Market overview

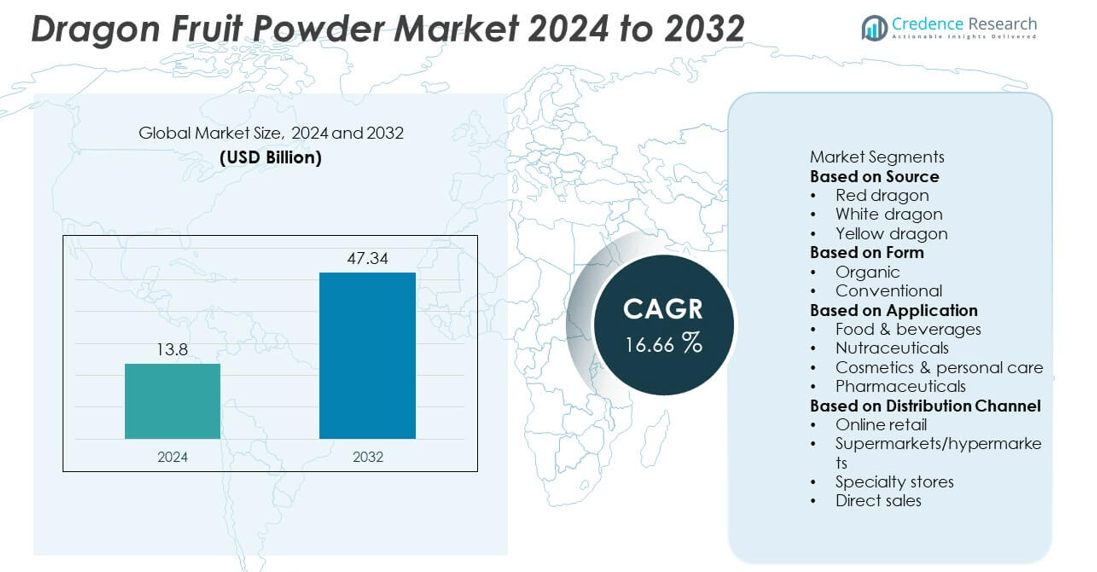

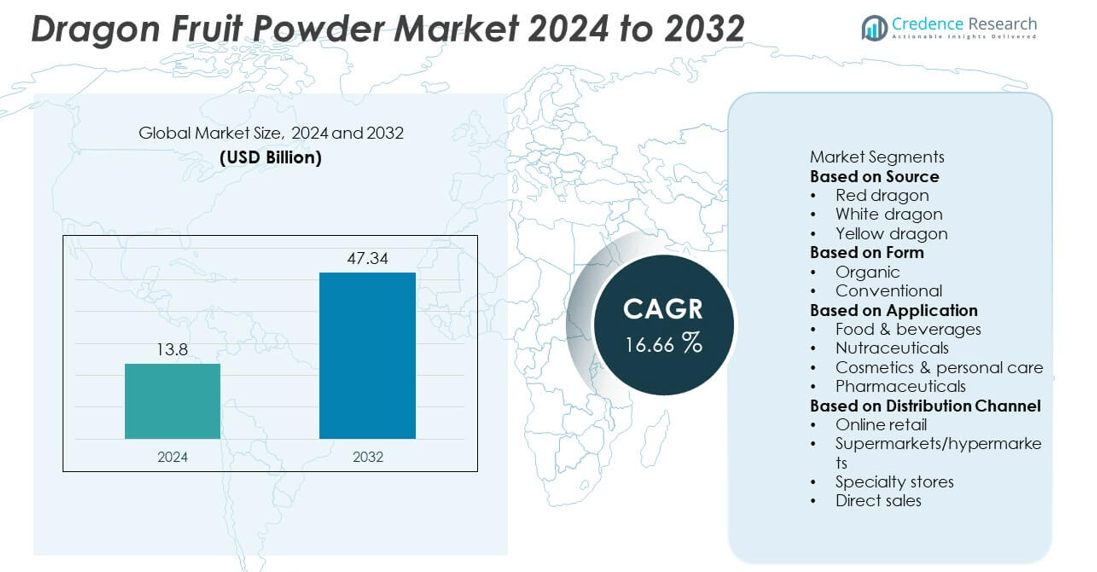

The Dragon Fruit Powder market was valued at USD 13.8 billion in 2024 and is projected to reach USD 47.34 billion by 2032, growing at a CAGR of 16.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dragon Fruit Powder Market Size 2024 |

USD 13.8 billion |

| Dragon Fruit Powder Market, CAGR |

16.66% |

| Dragon Fruit Powder Market Size 2032 |

USD 47.34 billion |

The dragon fruit powder market is led by key players such as Pitaya Plus, Sol Organica, Unicorn Superfoods, Wilderness Poets, Light Cellar, Hybrid Herbs, BR Ingredients, Rawnice, Superfruit Puree Co., and Nature Restore Inc. These companies dominate through organic sourcing, sustainable farming, and innovative powder formulations for food, nutraceutical, and cosmetic applications. North America leads the global market with a 36% share, driven by strong demand for natural and functional food ingredients. Europe follows with 29%, supported by clean-label trends and superfood adoption, while Asia-Pacific holds a 27% share, emerging as the fastest-growing region due to expanding production and export of dragon fruit-based ingredients.

Market Insights

- The dragon fruit powder market was valued at USD 13.8 billion in 2024 and is projected to reach USD 47.34 billion by 2032, growing at a CAGR of 16.66%.

- Rising consumer demand for natural, antioxidant-rich, and nutrient-dense ingredients is driving strong adoption across food, beverage, and nutraceutical sectors.

- The organic segment leads with a 58% share, supported by the growing preference for clean-label and chemical-free products.

- Key players such as Pitaya Plus, Sol Organica, and Unicorn Superfoods are focusing on sustainable sourcing, product innovation, and global expansion to enhance competitiveness.

- North America holds a 36% share, followed by Europe at 29% and Asia-Pacific at 27%, driven by expanding use in functional foods, health supplements, and personal care applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

The red dragon segment dominated the dragon fruit powder market in 2024 with a 54% share. Red dragon fruit contains high levels of antioxidants, vitamin C, and betalains, making it the preferred source for functional foods and beverages. Its vibrant color and nutritional value increase its use in smoothies, dairy alternatives, and natural food coloring. The rising consumer focus on plant-based antioxidants and superfoods drives this segment’s leadership. White dragon fruit follows, favored for its mild flavor and fiber content, particularly in dietary supplements and snack formulations.

- For instance, pink pitaya powder from various sources, including Vietnam, is processed through low-temperature freeze-drying to preserve its color and nutrients. The resulting product, derived from freeze-dried dragon fruit, retains the natural pigment betacyanin and offers antioxidant capacity for use as a natural food coloring.

By Form

The organic segment held the largest share of 57% in the dragon fruit powder market in 2024. Consumers’ growing inclination toward clean-label, chemical-free ingredients has increased the demand for organically cultivated dragon fruits. Organic powder is rich in phytonutrients and free from synthetic additives, making it popular in premium nutraceutical and cosmetic formulations. Expanding organic farming practices and higher disposable incomes are also supporting segment growth. The conventional segment remains important for mass-market applications, offering cost-effective solutions for food and beverage manufacturers.

- For instance, Sol Organica expanded its organic pitahaya processing unit in Nicaragua, sourcing fruit from a network of over 1,200 smallholder farmers. The facility uses solar dryers to produce solar-dried fruit and fruit powders, along with purees, juices, and Individually Quick Frozen (IQF) fruit.

By Application

The food and beverages segment accounted for a 48% share of the dragon fruit powder market in 2024, leading due to its wide use in smoothies, juices, bakery products, and functional foods. The powder’s natural color and nutritional value enhance its appeal as a clean-label ingredient in health-oriented products. Increasing consumer demand for antioxidant-rich and plant-based foods further drives segment growth. The nutraceutical segment is expanding rapidly as dragon fruit powder gains popularity in dietary supplements targeting immunity and digestion. Cosmetic and pharmaceutical applications also show steady growth with rising demand for natural bioactive ingredients.

Key Growth Drivers

Rising Demand for Nutrient-Rich Functional Foods

Growing consumer awareness about nutrition and wellness is driving demand for dragon fruit powder in functional foods. Rich in antioxidants, vitamins, and fiber, the product supports immunity and digestion, aligning with global health trends. Food manufacturers are incorporating it into energy drinks, smoothies, and supplements to cater to fitness-conscious consumers. The clean-label movement and preference for natural ingredients further strengthen its market growth, particularly among urban populations seeking plant-based and convenient health solutions.

- For instance, Pitaya Foods, formerly Pitaya Plus, has partnered with various U.S. beverage companies and retailers to supply its Organic Dragon Fruit Powder for use in plant-based beverages and smoothie bowls.

Expansion of the Nutraceutical and Dietary Supplement Industry

The nutraceutical industry’s expansion is a key driver for the dragon fruit powder market. Its bioactive compounds, such as polyphenols and flavonoids, support cardiovascular and metabolic health. Supplement producers are using it as a natural ingredient in capsules, powders, and gummies. Increasing consumer interest in preventive healthcare and immunity-boosting products post-pandemic has accelerated adoption. The rise of e-commerce platforms and direct-to-consumer nutraceutical brands has further enhanced accessibility and global demand for dragon fruit-based formulations.

- For instance, Nature Restore Inc. offers a Pink Pitaya Powder, which is a nutraceutical product rich in antioxidants, fiber, and vitamins. The powder is non-GMO, gluten-free, and vegan, and is independently tested for heavy metals to ensure safety and quality. It is marketed for its nutritional benefits and versatility in adding color and flavor to smoothies and other foods.

Growing Adoption in Cosmetic and Personal Care Products

Dragon fruit powder’s antioxidant and anti-aging properties are driving its use in cosmetics and skincare formulations. It helps protect skin from oxidative stress and enhances hydration, making it a popular ingredient in natural beauty products. Cosmetic companies are introducing dragon fruit-infused masks, scrubs, and serums to meet demand for plant-based formulations. The clean beauty trend, combined with rising awareness of botanical ingredients, continues to support the segment’s growth, especially in Asia-Pacific and European markets.

Key Trends & Opportunities

Shift Toward Organic and Sustainable Production

The growing preference for organic and sustainably sourced ingredients is reshaping the dragon fruit powder market. Consumers are increasingly choosing products cultivated without synthetic fertilizers or pesticides. Organic certification enhances brand value and supports long-term market differentiation. Farmers and manufacturers are investing in eco-friendly cultivation and freeze-drying methods to preserve nutrients and reduce carbon impact. This trend offers opportunities for new entrants focused on sustainable supply chains and premium organic product lines.

- For instance, the Brazilian-based company BR Ingredients supplies bulk dragon fruit powder to the global market, which is used in beverages and other food industries, while BRF Ingredients, a separate company, has implemented sustainability practices such as recycling animal-based waste and optimizing its circular economy within its supply chain, consistent with the UN’s Sustainable Development Goal 12.

Innovation in Processing and Product Diversification

Technological advancements in spray-drying and freeze-drying are improving the texture, color, and nutrient retention of dragon fruit powder. These innovations enable wider use in confectionery, bakery, and beverage applications. Manufacturers are launching flavored, fortified, and blended variants targeting specific dietary needs. Partnerships between food companies and ingredient suppliers are creating new formulations that combine functionality with appealing taste profiles. Product diversification into ready-to-drink mixes and snack powders presents significant opportunities for market expansion.

- For instance, Unicorn Superfoods offers a Freeze-Dried Pink Pitaya Powder, which is known to be rich in fiber, antioxidants, and vitamin C. The freeze-drying process helps preserve the fruit’s nutritional value and vibrant color.

Key Challenges

High Production and Processing Costs

Producing high-quality dragon fruit powder involves substantial costs in cultivation, drying, and preservation. The fruit’s perishable nature and the need for advanced freeze-drying technologies increase operational expenses. Price fluctuations in raw materials also affect profitability for small producers. Limited large-scale processing facilities in developing regions restrict cost efficiency. To overcome this, manufacturers are focusing on technology upgrades and regional sourcing strategies to balance product quality with competitive pricing.

Supply Chain and Seasonal Dependency

The supply of dragon fruit powder is highly dependent on seasonal fruit availability, leading to inconsistent production cycles. Poor weather conditions and limited cultivation areas can disrupt supply chains. Variability in fruit quality affects final product consistency, posing challenges for global buyers. Moreover, inadequate storage and logistics infrastructure in key producing regions add to transportation and quality control issues. Companies are investing in contract farming and cold-chain systems to ensure stable raw material availability and year-round production.

Regional Analysis

North America

North America held a 33% share of the dragon fruit powder market in 2024, driven by growing demand for natural superfood ingredients and functional beverages. The United States dominates regional consumption, supported by a strong health and wellness culture and high adoption of plant-based products. Food and nutraceutical manufacturers are increasingly incorporating dragon fruit powder into smoothies, snacks, and supplements. Expanding retail distribution and product launches in the organic segment further boost market presence. Rising awareness of antioxidant-rich foods and clean-label formulations continues to strengthen the region’s leadership in the global market.

Europe

Europe accounted for 27% of the dragon fruit powder market in 2024, supported by high consumer interest in sustainable and organic food products. The United Kingdom, Germany, and France lead consumption due to strong demand for functional foods and natural cosmetics. Manufacturers in the region are focusing on certified organic formulations and innovative packaging to appeal to eco-conscious consumers. The growing popularity of vegan diets and plant-based supplements further enhances demand. Additionally, the region’s robust import network and advanced processing technology contribute to steady supply and expansion across multiple end-use industries.

Asia-Pacific

Asia-Pacific captured a 29% share of the dragon fruit powder market in 2024 and emerged as the fastest-growing region. Countries such as Vietnam, Thailand, and China are major producers and exporters due to favorable climatic conditions and expanding cultivation areas. Rising demand for health-oriented food products and traditional herbal formulations supports market growth. Increasing use of dragon fruit powder in local beverages, bakery items, and supplements drives consumption. Moreover, government support for agricultural modernization and international trade partnerships is enhancing regional supply capabilities, solidifying Asia-Pacific’s position as both a key producer and consumer.

Latin America

Latin America held a 6% share of the dragon fruit powder market in 2024, driven by expanding fruit cultivation and growing exports to North America and Europe. Countries such as Ecuador, Colombia, and Peru are increasing production capacity to meet global demand. The region benefits from its ideal climate and rising investment in food processing infrastructure. Domestic consumption is also increasing with the popularity of health-focused products and superfruit beverages. However, supply chain inefficiencies and limited processing technologies constrain large-scale development. Ongoing investment in agricultural sustainability and export partnerships is expected to improve competitiveness.

Middle East & Africa

The Middle East & Africa accounted for a 5% share of the dragon fruit powder market in 2024. Rising health awareness, urbanization, and growing disposable incomes are fueling demand for natural and exotic fruit-based products. The United Arab Emirates and Saudi Arabia lead market adoption, supported by the growing retail presence of organic and functional food brands. Africa shows potential for future expansion as local processing facilities and agricultural projects develop. Despite limited production, increased imports and product diversification across nutraceuticals and beverages are enhancing market penetration across the region.

Market Segmentations:

By Source

- Red dragon

- White dragon

- Yellow dragon

By Form

By Application

- Food & beverages

- Nutraceuticals

- Cosmetics & personal care

- Pharmaceuticals

By Distribution Channel

- Online retail

- Supermarkets/hypermarkets

- Specialty stores

- Direct sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The dragon fruit powder market is highly competitive, with key players including Sol Organica, Pitaya Plus, Wilderness Poets, Unicorn Superfoods, Light Cellar, Hybrid Herbs, BR Ingredients, Rawnice, Superfruit Puree Co., and Nature Restore Inc. These companies compete through product quality, organic sourcing, and global distribution networks. Market leaders focus on expanding their portfolios with clean-label, non-GMO, and sustainably sourced products to meet rising consumer demand for natural ingredients. Strategic partnerships with food and beverage manufacturers help broaden their market reach. Firms are also investing in advanced drying technologies, such as freeze-drying and spray-drying, to enhance nutritional retention and shelf life. Product differentiation through packaging innovation and flavor variety further strengthens brand presence. Additionally, the growing popularity of plant-based and superfood-based formulations encourages continuous innovation, positioning leading players to capitalize on emerging health and wellness trends across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sol Organica

- Pitaya Plus

- Wilderness Poets

- Unicorn Superfoods

- Light Cellar

- Hybrid Herbs

- BR Ingredients

- Rawnice

- Superfruit Puree Co.

- Nature Restore Inc.

Recent Developments

- In October 2024, Light Cellar partnered with a Vietnamese cooperative to source pink-fleshed dragon fruit, processing 12 metric tons annually into freeze-dried powder certified as organic and non-GMO.

- In September 2024, Hybrid Herbs expanded its European distribution of 70 g dragon fruit powder packs, increasing production output by 45,000 units per quarter. Each batch underwent purity testing for heavy metals below 0.1 ppm, ensuring compliance with EU safety standards.

- In August 2024, IIHR (Indian Institute of Horticultural Research) introduced a new freeze-drying technology for dragon fruit powder that reduced processing costs by over 50% while preserving pigment stability and antioxidant content for commercial-scale applications.

- In February 2024, New Acai Amazonas launched an Organic Freeze-Dried Dragon Fruit Powder produced from sustainably farmed pitaya and processed in FSSC 22000-certified facilities, ensuring full traceability and food safety compliance

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and plant-based powders will continue to increase across global markets.

- The use of dragon fruit powder in smoothies, snacks, and bakery items will expand rapidly.

- Growing consumer focus on functional and antioxidant-rich foods will boost product adoption.

- The nutraceutical industry will witness strong growth with rising use in dietary supplements.

- Innovation in freeze-drying and spray-drying technologies will enhance product quality and shelf life.

- Organic and sustainable sourcing practices will gain importance among leading producers.

- Asia-Pacific will emerge as a key production and export hub for dragon fruit powder.

- Collaborations between food manufacturers and health brands will drive new product development.

- E-commerce platforms will strengthen distribution networks and increase global product accessibility.

- Rising health awareness and clean-label trends will sustain long-term market growth worldwide.