Market Overview

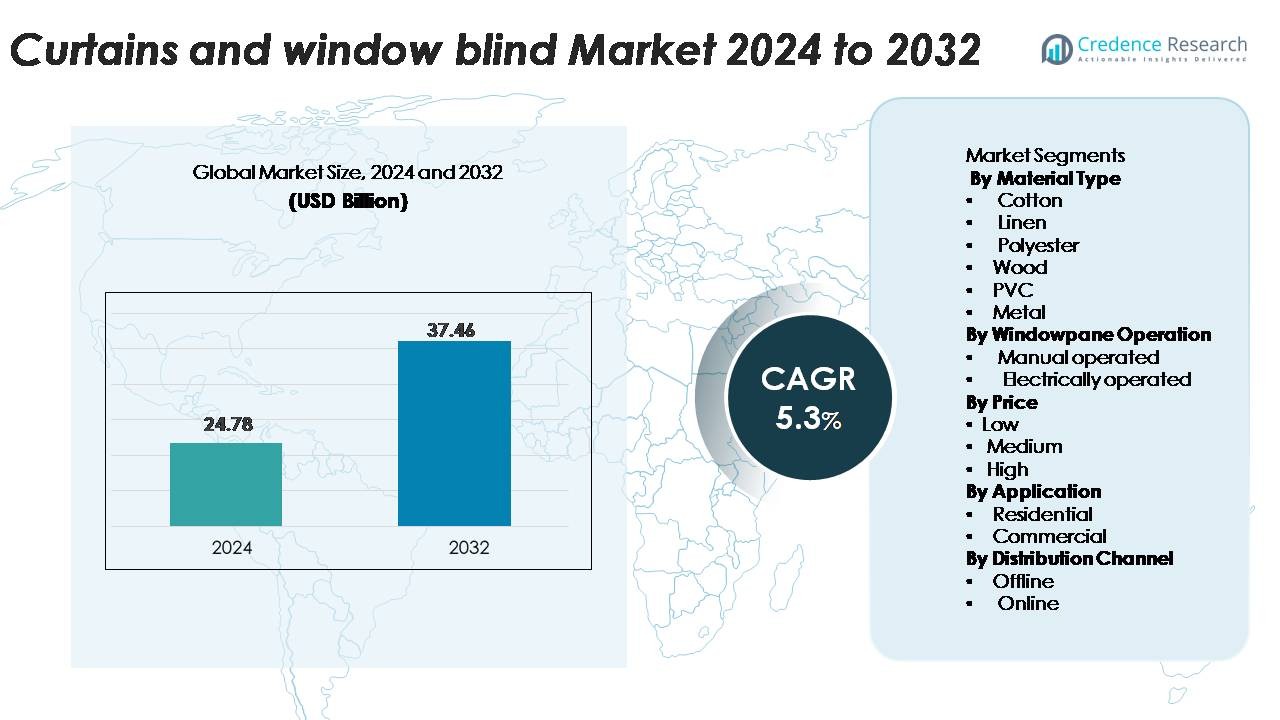

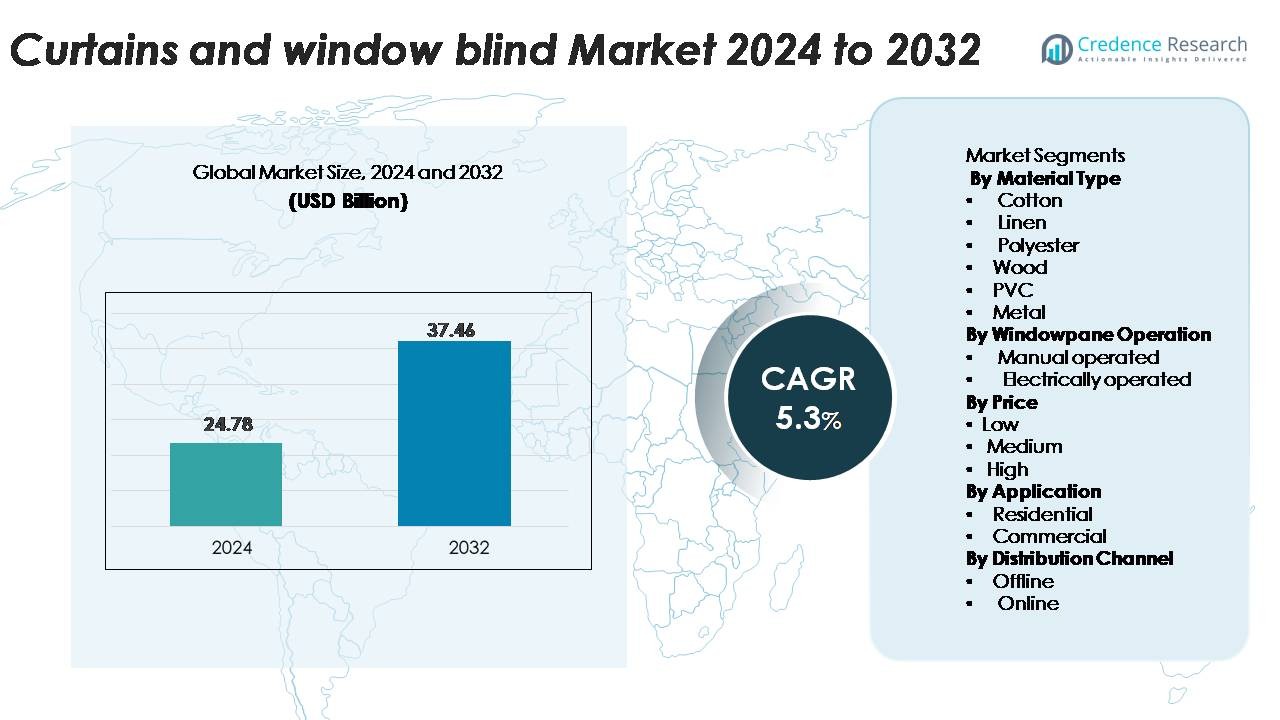

Curtains and Window Blinds Market size was valued at USD 24.78 Billion in 2024 and is projected to reach USD 37.46 Billion by 2032, growing at a CAGR of 5.3% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Curtains and Window Blinds Market Size 2024 |

USD 24.78 Billion |

| Curtains and Window Blinds Market, CAGR |

5.3% |

| Curtains and Window Blinds Market Size 2032 |

USD 37.46 Billion |

The curtains and window‑blind industry features major players like Hunter Douglas N.V., Comfortex Window Fashions, Budget Blinds, IKEA Group, Advanced Window Blinds, Aspect Blinds, Aluvert Blinds, Graber, Hillarys Blinds Limited and 3 Day Blinds. Hunter Douglas in particular holds a strong position—reportedly accounting for about 33% of the U.S. blind and shade manufacturing revenue. Regionally, North America leads with an estimated 25.5% share of the global curtains and window‑blinds market in 2024, driven by high‑end home décor demand and widespread automation uptake. This leadership underscores the importance of product innovation, smart‑home integration, and premium branding in capturing market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market size is projected to grow from USD 24.78 billion in 2024 to USD 37.46 billion by 2032, at a CAGR of 5.3%.

- Demand is driven by rapid urban housing growth, refurbishments in commercial spaces, and increasing interest in energy‑efficient window treatments.

- A key trend includes smart motorised blinds adopting IoT and automation, while online sales channels expand reach and customization options.

- Competitive analysis shows leading brands like Hunter Douglas and IKEA maintain strong presence, supported by regional leaders; North America holds ~25.5 % share in 2024 and Europe around 28.5 %.

- Market restraints include high upfront cost of premium motorised systems and intense competition from low‑cost DIY and alternative window coverings, which limit faster growth in emerging regions.

Market Segmentation Analysis:

By Material Type

Polyester leads the market due to durability, wide color availability, and affordable pricing. The material offers wrinkle resistance and easy maintenance, which increases adoption in both residential and commercial spaces. Growth also comes from high demand for blackout and thermal-insulated polyester blinds that improve energy efficiency in homes and offices. Cotton and linen remain popular in premium décor, while wood and metal blinds cater to luxury interiors and modern minimalist designs. PVC holds a strong share in moisture-prone areas such as kitchens and bathrooms due to water resistance and long service life.

- For instance, a 100% polyester blackout fabric (300 GSM) designed by a major supplier spans widths of up to 300 cm while carrying a waterproof finish.

By Windowpane Operation

Manual operated blinds dominate the market with the largest share, driven by low cost, easy installation, and suitability for small and mid-sized households. These products require no additional electrical components and are available across a wide variety of materials and price ranges, making them accessible for mass consumers. Electrically operated blinds grow steadily due to rising adoption of smart homes, remote control systems, and automation in commercial buildings. Motorized mechanisms also support child-safety and user convenience, boosting demand in premium real estate and modern office interiors.

- For instance, Somfy Sonesse 28 motors (specific models) can run as quietly as 44-45 dB with an adjustable speed range of 10-28 rpm; Hunter Douglas PowerView charges typically last about one year and use Bluetooth Low Energy (BLE) for two-way control (Gen 3 systems); Lutron’s Battery Boost supports shades wider than 37.5 inches (953 mm).

By Price

Medium-priced products generate the highest market share as consumers prefer quality fabrics, durable mechanisms, and aesthetic appeal without premium costs. This segment is supported by large retail chains and home improvement stores offering wide product portfolios. Low-priced curtains and blinds attract budget-focused households and rental properties, but they offer limited customization and shorter replacement cycles. High-priced options include luxury fabrics, custom-built wooden blinds, motorized systems, and designer finishes. Growth in interior décor spending continues to expand demand for all three price levels, with the medium range remaining the volume leader across many regions.

Key Growth Drivers

Rising Residential and Commercial Construction

The growth of urban housing projects and commercial infrastructure directly drives demand for curtains and window blinds. Expanding residential complexes, luxury apartments, and office spaces require both functional and decorative window treatments. Developers increasingly integrate energy-efficient and aesthetically pleasing blinds to enhance property value. For instance, demand for blackout and thermal-insulated blinds has risen in modern apartments for energy savings. Additionally, renovation projects in older buildings boost replacement sales. The combination of new construction and refurbishment projects ensures consistent market expansion, supporting both volume and value growth across material types and operation mechanisms.

- For instance, IKEA FYRTUR smart blackout blinds use rechargeable batteries that last 4–6 months with daily up-and-down use.

Increasing Adoption of Smart and Electrically Operated Blinds

Rising interest in smart homes and automation fuels growth in electrically operated and motorized window coverings. Consumers and commercial property owners prefer remote-controlled or app-integrated systems for convenience, energy management, and safety. Electrically operated blinds also support child-safe designs, automated light control, and integration with smart lighting and HVAC systems. Manufacturers are innovating with silent motors, durable mechanisms, and IoT-enabled devices, further driving adoption. Businesses in hospitality, offices, and luxury residential sectors increasingly install automated systems to enhance user experience, creating strong recurring opportunities for advanced blinds and window coverings.

- For instance, PowerView systems from Hunter Douglas use rechargeable Li-ion battery packs with a nominal capacity of 2400 mAh. These batteries are rated to support approximately 500 charge cycles while maintaining over 70% of their original capacity, which in typical use (operating an average-sized shade twice daily) translates to about one year of operation per charge.

Growing Focus on Aesthetic and Energy-Efficient Solutions

Consumers are investing in window treatments that combine décor appeal with energy efficiency. Thermal-insulated blinds, blackout curtains, and UV-blocking materials reduce heating and cooling costs while enhancing interior design. The popularity of eco-friendly materials like polyester blends, bamboo, and sustainably sourced wood supports this growth. Commercial establishments also adopt energy-efficient blinds to lower operational costs and comply with green building standards. Increasing awareness of environmental sustainability, along with rising disposable incomes, encourages homeowners to select premium materials and functional designs. As a result, the market experiences growth driven by dual objectives of comfort and aesthetics.

Key Trends & Opportunities

Integration with Interior Design and Décor

Consumers increasingly view curtains and blinds as integral components of interior design rather than functional necessities. Trend-driven patterns, textures, and colors are in high demand to match furniture, wall finishes, and flooring. Luxury and boutique homes prefer custom designs, while commercial offices opt for modern, minimalistic solutions. This trend creates opportunities for manufacturers to offer modular, customizable, and designer-ready options. Furthermore, collaborations with interior designers and home décor platforms help brands reach niche markets. Digital visualization tools and AR applications allow consumers to preview blinds in their spaces, enhancing purchase confidence and encouraging higher-value sales.

- For instance, Hunter Douglas’ “Aria Soft Blinds” line offers 14 distinct fabric‑and‑colour options, enabling installers to match décor palettes precisely.

Expansion of Online Sales Channels

E-commerce adoption presents significant opportunities for market players to reach wider audiences. Online platforms offer convenience, detailed product information, and customization options, which attract tech-savvy and busy consumers. Companies can leverage digital marketing, virtual showrooms, and customer reviews to influence purchase decisions. Subscription-based and rental models for blinds and curtains are emerging, especially for temporary commercial spaces or rental apartments. The ability to compare materials, prices, and features online reduces barriers for mid-market consumers. Online channels also allow manufacturers to introduce limited-edition designs and direct-to-consumer models, boosting profitability and market penetration in previously underrepresented regions.

- For instance,”FYRTUR by IKEA enables home delivery of battery-powered smart blinds in dozens of countries where IKEA operates, simplifying local logistics and deployment within those specific markets.”

Emerging Demand for Eco-Friendly and Sustainable Materials

Sustainability is becoming a key factor influencing consumer choice. Biodegradable fabrics, recycled polyester, and responsibly sourced wood are gaining traction. Energy-efficient blinds and thermal-insulated curtains reduce carbon footprints and operational costs, appealing to environmentally conscious homeowners and businesses. Governments and green building certifications further encourage adoption of sustainable materials in commercial projects. This trend provides opportunities for manufacturers to differentiate products through eco-friendly features, innovative design, and certifications. Companies investing in R&D for sustainable and durable solutions can capture market share while aligning with global environmental goals.

Key Challenges

High Initial Cost of Electrically Operated and Premium Blinds

Electrically operated, motorized, and luxury window treatments require substantial upfront investment, limiting adoption among budget-conscious consumers. The cost of smart motors, durable mechanisms, and high-quality materials can exceed the budget of mid-market households. Maintenance and repair of electrically operated systems add additional financial considerations. This challenge slows market penetration for advanced solutions, particularly in emerging regions where affordability is a concern. Manufacturers need to balance pricing, durability, and technology to expand adoption without compromising profitability or consumer trust, while educating consumers on long-term energy and convenience benefits to justify higher costs.

Competition from Alternative Window Coverings and DIY Solutions

Consumers increasingly explore alternative solutions such as roller shades, blinds kits, and do-it-yourself installations that offer lower costs and flexible design. Ready-made curtains and off-the-shelf blinds compete with custom and premium options. Rapid trends in interior décor also shorten replacement cycles, increasing pressure on manufacturers to innovate continuously. The availability of low-cost imports and local manufacturers intensifies competitive pricing pressures. Companies must differentiate through quality, design, energy efficiency, and automation features to retain market share. Strong branding, after-sales service, and value-added offerings are essential to mitigate competitive threats and maintain long-term growth.

Regional Analysis

North America

The North American market accounted for approximately 25.5% of global value in 2024. Growth stems from high spending on smart‑home systems, renovation of aging housing stock, and strong commercial real‑estate construction. Consumers in the U.S. and Canada favour motorised and electrically operated blinds integrated with home automation platforms. Energy‑efficiency regulations and premium interior design trends drive demand for advanced window treatments. High disposable incomes and well‑developed distribution channels across the region also support market expansion.

Europe

Europe holds an estimated 28.5% share of the window coverings market in 2024. Demand is primarily fuelled by eco‑friendly material preferences, renovation of historic buildings, and sophisticated design aesthetics. Countries such as Germany, France, and the U.K. are adopting energy‑efficient blinds and compliance with building‑insulation standards. The region’s mature retail network and rising consumer awareness of sustainable furnishings boost sales of premium and specialty products in both residential and commercial segments.

Asia‑Pacific

The Asia‑Pacific region is emerging as a major growth engine, with projected largest share by the end of the forecast period. The region’s rapid urbanisation, rising disposable incomes, and booming construction activity in China, India, and Southeast Asia drive strong demand. Local manufacturing hubs and online distribution channels expand market access and affordability. Consumers increasingly invest in decorative and functional window treatments as part of home‑improvement and commercial real‑estate projects.

Middle East & Africa (MEA)

The Middle East & Africa region held around 8.6% share of the broader window‑coverings market in 2024. Growth in MEA is supported by luxury hospitality projects, high‑end residential developments, and increasing adaptation of automation in Gulf Cooperation Council countries. However, economic and political volatility, plus comparatively lower residential volumes in some countries, moderate the overall market size despite strong per‑unit values for premium systems.

Latin America

Latin America contributed roughly 6% of the market in 2024. The region’s growth is driven by urban housing expansion, commercial refurbishments, and increased consumer interest in home décor. Brazil and Argentina lead the charge, with demand for both cost‑effective and premium window treatment solutions. Challenges such as import duties, currency fluctuations, and uneven retail infrastructure temper growth pace compared to Asia‑Pacific or North America.

Market Segmentations:

By Material Type

- Cotton

- Linen

- Polyester

- Wood

- PVC

- Metal

By Windowpane Operation

- Manual operated

- Electrically operated

By Price

By Application

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global curtains and window blinds market features a mix of large multinational corporations and regional specialists. Leading players such as Hunter Douglas N.V. (Netherlands), Springs Window Fashions, LLC (USA), and Somfy Systems (France) maintain strong positions through acquisitions, product diversification, and smart‑home integration strategies. These companies combine traditional retail supply‑chains with e‑commerce and motorised product lines to address changing consumer preferences. At the same time, mid‑size and regional firms compete on customisation, local manufacturing, and cost advantage. Market growth opens opportunities but also intensifies pricing pressure. The moderate market concentration—where top players hold less than half of global share—suggests space for innovative entrants and niche brands to capture segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hunter Douglas

- Comfortex Window Fashions

- 3 Day Blinds

- Budget Blinds

- Graber

- IKEA

- Aluvert Blinds

- Hillarys

- Advanced Window Blinds

- Aspect Blinds

Recent Developments

- In June 2025, the company rolled out its Spring 2025 launch encompassing design‑driven upgrades to its PowerView® Automation system, including support for specialty arch and angle shapes and a dual‑function shading system.

- In May 2025, Budget Blinds released trend guidance focusing on customization, eco‑materials, and smart integration as key priorities for 2025 window treatments.

Report Coverage

The research report offers an in-depth analysis based on Material type, Windowpane operation, Price, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth will accelerate in smart‑home integrated window coverings.

- Manufacturers will expand sustainable and recycled material offerings.

- E‑commerce and direct‑to‑consumer models will dominate distribution.

- Customised and designer‑led window treatments will gain popularity.

- Electrically operated blinds will penetrate mid‑market segments.

- Thermal‑insulated and blackout solutions will increase due to energy‑efficiency demands.

- Asia‑Pacific markets will outpace mature regions in adoption rates.

- Augmented reality tools will enhance consumer purchase experience.

- Rental property and hospitality sectors will drive replacement demand.

- Regional players will focus on local manufacturing to reduce costs and lead times.