Market Overview

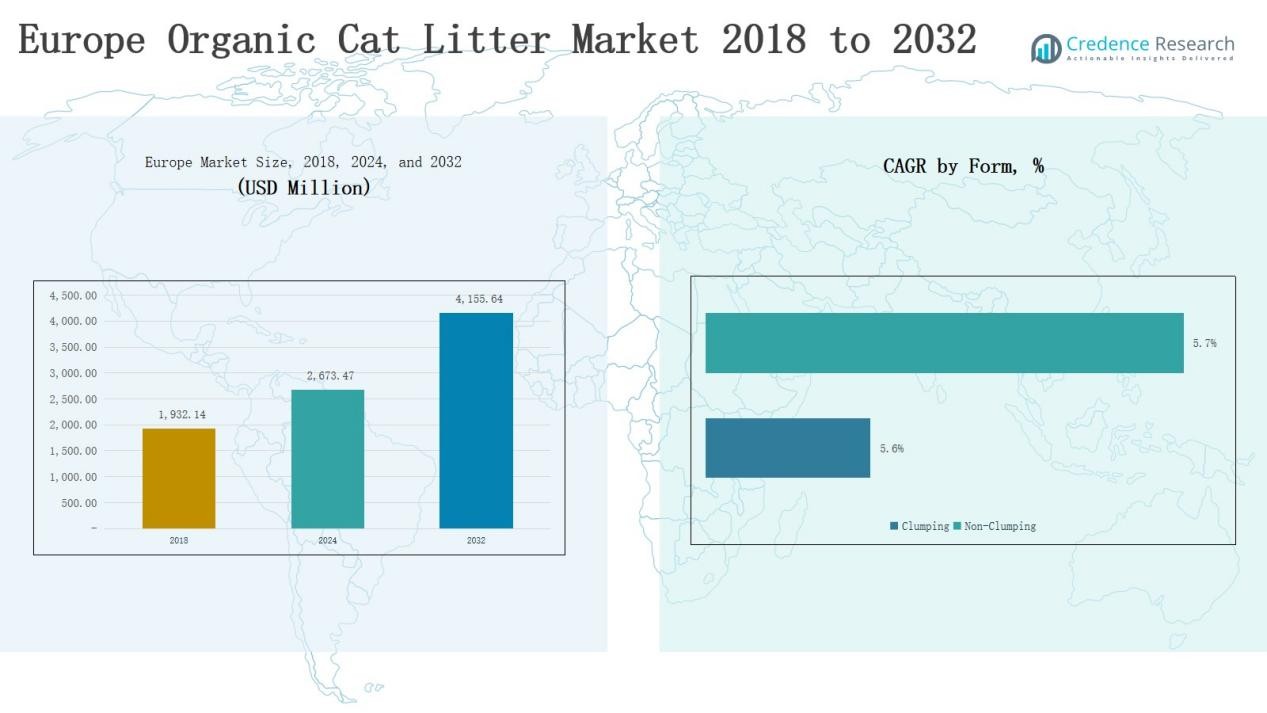

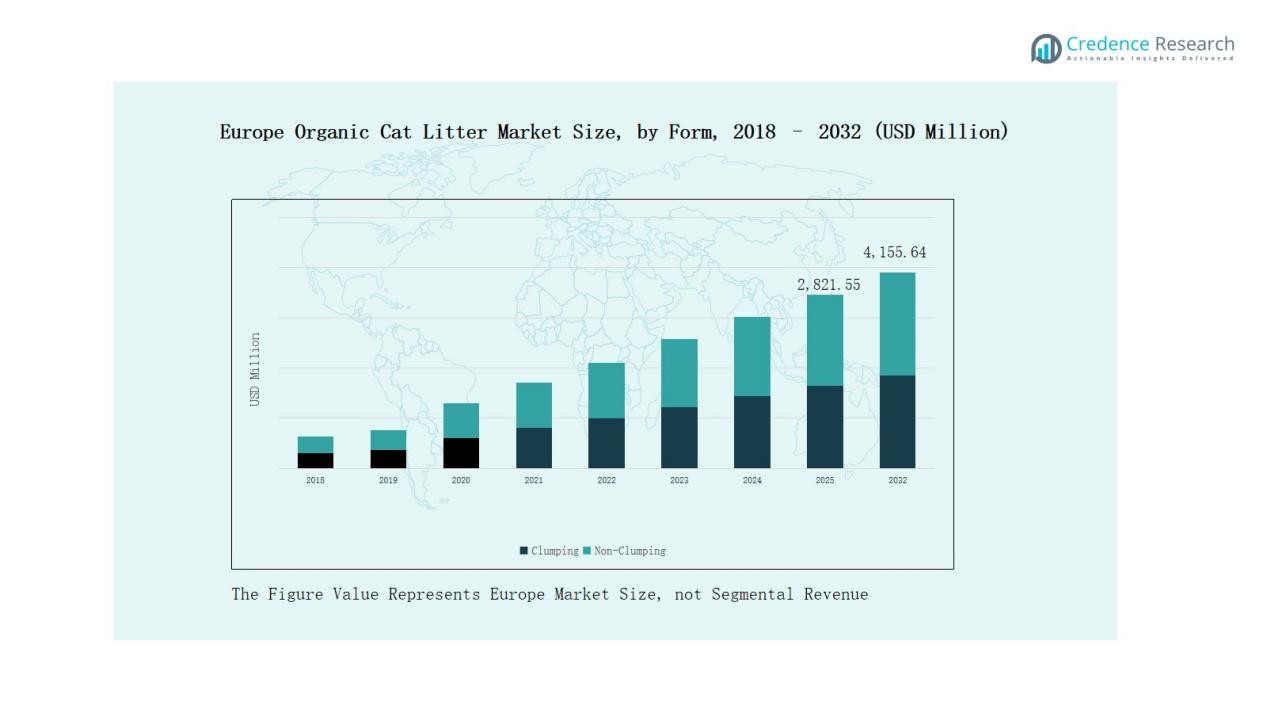

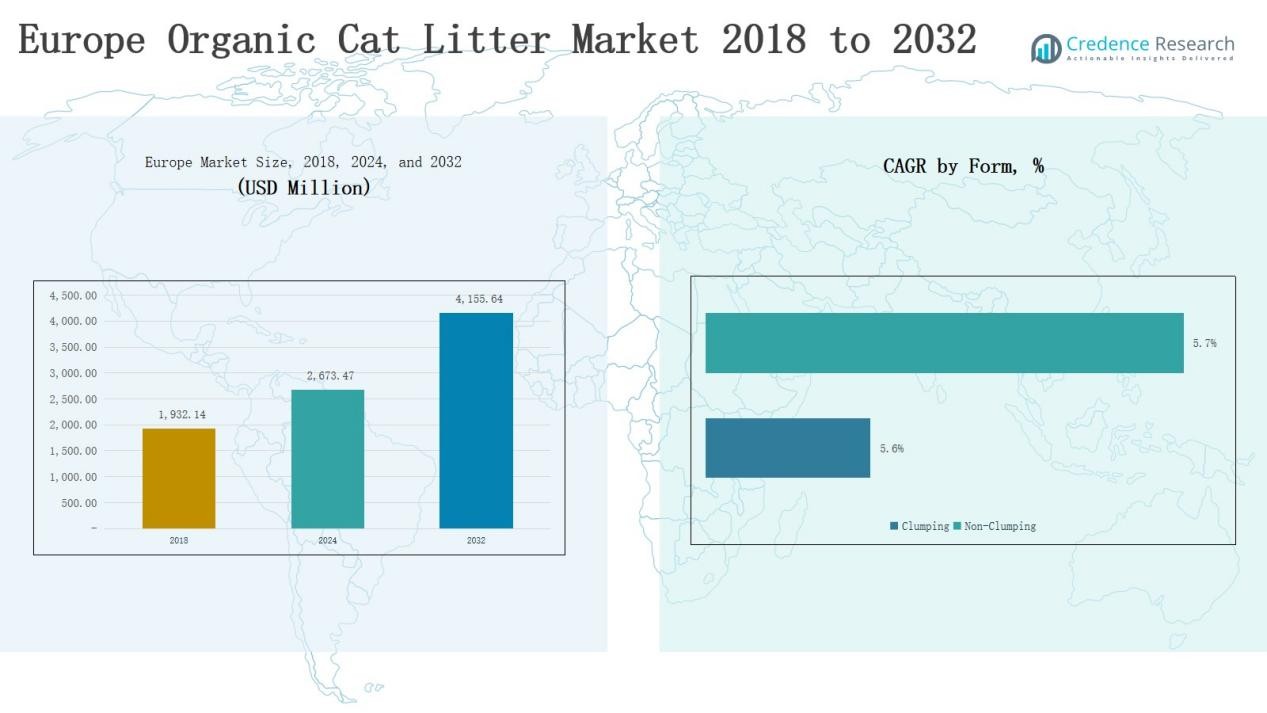

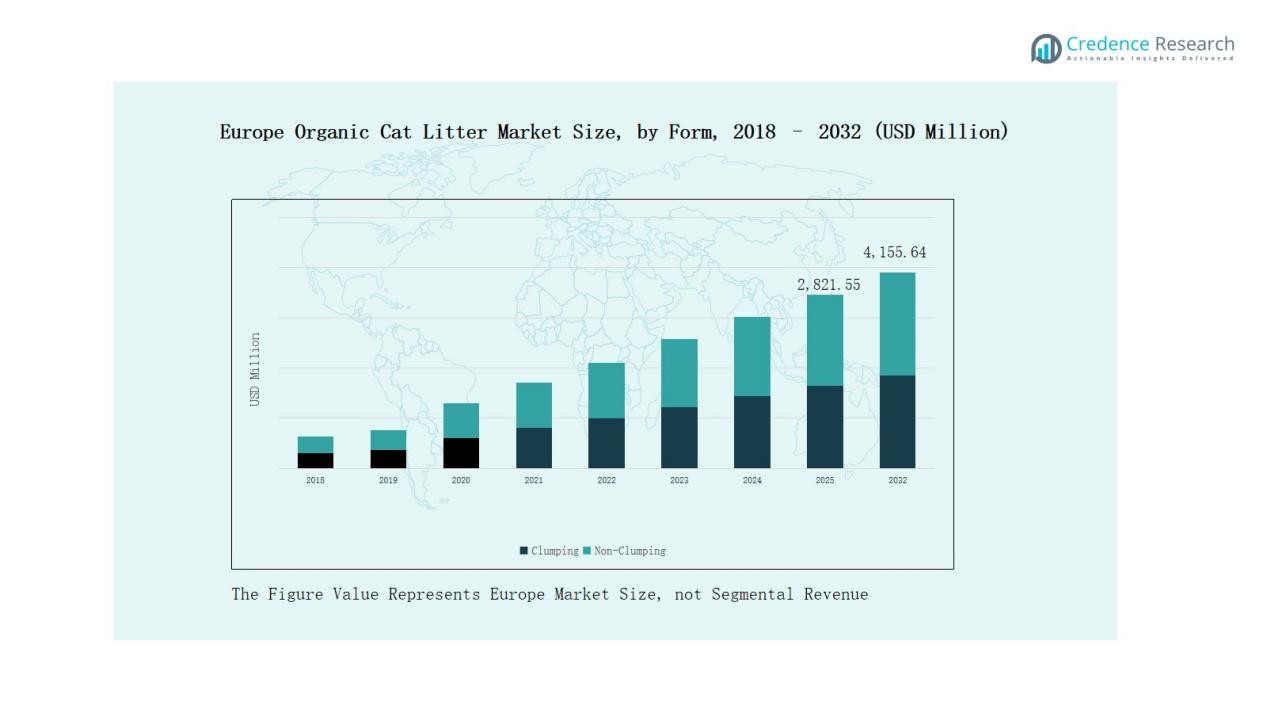

Europe Organic Cat Litter Market size was valued at USD 1,932.14 million in 2018, increased to USD 2,673.47 million in 2024, and is anticipated to reach USD 4,155.64 million by 2032, growing at a CAGR of 5.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Organic Cat Litter Market Size 2024 |

USD 2,673.47 Million |

| Europe Organic Cat Litter Market, CAGR |

5.63% |

| Europe Organic Cat Litter Market Size 2032 |

USD 4,155.64 Million |

The Europe Organic Cat Litter Market is led by prominent players such as Imerys, Minerals Technologies Inc., Healthy Pet, Labee Group, Cat Litter Company, pet-earth GmbH, and GREEN PET CARE. These companies maintain strong positions through eco-certified product portfolios, sustainable raw material sourcing, and strategic retail partnerships. Their focus on biodegradable, dust-free, and odor-control litter solutions aligns with Europe’s growing sustainability goals. Germany emerged as the leading regional market, capturing 22% of the total share in 2024, supported by high environmental awareness, advanced manufacturing capabilities, and widespread adoption of premium organic pet care products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Organic Cat Litter Market grew from USD 1,932.14 million in 2018 to USD 2,673.47 million in 2024 and is projected to reach USD 4,155.64 million by 2032, at a CAGR of 5.63%.

- Germany led the regional market with a 22% share in 2024, driven by strong environmental awareness, strict waste management policies, and advanced manufacturing capabilities.

- Wood-based litter dominated the material segment with a 32% share in 2024, supported by its biodegradability, odor control, and preference among eco-conscious consumers.

- The clumping form segment held a 61% share in 2024, favored for easy cleaning, odor management, and improved hygiene in multi-cat households.

- Residential end users accounted for 78% of market demand in 2024, boosted by rising pet ownership, online sales growth, and increasing adoption of sustainable pet care products across Europe.

Market Segment Insights

By Material:

Wood dominated the Europe Organic Cat Litter Market in 2024 with a 32% share. Its strong absorption, odor control, and biodegradable properties drive preference among eco-conscious consumers. Wood-based litter offers lightweight handling, low dust levels, and easy disposal, making it ideal for households focused on sustainability. The growing availability of recycled wood pellets and FSC-certified products further strengthens adoption, while rising awareness about natural pet hygiene supports the continued growth of wood-based organic litter products across Europe.

- For instance, the brand Cat’s Best launched an updated version of its Original Clumping Cat Litter made from 100% natural, FSC-certified wood fibers, featuring enhanced absorption and ease of disposal for sustainability-focused households.

By Form:

Clumping form led the market with a 61% share in 2024, driven by its convenience and superior odor management. Consumers prefer clumping litter for easy cleaning and reduced wastage, improving overall hygiene in multi-cat households. Organic clumping types made from corn, wheat, and coconut husk appeal to eco-conscious users seeking natural, flushable alternatives. The segment’s growth is reinforced by increased product innovation in dust-free, biodegradable clumping litters meeting European sustainability and pet safety standards.

- For instance, Germany-based Cat’s Best launched its “Cat’s Best GreenPower” clumping litter made from 100% organic plant fibers, touting biodegradability and low dust levels to support eco-friendly disposal and pet safety standards.

By End User:

Residential users accounted for 78% of the market share in 2024, reflecting strong demand from individual cat owners. The rise in pet adoption, urban living, and awareness of eco-friendly pet care drives preference for organic litter products. Households favor biodegradable, low-dust options that ensure odor control and environmental safety. Growing online sales of premium organic litter brands and marketing focused on pet wellness further strengthen residential dominance within Europe’s organic cat litter market.

Key Growth Drivers

Rising Pet Ownership and Humanization of Pets

The growing number of pet owners across Europe drives steady demand for organic cat litter. Consumers increasingly treat pets as family members, prioritizing hygiene and comfort. This shift encourages spending on eco-friendly and high-quality litter products. Urbanization and smaller living spaces also boost litter usage frequency. The preference for natural materials that minimize odor and dust aligns with sustainable lifestyle choices, making organic cat litter a preferred option among Europe’s environmentally aware pet-owning households.

- For instance, Catit (Hagen Group) introduced its Go Natural Wood Clumping Cat Litter across European markets, made entirely from recycled wood fibers to enhance biodegradability and reduce residue.

Increasing Environmental Awareness and Sustainability Focus

European consumers are becoming more conscious of environmental impact, pushing demand for biodegradable litter options. Rising concern over plastic waste and landfill accumulation accelerates the switch from conventional clay litter to plant-based materials such as wood, corn, and paper. Supportive government policies on green products and recycling further encourage eco-friendly purchases. Companies are investing in sustainable packaging and sourcing, aligning their products with Europe’s circular economy goals and reinforcing organic litter adoption across key regional markets.

- For instance, Zooplus expanded its private label portfolio with new plant-based and hypoallergenic litter products under the Tigerino brand, specifically curated for health-conscious and allergy-prone pet households in Europe.

Expansion of E-commerce and Retail Distribution Channels

The rapid growth of online retail and pet specialty stores enhances market accessibility and product visibility. Digital platforms enable consumers to explore eco-certified brands, compare features, and subscribe to regular deliveries. Leading players utilize e-commerce to launch new organic variants with targeted promotions. Partnerships between pet retailers and logistics providers support efficient distribution across urban and rural Europe. This expanding retail ecosystem strengthens market penetration and accelerates the availability of premium organic cat litter products.

Key Trends & Opportunities

Innovation in Biodegradable and Flushable Formulations

Manufacturers focus on developing improved biodegradable and flushable litter products to reduce waste. Innovations in clumping technology and odor control using natural enzymes enhance product performance. The introduction of dust-free, lightweight formulas caters to health-conscious consumers. Biodegradable blends using coconut, corn, and wheat offer both functionality and eco-safety. Such technological advancements present strong opportunities for brands targeting premium and sustainable segments in the European pet care industry.

- For instance, Tidy Cats launched a litter specifically designed for automated Litter-Robot systems, featuring enhanced clumping and motion-activated scent technology that improves hygiene and convenience.

Growing Popularity of Private Label and Premium Brands

Private label brands from major retailers are gaining traction due to affordability and sustainability claims. Meanwhile, premium brands emphasize organic certifications, hypoallergenic properties, and superior odor absorption. The rise of online-exclusive eco-friendly brands widens consumer choice. Increasing awareness of product ingredients and transparency drives loyalty toward trusted European manufacturers. This dual growth of premium and private label categories opens significant expansion opportunities for both established and emerging players.

- For instance, Carrefour expanded its “Simpl” private label range in France with eco-certified hygiene products made from FSC-certified materials.

Key Challenges

High Production Costs and Price Sensitivity

Organic materials such as wood, corn, and coconut are costlier to source and process than clay alternatives. These higher costs lead to elevated retail prices, restricting demand among price-sensitive consumers. Transport and packaging expenses for lightweight biodegradable materials further add to overall costs. Despite environmental benefits, affordability remains a barrier in Eastern and Southern Europe, where conventional litter retains dominance. Balancing sustainability with competitive pricing is a continuing challenge for manufacturers.

Limited Consumer Awareness in Emerging Regions

While Western Europe exhibits strong adoption, awareness of organic litter benefits remains low in several developing markets. Many pet owners still prioritize cost over sustainability, limiting the reach of eco-friendly options. Insufficient marketing, lack of local distributors, and weak retail visibility hinder adoption. Expanding educational campaigns and retail partnerships is essential to raise consumer understanding about the health and environmental advantages of organic cat litter products.

Performance Perception and Availability Issues

Some consumers perceive organic litter as less effective in odor control or clumping compared to traditional products. Limited shelf presence and inconsistent product availability across smaller retail outlets further challenge market penetration. Frequent stockouts or higher delivery costs in remote regions affect purchase continuity. Continuous product improvement, enhanced odor-neutralizing technologies, and wider retail distribution are critical to overcoming these perception and availability challenges in the Europe Organic Cat Litter Market.

Regional Analysis

Germany

Germany held the largest share of 22% in the Europe Organic Cat Litter Market in 2024. Strong environmental awareness and strict waste management policies drive consumer preference for biodegradable cat litter. Pet ownership is high, supported by a mature retail network offering premium eco-friendly products. German manufacturers invest in sustainable raw materials and recyclable packaging, reinforcing market leadership. The presence of well-established brands and innovation in clumping and odor-control formulations strengthen Germany’s role in the regional market. It remains the key production and export hub for organic litter products in Europe.

United Kingdom

The United Kingdom accounted for 18% of the regional share in 2024. The market benefits from high cat ownership rates and increasing demand for sustainable pet products. Growing online retail activity through platforms such as Zooplus and Pets at Home enhances accessibility for eco-conscious consumers. British brands emphasize cruelty-free and natural ingredient-based litter, aligning with local sustainability standards. Rising awareness about plastic waste reduction and recyclable packaging supports long-term adoption. It continues to attract investment in organic litter innovation and distribution expansion.

France

France captured 14% of the market share in 2024. Consumers prefer organic cat litter made from natural fibers such as wood, paper, and corn. Pet care awareness and green consumerism trends support steady growth. Local manufacturers collaborate with agricultural suppliers to develop low-impact biodegradable products. Expanding retail availability in supermarkets and pet specialty stores broadens the customer base. It benefits from increasing consumer willingness to pay for sustainable and odor-free solutions in urban areas.

Italy

Italy represented 11% of the regional market in 2024. Rising pet adoption and growing focus on home hygiene drive organic litter use. Italian consumers value natural ingredients and dust-free properties, encouraging the adoption of wood- and paper-based varieties. Domestic producers and private labels compete by offering cost-effective, eco-friendly options. Strong distribution through online and retail channels strengthens accessibility. It continues to grow steadily, supported by increasing consumer preference for sustainable household pet products.

Spain and Rest of Europe

Spain accounted for 9% of the market, while the Rest of Europe collectively held 26%. Growing urbanization and rising disposable income promote higher pet care spending across these markets. Awareness campaigns highlighting the environmental benefits of biodegradable litter boost sales. Northern and Eastern European countries are witnessing gradual adoption supported by improving retail networks. Local production expansion reduces dependency on imports, improving affordability. It reflects increasing harmonization in consumer preference toward sustainable pet care across the continent.

Market Segmentations:

By Material

- Wood

- Corn

- Wheat

- Paper

- Walnut

- Coconut

- Grass

By Form

By End User

By Sales Channel

By Country

- Germany

- United Kingdom (UK)

- France

- Italy

- Spain

- Netherlands

- Rest of Benelux

- Ukraine

- Czech Republic

- Poland

- Austria

- Portugal

- Nordic Countries

- Rest of Europe

Competitive Landscape

The Europe Organic Cat Litter Market features moderate competition, with leading players focusing on sustainability, product innovation, and regional expansion. Key companies such as Imerys, Minerals Technologies Inc., Healthy Pet, Cat Litter Company, and Labee Group dominate through strong distribution networks and eco-certified product lines. It is driven by rising consumer demand for biodegradable, dust-free, and odor-control litter products derived from wood, corn, and paper. Firms invest in advanced production technologies and recyclable packaging to meet Europe’s strict environmental standards. Private labels and regional manufacturers intensify price competition by offering affordable organic variants. Strategic partnerships, product diversification, and digital marketing campaigns enhance brand visibility across retail and e-commerce channels. Continuous innovation in clumping efficiency, fragrance-free options, and compostable packaging strengthens competitiveness, positioning the market as an evolving segment within Europe’s sustainable pet care industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Imerys

- KORODUR International GmbH

- Labee Group

- Minerals Technologies Inc.

- SILIKALZIT Marketing GmbH

- The Boden Group of Companies

- Healthy Pet

- Cat Litter Company

- pet-earth GmbH

- GREEN PET CARE

Recent Developments

- In April 2025, Pets Choice acquired Pettex Ltd’s cat litter and small animal business, integrating Pettex’s litter brands into its portfolio.

- In April 2024, pet-earth GmbH announced a new eco-friendly cat litter line, using biodegradable ingredients, along with a rebrand and new corporate identity.

- In October 2025, ökocat (Healthy Pet brand) launched ökocat Multi-Cat, a new formula with enhanced odor control, targeting households with multiple cats.

Report Coverage

The research report offers an in-depth analysis based on Material, Form, End User, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biodegradable and plant-based litter will continue to grow across Europe.

- Manufacturers will invest more in sustainable packaging and eco-friendly raw materials.

- E-commerce platforms will strengthen distribution and expand consumer reach.

- Innovation in odor control and clumping efficiency will enhance product performance.

- Private label brands will gain traction through affordability and regional availability.

- Premium organic litter products will attract health-conscious and urban consumers.

- Retailers will focus on expanding shelf space for certified eco-friendly pet products.

- Awareness campaigns will increase consumer education about sustainable pet care.

- Strategic mergers and partnerships will accelerate product development and market entry.

- Growing regulatory support for green products will reinforce the shift toward organic litter adoption.