Market overview

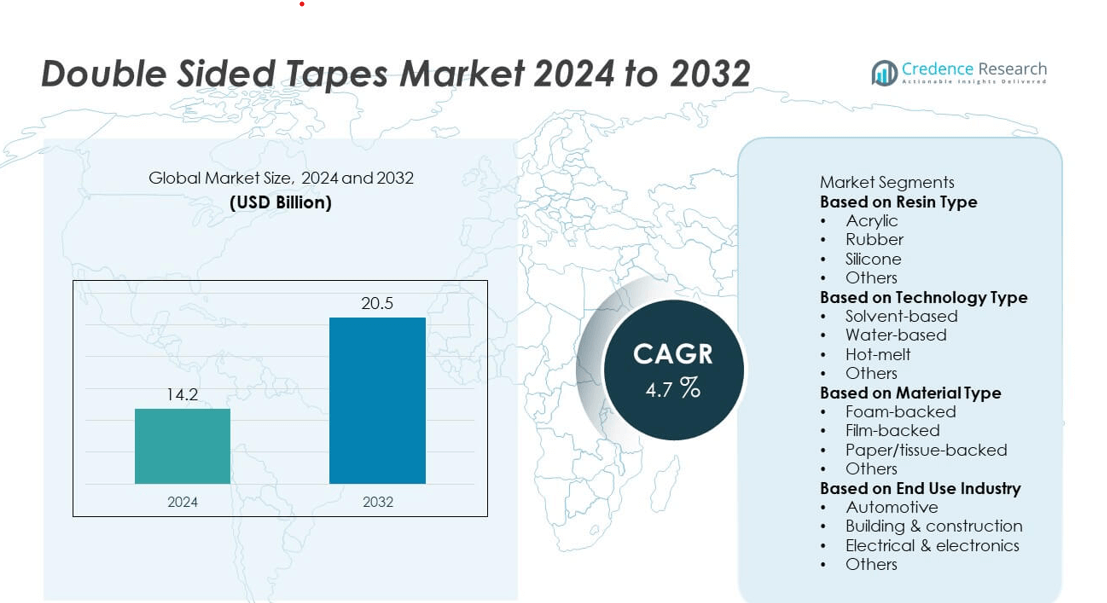

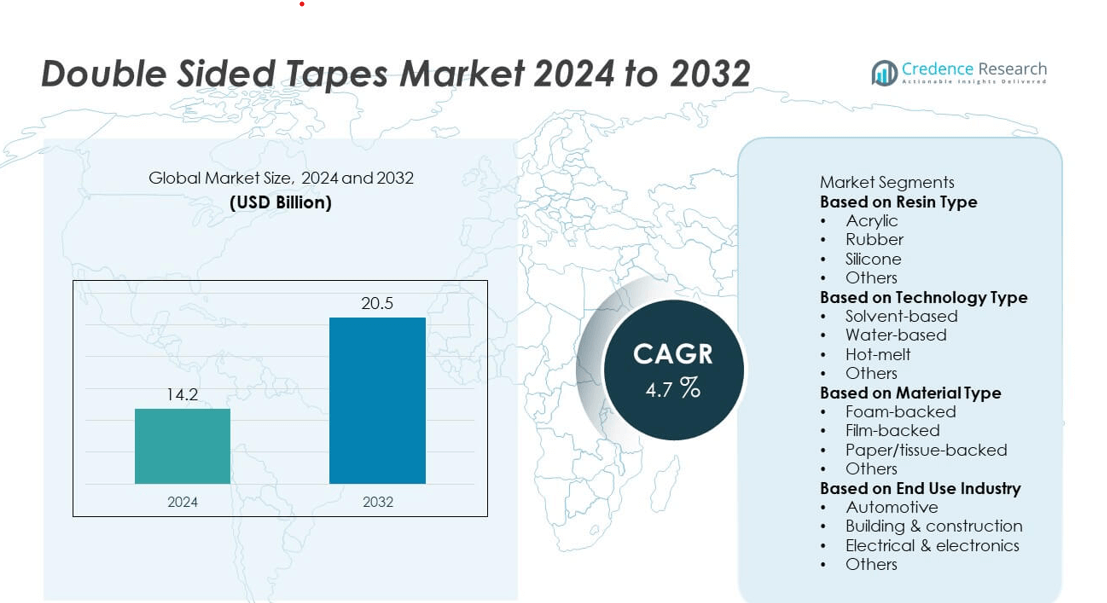

The Double-Sided Tapes market was valued at USD 14.2 billion in 2024 and is projected to reach USD 20.5 billion by 2032, expanding at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Double Sided Tapes Market Size 2024 |

USD 14.2 billion |

| Double Sided Tapes Market, CAGR |

4.7% |

| Double Sided Tapes Market Size 2032 |

USD 20.5 billion |

The double-sided tapes market is led by major players including Gergonne, Berry Global Inc. (Adchem), Intertape Polymer Group, Advance Tapes International, Lintec Corporation, Ajit Industries Pvt. Ltd., Coroplast Fritz Müller GmbH & Co. KG, Avery Dennison Corporation, Industrias Tuk, S.A. de C.V., and ATP Adhesive Systems AG. These companies dominate through advanced adhesive technologies, durable bonding solutions, and strong global distribution. North America leads the market with a 35% share, driven by high demand in automotive and construction applications. Europe follows with 30%, supported by industrial innovation and sustainable material usage, while Asia-Pacific accounts for 28%, emerging as the fastest-growing region due to rapid industrialization, packaging growth, and electronics manufacturing expansion.

Market Insights

- The double-sided tapes market was valued at USD 14.2 billion in 2024 and is projected to reach USD 20.5 billion by 2032, expanding at a CAGR of 4.7%.

- Rising demand from automotive, electronics, and packaging industries is driving market growth, supported by the need for lightweight, high-strength bonding materials.

- The market trend highlights increased adoption of eco-friendly, solvent-free adhesives and high-temperature-resistant tapes for industrial applications.

- Leading players such as Berry Global Inc. (Adchem), Avery Dennison Corporation, and Intertape Polymer Group focus on innovation, product diversification, and regional expansion to maintain competitiveness.

- North America holds a 35% share, followed by Europe at 30% and Asia-Pacific at 28%, while the acrylic resin segment leads with a 41% share due to superior adhesion and durability across diverse operating environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin Type

The acrylic segment dominated the double-sided tapes market in 2024 with a 46% share. Acrylic-based tapes are widely used due to their excellent adhesion, UV resistance, and durability across diverse environmental conditions. These tapes are preferred in automotive, electronics, and construction applications for providing long-lasting bonding on metal, glass, and plastic surfaces. Growing demand for lightweight materials and solvent-free adhesives further supports the segment’s growth. The rubber-based segment follows, driven by its cost-effectiveness and suitability for temporary bonding in packaging and general-purpose applications.

- For instance, Gergonne developed its GERGOTAPE X10080 polyethylene (PE) foam tape, which features WRAtech (Weather Resistant Adhesive) technology for weatherproof bonding performance in vehicle assembly applications.

By Technology Type

The water-based segment held the largest share of 41% in the double-sided tapes market in 2024. This dominance stems from growing environmental awareness and regulatory emphasis on low-VOC adhesives. Water-based tapes are gaining traction in electronics, healthcare, and automotive interiors due to their safety and eco-friendly composition. Manufacturers are increasingly replacing solvent-based adhesives with water-based technologies to comply with sustainability standards. Meanwhile, hot-melt technology is expanding rapidly as it offers faster curing, superior tack, and strong adhesion, making it ideal for packaging, insulation, and industrial applications.

- For instance, Avery Dennison Corporation has launched Advanced Acrylics and Solvent-free UV Acrylic adhesive technologies, eliminating solvents as a coating vehicle and providing sustainable options for demanding industrial applications. These formulations are capable of high shear strength and are designed to meet RoHS and REACH compliance standards.

By Material Type

The film-backed segment led the double-sided tapes market in 2024 with a 39% share. Film-backed tapes offer high tensile strength, uniform thickness, and moisture resistance, making them suitable for precision bonding in automotive and electronics applications. Their smooth surface and stability under high temperatures enhance performance in demanding conditions. Foam-backed tapes are also gaining popularity for vibration damping and gap-filling properties in construction and appliance assembly. The rising use of paper/tissue-backed tapes in crafts, labeling, and lightweight bonding further diversifies material applications across industrial and consumer markets.

Key Growth Drivers

Rising Demand from Automotive and Electronics Industries

The automotive and electronics industries are driving strong demand for double-sided tapes due to their lightweight, durable, and efficient bonding properties. These tapes replace traditional fasteners and rivets, reducing vehicle weight and improving aesthetics. In electronics, they are widely used for display assembly, insulation, and heat management. Growing adoption of EVs and compact electronic devices further accelerates usage. Manufacturers are developing heat-resistant and high-adhesion tapes tailored to withstand mechanical stress and thermal exposure, enhancing performance in industrial and consumer applications.

- For instance, Lintec Corporation developed its Adwill series of adhesive films used in semiconductor packaging. These materials are designed to be used with the company’s own equipment to ensure precise and reliable bonding of microelectronic components.

Shift Toward Sustainable and Solvent-Free Adhesives

Sustainability initiatives are propelling the adoption of water-based and solvent-free double-sided tapes. Stricter environmental regulations and rising corporate responsibility are encouraging industries to minimize VOC emissions. Manufacturers are investing in bio-based adhesives and recyclable backing materials to align with green manufacturing goals. The push for low-carbon production and the growing demand for eco-friendly packaging are major contributors to this trend. The shift toward sustainable formulations is expanding market opportunities, especially in Europe and North America, where green compliance standards are stringent.

- For instance, Berry Global Inc. (Adchem) has launched solvent-free, low-VOC (Volatile Organic Compound) adhesive tape series, such as the Adchem 1140, for industrial and commercial applications.

Expansion in Construction and Industrial Applications

The construction and manufacturing sectors are increasingly using double-sided tapes for structural bonding, insulation, and assembly applications. These tapes offer high shear strength and ease of application, reducing labor time compared to mechanical fasteners. Rapid urbanization and infrastructure projects in developing countries are fueling market demand. Additionally, industrial automation and the trend toward precision manufacturing support the integration of advanced adhesive tapes for durable bonding in machinery and fabricated components. Their versatility across surfaces enhances productivity and reduces production costs.

Key Trends & Opportunities

Growing Adoption of High-Performance Foam and Film-Backed Tapes

High-performance foam and film-backed tapes are gaining popularity due to their ability to absorb vibration, withstand temperature extremes, and maintain adhesion on uneven surfaces. These products are increasingly used in automotive interiors, electronic displays, and construction panels. Manufacturers are enhancing product performance through advanced polymers and coating technologies. The rising use of lightweight materials and composites further boosts the need for high-strength bonding solutions. This trend presents strong opportunities for innovation and premium product differentiation in industrial applications.

- For instance, 3M developed its VHB series acrylic foam tapes for high-performance automotive bonding. The series, which includes products like the VHB GPH family, provides high bond strength and long-term durability in applications like attaching exterior trim and assembling structural panels.

Integration of Smart Adhesive Technologies

Smart adhesive technologies are emerging as a key opportunity in the double-sided tapes market. Integration of nanomaterials and responsive polymers enables improved bonding precision and self-healing capabilities. Advanced tapes can now offer temperature or pressure-sensitive bonding, enhancing functionality in electronic and aerospace sectors. The growing focus on automated production lines supports demand for tapes compatible with robotic application systems. These innovations improve efficiency, reduce waste, and align with Industry 4.0 trends, expanding market prospects for technologically advanced adhesive solutions.

- For instance, self-healing polymer nanocomposites are being developed for aerospace applications, utilizing conductive additives like carbon nanotubes to enable electrical resistance-based damage sensing and thermal-activated healing.

Key Challenges

Fluctuating Raw Material Prices

Volatility in the prices of raw materials such as acrylics, rubbers, and silicone compounds poses a major challenge for manufacturers. Price fluctuations affect production costs and profit margins, especially for small and mid-sized companies. Global supply chain disruptions and dependence on petrochemical feedstocks intensify these challenges. Many producers are exploring regional sourcing and alternative bio-based materials to mitigate cost pressures. However, maintaining consistent quality and performance while managing price instability remains a key hurdle for long-term market stability.

Performance Limitations in Extreme Conditions

Double-sided tapes often face performance issues in high-temperature, high-humidity, or chemically exposed environments. Adhesive degradation or loss of bond strength can impact reliability in demanding applications such as aerospace or heavy manufacturing. Continuous product innovation and material testing are required to overcome these technical limitations. Manufacturers are focusing on developing advanced formulations with better thermal resistance and UV stability. Despite progress, ensuring consistent adhesion under diverse environmental conditions remains a key technical and commercial challenge for the market.

Regional Analysis

North America

North America held the largest share of 34% in the double-sided tapes market in 2024. Growth is driven by high demand across automotive, construction, and electronics industries. The United States leads with strong adoption of advanced adhesive technologies and high-performance tapes in EV assembly and packaging sectors. The region’s focus on lightweight materials and sustainable adhesive solutions supports market expansion. Canada contributes through rising construction and industrial applications. Leading manufacturers are investing in R&D for solvent-free and eco-friendly products, aligning with stringent environmental regulations and growing demand for high-strength bonding materials.

Europe

Europe accounted for 28% of the double-sided tapes market in 2024, supported by advanced manufacturing and sustainability initiatives. Germany, France, and the United Kingdom lead due to strong automotive and electronics production bases. The region’s emphasis on low-VOC adhesives and recyclable materials drives innovation in water-based and hot-melt technologies. Increasing use of high-strength tapes in automotive interiors, industrial assembly, and consumer goods manufacturing fuels steady growth. EU environmental regulations and green building standards further encourage adoption. Market leaders are enhancing production efficiency and material recycling to meet Europe’s evolving sustainability goals.

Asia-Pacific

Asia-Pacific captured a 29% share of the double-sided tapes market in 2024 and is the fastest-growing region. Rapid industrialization, rising automotive output, and expanding electronics manufacturing in China, Japan, South Korea, and India are key drivers. Growing infrastructure development and packaging demand in emerging economies further boost market growth. Local manufacturers are scaling up production capacities for cost-effective and durable adhesive solutions. The shift toward automation and high-precision assembly applications strengthens adoption. Increasing foreign investments and supportive government policies for industrial modernization enhance Asia-Pacific’s position as a global hub for adhesive tape production.

Latin America

Latin America held a 5% share of the double-sided tapes market in 2024. The region’s growth is driven by expanding construction and packaging industries in Brazil and Mexico. Rising automotive manufacturing and increasing demand for durable bonding materials support adoption. The packaging sector benefits from growing e-commerce and FMCG industries. However, limited access to advanced adhesive technologies and volatile raw material costs restrain faster expansion. Global adhesive manufacturers are forming partnerships with local distributors to strengthen market presence. Continued investment in industrial modernization and infrastructure projects is expected to sustain long-term market growth.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the double-sided tapes market in 2024. Growth is supported by rising construction activity, industrial expansion, and demand from automotive assembly and electronics manufacturing. The United Arab Emirates and Saudi Arabia lead adoption due to rapid urban development and infrastructure investments. Africa is gradually increasing consumption as industrial capabilities expand. However, high import dependency and limited local manufacturing capacity pose challenges. International players are entering through distribution partnerships, focusing on energy-efficient, durable, and climate-resistant adhesive solutions tailored for regional environmental conditions.

Market Segmentations:

By Resin Type

- Acrylic

- Rubber

- Silicone

- Others

By Technology Type

- Solvent-based

- Water-based

- Hot-melt

- Others

By Material Type

- Foam-backed

- Film-backed

- Paper/tissue-backed

- Others

By End Use Industry

- Automotive

- Building & construction

- Electrical & electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The double-sided tapes market is highly competitive, featuring key players such as Gergonne, Berry Global Inc. (Adchem), Intertape Polymer Group, Advance Tapes International, Lintec Corporation, Ajit Industries Pvt. Ltd., Coroplast Fritz Müller GmbH & Co. KG, Avery Dennison Corporation, Industrias Tuk, S.A. de C.V., and ATP Adhesive Systems AG. These companies focus on innovation, sustainability, and advanced adhesive technologies to strengthen market presence. Leading firms are investing in high-performance, low-VOC, and temperature-resistant adhesives suited for automotive, electronics, and construction applications. Strategic mergers, acquisitions, and regional expansions enhance product portfolios and global reach. Companies are also prioritizing eco-friendly manufacturing practices and lightweight bonding solutions to meet regulatory standards. Continuous R&D in solvent-free and hybrid adhesive formulations supports market competitiveness, while increasing partnerships with OEMs and packaging manufacturers reinforce long-term growth opportunities within the global double-sided tapes industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gergonne

- Berry Global Inc. (Adchem)

- Intertape Polymer Group

- Advance Tapes International

- Lintec Corporation

- Ajit Industries Pvt. Ltd.

- Coroplast Fritz Müller GmbH & Co. KG

- Avery Dennison Corporation

- Industrias Tuk, S.A. de C.V.

- ATP Adhesive Systems AG

Recent Developments

- In April 2025, Avery Dennison also revealed its Flashing and Seaming tape line for building envelopes, which includes high-performance double-coated tapes suitable for dual-surface adhesion under challenging conditions.

- In 2025, Avery Dennison Corporation introduced a new Solar Panel Bonding portfolio of pressure-sensitive adhesive (PSA) tapes suited for double-sided bonding in PV module assembly (frame mounting, cell fixation, etc.).

- In 2024, Gergonne upgraded its double-sided acrylic foam tapes in its GERGOTAPE portfolio, leveraging its LPCtech adhesive technology to improve bonding on dissimilar materials

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Technology Type, Material Type, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance adhesive solutions will continue to grow across automotive and electronics sectors.

- Manufacturers will focus on producing solvent-free and recyclable tape formulations to meet sustainability goals.

- The use of double-sided tapes in lightweight vehicle assembly will increase with rising EV production.

- Technological advancements will enhance temperature resistance and bonding strength for industrial applications.

- Growth in e-commerce packaging will boost demand for durable and easy-to-apply tape solutions.

- Asia-Pacific will emerge as the fastest-growing region due to expanding manufacturing and construction industries.

- Automation in production processes will improve precision and efficiency in tape manufacturing.

- Strategic mergers and partnerships will help key players expand their global reach and capabilities.

- Rising infrastructure and renewable energy projects will create new application opportunities.

- Development of specialty tapes for extreme conditions will strengthen market competitiveness worldwide.