Market Overview

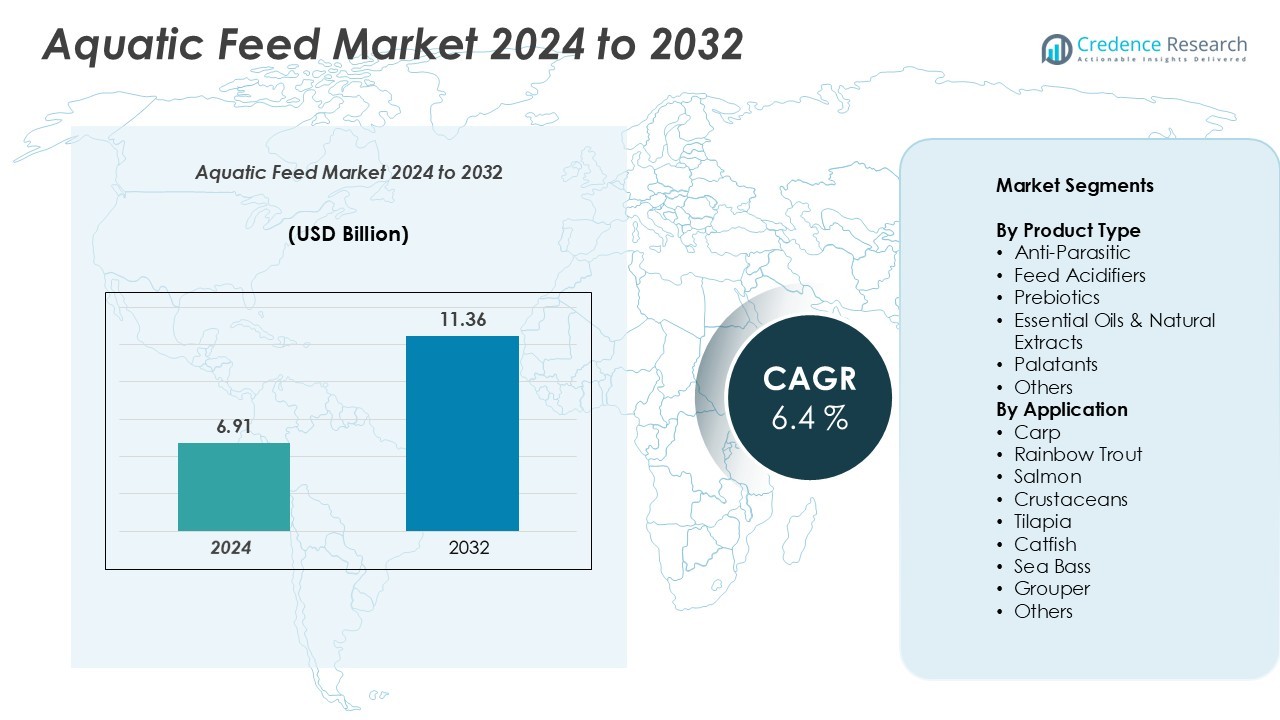

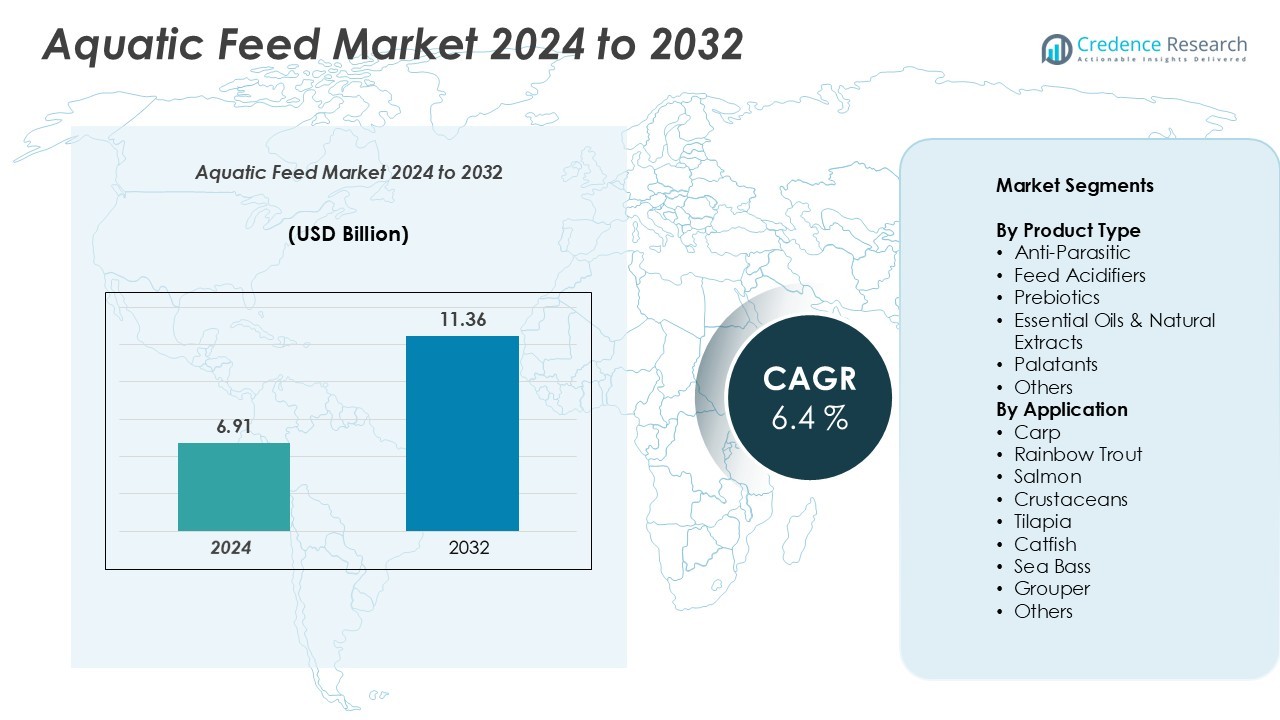

The Aquatic Feed Supplement Market size was valued at USD 6.91 billion in 2024 and is anticipated to reach USD 11.36 billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aquatic Feed Supplement Market Size 2024 |

USD 6.91 Billion |

| Aquatic Feed Supplement Market, CAGR |

6.4% |

| Aquatic Feed Supplement Market Size 2032 |

USD 11.36 Billion |

The aquatic feed supplement market is led by key players such as INVE Aquaculture, Aller Aqua, BENEO, Ridley Corp. Ltd., Skretting, Charoen Pokphand Foods PCL, Purina Animal Nutrition LLC, BioMar Group, Dibaq Aquaculture, Aker Biomarine, Alltech, and Cargill, Inc. These companies focus on functional nutrition, sustainable formulations, and strategic expansion into high-growth regions. Asia Pacific dominates the market with a 36% share, supported by large-scale carp, tilapia, and crustacean farming. North America follows with 28%, driven by salmon and trout production. Europe holds 24%, reflecting strong regulatory compliance and advanced farming practices. Together, these regions shape the competitive landscape through innovation, product differentiation, and targeted market penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The aquatic feed supplement market was valued at USD 6.91 billion in 2024 and is projected to reach USD 11.36 billion by 2032, growing at a CAGR of 6.4%.

- Rising aquaculture production and demand for high-quality seafood are major growth drivers, with strong uptake of feed acidifiers, prebiotics, and natural extracts to boost yield and fish health.

- Growing adoption of sustainable and antibiotic-free farming practices is shaping market trends, supported by increased use of natural ingredients and precision nutrition technologies.

- The market is competitive, with key players including INVE Aquaculture, Aller Aqua, BENEO, Ridley Corp. Ltd., Skretting, and Cargill, Inc., focusing on product innovation and global expansion.

- Asia Pacific leads with 36% market share, followed by North America at 28% and Europe at 24%; feed acidifiers dominate the product segment, while carp represents the leading application segment driving overall demand.

Market Segmentation Analysis:

By Product Type

Feed acidifiers hold the dominant market share in the aquatic feed supplement market. These products enhance nutrient absorption, improve gut health, and support overall growth performance in aquaculture species. Their ability to reduce harmful bacteria and maintain pH balance makes them essential for commercial fish farming. Rising demand for sustainable and cost-efficient production drives wider adoption of acidifiers. Prebiotics are also gaining traction as farms focus on disease prevention and growth optimization. Essential oils, palatants, and anti-parasitic additives contribute to species-specific health benefits and improved feed intake, supporting market expansion across multiple farming systems.

- For instance, Reda et al. in The Journal of Veterinary Science, a 60-day feeding trial showed that Nile tilapia (initial weight ~28.8 g) fed a diet supplemented with a mixture of formic acid, propionic acid, and calcium propionate (at 0.1% and 0.2% inclusion levels) demonstrated significant improvements in growth rates and feed efficiency compared to a control group. Specifically, the highest dose group (0.2%) displayed superior final body weight, specific growth rate, and feed conversion ratio.

By Application

Carp represents the leading application segment in the aquatic feed supplement market, driven by extensive production volumes in Asia Pacific. High consumption rates and cost-effective farming practices make carp farming a key growth driver. Farmers use feed acidifiers and prebiotics to improve feed conversion rates and immunity. Salmon and tilapia farming are also significant, supported by growing demand for premium seafood and strict health management practices. Crustaceans, catfish, sea bass, and grouper farming segments are expanding due to rising aquaculture investments and evolving dietary supplementation strategies.

- For instance, In a review of prebiotic use in aquatic species, supplementation improved microvilli length and digestive enzyme activity. These effects have been observed in multiple studies, including some involving hybrid grouper fed specific prebiotics like mannan-oligosaccharides (MOS) and xylooligosaccharides (XOS).

Market Dynamics Across Segments

The strong performance of feed acidifiers and carp farming reflects the market’s focus on productivity and biosecurity. High-intensity aquaculture operations demand supplements that improve growth rates, reduce disease risks, and support sustainable farming. Rising environmental regulations encourage natural and probiotic-based products. Innovation in formulation and delivery methods further boosts feed efficiency and animal health. Expanding salmon and tilapia farming in developed markets and crustacean farming in emerging regions reinforces product diversification and steady market growth.

Key Growth Drivers

Rising Aquaculture Production and Demand for High-Quality Yield

Global aquaculture production is expanding rapidly, driving the need for efficient nutritional solutions. Fish and shrimp farmers are adopting feed supplements to enhance growth performance, immunity, and survival rates. Rising seafood consumption across Asia Pacific, Europe, and North America strengthens this trend. Feed acidifiers, prebiotics, and essential oils help optimize gut health and reduce disease outbreaks, supporting higher yield. Sustainable production methods and export-oriented farming further increase supplement adoption. Countries like China, India, and Vietnam are investing in intensive aquaculture systems, accelerating product demand. This steady growth in aquaculture production directly fuels the market for effective and sustainable feed additives.

- For instance, A 10-week trial on Nile tilapia using Biotronic Top Liquid (BTL) showed a non-statistically significant survival rate increase under normal conditions with the highest BTL dosage compared to a control group. However, under bacterial challenge conditions, the group receiving the highest BTL dose demonstrated a significantly higher survival rate than the control.

Focus on Disease Prevention and Animal Health

Disease outbreaks in aquaculture systems often lead to major economic losses. Farmers are increasingly adopting functional supplements such as anti-parasitics, acidifiers, and probiotics to enhance immunity and reduce pathogen risks. These products improve digestive efficiency and maintain a healthy microbiome, limiting disease transmission. Regulatory pressure to minimize antibiotic usage strengthens the shift toward natural health boosters. Major aquaculture producers are integrating supplements into feed programs to reduce mortality rates and improve product quality. The growing need for preventive healthcare in fish farming is a strong driver of supplement market expansion.

- For instance, a controlled challenge trial of tilapia fed 0.5 % organic acid blend showed markedly improved survival when challenged with Flavobacterium orientale compared to untreated fish.

Regulatory Push Toward Sustainable and Natural Feed Solutions

Environmental regulations and consumer demand for sustainable seafood are encouraging natural supplement use. Governments and certification agencies promote eco-friendly inputs to reduce chemical discharge and water contamination. Essential oils, natural extracts, and probiotic solutions are gaining preference over synthetic additives. Producers view these ingredients as key tools to comply with regulations and maintain export quality standards. Retailers and end consumers also favor traceable, residue-free aquaculture products. This regulatory support and market pressure are accelerating the adoption of high-quality, natural supplements, further driving industry growth.

Key Trends & Opportunities

Rising Use of Natural Extracts and Probiotics

A major trend shaping the aquatic feed supplement market is the growing shift toward natural and functional ingredients. Essential oils and prebiotics are widely adopted to enhance feed conversion rates and boost fish immunity. These ingredients offer strong antibacterial and antifungal properties, making them suitable for sustainable aquaculture. Leading producers are investing in R&D to develop targeted blends that improve species-specific performance. The increasing acceptance of clean-label and residue-free products is opening new opportunities for exporters and premium aquaculture farms worldwide.

- For instance, a specific study on Nile tilapia, published in February 2025, confirms that a botanical blend (specifically, 0.50 g kg⁻¹ of a blend named PAN) improved immune functions, feed efficiency, and other health indicators.

Integration of Precision Nutrition and Smart Feeding Technologies

Technological advancements are enabling more efficient and customized supplement usage. Smart feeding systems, automated dispensers, and data-driven aquaculture platforms allow precise dosing and monitoring of feed supplements. This integration reduces feed waste, improves water quality, and enhances productivity. Precision nutrition supports species-specific growth optimization and reduces disease prevalence. Producers are collaborating with technology companies to design intelligent feeding programs that maximize return on investment. This trend is expected to create significant growth opportunities for supplement manufacturers.

Expanding Aquaculture in Emerging Markets

Rising investment in aquaculture infrastructure across Asia, Africa, and Latin America is creating new opportunities. Governments are promoting sustainable fish farming to meet domestic protein demand and boost exports. Local farmers are increasingly adopting feed supplements to improve growth rates and survival. Market players are expanding distribution networks and offering cost-effective solutions tailored to regional species like carp, tilapia, and catfish. This geographic expansion strengthens the global supply chain and broadens market access for supplement producers.

Key Challenges

High Cost of Functional Ingredients

The production and formulation of high-quality supplements, particularly natural extracts and probiotics, involve significant costs. Small-scale farmers often struggle to afford these products, especially in price-sensitive regions. Limited access to cost-effective solutions slows adoption in developing markets. Volatile raw material prices and complex processing further raise operational costs for manufacturers. Achieving large-scale affordability without compromising quality remains a major challenge for the industry.

Regulatory Complexity and Quality Control

The aquatic feed supplement market faces strict regulatory frameworks across multiple regions. Differences in import standards, safety testing, and labeling requirements create compliance barriers for producers. Smaller companies face difficulties in meeting these regulatory standards due to high certification costs. Maintaining consistent product quality and ensuring traceability throughout the supply chain adds further pressure. These factors can delay product launches and restrict market access, limiting the pace of global expansion.

Regional Analysis

North America

North America holds a 28% market share in the aquatic feed supplement market. Strong aquaculture production in the U.S. and Canada supports demand for prebiotics, acidifiers, and essential oils. Farmers in the region emphasize sustainable practices and strict regulatory compliance, which drives the use of natural supplements. High consumer awareness of premium seafood also supports the use of quality-enhancing additives. Large-scale salmon and trout farming operations contribute significantly to product uptake. Advanced feeding technologies and R&D investments from key players further strengthen regional growth and adoption rates.

Europe

Europe accounts for a 24% market share, supported by advanced aquaculture practices and strict regulatory standards. The region’s focus on antibiotic-free farming drives adoption of prebiotics, essential oils, and anti-parasitic products. Salmon, trout, and sea bass farming dominate production, particularly in Norway, Scotland, and the Mediterranean countries. High-quality standards for exports push farmers to use effective supplements that improve feed efficiency and fish health. Continuous R&D, coupled with sustainability initiatives, positions Europe as a strong market for functional feed additives.

Asia Pacific

Asia Pacific leads the aquatic feed supplement market with a 36% market share. China, India, Vietnam, and Indonesia drive high-volume aquaculture production, especially in carp, tilapia, and crustaceans. Rising protein consumption, growing exports, and supportive government policies boost supplement adoption. Farmers are increasingly using acidifiers and prebiotics to enhance growth performance and reduce disease risks in intensive farming systems. Expanding aquaculture infrastructure and favorable climatic conditions reinforce the region’s dominance in both volume and growth potential.

Latin America

Latin America holds a 7% market share, with strong growth in shrimp and tilapia farming. Brazil, Ecuador, and Chile are key contributors, supported by expanding export operations and increasing feed supplement adoption. Producers are investing in natural additives to improve survival rates and meet international quality standards. Technological improvements and access to global markets strengthen demand for efficient and cost-effective supplements. Growing private sector participation and government support enhance production capacity and market expansion.

Middle East & Africa

The Middle East & Africa region represents a 5% market share, with growing aquaculture development programs in countries like Egypt, Saudi Arabia, and South Africa. Rising seafood consumption and investments in aquaculture infrastructure are supporting feed supplement adoption. Producers are focusing on tilapia, catfish, and marine species farming. The market is at a developing stage but shows strong potential due to increasing interest in sustainable farming practices. Gradual adoption of natural feed additives and expanding production capacity will support long-term growth in this region.

Market Segmentations:

By Product Type

- Anti-Parasitic

- Feed Acidifiers

- Prebiotics

- Essential Oils & Natural Extracts

- Palatants

- Others

By Application

- Carp

- Rainbow Trout

- Salmon

- Crustaceans

- Tilapia

- Catfish

- Sea Bass

- Grouper

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The aquatic feed supplement market is highly competitive, with global and regional players focusing on innovation, product quality, and species-specific solutions. Key companies include INVE Aquaculture, Aller Aqua, BENEO, Ridley Corp. Ltd., Skretting, Charoen Pokphand Foods PCL, Purina Animal Nutrition LLC, BioMar Group, Dibaq Aquaculture, Aker Biomarine, Alltech, and Cargill, Inc.. These companies emphasize R&D investments to develop functional feed additives that enhance fish growth, disease resistance, and feed conversion efficiency. Strategic partnerships and acquisitions help expand their product portfolios and strengthen distribution networks. Many firms are introducing natural and sustainable ingredients to comply with strict aquaculture regulations and meet growing demand for eco-friendly solutions. Leading players also focus on expanding their presence in emerging aquaculture markets, such as Asia Pacific and Latin America, to capture new growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INVE Aquaculture

- Aller Aqua

- BENEO

- Ridley Corp. Ltd.

- Skretting

- Charoen Pokphand Foods PCL

- Purina Animal Nutrition LLC

- BioMar Group

- Dibaq Aquaculture

- Aker Biomarine

- Alltech

- Cargill, Inc.

Recent Developments

- In March 2025, IFFO recorded a 29% year-on-year rise in global fish-meal output and 34% in fish-oil, led by Peru’s rebound.

- In October 2024, Cellana acquired PhytoSmart, combining algae-based supplements with large-scale production for aquafeed.

- In September 2024, Cargill bought two U.S. feed mills from Compana Pet Brands to bolster its Animal Nutrition and Health business.

- In April 2024, Pelagia acquired UK seafood trader Ideal Foods to enhance the supply of fish meal and fish oil.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by expanding global aquaculture production.

- Feed acidifiers and prebiotics will remain the most adopted product segments.

- Natural and sustainable ingredients will replace synthetic additives at a faster pace.

- Precision feeding and smart aquaculture technologies will enhance supplement efficiency.

- Regulatory support will accelerate the shift toward eco-friendly farming solutions.

- Asia Pacific will continue to lead the market due to strong production capacity.

- North America and Europe will expand with advanced farming practices and high-value species.

- Strategic partnerships and R&D investments will strengthen the competitive landscape.

- Product diversification will increase to address species-specific nutritional needs.

- Rising global seafood demand will ensure long-term market stability and growth.