Market Overview

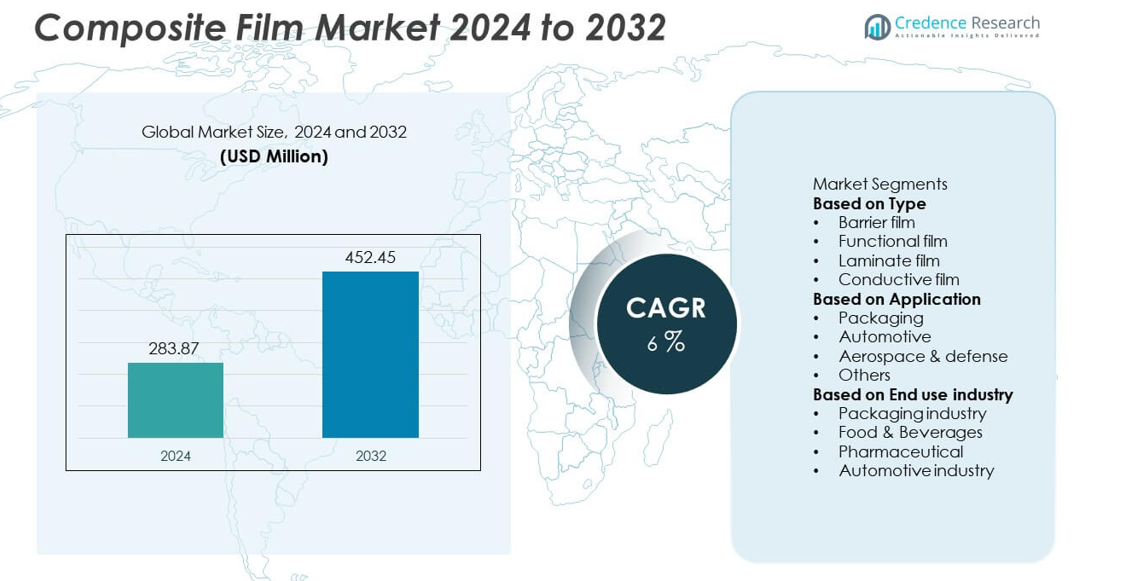

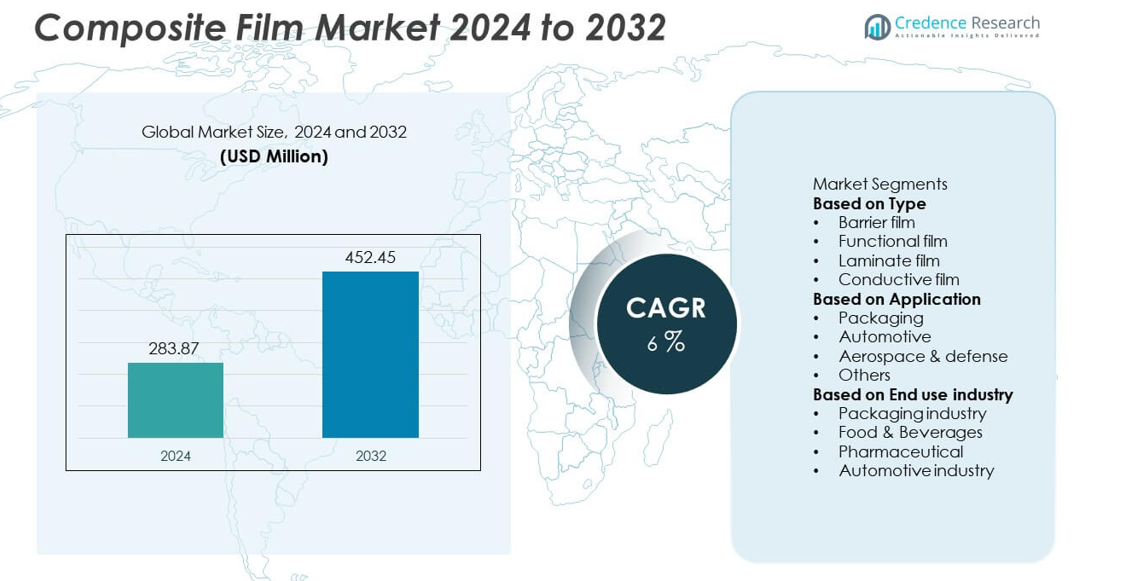

The Composite Film market was valued at USD 283.87 million in 2024 and is projected to reach USD 452.45 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Composite Film Market Size 2024 |

USD 283.87 million |

| Composite Film Market, CAGR |

6% |

| Composite Film Market Size 2032 |

USD 452.45 million |

The composite film market is driven by major players including Mondi Group, Henkel AG, AGC Inc, Hysum, 3M, Krus Company, Fengchen Group Co., Ltd, Benison, Guangdong Chaowei Plastic Film Co., Ltd, and Huizhou Yangrui Printing & Packaging Co., Ltd. These companies focus on developing advanced barrier and functional films with enhanced strength, flexibility, and recyclability. North America led the market in 2024 with a 34% share, driven by strong demand from packaging and aerospace sectors. Asia-Pacific followed with a 30% share, supported by rapid industrialization and technological innovation, while Europe accounted for 28%, emphasizing sustainable and eco-friendly composite film solutions in packaging and automotive applications.

Market Insights

- The composite film market was valued at USD 283.87 million in 2024 and is projected to reach USD 452.45 million by 2032, expanding at a CAGR of 6% during the forecast period.

- Rising demand for lightweight, durable, and high-barrier materials in packaging, automotive, and aerospace sectors is driving market growth globally.

- Advancements in multilayer coating, nanocomposite materials, and recyclable laminates are shaping key trends in sustainable film production.

- Major players such as Mondi Group, Henkel AG, and 3M focus on innovation, eco-friendly designs, and regional expansion to strengthen competitiveness.

- North America holds 34%, Asia-Pacific 30%, and Europe 28% market share, while the barrier film segment dominates with 41%, driven by high usage in food packaging and industrial protection applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The barrier film segment dominated the composite film market in 2024 with a 41% share, driven by rising demand for moisture, oxygen, and UV-resistant materials across packaging and electronics applications. These films enhance product shelf life and maintain quality, making them vital in food, pharmaceutical, and industrial packaging. Their superior thermal stability and flexibility also support use in high-performance sectors such as aerospace and automotive. Increasing preference for lightweight, durable, and recyclable materials continues to strengthen the adoption of barrier films, supported by advancements in multilayer coating and lamination technologies.

- For instance, 3M developed an Ultra-Barrier Film platform for flexible electronics and displays that provides enhanced moisture protection. The technology utilizes multilayer coatings to deliver a very low water vapor transmission rate (WVTR). This moisture resistance is vital for devices like OLED displays, ensuring they remain reliable in high-humidity environments. The films are thin, flexible, and feature multilayer constructions of polymers and oxides.

By Application

The packaging segment held the largest share of 46% in 2024, fueled by rapid growth in food, beverage, and pharmaceutical packaging. Composite films offer enhanced protection, extended product freshness, and design flexibility, aligning with sustainability trends. The growing demand for flexible, resealable, and recyclable packaging materials is driving innovation across industries. E-commerce expansion and increased consumption of packaged goods further boost this segment’s dominance. Rising awareness of environmental impact and strict regulatory standards are accelerating the adoption of eco-friendly and bio-based composite films in modern packaging solutions.

- For instance, Mondi Group introduced its recyclable FlexiBag Recyclable film with a multilayer polyethylene structure designed for dry food packaging. The film meets recyclability standards set by Ceflex and achieves an oxygen transmission rate below 0.5 cm³/m²/day, significantly improving shelf stability for packaged food products.

By End-Use Industry

The packaging industry accounted for a 39% share of the composite film market in 2024, driven by expanding applications in food preservation, pharmaceutical protection, and consumer goods. Manufacturers are increasingly adopting composite films for their barrier efficiency, heat resistance, and lightweight nature. The food and beverage sector also contributes significantly, with growing reliance on high-performance films to ensure safety and extend shelf life. Continuous innovation in biodegradable and recyclable film materials supports sustainability goals. The industry’s push toward flexible, durable, and cost-efficient solutions sustains its strong demand across global markets.

Key Growth Drivers

Rising Demand for High-Performance Packaging Materials

The growing demand for durable and flexible packaging materials is a major driver of the composite film market. Industries such as food, pharmaceuticals, and electronics increasingly rely on barrier films for superior protection against moisture, oxygen, and contaminants. The shift toward lightweight and sustainable packaging further accelerates adoption. Manufacturers are investing in advanced multilayer films that enhance shelf life and reduce environmental impact. The combination of functionality, durability, and recyclability continues to strengthen market growth across global packaging applications.

- For instance, Henkel AG developed its Loctite Liofol HS 2809-22 RE heat-seal coating for paper-based food-grade and non-food packaging, enabling replacement of plastic and ensuring repulpability for recycling. It is used for applications like chocolate overwraps and tea bags, and contributes to improved preservation and product stability.

Expansion in Automotive and Aerospace Applications

Composite films are gaining traction in the automotive and aerospace sectors due to their lightweight, heat-resistant, and corrosion-proof properties. They are used for surface protection, insulation, and structural reinforcement, contributing to vehicle efficiency and safety. The trend toward electric vehicles and fuel-efficient aircraft amplifies demand for high-strength, low-weight materials. Continuous advancements in polymer composites and adhesive technologies further enhance performance. The drive for energy efficiency and reduced carbon emissions continues to expand the use of composite films in transportation industries.

- For instance, AGC Inc. manufactures fluoropolymer-based composite films with heat resistance up to 260°C and tensile strength exceeding 70 MPa, used in EV battery modules and aircraft interiors. These films provide insulation and flame-retardant performance, supporting lightweight component design in next-generation mobility solutions.

Technological Advancements in Film Manufacturing

Ongoing innovations in film processing technologies, including co-extrusion, nano-layering, and plasma coating, are significantly improving film performance. These advancements enable greater control over barrier properties, transparency, and flexibility while reducing material usage and production costs. Manufacturers are also adopting smart and functional coatings that enhance conductivity and anti-static behavior. Integration of automation and precision engineering ensures higher consistency and scalability in production. Such technological progress is driving product diversification and strengthening the market’s presence across high-performance and specialized industrial applications.

Key Trends and Opportunities

Shift Toward Sustainable and Recyclable Films

Sustainability is a defining trend, with manufacturers focusing on bio-based and recyclable composite films. The growing global emphasis on reducing plastic waste and achieving circular economy goals drives the adoption of eco-friendly materials. Companies are developing films with biodegradable polymers and water-based adhesives to meet regulatory standards. This trend is especially strong in the packaging and food industries, where sustainability influences consumer preferences. Investments in green technologies and closed-loop recycling systems present major growth opportunities for environmentally responsible market participants.

- For instance, Toray Industries produces bio-based and recycled PET films derived from plant feedstock or post-consumer plastic, under its Ecouse™ Lumirror™ brand. The company has developed eco-friendly PET films that can reduce carbon dioxide emissions from solvent-derived sources.

Integration of Functional and Smart Features

Composite films are evolving to include advanced functionalities such as conductivity, UV shielding, and anti-bacterial properties. These smart features enhance product performance across electronics, healthcare, and automotive sectors. Conductive films are increasingly used in sensors, displays, and flexible circuits, aligning with the expansion of IoT and smart devices. The integration of nanomaterials and surface-modification technologies further enhances film versatility. This convergence of functionality and performance offers manufacturers new avenues for differentiation and high-value applications in emerging technology-driven industries.

- For instance, DuPont offers its Kapton® polyimide films, including the corona-resistant Kapton® CRC, for use as electrical insulation in electric vehicle batteries and high-voltage components. These films feature high dielectric strength, with Kapton® 100CRC offering 256 kV/mm, and high-temperature endurance, with some grades capable of withstanding temperatures up to 400°C for short periods.

Key Challenges

High Production and Raw Material Costs

The complex manufacturing process and reliance on premium polymers and adhesives increase the production cost of composite films. Specialized coating, lamination, and extrusion processes require high investment in advanced machinery and energy-intensive operations. Volatility in raw material prices, especially petroleum-based resins, further impacts profit margins. Small and medium manufacturers face difficulties competing with larger firms due to cost constraints. Addressing these challenges through material innovation and process optimization remains essential for improving cost efficiency and market accessibility.

Recycling and Disposal Challenges

Composite films pose recycling difficulties due to their multi-layered structure combining diverse materials such as plastics, metals, and adhesives. This complexity limits recyclability and increases waste management issues, especially in packaging applications. Inadequate recycling infrastructure and lack of standardization across regions further exacerbate the problem. Environmental regulations are tightening, compelling manufacturers to develop recyclable or mono-material alternatives. Overcoming these limitations through material redesign, mechanical separation technologies, and adoption of sustainable production practices is critical for long-term market growth and environmental compliance.

Regional Analysis

North America

North America held a 34% share of the composite film market in 2024, driven by strong demand from packaging, automotive, and aerospace sectors. The United States leads regional growth, supported by technological advancements in high-barrier films and lightweight materials. Increasing focus on sustainable packaging and adoption of advanced composite coatings enhance product innovation. The aerospace and defense industries continue to invest in high-performance films for insulation and protection applications. Ongoing R&D efforts and the presence of major material manufacturers further solidify North America’s position as a key market for composite films.

Europe

Europe accounted for a 28% share of the global composite film market in 2024, fueled by stringent sustainability regulations and strong demand from the automotive and packaging industries. Germany, France, and the United Kingdom are leading adopters, emphasizing recyclable and bio-based composite materials. The region’s focus on reducing carbon emissions encourages the use of lightweight, durable films in transportation and manufacturing. Advancements in multilayer technology and improved barrier properties enhance product performance. Continuous innovation and green initiatives across EU countries reinforce Europe’s leadership in sustainable composite film production.

Asia-Pacific

Asia-Pacific captured a 30% share of the composite film market in 2024, emerging as the fastest-growing region. Expanding packaging, electronics, and automotive industries in China, India, Japan, and South Korea are key drivers. Rapid industrialization and rising consumer demand for flexible packaging strengthen market growth. Local manufacturers are investing in cost-efficient production technologies and recyclable materials. The region’s growing emphasis on electric vehicles and renewable energy also supports increased use of composite films. Favorable government policies promoting manufacturing and sustainability continue to enhance Asia-Pacific’s competitive position globally.

Latin America

Latin America held a 5% share of the composite film market in 2024, supported by growing demand from packaging and automotive applications. Brazil and Mexico dominate regional consumption, driven by the expansion of food packaging, consumer goods, and industrial production. Increasing awareness of sustainability and adoption of eco-friendly materials are promoting gradual market growth. However, limited technological infrastructure and high raw material costs restrict large-scale adoption. Ongoing investments in local manufacturing and packaging modernization projects are expected to strengthen the region’s role in the global composite film market.

Middle East & Africa

The Middle East & Africa accounted for a 3% share of the composite film market in 2024, driven by rapid industrial growth and infrastructure development. Countries such as Saudi Arabia, the UAE, and South Africa are expanding their use of composite films in packaging, automotive, and construction applications. Growing awareness of energy efficiency and sustainability is encouraging the adoption of advanced film technologies. Although high production costs and limited recycling infrastructure pose challenges, increasing investments in manufacturing and diversification efforts are supporting the region’s gradual market expansion.

Market Segmentations:

By Type

- Barrier film

- Functional film

- Laminate film

- Conductive film

By Application

- Packaging

- Automotive

- Aerospace & defense

- Others

By End use industry

- Packaging industry

- Food & Beverages

- Pharmaceutical

- Automotive industry

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the composite film market features key players such as Mondi Group, Henkel AG, AGC Inc, Hysum, 3M, Krus Company, Fengchen Group Co., Ltd, Benison, Guangdong Chaowei Plastic Film Co., Ltd, and Huizhou Yangrui Printing & Packaging Co., Ltd. These companies focus on innovation in multilayer barrier, functional, and conductive film technologies to meet the rising demand for lightweight and sustainable materials. Leading manufacturers emphasize product performance, recyclability, and advanced coating solutions to enhance durability and protection. Strategic partnerships, product diversification, and capacity expansion are central strategies to strengthen global market presence. Continuous research in nanocomposite materials and eco-friendly laminates is improving performance across packaging, automotive, and electronics sectors. With growing sustainability regulations and evolving customer preferences, market competition is intensifying as companies invest in high-barrier, cost-efficient, and environment-friendly film production technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mondi Group

- Henkel AG

- AGC Inc

- Hysum

- 3M

- Krus Company

- Fengchen Group Co., Ltd

- Benison

- Guangdong Chaowei Plastic Film Co., Ltd

- Huizhou Yangrui Printing & Packaging Co., Ltd

Recent Developments

- In September 2025, Henkel expanded its Brandon, South Dakota facility, adding mixers to boost volume of advanced thermal management and adhesive products.

- In August 2025, Mondi Group ramped up production of its FunctionalBarrier Paper Ultimate to meet demand for sustainable high-barrier packaging.

- In 2025, Henkel reported acceleration in organic sales growth in H1 2025, driven by its Adhesive Technologies unit

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End use industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for composite films will rise due to increasing applications in packaging and automotive sectors.

- Adoption of recyclable and bio-based films will expand as sustainability regulations strengthen.

- Advancements in nanocomposite and multilayer coating technologies will improve film performance.

- Growth in electric vehicles and lightweight components will boost usage in transportation industries.

- Manufacturers will invest in energy-efficient production and eco-friendly adhesive technologies.

- Expanding e-commerce and food packaging sectors will drive demand for high-barrier films.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization and innovation.

- Integration of smart and conductive films will open new opportunities in electronics applications.

- Partnerships between film producers and packaging companies will enhance material customization.

- Increasing investment in research and recycling infrastructure will support sustainable market growth.