Market Overview

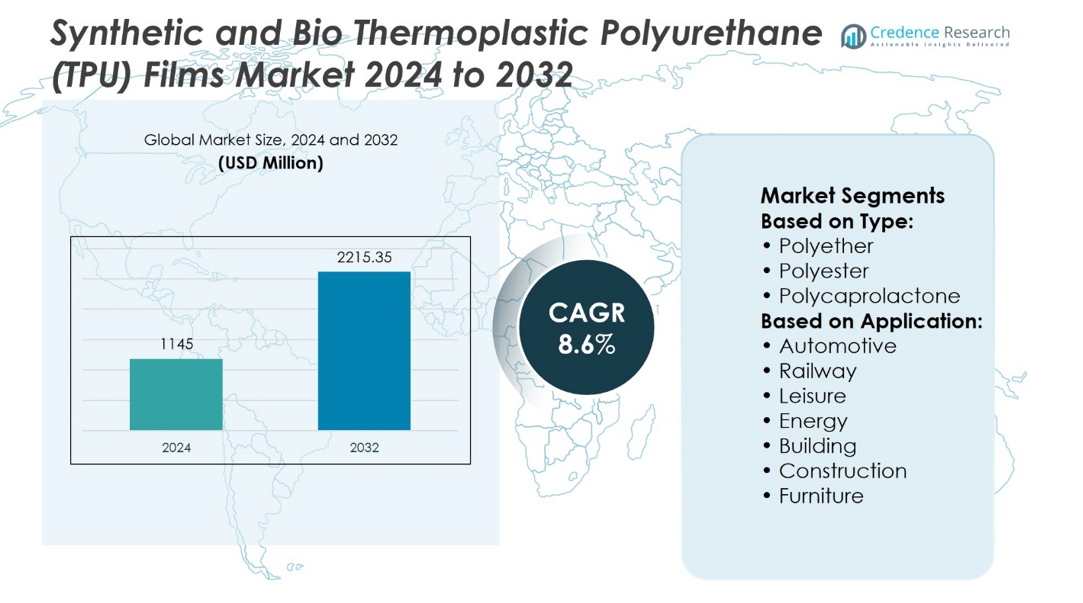

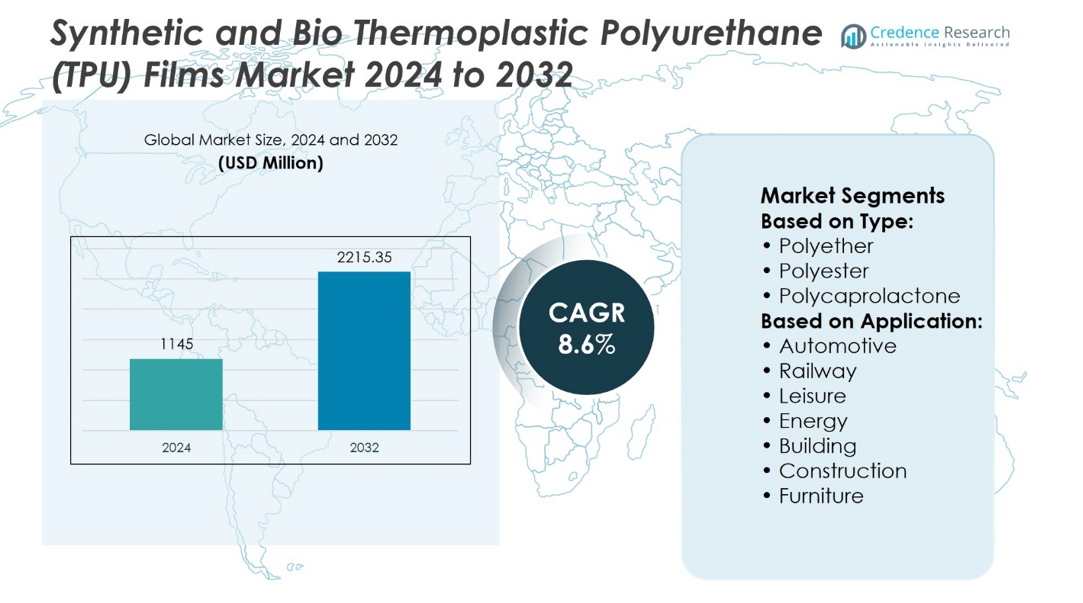

Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market size was valued at USD 1145 million in 2024 and is anticipated to reach USD 2215.35 million by 2032, at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market Size 2024 |

USD 1145 million |

| Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market, CAGR |

8.6% |

| Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market Size 2032 |

USD 2215.35 million |

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market grows steadily due to rising demand for flexible, durable, and lightweight materials across automotive, healthcare, electronics, and construction sectors. Increased focus on sustainable and bio-based alternatives drives innovation in film formulations. Advancements in wearable technology, protective coatings, and medical packaging continue to expand application scope. Regulatory support for eco-friendly materials and rising consumer awareness further boost adoption. The market benefits from improvements in production efficiency, recyclability, and thermal resistance. Ongoing product development and customization trends shape competitive dynamics and support long-term industry growth across both developed and emerging regions.

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market shows strong growth across Asia-Pacific, North America, and Europe, with Asia-Pacific leading due to its robust manufacturing base. North America and Europe drive demand for high-performance and sustainable TPU films. Key players operating in this market include BASF SE, Covestro AG, The Lubrizol Corporation, Huntsman International LLC, 3M Company, Avery Dennison, American Polyfilm Inc., MH&W International Corporation, PAR Group, and Permali Gloucester Limited, each contributing through innovation, capacity expansion, and regional presence.

Market Insights

- The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market was valued at USD 1145 million in 2024 and is projected to reach USD 2215.35 million by 2032, growing at a CAGR of 8.6%.

- Rising demand for lightweight, flexible, and durable materials in automotive, electronics, and healthcare sectors drives steady market growth.

- Increasing focus on sustainability accelerates the adoption of bio-based TPU films and promotes innovation in eco-friendly formulations.

- Key players actively invest in R&D, capacity expansion, and strategic partnerships to strengthen market presence and technology leadership.

- High raw material costs and sensitivity to price fluctuations restrain production scalability and challenge profit margins.

- Asia-Pacific leads the market due to strong manufacturing infrastructure, while North America and Europe prioritize high-performance and sustainable solutions.

- Ongoing advancements in medical packaging, wearable tech, and thermal-resistant films continue to expand application opportunities globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand Across Automotive and Construction Industries Drives Market Expansion

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market benefits significantly from rising usage in the automotive and construction sectors. Manufacturers prefer TPU films for their superior abrasion resistance, elasticity, and durability in high-performance components. In the automotive industry, these films support lightweighting goals and help improve fuel efficiency. Construction applications include protective coatings and roofing membranes that require high tensile strength and flexibility. The demand for premium interiors, vehicle wraps, and surface protection in cars increases the adoption of TPU films. It supports the market’s continuous growth in both original equipment and aftermarket segments.

- For instance, Covestro AG reported delivering approximately 8,200 metric tons of Desmopan® TPU globally for automotive and construction-related applications in 2023, supported by its production facility

Increased Adoption in Medical Applications Enhances Market Opportunities

Medical-grade TPU films offer biocompatibility, sterilization capability, and flexibility, making them suitable for surgical drapes, wound care, and wearable medical devices. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market grows as healthcare systems expand and prioritize patient safety and hygiene. Demand rises for transparent, breathable films used in medical packaging and personal protective equipment. It enables companies to meet strict regulatory and safety standards in healthcare product manufacturing. Innovation in bio-based TPU films aligns with sustainability goals of hospitals and medical device makers. The market gains traction from rising healthcare expenditure and demand for advanced medical solutions.

- For instance, Lubrizol Life Science Health manufactured over 3,200 metric tons of medical-grade TPU in 2023 through its Pathway™ TPU portfolio, which is used in Class I and Class II medical devices

Sustainability Goals and Bio-Based Alternatives Fuel Industry Transformation

Bio-based TPU films present a compelling alternative to conventional petroleum-based materials, supporting the shift toward greener manufacturing. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market adapts quickly to evolving environmental regulations and consumer preferences for eco-friendly products. It attracts investment from companies developing bio-content films with similar mechanical properties to synthetic variants. Government mandates in Europe and North America further accelerate this transition. Brands across industries adopt bio-TPU films to meet internal ESG targets and regulatory compliance. This shift strengthens the market position of sustainable TPU film producers.

Technological Advancements in Processing and Product Innovation Strengthen Market Position

Innovations in extrusion technologies and material science improve film performance, design flexibility, and production efficiency. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market evolves as manufacturers develop TPU films with higher clarity, strength, and barrier properties. It allows for expansion into emerging applications such as electronics and sportswear. Faster processing speeds and enhanced film uniformity reduce costs and expand commercial viability. Research into multilayer films and smart TPU materials supports next-generation product development. These improvements keep the market competitive and responsive to diverse end-user needs.

Market Trends

Shift Toward Bio-Based TPU Films Reflects Rising Environmental Consciousness

Manufacturers are increasingly investing in bio-based TPU films to align with global sustainability targets. These films reduce dependence on fossil fuels while offering comparable performance to conventional TPU. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market sees greater adoption of renewable feedstocks, such as vegetable oils and starch derivatives. It addresses growing consumer preference for eco-friendly products across automotive, textile, and medical industries. Governments in Europe and North America continue to enforce stricter regulations on carbon emissions and plastic waste. This trend accelerates research and development of greener TPU film alternatives.

- For instance, BASF SE reported producing over 5,000 metric tons of bio-based Elastollan® TPU in 2023, using renewable feedstocks derived

Expansion of Wearable Electronics and Smart Textiles Drives Film Innovation

The growing popularity of wearable devices and smart textiles increases demand for flexible, durable, and breathable TPU films. These films offer high transparency, skin compatibility, and resistance to sweat and UV exposure. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market supports electronics integration by enabling compact, lightweight designs. It also enables enhanced product lifespan and functionality in consumer electronics. Companies are focusing on stretchable and conductive TPU composites that meet the demands of next-generation wearables. This trend strengthens the market’s relevance in emerging lifestyle and health-monitoring applications.

- For instance, SWM International produced over 1,700 metric tons of Argotec™ TPU films in 2023 specifically for wearable electronics

Increased Customization and Multi-Functional Films Meet Diverse Industry Requirements

End-use industries now require TPU films tailored for specific functions, such as anti-fog, flame retardant, and antimicrobial properties. Film manufacturers develop multi-layered and coated variants to serve these evolving needs. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market grows more dynamic with the introduction of smart and responsive materials. It allows producers to penetrate niche markets such as aerospace interiors, cleanroom environments, and protective apparel. Continuous innovation in additives and processing techniques enhances film performance across multiple parameters. This shift toward customization enables companies to differentiate and build competitive advantage.

Rapid Growth of Asian Manufacturing Hubs Supports Market Expansion

Countries like China, India, and South Korea lead the production and consumption of TPU films due to expanding industrial infrastructure. Rising demand in automotive, footwear, and electronics sectors fuels regional market growth. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market benefits from lower production costs and government support in these economies. It also attracts global manufacturers establishing joint ventures and new facilities across Asia. The region’s focus on export-oriented manufacturing increases TPU film volumes across global supply chains. Strong demand from regional OEMs and multinational brands reinforces Asia’s dominant position in the market.

Market Challenges Analysis

High Production Costs and Raw Material Volatility Limit Market Penetration

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market faces cost-related challenges that hinder wider adoption, particularly in price-sensitive industries. TPU film production requires advanced processing equipment and specialized raw materials, many of which are petroleum-based or derived from renewable sources with fluctuating prices. It increases operational costs and affects pricing strategies for end-use applications. Volatility in crude oil prices and limited supply of bio-based feedstocks create uncertainty for manufacturers. Small and medium enterprises often struggle to compete due to high capital investment requirements. These financial pressures can delay expansion plans and slow innovation efforts across the industry.

Technical Limitations and Compatibility Issues Restrict Application Scope

Despite strong material properties, TPU films face compatibility challenges in certain high-temperature or chemically aggressive environments. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market contends with limitations in applications requiring extreme resistance or specific regulatory certifications. It creates barriers in industries such as aerospace and advanced medical devices where alternative materials may be more suitable. Bio-based TPU films, while sustainable, may not always match the mechanical performance of synthetic variants. Quality consistency and scalability remain concerns in large-volume production. These technical limitations can restrict the film’s use in demanding or emerging sectors, limiting overall market growth potential.

Market Opportunities

Rising Demand for Sustainable and High-Performance Materials Creates New Avenues

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market holds strong potential in sectors seeking sustainable and high-performance alternatives to conventional plastics. Industries such as sportswear, automotive, and medical devices are moving toward materials that combine durability with environmental responsibility. It opens opportunities for manufacturers offering bio-based TPU films with reduced carbon footprints. Companies can leverage growing regulatory support for green materials to introduce certified, eco-friendly products. Consumer demand for recyclable and biodegradable materials supports innovation in new film formulations. This trend provides a clear path for businesses to capture market share through sustainable differentiation.

Emergence of Advanced Applications in Electronics and Healthcare Expands Market Scope

Rapid development in wearable technology, flexible displays, and soft robotics boosts the need for stretchable and transparent TPU films. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market can capitalize on this shift by supplying specialized films tailored to advanced electronic and biomedical applications. It supports innovation in skin-friendly adhesives, implantable devices, and responsive materials that adapt to body movement. Research partnerships and cross-industry collaboration create favorable conditions for the development of next-generation TPU solutions. Growth in minimally invasive procedures and digital health products also increases demand for medical-grade TPU films. These expanding applications offer scalable growth prospects across both established and emerging economies.

Market Segmentation Analysis:

By Type

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market is categorized into polyether, polyester, and polycaprolactone types. Polyether-based TPU films dominate segments requiring moisture resistance, such as medical and textile applications, due to their elasticity and resistance to microbial growth. Polyester-based TPU films offer superior tensile strength and abrasion resistance, making them ideal for industrial and automotive uses. Polycaprolactone-based TPU films are increasingly adopted in medical and biodegradable packaging applications, supported by their excellent compatibility and controlled degradation properties. Each type delivers distinct advantages, allowing manufacturers to meet varied industry requirements through targeted formulations.

- For instance, Epurex Films, a subsidiary of Covestro, manufactured approximately 2,300 metric tons of Platilon® polyether-based TPU films in 2023, primarily for moisture-sensitive applications

By Application

The market serves diverse applications including automotive, railway, leisure, energy, and building industries. In the automotive sector, it is widely used in protective coatings, interior trims, and surface protection films due to its mechanical durability and flexibility. Railway applications benefit from TPU films in insulation, sealing, and underbody protection, where material resilience under high stress and fluctuating temperatures is essential. The leisure industry relies on TPU films for lightweight and durable items such as sports gear, backpacks, and inflatables. In the energy sector, TPU films provide insulating and weather-resistant layers for cables, batteries, and solar equipment. The building segment employs TPU films for roofing membranes, waterproof barriers, and structural reinforcement layers, benefiting from the material’s chemical resistance and longevity. Each application reflects the market’s strength in delivering performance-driven solutions across critical end-use sectors.

- For instance, Covestro’s new TPU plant in Zhuhai, China, is designed to reach a production capacity of 120 000 metric tons of TPU per year

Segments:

Based on Type:

- Polyether

- Polyester

- Polycaprolactone

Based on Application:

- Automotive

- Railway

- Leisure

- Energy

- Building

- Construction

- Furniture

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America captures roughly 30% of the Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market. The United States dominates regional demand, driven by healthcare, automotive, and sustainable packaging requirements. Firms in this region lead adoption of bio-based TPU grades and low-emission materials. Researchers and industry developers optimize film formulations for biocompatibility and recyclability. Suppliers leverage advanced manufacturing infrastructure and strong regulatory frameworks to deliver high-quality TPU films quickly. They respond to demand for medical device films, vehicle protective layers, and specialized packaging with consistent innovation. North America’s strength stems from its mature industry structure, strong R&D base, and growing emphasis on sustainability.

Asia‑Pacific

Asia‑Pacific leads the global Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market with approximately 40% share. China accounts for the bulk of regional consumption and production, followed by Japan, South Korea, and India. Manufacturers in the region scale rapidly to meet demand across automotive, electronics, footwear, and textile coating applications. They invest in cost-efficient production and local R&D centers to support fast product development cycles. Firms cater to emerging segments such as wearable tech, medical disposables, and eco-friendly packaging. Regional growth reflects dynamic market demand, cost advantage, and strong industrial ecosystems.

Europe

Europe holds about 20% of the Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market. Germany, France, the UK, and Italy lead consumption. This region focuses on regulatory compliance, circular economy models, and renewable material adoption. Companies invest in bio-based TPU films and certification for recycling and low carbon footprints. They deploy films in sectors such as sustainable construction, railway insulation, healthcare packaging, and high-end automotive. Firms build partnerships between material researchers and application engineers to deliver compliant, high-performance TPU solutions that address both performance and environmental requirements.

Latin America

Latin America represents approximately 5% of the Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market. Brazil and Mexico contribute the highest shares. Demand originates from automotive components, footwear, flexible packaging, and building material applications. Regional manufacturers offer mid-range TPU films that balance cost and performance. Growth stems from rising infrastructure projects, industrial consolidation, and growing middle-class consumption. Suppliers forge alliances with global producers and improve logistics to support regional availability and affordability.

Middle East & Africa

Middle East & Africa contribute roughly 5% to the Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market. Key markets include Saudi Arabia, the UAE, and South Africa, where demand stems from construction, energy infrastructure, automotive, and healthcare sectors. Firms offer UV- and temperature-resistant TPU films tailored for harsh climates and long-term performance. Regional players partner with local distributors and invest in technical service centers to meet project-based demand. Market growth relies on expanding renewable energy installations, infrastructure development, and emerging industrial diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market include BASF SE, Covestro AG, The Lubrizol Corporation, Huntsman International LLC, 3M Company, Avery Dennison, MH&W International Corporation, American Polyfilm Inc., PAR Group, and Permali Gloucester Limited. The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market remains highly competitive, characterized by rapid innovation, material advancements, and a strong focus on sustainable product development. Companies compete on product performance, durability, and adaptability across industries such as automotive, construction, healthcare, and consumer goods. The market sees increasing demand for bio-based TPU films, prompting firms to invest in R&D and expand production capacity. Strategic partnerships, regional expansions, and technology upgrades drive differentiation. Suppliers emphasize precision-engineered films with enhanced UV resistance, elasticity, and chemical stability to meet varied industrial requirements. Competitive pressure continues to rise as players aim to balance cost-efficiency with high-performance attributes and environmental compliance.

Recent Developments

- In January 2024, BASF unveiled its new thermoplastic polyurethane (TPU) plant at the Zhanjiang Verbund site. The new plant is the largest single TPU production line for BASF globally.

- In October 2023, Covestro’s TPU films were introduced in its Platilon range with increasing the production capabilities in Bomlitz, Lower Saxony, Germany and the infrastructure and logistics in the same region, amounting to a low double-digit million euros.

- In May 2023, Covestro unveiled a new production line for high-performance thermoplastic polyurethanes (TPUs) used for paint protection films (PPF) . The new line is at the company’s existing site in Changhua, Taiwan. The series offers high durability, adaptability, and aesthetics, protecting automotive surface coatings from harsh environmental conditions.

- In February 2023, Covestro AG announced that it is going to build its largest thermoplastic polyurethane manufacturing plant in Zhuhai, South China. The company has planned to complete the expansion in three phases, one to be completed in late 2025. After final completion, the plant is to have a total manufacturing capacity of 20,000 tons of TPU per year

Market Concentration & Characteristics

The Synthetic and Bio Thermoplastic Polyurethane (TPU) Films Market exhibits moderate to high market concentration, with a mix of global conglomerates and specialized regional players dominating supply. It is characterized by steady technological advancements, sustainability-driven innovation, and a strong emphasis on product customization. The market responds directly to evolving demand across automotive, construction, medical, and consumer electronics sectors. High-performance expectations related to durability, elasticity, and environmental compliance define competitive dynamics. Key suppliers leverage integrated production, proprietary formulations, and global distribution to maintain leadership. It presents moderate entry barriers due to capital-intensive manufacturing, stringent quality standards, and regulatory compliance requirements. Buyers prioritize consistent film quality, technical support, and on-time delivery, placing pressure on suppliers to maintain operational excellence. Bio-based TPU films are gaining traction, prompting firms to invest in R&D and capacity expansion. Regional growth patterns influence market behavior, with Asia-Pacific acting as a manufacturing hub and North America and Europe driving premium product adoption. The market remains sensitive to raw material price volatility and regulatory shifts, requiring agility and strategic planning from producers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased demand for bio-based TPU films driven by sustainability goals and regulatory pressure.

- Manufacturers will expand production capacities to meet growing needs in automotive, healthcare, and consumer electronics sectors.

- Advancements in biodegradable TPU technology will open new opportunities in medical and packaging applications.

- Asia-Pacific will continue to lead global production due to cost advantages and expanding industrial base.

- North America and Europe will focus on premium-grade TPU films with enhanced durability and compliance with environmental standards.

- TPU films will gain more traction in wearable electronics and flexible device components.

- Market players will invest more in R&D to develop lightweight, high-performance, and chemically resistant TPU variants.

- Strategic partnerships and mergers will increase as companies aim to strengthen distribution and technology capabilities.

- Demand for recyclable and transparent TPU films will grow across construction and consumer goods applications.

- Raw material sourcing and price volatility will remain a key concern influencing long-term production planning.