly influence consumer choices. Small and emerging brands use online channels to enter markets with minimal distribution barriers. Subscription services offer convenience by automating recurring purchases and reducing stockout risks. These platforms often include customizable boxes, trial packs, and eco-friendly bundles. Urban consumers are particularly responsive to digital outreach and influencer marketing in the personal care space. E-commerce also allows penetration into rural areas where offline availability remains limited. Tampon brands leverage analytics to personalize marketing and improve customer retention. It makes digital platforms a critical channel for market expansion and brand visibility.

- For example, some premium tampons utilize compostable wrappers and cotton applicators certified for organic sourcing, achieving eco-label certifications that enhance consumer trust and loyalty.

Market Trends:

Sustainability Trends Accelerate the Rise of Biodegradable and Recyclable Tampon Products:

The tampon market is undergoing a shift toward environmentally responsible products in response to growing global sustainability awareness. Consumers are demanding biodegradable applicators, organic cotton cores, and plastic-free packaging. Companies are rethinking design and production processes to meet zero-waste and eco-certification goals. Some brands now offer reusable applicators or tampons made from plant-based fibers. Sustainability labeling has become a purchase driver among millennials and Gen Z users. Governments in some countries are introducing restrictions on single-use plastics, which further boosts demand for green alternatives. Retailers are highlighting eco-conscious tampon lines on shelves and digital storefronts. Product differentiation increasingly depends on environmental positioning rather than just functionality or price. It reinforces a long-term trend shaping product development strategies.

- For instance, Natracare has pioneered 100% organic cotton tampons with biodegradable, compostable applicators made from renewable materials, achieving certifications including USDA Organic and FSC, and successfully reducing plastic use by over 95% across its entire product line.

Increased Brand Competition from Startups and Direct-to-Consumer Brands Disrupts Legacy Players:

The tampon market is experiencing growing fragmentation as new entrants challenge legacy players through direct-to-consumer models. Startups position themselves as transparent, inclusive, and ethically driven brands that appeal to modern values. These players emphasize clean formulations, socially conscious sourcing, and user-centric packaging. They use digital storytelling and influencer engagement to build loyal customer communities. Unlike traditional companies, they bypass retail middlemen and rely on agile supply chains. Legacy brands face pressure to adapt their messaging and product lines to maintain relevance. The shift also drives faster innovation cycles and stronger price competition. It introduces new product experiences like scented-free, size-adjustable, or starter kits. The market becomes more dynamic with diverse offerings tailored to varied preferences.

Inclusion and Body Positivity Campaigns Broaden Consumer Demographics:

The tampon market is increasingly shaped by inclusive marketing campaigns that embrace body diversity, gender neutrality, and menstrual equity. Brands are stepping away from traditionally feminine packaging and language, creating products that cater to trans, non-binary, and differently abled individuals. Inclusive sizing, adaptive applicators, and customizable boxes ensure a wider range of users feel represented. Retailers support this shift by expanding shelf space for diverse brands and reducing stigma through visible education. Marketing materials focus on empowerment and realistic body narratives. This approach deepens customer trust and builds emotional loyalty. It also enables brands to enter new consumer segments previously overlooked by conventional messaging. Inclusion becomes not just a value proposition but a market expansion tool.

Tech-Enabled Product Innovation Expands Functional Use and Health Monitoring:

Innovation in the tampon market now extends into smart features and digital integration. Companies are experimenting with tampons that include sensors to detect flow levels or track health metrics. While still in early stages, these developments suggest a shift toward hybrid wellness technologies. It reflects growing demand for personalized health tracking tools. Some concepts integrate apps to remind users of replacement times or provide product use analytics. Product packaging may feature QR codes for virtual education and product information. Such innovations appeal to tech-savvy consumers and reinforce brand differentiation. It also helps position tampons as part of a connected self-care routine. The intersection of femtech and hygiene presents significant long-term growth potential.

Market Challenges Analysis:

Persistent Cultural Taboos and Limited Awareness Restrict Adoption in Developing Regions:

The tampon market faces adoption barriers in developing countries where cultural stigma and lack of awareness still dominate menstrual hygiene practices. Many women remain unfamiliar with tampon usage or believe myths around virginity, discomfort, or health risks. Education systems rarely address menstrual product options comprehensively. Retail availability is limited in rural and low-income areas, where affordability also becomes a constraint. Women who do encounter tampons often receive no guidance on proper insertion or disposal. Marketing campaigns must navigate sensitive cultural contexts to build acceptance. Religious or traditional views further complicate outreach efforts. Brands entering such markets must invest in community-based education and localized engagement. Without these efforts, penetration remains low despite rising demand for menstrual care.

Price Sensitivity and Perception of Tampons as Premium Products Limit Mass-Market Reach:

The tampon market struggles with consumer perception in many regions where pads dominate due to lower cost and wider availability. Tampons are often viewed as premium products suited only for urban or high-income users. Their unit price can be higher, especially for imported or organic variants. Cost-sensitive consumers prioritize essentials, pushing tampons down the purchase hierarchy. Retailers in emerging markets stock fewer tampon options due to slower inventory turnover. Smaller pack sizes and sample kits are needed to attract trial usage. Without aggressive pricing or subsidy models, brands face resistance from first-time buyers. Economic volatility also impacts purchasing behavior, making affordability a consistent barrier to growth.

Market Opportunities:

Untapped Growth Potential in Menstrual Education and Rural Distribution Channels:

The tampon market holds significant growth potential in rural and underpenetrated regions where access and awareness remain low. By investing in school-based hygiene education, brands can foster early familiarity and trust. Collaborations with NGOs, healthcare workers, and local governments can improve distribution in remote areas. Affordable product variants and trial kits will ease entry barriers for first-time users. Expanding beyond urban retail channels offers long-term volume growth. Localized messaging and culturally sensitive training materials improve engagement. These efforts not only address a social gap but also unlock new demand segments. It creates scalable opportunities in both commercial and social enterprise models.

Premiumization and Personalization Drive Future Brand Differentiation:

The tampon market can capture high-value growth through product customization, subscription kits, and targeted wellness bundles. Premium consumers seek products tailored to their lifestyle, sensitivity, or aesthetic preferences. Brands that offer options by flow level, applicator type, or packaging design can build stronger loyalty. Subscription services with flexible delivery schedules and add-on wellness items increase customer lifetime value. Customizable products help brands stand out in a crowded shelf space. It aligns with the broader self-care and personalization trend across beauty and hygiene sectors. These innovations allow price premiums without compromising user satisfaction. It reinforces tampons as lifestyle-oriented products.

Market Segmentation Analysis:

By Product Type

The tampon market is led by radially wound pledgets, which hold approximately 76.4% of the market share due to their superior absorbency and user comfort. These tampons are the standard choice for most consumers globally. The rectangular/square pad segment captures a smaller portion of the market and sees limited adoption, primarily in specific regional or low-cost product lines.

- For instance, Procter & Gamble’s Tampax employs advanced radial winding technology tested to provide up to 8 hours of leak protection with a consistent absorbency rate controlled within +/- 3% variation across batches during production scaling.

By Material Type

Cotton remains the leading material segment, accounting for an estimated 35.8% to 45% of the market. It is preferred for being natural, hypoallergenic, and biodegradable. Rayon is used for its absorbency but draws criticism over synthetic processing. Blended (cotton-rayon) tampons offer a balance of comfort and performance, gaining popularity among mainstream users seeking both efficiency and safety.

- For instance, ESSITY AB’s Organyc brand features tampons made from 100% certified organic cotton achieving 99.9% free-from-chemical content verified through rigorous third-party lab testing, providing an allergen-minimized option that captures increasing consumer preference.

By Distribution Channel

Supermarkets and hypermarkets dominate the distribution landscape, providing strong visibility and ease of access. Online retail is the fastest-growing channel, driven by discreet delivery options, personalized subscription models, and increased digital engagement. Offline stores still hold relevance in areas with limited digital penetration or traditional shopping habits.

By Type

Applicator tampons remain the dominant segment due to their hygienic features and ease of insertion, especially in Western markets. Non-applicator tampons, including organic and eco-friendly variants, are gaining traction among sustainability-focused consumers. These products are particularly popular in Europe and among younger users seeking minimal environmental impact.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Product Type:

- Radially Wound Pledget

- Rectangular/Square Pad

By Material Type:

- Cotton

- Rayon

- Blended (Cotton-Rayon Blend)

By Distribution Channel:

- Supermarkets & Hypermarkets

- Online Retail

- Offline Stores

By Type:

- Applicator Tampons

- Non-applicator Tampons

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Commands the Largest Market Share

North America leads the tampon market with an estimated 38% share of global revenue. High awareness of menstrual hygiene, early product adoption, and wide distribution through supermarkets, pharmacies, and e-commerce platforms support regional dominance. The United States drives most of the consumption, backed by a well-established product portfolio and strong brand loyalty. Consumers in this region prefer premium, applicator-based tampons for convenience and hygiene. Subscription services and digital retail channels are also well developed. The region’s focus on sustainable and organic products is shifting demand toward biodegradable tampon variants. The market maintains steady growth through innovation and brand-led education campaigns.

Europe Holds a Strong Position with Diverse Consumer Preferences

Europe accounts for approximately 30% of the tampon market, supported by a mix of mainstream and niche consumer preferences. Countries such as Germany, the UK, and France lead in both volume and value, while Nordic countries show high adoption of organic and non-applicator tampons. It benefits from mature retail infrastructure and strong regulatory oversight on product safety and labeling. Consumers in Western Europe increasingly prefer sustainable and reusable menstrual products. Local brands and private labels perform well alongside global companies. The region sees active promotion of menstrual equity through public initiatives and education programs. This blend of maturity and evolving trends keeps the market competitive.

Asia Pacific Emerges as the Fastest-Growing Region

Asia Pacific holds around 20% of the global tampon market and shows the highest growth potential. Urbanization, increasing female workforce participation, and rising awareness of menstrual hygiene drive demand across China, India, Japan, and Southeast Asia. Tampons remain underpenetrated compared to sanitary pads, but social acceptance is gradually improving. International brands are expanding into the region through online platforms and health-focused campaigns. Governments and NGOs support growth by promoting menstrual education and product accessibility. It represents a critical expansion area for both mainstream and organic tampon manufacturers. Market players are tailoring strategies to address regional taboos, affordability, and infrastructure gaps.

Key Player Analysis:

- Procter & Gamble (brand: Tampax)

- Kimberly-Clark (brand: U by Kotex)

- Johnson & Johnson (brand: o.b.)

- Edgewell Personal Care Company (brand: Playtex)

- Natracare

- Lil-lets

- First Quality Enterprises Inc.

- MOXIE

- Rossmann

- Bodywise Ltd.

- Cora

- Corman S.p.A.

- Svenska Cellulosa Aktiebolaget (SCA)

- Unicharm

- Libra

- Tempo

- TZMO SA

- ESSITY AB

- UNILEVER PLC

Competitive Analysis:

The tampon market features a mix of multinational giants and niche organic brands competing across price, sustainability, and product innovation. Procter & Gamble, Kimberly-Clark, and Johnson & Johnson hold dominant shares due to their global distribution, brand recognition, and extensive product portfolios. These companies focus on applicator-based and mainstream products, supported by mass marketing and retail presence. Emerging players such as Natracare, Cora, and MOXIE disrupt the space through eco-conscious offerings, subscription models, and digital-first strategies. The tampon market responds to shifting consumer expectations around transparency, biodegradability, and health safety. It remains highly competitive with product diversification and brand repositioning strategies driving differentiation.

Recent Developments:

- In 2025, Procter & Gamble, under its Tampax and Always brands, launched a new product called Always Pocket Flexfoam, a compact, full-sized Flexfoam pad designed for portability with up to zero leaks, zero feel, and zero bunching.

- In November 2024, Procter & Gamble and Kimberly‑Clark faced proposed class action lawsuits alleging that their Tampax and U by Kotex tampon products contained undisclosed unsafe levels of lead.

Market Concentration & Characteristics:

The tampon market is moderately concentrated, with leading players holding substantial global share and maintaining dominance through brand equity, retail reach, and product innovation. It features both mass-market and premium segments, with strong competition emerging in the organic and sustainable category. Consumer loyalty, regulatory compliance, and shelf positioning shape brand success. Product differentiation relies on features such as comfort, eco-friendliness, and applicator design. It evolves rapidly in response to shifting health trends and sustainability priorities. Distribution strategies range from traditional retail to direct-to-consumer platforms, creating a multi-channel competitive landscape.

Report Coverage:

The research report offers an in-depth analysis based on product type, material type, distribution channel, and tampon type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Online sales channels will account for an increasing share of tampon distribution

- Demand for organic and biodegradable tampons will accelerate across regions

- Education and awareness campaigns will expand adoption in underpenetrated markets

- Emerging brands will challenge incumbents with direct-to-consumer business models

- Asia Pacific will become a key target for multinational expansion strategies

- Regulatory focus on menstrual hygiene products will tighten quality standards

- Personalization and subscription models will enhance consumer engagement

- Retailers will expand shelf space for eco-friendly and inclusive brands

- Technological innovation will introduce health-monitoring tampon features

- Strategic collaborations will rise between NGOs, healthcare bodies, and manufacturers